- Federal Deposit Insurance Corporation

-

Federal Deposit Insurance Corporation FDIC

Agency overview Formed June 16, 1933 Jurisdiction Federal government of the United States Headquarters Washington, D.C. Employees 5,381 (2009, Q1)[1] Agency executive Martin J. Gruenberg, Acting Chairman Website www.fdic.gov Banking in the United States Lending

Credit cardDeposit accounts

Savings account

Checking account

Money market account

Certificate of depositDeposit account insurance

FDIC and NCUAElectronic funds transfer (EFT)

ATM card

Debit card

ACH

Bill payment

EBT

Wire transferCheck Clearing System

Checks

Substitute checks • Check 21 ActTypes of bank charter

Credit union

Federal savings bank

Federal savings association

National bankv · The FDIC's satellite campus in Arlington, Virginia, is home to many administrative and support functions, though the most senior officials work at the main building in Washington

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. As of November 18, 2010 (2010 -11-18)[update], the FDIC insures deposits at 7,723 institutions.[2] The FDIC also examines and supervises certain financial institutions for safety and soundness, performs certain consumer-protection functions, and manages banks in receiverships (failed banks).

Insured institutions are required to place signs at their place of business stating that "deposits are backed by the full faith and credit of the United States Government."[3] Since the start of FDIC insurance on January 1, 1934, no depositor has lost any insured funds as a result of a failure.[4]

At Q4 2010 there were 884 banks having very low capital cushions against risk. It was nearly 12 percent of all federally insured banks, the highest level in 18 years.[5]

Contents

Board of directors

The Board of Directors of the FDIC is the governing body of the FDIC. The Board is composed of five members, three appointed by the President of the United States with the consent of the United States Senate and two ex officio members. The three appointed members each serve six year terms. No more than three members of the Board may be of the same political affiliation. The President, with the consent of the Senate, also designates one of the appointed members as Chair of the Board, to serve a five year term, and one of the appointed members as Vice Chair of the Board, to also serve a five year term.

As of July 9, 2011, the members of the Board of Directors of the Federal Deposit Insurance Corporation are:

- Martin J. Gruenberg - Acting Chairman of the Board

- Thomas J. Curry

- John Walsh - Acting Comptroller of the Currency

- John E. Bowman - Acting Director of the Office of Thrift Supervision

History

Inception

During the 1930s, the U.S. and the rest of the world experienced a severe economic contraction that is now called the Great Depression. In the U.S. during the height of the Great Depression, the official unemployment rate was 25% and the stock market had declined 75% since 1929. Bank runs were common because there wasn't insurance on deposits at banks, banks kept only a fraction of deposits in reserve, and customers ran the risk of losing the money that they had deposited if their bank failed.[6]

On June 16, 1933, President Franklin D. Roosevelt signed the Banking Act of 1933. This legislation:[6]

- Established the FDIC as a temporary government corporation

- Gave the FDIC authority to provide deposit insurance to banks

- Gave the FDIC the authority to regulate and supervise state nonmember banks

- Funded the FDIC with initial loans of $289 million through the U.S. Treasury and the Federal Reserve

- Extended federal oversight to all commercial banks for the first time

- Separated commercial and investment banking (Glass–Steagall Act)

- Prohibited banks from paying interest on checking accounts

- Allowed national banks to branch statewide, if allowed by state law.

Historical insurance limits

- 1934 - $2,500

- 1935 - $5,000

- 1950 - $10,000

- 1966 - $15,000

- 1969 - $20,000

- 1974 - $40,000

- 1980 - $100,000

- 2008 - $250,000

The temporary increase in 2008 of the insurance limit to $250,000 was set to expire on 31 December 2013. However, the Wall Street Reform and Consumer Protection Act (P.L.111-203), which was signed into law on July 21, 2010, made the $250,000 insurance limit permanent.[7] In addition, the Federal Deposit Insurance Reform Act of 2005 (P.L.109-171) allows for the Boards of the FDIC and the National Credit Union Administration (NCUA) to consider inflation and other factors every five years beginning in 2010 and, if warranted, to adjust the amounts under a specified formula.[8][9]

S&L and bank crisis of the 1980s

Main article: Savings and loan crisisFederal deposit insurance received its first large-scale test in the late 1980s and early 1990s during the savings and loan crisis (which also affected commercial banks and savings banks).

