- 2000s energy crisis

-

This article is about the causes and analysis of the relatively high oil prices of the 2000s. For discussion of the effects of the crisis, see Effects of the 2000s energy crisis. For a chronology of oil prices during this time, see 2003 to 2011 world oil market chronology.

2000s oil crisis

Medium term crude oil prices Jan. 2003 - Nov. 2008, (not adjusted for inflation)Other names Third oil crisis Date 2003 - 2008 From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. During 2003, the price rose above $30, reached $60 by August 11, 2005, and peaked at $147.30 in July 2008.[1] Commentators attributed these price increases to many factors, including reports from the United States Department of Energy and others showing a decline in petroleum reserves,[2] worries over peak oil,[3] Middle East tension, and oil price speculation.[4]

For a time, geo-political events and natural disasters indirectly related to the global oil market had strong short-term effects on oil prices, such as North Korean missile tests,[5] the 2006 conflict between Israel and Lebanon,[6] worries over Iranian nuclear plans in 2006,[7] Hurricane Katrina,[8][9] and various other factors.[10] By 2008, such pressures appeared to have an insignificant impact on oil prices given the onset of the global recession.[11] The recession caused demand for energy to shrink in late 2008, with oil prices falling from the July 2008 high of $147 to a December 2008 low of $32.[12] Oil prices stabilized by October 2009 and established a trading range between $60 and $80.[12]

Contents

New inflation-adjusted records

The price of crude oil in 2003 traded in a range between $20–$30/bbl.[13] Between 2003 and July 2008, prices steadily rose, reaching $100/bbl in late 2007, tying the previous all time inflation-adjusted record set in 1980.[14] A steep rise in the price of oil in 2008 - also mirrored by other commodities - culminated in an all time high of $147.27 during trading on July 11, 2008, more than a third above the previous inflation-adjusted high.[15]

High oil prices and economic weakness contributed to a demand contraction in 2007-2008. In the United States, gasoline consumption declined by 0.4% in 2007,[16] then fell by 0.5% in the first two months of 2008 alone.[17] Record-setting oil prices in the first half of 2008 and economic weakness in the second half of the year prompted a 1.2 Mbbl (190,000 m3)/day contraction in US consumption of petroleum products, representing 5.5% of total US consumption, the largest decline since 1980 at the climax of the 1979 energy crisis.[18]

Possible causes

Detailed analysis of changes in oil price from 1970–2007. The graph is based on the nominal, not real, price of oil.Demand

World crude oil demand grew an average of 1.76% per year from 1994 to 2006, with a high of 3.4% in 2003-2004. World demand for oil is projected to increase 37% over 2006 levels by 2030, according to the 2007 U.S. Energy Information Administration's (EIA) annual report.[19] In 2007, the EIA expected demand to reach an ultimate high of 118 million barrels per day (18.8×106 m3/d), from 2006's 86 million barrels (13.7×106 m3), driven in large part by the transportation sector.[20][21] A 2008 report from the International Energy Agency (IEA) predicted that although drops in petroleum demand due to high prices have been observed in developed countries and are expected to continue, a 3.7 percent rise in demand by 2013 is predicted in developing countries. This is projected to cause a net rise in global petroleum demand during that period.[22]

Transportation consumes the largest proportion of energy, and has seen the largest growth in demand in recent decades. This growth has largely come from new demand for personal-use vehicles powered by internal combustion engines.[23] This sector also has the highest consumption rates, accounting for approximately 55% of oil use worldwide as documented in the Hirsch report and 68.9% of the oil used in the United States in 2006.[24] Cars and trucks are predicted to cause almost 75% of the increase in oil consumption by India and China between 2001 and 2025.[25] In 2008, auto sales in China have been expected to grow by as much as 15-20 percent, resulting in part from economic growth rates of over 10 percent for 5 years in a row.[26]

Demand growth is highest in the developing world,[27] but the United States is the world's largest consumer of petroleum. Between 1995 and 2005, US consumption grew from 17.7 million barrels (2,810,000 m3) a day to 20.7 million barrels (3,290,000 m3) a day, a 3-million-barrel (480,000 m3) a day increase. China, by comparison, increased consumption from 3.4 million barrels (540,000 m3) a day to 7 million barrels (1,100,000 m3) a day, an increase of 3.6 million barrels (570,000 m3) a day, in the same time frame.[28] Per capita, annual consumption by people in the US is 24.85 barrels (3.951 m3),[29] 1.79 barrels (0.285 m3) in China,[30] and 0.79 barrels (0.126 m3) in India.[31]

As countries develop, industry, rapid urbanization and higher living standards drive up energy use, most often of oil. Thriving economies such as China and India are quickly becoming large oil consumers.[32] China has seen oil consumption grow by 8% yearly since 2002, doubling from 1996-2006.[27]

Although swift continued growth in China is often predicted, others predict that China's export dominated economy will not continue such growth trends due to wage and price inflation and reduced demand from the US.[33] India's oil imports are expected to more than triple from 2005 levels by 2020, rising to 5 million barrels per day (790×103 m3/d).[34]

Another large factor on petroleum demand has been human population growth. Because world population grew faster than oil production, production per capita peaked in 1979 (preceded by a plateau during the period of 1973-1979).[35] The world’s population in 2030 is expected to be double that of 1980.[36]

The role of fuel subsidies

State fuel subsidies have shielded consumers in many nations from the price rises, but many of these subsidies are being reduced or removed as the cost to governments of subsidization increases.

In June 2008, AFP reported that:

“ China became the latest Asian nation to curb energy subsidies last week after hiking retail petrol and diesel prices as much as 18 percent... Elsewhere in Asia, Malaysia has hiked fuel prices by 41 percent and Indonesia by around 29 percent, while Taiwan and India have also raised their energy costs.[37] ” In the same month, Reuters reported that:

“ Countries like China and India, along with Gulf nations whose retail oil prices are kept below global prices, contributed 61 percent of the increase in global consumption of crude oil from 2000 to 2006, according to JPMorgan. Other than Japan, Hong Kong, Singapore and South Korea, most Asian nations subsidize domestic fuel prices. The more countries subsidize them, the less likely high oil prices will have any affect [sic] in reducing overall demand, forcing governments in weaker financial situations to surrender first and stop their subsidies.

