- Household income in the United States

-

Income in the United States - Affluence in the United States

- Household income in the United States

- Income inequality in the United States

- Personal income in the United States

- Social class in the United States

Income by:

- State (localities by state)

- County (highest | lowest)

- Metropolitan statistical area

- Place (highest | lowest)

- Urban areas

- ZIP Code Tabulation Area

Household income is a measure commonly used by the United States government and private institutions, that counts the income of all residents over the age of 18 in each household, including not only all wages and salaries, but such items as unemployment insurance, disability payments, child support payments (not removing child support from wages and salaried yet counting it as overall income actually results in this money counting toward two households, artificially inflating the income between the two households), regular rental receipts, as well as any personal business, investment, or other kinds of income received routinely.[1] The residents of the household do not have to be related to the head of the household for their earnings to be considered part of the household's income.[2] As households tend to share a similar economic context, the use of household income remains among the most widely accepted measures of income. That the size of a household is not commonly taken into account in such measures may distort any analysis of fluctuations within or among the household income categories, and may render direct comparisons between quintiles difficult or even impossible.[3]

In 2006, the "real" (adjusted for inflation) median annual household income rose 1.3% to $50,233.00 according to the Census Bureau.[4] The real median earnings of men who worked full time, year-round climbed between 2006 and 2007, from $43,460 to $45,113 (about 3.6 time minimum wage in 2006 to 3.7 time minimum wage in 2007). For women, the corresponding increase was from $33,437 to $35,102 (2.8 and 2.9 times minimum wage respectively). The median income per household member (including all working and non-working members above the age of 14) was $26,036 in 2006.[5] In 2006, there were approximately 116,011,000 households in the United States. 1.93% of all households had annual incomes exceeding $250,000.[6] 12.3% fell below the federal poverty threshold[7] and the bottom 20% earned less than $19,178.[8] The aggregate income distribution is highly concentrated towards the top, with the top 6.37% earning roughly one third of all income, and those with upper-middle incomes controlling a large, though declining, share of the total earned income.[3][9] Income inequality in the United States, which had decreased slowly after World War II until 1970, began to increase in the 1970s until reaching a peak in 2006. It declined a little in 2007.[10] Households in the top quintile (i.e., top 20%), 77% of which had two or more income earners, had incomes exceeding $91,705. Households in the mid quintile, with a mean of approximately one income earner per household had incomes between $36,000 and $57,657. Households in the lowest quintile had incomes less than $19,178 and the majority had no income earner.[11]

The 2006 economic survey also found that households in the top two income quintiles, those with an annual household income exceeding $60,000, had a median of two income earners while those in the lower quintiles (2nd and middle quintile) had median of only one income earner per household. Overall, the United States followed the trend of other developed nations with a relatively large population of relatively affluent households outnumbering the poor. Among those in between the extremes of the income strata are a large number of households with moderately high middle class incomes[9] and an even larger number of households with moderately low incomes.[6] While the median household income has increased 30% since 1990, it has increased only slightly when considering inflation. In 1990, the median household income was $30,056 or $44,603 in 2003 dollars. While personal income has remained relatively stagnant over the past few decades, household income has risen due to the rising percentage of households with two or more income earners. Between 1999 and 2004 household income stagnated showing a slight increase since 2004.[12][13] According to the Bureau of Economic Analysis, per capita income has increased every year for the past 10 years, with an annual average of 5.2% gains for the past 4 years. The recently released US Income Mobility Study showed economic growth resulted in rising incomes for most taxpayers over the period from 1996 to 2005. Median incomes of all taxpayers increased by 24 percent after adjusting for inflation. The real incomes of two-thirds of all taxpayers increased over this period. Income mobility of individuals was considerable in the U.S. economy during the 1996 through 2005 period with roughly half of taxpayers who began in the bottom quintile moving up to a higher income group within 10 years. In addition, the median incomes of those initially in the lower income groups increased more than the median incomes of those initially in the higher income groups.[14]

Contents

Household income

The 2003 Median Income of US households was $45,018 per annum.

Income range Households

(thousands)Percent Percentile Mean number of earners Mean household size $0 to $25,000 (28.22%) 0.6 1.9 Under $2,500 2,566 2.26% 0 0.23 1.97 $2,500 to $4,999 1,389 1.22% 2.26% 0.52 2.04 $5,000 to $7,499 2,490 2.20% 3.48% 0.39 1.76 $7,500 to $9,999 3,360 2.96% 5.68% 0.33 1.66 $10,000 to $12,499 4,013 3.54% 8.64% 0.46 1.71 $12,500 to $14,999 3,543 3.13% 12.18% 0.50 1.84 $15,000 to $17,499 3,760 3.32% 15.31% 0.67 1.99 $17,500 to $19,999 3,438 3.03% 18.63% 0.73 2.10 $20,000 to $22,499 4,061 3.58% 21.66% 0.84 2.11 $22,500 to $24,999 3,375 2.98% 25.24% 0.79 2.14 $25,000 to $50,000 (26.65%) 1 2.5 $25,000 to $27,499 3,938 3.48% 28.22% 0.93 2.21 $27,500 to $29,999 2,889 2.55% 31.70% 1.01 2.30 $30,000 to $32,499 3,921 3.46% 34.25% 1.12 2.38 $32,500 to $34,999 2,727 2.41% 37.71% 1.17 2.39 $35,000 to $37,499 3,360 2.96% 40.12% 1.22 2.36 $37,500 to $39,999 2,633 2.32% 43.08% 1.25 2.49 $40,000 to $42,499 3,378 2.98% 45.40% 1.31 2.46 $42,500 to $44,999 2,294 2.02% 48.38% 1.38 2.60 National Median $44,389 50.00% 1.35 2.57 $45,000 to $47,499 2,700 2.38% 50.40% 1.39 2.60 $47,500 to $49,999 2,371 2.09% 52.78% 1.49 2.62 $50,000 to $75,000 (18.27%) 2 3 $50,000 to $52,499 3,071 2.71% 54.87% 1.46 2.60 $52,500 to $54,999 2,006 1.77% 57.58% 1.58 2.72 $55,000 to $57,499 2,420 2.13% 59.35% 1.61 2.75 $57,500 to $59,999 1,786 1.57% 61.48% 1.70 2.87 $60,000 to $62,499 2,566 2.26% 63.05% 1.63 2.82 $62,500 to $64,999 1,774 1.56% 65.31% 1.79 2.89 $65,000 to $67,499 2,101 1.85% 66.87% 1.81 2.93 $67,500 to $69,999 1,637 1.44% 68.72% 1.74 2.80 $70,000 to $72,499 1,978 1.74% 70.16% 1.77 2.88 $72,500 to $74,999 1,413 1.24% 71.90% 1.82 3.00 $75,000 to $100,000 (10.93%) 2 3 $75,000 to $77,499 1,802 1.59% 73.14% 1.82 2.95 $77,500 to $79,999 1,264 1.11% 74.73% 1.98 3.04 $80,000 to $82,499 1,673 1.47% 75.84% 1.89 3.01 $82,500 to $84,999 1,219 1.07% 77.31% 1.97 3.10 $85,000 to $87,499 1,418 1.25% 78.38% 1.94 3.00 $87,500 to $89,999 984 0.86% 79.63% 1.98 3.03 $90,000 to $92,499 1,282 1.13% 80.49% 1.95 3.03 $92,500 to $94,999 917 0.81% 81.62% 2.17 3.25 $95,000 to $97,499 1,023 0.90% 82.43% 2.06 3.29 $97,500 to $99,999 846 0.74% 83.33% 2.12 3.33 $100,000 or more (15.93%) 2 3 $100,000 to $149,999 11,940 9.89% 84.07% ca. 2 ca. 3 $150,000 to $199,999 3,595 3.17% 93.96% $200,000 to $249,999 1,325 1.37% 97.13% $250,000 and above 1,699 1.50% 98.50% SOURCE: US Census Bureau, 2005[6]