The brunt of the crisis fell upon a parallel institution, the Federal Savings and Loan Insurance Corporation (FSLIC), created to insure savings and loan institutions (S&Ls, also called thrifts). Due to a confluence of events, much of the S&L industry was insolvent, and many large banks were in trouble as well. The FSLIC became insolvent and merged into the FDIC. Thrifts are now overseen by the Office of Thrift Supervision, an agency that works closely with the FDIC and the Comptroller of the Currency. (Credit unions are insured by the National Credit Union Administration.) The primary legislative responses to the crisis were the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA), and Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA).

This crisis cost taxpayers an estimated $150 billion to resolve.

2008-2010 Financial crisis

2008

As a result of the financial crisis in 2008, twenty-five U.S. banks became insolvent and were taken over by the FDIC.[10] However, during that year, the largest bank failure in terms of dollar value occurred on September 26, 2008 when Washington Mutual experienced a 10-day bank run on its deposits.[11][12]

2009

On July 31, 2009, the FDIC launched its Legacy Loans Program (LLP). This initiative is aimed at helping banks rid their balance sheets of toxic assets so they can raise new capital and increase lending.[13]

On August 14, 2009, Bloomberg reported that more than 150 publicly traded U.S. lenders had nonperforming loans above 5% of their total holdings. This is important because former regulators say that this is the level that can wipe out a bank's equity and threaten its survival. While this ratio doesn't always lead to bank failures if the banks in question have raised additional capital and have properly established reserves for the bad debt, it is an important indicator for future FDIC activity.[14]

On August 21, 2009, the 2nd largest bank, Guaranty Bank, in Texas became insolvent and was taken over by BBVA Compass , the U.S. division of Banco Bilbao Vizcaya Argentaria SA, the second-largest bank in Spain. This is the first foreign company to buy a failed bank during the credit crisis of 2008 and 2009. In, addition, the FDIC agreed to share losses with BBVA on about 11 billion of Guaranty Bank's loans and other assets.[15] This transaction alone cost the FDIC Deposit Insurance Fund $3 Billion.

On August 27, 2009, the FDIC increased the number of troubled banks to 416 in the second quarter. That number compares to 305 just three months earlier.[16] At the end of the third quarter that number jumped to 552.[17]

At the close of 2009, a total of 140 banks had become insolvent.[18] This is the largest number of bank failures in a year since 1992, when 179 institutions failed.[19]

2010

On February 23, 2010, FDIC chairman Sheila Bair warned that the number of failures in 2010 could surpass the 140 banks that were seized in 2009. Commercial Real Estate overexposure was deemed the most serious threat to banks in 2010.[18]

On April 30, 2010, the FDIC used emergency powers to seize three banks in Puerto Rico at a cost of $5.3 billion.[20]

In 2010, 157 banks with approximately $92 billion in total assets failed.[21]

Funds

Former funds

Between 1989 and 2006, there were two separate FDIC funds — the Bank Insurance Fund (BIF), and the Savings Association Insurance Fund (SAIF). The latter was established after the savings & loans crisis of the 1980s. The existence of two separate funds for the same purpose led to banks attempting to shift from one fund to another, depending on the benefits each could provide. In the 1990s, SAIF premiums were at one point five times higher than BIF premiums; several banks attempted to qualify for the BIF, with some merging with institutions qualified for the BIF to avoid the higher premiums of the SAIF. This drove up the BIF premiums as well, resulting in a situation where both funds were charging higher premiums than necessary.[22]

