- 1973 oil crisis

-

Further information: 1973 world oil market chronology

1973 Oil Crisis Other names Arab Oil Embargo The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC (consisting of the Arab members of OPEC, plus Egypt, Syria and Tunisia) proclaimed an oil embargo. This was "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war.[citation needed] It lasted until March 1974.[1] With the U.S. actions seen as initiating the oil embargo and the long term possibility of high oil prices, disrupted supply and recession, a strong rift was created within NATO. Additionally, some European nations and Japan sought to disassociate themselves from the U.S. Middle East policy. Arab oil producers had also linked the end of the embargo with successful U.S. efforts to create peace in the Middle East, which complicated the situation. To address these developments, the Nixon Administration began parallel negotiations with both Arab oil producers to end the embargo, and with Egypt, Syria, and Israel to arrange an Israeli pull back from the Sinai and the Golan Heights after the fighting stopped. By January 18, 1974, Secretary of State Henry Kissinger had negotiated an Israeli troop withdrawal from parts of the Sinai. The promise of a negotiated settlement between Israel and Syria was sufficient to convince Arab oil producers to lift the embargo in March 1974. By May, Israel agreed to withdraw from some parts of the Golan Heights.[1]

Independently, the OAPEC members agreed to use their leverage over the world price setting mechanism for oil to stabilize their real incomes by raising world oil prices. This action followed several years of steep income declines after the recent failure of negotiations with the major Western oil companies earlier in the month.

Industrialized economies relied on crude oil, and OPEC was their predominant supplier. Because of the dramatic inflation experienced during this period, a popular economic theory has been that these price increases were to blame, as being suppressive of economic activity. A minority dissenting opinion questions the causal relationship described by this theory.[2] The targeted countries responded with a wide variety of new, and mostly permanent, initiatives to contain their further dependency. The 1973 "oil price shock", along with the 1973–1974 stock market crash, have been regarded as the first event since the Great Depression to have a persistent economic effect.[3]

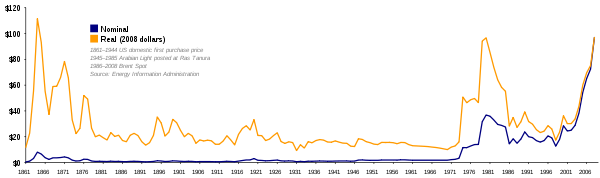

Graph of oil prices from 1861–2007, showing a sharp increase in 1973, and again during the 1979 energy crisis. The orange line is adjusted for inflation.

Graph of oil prices from 1861–2007, showing a sharp increase in 1973, and again during the 1979 energy crisis. The orange line is adjusted for inflation.

Background

Founding of OPEC

The Organization of the Petroleum Exporting Countries (OPEC), which then consisted of twelve countries, including Iran, seven Arab countries (Iraq, Kuwait, Libya, Qatar, Saudi Arabia, the United Arab Emirates), plus Venezuela, Indonesia, Nigeria, and Ecuador, had been formed at a Baghdad conference on September 14, 1960. OPEC was organized to resist pressure by the "Seven Sisters" (mostly owned by U.S., British and Dutch nationals) to reduce oil prices and payments to producing countries. At first OPEC had operated as an informal bargaining unit for the sale of oil by resource-rich Third World nations. OPEC confined its activities to gaining a larger share of the profits generated by the Western oil companies and greater control over the members' levels of production. As a result of this and other events in the early 1970s, it began to exert its economic and political strength; the major Western oil conglomerates, as well as the importing nations, suddenly faced a unified bloc of exporters.

End of Bretton Woods

On August 15, 1971, the United States unilaterally pulled out of the Bretton Woods Accord taking the US off the Gold Exchange Standard (whereby only the value of the US dollar had been pegged to the price of gold and all other currencies were pegged to the US dollar), allowing the dollar to "float". Shortly thereafter, Britain followed, floating the pound sterling. The industrialized nations followed suit with their respective currencies. In anticipation of the fluctuation of currencies as they stabilized against each other, the industrialized nations also increased their reserves (printing money) in amounts far greater than ever before. The result was a depreciation of the value of the US dollar, as well as the other currencies of the world. Because oil was priced in dollars, this meant that oil producers were receiving less real income for the same price. The OPEC cartel issued a joint communique stating that, from then on, they would price a barrel of oil against gold.