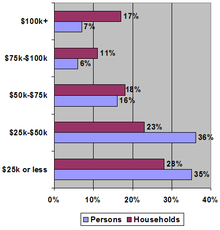

Quintiles

Households are often divided into quintiles according to their gross income. Each quintile represents 20%, or one fifth, of all households.

Household type is strongly correlated with household income. Married couples are disproportionately represented in the upper two quintiles, compared to the general population of households. Cross-referencing shows that this is likely due to the presence of multiple income earners in these families. Non-family households (individuals) are disproportionately represented in the lower two quintiles. Households headed by single males are disproportionately found in the middle three quintiles; single females head households concentrated in the bottom three quintiles.

The highest income households are almost ten times as likely to own their homes rather than rent, but in the lowest quintile, the ratio of owners to renters is nearly one to one.

The New York Times has used the quintiles to define class. It has assigned the quintiles from lowest to highest as bottom fifth, lower middle, middle, upper middle, and top fifth.[15]

Data All households Lowest fifth Second fifth Middle fifth Fourth fifth Highest fifth Top 5% Households (in 1000s) 113,146 22,629 22,629 22,629 22,629 22,629 5,695 Lower limit $0 $0 $18,500 $34,738 $55,331 $88,030 $157,176 Median number of income earners 1 0 1 1 2 2 2 Tenure Owner occupied 62.4% 49.0% 58.8% 68.9% 80.5% 90.0% 92.8% Renter occupied 29.2% 48.3% 39.7% 29.9% 18.7% 9.6% 6.9% Type of household Non-family households 31.93% 58.92% 40.02% 29.96% 19.12% 11.64% 9.36% Family households 68.06% 41.06% 59.97% 70.04% 80.87% 88.35% 90.61% Breakdown of family households Married couple families 51.35% 19.03% 38.89% 51.00% 67.05% 80.08% 85.59% Single-male family 4.32% 3.08% 4.64% 5.69% 4.89% 3.30% 2.47% Single-female family 12.38% 18.94% 16.43% 13.35% 8.93% 4.24% 2.54% SOURCE: US Census Bureau, 2004[16]

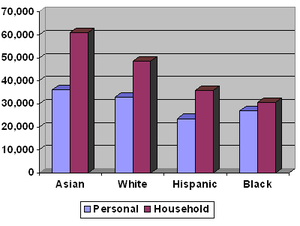

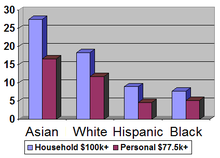

Race

Despite advances minorities have made to exit poverty, there is still an uneven racial distribution among the income quintiles. While White Americans made up roughly 75.1% of all persons in 2000,[17] 87.93% of all households in the top 5% were headed by a person who identified as being White alone. Only 4.75% of all household in the top 5% were headed by someone who identified him or herself as being Hispanic or Latino of any race,[18] versus 12.5% of persons identifying themselves as Hispanic or Latino in the general population.[17] Overall, 86.01% of all households in the top two quintiles with upper-middle range incomes of over $55,331 were headed by a head of household who identified him or herself as White alone, while only 7.21% were being headed by someone who identified as being Hispanic and 7.37% by someone who identified as being African American or Black.[18] Overall, households headed by Hispanics and African Americans were underrepresented in the top two quintiles and overrepresented in the bottom two quintiles. Households headed by persons who identified as being Asian alone, on the other hand, were overrepresented among the top two quintiles. In the top five percent the percentage of Asians was nearly twice as high as the percentage of Asians among the general population. Whites were relatively even distributed throughout the quintiles only being underrepresented in the lowest quintile and slightly overrepresented in the top quintile and the top five percent.[18]

Race All households Lowest fifth Second fifth Middle fifth Fourth fifth Highest fifth Top 5% White alone Number in 1000s 92,702 16,940 18,424 18,978 19,215 19,721 5,029 Percentage 81.93% 74.87% 81.42% 83.87% 84.92% 87.16% 87.93% Asian alone Number in 1000s 4,140 624 593 786 871 1,265 366 Percentage 3.65% 2.76% 2.26% 3.47% 3.84% 5.59% 6.46% Black or African American Number in 1000s 13,792 4,474 3,339 2,637 2,053 1,287 236 Percentage 12.19% 19.77% 14.75% 11.65% 9.07% 5.69% 4.17% Hispanic or Latino

(of any race)Number in 1000s 12,838 3,023 3,130 2,863 1,931 1,204 269 Percentage 11.33% 13.56% 13.83% 12.20% 8.53% 5.89% 4.75% SOURCE: US Census Bureau, 2004[18]

Education and gender

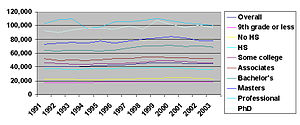

This graph shows the median household income in accordance with the householder's educational attainment. The data only applies to household with a householder over the age of twenty-five.[19]

This graph shows the median household income in accordance with the householder's educational attainment. The data only applies to household with a householder over the age of twenty-five.[19]

Household income as well as per capita income in the United States rise significantly as the educational attainment increases.[20] In 2005 graduates with a Master's in Business Administration (MBA) who accepted job offers were expected to earn a base salary of $88,626. They were also expected to receive an "average signing bonus of $17,428."[21] According to the US Census Bureau persons with doctorates in the United States had an average income of roughly $81,400. The average for an advanced degree was $72,824 with men averaging $90,761 and women averaging $50,756 annually. Year-round full-time workers with a professional degree had an average income of $109,600 while those with a Master's degree had an average income of $62,300. Overall, "…[a]verage earnings ranged from $18,900 for high school dropouts to $25,900 for high school graduates, $45,400 for college graduates and $99,300 for workers with professional degrees (M.D., D.P.T., D.P.M., D.O., J.D., Pharm.D., D.D.S., or D.V.M.).[22]

