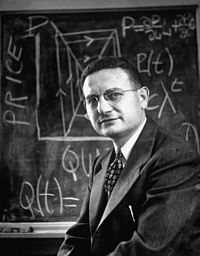

- Paul Samuelson

-

Paul A. Samuelson Neo-Keynesian economics

Photo taken 1950 (age 35)Born May 15, 1915

Gary, Indiana, USADied December 13, 2009 (aged 94)

Belmont, Massachusetts, USANationality United States Institution Massachusetts Institute of Technology Field Macroeconomics Alma mater Harvard University (Ph.D.)

University of Chicago (B.A.)Opposed Friedman Influences Keynes • Schumpeter • Leontief • Haberler • Hansen • Wilson • Wicksell • Lindahl Influenced Fischer • Klein • Merton • Solow • Phelps • Subramanian Contributions Neoclassical synthesis

Mathematical economics

Economic methodology

Revealed preferences theory

International trade theory

Economic growth theory

Public goods theoryAwards John Bates Clark Medal (1947)

Nobel Memorial Prize in Economic Sciences (1970)Information at IDEAS/RePEc Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist, and the first American to win the Nobel Memorial Prize in Economic Sciences. The Swedish Royal Academies stated, when awarding the prize, that he "has done more than any other contemporary economist to raise the level of scientific analysis in economic theory."[1] Economic historian Randall E. Parker calls him the "Father of Modern Economics",[2] and The New York Times considered him to be the "foremost academic economist of the 20th century."[3]

He was author of the largest-selling economics textbook of all time: Economics: An Introductory Analysis, first published in 1948. It was the second American textbook to explain the principles of Keynesian economics and how to think about economics, and the first one to be successful,[4] and is now in its 19th edition, having sold nearly 4 million copies in 40 languages. James Poterba, former head of MIT's Department of Economics, noted that by his book, Samuelson "leaves an immense legacy, as a researcher and a teacher, as one of the giants on whose shoulders every contemporary economist stands."[1] In 1996, when he was awarded the National Medal of Science, considered America's top science honor, President Bill Clinton commended Samuelson for his "fundamental contributions to economic science" for over 60 years.[1]

He entered the University of Chicago at age 16, during the depths of the Great Depression, and received his PhD in economics from Harvard. After graduating, he became an assistant professor of economics at Massachusetts Institute of Technology (MIT) when he was 25 years of age and a full professor at age 32. In 1966, he was named Institute Professor, MIT's highest faculty honor.[1] He spent his career at MIT where he was instrumental in turning its Department of Economics into a world-renowned institution by attracting other noted economists to join the faculty, including Robert M. Solow, Paul Krugman, Franco Modigliani, Robert C. Merton and Joseph E. Stiglitz, all of whom went on to win Nobel Prizes. Samuelson was instrumental in the initial development of Indian Institute of Management Calcutta, the first Indian Institute of Management.[5]

He served as an advisor to Presidents John F. Kennedy and Lyndon B. Johnson, and was a consultant to the United States Treasury, the Bureau of the Budget and the President's Council of Economic Advisers. Samuelson wrote a weekly column for Newsweek magazine along with Chicago School economist Milton Friedman, where they represented opposing sides: Samuelson took the Keynesian perspective, and Friedman represented the Monetarist perspective.[6] Samuelson died on December 13, 2009, at the age of 94.

Contents

Biography

Samuelson was born in Gary, Indiana, on May 15, 1915, to Frank Samuelson, a pharmacist, and the former Ella Lipton. His family, he said, was “made up of upwardly mobile Jewish immigrants from Poland who had prospered considerably in World War I, because Gary was a brand new steel town when my family went there.”[3] In 1923 Samuelson moved to Chicago; he studied at the University of Chicago and received his Bachelor of Arts degree there in 1935. He then completed his Master of Arts degree in 1936, and his Doctor of Philosophy in 1941 at Harvard University. As a graduate student at Harvard, Samuelson studied economics under Joseph Schumpeter, Wassily Leontief, Gottfried Haberler, and the "American Keynes" Alvin Hansen. Samuelson comes from a family of well-known economists, including brother Robert Summers, sister-in-law Anita Summers, and nephew Larry Summers.

During his seven decades as an economist, Samuelson's professional positions included:

- Assistant Professor of Economics at M.I.T, 1940, Associate Professor, 1944.

- Member of the Radiation Laboratory 1944-1945.

- Professor of International Economic Relations (part-time) at the Fletcher School of Law and Diplomacy in 1945.

- Guggenheim Fellowship from 1948 to 1949

- Professor of Economics at M.I.T. beginning in 1947 and Institute Professor beginning in 1962.