This led to the "Oil Shock" of the mid-seventies. In the years after 1971, OPEC was slow to readjust prices to reflect this depreciation. From 1947-1967 the price of oil in U.S. dollars had risen by less than two percent per year. Until the Oil Shock, the price remained fairly stable versus other currencies and commodities, but suddenly became extremely volatile thereafter. OPEC ministers had not developed the institutional mechanisms to update prices rapidly enough to keep up with changing market conditions, so their real incomes lagged for several years. The substantial price increases of 1973-74 largely caught up their incomes to Bretton Woods levels in terms of other commodities such as gold.[4]

Yom Kippur War

On October 6, 1973, Syria and Egypt launched a surprise attack on Israel.[5] This new round in the Arab-Israeli conflict triggered a crisis already in the making; the price of oil was going to rise. The West could not continue to increase its energy consumption 5% annually, while also paying low oil prices, and selling inflation-priced goods to the petroleum producers in the developing Third World. This was stressed by the Shah of Iran, whose nation was the world's second-largest exporter of oil and a close ally of the United States in the Middle East at the time. "Of course [the world price of oil] is going to rise", the Shah told The New York Times in 1973. "Certainly! And how...; You [Western nations] increased the price of wheat you sell us by 300%, and the same for sugar and cement...; You buy our crude oil and sell it back to us, refined as petrochemicals, at a hundred times the price you've paid to us...; It's only fair that, from now on, you should pay more for oil. Let's say ten times more."[6]

On October 12, 1973, President Richard Nixon authorized Operation Nickel Grass, an overt strategic airlift to deliver weapons and supplies to Israel, after the Soviet Union began sending arms to Syria and Egypt.

Arab oil embargo

On October 16, 1973, OPEC announced a decision to raise the posted price of oil by 70%, to $5.11 a barrel.[7] The following day, oil ministers agreed to the embargo, a cut in production by five percent from September's output, and to continue to cut production over time in five percent increments until their economic and political objectives were met.[8] October 19, US President Richard Nixon requested Congress to appropriate $2.2 billion in emergency aid to Israel, including $1.5 billion in out-right grants. George Lenczowski notes, "Military supplies did not exhaust Nixon's eagerness to prevent Israel's collapse. ... This [$2.2B] decision triggered a collective OPEC response." [9] Libya announced it would embargo all oil shipments to the United States. Saudi Arabia and the other OPEC states quickly followed suit, joining the embargo on October 20, 1973.[10] At their meeting in Kuwait the OPEC oil-producing countries, proclaimed the oil boycott that provided for curbs on their oil exports to various consumer countries and a total embargo on oil deliveries to the United States as a "principal hostile country".[11] The embargo was thus variously extended to Western Europe and Japan.

Though United States was the initial target of the embargo, it was later expanded to the Netherlands.[12] Price increases were also imposed. Since short term oil demand is inelastic, demand falls little when the price is raised. Thus, oil prices had to be raised dramatically to reduce demand to the new lower level of supply. Anticipating this, the market price for oil immediately rose substantially, from $3 a barrel to $12.[12] The world financial system, which was already under pressure from the breakdown of the Bretton Woods agreement, was set on a path of recessions and high inflation that persisted until the early 1980s, with oil prices continuing to rise until 1986.

The price of oil during the embargo. The graph is based on the nominal, not real, price of oil, and so overstates prices at the end. However, the effects of the Arab Oil Embargo are clear—it effectively doubled the real price of crude oil at the refinery level, and caused massive shortages in the U.S.

