- Econometrics

-

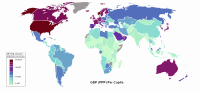

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal Econometrics has been defined as "the application of mathematics and statistical methods to economic data" and described as the branch of economics "that aims to give empirical content to economic relations." [1] More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference."[2] The first known use of the term "econometrics" (in cognate form) was by Paweł Ciompa in 1910. Ragnar Frisch is credited with coining the term in the sense that it is used today.[3]

Contents

Purpose

Two main purposes of econometrics are to give empirical content to economic theory by formulating economic models in testable form, to estimate those models, and to test them as to acceptance or rejection.[1][4]

For example, consider one of the basic relationships in economics: the relationship between the price of a commodity and the quantities of that commodity that people wish to purchase at each price (the demand relationship). According to economic theory, an increase in the price would lead to a decrease in the quantity demanded, holding other relevant variables constant so as to isolate the relationship of interest. A mathematical equation can be written that describes the relationship between quantity, price, other demand variables like income, and a random term ε to reflect simplification and imprecision of the theoretical model:

- Q = β0 + β1Price + β2Income + ε.

Regression analysis could be used to estimate the unknown parameters β0, β1, and β2 in the relationship, using data on price, income, and quantity. The model could then be tested for statistical significance as to whether an increase in price is associated with a decrease in the quantity, as hypothesized: β1 < 0.

There are complications even in this simple example, and it is often easy to mistake statistical significance with economic significance. Statistical significance is neither necessary nor sufficient for economic significance.[5] In order to estimate the theoretical demand relationship, the observations in the data set must be price and quantity pairs that are collected along a demand schedule that is stable. If those assumptions are not satisfied, a more sophisticated model or econometric method may be necessary to derive reliable estimates and tests.

Methods

-

- See also Methodology of econometrics

Theoretical econometrics examines the statistical properties of econometric procedures. Such properties include the power of hypothesis tests and efficiency of estimators and of survey-sampling methods.[6] Applied econometrics uses theoretical econometrics and real-world data for assessing economic theories, developing econometric models, analyzing economic history, and forecasting.[7]

Econometrics may use standard statistical models to study economic questions, but most often they are with observational data, rather than in controlled experiments. In this, the design of observational studies in econometrics is similar to the design of studies in other observational disciplines, such as astronomy, epidemiology, and political science. Analysis of data from an observational studies is guided by the study protocol, although exploratory data analysis may by useful for generating new hypotheses.[8] Economics often analyzes systems of equations and inequalities, such as supply and demand hypothesized to be in equilibrium. Consequently, the field of econometrics has developed methods for identification and estimation of simultaneous-equation models. These methods are analogous to methods used in other areas of science, such as the field of system identification in systems analysis and control theory. Such methods may allow researchers to estimate models and investigate their empirical consequences, without directly manipulating the system.

In recent decades, econometricians have increasingly turned to use of experiments to evaluate the often-contradictory conclusions of observational studies. Here, controlled and randomized experiments provide statistical inferences that may yield better empirical performance than do purely observational studies.[9]

One of the fundamental statistical methods used by econometricians is regression analysis. For an overview of a linear implementation of this framework, see linear regression. Regression methods are important in econometrics because economists typically cannot use controlled experiments. Econometricians often seek illuminating natural experiments in the absence of evidence from controlled experiments. Observational data may be subject to omitted-variable bias and a list of other problems that must be addressed using causal analysis of simultaneous-equation models.[10]

Data sets to which econometric analyses are applied can be classified as time-series data, cross-sectional data, panel data, and multidimensional panel data. Time-series data sets contain observations over time; for example, inflation over the course of several years. Cross-sectional data sets contain observations at a single point in time; for example, many individuals' incomes in a given year. Panel data sets contain both time-series and cross-sectional observations. Multi-dimensional panel data sets contain observations across time, cross-sectionally, and across some third dimension. For example, the Survey of Professional Forecasters contains forecasts for many forecasters (cross-sectional observations), at many points in time (time series observations), and at multiple forecast horizons (a third dimension).