Considering how education significantly enhances the earnings potential of individuals, it should come as no surprise that individuals with graduate degrees have an average per capita income exceeding the median household income of married couple families among the general population ($63,813).[22][23] Higher educational attainment did not, however, help close the income gap between the genders as the life-time earnings for a male with a professional degree were roughly forty percent (39.59%) higher than those of a female with a professional degree. The lifetime earnings gap between males and females was the smallest for those individuals holding an Associate degrees with male life-time earnings being 27.77% higher than those of females. While educational attainment did not help reduce the income inequality between men and women, it did increase the earnings potential of individuals of both sexes, enabling many households with one or more graduate degree householders to enter the top household income quintile.[22]

Household income also increased significantly with the educational attainment of the householder. The US Census Bureau publishes educational attainment and income data for all households with a householder who was aged twenty-five or older. The biggest income difference was between those with some college education and those who had a Bachelor's degree, with the latter making $23,874 more annually. Income also increased substantially with increased post-secondary education. While the median household income for a household with a householder having an Associates degree was $51,970, the median household income for householders with a Bachelor's degree or higher was $73,446. Those with doctorates had the second highest median household with a median of $96,830; $18,289 more than that for those at the Master's degree level, but $3,170 lower than the median for households with a professional degree holding householder.[19]

Criteria Overall Less than 9th grade High school drop-out High school graduate Some college Associates degree Bachelor's degree Bachelor's degree or more Master's degree Professional degree Doctoral degree Median individual income Male, age 25+ $33,517 $15,461 $18,990 $28,763 $35,073 $39,015 $50,916 $55,751 $61,698 $88,530 $73,853 Female, age 25+ $19,679 $9,296 $10,786 $15,962 $21,007 $24,808 $31,309 $35,125 $41,334 $48,536 $53,003 Both sexes, age 25+ $32,140 $17,422 $20,321 $26,505 $31,054 $35,009 $43,143 $49,303 $52,390 $82,473 $70,853 Median household income $45,016 $18,787 $22,718 $36,835 $45,854 $51,970 $68,728 $73,446 $78,541 $100,000 $96,830 SOURCE: US Census Bureau, 2003[19][24]

This graph shows the median household income in 2003 dollars according to educational attainment.[19]

This graph shows the median household income in 2003 dollars according to educational attainment.[19]

The change in median personal and household since 1991 also varied greatly with educational attainment. The following table shows the median household income according to the educational attainment of the householder. All data is in 2003 dollars and only applies to householders whose householder is aged twenty-five or older. The highest and lowest points of the median household income are presented in bold face.[19][24] Since 2003, median income has continued to rise for the nation as a whole, with the biggest gains going to those with Associate's Degrees, Bachelor's Degree or More, and Master's Degrees. High-school dropouts fared worse with negative growth.

Year Overall Median Less than 9th grade High school drop-out High school graduate Some college Associates degree Bachelor's degree Bachelor's degree or more Master's degree Professional degree Doctoral degree 1991 $40,873 $17,414 $23,096 $37,520 $46,296 $52,289 $64,150 $68,845 $72,669 $102,667 $92,614 1993 $40,324 $17,450 $22,523 $35,979 $44,153 $49,622 $64,537 $70,349 $75,645 $109,900 $93,712 1995 $42,235 $18,031 $21,933 $37,609 $44,537 $50,485 $63,357 $69,584 $77,865 $98,302 $95,899 1997 $43,648 $17,762 $22,688 $38,607 $45,734 $51,726 $67,487 $72,338 $77,850 $105,409 $99,699 1999 $46,236 $19,008 $23,977 $39,322 $48,588 $54,282 $70,925 $76,958 $82,097 $110,383 $107,217 2001 $42,900 $18,830 $24,162 $37,468 $47,605 $53,166 $69,796 $75,116 $81,993 $103,918 $96,442 2003 $45,016 $18,787 $22,718 $36,835 $45,854 $56,970 $68,728 $73,446 $78,541 $100,000 $96,830 Average $43,376 $18,183 $23,013 $37,620 $46,109 $51,934 $66,997 $72,376 $78,094 $104,368 $94,487 SOURCE: US Census Bureau, 2003[19]

Age of householder

Household income in the United States varies substantially with the age of the person who heads the household. Overall, the median household income increased with the age of householder until retirement age when household income started to decline.[25] The highest median household income was found among households headed by working baby-boomers.[25] Households headed by persons between the ages of 45 and 54 had a median household income of $61,111 and a mean household income of $77,634. The median income per member of household for this particular group was $27,924. The highest median income per member of household was among those between the ages of 54 and 64 with $30,544 [The reason this figure is lower than the next group is because Pensions and Social Security add to income while a portion of older individuals also have work-related income.]). The group with the second highest median household income, were households headed by persons between the ages 35 and 44 with a median income of $56,785, followed by those in the age group between 55 and 64 with $50,400. Not surprisingly the lowest income group was composed of those households headed by individuals younger than 24, followed by those headed by persons over the age of 75. Overall, households headed by persons above the age of seventy-five had a median household income of $20,467 with the median household income per member of household being $18,645. These figures support the general assumption that median household income as well as the median income per member of household peaked among those households headed by middle aged persons, increasing with the age of the householder and the size of the household until the householder reaches the age of 64. With retirement income replacing salaries and the size of the household declining, the median household income decreases as well.[25]

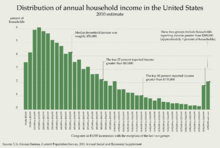

Aggregate income distribution

The aggregate income measures the combined income earned by all persons in a particular income group. In 2007, all households in the United States earned roughly $7.723 trillion.[26] One half, 49.98%, of all income in the US was earned by households with an income over $100,000, the top twenty percent. Over one quarter, 28.5%, of all income was earned by the top 8%, those households earning more than $150,000 a year. The top 3.65%, with incomes over $200,000, earned 17.5%. Households with annual incomes from $50,000 to $75,000, 18.2% of households, earned 16.5% of all income. Households with annual incomes from $50,000 to $95,000, 28.1% of households, earned 28.8% of all income. The bottom 10.3% earned 1.06% of all income.

Distribution

- Family Income

- Percent change in family gross income

Percentiles of net worth 1989 1992 1995 1998 2001 2004 90–100 205.1 158.5 172.8 206.3 272.7 256.2 75–89.9 74.6 67.0 65.0 78.3 83.7 87.9 50–74.9 52.9 48.1 50.1 54.3 62.7 60.6 25–49.9 36.9 36.4 38.6 39.3 42.1 42.2 0–24.9 21.5 22.9 22.9 23.6 25.6 25.1 Percentiles of gross (pre-tax) income 1989 1992 1995 1998 2001 2004 90–100 114.7 106.6 99.1 102.4 134.7 143.8 75–89.9 61.2 56.7 52.6 65.8 74.1 77.0 50–74.9 46.3 43.2 43.6 47.0 54.4 52.4 25–49.9 32.3 32.2 35.3 35.3 37.2 37.0 0–24.9 15.3 17.2 17.8 18.5 21.0 20.5 Household income over time

All figures are in 2003 dollars.