The price of oil during the embargo. The graph is based on the nominal, not real, price of oil, and so overstates prices at the end. However, the effects of the Arab Oil Embargo are clear—it effectively doubled the real price of crude oil at the refinery level, and caused massive shortages in the U.S.

Over the long term, the oil embargo changed the nature of policy in the West towards increased exploration, energy conservation, and more restrictive monetary policy to better fight inflation.

Chronology

- January 1973—The 1973–1974 stock market crash begins, as a result of inflation pressure, the Nixon Shock and the collapsing monetary system.

- August 23, 1973—In preparation for the Yom Kippur War, Saudi King Faisal and Egyptian president Anwar Sadat meet in Riyadh and secretly negotiate an accord whereby the Arabs will use the "oil weapon" as part of the upcoming military conflict.[13]

- October 6 - Egypt and Syria attack Israeli occupied lands in Sinai and Golan Heights on Yom Kippur, starting the fourth Arab-Israeli War.

- October 8–October 10—OPEC negotiations with major oil companies to revise the 1971 Tehran price agreement fail.

- October 12— The United States initiates Operation Nickel Grass, an overt strategic airlift operation to provide replacement weapons and supplies to Israel during the Yom Kippur War. This followed similar Soviet moves to supply the Arab side.

- October 16 - Saudi Arabia, Iran, Iraq, Abu Dhabi, Kuwait, and Qatar unilaterally raise posted prices by 17% to $3.65 per barrel and announce production cuts.[14]

- October 17—OPEC oil ministers agree to use oil as a weapon to influence the West's support of Israel in the Yom Kippur war. They recommend an embargo against non-complying states and mandate a cut in exports.

- October 19—US President Richard Nixon requests Congress to appropriate $2.2billion in emergency aid to Israel. This decision triggered a collective Arab response.[9] Libya proclaims an embargo on oil exports to the United States; Saudi Arabia and other Arab states follow.

- October 23–October 28—The Arab oil embargo is extended to the Netherlands.

- October 26—The Yom Kippur War ends.

- November 5—Arab producers announce a 25% output cut. A further 5% cut is threatened.

- November 23—The Arab embargo is extended to Portugal, Rhodesia, and South Africa.

- November 27—U.S. President Richard Nixon signs the Emergency Petroleum Allocation Act authorizing price, production, allocation and marketing controls.

- December 9—Arab oil ministers agree to another five percent cut for non-friendly countries for January 1974.

- December 25—Arab oil ministers cancel the five percent output cut for January. Saudi oil minister Ahmed Zaki Yamani promises a ten percent OPEC production rise.

- January 7–January 9, 1974—OPEC decides to freeze prices until April 1.

- January 18—Israel signs a withdrawal agreement to pull back to the east side of the Suez Canal.

- February 11 - United States Secretary of State Henry Kissinger unveils the Project Independence plan to make U.S. energy independent.

- February 12–February 14—Progress in Arab-Israeli disengagement brings discussion of oil strategy among the heads of state of Algeria, Egypt, Syria and Saudi Arabia.

- March 5—Israel withdraws the last of its troops from the west side of the Suez Canal.

- March 17—Arab oil ministers, with the exception of Libya, announce the end of the embargo against the United States.

- May 31—Diplomacy by Henry Kissinger produces a disengagement agreement on the Syrian front.

- December 1974—The 1973–1974 stock market crash ends.

Immediate economic effects

The effects of the embargo were immediate. OPEC forced the oil companies to increase payments drastically. The price of oil quadrupled by 1974 to nearly US$12 per barrel (75 US$/m3).[15]

This increase in the price of oil had a dramatic effect on oil exporting nations, for the countries of the Middle East who had long been dominated by the industrial powers were seen to have acquired control of a vital commodity. The traditional flow of capital reversed as the oil exporting nations accumulated vast wealth. Some of the income was dispensed in the form of aid to other underdeveloped nations whose economies had been caught between higher prices of oil and lower prices for their own export commodities and raw materials amid shrinking Western demand for their goods. Much was absorbed in massive arms purchases that exacerbated political tensions, particularly in the Middle East.