Econometric analysis may also be classified on the basis of the number of relationships modeled. Single-equation methods model a single variable (the dependent variable) as a function of one or more explanatory (or independent) variables. In many econometric contexts, the commonly-used ordinary least squares method may not recover the theoretical relation desired or may produce estimates with poor statistical properties, because the assumptions for valid use of the method are violated. One widely-used remedy is the method of instrumental variables (IV). For an economic model described by more than one equation, simultaneous-equation methods may be used to remedy similar problems, including two IV variants, Two-Stage Least Squares (2SLS), and Three-Stage Least Squares (3SLS).[11]

Other important unifying or distinguishing methods include the Method of Moments, Generalized Method of Moments (GMM),[12] time series analysis,[13] and Bayesian methods.[14]

Computational concerns are important for evaluating econometric methods and for use in decision making.[15] Such concerns include mathematical well-posedness: the existence, uniqueness, and stability of any solutions to econometric equations. Another concern is the numerical efficiency and accuracy of software.[16] A third concern is also the usability of econometric software.[17]

Example

A simple example of a relationship in econometrics from the field of labor economics is:

- ln(wage) = β0 + β1(years of education) + ε.

This example assumes that the natural logarithm of a person's wage is a linear function of (among other things) the number of years of education that person has acquired. The parameter β1 measures the increase in the natural log of the wage attributable to one more year of education. The term

is a random variable representing all other factors that may have direct influence on wage. The econometric goal is to estimate the parameters, β0 and β1 under specific assumptions about the random variable

is a random variable representing all other factors that may have direct influence on wage. The econometric goal is to estimate the parameters, β0 and β1 under specific assumptions about the random variable  . For example, if

. For example, if  is uncorrelated with years of education, then the equation can be estimated with ordinary least squares.

is uncorrelated with years of education, then the equation can be estimated with ordinary least squares.If the researcher could randomly assign people to different levels of education, the data set thus generated would allow estimation of the effect of changes in years of education on wages. In reality, those experiments cannot be conducted. Instead, the econometrician observes the years of education of and the wages paid to people who differ along many dimensions. Given this kind of data, the estimated coefficient on Years of Education in the equation above reflects both the effect of education on wages and the effect of other variables on wages, if those other variables were correlated with education. For example, people born in certain places may have higher wages and higher levels of education. Unless the econometrician controls for place of birth in the above equation, the effect of birthplace on wages may be falsely attributed to the effect of education on wages.

The most obvious way to control for birthplace is to include a measure of the effect of birthplace in the equation above. Exclusion of birthplace, together with the assumption that

is uncorrelated with education produces a misspecified model. A second technique for dealing with omitted variables is instrumental variables estimation. Still a third technique is to include in the equation additional set of measured covariates which are not instrumental variables, yet render β1 identifiable.[18] An overview of econometric methods used to study this problem can be found in Card (1999).[19]

is uncorrelated with education produces a misspecified model. A second technique for dealing with omitted variables is instrumental variables estimation. Still a third technique is to include in the equation additional set of measured covariates which are not instrumental variables, yet render β1 identifiable.[18] An overview of econometric methods used to study this problem can be found in Card (1999).[19]Noted econometricians

The following are the Nobel Memorial Prize in Economic Sciences recipients in the field of econometrics:

- Jan Tinbergen, former Professor at the Erasmus University Rotterdam, and Ragnar Frisch were awarded the first prize in 1969 for having developed and applied dynamic models for the analysis of economic processes.

- Lawrence Klein, Professor of Economics at the University of Pennsylvania, was awarded the Nobel Memorial Prize in Economic Sciences in 1980 for his computer modeling work in the field.

- Trygve Haavelmo was awarded the Nobel Memorial Prize in Economic Sciences in 1989. His main contribution to econometrics was his 1944 article (published in Econometrica) "The Probability Approach to Econometrics."

- Daniel McFadden and James Heckman were awarded in 2000 for their work in microeconometrics. McFadden founded the econometrics lab at the University of California, Berkeley.

- Robert Engle at the University of California, San Diego, and Clive Granger, at the University of Nottingham, were awarded in 2003 for work on analyzing economic time series. Engle pioneered the method of autoregressive conditional heteroskedasticity (ARCH) and Granger the method of cointegration.