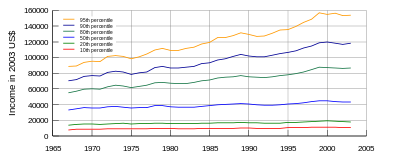

Since 1967, the median household income in the United States has risen by 31%, fluctuating several times. The rise in household income is largely the result of an increase in personal income among college graduates, a group that has doubled in size since the 1960s, and women entering the labor force. Today, 42% of all households have two income earners. Household income increased dramatically faster for affluent households with income inequality having increased steadily since the 1970s.[28][29]

While household income has increased, its growth has been slowed by a decrease in married-couple households who tend to have two earners and, therefore, higher incomes. While the proportion of wives working year-round in married couple households with children has increased from 17% in 1967 to 39% in 1996, the proportion of such households among the general population has decreased. This means that the share the most economically prosperous type of household has been dwindling in the United States.[30]

In 1969, more than 40% of all households consisted of a married couple with children. By 1996 only a rough quarter of US households consisted of married couples with children. As a result of these changing household demographics, median household income rose relatively slowly despite an ever-increasing female labor force and a considerable increase in the percentage of college graduates.[30]

“ "From 1969 to 1996, median household income rose a very modest 6.3 percent in constant dollars... The 1969 to 1996 stagnation in median household income may, in fact, be largely a reflection of changes in the size and composition of households rather than a reflection of a stagnating economy."- John McNeil, US Census Bureau ” Overall, the median household income rose from $33,338 in 1967 to an all-time high of $44,922 in 1999, and has since decreased slightly to $43,318. Decreases in household income are visible during each recession, while increases are visible during economic upturns. These fluctuations were felt across the income strata as the incomes of both the 95th and 20th percentile were affected by fluctuations in the economy. Income in the period between 1967 and 1999 grew considerably faster among wealthier households than it did among poorer households. For example the household income for the 80th precentile, the lower threshold for the top quintile, rose from $55,265 in 1967 to $86,867 in 2003, a 57.2% increase. The median household income rose by 30% while the income for the 20th percentile (the lower threshold for the second lowest quintile) rose by only 28% from $14,002 to $17,984. As the majority of households in the top quintile had two income earners, versus zero for the lowest quintile and that the widening gap between the top and lowest quintile may largely be the reflection of changing household demographics including the addition of women to the workforce.[27][30]

Household demographics are not, however, the cause of the growing gap between the top 5% and the rest of the upper quintile. The top 5% had fewer dual earner households and full-time workers than the top quintile overall. In 2003 a household in the 95th percentile earned 77.2% more than a household in the 80th percentile, compared to 60.5% in 1967, a 27.6% increase in the earnings increase discrepancy between the two groups. Overall the income of the 95th percentile grew 15.2% faster than that of the 80th, 146.8% faster than that of the median and 159.9% faster than that of the 20th percentile.[31]

Households in the top 1% experienced the by far greatest increases in household income. According to economist Janet Yellen "the growth [in real income] was heavily concentrated at the very tip of the top, that is, the top 1 percent."[32] A 2006 analysis of IRS income data by economists Emmanuel Saez at the University of California, Berkeley and Thomas Piketty at the Paris School of Economics showed that the share of income held by the top 1% was as large in 2005 as in 1928. The data revealed that reported income increased by 9% in 2005, with the mean for the top 1% increasing by 14% and that for the bottom 90% dropping slightly by 0.6%.[33]

While per-capita disposable income has increased 469% since 1972, it has only increased moderately when inflation is considered. In 1972, disposable personal income was determined to be $4,129; $19,385 in 2005 dollars. In 2005, disposable personal income was, however, $27,640, a 43% increase.[34][35] Since the late 1990s, household income has fallen slightly.[36]

The following table shows US household income in 2009 constant (CPI-U-RS adjusted) dollars.[37] The final column shows the average change per year from 1976 to 2009.

Percentile 2009 2006 2003 2000 1997 1994 1991 1988 20th $20,453 $21,314 $20,974 $22,320 $20,520 $19,215 $19,338 $19,830 50th $49,777 $51,278 $50,519 $52,301 $49,309 $46,175 $46,269 $47,433 80th $100,000 $103,226 $101,307 $101,884 $95,273 $89,936 $87,173 $88,146 95th $180,001 $185,119 $179,740 $180,879 $168,626 $157,172 $148,055 $149,207 Percentile 1985 1982 1979 1976 1973 1970 1967 Per Year 20th $18,898 $17,927 $19,274 $18,526 $18,973 $18,180 $16,845 .30% 50th $44,898 $43,048 $45,325 $43,483 NA NA NA .41% 80th $82,843 $77,683 $79,851 $75,648 $77,723 $72,273 $66,481 .85% 95th $136,881 $128,232 $129,029 $119,967 $124,921 $114,243 $106,684 1.24% International comparison

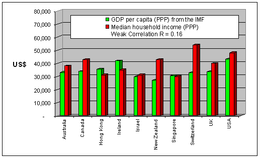

Median household income for other countries is shown in the table below. The data for each country has been converted to US dollars using Purchasing Power Parity (obtained from the OECD).[38] Median household income in the United States remains slightly higher than in the UK and Ireland, yet lower than the mean household income in Switzerland. It is important to note that the differences in median household income between US states can be as large as those between the developed nations. The median household income of the UK, for example, is comparable to that of Florida or South Carolina, while the mean household income in Switzerland is comparable to median household incomes in New Jersey or New Hampshire.

Country or region Median household income national currency units Year PPP rate (OECD) Median household income (PPP) Switzerland[39] (gross) 109,236 CHF, $100,387 2008 1.68375 $64,877 US Connecticut[40] 66,452 USD 2010 1.00 $66,452 US California[40] 54,459 USD 2010 1.00 $54,549 Canada[41] 68,410 CAD 2009 1.254989 $54,510 United States[40] 49,445 USD 2010 1.00 $49,445 Switzerland[39] (after taxes and health insurance) 77,580 CHF, $71,296 2008 1.640256 $47,297 Australia[42] 66,890 AUD 2007/2008 1.5162805 $44,115 New Zealand[43] 63,867 NZD 2008/2009 1.5881895 $40,214 United Kingdom[44] 24,700 GBP 2004 0.632 $39,000 Israel[45] 107,820 ILS 2006 2.90 $37,000 US Mississippi[40] 35,076 USD 2009 1.00 $35,076 Ireland 35,410 EUR 2005 1.02 $35,000 UK Scotland[46] 21,892 GBP 2005 0.649 $34,000 South Korea[47] 26,640,000 KRW 2009 804.718137 $33,105 Hong Kong[48] 186,000 HKD 2005 5.96 $31,000 Singapore[49] 45,960 SGD 2005 1.55 $30,000 Social class

Household income is one of the most commonly used measures of income and, therefore, also one of the most prominent indicators of social class. Household income and education do not, however, always reflect perceived class status correctly. Sociologist Dennis Gilbert acknowledges that "... the class structure... does not exactly match the distribution of household income" with "the mismatch [being] greatest in the middle..." (Gilbert, 1998: 92) As social classes commonly overlap, it is not possible to define exact class boundaries. According to Leonard Beeghley[citation needed] a household income of roughly $95,000 would be typical of a dual-earner middle class household while $60,000 would be typical of a dual-earner working class household and $18,000 typical for an impoverished household. William Thompson and Joseph Hickey[citation needed] see common incomes for the upper class as those exceeding $500,000 with upper middle class incomes ranging from the high 5-figures to most commonly in excess of $100,000. They claim the lower middle class ranges from $35,000 to $75,000; $16,000 to $30,000 for the working class and less than $2,000 for the lower class.