- Vernon F. Taylor Visiting Distinguished Professor at Trinity University (Texas) in Spring 1989.

Death

Samuelson died after a brief illness on December 13, 2009, at the age of 94.[7] His death was announced by the Massachusetts Institute of Technology.[3] James M. Poterba, an economics professor at MIT and the president of the National Bureau of Economic Research, commented that Samuelson "leaves an immense legacy, as a researcher and a teacher, as one of the giants on whose shoulders every contemporary economist stands".[7] Susan Hockfield, the president of MIT, said that Samuelson "transformed everything he touched: the theoretical foundations of his field, the way economics was taught around the world, the ethos and stature of his department, the investment practices of MIT, and the lives of his colleagues and students".[8]

Impact

Samuelson is considered to be one of the founders of neo-Keynesian economics and a seminal figure in the development of neoclassical economics. In awarding him the Nobel Memorial Prize in Economic Sciences the committee stated:

More than any other contemporary economist, Samuelson has helped to raise the general analytical and methodological level in economic science. He has simply rewritten considerable parts of economic theory. He has also shown the fundamental unity of both the problems and analytical techniques in economics, partly by a systematic application of the methodology of maximization for a broad set of problems. This means that Samuelson's contributions range over a large number of different fields.He was also essential in creating the Neoclassical synthesis, which incorporated Keynesian and neoclassical principles and still dominates current mainstream economics. In 2003, Samuelson was one of the 10 Nobel Prize winning economists signing the Economists' statement opposing the Bush tax cuts.[9]

Thermodynamics and economics

Samuelson was one of the first economists to generalize and apply mathematical methods developed for the study of thermodynamics to economics. As a graduate student at Harvard, he was the sole protégé of the polymath Edwin Bidwell Wilson, who had himself been a student of Yale physicist Willard Gibbs.[10] Gibbs, the founder of chemical thermodynamics, was also mentor to American economist Irving Fisher and he influenced them both in their ideas on the equilibrium of economic systems.[11][12]

Samuelson also published one of the first papers on nonlinear dynamics in economic analysis.[13]

Samuelson's 1947 magnum opus Foundations of Economic Analysis, from his doctoral dissertation, is based on the classical thermodynamic methods of American thermodynamicist Willard Gibbs, specifically Gibbs' 1876 paper On the Equilibrium of Heterogeneous Substances.[14][15][16]

In 1947, based on the Le Chatelier principle of thermodynamics, a principle taught to Samuelson by Wilson in lecture, he established the method of comparative statics in economics. This method explains the changes in the equilibrium solution of a constrained maximization problem (economic or thermodynamic) when one of the constraints is marginally tightened or relaxed. The Le Chatelier principle was developed by French chemist Henri Louis le Chatelier, who is notable for being one of the first to translate Gibbs' equilibrium papers (in French, 1899). Samuelson's use of the Le Chatelier principle has proven to be a very powerful tool and found widespread use in modern economics.[17] Attempts at neo-classical equilibrium economics analogies with thermodynamics generally, go back to Guillaume and Samuelson.[18]

Publications

Samuelson's book Foundations of Economic Analysis (1947, Enlarged ed. 1983), is considered his magnum opus. It is derived from his doctoral dissertation at Harvard University, and makes use of the classical thermodynamic methods of American thermodynamicist Willard Gibbs.[14] The book proposes to:

- examine underlying analogies between central features in theoretical and applied economics and

- study how operationally meaningful theorems can be derived with a small number of analogous methods (p. 3),

in order to derive "a general theory of economic theories" (Samuelson, 1983, p. xxvi). The book showed how these goals could be parsimoniously and fruitfully achieved, using the language of the mathematics applied to diverse subfields of economics. The book proposes two general hypotheses as sufficient for its purposes:

- maximizing behavior of agents (including consumers as to utility and business firms as to profit) and

- economic systems (including a market and an economy) in stable equilibrium.

In the course of analysis, comparative statics, (the analysis of changes in equilibrium of the system that result from a parameter change of the system) is formalized and clearly stated.

The chapter on welfare economics "attempt(s) to give a brief but fairly complete survey of the whole field of welfare economics" (Samuelson, 1947, p. 252). It also exposits on and develops what became commonly called the Bergson–Samuelson social welfare function. It shows how to represent (in the maximization calculus) all real-valued economic measures of any belief system that is required to rank consistently different feasible social configurations in an ethical sense as "better than," "worse than," or "indifferent to" each other (p. 221).

There are 388 papers to date in Samuelson's Collected Scientific Papers. Stanley Fischer (1987, p. 234) writes that taken together they are unique in their verve, breadth of economic and general knowledge, mastery of setting, and generosity of allusions to predecessors.