That is what happened over the past two weeks. Indonesia, Taiwan, Sri Lanka, Bangladesh, India, and Malaysia have either raised regulated fuel prices or pledged that they will.[38]

” The Economist reported: "Half of the world's population enjoys fuel subsidies. This estimate, from Morgan Stanley, implies that almost a quarter of the world's petrol is sold at less than the market price."[39] U.S. Secretary of Energy Samuel Bodman stated that around 30 million barrels per day (4,800,000 m3/d) of oil consumption (over a third of the global total) is subsidized.[37] But energy analyst Jeff Vail warned that cutting subsidies would do little to reduce global prices.[40]

Supply

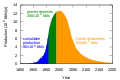

An important contributor to price increases has been the slow down in oil supply growth, which has continued since oil production surpassed new discoveries in 1980. The fact that global oil production will decline at some point, leading to lower supply is the main long-term fundamental cause of rising prices.[41] Although there is contention about the exact time at which global production will peak, there are now very few parties who do not acknowledge that the concept of a production peak is valid[citation needed]. However, before the record oil prices of 2008, some commentators argued that global warming awareness and new energy sources would limit demand before the effects of supply could, suggesting that reserve depletion would be a non-issue.[42]

A large factor in the lower supply growth of petroleum has been that oil's historically high ratio of Energy Returned on Energy Invested is in significant decline. Petroleum is a limited resource, and the remaining accessible reserves are consumed more rapidly each year. Remaining reserves are increasingly more technically difficult to extract and therefore more expensive. Eventually, reserves will only be economically feasible to extract at extremely high prices. Even if total oil supply does not decline, increasing numbers of experts[who?] believe the easily accessible sources of light sweet crude are almost exhausted and in the future the world will depend on more expensive unconventional oil reserves and heavy oil, as well as renewable energy sources. It is thought by many, including energy economists such as Matthew Simmons, that prices could continue to rise indefinitely until a new market equilibrium is reached at which point supply satisfies worldwide demand.

A prominent example of investment in non-conventional sources is seen in the Canadian tar sands. They are a far less cost-efficient source of heavy, low-grade oil than conventional crude, but when oil trades above $60/bbl, the tar sands become attractive to exploration and production companies. While Canada's tar sands region is estimated to contain as much "heavy" oil as all the world's reserves of "conventional" oil,[citation needed] efforts to economically exploit these resources lag behind the increasing demand of recent years.[43]

Until 2008, CERA (a consulting company wholly owned by energy consultants IHS Energy[44]) did not believe this would be such an immediate problem. However, in an interview with The Wall Street Journal, Daniel Yergin, previously known for his quotes that the price of oil would soon return down to "normal", amended the company's position on May 7, 2008 to predict that oil would reach $150 during 2008, due to tightness of supply[45] This reversal of opinion was significant, as CERA, among other consultancies, provided price projections that were used by many official bodies to plan long term strategy in respect of energy mix and price.

Other major energy organisations, such as the International Energy Agency (IEA), had already been much less optimistic in their assessments for some time.[46] In 2008, the IEA drastically reduced its prediction of production decline from 3.7% a year to 6.7% a year, based largely on better accounting methods, including actual research of individual oil field production throughout the world.[47]

Terrorist and insurgent groups have increasingly targeted oil and gas installations. Such attacks are sometimes perpetrated by militias in regions where oil wealth has produced few tangible benefits for the local citizenry, as is the case in the Niger Delta.

Many factors have resulted in possible and/or actual concerns about reduced supply of oil. The post-9/11 war on terror, Labor strikes, hurricane threats to oil platforms, fires and terrorist threats at refineries, and other short-lived problems are not solely responsible for the higher prices. Such problems do push prices higher temporarily, but have not historically been fundamental to long-term price increases.[clarification needed]

Investment demand

Investment demand for oil occurs when investors purchase futures contracts to buy a commodity at a set price for future delivery. "Speculators are not buying any actual crude. ... When [the] contracts mature, they either settle them with a cash payment or sell them on to genuine consumers."[48]

Several claims have been made implicating financial speculation as a major cause of the price increases. In May 2008 the transport chief for Germany's Social Democrats estimated that 25 percent of the rise to $135 a barrel had nothing to do with underlying supply and demand.[49] Testimony was given to a U.S. Senate committee in May indicating that "demand shock" from "Institutional Investors" had increased by 848 million barrels (134,800,000 m3) over the last five years, similar to increases in demand from China (920 million barrels (146,000,000 m3)).[50] The influence of Institutional Investors, such as sovereign-wealth funds, was also discussed in June 2008, when Lehman Brothers suggested that price increases were related to increases in exposure to commodities by such investors. It claimed that "for every $100 million in new inflows, the price of West Texas Intermediate, the U.S. benchmark, increased by 1.6%."[51] Also in May 2008, an article in The Economist pointed out that oil futures transactions on the New York Mercantile Exchange (NYMEX), nearly mirrored the price of oil increases for a several year period, however the article conceded that the increased investment might be following rising prices, rather than causing them, and that the nickel commodity market had halved in value between May 2007 and May 2008 despite significant speculative interest.[48] It also reminds readers "Investment can flood into the oil market without driving up prices because speculators are not buying any actual crude... no oil is hoarded or somehow kept off the market," and that prices of some commodities which are not openly traded have actually risen faster than oil prices.[48] In June 2008, OPEC's Secretary General Abdullah al-Badri stated that current world consumption of oil at 87 Mbbl/d (13,800,000 m3/d) was far exceeded by the "paper market" for oil, which equals about 1.36 billion bpd, or more than 15 times the actual market demand.[52]

In response to the possibility that financial speculators artificially inflated the oil market, the U.S. Congress began hearings in June 2008 to discover if actions to "tighten restrictions on pension funds, investment banks and other investors that they say are driving up fuel prices" were necessary.[53]

An interagency task force on commodities markets was formed in the U.S. government to investigate the claims of speculators influence on the petroleum market concluded in July 2008 that "market fundamentals" such as supply and demand provide the best explanations for oil price increases, and that increased speculation was not statistically correlated with the increases. The report also noted that increased prices with an elastic supply would cause increases in petroleum inventories. As inventories have actually declined, the task force concluded market pressures are most likely to blame. Similarly, other commodities which are not subject to market speculation (such as coal, steel, and onions) have seen similar price increases over the same time period.[54]

In June 2008 U.S. energy secretary Samuel Bodman had said that insufficient oil production, not financial speculation, was driving rising crude prices. He said that oil production has not kept pace with growing demand. "In the absence of any additional crude supply, for every 1% of crude demand, we will expect a 20% increase in price in order to balance the market," Bodman said.[55] This contradicts earlier statements by Iranian OPEC governor Mohammad-Ali Khatibi indicating that the oil market is saturated and that an increase in production announced by Saudi Arabia was "wrong". OPEC itself had also previously stated that the oil market was well supplied and that high prices were a result of speculation and a weak U.S. dollar.[56]