Academic Class Models Dennis Gilbert, 2002 William Thompson & Joseph Hickey, 2005 Leonard Beeghley, 2004 Class Typical characteristics Class Typical characteristics Class Typical characteristics Capitalist class (1%) Top-level executives, high-rung politicians, heirs. Ivy League education common. Upper class (1%) Top-level executives, celebrities, heirs; income of $500,000+ common. Ivy league education common. The super-rich (0.9%) Multi-millionaires whose incomes commonly exceed $350,000; includes celebrities and powerful executives/politicians. Ivy League education common. Upper middle class[1] (15%) Highly-educated (often with graduate degrees), most commonly salaried, professionals and middle management with large work autonomy. Upper middle class[1] (15%) Highly-educated (often with graduate degrees) professionals & managers with household incomes varying from the high 5-figure range to commonly above $100,000. The Rich (5%) Households with net worth of $1 million or more; largely in the form of home equity. Generally have college degrees. Middle class (plurality/

majority?; ca. 46%)College-educated workers with considerably higher-than-average incomes and compensation; a man making $57,000 and a woman making $40,000 may be typical. Lower middle class (30%) Semi-professionals and craftsmen with a roughly average standard of living. Most have some college education and are white-collar. Lower middle class (32%) Semi-professionals and craftsman with some work autonomy; household incomes commonly range from $35,000 to $75,000. Typically, some college education. Working class (30%) Clerical and most blue-collar workers whose work is highly routinized. Standard of living varies depending on number of income earners, but is commonly just adequate. High school education. Working class (32%) Clerical, pink- and blue-collar workers with often low job security; common household incomes range from $16,000 to $30,000. High school education. Working class

(ca. 40% - 45%)Blue-collar workers and those whose jobs are highly routinized with low economic security; a man making $40,000 and a woman making $26,000 may be typical. High school education. Working poor (13%) Service, low-rung clerical and some blue-collar workers. High economic insecurity and risk of poverty. Some high school education. Lower class (ca. 14% - 20%) Those who occupy poorly-paid positions or rely on government transfers. Some high school education. Underclass (12%) Those with limited or no participation in the labor force. Reliant on government transfers. Some high school education. The poor (ca. 12%) Those living below the poverty line with limited to no participation in the labor force; a household income of $18,000 may be typical. Some high school education. - References: Gilbert, D. (2002) The American Class Structure: In An Age of Growing Inequality. Belmont, CA: Wadsworth; Thompson, W. & Hickey, J. (2005). Society in Focus. Boston, MA: Pearson, Allyn & Bacon; Beeghley, L. (2004). The Structure of Social Stratification in the United States. Boston, MA: Pearson, Allyn & Bacon.

- 1 The upper middle class may also be referred to as "Professional class" Ehrenreich, B. (1989). The Inner Life of the Middle Class. NY, NY: Harper-Colins.

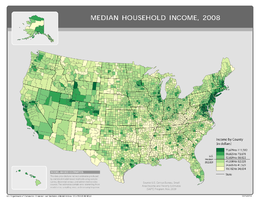

Income by state

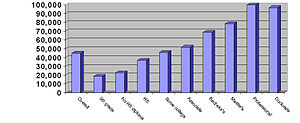

In 2010, the median household income by state ranged from $35,693 in Mississippi to $66,334 in Maryland. California, with the highest median home price in the nation[50] and home prices that far outpaced incomes,[52] only ranked ninth with a median household income of $61,021.[51] While California's median income was not near enough to afford the average California home or even a starter home, West Virginia, which had one of the nation's lowest median household incomes, also had the nation's lowest median home price.[50][51]

By Census Bureau Region, of the 15 states with the highest median household income, only Minnesota is located in the Mid-West, while five are in the Northeast (New Jersey, Connecticut, Massachusetts, New Hampshire and New York) three are in the South (Delaware, Maryland and Virginia), and the other six (Alaska, Hawaii, California, Washington, Colorado and Utah) are in the West.

The southern states had, on average, the lowest median household income, with nine of the country's fifteen poorest states located in the South. However, most of the poverty in the South is located in rural areas. Metropolitan areas such as Atlanta, Nashville, Charlotte, Raleigh-Durham, Richmond, Birmingham, Dallas, Houston, and Miami are areas within the southern states that have above average income levels. Overall, median household income tended to be the highest in the nation's most urbanized northeastern, upper midwestern and west coast states, while rural areas, mostly in the southern and mountain states, had the lowest median household income.[51]

Median Household Income by State[53]