- Christopher Sims and Thomas Sargent were awarded the 2011 nobel prize in economics for the development of vector autoregression models and methods for the analysis of structural breaks.

The following are other influential econometricians that have won the John Bates Clark Medal in the field of econometrics:

- Jerry Hausman, professor at the MIT, who among other distinctions developed the Hausman specification test in econometrics.

Journals

The main journals which publish work in econometrics are Econometrica, the Journal of Econometrics, the Review of Economics and Statistics, Econometric Theory, the Journal of Applied Econometrics, Econometric Reviews, the Econometrics Journal,[20] Applied Econometrics and International Development, the Journal of Business & Economic Statistics, and the Journal of Economic and Social Measurement.

Software

See also: Econometric softwareSee also

- Macroeconomic model

- Important publications in econometrics

- Single equation methods (econometrics)

- Granger causality

- Augmented Dickey–Fuller test

- Unit root

- Predetermined variables

- Methodology of econometrics

- Spatial econometrics

- Master of Economics

Notes

- ^ a b M. Hashem Pesaran (1987). "Econometrics," The New Palgrave: A Dictionary of Economics, v. 2, p. 8 [pp. 8-22]. Reprinted in J. Eatwell et al., eds. (1990). Econometrics: The New Palgrave, p. 1 [pp. 1-34]. Abstract (2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran).

- ^ P. A. Samuelson, T. C. Koopmans, and J. R. N. Stone (1954). "Report of the Evaluative Committee for Econometrica," Econometrica 22(2), p. 142. [pp. 141-146], as described and cited in Pesaran (1987) above.

- ^ • H. P. Pesaran (1990), "Econometrics," Econometrics: The New Palgrave, p. 2, citing Ragnar Frisch (1936), "A Note on the Term 'Econometrics'," Econometrica, 4(1), p. 95.

• Aris Spanos (2008), "statistics and economics," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract. - ^ G. S. Maddala (1992). Introduction to Econometrics, 2nd ed., p. 4. Macmillan.

- ^ Stephen T. Ziliak and Deirdre N. McCloskey (2004). "Size Matters: The Standard Error of Regressions in the American Economic Review," Journal of Socio-economics, 33(5), pp. 527-46 (press +).

- ^ • Jeffrey M. Wooldridge (2008). "stratified and cluster sampling,"The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

• Jeff Dominitz and Arthur van Soest (2008). "survey data, analysis of," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract. - ^ Clive Granger (2008). "forecasting," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- ^ Herman O. Wold (1969). "Econometrics as Pioneering in Nonexperimental Model Building," Econometrica, 37(3), pp. 369-381.

- ^ • H. Wold 1954. "Causality and Econometrics," Econometrica, 22(2), p p. 162-177.

• Kevin D. Hoover (2008). "causality in economics and econometrics," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract and galley proof. - ^ Edward E. Leamer (2008). "specification problems in econometrics," The New Palgrave Dictionary of Economics. Abstract.

- ^ Peter Kennedy (2003). A Guide to Econometrics, 5th ed. Description, preview, and TOC, ch. 9, 10, 13, and 18.

- ^ • Fumio Hayashi. (2000) Econometrics, Princeton University Press. ISBN 0691010188 Description and contents links.

• Russell Davidson and James G. MacKinnon (2004). Econometric Theory and Methods. New York: Oxford University Press. Description. - ^ James D. Hamilton (1994, 1st ed.) Time Series Analysis, Princeton University Press. Description and preview.

- ^ Peter Kennedy (2003). A Guide to Econometrics, 5th ed. TOC, ch. 13.

- ^ Keisuke Hirano (2008). "decision theory in econometrics," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- ^ B. D. McCullough and H. D. Vinod (1999). "The Numerical Reliability of Econometric Software," Journal of Economic Literature, 37(2), pp. 633-665.

- ^ • Vassilis A. Hajivassiliou (2008). "computational methods in econometrics," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

• Richard E. Quandt (1983). "Computational Problems and Methods," ch. 12, in Handbook of Econometrics, v. 1, pp. 699-764.