Samuelson is also author (and since 1985 co-author) of an influential principles textbook, Economics, first published in 1948, now in its 19th edition. The book has been translated into forty-one languages and sold over four million copies; it is considered the best-selling economics textbook in history. Written in the shadow of the Great Depression and World War II, it helped to popularize the insights of John Maynard Keynes. A main focus was how to avoid, or at least mitigate, the recurring slumps in economic activity. Samuelson wrote: "It is not too much to say that the widespread creation of dictatorships and the resulting World War II stemmed in no small measure from the world's failure to meet this basic economic problem [the Great Depression] adequately."[19] This reflected the concern of Keynes himself with the economic causes of war and the importance of economic policy in promoting peace.[20] Samuelson's influential textbook has been criticized for including comparative growth rates between the US and Soviet Union that were inconsistent with historical GNP differences.[21] The 1967 edition extrapolates the possibility of Soviet/US real GNP parity between 1977 and 1995. Each subsequent edition extrapolated a date range further in the future until those graphs were dropped from the 1985 edition.[22]

Samuelson is co-editor of Inside the Economist's Mind: Conversations with Eminent Economists (Blackwell Publishing, 2007), along with William A. Barnett, a collection of candid interviews with top economists of the 20th century.

Fields of interest

As professor of economics at the Massachusetts Institute of Technology, Samuelson worked in many fields including:

- Welfare economics, in which he popularised the Lindahl–Bowen–Samuelson conditions (criteria for deciding whether an action will improve welfare) and demonstrated in 1950 the insufficiency of a national-income index to reveal which of two social options was uniformly outside the other's (feasible) possibility function (Collected Scientific Papers, v. 2, ch. 77; Fischer, 1987, p. 236).

- Public finance theory, in which he is particularly known for his work on determining the optimal allocation of resources in the presence of both public goods and private goods.

- International economics, where he influenced the development of two important international trade models: the Balassa–Samuelson effect, and the Heckscher–Ohlin model (with the Stolper–Samuelson theorem).

- Macroeconomics, where he popularized the overlapping generations model as a way to analyze economic agents' behavior across multiple periods of time (Collected Scientific Papers, v. 1, ch. 21).

- Consumer theory, he pioneered the Revealed Preference Theory, which is a method by which it is possible to discern the best possible option, and thus define consumer's utility functions, by observing the consumer behaviour.

Miscellaneous

Stanislaw Ulam once challenged Samuelson to name one theory in all of the social sciences which is both true and nontrivial. Several years later, Samuelson responded with David Ricardo's theory of comparative advantage: That it is logically true need not be argued before a mathematician; that is not trivial is attested by the thousands of important and intelligent men who have never been able to grasp the doctrine for themselves or to believe it after it was explained to them.[23]

For many years, Samuelson wrote a column for Newsweek. One article included Samuelson's most quoted remark, and a favorite economics joke:

To prove that Wall Street is an early omen of movements still to come in GNP, commentators quote economic studies alleging that market downturns predicted four out of the last five recessions. That is an understatement. Wall Street indexes predicted nine out of the last five recessions! And its mistakes were beauties.[24]

Memberships

- member of the American Academy of Arts and Sciences, National Academy of Sciences, Fellow of Royal Society of London

- fellow of the American Philosophical Society and the British Academy;

- member and past President (1961) of the American Economic Association

- member of the editorial board and past-President (1951) of the Econometric Society

- fellow, council member and past Vice-President of the Economic Society.

- member of Phi Beta Kappa.

List of publications

- 1947, Enlarged ed. 1983. Foundations of Economic Analysis, Harvard University Press.

- 1948. Economics: An Introductory Analysis,ISBN 0-07-074741-5; with William D. Nordhaus (since 1985), 2009, 19th ed., McGraw–Hill. ISBN 9780071263832

- 1952. "Economic Theory and Mathematics — An Appraisal," American Economic Review, 42(2), pp. 56-66.

- 1954. "The Pure Theory of Public Expenditure". Review of Economics and Statistics, 36 (4): 387–389. doi:10.2307/1925895

- 1958. Linear Programming and Economic Analysis with Robert Dorfman and Robert M. Solow, McGraw–Hill. Chapter-preview links.

- The Collected Scientific Papers of Paul A. Samuelson, MIT Press. Article-preview links for vol. I-V and Contents links for vol. VI-VII.

- 1966. Vol. I, 1937–mid-1964.

- 1966. Vol. II, 1937–mid-1964.

- 1972. Vol. III, mid-1964–1970.

- 1977. Vol. IV 1971–76.