Rank State 2009 2008 2007 2004–2006 Cost of Living Index[54] 2009 Data adjusted for COL 1 Maryland $69,272 $70,545 $68,080 $62,372 124.81 $55,502 2 New Jersey $68,342 $70,378 $67,035 $64,169 128.47 $53,197 3 Connecticut $67,034 $68,595 $65,967 $59,972 130.22 $51,477 4 Alaska $66,953 $68,460 $64,333 $57,639 132.64 $50,477 5 Hawaii $64,098 $67,214 $63,746 $60,681 165.56 $38,716 6 Massachusetts $64,081 $65,401 $62,365 $56,236 117.8 $54,398 7 New Hampshire $60,567 $63,731 $62,369 $60,489 116.68 $51,909 8 Virginia $59,330 $61,233 $59,562 $55,108 97.66 $60,752 District of Columbia $59,290 $57,936 $54,317 $47,221 (2005)[55] 139.92 $42,374 9 California $58,931 $61,021 $59,948 $53,770 132.56 $44,456 10 Delaware $56,860 $57,989 $54,610 $52,214 102.4 $55,527 11 Washington $56,548 $58,078 $55,591 $53,439 103.98 $54,384 12 Minnesota $55,616 $57,288 $55,082 $57,363 102.23 $54,403 13 Colorado $55,430 $56,993 $55,212 $54,039 102.23 $54,221 14 Utah $55,117 $56,633 $55,109 $55,179 95.15 $57,926 15 New York $54,659 $56,033 $53,514 $48,201 128.29 $42,606 16 Rhode Island $54,119 $55,701 $53,568 $52,003 123.25 $43,910 17 Illinois $53,966 $56,235 $54,124 $49,280 96.08 $56,168 18 Nevada $53,341 $56,361 $55,062 $50,819 101.39 $52,610 19 Wyoming $52,664 $53,207 $51,731 $47,227 98.66 $53,379 20 Vermont $51,618 $52,104 $49,907 $51,622 120.38 $42,879 United States $50,221 $52,029 $50,740 $46,242 (2005)[55] 21 Wisconsin $49,993 $52,094 $50,578 $48,874 96.45 $51,833 22 Pennsylvania $49,520 $50,713 $48,576 $47,791 100.67 $49,190 23 Arizona $48,745 $50,958 $49,889 $46,729 103.73 $46,992 24 Oregon $48,457 $50,169 $48,730 $45,485 110.47 $43,864 25 Texas $48,259 $50,043 $47,548 $43,425 91.04 $53,009 26 Iowa $48,044 $48,980 $47,292 $47,489 93.98 $51,122 27 North Dakota $47,827 $45,685 $43,753 $43,753 95.91 $49,867 28 Kansas $47,817 $50,177 $47,451 $44,264 91.31 $52,368 29 Georgia $47,590 $50,861 $49,136 $46,841 92.21 $51,610 30 Nebraska $47,357 $49,693 $47,085 $48,126 91.09 $51,989 31 Maine $45,734 $46,581 $45,888 $45,040 116.42 $39,284 32 Indiana $45,424 $47,966 $47,448 $44,806 94.19 $48,226 33 Ohio $45,395 $47,988 $46,597 $45,837 93.85 $48,370 34 Michigan $45,255 $48,591 $47,950 $47,064 95.25 $47,512 35 Missouri $45,229 $46,867 $45,114 $44,651 91.66 $49,344 36 South Dakota $45,043 $46,032 $43,424 $44,624 98.53 $45,715 37 Idaho $44,926 $47,576 $46,253 $46,395 93.04 $48,287 38 Florida $44,736 $47,778 $47,804 $44,448 98.39 $45,468 39 North Carolina $43,674 $46,549 $44,670 $42,061 96.21 $45,394 40 New Mexico $43,028 $43,508 $41,452 $40,827 98.88 $43,515 41 Louisiana $42,492 $43,733 $40,926 $37,943 96.15 $44,193 42 South Carolina $44,625 $43,329 $40,822 98.71 $42,997 43 Montana $42,322 $43,654 $43,531 $38,629 100 $42,322 44 Tennessee $41,725 $43,614 $42,367 $40,676 89.49 $46,625 45 Oklahoma $41,664 $42,822 $41,567 $40,001 90.09 $46,247 46 Alabama $40,489 $42,666 $40,554 $38,473 92.74 $43,659 47 Kentucky $40,072 $41,538 $40,267 $38,466 89.21 $44,919 48 Arkansas $37,823 $38,815 $38,134 $37,420 90.61 $41,743 49 West Virginia $37,435 $37,989 $37,060 $37,227 94.4 $39,656 50 Mississippi $36,646 $37,790 $36,338 $35,261 92.26 $39,720 Puerto Rico $18,314 $18,401 $17,741 $17,184 (2005)[55] Median income

The median income divides households in the US evenly in the middle with half of all household earning more than the median income and half of all households earning less than the median household income. In 2004 the median household income in the United States was $44,389.[6] According to the US Census Bureau, the median is "considerably lower than the average, and provides a more accurate representation."[56] Considering other racial and geographical differences in regards to household income, it should come as no surprise that the median household income varies with race, size of household and geography. The state with the highest median household income in the United States as of the US Census Bureau 2005/06 is New Jersey with $66,752, followed by Maryland, Hawaii and Connecticut, making the Northeastern United States the wealthiest area by income in the entire country.[57]

Regionally, in 2010, the Northeast reached a median income of $53,283, the West, $53,142, the South, $45,492, and the Midwest, $48,445.[58] Each figure represents a decline from the previous year.

While median household income has a tendency to increase up to four persons per household, it declines thereon after. This indicated that while four person households have larger incomes than those with one, two or three members, households seem to earn progressively less as their size increases beyond four persons. According to the US Census Bureau 2004 Community Survey, two-person households had a median income of $39,755, with $48,957 for three-person households, $54,338 for four-person households, $50,905 for five-person households, $45,435 for six-person households, with seven-or-more-person households having the second lowest median income of only $42,471.[59] In terms of race, Asian-American households had the highest median household income of $57,518, European-American households ranked second with $48,977, Hispanic or Latino households ranked third with $34,241. African-American or Black households had the lowest median household income of all races with $30,134.[60]

Mean income

Another common measurement of personal income is the mean household income. Unlike the median household income, which divides all households in two halves, the mean income is the average income earned by American households. In the case of mean income, the income of all households is divided by the number of all households.[61] The mean income is usually more affected by the relatively unequal distribution of income which tilts towards the top.[56] As a result, the mean tends to be higher than the median income, with the top earning households boosting it. Overall, the mean household income in the United States, according to the US Census Bureau 2004 Economic Survey, was $60,528, or $17,210 (39.73%) higher than the median household income.[62]

“ "Median income is the amount which divides the income distribution into two equal groups, half having income above that amount, and half having income below that amount. Mean income (average) is the amount obtained by dividing the total aggregate income of a group by the number of units in that group. The means and medians for households and families are based on all households and families. Means and medians for people are based on people 15 years old and over with income."[61]

-US Census Bureau, Frequently Asked Question, published by First Gov.” The US Census Bureau also provides a breakdown by self-identified ethnic groups as follows (as of March 2005):

Mean Household Income by Ethnicity[62] Ethnic Category Mean Household Income White alone $65,317 Black $40,685 Hispanic or Latino $45,871 Asian alone $76,747 See also

- Economy of the United States

- Excise

- Income inequality metrics

- Atkinson index

- Gini coefficient

- Hoover index

- Theil index

- International Ranking of Household Income

- Marriage gap

- Median household income in Australia and New Zealand

- Median income per household member

References

- ^ HUD.gov

- ^ "Definition of household income". Archived from the original on 2006-04-21. http://web.archive.org/web/20060421192927/http://www.sccommunityprofiles.org/glossary.asp. Retrieved 2006-08-10.

- ^ a b Gilbert, Dennis (1998). The American Class Structure. New York: Wadsworth Publishing. ISBN 0-534-50520-1.

- ^ "US Census Bureau news release in regards to median income". http://www.census.gov/Press-Release/www/releases/archives/income_wealth/012528.html. Retrieved 2007-08-28.[dead link]

- ^ "US Census Bureau median income per household member". http://pubdb3.census.gov/macro/032007/hhinc/new02_001.htm. Retrieved 2008-08-28.

- ^ a b c d e "US Census 2006 Economic Survey, income data". http://pubdb3.census.gov/macro/032007/hhinc/new06_000.htm. Retrieved 2007-08-28.

- ^ "US Census Bureau press release regarding poverty". http://www.census.gov/prod/2007pubs/p60-233.pdf. Retrieved 2008-07-04.

- ^ "US Census Bureau, income quintiles, 2007". http://pubdb3.census.gov/macro/032007/hhinc/new05_000.htm. Retrieved 2007-08-28.