Then Chairman of the Federal Reserve Alan Greenspan was a critic of the system, saying that "We are, in effect, attempting to use government to enforce two different prices for the same item – namely, government-mandated deposit insurance. Such price differences only create efforts by market participants to arbitrage the difference." Greenspan proposed "to end this game and merge SAIF and BIF".[23]

Deposit Insurance Fund

In February, 2006, President George W. Bush signed into law the Federal Deposit Insurance Reform Act of 2005 ("FDIRA") and a related conforming amendments act. The FDIRA contains technical and conforming changes to implement deposit insurance reform, as well as a number of study and survey requirements. Among the highlights of this law was merging the Bank Insurance Fund (BIF) and the Savings Association Insurance Fund (SAIF) into a new fund, the Deposit Insurance Fund (DIF). This change was made effective March 31, 2006. The FDIC maintains the DIF by assessing depository institutions an insurance premium. The amount each institution is assessed is based both on the balance of insured deposits as well as on the degree of risk the institution poses to the insurance fund.

Bank failures typically represent a cost to the DIF because FDIC, as receiver of the failed institution, must liquidate assets that have declined substantially in value while at the same time making good on the institution's deposit obligations.

A March 2008 memorandum to the FDIC Board of Directors shows a 2007 year-end Deposit Insurance Fund balance of about $52.4 billion, which represented a reserve ratio of 1.22% of its exposure to insured deposits totaling about $4.29 trillion. The 2008 year-end insured deposits were projected to reach about $4.42 trillion with the reserve growing to $55.2 billion, a ratio of 1.25%.[24] As of June 2008, the DIF had a balance of $45.2 billion.[25] However, 9 months later, in March, 2009, the DIF fell to $13 billion.[26] That was the lowest total since September, 1993[26] and represented a reserve ratio of 0.27% of its exposure to insured deposits totaling about $4.83 trillion.[27] In the second quarter of 2009, the FDIC imposed an emergency fee aimed at raising $5.6 billion to replenish the DIF.[28] However, Saxo Bank Research reported that after Aug 7th further bank failures had reduced the DIF balance to $648.1 million.[29] FDIC-estimated costs of assuming additional failed banks on Aug 14th exceeded that amount.[citation needed] The FDIC announced its intent, on September 29, 2009 to assess the banks in advance for three years of premiums in an effort to avoid DIF insolvency. The FDIC revised its estimated costs of bank failures to about $100 billion over the next four years, an increase of $30 billion from the $70 billion estimate of earlier in 2009. The FDIC board voted to require insured banks to prepay $45 billion in premiums to replenish the fund. News media reported that the prepayment move would be inadequate to assure the financial stability of the FDIC insurance fund. The FDIC elected to request the prepayment so that the banks could recognize the expense over three years, instead of drawing down banks' statutory capital abruptly, at the time of the assessment.[30] The fund is mandated by law to keep a balance equivalent to 1.15 percent of insured deposits.[30] As of June 30, 2008, the insured banks held approximately $7,025 billion in total deposits, though not all of those are insured.[31]

The DIF's reserves are not the only cash resources available to the FDIC: in addition to the $18 billion in the DIF as of June, 2010;[32] the FDIC has $19 billion of cash and U.S. Treasury securities held as of June, 2010[32] and has the ability to borrow up to $500 billion from the Treasury. The FDIC can also demand special assessments from banks as it did in the second quarter of 2009.[33][34]

"Full Faith and Credit"

In light of apparent systemic risks facing the banking system, the adequacy of FDIC's financial backing has come into question. Beyond the funds in the Deposit Insurance Fund above and the FDIC's power to charge insurance premia, FDIC insurance is additionally assured by the Federal government. According to the FDIC.gov website (as of January 2009), "FDIC deposit insurance is backed by the full faith and credit of the United States government". This means that the resources of the United States government stand behind FDIC-insured depositors."[35] The statutory basis for this claim is less than clear. Congress, in 1987, passed a non-binding "Sense of Congress" to that effect,[36] but there appear to be no laws strictly binding the government to make good on any insurance liabilities unmet by the FDIC.