- 1986. Vol. V, 1977–1985.

- 2011. Vol. VI, 1986-2009. Description

- 2011. Vol. VII, 1986-2009.

- Paul A. Samuelson Papers, 1930s-2010, Rubenstein Library, Duke University.

- 2007. Inside the Economist's Mind: Conversations with Eminent Economists with William A. Barnett, Blackwell Publishing, ISBN 1405159170

See also

- Guaranteed minimum income

- Neoclassical economics

- Social welfare function

- List of economists

- List of Jewish Nobel laureates

- History of economic thought

References

- ^ a b c d Frost, Greg (Dec. 13, 2009). "Nobel-winning economist Paul A. Samuelson dies at age 94". MIT News. http://web.mit.edu/newsoffice/2009/obit-samuelson-1213.html. "In a career that spanned seven decades, he transformed his field, influenced millions of students and turned MIT into an economics powerhouse"

- ^ Parker, Randall E. (2002), Reflections on the Great Depression, Cheltenham: Edward Elgar, p. 25, ISBN 1843763354

- ^ a b c Weinstein, Michael M. (December 13, 2009). "Paul A. Samuelson, Economist, Dies at 94". New York Times. http://www.nytimes.com/2009/12/14/business/economy/14samuelson.html.

- ^ Samuelson's text was preceded by the 1947 The Elements of Economics by Lorie Tarshis, which did not ultimately prove successful; see discussion.

- ^ "IIM-C Golden Jubilee: Interview with Prof Sougata Ray, Dean (PI)". mbauniverse.com. 13-Nov-2010. http://www.mbauniverse.com/article.php?id=3877. Retrieved 11 September 2011. "During the initial years of IIM Calcutta, several renowned academics and visionaries formed part of its core team, including Paul Samuelson"

- ^ Szenberg, Michael; Gottesman, Aron A.; Ramrattan, lall (2005), Paul Samuelson: On Being an Economist, New York: Jorge Pinto Books, p. 18, ISBN 097426153X

- ^ a b "Nobel economics laureate Samuelson dies at 94". Reuters. December 13, 2009. http://www.reuters.com/article/idUSTRE5BC15620091213.

- ^ "Economist Samuelson, Nobel laureate, dead at 94". Associated Press. http://www.google.com/hostednews/ap/article/ALeqM5j-K6_R2y2lpSFlgfXk_6OxTywQGwD9CIIR0O2.

- ^ "Economists' statement opposing the Bush tax cuts". April 3, 2003. http://www.epi.org/publications/entry/econ_stmt_2003/. Retrieved 2007-10-31.

- ^ Samuelson, Paul A. (5 September 2003), How I Became an Economist, http://nobelprize.org/nobel_prizes/economics/articles/samuelson-2/index.html

- ^ Smith, Eric; Foley, Duncan (2005), Classical Thermodynamics and Economic General Equilibrium Theory, http://homepage.newschool.edu/~foleyd/econthermo.pdf

- ^ Mirowski, Philip (1989), More Heat than Light: Economics as Social Physics, Physics as Nature's Economics, Cambridge University Press, ISBN 0521426898

- ^ Sethi, Rajiv (10 January 2010), "Paul Samuelson on Linear Dynamics", Rajiv Sethi's Blog, http://rajivsethi.blogspot.com/2010/01/paul-samuelson-on-nonlinear-dynamics.html

- ^ a b Liossatos, Panagis, S. (2004). "Statistical Entropy in General Equilibrium Theory," (pg. 3). Department of Economics, Florida International University.

- ^ Samuelson, P. A. (1990), "Gibbs in economics", Proceedings of the Gibbs Symposium (Providence, RI): pp. 255–267

- ^ Jolls, K. R. (1990), "Gibbs and the art of thermodynamics, Gibbs in economics", Proceedings of the Gibbs Symposium (Providence, RI): pp. 293–321

- ^ Baumgarter, Stefan (2004), "Thermodynamic Models", Modeling in Ecological Economics (Ch. 18), http://www.eco.uni-heidelberg.de/ng-oeoe/research/papers/Baumgaertner%202004%20ModEE.pdf

- ^ McCauley, Joseph (2003), "Thermodynamic analogies in economics and finance: instability of markets", Physica A 329: 199–212, http://mpra.ub.uni-muenchen.de/2159/01/MPRA_paper_2159.pdf

- ^ See Mankiw, Gregory (January 10, 2009), "Is government spending too easy an answer?", New York Times, http://www.nytimes.com/2009/01/11/business/economy/11view.html

- ^ See Markwell, Donald (2006), John Maynard Keynes and International Relations: Economic Paths to War and Peace, New York: Oxford University Press, ISBN 0198292368

- ^ Levy, David M.; Peart, Sandra J. (December 3, 2009), "Soviet Growth & American Textbooks", SSRN Working Paper: pp. 8–12, SSRN 1517983, "the optimistic forecast of time before the Soviet overtaking is 23 years; the more pessimistic time to overtaking in the max-max world is 36 years. The non-overtaking trajectory is constructed on the specification that something reduces Soviet growth in out years below what simple extrapolation would have it."

