- Real versus nominal value (economics)

-

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal For engineering and other usages, see Real versus nominal value.In economics, nominal value refers to a value expressed in money terms (that is, in units of a currency) in a given year or series of years. By contrast, real value adjusts nominal value to remove effects of price changes over time. For example, changes in the nominal value of some commodity bundle over time can happen because of a change in the quantities in the bundle or their associated prices, whereas changes in real values reflect only changes in quantities.

Real values over time are a measure purchasing power net of any price changes over time. They are often used for restating nominal income to real income, thus adjusting that part of income changes that merely offset inflation (a general increase in prices). Similarly, for aggregate measures of output, such as gross domestic product (GDP), the nominal amount reflects production quantities and prices in that year, whereas real amounts in different years reflect only changes in quantities. A series of real values over time, such as for real GDP, measures relative quantities over time expressed in prices of one year, called the base year (or more generally the base period).

In a related fashion, the real value of a commodity bundle in a given year may be derived from its nominal value by replacing then-current prices of commodities in the bundle with prices that prevailed in the base year. Real values in different years then express values of the bundles as if prices had been constant for all the years, with any differences due to differences in underlying quantities.

The nominal value of a commodity bundle in a given year may be expressed in prices and quantities, namely, as a sum of prices times quantities for the different commodities in the bundle. In turn nominal values are related to real values by the following arithmetic definition:

- nominal value / real value = P x Q / Q = P.

Here P serves as a price index, and Q serves as a quantity index of real value. In the equation, P is constructed to equal 1.00 in the base year. Alternatively, P can be constructed to equal 100 in the base year:

- (nominal value / real value) x 100 = P.

note: the base year can be any year but government economists usually uses the same base year for 5 consecutive years. In Canada, a base year was 2002 then 2007 and Canadians will continue using 2007 as a base year up until 2013.

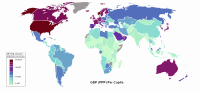

The nominal/real value distinction can apply not only to time-series data, as above, but to cross-section data varying by region, for example a cost-of-living index.

Contents

Illustration, notation, and generalization

The simplest case of a bundle of commodities (goods) is one that has only one commodity. In that case, output or consumption may be measured either in terms of money value (nominal) or physical quantity (real). Let i designate that commodity and let:

- Pi = the unit price of i, say, $5

- Qi = the quantity of i, say, 10 units.

The nominal value of the bundle would then be price times quantity:

- nominal value of i = Pi x Qi = $5 x 10 = $50.

Given only the nominal value and price, derivation of a real value is immediate:

- real value of bundle i = Pi x Qi/Pi = Qi = 50/5 = 10.

The price "deflates" (divides) the nominal value to derive a real value, the quantity itself.

Similarly for a series of years, say five, given only nominal values of the good and prices in each year t, a real value can be derived for each of the five years:

- real value of bundle i in year t = nominal value of Qit/Pit = Qit.

This example generalizes for nominal values relative to real values across different years for which P, a price index comparing the general price level across years, is available. Consider a nominal value (say of an hourly wage rate) in each different year t. To derive a real-value series from a series of nominal values in different years, divide nominal value in each year by Pt, the price index in that year. By definition then:

- real value in year t = nominal value in year t/Pt.

Numerical example: If for years 1 and 2 (say 20 years apart) the nominal wage and P are respectively

- $10 and $16

- $1.00 and $1.333,

real wages are respectively:

- 10 (= $10/$1.00) and 12 (= $16/$1.333).

The real wage so constructed in each different year indexes the amount of commodities in that year that could be purchased relative to other years. Thus, in the example the price level increased by 33 percent, but the real wage rate still increased by 20 percent, permitting a 20 percent increase in the quantity of commodities the nominal wage could purchase.

The generalization to a commodity bundle from the single-good illustration above is to a bundle of quantities of different commodities and different years. This has practical use, because price indexes and the National Income and Product Accounts are constructed from such bundles of commodities and their respective prices.

