- Opportunity cost

-

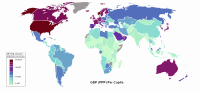

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen (that is foregone). It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices.[1] The opportunity cost is also the cost of the foregone products after making a choice. Opportunity cost is a key concept in economics, and has been described as expressing "the basic relationship between scarcity and choice".[2] The notion of opportunity cost plays a crucial part in ensuring that scarce resources are used efficiently.[3] Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output foregone, lost time, pleasure or any other benefit that provides utility should also be considered opportunity costs.

The term was coined in 1914 by Friedrich von Wieser in his book "Theorie der gesellschaftlichen Wirtschaft".[4] However, in 1848 Frédéric Bastiat described this concept in his essay...What Is Seen and What Is Not Seen

Contents

Opportunity costs in consumption

Opportunity cost is assessed in not only monetary or material terms, but also in terms of anything which is of value. For example, a person who desires to watch each of two television programs being broadcast simultaneously, and does not have the means to make a recording of one, can watch only one of the desired programs. Therefore, the opportunity cost of watching Dallas could be not enjoying the other program (such as Dynasty). If an individual records one program while watching the other, the opportunity cost will be the time that the individual spends watching one program versus the other. In a restaurant situation, the opportunity cost of eating steak could be trying the salmon. The opportunity cost of ordering both meals could be twofold: the extra $20 to buy the second meal, and his reputation with his peers, as he may be thought of as greedy or extravagant for ordering two meals. A family might decide to use a short period of vacation time to visit Disneyland rather than doing household improvements. The opportunity cost of having happier children could therefore be a remodeled bathroom.

In environmental protection, opportunity cost is also applicable. This has been demonstrated in the legislation that required the carcinogenic aromatics (mainly reformate) to be largely eliminated from gasoline. Unfortunately, this required refineries to install equipment at a cost of hundreds of millions of dollars – and pass the cost to the consumer. The absolute number of cancer cases attributed to exposure to gasoline, however, is low, estimated a few cases per year in the U.S. Thus, the decision to require fewer aromatics has been criticized on the grounds of opportunity cost: the hundreds of millions of dollars spent on process redesign could have been spent on other, more fruitful ways of reducing deaths caused by cancer or automobiles.[5] These actions (or strictly, the best one of them) are the opportunity cost of reduction of aromatics in gasoline.

The Opportunity Cost of consuming good x, as compared to good y (x:y) can be calculated by the price of good y, as compared to good x (Py/Px). In other words, a movie costs $10 and bowling costs $15, the opportunity cost of going to the movies is 15:10 or 3:2. As 3/2 > 1, going to the movies is more efficient, economically.

Opportunity costs in production

Opportunity costs may be assessed in the decision-making process of production. If the workers on a farm can produce either one million pounds of wheat or two million pounds of barley, then the opportunity cost of producing one pound of wheat is the two pounds of barley foregone. Firms would make rational decisions by weighing the sacrifices involved.

Explicit costs

Explicit costs are opportunity costs that involve direct monetary payment by producers. The opportunity cost of the factors of production not already owned by a producer is the price that the producer has to pay for them. For instance, a firm spends $100 on electrical power consumed, their opportunity cost is $100. The firm has sacrificed $100, which could have been spent on other factors of production.

Implicit costs

Implicit costs are the opportunity costs that involve only factors of production that a producer already owns. They are equivalent to what the factors could earn for the firm in alternative uses, either operated within the firm or rent out to other firms. For example, a firm pays $300 a month all year for rent on a warehouse that only holds product for six months each year. The firm could rent the warehouse out for the unused six months, at any price (assuming a year-long lease requirement), and that would be the cost that could be spent on other factors of production.

Non-monetary opportunity costs

Opportunity costs are not always measured in monetary units or being able to produce one good over another. For instance, an individual could choose not to mow his or her lawn, in an attempt to create a prairie land for additional wild life. Neighbors of this individual may see this as unsightly, and want the lawn to be mowed. In this case, the opportunity cost of additional wild life is unhappy neighbors.