- ^ Bethell, Tom (October 1999). "The Soviet Experiment". The noblest triumph: property and prosperity through the ages. Palgrave MacMillan. p. 151. ISBN 9780312223373.

- ^ Samuelson, Paul (1969), "The Way of an Economist", in Samuelson, P. A., International Economic Relations: Proceedings of the Third Congress of the International Economic Association, London: Macmillan, pp. 1–11

- ^ Samuelson, Paul (September 19, 1966), "Science and Stocks", Newsweek: p. 92

Further reading

- Fischer, Stanley (1987), "Samuelson, Paul Anthony", The New Palgrave: A Dictionary of Economics (London: Macmillan) 4: pp. 234–241, ISBN 0935859101.

- Silk, Leonard (1976), The Economists, New York: Basic Books, ISBN 0465018106.

- Sobel, Robert (1980), The Worldly Economists, New York: Free Press, ISBN 002929780X.

- Fusfeld, Daniel R. (2002), "The Neoclassical Synthesis", The Age of the Economist (9th ed.), Boston: Addison Wesley, pp. 198–201, ISBN 0321088123.

External links

- Biography at the Nobel e-Museum

- 1970 Press Release, Nobel Prize in Economics

- A History of Economic Thought biography

- the scientific work through which he has developed static and dynamic economic theory and actively contributed to raising the level of analysis in economic science.

- Yale Honorand Biography

- Nobel-winning economist Paul A. Samuelson dies at age 94

- New York Times Obituary (14 December 2009)

- Paul Samuelson - Daily Telegraph obituary

- Paul Samuelson Memorial Session (January 4, 2010), American Economic Association meetings, Webcast links to remarks of: Solow & Diamond (after intro) in Part 1 (34 min.); Dixit, Merton, Poterba, & Hall (including read remarks of Arrow & Fischer) Part 2 (48 min.).

Macroeconomic schools of thought John Bates Clark Medal recipients Paul Samuelson (1947) · Kenneth E. Boulding (1949) · Milton Friedman (1951) · No Award (1953) · James Tobin (1955) · Kenneth Arrow (1957) · Lawrence Klein (1959) · Robert Solow (1961) · Hendrik S. Houthakker (1963) · Zvi Griliches (1965) · Gary Becker (1967) · Marc Nerlove (1969) · Dale W. Jorgenson (1971) · Franklin M. Fisher (1973) · Daniel McFadden (1975) · Martin Feldstein (1977) · Joseph Stiglitz (1979) · Michael Spence (1981) · James Heckman (1983) · Jerry A. Hausman (1985) · Sanford J. Grossman (1987) · David M. Kreps (1989) · Paul Krugman (1991) · Lawrence Summers (1993) · David Card (1995) · Kevin M. Murphy (1997) · Andrei Shleifer (1999) · Matthew Rabin (2001) · Steven Levitt (2003) · Daron Acemoğlu (2005) · Susan Athey (2007) · Emmanuel Saez (2009) · Esther Duflo (2010) · Jonathan Levin (2011)

Nobel Memorial Laureates in Economics (1969–1975) - Ragnar Frisch / Jan Tinbergen (1969)

- Paul Samuelson (1970)

- Simon Kuznets (1971)

- John Hicks / Kenneth Arrow (1972)

- Wassily Leontief (1973)

- Gunnar Myrdal / Friedrich Hayek (1974)

- Leonid Kantorovich / Tjalling Koopmans (1975)

- Complete list

- (1969–1975)

- (1976–2000)

- (2001–2025)

United States National Medal of Science laureates Behavioral and social science 1960s1980s1986: Herbert A. Simon · 1987: Anne Anastasi · George J. Stigler · 1988: Milton Friedman

1990s1990: Leonid Hurwicz · Patrick Suppes · 1991: Robert W. Kates · George A. Miller · 1992: Eleanor J. Gibson · 1994: Robert K. Merton · 1995: Roger N. Shepard · 1996: Paul Samuelson · 1997: William K. Estes · 1998: William Julius Wilson · 1999: Robert M. Solow

2000s2000: Gary Becker · 2001: George Bass · 2003: R. Duncan Luce · 2004: Kenneth Arrow · 2005: Gordon H. Bower · 2008: Michael I. Posner · 2009: Mortimer Mishkin