In September 2008, a study of the oil market by Masters Capital Management was released which claimed that speculation did significantly impact the market. The study stated that over $60 billion was invested in oil during the first 6 months of 2008, helping drive the price per barrel from $95 to $147 per barrel, and that by the beginning of September, $39 billion had been withdrawn by speculators, causing prices to fall.[57]

Monetary inflation and the value of the US Dollar

The Austrian School of economics holds that price inflation derives from monetary inflation, and its advocates, such as the Ludwig von Mises Institute and congressman Ron Paul, argue that loose monetary policy from the Federal Reserve and other central banks is a major contributor to the increase in oil prices, and the cause of both commodity speculation and dollar devaluation.[58][59]

Oil is quoted and traded in US Dollars. Therefore by definition the price or value of oil fluctuates based on investors' assessment of the value of oil and US Dollars. This has led to concern among some economists that the principal earned from the sale of oil may lose value in the long run if the U.S. dollar loses real value.[citation needed] Some analysts believe that as much as $25 of the June 2008 prices around $140 were due to dollar devaluation.[60]

The US Dollar price of oil demonstrated a strong positive correlation with the EUR/USD exchange rate from 2006 to 2010.[61]

Effects

Main article: Effects of the 2000s energy crisisThere is debate over what the effects of the 2000s energy crisis will be over the long term. Some speculate that an oil-price spike could create a recession comparable to those that followed the 1973 and 1979 energy crises or a potentially worse situation such as a global oil crash. Increased petroleum prices are however reflected in a vast number of products derived from petroleum, as well as those transported using petroleum fuels.[62]

Political scientist George Friedman has postulated that if high prices for oil and food persist, they will define the fourth distinct geopolitical regime since the end of World War II, the previous three being the Cold War, the 1989-2001 period in which economic globalization was primary, and the post-9/11 "war on terror".[63]

In addition to high oil prices, from year 2000 volatility in the price of oil has increased notably and this volatility has been suggested to be a factor in the ongoing financial crisis which began in 2008.[64]

Forecasted prices and trends

According to informed observers, OPEC, meeting in early December, 2007, seemed to desire a high but stable price that would deliver substantial needed income to the oil producing states, but avoid prices so high that they would negatively impact the economies of the oil consuming nations. A range of 70–80 dollars a barrel was suggested by some analysts to be OPEC's goal.[65]

Some analysts point out that major oil exporting countries are rapidly developing; and because they are using more oil domestically, less oil may be available on the international market. This effect, outlined in the export land economic model, could significantly reduce the oil available for trade and cause prices to continue to rise. Particularly significant are Indonesia (which is now a net importer of oil), Mexico and Iran (where demand is projected to exceed production in about 5 years), and Russia (whose domestic petroleum demand is growing rapidly).[66]

In May 2008, T. Boone Pickens, an influential oil investor who believes the world’s oil output is about to peak, predicted oil prices would hit $150 a barrel by the end of the year. “Eighty-five million barrels of oil a day is all the world can produce, and the demand is 87 m,” Mr Pickens said in an interview with CNBC. “It’s just that simple.”[67]

In June 2008, Alexei Miller, head of Russian energy giant Gazprom, warned that the price of oil is likely to hit $250 a barrel sometime in 2009. Miller said that while speculation had played a role in oil prices, "this influence was not decisive."[68] Bloomberg reported that, as of mid-June, "At least 3,008 options contracts have been purchased giving holders the right to buy oil at $250 a barrel in December".[69]

Also in June 2008, Shukri Ghanem, head of Libya's National Oil Corporation, said: "I think it [the oil price] will go higher. That is a trend that will continue for some time. The easy, cheap oil is over, peak oil is looming."[70]

On June 26, 2008, OPEC President Chakib Khelil said in an interview: "I forecast prices probably between $150-170 during this summer. That will perhaps ease towards the end of the year."[71] Iran's OPEC governor Mohammad-Ali Khatibi predicts that the price of oil would reach $150 a barrel by the end of this summer.[72]

Near-term peak oil proponent Matthew Simmons predicts a rise to $300 a barrel or higher by 2013 as sweet crude petroleum becomes more scarce and major producers begin failing to meet demand.[73]

In November, as prices fell below $60 a barrel, the IEA warned that falling prices may create both a lack of investment in new sources of oil and a fall in production of more expensive unconventional reserves such as the oil sands of Canada. The IEA's chief economist warned, "Oil supplies in the future will come more and more from smaller and more difficult fields," meaning that future production requires more investment every year. A lack of new investment in such projects, which had already been observed, could eventually cause new and more severe supply issues than had been experienced in the early 2000s according to the IEA. Because the sharpest production declines had been seen in developed countries, the IEA warned that the greatest growth in production was expected to come from smaller projects in OPEC states, raising their world production share from 44% in 2008 to a projected 51% in 2030. The IEA also pointed out that demand from the developed world may have also peaked, so that future demand growth was likely to come from developing nations such as China, contributing 43%, and India and the Middle East, each about 20%).[74]

Timothy Kailing argued against the IEA's earlier predictions in a 2008 Journal of Energy Security article. He pointed out the difficulty of increasing production even with vastly increased investment in exploration and production in mature petroleum regions. By looking at the historical response of production to variation in drilling effort, this analysis claimed that very little increase of production could be attributed to increased drilling. This was due to a tight the quantitative relationship of diminishing returns with increasing drilling effort: as drilling effort increased, the energy obtained per active drill rig was reduced according to a severely diminishing power law. This fact means that even an enormous increase of drilling effort is unlikely to lead to significantly increased oil and gas production in a mature petroleum region like the United States.[75]

In its 2008 World Energy Outlook, the International Energy Agency (IEA) predicted a rate of decline in output from the world's existing oilfields of 6.7% a year.[47]

The end of the crisis

By the beginning of September 2008, prices had fallen to $110. OPEC secretary Abdalla El-Badri said that it intended to cut output by about 500,000 barrels (79,000 m3) a day, which he saw as correcting a "huge oversupply" due to declining economies and a stronger U.S. dollar.[76] On September 10, the International Energy Agency (IEA) lowered its 2009 demand forecast by 140,000 barrels (22,000 m3) to 87.6 million barrels (13,930,000 m3) a day.[76]

As many countries throughout the world entered an economic recession in the third quarter of 2008, prices continued to slide. In November and December, global demand growth fell, and U.S. demand fell 10% overall from early October to early November 2008 (accompanying a significant drop in auto sales).[77]

In their December meeting, OPEC planned to reduce their production by 2.2 million barrels (350,000 m3) per day, though they admitted their resolution to reduce production in October had only an 85% compliance rate.[78]