Insurance requirements

To receive this benefit, member banks must follow certain liquidity and reserve requirements. Banks are classified in five groups according to their risk-based capital ratio:

- Well capitalized: 10% or higher

- Adequately capitalized: 8% or higher

- Undercapitalized: less than 8%

- Significantly undercapitalized: less than 6%

- Critically undercapitalized: less than 2%

When a bank becomes undercapitalized the FDIC issues a warning to the bank. When the number drops below 6% the FDIC can change management and force the bank to take other corrective action. When the bank becomes critically undercapitalized the FDIC declares the bank insolvent and can take over management of the bank.

Resolution of insolvent banks

The two most common methods employed by FDIC in cases of insolvency or illiquidity are:

- Purchase and Assumption Method (P&A), in which all deposits (liabilities) are assumed by an open bank, which also purchases some or all of the failed bank's loans (assets). Other failed assets are auctioned online, primarily through The Debt Exchange and First Financial Network.[37]

- Payout Method, in which insured deposits are paid by the FDIC, which attempts to recover its payments by liquidating the receivership estate of the failed bank. These are straight deposit payoffs and are only executed if the FDIC doesn’t receive a bid for a P&A transaction or for an insured deposit transfer transaction. In a straight deposit payoff, no liabilities are assumed and no assets are purchased by another institution. Also, the FDIC determines the insured amount for each depositor and pays that amount to him or her. In calculating each customer’s total deposit amount, the FDIC includes all the interest accrued up to the date of failure under the contractual terms of the depositor’s account.[38]

Insured products

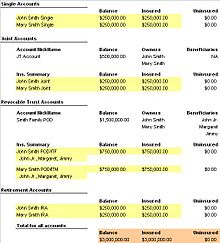

FDIC deposit insurance covers deposit accounts, which, by the FDIC definition, include:

- demand deposit accounts (checking accounts), and negotiable order of withdrawal accounts (NOW accounts, i.e., savings accounts that have check-writing privileges)

- savings deposit accounts (savings accounts), and money market deposit accounts (MMDAs, i.e., higher-interest savings accounts subject to check-writing restrictions)

- time deposit accounts including certificates of deposit (CDs)

- outstanding cashier's checks, interest checks, and other negotiable instruments drawn on the accounts of the bank.

- accounts denominated in foreign currencies[39]

Accounts at different banks are insured separately. All branches of a bank are considered to form a single bank. Also, an Internet bank that is part of a brick and mortar bank is not considered to be a separate bank, even if the name differs. Non-US citizens are also covered by FDIC insurance.[39]

The FDIC publishes a guide entitled "Your Insured Deposits",[40] which sets forth the general characteristics of FDIC deposit insurance, and addresses common questions asked by bank customers about deposit insurance.[41]

Items not insured

Only the above types of accounts are insured. Some types of uninsured products, even if purchased through a covered financial institution, are:[41]

- Stocks, bonds, mutual funds, and money funds

- The Securities Investor Protection Corporation, a separate institution chartered by Congress, provides protection against the loss of many types of such securities in the event of a brokerage failure, but not against losses on the investments.

- Further, as of September 19, 2008, the US Treasury is offering an optional insurance program for money market funds, which guarantees the value of the assets.[42]

- Exceptions have occurred, such as the FDIC bailout of bondholders of Continental Illinois.

- Investments backed by the U.S. government, such as US Treasury securities

- The contents of safe deposit boxes.

- Even though the word deposit appears in the name, under federal law a safe deposit box is not a deposit account – it is merely a secured storage space rented by an institution to a customer.

- Losses due to theft or fraud at the institution.

- These situations are often covered by special insurance policies that banking institutions buy from private insurance companies.

- Accounting errors.

- In these situations, there may be remedies for consumers under state contract law, the Uniform Commercial Code, and some federal regulations, depending on the type of transaction.

- Insurance and annuity products, such as life, auto and homeowner's insurance.

