- OMV

-

OMV Aktiengesellschaft

Type Aktiengesellschaft Traded as WBAG: OMV Industry Energy industry Founded 1956 Headquarters Vienna, Austria Key people Gerhard Roiss (CEO), Peter Michaelis (Chairman of the supervisory board) Products Oil and gas exploration and production, natural gas trading and transportation, oil refining, electricity generation Services Fuel stations Revenue €23.32 billion (2010)[1] Operating income €2.334 billion (2010)[1] Profit €920.6 million (2010)[1] Total assets €26.40 billion (end 2010)[1] Total equity €11.31 billion (end 2010)[1] Employees 31,400 (end 2010)[1] Website www.omv.com OMV (originally ÖMV for "Österreichische Mineralölverwaltung", meaning Austrian mineral oil authority) is Austria's largest oil-producing, refining and gas station operating company with important activities in other Central European countries. It is Austria's largest listed industrial company (concerning turnover) and one of the largest integrated oil and gas groups in Central Europe.

Contents

History

OMV was founded in 1956 as a joint stock company. In 1960, the company commissioned the Schwechat Refinery near Vienna. International activities of OMV started in 1985 with exploration and production activities in Libya. In 1990, OMV enlarged its activities into retail sale inaugurating its first filling station followed by the first filling station on abroad (Hungary) in 1991. In 1995, the company changed its name from ÖMV to OMV.[2]

In 2000s OMV had several important acquisitions. In 2002, it bought 25.1% of shares in Rompetrol Group In 2003, it took over the international portfolio of Preussag Energie and 45% of Bayernoil-Raffinerieverbund. One year later, it acquired 51% of the Romanian oil and gas group Petrom SA, which was the largest acquisition in the company's history. In 2005, OMV sold its stake in the Rompetrol Group and together with IPIC of Abu Dhabi acquired petrochemical company Borealis.[2]

In June 2006, OMV established the OMV Future Energy Fund for identifying projects in the field of renewable energy, providing assistance with their implementation and financing.[2] In 2007, OMV tried to take over Hungarian oil company MOL, but was forced to withdraw its merger proposal in 2008.[3] In 2008, OMV and Gazprom to develop the Central European Gas Hub, based on the Baumgarten underground gas storage, into a leading hub platform in continental Europe and to establish a gas exchange there for trading on spot and futures markets for gas products.[4]

Operations

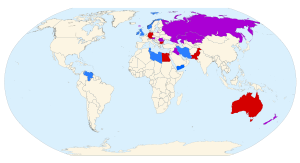

In 2006, OMV has consolidated sales of €18.97 billion, a workforce of 40,993 employees, and a market capitalization of approximately €14 billion. It has refining and marketing activities in 13 countries and explorations and production activities in 18 countries on five continents.[2] OMV operates refineries in Germany, Austria and Romania and it runs over 2500 gas stations in Central Europe, with brands OMV, Avanti, Stroh and PETROM.

Subsidiaries

OMV holds stakes in several oil and petrochemical companies. Most important shareholdings are:

- Petrom S.A. (51%)

- Borealis A/S (36%)

- Agrolinz Melamine International (AMI) GmbH (51%)

- Bayernoil Raffineriegesellschaft GmbH (45%)

- EconGas GmbH (50%)

- Petrol Ofisi A.Ş. (55.40%)

- Nabucco Gas Pipeline International GmbH (16.67%)[5]

OMV Aktiengesellschaft

According to OMV:[6]

- OMV Aktiengesellschaft

- OMV Refining & Marketing GmbH (100%)

- OMV Exploration & Production GmbH (100%)

- OMV Gas & Power GmbH (100%)

- OMV Solutions GmbH (100%)

- Petrom SA (51%)

- Petrol Ofisi (41.58%)

- OMV Deutschland (10%)

- Borealis (36 %)

Refining and marketing

According to OMV:[6]

- Refining & Marketing GmbH (100%)

- OMV Deutschland (90%)

- Bayernoil Raffinerie GmbH (45%)

- Adria Wien Pipeline (76 %)

- Borealis (36%)

- OMV Supply & Trading (100%)

- OMV Trading Services (100%)

- OMV Wärme VertriebsGmbH (100%)

- OMV Česká republika (100%)

- OMV Slovensko (100%)

- OMV Hungaria (100%)

- OMV Slovenija (92.25%)

- OMV Hrvatska (100%)

- OMV Bosnia-Hercegovina (100%)

- OMV Italia (100%)

- OMV Deutschland (90%)

Exploration and production

According to OMV:[6]

- OMV (ALBANIEN) Adriatic Sea Exploration GmbH

- OMV Petroleum Exploration GmbH

- OMV Austria Exploration & Production GmbH

- OMV (BULGARIA) offshore Exploration GmbH

- OMV (EGYPT) Exploration GmbH

- OMV Exploration & Production Limited

- OMV (FAROE ISLANDS) Exploration GmbH

- OMV Global Oil & Gas GmbH

- OMV (RUSSLAND) Exploration & Production GmbH

- OMV (Tunesien) Exploration GmbH

- OMV (Tunesien) Production GmbH

- OMV (TUNESIEN) Sidi Mansour GmbH

- OMV (U.K.) Limited

- OMV (IRELAND) Exploration GmbH

- OMV (Yemen Block S 2) Exploration GmbH

- OMV (IRAN) onshore Exploration GmbH

- OMV (IRELAND) Killala Exploration GmbH

- OMV New Zealand Ltd.