A sum of nominal values for each of the different commodities in the bundle is also called a nominal value. A bundle of n different commodities with corresponding prices and quantities for each year t defines:

- nominal value of that bundle in year t = P1t x Q1t + . . . + Pnt x Qnt.

From the above:

- Pt = the value of a price index in year t.

The nominal value of the bundle over a series of years and corresponding Pt define:

- real value of the bundle in year t = Qt = nominal value of the bundle in year t/Pt.

Alternatively, multiplying both sides by Pt:

- nominal value of the bundle in year t = Pt x Qt.

So, every nominal value can be dichotomized into a price-level part and a real part. The real part Qt is an index of the quantities in the bundle.

An illustration of a nominal-value sum is nominal GDP. An illustration of a real-value sum (or quotient) is real GDP.

Uses and examples

Nominal values—such as nominal wages or (nominal) gross domestic product—refer to amounts that are paid or earned in money terms. In the illustration of the previous section, for a single good with a nominal value, the nominal value of the good was divided by its unit price to calculate its real value, namely the quantity of the good. The same general method applies for calculation of other real values, except that a price index is used instead of the price of a single commodity. Real values (such as real wages or real gross domestic product) can be derived by dividing the relevant nominal value (money wages or nominal GDP) by the appropriate price index. For consumers, a relevant bundle of goods is that used to compute the Consumer Price Index. So, for wage earners as consumers a relevant real wage is the nominal wage (after-tax) divided by the CPI. A relevant divisor of nominal GDP is the GDP price index.

Real values represent the purchasing power of nominal values in a given period, including wages, interest, or total production. In particular, price indexes are typically calculated relative to some base year. If for example the base year is 1992, real values are expressed in constant 1992 dollars, referenced as 1992=100, since the published index is usually normalized to equal 100 in the base year. To use the price index as a divisor for converting a nominal value into a real value, as in the previous section, the published index is first divided by the base-year price-index value of 100. In the U.S. National Income and Product Accounts, nominal GDP is called GDP in current dollars (that is, in prices current for each designated year), and real GDP is called GDP in [base-year] dollars (that is, in dollars that can purchase the same quantity of commodities as in the base year). In effect the price index of 100 for the base year is a numéraire for price-index values in other years.

The terminology of classical economics used by Adam Smith used a unit of labour as the purchasing power unit, so monetary quantities were deflated by wages to indicate the number of hours of labour required to produce or purchase a given quantity.

Interest rates

- Real interest rates are measured as the difference between nominal interest rates and the rate of inflation.

- The expected real interest rate is the nominal interest rate minus the inflation rate expected over the term of the loan.

- The realized (ex post) real interest rate has the actual inflation rate subtracted from the nominal interest rate.

The relationship above is approximate only. The actual relationship is:[1] (1+IRN)=(1+IRR)(1+I), where:

- IRN is the nominal interest rate,

- IRR is the real interest rate, and

- I is the inflation rate

See also

- Constant Item Purchasing Power Accounting

- Aggregation problem

- Classical dichotomy

- Cost-of-living index

- Deflation

- Index (economics)

- Inflation

- Money illusion

- National accounts

- Neutrality of money

- Numéraire

- Peppercorn (legal), a nominal fee paid to fulfill a contractual requirement

- Real interest rate

- Inflation accounting

- real prices and ideal prices

- Financial repression

Notes

References

- W.E. Diewert, "index numbers," ([1987] 2008)The New Palgrave Dictionary of Economics, 2nd ed. Abstract.

- R. O'Donnell (1987). "real and nominal quantities," The New Palgrave: A Dictionary of Economics, v. 4, pp. 97-98 (Adam Smith's early distinction vindicated)

- Amartya Sen (1979). "The Welfare Basis of Real Income Comparisons: A Survey," Journal of Economic Literature, 17(1), pp. 1-45.

- D. Usher (1987). "real income," The New Palgrave: A Dictionary of Economics, v. 4, pp. 104-05

External links

- DataBasics: Deflating Nominal Values to Real Values from Federal Reserve Bank of Dallas

- CPI Inflation Calculator from U.S. Bureau of Labor Statistics

Wikimedia Foundation. 2010.