See also

- 2008–2010 bank failures in the United States

- Canada Deposit Insurance Corporation

- FDIC Enterprise Architecture Framework

- FDIC problem bank list

- Financial crisis of 2007-2010

- List of acquired or bankrupt United States banks in the late 2000s financial crisis

- List of largest U.S. bank failures

- National Credit Union Administration

- Temporary Liquidity Guarantee Program

- Too Big to Fail policy

Notes

- ^ "Statistics At A Glance". FDIC. http://www.fdic.gov/bank/statistical/stats/2009mar/fdic.pdf. Retrieved 15 September 2011.

- ^ "fdic key statistics". http://www2.fdic.gov/idasp/. Retrieved 2010-06-03.

- ^ 12 U.S.C. section 1828(a)(1)(B). Accessible online from Cornell law: US CODE: Title 12,1828. Regulations governing insured depository institutions

- ^ FDIC. "FDIC: Who is the FDIC?". http://www.fdic.gov/about/learn/symbol/index.html. Retrieved 2009-07-24.

- ^ "Troubled banks rise to highest level in 18 years". New York Post (News Corporation). February 24, 2011. http://www.nypost.com/p/news/business/bank_mess_hits_year_high_Din5AiDbunYFyUoiFIrh3M?CMP=OTC-rss&FEEDNAME=. Retrieved September 15, 2011.

- ^ a b "FDIC: Learning Bank". Fdic.gov. http://www.fdic.gov/about/learn/learning/when/1930s.html. Retrieved 2011-09-15.

- ^ "Changes in FDIC Deposit Insurance Coverage". fdic.gov. July 21, 2010. http://www.fdic.gov/deposit/deposits/changes.html.

- ^ "Reform of Deposit Insurance (including the adjustment to $250,000 and allowing for adjustments every five years)". http://www.fdic.gov/deposit/insurance/reform.html.

- ^ "FDIC Interim rule". gpo.gov. http://www.gpo.gov/fdsys/pkg/FR-2006-03-23/pdf/06-2779.pdf.

- ^ FDIC. "Failed Bank List". http://www.fdic.gov/bank/individual/failed/banklist.html. Retrieved 2009-06-27.

- ^ Shen, Linda (2008-09-26). "WaMu's Bank Split From Holding Company, Sparing FDIC". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601087&sid=a2VofC5midrw&refer=home. Retrieved 2008-09-27.

- ^ Dash, Eric (2008-04-07). "$5 Billion Said to Be Near for WaMu". The New York Times. http://www.nytimes.com/2008/04/07/business/07cnd-wamu.html?_r=1&oref=slogin. Retrieved 2008-09-27.

- ^ FDIC. "Legacy Loans Program". http://www.fdic.gov/news/news/press/2009/pr09131.html. Retrieved 2009-07-31.

- ^ Ari Levy. "Toxic Loans Topping 5% May Push 150 Banks to Point of No Return". http://www.bloomberg.com/apps/news?pid=20601087&sid=aTTT9jivRIWE. Retrieved 2009-08-14.

- ^ Barr, Colin (August 21, 2009). "Foreign banks can't save everyone". CNN. http://money.cnn.com/2009/08/21/news/companies/banks.invasion.fortune/?postversion=2009082115. Retrieved May 2, 2010.

- ^ "FDIC: Press Releases - PR-153-2009 8/27/2009". Fdic.gov. http://www.fdic.gov/news/news/press/2009/pr09153.html. Retrieved 2011-09-15.

- ^ Eric Dash (November 24, 2009). "As Bank Failures Rise, F.D.I.C. Fund Falls Into Red". The New York Times. p. B4. http://www.nytimes.com/2009/11/25/business/economy/25fdic.html. Retrieved 2009-11-28.

- ^ a b Dakin Campbell. "Avanta Bank, Six other U.S. Banks Collapse Due to Bad Loans". http://www.bloomberg.com/apps/news?pid=20601087&sid=aSAZEmeZ5Ek4&pos=6. Retrieved 2010-03-19.