Petroleum prices had fallen to below $35 in February 2009, but on May 6, 2009 had risen back to mid-November 2008 levels at about $56. The global economic downturn left oil storage facilities with more oil than in any year since 1990, when Iraq's invasion of Kuwait upset the market.[79]

As of May 2011, the price of U.S. WTI crude reached $113, while Brent crude, more indicative of world price due to a supply glut at Cushing Oklahoma, reached $127 a barrel.[80][81] After several weeks of fluctuating between rising and falling prices, protests in the Middle East and North Africa drove prices up. Although prices were beginning to ease with the calming of the revolution in Egypt, prices spiked to $100 for the first time since September 2008 with the 2011 Libyan civil war.[82]

Possible mitigations

Attempts to mitigate the impacts of oil price increases include:

- Increasing the supply of petroleum

- Finding substitutes for petroleum

- Decreasing the demand for petroleum

- Attempting to reduce the impact of rising prices on petroleum consumers

In mainstream economic theory, a free market rations an increasingly scarce commodity by increasing its price. A higher price should stimulate producers to produce more, and consumers to consume less, while possibly shifting to substitutes. The first three mitigation strategies in the above list are, therefore, in keeping with mainstream economic theory, as government policies can affect the supply and demand for petroleum as well as the availability of substitutes. In contrast, the last type of strategy in the list (attempting to shield consumers from rising prices) would seem to work against classical economic theory, by encouraging consumers to overconsume the scarce quantity, thus making it even scarcer. To avoid creating outright shortages, attempts at price control may require some sort of rationing scheme.

Alternative propulsion

Alternative fuels

Economists say that the substitution effect will spur demand for alternate fossil fuels, such as coal or liquefied natural gas and for renewable energies, such as solar power, wind power, and advanced biofuels.

For example, China and India are currently heavily investing in natural gas and coal liquefaction facilities. Nigeria is working on burning natural gas to produce electricity instead of simply flaring the gas, where all non-emergency gas flaring will be forbidden after 2008.[83][84] Outside the U.S., more than 50% of oil is consumed for stationary, non-transportation purposes such as electricity production where it is relatively easy to substitute natural gas for oil.[85]

Oil companies including the supermajors have begun to fund research into alternative fuel. BP has invested half a billion dollars for research over the next several years. The motivations behind such moves are to acquire the patent rights as well as understanding the technology so vertical integration of the future industry could be achieved.

Bioplastics and bioasphalt

Another major factor in petroleum demand is the widespread use of petroleum products such as plastic. These could be partially replaced by bioplastics, which are derived from renewable plant feedstocks such as vegetable oil, cornstarch, pea starch,[86] or microbiota.[87] They are used either as a direct replacement for traditional plastics or as blends with traditional plastics. The most common end use market is for packaging materials. Japan has also been a pioneer in bioplastics, incorporating them into electronics and automobiles.

Bioasphalt can also be used as a replacement of petroleum asphalt.

United States Strategic Fuel Reserve

The United States Strategic Petroleum Reserve could, on its own, supply current U.S. demand for about a month in the event of an emergency, unless it were also destroyed or inaccessible in the emergency. This could potentially be the case if a major storm were to hit the Gulf of Mexico, where the reserve is located. While total consumption has increased,[88] the western economies are less reliant on oil than they were twenty-five years ago, due both to substantial growth in productivity and the growth of sectors of the economy with little oil dependence such as finance and banking, retail, etc. The decline of heavy industry and manufacturing in most developed countries has reduced the amount of oil per unit GDP; however, since these items are imported anyway, there is less change in the oil dependence of industrialized countries than the direct consumption statistics indicate.

Fuel taxes

One recourse used and discussed in the past to avoid the negative impacts of oil shocks in the many developed countries which have high fuel taxes has been to temporarily or permanently suspend these taxes as fuel costs rise.

France, Italy, and the Netherlands lowered taxes in 2000 in response to protests over high prices, but other European nations resisted this option because public service financiation is partly based on energy taxes.[89] The issue came up again in 2004, when oil reached $40 a barrel causing a meeting of 25 EU finance ministers to lower economic growth forecasts for that year. Because of budget deficits in several countries, they decided to pressure OPEC to lower prices instead of lowering taxes.[90] In 2007, European truckers, farmers, and fishermen again raised concerns over record oil prices cutting into their earnings, hoping to have taxes lowered. In the United Kingdom, where fuel taxes were raised in October and are scheduled to rise again in April 2008, there was talk of protests and roadblocks if the tax issue was not addressed.[91] On April 1, 2008, a 25 yen per liter fuel tax in Japan was allowed to lapse temporarily.[92]

This method of softening price shocks is even less viable to countries with much lower gas taxes, such as the United States.

Demand management

Transportation demand management has the potential to be an effective policy response to fuel shortages[93] or price increases and has a greater probability of long term benefits than other mitigation options.[94]

There are major differences in energy consumption for private transport between cities; an average U.S. urban dweller uses 24 times more energy annually for private transport as a Chinese urban resident. These differences cannot be explained by wealth alone but are closely linked to the rates of walking, cycling, and public transport use and to enduring features of the city including urban density and urban design.[95]

For individuals, telecommuting provides alternatives to daily commuting and long-distance air travel for business. Technologies for telecommuting, such as videoconferencing, e-mail, and corporate wikis, continue to improve, in keeping with the overall improvement in information technologies ascribed to Moore's law. As the cost of moving information by moving human workers continues to rise, while the cost of moving information electronically continues to fall, presumably market forces should cause more people to substitute virtual travel for physical travel. Matthew Simmons explicitly calls for "liberating the workforce" by changing the corporate mindset from paying people to show up physically to work every day, to paying them instead for the work they do, from any location.[96] This would allow many more information workers to work from home either part-time or full-time, or from satellite offices or Internet cafes near to where they live, freeing them from long daily commutes to central offices. However, even full adoption of telecommuting by all eligible workers might only decrease energy consumption by about 1% (with present energy savings estimated at 0.01-0.04%). By comparison, a 20% increase in automobile fuel economy would save 5.4%.[97]

High energy prices and a slowed economy caused petroleum consumption to reach a three year low in crude oil imports to the United States in December 2008.[98]

Political action against market speculation

The price rises of mid-2008 led to a variety of proposals to change the rules governing energy markets and energy futures markets, in order to prevent rises due to market speculation.

On July 26, 2008, the United States House of Representatives passed the Energy Markets Emergency Act of 2008 (H.R. 6377),[99] which directs the Commodity Futures Trading Commission (CFTC) "to utilize all its authority, including its emergency powers, to curb immediately the role of excessive speculation in any contract market within the jurisdiction and control of the Commodity Futures Trading Commission, on or through which energy futures or swaps are traded, and to eliminate excessive speculation, price distortion, sudden or unreasonable fluctuations or unwarranted changes in prices, or other unlawful activity causing major market disturbances that prevent the market from accurately reflecting the forces of supply and demand for energy commodities.