This control of a vital commodity became known as the "oil weapon," which came in the form of an embargo and cutbacks in oil production from the Arab states to select industrial governments of the world to pressure Israel during the fourth Arab-Israeli War in October 1973. These target industrial governments included the United States, Great Britain, Canada, Japan, and the Netherlands. In retrospect, the purpose of the embargo, as perceived by these target governments, was to sway their foreign policies concerning Israel towards a more pro-Arab position by threatening to cut off exports of Arab oil, and that in altering their policies the Arab states would respond by again allowing their purchase of more oil.[16] The Arab states selected their target governments to emplace their embargo, mostly affecting the European Common Market countries and Japan with a eventual 25% oil cut in production.[17] However, in all five cases there did not appear to be the dramatic change in policy making as envisioned by the Arab states.[18]

In the case of the United States, scholars argue that there already existed a negotiated settlement based on equality between both parties prior to 1973. Second, Soviet involvement in the Middle East as a threat to becoming another superpower confrontation was of more concern to the United States than the oil weapon. A third reason, the interest groups and other government agencies that were more concerned with the implications of the oil weapon held little influential power concerning foreign policy in the Arab-Israeli conflict because of Kissinger's total dominance over this process.[19] Also within the United States concerning the economic impact at the macro level, direct correlations have been drawn between the rise in oil prices and economic recessions. "Oil price shocks", referring to disruptions in the production and distribution of oil, that result in the increase of oil prices "have been held responsible for recessions, periods of excessive inflation, reduced productivity, and lower economic growth"[20]

The effect of the Arab embargo had a negative influence on the U.S economy through causing immediate demands to address the threats to U.S energy security.[21] On an international level, the price increases of petroleum disrupted market systems in changing competitive positions. At the macro level, economic problems consisted of both inflationary and deflationary impacts of domestic economies.[22] The Arab embargo left many U.S companies searching for new ways to develop expensive oil, even in the elements of rugged terrain such as in hostile arctic environments. The problem that many of these companies faced is that finding oil and developing new oil fields usually require a time lag of 5 to 10 years between the planning process and significant oil production.[23]

OPEC-member states in the developing world withheld the prospect of nationalization of the companies' holdings in their countries. Most notably, the Saudis acquired operating control of Aramco, fully nationalizing it in 1980 under the leadership of Ahmed Zaki Yamani. As other OPEC nations followed suit, the cartel's income soared. Saudi Arabia, awash with profits, undertook a series of ambitious five-year development plans, of which the most ambitious, begun in 1980, called for the expenditure of $250 billion. Other cartel members also undertook major economic development programs.

Meanwhile, the shock produced chaos in the West. In the United States, the retail price of a gallon of gasoline (petrol) rose from a national average of 38.5 cents in May 1973 to 55.1 cents in June 1974. State governments requested citizens not put up Christmas lights, with Oregon banning Christmas as well as commercial lighting altogether.[12] Politicians called for a national gas rationing program.[24] Nixon requested gasoline stations to voluntarily not sell gasoline on Saturday nights or Sundays; 90% of owners complied, which resulted in lines on weekdays.[12]

The embargo was not uniform across Europe. Of the nine members of the European Economic Community (EEC), the Netherlands faced a complete embargo, the United Kingdom and France received almost uninterrupted supplies (having refused to allow America to use their airfields and embargoed arms and supplies to both the Arabs and the Israelis), whilst the other six faced only partial cutbacks. The UK had traditionally been an ally of Israel, and Harold Wilson's government had supported the Israelis during the Six Day War, but his successor, Ted Heath, had reversed this policy in 1970, calling for Israel to withdraw to its pre-1967 borders. The members of the EEC had been unable to achieve a common policy during the first month of the Yom Kippur War. The Community finally issued a statement on November 6, after the embargo and price rises had begun; widely seen as pro-Arab, this statement supported the Franco-British line on the war, and OPEC duly lifted its embargo from all members of the EEC. The price rises had a much greater impact in Europe than the embargo, particularly in the UK (where they combined with strikes by coal miners and railroad workers to cause an energy crisis over the winter of 1973-74, a major factor in the change of government).[25] The UK, Germany, Italy, Switzerland, and Norway banned flying, driving and boating on Sundays.[12] Sweden rationed gasoline and heating oil.[12] The Netherlands imposed prison sentences for those who used more than their given ration of electricity.[12] Ted Heath asked the British to heat only one room in their houses over the winter.[26]