- ^ FDIC. "FDIC Trends, March, 2009". http://www.fdic.gov/bank/statistical/stats/2009mar/fdic.pdf. Retrieved 2009-07-10.

- ^ Dakin Campbell. "Puerto Rico Banks Seized as Regulators Waive Deposit Limits". http://www.bloomberg.com/apps/news?pid=20601087&sid=amOYkeUXdioM&pos=7. Retrieved 2010-04-30.

- ^ "Failed Banks Class of 2010". http://www.snl.com/InteractiveX/article.aspx?ID=10564971. Retrieved 2011-01-05.

- ^ Sicilia, David B. & Cruikshank, Jeffrey L. (2000). The Greenspan Effect, pp. 96–97. New York: McGraw-Hill. ISBN 0-07-134919-7.

- ^ Sicilia & Cruikshank, pp. 97–98.

- ^ "Assessment Rates for 2008" (PDF). p. 11. http://www.fdic.gov/deposit/insurance/assessments/assessment_rates_2008.pdf. Retrieved 2011-09-15.

- ^ "Chief Financial Officer's (CFO) Report to the Board: DIF Balance Sheet - Third Quarter 2008". Fdic.gov. http://www.fdic.gov/about/strategic/corporate/cfo_report_3rdqtr_08/balance.html. Retrieved 2011-09-15.

- ^ a b Ari Levy and Margaret Chadbourn (July 10, 2009). "Bank of Wyoming Seized; 53rd U.S. Failure This Year (Update1)". http://www.bloomberg.com/apps/news?pid=20601087&sid=agpbmkGrsbu4. Retrieved 2009-07-10.

- ^ "FDIC Statistics at a Glance" (PDF). http://www.fdic.gov/bank/statistical/stats/2009mar/fdic.pdf. Retrieved 2011-09-15.

- ^ Ari Levy and Margaret Chadbourn. "Lender Failures Reach 64 as Georgia Shuts Security Bank’s Units". http://www.bloomberg.com/apps/news?pid=20601087&sid=aTvSvyYr_sEE. Retrieved 2009-07-224.

- ^ Bagger-Sjöbäck, Robin (August 12, 2009). "FDIC’s Shrinking Deposit Insurance Fund – A Testimony of Current Accounting Standards". Saxo Bank Research. http://www.tradingfloor.com/EN/Pages/Financial_News.aspx?blogid=280. Retrieved 2009-08-20.

- ^ a b "FDIC Insurance Plan Is No Long-Term Solution". New York Times. Associated Press. September 29, 2009. http://www.nytimes.com/aponline/2009/09/29/business/AP-US-FDIC-Shrinking-Fund.html. Retrieved September 29, 2009.

- ^ "Deposits of all FDIC-Insured Institutions, National Totals* by Asset Size: Data as of June 30, 2008". Summary of Deposits. Federal Deposit Insurance Corporation. http://www2.fdic.gov/sod/sodSumReport.asp?barItem=3&sInfoAsOf=2008. Retrieved October 3, 2009.

- ^ a b [1] "FDIC 2nd quarter 2010 balance"]. fdic.gov. http://www.fdic.gov/about/strategic/corporate/cfo_report_2ndqtr_10/balance.html].

- ^ "Banks Tapped to Bolster FDIC Resources: FDIC Board Approves Proposed Rule to Seek Prepayment of Assessments". Press Release (Federal Deposit Insurance Corporation). September 29, 2009. http://www.fdic.gov/news/news/press/2009/pr09153.html. Retrieved October 4, 2009.

- ^ "FDIC Extends Restoration Plan: Imposes Special Assessment". Press Release (Federal Deposit Insurance Corporation). February 27, 2009. http://www.fdic.gov/news/news/press/2009/pr09030.html. Retrieved October 5, 2009.

- ^ "FDIC: Symbol of Confidence for 75 Years". http://www.fdic.gov/consumers/banking/confidence/symbol.html#Full. Retrieved 2009-01-16.