See also

- Hirsch report

- Oil consumption

- 2003 to 2008 world oil market chronology

- World food price crisis

- 2000s commodities boom

Notes

- ^ http://tfc-charts.com/chart/QM/W

- ^ "Record oil price sets the scene for $200 next year". AME. July 6, 2006. http://www.ameinfo.com/90848.html. Retrieved 2007-11-29.

- ^ "Peak Oil News Clearinghouse". EnergyBulletin.net. http://www.energybulletin.net/.

- ^ "The Hike in Oil Prices: Speculation -- But Not Manipulation". http://www.spiegel.de/international/business/0,1518,556519,00.html.

- ^ "Missile tension sends oil surging". CNN. http://edition.cnn.com/2006/BUSINESS/07/05/oil.price/index.html. Retrieved 2010-04-21.

- ^ "Oil hits $100 barrel". BBC News. 2008-01-02. http://news.bbc.co.uk/2/hi/business/7083015.stm. Retrieved 2009-12-31.

- ^ "Iran nuclear fears fuel oil price". BBC News. 2006-02-06. http://news.bbc.co.uk/2/hi/business/4684844.stm. Retrieved 2009-12-31.

- ^ The Macroeconomic Effects of Hurricane Katrina, CRS Report for Congress

- ^ Hurricane Katrina whips oil price to a record high - The Times Online, August 30, 2005

- ^ Gross, Daniel (2008-01-05). "Gas Bubble: Oil is at $100 per barrel. Get used to it.". Slate. http://www.slate.com/id/2181282/.

- ^ "Oil Prices Fall As Gustav Hits". Sky News. September 2, 2008. http://news.sky.com/skynews/Home/Business/Oil-Prices-Fall-To-Four-month-Lows-Despite-Production-In-Gulf-of-Mexico-Shut-Due-To-Hurricane-Gustav/Article/200809115091229?lpos=Business_3&lid=ARTICLE_15091229_Oil%2BPrices%2BFall%2BTo%2BFour-month%2BLows%2BDespite%2BProduction%2BIn%2BGulf%2Bof%2BMexico%2BShut%2BDue%2BTo%2BHurricane%2BGustav. Retrieved May 5, 2009.

- ^ a b "Oil Ministers See Demand Rising, Price May Exceed $85". Bloomberg. 2010-05-10. http://www.bloomberg.com/apps/news?pid=20601072&sid=aqjfU59OuXbA.

- ^ "Weekly United States Spot Price FOB Weighted by Estimated Import Volume". U.S. Energy Information Administration. February 2009. Archived from the original on 2009-05-14. http://tonto.eia.doe.gov/dnav/pet/hist/wtotusaw.htm. Retrieved February 13, 2009.

- ^ "What is driving oil prices so high?". BBC. November 5, 2007. http://news.bbc.co.uk/1/hi/business/7048600.stm. Retrieved 2009-12-31.

- ^ Read, Madlen (July 11, 2008). "Oil sets new trading record above $147 a barrel". USA Today. http://www.usatoday.com/money/economy/2008-07-11-3815204975_x.htm.

- ^ Marianne Lavelle (March 4, 2008). "Oil Demand Is Dropping, but Prices Aren't". U.S. News & World Report. http://www.usnews.com/blogs/beyond-the-barrel/2008/3/4/oil-demand-is-dropping-but-prices-arent.html.

- ^ Frank Langfitt (March 5, 2008). "Americans Using Less Gasoline". NPR. Archived from the original on 2009-05-14. http://www.npr.org/templates/story/story.php?storyId=87924270. Retrieved 2009-05-07.

- ^ AC2 (February 10, 2009). "Short-Term Energy Outlook". U.S. Energy Information Administration. Archived from the original on 2009-05-14. http://www.eia.doe.gov/emeu/steo/pub/feb09.pdf. Retrieved February 13, 2009.

- ^ "Global Oil Consumption". U.S. Energy Information Administration. http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/oil_market_basics/demand_text.htm#Global%20Oil%20Consumption. Retrieved 2008-07-27.

- ^ "World oil demand 'to rise by 37%'". BBC News. 2006-06-20. http://news.bbc.co.uk/2/hi/business/5099400.stm. Retrieved 2009-12-31.

- ^ "2007 International Energy Outlook: Petroleum and other liquid fuels". U.S. Energy Information Administration. May 2007. http://www.eia.doe.gov/oiaf/ieo/oil.html.

- ^ Clifford Krauss (July 2, 2008). "Oil Demand Will Grow, Despite Prices, Report Says". The New York Times. http://www.nytimes.com/2008/07/02/business/02oil.html?ei=5124&en=d92ebb45abddef25&ex=1372651200&adxnnl=1&partner=digg&exprod=digg&adxnnlx=1215090471-nCZUb0Eg4s/EwFnWc0QBBg. Retrieved 2008-07-03.

- ^ Wood John H, Long Gary R, Morehouse David F (2004-08-18). "Long-Term World Oil Supply Scenarios: The Future Is Neither as Bleak or Rosy as Some Assert". Energy Information Administration. http://www.eia.doe.gov/pub/oil_gas/petroleum/feature_articles/2004/worldoilsupply/oilsupply04.html. Retrieved 2008-07-27.

- ^ "Domestic Demand for Refined Petroleum Products by Sector". U.S. Bureau of Transportation Statistics. http://www.bts.gov/publications/national_transportation_statistics/html/table_04_03.html. Retrieved 2007-12-20.

- ^ "Asia's Thirst for Oil". Wall Street Journal. 2004-05-05. http://www.iags.org/wsj050504.htm.

- ^ Joe Mcdonald (April 21, 2008). "Gas guzzlers a hit in China, where car sales are booming". Associated Press. http://biz.yahoo.com/ap/080421/china_auto_show_big_cars.html.

- ^ a b "International Petroleum (Oil) Consumption Data". U.S. Energy Information Administration. http://www.eia.doe.gov/emeu/international/oilconsumption.html. Retrieved 2007-12-20.

- ^ "BP Statistical Review of Energy - 2008". Beyond Petroleum. 2008. http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622. Retrieved 2008-07-27.

- ^ 20.7 Mbpd divided by the population of 304 million times 365 days/year

- ^ 6.5 Mbpd divided by the population of 1,325 million people times 365 days/year(figures from the CIA Factbook)

- ^ 2.45 Mbpd divided by the population of 1,136 million people times 365 days/year(figures from the CIA Factbook)

- ^ Oil price 'may hit $200 a barrel', BBC News

- ^ Kevin O'Brien (2008-07-02). "China's Negative Economic Outlook". Seeking Alpha. http://seekingalpha.com/article/83459-china-s-negative-economic-outlook. Retrieved 2008-07-27.