- ^ a b Dugas, Christine (2003-09-15). "USAToday, the definition of middle class income". USA Today. http://www.usatoday.com/money/perfi/general/2003-09-14-middle-cover_x.htm. Retrieved 2006-07-14.

- ^ "Distribution of Income, Frank Levy". http://www.census.gov/Press-Release/www/releases/archives/income_wealth/012528.html. Retrieved 2007-11-10.[dead link]

- ^ "US Census Bureau, income quintiles, 2006". http://pubdb3.census.gov/macro/032006/hhinc/new05_000.htm. Retrieved 2007-02-11.

- ^ "US Census Bureau, Median household income 1990". http://www.demographia.com/db-stateinc2000.htm. Retrieved 2006-08-10.

- ^ "CPI inflation calculator, 1990 USD to 2003 USD". http://www.demographia.com/db-stateinc2000.htm. Retrieved 2006-08-10.

- ^ "US Treasury Income Mobility Study,, income data". http://www.treas.gov/press/releases/hp673.htm. Retrieved 2008-08-29.

- ^ "New York Times definition of class according to the quintiles". The New York Times. 2005-05-15. http://www.nytimes.com/packages/html/national/20050515_CLASS_GRAPHIC/index_01.html. Retrieved 2008-05-02.

- ^ "US Census Bureau, income quintilea and Top 5 Percent, 2004". http://pubdb3.census.gov/macro/032005/hhinc/new05_000.htm. Retrieved 2006-07-08.

- ^ a b "US Census Bureau, 2000 Census racial data". http://factfinder.census.gov/servlet/QTTable?_bm=y&-geo_id=01000US&-qr_name=DEC_2000_SF1_U_QTP6&-ds_name=D&-_lang=en&-redoLog=false. Retrieved 2006-06-29.

- ^ a b c d "US Census Bureau 2005 Economic survey, racial income distribution". http://pubdb3.census.gov/macro/032005/hhinc/new05_000.htm. Retrieved 2006-06-29.

- ^ a b c d e f "Educational attainment and median household income". http://www.census.gov/hhes/income/histinc/h13.html. Retrieved 2006-09-24.

- ^ "US Census Bureau, Income by education and sex". Archived from the original on 2006-04-11. http://web.archive.org/web/20060411165615/http://www.census.gov/hhes/income/earnings/call1usboth.html. Retrieved 2006-06-30.

- ^ "Wall Street Journal on MBA salary base". http://www.collegejournal.com/salarydata/mba/mbas.html. Retrieved 2006-06-30.

- ^ a b c "US Census Bureau on Education and Income". http://www.census.gov/prod/2002pubs/p23-210.pdf. Retrieved 2006-06-30.

- ^ "Infoplease, median household income". http://www.infoplease.com/ipa/A0104688.html. Retrieved 2006-06-29.

- ^ a b "Personal income and educational attainment, US Census Bureau". Archived from the original on 2006-09-07. http://web.archive.org/web/20060907174557/http://www.census.gov/hhes/income/histinc/p16.html. Retrieved 2006-09-24.

- ^ a b c "US Census Bureau median household income by age of householder". http://pubdb3.census.gov/macro/032005/hhinc/new02_001.htm. Retrieved 2006-07-07.

- ^ "US Census 2007 Economic Survey, income data". US Census Bureau. May 2008. http://www.census.gov/hhes/www/macro/032008/hhinc/new06_000.htm.

- ^ a b c "Income and poverty since 1967, US Census Bureau". http://www.census.gov/prod/2004pubs/p60-226.pdf. Retrieved 2006-09-26.

- ^ "US Census Bureau. (2001). Historical Income Tables – Income Equality.". Archived from the original on 2007-02-08. http://web.archive.org/web/20070208142023/http://www.census.gov/hhes/www/income/histinc/ie6.html. Retrieved 2007-06-20.

- ^ "Weinberg, D. H. (June 1996). A Brief Look At Postwar U.S. Income Inequality. US Census Bureau.". http://www.census.gov/prod/1/pop/p60-191.pdf. Retrieved 2007-06-20.

- ^ a b c "Income from 1969 to 1996, US Census Bureau". http://www.census.gov/prod/3/98pubs/p23-196.pdf. Retrieved 2006-09-26.

- ^ "Yellen, J. L. (November 6, 2006). Speech to the Center for the Study of Democracy at the University of California, Irvine. Federal Reserve Bank of San Francisco.". http://www.frbsf.org/news/speeches/2006/1106.html. Retrieved 2007-06-20.

- ^ "Johnston, D. (March 29, 2007). Income Gap Is Widening, Data Shows. The New York Times". 2007-03-29. http://www.nytimes.com/2007/03/29/business/29tax.html?ex=1332820800&en=fb472e72466c34c8&ei=5088&partner=rssnyt&emc=rss. Retrieved 2007-06-20.

- ^ "US Personal Income News Release". http://bea.gov/bea/newsrel/pinewsrelease.htm. Retrieved 2006-12-18.

- ^ "Overview of BLS statistics on Inflation and Spending". http://www.bls.gov/bls/inflation.htm. Retrieved 2006-12-18.

- ^ "US Households and Families 2000". http://www.census.gov/prod/2001pubs/c2kbr01-8.pdf. Retrieved 2006-12-18.

- ^ US Census Bureau. "Historical Income Tables – Households." Tables H-1 and H-6. Retrieved 2011-07-18.

- ^ "OECD, PPP conversion rates". http://www.oecd.org/dataoecd/61/56/1876133.xls. Retrieved 2006-01-20.

- ^ a b "Household income and expenditure 2008". http://www.bfs.admin.ch/bfs/portal/en/index/themen/20/02/blank/key/einkommen0/niveau.html. Retrieved 2010-08-23.

- ^ a b c d "Median Household Income for States by state 1984-2010". http://www.census.gov/hhes/www/income/data/historical/household/2010/H08_2010.xls.

- ^ "Median total income, by family type, by province and territory". http://www40.statcan.ca/l01/cst01/FAMIL108A-eng.htm.

- ^ 1.2'!L21 "Household income and income distribution". http://www.ausstats.abs.gov.au/Ausstats/subscriber.nsf/0/EE0E4B902276B5BCCA25761700191F85/$File/65230_detailed_tables_2007-08.xls#'Table 1.2'!L21. Retrieved 2010-07-17.

- ^ "New Zealand income survey showing median household income". http://www.stats.govt.nz/products-and-services/hot-off-the-press/nz-income-survey/new-zealand-income-survey-jun-07-qtr-hotp.htm?page=para002Master. Retrieved 2007-10-04.

- ^ "UK parliament discussion showing median household income". http://www.parliament.the-stationery-office.co.uk/pa/cm200506/cmhansrd/cm060719/text/60719w1831.htm. Retrieved 2006-12-31.

- ^ "israeli median household income, 2006". http://www1.cbs.gov.il/www/publications/households06/pdf/t03_1.pdf. Retrieved 2008-01-15.