- ^ "FDIC Law, Regulations, Related Acts". http://www.fdic.gov/regulations/laws/rules/4000-2660.html. Retrieved 2009-01-16.

- ^ FDIC Website (accessed June 17, 2009)

- ^ "Chapter 4 - Deposit Payoffs". FDIC. http://www.fdic.gov/bank/historical/reshandbook/ch4payos.pdf. Retrieved 15 September 2011.

- ^ a b "FDIC Law, Regulations, Related Acts - Rules and Regulations". Fdic.gov. http://www.fdic.gov/regulations/laws/rules/2000-5400.html#2000part330.3. Retrieved 2011-09-15.

- ^ fdic.gov

- ^ a b "FDIC: Insured or Not Insured?". Fdic.gov. http://www.fdic.gov/consumers/consumer/information/fdiciorn.html. Retrieved 2011-09-15.

- ^ Henriques, Diana B. (2008-09-19). "Treasury to Guarantee Money Market Funds". The New York Times. http://www.nytimes.com/2008/09/20/business/20moneys.html?em. Retrieved 2008-09-20.

External links

- Federal Deposit Insurance Corporation (official website)

- FDIC Statistics at a Glance (FDIC.gov)

- FDIC List of Failed Banks

- The Federal Deposit Insurance Reform Conforming Amendments Act of 2005

- History including Boards of Directors

- 60 Minutes - Your Bank Has Failed: What Happens Next?

v · d · eBank regulation in the United States Fair debt collection Federal authorities Federal Financial Institutions Examination Council • Federal Deposit Insurance Corporation • Federal Reserve Board • National Credit Union Administration • Office of the Comptroller of the Currency • Office of Thrift SupervisionMajor federal legislation

(Category)Credit CARD Act of 2009 • Emergency Economic Stabilization Act of 2008 • Fair and Accurate Credit Transactions Act • Gramm–Leach–Bliley Act • Truth in Savings Act • Electronic Fund Transfer Act • Community Reinvestment Act • Home Mortgage Disclosure Act • Fair Credit Reporting Act • Truth in Lending Act • Bank Secrecy Act • Bank Holding Company Act • Federal Credit Union Act • Glass–Steagall Act • Federal Reserve Act

(Category)Credit CARD Act of 2009 • Emergency Economic Stabilization Act of 2008 • Fair and Accurate Credit Transactions Act • Gramm–Leach–Bliley Act • Truth in Savings Act • Electronic Fund Transfer Act • Community Reinvestment Act • Home Mortgage Disclosure Act • Fair Credit Reporting Act • Truth in Lending Act • Bank Secrecy Act • Bank Holding Company Act • Federal Credit Union Act • Glass–Steagall Act • Federal Reserve ActFederal Reserve Board

regulationsExtensions of Credit by Federal Reserve Banks (Reg A)

Equal Credit Opportunity (Reg B)

Home Mortgage Disclosure (Reg C)

Reserve Requirements for Depository Institutions (Reg D)

Electronic Fund Transfer (Reg E)

Limitations on Interbank Liabilities (Reg F)

International Banking Operations (Reg K)

Consumer Leasing (Reg M)

Loans to Insiders (Reg O)

Privacy of Consumer Financial Information (Reg P)

Prohibition Against the Paying of Interest on Demand Deposits (Reg Q)

Credit by Brokers and Dealers (Reg T)

Credit by Banks and Persons Other Than Brokers or Dealers for the Purpose of Purchasing or Carrying Margin Stock (Reg U)

Transactions Between Member Banks and Their Affiliates (Reg W)

Borrowers of Securities Credit (Reg X)

Truth in Lending (Reg Z)

Unfair or Deceptive Acts or Practices (Reg AA)

Community Reinvestment (Reg BB)

Availability of Funds and Collection of Checks (Reg CC)

Truth in Savings (Reg DD)Types of bank charter State authorities Terms Other topics Categories:- New Deal agencies

- Government-owned companies in the United States

- Federal Deposit Insurance Corporation

- Companies established in 1933

- Independent agencies of the United States government

- Bank regulation in the United States

- Financial regulatory authorities of the United States

- Organizations based in Washington, D.C.