- ^ "China and India: A Rage for Oil". Business Week. 2005-08-25. http://www.businessweek.com/bwdaily/dnflash/aug2005/nf20050825_4692_db016.htm?chan=gb. Retrieved 2008-07-27.

- ^ Duncan Richard C (November 2001). "The Peak of World Oil Production and the Road to the Olduvai Gorge". Population & Environment 22 (5): 503–522. doi:10.1023/A:1010793021451. ISSN (Print) 1573-7810 (Online) 0199-0039 (Print) 1573-7810 (Online). http://dieoff.org/page224.htm.

- ^ "Total Midyear Population for the World: 1950-2050". U.S. Census Bureau. http://www.census.gov/ipc/www/idb/worldpop.html. Retrieved 2007-12-20.

- ^ a b "Chinese cut fuel subsidies but demand fears remain". AFP. http://afp.google.com/article/ALeqM5habiTClO6-7n56i9zrbBMxdYvWBA. Retrieved 2008-07-10.

- ^ "The hidden costs of fuel subsidies". Reuters. http://www.iht.com/articles/2008/06/04/business/rtrcol05.php. Retrieved 2008-07-10.

- ^ "Crude measures". The Economist. 2008-05-29. http://www.economist.com/finance/displaystory.cfm?story_id=11453151. Retrieved 2008-07-10.

- ^ "Eliminating Subsidies Won't Solve the Oil Demand Problem". Jeff Vail. http://www.jeffvail.net/2008/06/eliminating-subsidies-wont-solve-oil.html. Retrieved 2008-07-10.

- ^ Peak oil primer and links | EnergyBulletin.net | Peak Oil News Clearinghouse

- ^ Peter Davies, Economist for BP (14 June 2007). "____". The Independent. ""We don't believe there is an absolute resource constraint. When peak oil comes, it is just as likely to come from consumption peaking, perhaps because of climate change policies as from production peaking.""

- ^ "Canada: Pinning hopes on the tar sand". EnergyBulletin.net. http://www.energybulletin.net/1191.html.

- ^ "IHS Energy Acquires Cambridge Energy Research Associates (CERA)". September 1, 2004. http://www.ihs.com/News/Press-Releases/2004/04cera.htm. Retrieved 2007-11-30.

- ^ Neil King Jr, Spencer Swartz (May 7, 2008). "Some See Oil At $150 a Barrel This Year". Wall Street Journal. http://online.wsj.com/article/SB121010625118671575.html.

- ^ "Transcript: Interview with IEA chief economist". Financial Times. http://www.ft.com/cms/s/0/3c8940ca-8d46-11dc-a398-0000779fd2ac.html?nclick_check=1. Interview with Fatih Birol.

- ^ a b George Monbiot asks Fatih Birol, chief economist of IEA, when will the oil run out?, The Guardian,

- ^ a b c "Double, double, oil and trouble". The Economist. 2008-05-29. http://www.economist.com/research/articlesBySubject/displaystory.cfm?subjectid=381586&story_id=11453090. Retrieved 2008-06-17.

- ^ Evans-Pritchard, Ambrose (26 May 2008). "Germany in call for ban on oil speculation". The Daily Telegraph (London: The Telegraph). http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2008/05/26/cnoil126.xml. Retrieved 2008-06-07.

- ^ Masters, Michael. "Written Testimony" (PDF). United States Senate Committee on Homeland Security and Governmental Affairs. http://hsgac.senate.gov/public/_files/052008Masters.pdf. Retrieved 2008-05-28.

- ^ "Is Oil the Next 'Bubble' to Pop?". Wall Street Journal. 2008-06-04. http://online.wsj.com/article/SB121251666620041937.html. Retrieved 2008-06-17.

- ^ "OPEC chief appeals for calm over oil". Reuters. 2008-06-10. http://www.reuters.com/article/newsOne/idUSWLA462520080610?pageNumber=1&virtualBrandChannel=0. Retrieved 2008-06-10.

- ^ Associated Press (June 24, 2008). "Congress Plans to Tighten Rules on Energy Speculation". The New York Times. http://www.nytimes.com/2008/06/24/business/24speculate.html.

- ^ Interagency Task Force on Commodity Markets (July 2008). "Interim Report on Crude Oil" (PDF). Washington DC. http://www.cftc.gov/stellent/groups/public/@newsroom/documents/file/itfinterimreportoncrudeoil0708.pdf.

- ^ "Bodman: Insufficient oil production behind prices". International Herald Tribune. http://www.iht.com/articles/ap/2008/06/21/news/Saudi-Oil-Summit.php.

- ^ "Riyadh's crude output decision, wrong". Presstv.ir. http://www.presstv.ir/Detail.aspx?id=60393§ionid=351020103.

- ^ H. JOSEF HEBERT (2008-09-10). "Study links oil prices to speculation". The Associated Press. http://www.salon.com/wires/ap/2008/09/10/D933TU500_oil_speculation/. Retrieved 2008-09-11.

- ^ Frank Shostak (June 2, 2008). "The Oil-Price Bubble". Ludwig von Mises Institute. http://mises.org/story/2999.

- ^ Ron Paul (June 9, 2008). "Rising Energy Prices and the Falling Dollar". US House of Representatives website. http://www.house.gov/paul/tst/tst2008/tst060908.htm.

- ^ Tom Raum (July 6, 2008). "The buck doesn't stop here; it just keeps falling". Associated Press. Archived from the original on 2008-07-13. http://web.archive.org/web/20080713074902/http://news.yahoo.com/s/ap/20080706/ap_on_bi_ge/dollar_doldrums. Retrieved 2008-07-06.

- ^ OilInsights.net (May 21, 2010). "Euro and Oil outlook – Trailing correlation between crude oil prices and Euro-USD exchange rates". http://oilinsights.net/index.php/2010/05/21/euro-and-oil-outlook-%E2%80%93-trailing-correlation-between-crude-oil-prices-and-euro-usd-exchange-rates/. Retrieved 2010-05-24.

- ^ Gas costs are reflected in nearly everything you buy | Dallas Morning News | News for Dallas, Texas | Breaking News for Dallas-Fort Worth | Dallas Morning News

- ^ Friedman, George (2008-05-27). "The geopolitics of $130 oil". Stratfor. http://www.stratfor.com/weekly/geopolitics_130_oil. Retrieved 2008-07-11.