- ^ "Scottish Economic Statistics 2007". http://www.scotland.gov.uk/Publications/2007/07/18083820/71. Retrieved 2007-10-09.

- ^ "(Korean) [통계로 읽는 경제 내 월급이 중간수준도 안돼? … `평균의 함정`에 빠졌네"]. http://www.hankyung.com/news/app/newsview.php?aid=2010122612051. Retrieved 2010-12-27.

- ^ "Hong Kong median household income, 2005". http://www.adb.org/Documents/Books/ADO/2005/hkg.asp. Retrieved 2007-01-19.

- ^ "Singapore median household income, 2005". http://www.singstat.gov.sg/keystats/annual/ghs/r2/chap3.pdf. Retrieved 2007-01-19.

- ^ a b c "Median home price by state". http://www.clevelandfed.org/Research/Regional/Trends/2005/nov/housing/home_values.cfm. Retrieved 2006-07-01.

- ^ a b c d "US Census Bureau, median household income by state 2004". Archived from the original on 2006-06-28. http://web.archive.org/web/20060628082502/http://www.census.gov/hhes/www/income/income04/statemhi.html. Retrieved 2006-07-01.

- ^ "Home prices outpacing income". http://www.jchs.harvard.edu/publications/markets/Son2002.pdf. Retrieved 2006-07-01.

- ^ 2008 Median Household Income. U.S. Census Bureau. Retrieved 2009-12-23. 2007 Median Household Income. U.S. Census Bureau. Retrieved 2009-12-23.

- ^ [1]

- ^ a b c Census.govPDF

- ^ a b "US Census Bureau on the nature the median in determining wealth". http://www.census.gov/prod/2003pubs/p70-88.pdf. Retrieved 2006-06-29.

- ^ "US Census Bureau, median household income by state". Archived from the original on 2006-06-28. http://web.archive.org/web/20060628082502/http://www.census.gov/hhes/www/income/income04/statemhi.html. Retrieved 2006-06-29.

- ^ "US Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States". http://www.census.gov/prod/2011pubs/p60-239.pdf. Retrieved 2011-11-19.

- ^ "US Census Bureau, median family income by family size". Archived from the original on 2006-06-26. http://web.archive.org/web/20060626001929/http://www.census.gov/hhes/www/income/medincsizeandstate.html. Retrieved 2006-06-29.

- ^ "US Census Bureau, median household income according to certain demographic characteristics". Archived from the original on 2006-06-18. http://web.archive.org/web/20060618064117/http://www.census.gov/Press-Release/www/releases/archives/income_wealth/005647.html. Retrieved 2006-06-29.

- ^ a b "US Government, the different between mean and median". Archived from the original on 2006-09-22. http://web.archive.org/web/20060922200944/http://www.business.gov/topics/research_resources/market_research/census_bureau_faq.html. Retrieved 2006-06-29.

- ^ a b "US Census Bureau, mean household income". http://pubdb3.census.gov/macro/032005/hhinc/new06_000.htm. Retrieved 2006-06-29.

External links

- Income, Poverty, and Health Insurance Coverage in the United States: 2003

- Has U.S. Income Inequality Really Increased? (CATO Institute)

- U.S. Census Bureau's web-site for income statistics

- NPR.org statistics and background on income inequality in the United States

- Datasets by U.S. State of low income, very low income, extremely low income limits

Social stratification: Social class Baronets • Bourgeoisie • Chattering classes • Classlessness • Creative class • Gentry • Lower middle class • Lumpenproletariat • Middle class • New class • Nobility • Nouveau riche/Parvenu • Old Money • Peasant/Serf • Petite bourgeoisie • Proletariat • Redneck • Ruling class • Slave class • Subaltern • Underclass • Upper class • Upper middle class • White trash • Working class • Working poorBy collar Life in the United States Affluence · Crime · Culture · Economic issues · Education (attainment) · Family structure · Health care · Health insurance · Holidays · Household income · Homelessness · Homeownership · Human rights · Income inequality · Labor unions · Languages · Middle class · Passenger vehicle transport · Personal income · Political ideologies · Poverty · Racism · Religion · Social class · Society · Sports · Standard of living · Wealth

United States (Outline) History Pre-Columbian era · Colonial era (Thirteen Colonies · Colonial American military history) · American Revolution (War) · Federalist Era · War of 1812 · Territorial acquisitions · Territorial evolution · Mexican–American War · Civil War · Reconstruction era · Indian Wars · Gilded Age · African-American Civil Rights Movement (1896–1954) · Spanish–American War · Imperialism · World War I · Roaring Twenties · Great Depression · World War II (Home front) · Cold War · Korean War · Space Race · African-American Civil Rights Movement (1955–1968) · Feminist Movement · Vietnam War · Post-Cold War (1991–present) · War on Terror (War in Afghanistan · Iraq War) · Timeline of modern American conservatismTopicsDemographic · Discoveries · Economic (Debt Ceiling) · Inventions (before 1890 · 1890–1945 · 1946–1991 · after 1991) · Military · Postal · Technological and industrialFederal

governmentLegislature - Congress

Senate

· Vice President

· President pro tem

House of Representatives

· Speaker

Judiciary - Supreme Court

Federal courts

Courts of appeal

District courtsExecutive - President

Executive Office

Cabinet / Executive departments

Civil service

Independent agencies

Law enforcement

Public policy

Intelligence

Central Intelligence Agency

Defense Intelligence Agency

National Security Agency

Federal Bureau of InvestigationPolitics Divisions · Elections (Electoral College) · Foreign policy · Foreign relations · Ideologies · Local governments · Parties (Democratic Party · Republican Party · Third parties) · Political status of Puerto Rico · Red states and blue states · Scandals · State governments · Uncle SamGeography Cities, towns, and villages · Counties · Extreme points · Islands · Mountains (Peaks · Appalachian · Rocky) · National Park System · Regions (Great Plains · Mid-Atlantic · Midwestern · New England · Northwestern · Southern · Southwestern · Pacific · Western) · Rivers (Colorado · Columbia · Mississippi · Missouri · Ohio · Rio Grande) · States · Territory · Water supply and sanitationEconomy Agriculture · Banking · Communications · Companies · Dollar · Energy · Federal Budget · Federal Reserve System · Financial position · Insurance · Mining · Public debt · Taxation · Tourism · Trade · Transportation · Wall StreetSociety TopicsCrime · Demographics · Education · Family structure · Health care · Health insurance · Incarceration · Languages (American English · Spanish · French) · Media · People · Public holidays · Religion · SportsAffluence · American Dream · Educational attainment · Homelessness · Homeownership · Household income · Income inequality · Middle class · Personal income · Poverty · Professional and working class conflict · Standard of living · WealthArchitecture · Art · Cinema · Cuisine · Dance · Fashion · Flag · Folklore · Literature · Music · Philosophy · Radio · Television · TheaterIssuesCategories:

Wikimedia Foundation. 2010.