A few months later, the crisis eased. The embargo was lifted in March 1974 after negotiations at the Washington Oil Summit, but the effects of the energy crisis lingered on throughout the 1970s. The price of energy continued increasing in the following year, amid the weakening competitive position of the dollar in world markets.

Price controls and rationing

Gasoline ration stamps printed by the Bureau of Engraving and Printing in 1974

Gasoline ration stamps printed by the Bureau of Engraving and Printing in 1974

Government price controls further exacerbated the crisis in the United States,[24] which limited the price of "old oil" (that already discovered) while allowing newly discovered oil to be sold at a higher price, resulting in a withdrawal of old oil from the market and the creation of artificial scarcity. The rule also discouraged alternative energies or more efficient fuels or technologies from being developed.[24] The rule had been intended to promote oil exploration.[27] This scarcity was dealt with by rationing of gasoline (which occurred in many countries), with motorists facing long lines at gas stations beginning in summer 1972 and increasing by summer 1973.[24]

In 1973, U.S. President Richard Nixon named William E. Simon as the first Administrator of the Federal Energy Office, or the "Energy Czar".[28] Simon allocated states the same amount of domestic oil for 1974 that each consumed in 1972, which worked well for states whose populations were not increasing.[29] In states with increased populations, lines at gasoline stations were common.[29] The American Automobile Association reported that in the last week of February 1974, 20% of American gasoline stations had no fuel at all.[29]

In the U.S., odd-even rationing was implemented; drivers of vehicles with license plates having an odd number as the last digit (or a vanity license plate) were allowed to purchase gasoline for their cars only on odd-numbered days of the month, while drivers of vehicles with even-numbered license plates were allowed to purchase fuel only on even-numbered days.[30] The rule did not apply on the 31st day of those months containing 31 days, or on February 29 in leap years— the latter never came into play, since the restrictions had been abolished by 1976.

In some U.S. states, a three-color flag system was used to denote gasoline availability at service stations — a green flag denoted unrationed sale of gasoline, a yellow flag denoted restricted and rationed sales, and a red flag denoted that no gasoline was available but the service station was open for other services.[31] Additionally, coupons for gasoline rationing were ordered in 1974 and 1975 for Federal Energy Administration, but were never actually used for this crisis or the 1979 energy crisis.[32]

The rationing led to incidents of violence, after truck drivers nationwide chose to strike for two days in December 1973 because they objected to the supplies Simon had rationed for their industry.[29] In Pennsylvania and Ohio, non-striking truckers were shot at by striking truckers, and in Arkansas, trucks of non-strikers were attacked with bombs.[29]

America had controlled the price of natural gas since the 1950s, and with the inflation of the 1970s, the market price of natural gas was not encouraging the search for new reserves.[33] America's natural gas reserves dwindled from 237 trillion in 1974 to 203 trillion in 1978, and the price controls were not changed despite President Gerald Ford's repeated requests to Congress.[33]

Conservation and reduction in demand

To help reduce consumption, in 1974 a national maximum speed limit of 55 mph (about 88 km/h) was imposed through the Emergency Highway Energy Conservation Act. Development of the United States Strategic Petroleum Reserve began in 1975, and in 1977, the cabinet-level Department of Energy was created, followed by the National Energy Act of 1978.

Year-round daylight saving time was implemented from January 6, 1974 to February 23, 1975. The move spawned significant criticism because it forced many children to commute to school before sunrise. The pre-existing daylight-saving rules, calling for the clocks to be advanced one hour on the last Sunday in April, were restored in 1976.