- ^ Tom Therramus, (editor, Gail the Actuary) - Was Volatility in the Price of Oil a Cause of the 2008 Financial Crisis? The Energy Bulletin, 2009

- ^ Mouawad, Jad (2007-12-06). "OPEC Finds Price Range to Live With". The New York Times. http://www.nytimes.com/2007/12/06/business/worldbusiness/06opec.html. Retrieved 2008-05-08.

- ^ Krauss, Clifford (2007-12-09). "Oil-Rich Nations Use More Energy, Cutting Exports". The New York Times. http://www.nytimes.com/2007/12/09/business/worldbusiness/09oil.html. Retrieved 2008-05-08.

- ^ Pickens: Oil Going to $150, So Move to Gas, CNBC.com

- ^ Russia's Gazprom predicts $250 oil in 2009, Reuters

- ^ "Gazprom CEO's $250 Oil Forecast Is Doom Traders Love". Bloomberg.com. 2008-06-16. http://www.bloomberg.com/apps/news?pid=20601109&sid=a1OfxCNSkbnI&refer=home. Retrieved 2008-06-17.

- ^ Domestic energy bills expected to soar as cost of oil keeps increasing, The Guardian

- ^ Chief Sees $150-170 Oil in Coming Months, Reuters

- ^ OPEC governor: Oil to hit $150, Press TV

- ^ Ferris-Lay, Claire (2008-02-28). "Oil could reach $300, says expert". ArabianBusiness.com. http://www.arabianbusiness.com/512436-oil-could-reach-us300-claims-expert. Retrieved 2008-03-27.

- ^ IEA warns of new oil supply crunch (Subscription Required). By Carola Hoyos, Ed Crooks, and Javier Blas. Financial Times. Published November 12, 2008.

- ^ Kailing Timothy D (December 2008). "Can the United States Drill Its Way to Energy Security?". Journal of Energy Security. http://www.ensec.org/index.php?option=com_content&view=article&id=166:can-us-drill-its-way-to-energy-security&catid=90:energysecuritydecember08&Itemid=334/.

- ^ a b Crude Oil Rises After OPEC Agrees to Trim Excess Production. By Margot Habiby and Alexander Kwiatkowski. Bloomberg L.P. Published September 10, 2008.

- ^ Well Prepared. The Economist. Published November 6, 2008.

- ^ OPEC Cut Has Little Zing. By Parmy Olson. Forbes.com Published December 18, 2008.

- ^ Dirk Lammers (May 6, 2009). "Oil prices jump to high for the year". Yahoo! Finance. Archived from the original on 2009-05-14. http://www.webcitation.org/5glwc7hoY. Retrieved 2009-05-07.

- ^ http://www.uprr.com/customers/surcharge/wti.shtml

- ^ Mason, Rowena (2011-08-10). "Brent crude price drops below $100". The Daily Telegraph (London). http://www.telegraph.co.uk/finance/oilprices/8692458/Brent-crude-price-drops-below-100.html.

- ^ Assis, Claudia, "Oil futures extend gains amid unrest," USA Today, February 23, 2011.[1]

- ^ http://www.tribune.com.ng/20062006/eog.html

- ^ http://www.climatelaw.org/media/gas.flaring/report/section5

- ^ Demand

- ^ Development of a pea starch film with trigger biodegradation properties for agricultural applications

- ^ Accumulation of biopolymers in activated sludge biomass

- ^ "Demand" (PDF). Energy Information Administration. http://www.eia.doe.gov/emeu/aer/pdf/pages/sec11_21.pdf.

- ^ Barry James (September 12, 2000). "Amid Protests, Europe's Leaders Resist Oil-Tax Cut". International Herald Tribune. http://www.iht.com/articles/2000/09/12/belg.2.t.php.

- ^ Paul Meller (June 3, 2004). "EU states to avoid unilateral oil tax cuts". International Herald Tribune. http://www.iht.com/articles/2004/06/03/euoil_ed3_.php.

- ^ James Kanter (November 9, 2007). "European politicians wrestle with high gasoline prices". International Herald Tribune. http://www.iht.com/articles/2007/11/09/business/fuel.php.

- ^ Peter Alford (April 2, 2008). "Japanese motorists reap fuel windfall". The Australian. http://www.theaustralian.news.com.au/story/0,25197,23468940-2703,00.html.

- ^ Gueret, Thomas Travel Demand Management Insights IEA conference 2005

- ^ Litman, Todd "Appropriate Response to Rising Fuel Prices" Victoria Transport Policy Institute

- ^ Kenworthy, J R Transport Energy Use and Greenhouse Emissions in Urban Passenger Transport Systems : A Study of 84 Global Cities Murdoch University

- ^ Lundberg, Jan. "The maturation of Matt Simmons, energy-industry investment banker and peak oil guru". www.energybulletin.net. Archived from the original on 2008-04-11. http://web.archive.org/web/20080411035026/http://www.energybulletin.net/17555.html. Retrieved 2011-10-05.

- ^ Matthews, H. Scott. "Telework Adoption and Energy Use in Building and Transport Sectors in the United States and Japan". Journal of Infrastructure Systems. http://scitation.aip.org/getabs/servlet/GetabsServlet?prog=normal&id=JITSE4000011000001000021000001&idtype=cvips&gifs=yes/&ref=no. Retrieved 2010-07-15.

- ^ CRUTSINGER, MARTIN (2009-03-13). "Trade deficit falls to $36 billion in January". The Associated Press. http://www.google.com/hostednews/ap/article/ALeqM5jsanM66tszKz1zFq0LOG4XvWS7zAD96T5NEO0. Retrieved 2009-03-13.

- ^ Energy Markets Emergency Act of 2008, Opencongress.org

External links

Peak Oil Core issues

Results/responses Hirsch report · Oil Depletion Protocol · Price of petroleum · 2000s energy crisis · Energy crisis · Export Land Model · Food vs fuel · Oil reserves · Pickens Plan · Swing producer · Transition TownsPeople Books Films A Crude Awakening · Collapse · The End of Suburbia · Oil Factor · PetroApocalypse Now? · How Cuba Survived Peak Oil · What a Way to GoOrganizations Other "peaks" Late-2000s financial crisis - Late-2000s recession

- 2008 G-20 Washington summit

- APEC Peru 2008

- 2009 G-20 London Summit

- 2009 G-20 Pittsburgh summit

- APEC Singapore 2009

- 2010 G-20 Toronto summit

- 2010 G-20 Seoul summit

Specific issues - 2000s energy crisis (2008 Central Asia energy crisis)