- OMV (NORGE) AS

- OMV of Libya Limited Exploration GmbH

- OMV (YEMEN) Al Mabar Exploration GmbH

- OMV (YEMEN) South Sanau Exploration GmbH

- OMV Oil Exploration GmbH

- OMV Oil & Gas Exploration GmbH

- OMV Oil Production GmbH

- OMV (PAKISTAN) Exploration GmbH

- PEI Venezuela GmbH

- Preussag Energie International GmbH

Gas and power

According to OMV:[6]

- OMV Gas & Power GmbH (100%)

- OMV Gas GmbH (100%)

- AGGM Austrian Gas Grid Management AG (100%)

- AGCS Gas Clearing and Settlement AG (23.1%)

- TAG Trans Austria Gasleitung GmbH (11%)

- OMV Power International GmbH (100%)

- OMV Gaz ve Enerji Ltd. Sti. (100%)

- Nabucco Gas Pipeline International GmbH (16.67%)

- EconGas GmbH (59.26%)

- Central European Gas Hub AG (100%)

- Adria LNG d.o.o. (25.58%)

- Gate terminal b.v. (5%)

- OMV Gas GmbH (100%)

OMV is a publicly traded company. The main shareholders are ÖIAG (Austrian state holding - 31.5%) and IPIC (20%) with 48.3% of shares freely floating in the market (without treasury shares).

Controversies

Petrom

The acquisition of 51% stake in Petrom S.A. was considered controversial as the privatization contract was not been made public and it consists of several disputed clauses.[7] The privatization allegedly produced a market monopoly. Critics say that OMV can use the resources Petrom owns until their exhaustion. Also fixing of tax for gas and oil exploration at 3 to 13.5 percent from the final delivery price for 10 years was criticized. Some critics claimed, that the price €1.5 billion was too low.[7]

MOL

In June 2007, OMV made an unsolicited bid to take over MOL, which was rejected by the Hungarian company. MOL criticized OMV's advertisement in which OMV had suggested the two had already worked together on the European market. MOL thought that to be misleading and unethical and asked OMV to remove the name MOL from those advertisements. OMV dismissed its bid after negative results of the investigation by the European competition authorities.[3][8]

OMV sold its entire stake to Surgutneftegas in March 2009.[9]

References

- ^ a b c d e f "Annual Report 2010". OMV. http://www.omv.com/SecurityServlet/secure?cid=1255733340356&lang=en&swa_id=611076724723.7091&swa_site=wps.vp.com. Retrieved 29 April 2011.

- ^ a b c d "OMV — Company Profile". OilVoice. http://www.oilvoice.com/Printer/OMV/9302c548.aspx. Retrieved 2008-12-07.

- ^ a b "European Commission closes door on OMV-MOL merger plan". Realdeal.hu. 2008-08-07. http://www.realdeal.hu/20080807/european-commission-closes-door-on-omvmol-merger-plan. Retrieved 2008-12-07.

- ^ Vladimir Socor (2008-11-07). "Austria’s OMV to Share Strategic Terminal with Gazprom". Eurasia Daily Monitor. http://www.gab-ibn.com/IMG/pdf/Re8-_Austria_s_OMV_to_Share_Strategic_Terminal_with_Gazprom.pdf. Retrieved 2008-12-07.

- ^ "RWE joins Nabucco consortium as sixth partner" (PDF) (Press release). Nabucco Gas Pipeline International GmbH. 2008-02-06. http://www.nabucco-pipeline.com/cms/upload/press_release/Press%20Release%20Nabucoo%20e%20-%20RWE%20joins%20Nabucco%20consortium%20as%20sixth%20partner.pdf. Retrieved 2008-12-07.

- ^ a b c d OMV Groups - Facts & figures. OMV. September 9, 2009.

- ^ a b Cristina Muntean (2006-12-18). "Petrom deal examined". CBW. http://www.cbw.cz/en/petrom-deal-examined/3829.html. Retrieved 2008-12-07.[dead link]

- ^ "OMV gets EU objections statement over MOL takeover bid". Forbes. 2008-06-24. http://www.forbes.com/afxnewslimited/feeds/afx/2008/06/24/afx5146214.html. Retrieved 2008-12-06.

- ^ "OMV sells MOL stake". OilVoice. 2009-03-30. http://www.oilvoice.com/n/OMV_Sells_its_212_Stake_in_MOL/ef801d0a.aspx. Retrieved 2009-03-30.

See also

External links

ATX companies of Austria

ATX companies of AustriaAndritz · CA Immobilien Anlagen · Conwert Immobilien Invest · EVN Group · Erste Group Bank · Immofinanz · Lenzing · Mayr-Melnhof · Österreichische Post · OMV · Raiffeisen International · RHI · Schoeller-Bleckmann · Strabag · Telekom Austria · Verbund · voestalpine · Wiener Städtische · Wienerberger · Zumtobel

Categories:- Oil and gas companies of Austria

- Oil and gas companies of New Zealand

Wikimedia Foundation. 2010.