Biological sciences 1960s1963: C. B. van Niel · 1964: Marshall W. Nirenberg · 1965: Francis P. Rous · George G. Simpson · Donald D. Van Slyke · 1966: Edward F. Knipling · Fritz Albert Lipmann · William C. Rose · Sewall Wright · 1967: Kenneth S. Cole · Harry F. Harlow · Michael Heidelberger · Alfred H. Sturtevant · 1968: Horace Barker · Bernard B. Brodie · Detlev W. Bronk · Jay Lush · Burrhus Frederic Skinner · 1969: Robert Huebner · Ernst Mayr

1970s1970: Barbara McClintock · Albert B. Sabin · 1973: Daniel I. Arnon · Earl W. Sutherland, Jr. · 1974: Britton Chance · Erwin Chargaff · James V. Neel · James Augustine Hannon · 1975: Hallowell Davis · Paul Gyorgy · Sterling Brown Hendricks · Orville lvin Vogel · 1976: Roger C.L. Guillemin · Keith Roberts Porter · Efraim Racker · E. O. Wilson · 1979: Robert H. Burris · Elizabeth C. Crosby · Arthur Kornberg · Severo Ochoa · Earl Reece Stadtman · George Ledyard Stebbins · Paul Alfred Weiss

1980s1981: Philip Handler · 1982: Seymour Benzer · Glenn W. Burton · Mildred Cohn · 1983: Howard L. Bachrach · Paul Berg · Wendell L. Roelofs · Berta Scharrer · 1986: Stanley Cohen · Donald A. Henderson · Vernon B. Mountcastle · George Emil Palade · Joan A. Steitz · 1987: Michael E. Debakey · Theodor O. Diener · Harry Eagle · Har Gobind Khorana · Rita Levi-Montalcini · 1988: Michael S. Brown · Stanley Norman Cohen · Joseph L. Goldstein · Maurice R. Hilleman · Eric R. Kandel · Rosalyn Sussman Yalow · 1989: Katherine Esau · Viktor Hamburger · Philip Leder · Joshua Lederberg · Roger W. Sperry · Harland G. Wood

1990s1990: Baruj Benacerraf · Herbert W. Boyer · Daniel E. Koshland, Jr. · Edward B. Lewis · David G. Nathan · E. Donnall Thomas · 1991: Mary Ellen Avery · G. Evelyn Hutchinson · Elvin A. Kabat · Salvador Luria · Paul A. Marks · Folke K Skoog · Paul C. Zamecnik · 1992: Maxine Singer · Howard M. Temin · 1993: Daniel Nathans · Salome G. Waelsch · 1994: Thomas Eisner · Elizabeth F. Neufeld · 1995: Alexander Rich · 1996: Ruth Patrick · 1997: James D. Watson · Robert A. Weinberg · 1998: Bruce Ames · Janet Rowley · 1999: David Baltimore · Jared Diamond · Lynn Margulis

2000s2000: Nancy C. Andreasen · Peter H. Raven · Carl Woese · 2001: Francisco J. Ayala · Mario R. Capecchi · Ann M. Graybiel · Gene E. Likens · Victor A. McKusick · Harold Varmus · 2002: James E. Darnell · Evelyn M. Witkin · 2003: J. Michael Bishop · Solomon H. Snyder · Charles Yanofsky · 2004: Norman E. Borlaug · Phillip A. Sharp · Thomas E. Starzl · 2005: Anthony Fauci · Torsten N. Wiesel · 2006: Rita R. Colwell · Nina Fedoroff · Lubert Stryer · 2007: Robert J. Lefkowitz · Bert W. O'Malley · 2008: Francis S. Collins · Elaine Fuchs · J. Craig Venter · 2009: Susan L. Lindquist · Stanley B. Prusiner

Chemistry 1980s1982: F. Albert Cotton · Gilbert Stork · 1983: Roald Hoffmann · George C. Pimentel · Richard N. Zare · 1986: Harry B. Gray · Yuan Tseh Lee · Carl S. Marvel · Frank H. Westheimer · 1987: William S. Johnson · Walter H. Stockmayer · Max Tishler · 1988: William O. Baker · Konrad E. Bloch · Elias J. Corey · 1989: Richard B. Bernstein · Melvin Calvin · Rudoph A. Marcus · Harden M. McConnell