• Ray C. Fair (1996). "Computational Methods for Macroeconometric Models," Handbook of Computational Economics, v. 1, pp. [1]-169. - ^ Judea Pearl (2000). Causality: Model, Reasoning, and Inference, Cambridge University Press.

- ^ David Card (1999) "The Causal Effect of Education on Earning," in Ashenfelter, O. and Card, D., (eds.) Handbook of Labor Economics, pp 1801-63.

- ^ http://www.wiley.com/bw/journal.asp?ref=1368-4221

- ^ http://www.mathworks.com/products/econometrics

References

- Handbook of Econometrics Elsevier, links to:

- v. 1, pp. 3-771 (1983)

- v. 2, pp. 775-1461 (1984)

- v. 3, pp. 1465-2107 (1986)

- v. 4, pp. 2111-3155 (1994)

- v. 5, pp. 3159-3843 (2001)

- v. 6, Part 1, pp. 3845-4776 (2007)

- v. 6, Part 2, pp. 4777-5752 (2007)

- Handbook of Statistics, v. 11, Econometrics (1993), Elsevier. Links to first-page chapter previews.

- International Encyclopedia of the Social & Behavioral Sciences (2001), Statistics, "Econometrics and Time Series," links to first-page previews of 21 articles.

- Angrist, Joshua & Pischke, Jörn‐Steffen (2010). "The Credibility Revolution in Empirical Economics: How Better Research Design Is Taking the Con out of Econometrics], 24(2), , pp. 3–30. Abstract.

- Eatwell, John, et al., eds. (1990). Econometrics: The New Palgrave. Article-preview links (from The New Palgrave: A Dictionary of Economics, 1987).

- Greene, William H. (1999, 4th ed.) Econometric Analysis, Prentice Hall.

- Hayashi, Fumio. (2000) Econometrics, Princeton University Press. ISBN 0691010188 Description and contents links.

- Hamilton, James D. (1994) Time Series Analysis, Princeton University Press. Description and preview.

- Kelejian, Harry H., and Wallace E. Oates (1989, 3rd ed.) Introduction to Econometrics.

- Kennedy, Peter (2003). A Guide to Econometrics, 5th ed. Description, TOC, and preview.

- Russell Davidson and James G. MacKinnon (2004). Econometric Theory and Methods. New York: Oxford University Press. Description.

- Mills, Terence C., and Kerry Patterson, ed. Palgrave Handbook of Econometrics:

- (2007) v. 1: Econometric Theoryv. 1. Links to description and contents.

- (2009) v. 2, Applied Econometrics. Palgrave Macmillan. ISBN 9781403917997 Links to description and contents.

- Pearl, Judea (2009, 2nd ed.). Causality: Models, Reasoning and Inference, Cambridge University Press, Description, TOC, and preview, ch. 1-10 and ch. 11. 5 economics-journal reviews, including Kevin D. Hoover, Economics Journal.

- Pindyck, Robert S., and Daniel L. Rubinfeld (1998, 4th ed.). Econometric Methods and Economic Forecasts, McGraw-Hill.

- Studenmund, A.H. (2011, 6th ed.). Using Econometrics: A Practical Guide. Contents (chapter-preview) links.

- Wooldridge, Jeffrey (2003). Introductory Econometrics: A Modern Approach. Mason: Thomson South-Western. ISBN 0-324-11364-1 Chapter-preview links in brief and detail.

Further reading

- Econometric Theory book on Wikibooks

- Giovanini, Enrico Understanding Economic Statistics, OECD Publishing, 2008, ISBN 978-92-64-03312-2

External links

- Econometric Links

- Econometric Society

- Directory of Econometricians

- The Econometrics Journal

- Teaching Econometrics (Index by the Economics Network (UK))

- Applied Econometric Association

- "The Art and Science of Cause and Effect": a slide show and tutorial lecture by Judea Pearl

- Econometric Institute Erasmus University: one of the leading Econometric Institutes

- Tinbergen Institute: one of the leading Economic/Econometric institutes

- The Society for Financial Econometrics

- Econometrics Books

Categories:- Econometrics

- Mathematical and quantitative methods (economics)

- Metrics

- Formal sciences

Wikimedia Foundation. 2010.