The crisis also prompted a call for individuals and businesses to conserve energy, most notably a campaign by the Advertising Council using the tag line "Don't Be Fuelish."[34] Many newspapers carried full-page advertisements that featured cut-outs which could be attached to light switches, reading "Last Out, Lights Out: Don't Be Fuelish."

By 1980, there were no longer full-size luxury cars with a 130-inch (3.3 m) wheelbase and gross weights averaging 4,500 pounds (2,041 kg). The automakers began phasing out the traditional front engine/rear wheel drive layout in favor of more efficient front engine/front wheel drive designs.

Though not regulated by the new legislation, auto racing groups voluntarily began conserving as well. In 1974 the 24 Hours of Daytona was canceled and NASCAR reduced all race distances by 10%. The 12 Hours of Sebring race was cancelled.

In 1976, the U.S. Congress created the Weatherization Assistance Program to help low-income homeowners and renters deal with rising heating costs by reducing their demand through advanced insulation.

Secondary effects

Various secondary effects occurred, notably toilet paper panics in Japan and the United States; these were unfounded panics which became self-fulfilling prophesies, and are classic examples of the Thomas theorem. Price rises and unfounded rumors of a toilet paper shortage – based on oil being used in paper manufacturing – caused a panic and hoarding of toilet paper in late October and early November in Osaka and Kobe, among other cities.[35][36] In the US, Johnny Carson inadvertently caused a three-week panic when, on December 19, 1973, he read a news item regarding the US government falling behind on bids for toilet paper and quipping that the nation faced a toilet paper shortage on the Tonight Show.

Search for alternatives

The energy crisis led to greater interest in renewable energy and spurred research in solar power and wind power. It also led to greater pressure to exploit North American oil sources, and increased the West's dependence on coal and nuclear power. This included increased interest in mass transit.

In Australia, heating oil ceased being considered an appropriate winter heating fuel. This often meant that a lot of oil-fired room heaters that were popular from the late-1950s to the early-1970s were considered outdated. Gas-conversion kits that let the heaters burn natural gas or propane were introduced.

For the handful of industrialized nations that were net energy exporters, the effects of the oil crisis were very different. In Canada the industrial east suffered many of the same problems of the United States. In oil rich Alberta, however, there was a sudden and massive influx of money that quickly made it the richest province in the country. The federal government attempted to correct this imbalance through the creation of the government-owned Petro-Canada and later the National Energy Program. These efforts produced a great deal of anger in the west producing a sentiment of alienation that has remained a central element of Canadian politics to this day. Overall the oil embargo had a sharply negative effect on the Canadian economy. The economic malaise in the United States easily crossed the border and increases in unemployment, and stagflation hit Canada as hard as the United States despite Canadian fuel reserves.

The Brazilian government implemented a very large project called "Proálcool" (pro-alcohol) that mixed ethanol with gasoline for automotive fuel.

To supplement Israel's over-taxed power grid, Harry Zvi Tabor, the father of Israel's solar industry, developed the prototype for a solar water heater now used in over 90% of Israeli homes.[37]

Macroeconomic effects

The 1973 oil crisis was a major factor in Japan's economy shifting from oil-intensive industries, and resulted in huge Japanese investments in industries such as electronics. The Japanese auto makers also took advantage of this embargo. After they realized what fuel costs were in the United States, they started producing small, more fuel efficient models, which began selling as an alternative to "gas-guzzling" American vehicles of the time. This triggered a drop in American auto sales that lasted into the 1980s.

The Western nations' central banks decided to sharply cut interest rates to encourage growth, deciding that inflation was a secondary concern. Although this was the orthodox macroeconomic prescription at the time, the resulting stagflation surprised economists and central bankers, and the policy is now considered by some to have deepened and lengthened the adverse effects of the embargo.

Long-term effects of the embargo are still felt. Many in the public remain suspicious of oil companies, believing they profiteered, or even colluded with OPEC. In 1974, seven of the fifteen top Fortune 500 companies were oil companies.