1990s1990: Elkan Blout · Karl Folkers · John D. Roberts · 1991: Ronald Breslow · Gertrude B. Elion · Dudley R. Herschbach · Glenn T. Seaborg · 1992: Howard E. Simmons, Jr. · 1993: Donald J. Cram · Norman Hackerman · 1994: George S. Hammond · 1995: Thomas Cech · Isabella L. Karle · 1996: Norman Davidson · 1997: Darleane C. Hoffman · Harold S. Johnston · 1998: John W. Cahn · George M. Whitesides · 1999: Stuart A. Rice · John Ross · Susan Solomon

2000s2000: John D. Baldeschwieler · Ralph F. Hirschmann · 2001: Ernest R. Davidson · Gabor A. Somorjai · 2002: John I. Brauman · 2004: Stephen J. Lippard · 2006: Marvin H. Caruthers · Peter B. Dervan · 2007: Mostafa A. El-Sayed · 2008: Joanna S. Fowler · JoAnne Stubbe · 2009: Stephen J. Benkovic · Marye Anne Fox

Engineering sciences 1960s1962: Theodore von Kármán · 1963: Vannevar Bush · John Robinson Pierce · 1964: Charles S. Draper · 1965: Hugh L. Dryden · Clarence L. Johnson · Warren K. Lewis · 1966: Claude E. Shannon · 1967: Edwin H. Land · Igor I. Sikorsky · 1968: J. Presper Eckert · Nathan M. Newmark · 1969: Jack St. Clair Kilby

1970s1970: George E. Mueller · 1973: Harold E. Edgerton · Richard T. Whitcomb · 1974: Rudolf Kompfner · Ralph Brazelton Peck · Abel Wolman · 1975: Manson Benedict · William Hayward Pickering · Frederick E. Terman · Wernher von Braun · 1976: Morris Cohen · Peter C. Goldmark · Erwin Wilhelm Müller · 1979: Emmett N. Leith · Raymond D. Mindlin · Robert N. Noyce · Earl R. Parker · Simon Ramo

1980s1982: Edward H. Heinemann · Donald L. Katz · 1983: William R. Hewlett · George M. Low · John G. Trump · 1986: Hans Wolfgang Liepmann · T. Y. Lin · Bernard M. Oliver · 1987: R. Byron Bird · H. Bolton Seed · Ernst Weber · 1988: Daniel C. Drucker · Willis M. Hawkins · George W. Housner · 1989: Harry George Drickamer · Herbert E. Grier

1990s1990: Mildred S. Dresselhaus · Nick Holonyak Jr. · 1991: George Heilmeier · Luna B. Leopold · H. Guyford Stever · 1992: Calvin F. Quate · John Roy Whinnery · 1993: Alfred Y. Cho · 1994: Ray W. Clough · 1995: Hermann A. Haus · 1996: James L. Flanagan · C. Kumar N. Patel · 1998: Eli Ruckenstein · 1999: Kenneth N. Stevens

2000s2000: Yuan-Cheng B. Fung · 2001: Andreas Acrivos · 2002: Leo Beranek · 2003: John M. Prausnitz · 2004: Edwin N. Lightfoot · 2005: Jan D. Achenbach · Tobin J. Marks · 2006: Robert S. Langer · 2007: David J. Wineland · 2008: Rudolf E. Kálmán · 2009: Amnon Yariv

Mathematical, statistical, and computer sciences 1960s1963: Norbert Wiener · 1964: Solomon Lefschetz · H. Marston Morse · 1965: Oscar Zariski · 1966: John Milnor · 1967: Paul Cohen · 1968: Jerzy Neyman · 1969: William Feller

1970s1970: Richard Brauer · 1973: John Tukey · 1974: Kurt Gödel · 1975: John W. Backus · Shiing-Shen Chern · George Dantzig · 1976: Kurt Otto Friedrichs · Hassler Whitney · 1979: Joseph Leo Doob · Donald E. Knuth

1980s1982: Marshall Harvey Stone · 1983: Herman Goldstine · Isadore Singer · 1986: Peter Lax · Antoni Zygmund · 1987: Raoul Bott · Michael Freedman · 1988: Ralph E. Gomory · Joseph B. Keller · 1989: Samuel Karlin · Saunders MacLane · Donald C. Spencer

1990s1990: George F. Carrier · Stephen Cole Kleene · John McCarthy · 1991: Alberto Calderón · 1992: Allen Newell · 1993: Martin David Kruskal · 1994: John Cocke · 1995: Louis Nirenberg · 1996: Richard Karp · Stephen Smale · 1997: Shing-Tung Yau · 1998: Cathleen Synge Morawetz · 1999: Felix Browder · Ronald R. Coifman