- 2007–2008 world food price crisis

- 2008–2009 Keynesian resurgence

- 2008–10 California budget crisis

- 2008–2011 Irish banking crisis

- Automotive industry crisis of 2008–2010

- Effects of the financial crisis of 2007–2010 on museums

- European sovereign debt crisis (timeline)

- Future of newspapers

- January 2008 Société Générale trading loss incident

- List of entities involved in 2007–2008 financial crises (acquired or bankrupt banks; business failures)

- Subprime mortgage crisis (timeline; writedowns)

- United States housing market correction

By country (or region) - Belgium

- Greece

- Iceland

- Ireland

- Latvia

- Russia

- Spain

- Ukraine

- Africa

- Americas

- United States

- Asia

- Europe

- Oceania

Legislation and policy responses Banking and finance

stability and reform- Banking (Special Provisions) Act 2008

- Commercial Paper Funding Facility

- Emergency Economic Stabilization Act of 2008

- Troubled Asset Relief Program

- Term Asset-Backed Securities Loan Facility

- Temporary Liquidity Guarantee Program

- 2008 United Kingdom bank rescue package

- China–Japan–South Korea trilateral summit

- Anglo Irish Bank Corporation Act 2009

- 2009 G-20 London Summit

- Irish emergency budget, 2009

- National Asset Management Agency

- Irish budget, 2010

- Dodd–Frank Wall Street Reform and Consumer Protection Act

Bank stress tests- EU

- US

Stimulus and recovery - National fiscal policy response to the late 2000s recession

- Housing and Economic Recovery Act of 2008

- Economic Stimulus Act of 2008

- Chinese economic stimulus program

- 2008 European Union stimulus plan

- American Recovery and Reinvestment Act of 2009

- Fraud Enforcement and Recovery Act of 2009

- Green New Deal

Companies and banking institutions Companies in bankruptcy,

reorganization, administration,

or other insolvency proceedings

(listed alphabetically)- Air America Radio

- Allco Finance Group

- American Freedom Mortgage

- American Home Mortgage

- Arena Football League

- Babcock & Brown

- BearingPoint

- Bernard L. Madoff Investment Securities LLC

- BI-LO (United States)

- Borders Group

- Charter Communications

- Chrysler (Chapter 11 reorganization)

- Circuit City Stores

- CIT Group

- Citadel Broadcasting

- Conquest Vacations

- DSB Bank

- Eddie Bauer

- FairPoint Communications

- Friendly's Ice Cream

- General Growth Properties

- General Motors (Chapter 11 reorganization)

- Great Southern Group

- Icesave

- Kaupthing Singer & Friedlander

- Lehman Brothers (bankruptcy)

- Linens 'n Things

- Mervyns

- Midway Games

- Movie Gallery

- NetBank

- New Century

- Nortel

- Petters Group Worldwide

- R. H. Donnelley

- Rothstein Rosenfeldt Adler

- Saab Automobile

- Sbarro

- Sentinel Management Group

- Silicon Graphics

- Stanford Financial Group

- Sun-Times Media Group

- Terra Securities (scandal)

- Thornburg Mortgage

- Tribune Company

- Tweeter Opco, LLC

- Uno Chicago Grill

- Washington Mutual

- Waterford Wedgwood

- Woolworths Group

- Yamato Life

Government interventions,

rescues, and acquisitions

(listed alphabetically)- ACC Capital Holdings

- Allied Irish Banks

- American International Group

- Anglo Irish Bank (nationalisation)

- Bank of America

- Bank of Antigua

- Bank of Ireland

- Bear Stearns

- Bradford & Bingley

- Chrysler

- Citigroup

- CL Financial

- Dexia

- Fannie Mae (takeover)

- Fortis

- Freddie Mac (takeover)

- General Motors

- Glitnir

- HBOS

- Hypo Real Estate

- IndyMac Federal Bank

- ING Group

- Kaupthing Bank

- Landsbanki

- Northern Rock (nationalisation)

- Parex Bank

- Royal Bank of Scotland Group

- Straumur Investment Bank

- U.S. Central Credit Union

Company acquisitions

(listed alphabetically)- Alliance & Leicester

- Ameriquest Mortgage

- Barnsley Building Society

- Bear Stearns

- Blockbuster Inc.

- Cheshire Building Society

- Countrywide Financial

- Derbyshire Building Society

- Dunfermline Building Society

- HBOS

- Merrill Lynch

- National City Corp. (acquisition by PNC)

- Scarborough Building Society

- Sovereign Bank

- Wachovia

- Washington Mutual

Other topics Alleged frauds

and fraudsters- Nicholas Cosmo

- Fairfield Greenwich Group

- Seán FitzPatrick (Anglo Irish Bank hidden loans controversy)

- Paul Greenwood

- Angelo Mozilo

- Arthur Nadel

- Kazutsugi Nami (Enten controversy)

- Stanford Financial Group (Allen Stanford; James M. Davis; Laura Pendergest-Holt)

- Barry Tannenbaum

- UBS

- Stephen Walsh

Proven or admitted

frauds and fraudsters- Marc Stuart Dreier

- Joseph S. Forte

- Norman Hsu

- Du Jun

- Bernard Madoff (Madoff investment scandal; Frank DiPascali; David G. Friehling)

- Tom Petters

- Raj Rajaratnam (Galleon Group)

- Scott W. Rothstein

- Mahindra Satyam (Satyam scandal; Byrraju Ramalinga Raju)

Related entities - Federal Deposit Insurance Corporation

- Federal Home Loan Banks

- Federal Housing Administration

- Federal Housing Finance Agency

- Federal Housing Finance Board

- Federal Reserve System

- Government National Mortgage Association

- Office of Federal Housing Enterprise Oversight

- Office of Financial Stability

- UK Financial Investments Limited

- United States Consumer Financial Protection Bureau

Securities involved

and financial marketsRelated topics - 2008 Greek riots

- 2009 California college tuition hike protests

- 2009 Icelandic financial crisis protests

- 2009 May Day protests

- 2010 French pension reform strikes

- 2010 UK student protests

- 2010–2011 Greek protests

- 2011 United Kingdom anti-austerity protests

- 2011 United States public employee protests

- Arab Spring

- Bailout

- Bank run

- Capitalism: A Love Story

- Credit crunch

- Dot-com bubble

- Economic bubble

- Financial contagion

- Financial crisis

- Great Depression

- Impact of the Arab Spring

- Inside Job

- Interbank lending market

- Jon Stewart's 2009 criticism of CNBC

- Liquidity crisis

- PIIGS

- Tea Party protests

- Occupy movement

- United States housing bubble

- Wall Street: Money Never Sleeps

Categories:- 2000s energy crisis

- Economic problems

- Peak oil

Wikimedia Foundation. 2010.