Effects on international relations

The Cold War policies of the Nixon administration also suffered a major blow in the aftermath of the oil embargo. They had focused on China and the Soviet Union, but the latent challenge to U.S. hegemony coming from the Third World became evident. U.S. power was under attack even in Latin America.

The oil embargo was announced roughly one month after a right-wing military coup in Chile led by General Augusto Pinochet Chilean coup of 1973 toppled socialist president Salvador Allende on September 11, 1973. The United States' subsequent assistance to this government did little to curb the activities of socialist guerrillas in the region. The response of the Nixon administration was to propose doubling of the amount of military arms sold by the United States. As a consequence, a Latin American bloc was organized and financed in part by Venezuela and its oil revenues, which quadrupled between 1970 and 1975.

In addition, Western Europe and Japan began switching from pro-Israel to more pro-Arab policies.[38][39][40] This change further strained the Western alliance system, for the United States, which imported only 12% of its oil from the Middle East (compared with 80% for the Europeans and over 90% for Japan), remained staunchly committed to backing Israel. The percentage of U.S. oil which comes from the nations bordering the Persian Gulf has remained steady over the years, with a figure of a little more than 10% in 2008.[41]

Although historically having no connections to the Middle East, Japan was the most heavily dependent on its oil from this region, making up 71% of its imported oil from the Middle East in 1970. However, on November 7, 1973, the Saudi and Kuwaiti governments declared Japan a "nonfriendly" country directed towards changing its policy of noninvolvement in the Arab-Israeli conflict, placing a 5 percent production cut in December to Japan.[42] The December production cut to the Japanese government caused somewhat of a panic, where on November 22 Japan issued a statement "asserting that Israel should withdraw from all of the 1967 territories, advocating Palestinian self-determination, and threatening to reconsider its policy toward Israel if Israel refused to accept these preconditions"[42] By December 25, Japan was considered a friendly state.

With the oil embargo in place, the industrial governments of the world in some way altered their foreign policy regarding the Arab-Israeli conflict and after the use of the Arab oil weapon. These included European countries such as the UK who decided to refuse to allow the United States to use British bases in the UK and in Cyprus to airlift resupplies to Israel along with the rest of the members of the European Community.[43] It also included the Japanese restatement on November 22, to "reconsider" their relations with Israel if Israel did not acknowledge their avocations to return to their pre-1967 territorial state, although this was never acted upon. Canada shifted towards a more pro-Arab position after displeasure was expressed by many Arab governments towards Canada's Middle Eastern position as one of being mostly neutral. "On the other hand, after the embargo the Canadian government moved quickly indeed toward the Arab position, despite its low dependence on Middle Eastern oil"[42]

A year after the start of the 1973 oil embargo, the nonaligned bloc in the United Nations passed a resolution demanding the creation of a "new international economic order" in which resources, trade, and markets would be distributed more equitably, with the local populations of nations within the global South receiving a greater share of benefits derived from the exploitation of southern resources, and greater respect for the right to self-directed development in the South be afforded by the North.

In the post-Cold War era, Israel continues to serve the U.S.A. as a strategically important non-NATO ally in the Middle East. According to the American military journalist and commentator William M. Arkin in his book Code Names, the U.S. has prepositioned munitions, vehicles, and military equipment, and even a 500-bed hospital for use by US Marines, Special Forces, and Air Force fighter and bomber aircraft in a wartime contingency at least six sites in Israel.[44] Late Republican Senator Jesse Helms used to call Israel "America's aircraft carrier in the Middle East", when explaining why the US viewed Israel as such a strategic ally, saying that the military foothold in the region offered by the Jewish State alone justified the military aid that the US grants Israel every year.[45] Israel is not the only country in the Middle East to host US military bases, though. There are American military facilities in Egypt, Jordan, Saudi Arabia, Oman, and the Persian Gulf states of Kuwait, Bahrain (headquarters of the United States Fifth Fleet), and Qatar.[45]