2000s2000: John Griggs Thompson · Karen K. Uhlenbeck · 2001: Calyampudi R. Rao · Elias M. Stein · 2002: James G. Glimm · 2003: Carl R. de Boor · 2004: Dennis P. Sullivan · 2005: Bradley Efron · 2006: Hyman Bass · 2007: Leonard Kleinrock · Andrew J. Viterbi · 2009: David B. Mumford

Physical sciences 1960s1963: Luis W. Alvarez · 1964: Julian Schwinger · Harold Clayton Urey · Robert Burns Woodward · 1965: John Bardeen · Peter Debye · Leon M. Lederman · William Rubey · 1966: Jacob Bjerknes · Subrahmanyan Chandrasekhar · Henry Eyring · John H. Van Vleck · Vladimir K. Zworykin · 1967: Jesse Beams · Francis Birch · Gregory Breit · Louis Hammett · George Kistiakowsky · 1968: Paul Bartlett · Herbert Friedman · Lars Onsager · Eugene Wigner · 1969: Herbert C. Brown · Wolfgang Panofsky

1970s1970: Robert H. Dicke · Allan R. Sandage · John C. Slater · John A. Wheeler · Saul Winstein · 1973: Carl Djerassi · Maurice Ewing · Arie Jan Haagen-Smit · Vladimir Haensel · Frederick Seitz · Robert Rathbun Wilson · 1974: Nicolaas Bloembergen · Paul Flory · William Alfred Fowler · Linus Carl Pauling · Kenneth Sanborn Pitzer · 1975: Hans A. Bethe · Joseph Hirschfelder · Lewis Sarett · E. Bright Wilson · Chien-Shiung Wu · 1976: Samuel Goudsmit · Herbert S. Gutowsky · Frederick Rossini · Verner Suomi · Henry Taube · George Uhlenbeck · 1979: Richard P. Feynman · Herman Mark · Edward M. Purcell · John Sinfelt · Lyman Spitzer · Victor F. Weisskopf

1980s1982: Philip W. Anderson · Yoichiro Nambu · Edward Teller · Charles H. Townes · 1983: E. Margaret Burbidge · Maurice Goldhaber · Helmut Landsberg · Walter Munk · Frederick Reines · Bruno B. Rossi · J. Robert Schrieffer · 1986: Solomon Buchsbaum · Horace Crane · Herman Feshbach · Robert Hofstadter · Chen Ning Yang · 1987: Philip Abelson · Walter Elsasser · Paul C. Lauterbur · George Pake · James A. Van Allen · 1988: D. Allan Bromley · Paul Ching-Wu Chu · Walter Kohn · Norman F. Ramsey · Jack Steinberger · 1989: Arnold O. Beckman · Eugene Parker · Robert Sharp · Henry Stommel

1990s1990: Allan M. Cormack · Edwin M. McMillan · Robert Pound · Roger Revelle · 1991: Arthur L. Schawlow · Ed Stone · Steven Weinberg · 1992: Eugene M. Shoemaker · 1993: Val Fitch · Vera Rubin · 1994: Albert Overhauser · Frank Press · 1995: Hans Dehmelt · Peter Goldreich · 1996: Wallace S. Broecker · 1997: Marshall Rosenbluth · Martin Schwarzschild · George Wetherill · 1998: Don L. Anderson · John N. Bahcall · 1999: James Cronin · Leo Kadanoff

2000s2000: Willis E. Lamb · Jeremiah P. Ostriker · Gilbert F. White · 2001: Marvin L. Cohen · Raymond Davis Jr. · Charles Keeling · 2002: Richard Garwin · W. Jason Morgan · Edward Witten · 2003: G. Brent Dalrymple · Riccardo Giacconi · 2004: Robert N. Clayton · 2005: Ralph A. Alpher · Lonnie Thompson · 2006: Daniel Kleppner · 2007: Fay Ajzenberg-Selove · Charles P. Slichter · 2008: Berni Alder · James E. Gunn · 2009: Yakir Aharonov · Esther M. Conwell · Warren M. Washington

Categories:- 1915 births

- 2009 deaths

- American economists

- American Jews

- American Nobel laureates

- Fellows of the Econometric Society

- Guggenheim Fellows

- Harvard University alumni

- Jewish American scientists

- Jewish American writers

- Jewish American social scientists

- Kennedy Administration personnel

- Massachusetts Institute of Technology faculty

- Indian Institute of Management Calcutta faculty

- Members of the United States National Academy of Sciences

- National Medal of Science laureates

- Nobel laureates in Economics

- People from Gary, Indiana

- Trade economists

- University of Chicago alumni

- Neo-Keynesian economists

- Presidents of the Econometric Society

- People from Belmont, Massachusetts

- MIT Sloan School of Management faculty

Wikimedia Foundation. 2010.