Wikimedia Foundation. 2010.

Look at other dictionaries:

Federal Deposit Insurance Corporation — n. An agency within the executive branch of the U.S. government that insures deposits in banks and savings associations. abbrv. FDIC The Essential Law Dictionary. Sphinx Publishing, An imprint of Sourcebooks, Inc. Amy Hackney Blackwell. 2008.… … Law dictionary

Federal Deposit Insurance Corporation — [ fedərəl dɪpɑzɪt ɪnʃʊərəns kɔːpə reɪʃn], Abkürzung FDIC, staatliche Einlagenversicherung in den USA (Einlagensicherung) … Universal-Lexikon

Federal Deposit Insurance Corporation — 38° 53′ 50″ N 77° 02′ 24″ W / 38.8971, 77.0401 … Wikipédia en Français

Federal Deposit Insurance Corporation — ( FDIC) A federal institution that insures bank deposits. Bloomberg Financial Dictionary * * * Federal Deposit Insurance Corporation ˌFederal Deˈposit Inˌsurance Corpoˌration abbreviation FDIC noun ORGANIZATIONS BANKING a US government… … Financial and business terms

Federal Deposit Insurance Corporation — Logo der FDIC Die Federal Deposit Insurance Corporation (FDIC) ist ein durch den Glass Steagall Act von 1933 ins Leben gerufener Einlagensicherungsfonds der Vereinigten Staaten. Inhaltsverzeichnis … Deutsch Wikipedia

Federal Deposit Insurance Corporation Improvement Act (FDICIA) 305 — A section in the FDICIA that requires the FDIC, the Office of the Comptroller of Currency ( OCC), Office of Thrift Supervision ( OTS), and the Federal Reserve to add an interest rate risk component to bank and thrift capital requirements.… … Financial and business terms

Federal Deposit Insurance Corporation Improvement Act 305 — Federal Deposit Insurance Corporation Improvement Act (FDICIA) 305 A section in the FDICIA that requires the FDIC, the Office of the Comptroller of Currency ( OCC), Office of Thrift Supervision ( OTS), and the Federal Reserve to add an interest… … Financial and business terms

Federal Deposit Insurance Corporation Improvement Act of 1991 — The Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA), passed during the Savings and loan crisis, strengthened the power of the Federal Deposit Insurance Corporation.It allowed the FDIC to borrow directly from the Treasury… … Wikipedia

Federal Deposit Insurance Corporation — a public corporation, established in 1933, that insures, up to a specified amount, all demand deposits of member banks. Abbr.: FDIC * * * ▪ United States banking independent U.S. government corporation created under authority of the Banking … Universalium

Federal Deposit Insurance Corporation — FDIC A corporation that provides deposit insurance for US banks through the Bank Insurance Fund. It operates throughout the Federal Reserve System and also for other banks outside it (see state banks) … Big dictionary of business and management

18+© Academic, 2000-2025- Contact us: Technical Support, Advertising

Dictionaries export, created on PHP, Joomla, Drupal, WordPress, MODx.Share the article and excerpts

Federal Deposit Insurance Corporation

- Federal Deposit Insurance Corporation

-

Federal Deposit Insurance Corporation FDIC

Agency overview Formed June 16, 1933 Jurisdiction Federal government of the United States Headquarters Washington, D.C. Employees 5,381 (2009, Q1)[1] Agency executive Martin J. Gruenberg, Acting Chairman Website www.fdic.gov Banking in the United States Lending

Credit cardDeposit accounts

Savings account

Checking account

Money market account

Certificate of depositDeposit account insurance

FDIC and NCUAElectronic funds transfer (EFT)

ATM card

Debit card

ACH

Bill payment

EBT

Wire transferCheck Clearing System

Checks

Substitute checks • Check 21 ActTypes of bank charter

Credit union

Federal savings bank

Federal savings association

National bank