Evaluation

The consideration of opportunity costs is one of the key differences between the concepts of economic cost and accounting cost. Assessing opportunity costs is fundamental to assessing the true cost of any course of action. In the case where there is no explicit accounting or monetary cost (price) attached to a course of action, or the explicit accounting or monetary cost is low, then, ignoring opportunity costs may produce the illusion that its benefits cost nothing at all. The unseen opportunity costs then become the implicit hidden costs of that course of action. Accounting cost includes only costs that have been explicitly incurred, whereas, economic cost includes opportunity costs. Similarly, this is a major difference between economic profit and accounting profit; opportunity cost being a variable in the calculation of economic profit.

Note that opportunity cost is not the sum of the available alternatives when those alternatives are, in turn, mutually exclusive to each other. The opportunity cost of a city's decision to build the hospital on its vacant land is the loss of the land for a sporting center, or the inability to use the land for a parking lot, or the money which could have been made from selling the land. Use for any one of those purposes would preclude the possibility to implement any of the other.

However, most opportunities are difficult to compare. Opportunity cost has been seen as the foundation of the marginal theory of value as well as the theory of time and money. In some cases, it may be possible to have more of everything by making different choices; for instance, when an economy is within its production possibility frontier. In microeconomic models this is unusual, because individuals are assumed to maximize utility, but it is a feature of Keynesian macroeconomics. In these circumstances, opportunity cost is a less useful concept.

See also

- Trade-off

- Cost of capital

- Opportunity cost of capital

- Economic value added

- Marginalism

- Net income

- Parable of the broken window

- Production-possibility frontier

- There Ain't No Such Thing As A Free Lunch

- Time management

References

- ^ "Opportunity Cost". Investopedia. http://www.investopedia.com/terms/o/opportunitycost.asp. Retrieved 2010-09-18.

- ^ James M. Buchanan (2008). "Opportunity cost". The New Palgrave Dictionary of Economics Online (Second ed.). http://www.dictionaryofeconomics.com/search_results?q=opportunity+cost&edition=current&button_search=GO. Retrieved 2010-09-18.

- ^ "Opportunity Cost". Economics A-Z. The Economist. http://www.economist.com/research/Economics/alphabetic.cfm?letter=O#opportunitycost. Retrieved 2010-09-18.

- ^ Friedrich von Wieser (1927). A. Ford Hinrichs (translator). ed. Social Economics. New York: Adelphi. http://mises.org/books/Social_Economics_Wieser.pdf. Retrieved 2011-10-07.

• Friedrich von Wieser (November 1914) (in German). Theorie der gesellschaftlichen Wirtschaft [Theory of Social Economics]. Original publication. - ^ Harold A. Wittcoff; Bryan G. Reuben; Jeffery S. Plotkin (2004). Industrial Organic Chemicals. Wiley. p. [page needed]. ISBN 9780471443858.

External links

Microeconomics Major topics Aggregation · Budget · Consumer · Convexity and non-convexity · Cost · Cost-benefit analysis · Distribution · Deadweight loss · Income–consumption curve · Duopoly · Equilibria · Economies of scale · Economies of scope · Elasticity · Exchange · Expected utility · Externality · Firms · General equilibria · Household · Information · Indifference curve · Intertemporal choice · Marginal cost · Market failure · Market structure · Monopoly · Monopsony · Oligopoly · Opportunity cost · Preferences · Prices · Production · Profit · Public goods · Returns to scale · Risk · Scarcity · Shortage · Social choice · Sunk costs · Supply & demand · Surplus · Uncertainty · Utility · WelfareRelated Behavioral · Business · Computational · Decision theory · Econometrics · Experimental · Game theory · Industrial organization · Mathematical economics · Microfoundations of Macroeconomics · Managerial · Operations research · OptimizationCategories:- Microeconomics

- Costs

- Economics terminology

- Time-based economics

Wikimedia Foundation. 2010.