Decline of OPEC

Further information: 1980s oil glut OPEC net oil export revenues for 1971–2007[46]

OPEC net oil export revenues for 1971–2007[46]

Since 1973, OPEC failed to hold on to its preeminent position, and by 1981, its production was surpassed by that of other countries. Additionally, its own member nations were divided among themselves. Saudi Arabia, trying to gain back market share, increased production and caused downward pressure on prices, making high-cost oil production facilities less profitable or even unprofitable. The world price of oil, which had reached a peak in 1979 during the 1979 energy crisis, at more than US$80 per barrel, decreased during the early 1980s to US$38 per barrel (239 US$/m3). In real prices, oil briefly fell back to pre-1973 levels. Overall, the reduction in price was a windfall for the oil-consuming nations: United States, Japan, Europe, and especially the Third World.

Part of the decline in prices and economic and geopolitical power of OPEC comes from the move away from oil consumption to alternate energy sources. OPEC had relied on the famously limited price inelasticity of oil demand [47] to maintain high consumption but had underestimated the extent to which other sources of supply would become profitable as the price increased. Electricity generation from nuclear power and natural gas, home heating from natural gas and ethanol blended gasoline all reduced the demand for oil.

At the same time, the drop in prices represented a serious problem for oil-producing countries in northern Europe and the Persian Gulf region. For a handful of heavily populated, impoverished countries, whose economies were largely dependent on oil — including Mexico, Nigeria, Algeria, and Libya — governments and business leaders failed to prepare for a market reversal, the price drop placed them in wrenching, sometimes desperate situations.

When reduced demand and over-production produced a glut on the world market in the mid-1980s, oil prices plummeted and the cartel lost its unity. Oil exporters such as Mexico, Nigeria, and Venezuela, whose economies had expanded in the 1970s, were plunged into near-bankruptcy, and even Saudi Arabian economic power was significantly weakened. The divisions within OPEC made subsequent concerted action more difficult.

Nevertheless, the 1973 oil shock provided dramatic evidence of the potential power of Third World resource suppliers in dealing with the developed world.[weasel words] The vast reserves of the leading Middle East producers guaranteed the region its strategic importance, but the politics of oil still proves dangerous for all concerned to this day.

Long-term effects

Prior to the embargo, the geo-political competition between the Soviet Union and the United States, in combination with low oil prices that hindered the necessity and feasibility for the West to seek alternative energy sources, presented the Arab States with financial security, moderate economic growth, and disproportionate international bargaining power.[48] Following the embargo, higher oil prices instigated new avenues for energy exploration or expansion including Alaska, the North Sea, the Caspian Sea, and Caucasus.[49]

Soviet reaction

Prior to the ascendancy of Anwar Sadat to president of Egypt in 1970, the Middle East had been an important arena in the global superpower competition, most lucidly displayed in the arms sales and cooperation between the American and Soviet governments with Israel, Saudi Arabia, and Iran allied to The United States, and Egypt, Syria, and Iraq allied with the Soviet Union. Although none of these states entered into any formal alliances comparative to the North Atlantic Treaty Organization, they did benefit greatly from the geo-political competition in the region and vacillations in alignment often resulted in greater gains of assistance. This competitive environment, beneficial to the regional states involved, was mitigated sharply after 1970. Sadat's dismissal of Soviet specialists in Egypt and the dramatic price increases in hydrocarbons hardened relations with all of the Middle East and created new opportunities for the export of Soviet oil. Exploration in the Caspian Basin and Siberia became more cost effective. Former cooperation evolved into a far more adversarial relationship as the Soviet Union increased oil production and export (by 1980 the Soviet Union was the world's largest producer of oil) to take advantage of the supply problems in the West created by OPEC's production reductions.[50][51] This growing economic competition turned into genuine fears of military aggression after the 1979 Soviet invasion of Afghanistan, leaving the Persian Gulf states to look to the United States for the type of security guarantees against Soviet military action in the Persian Gulf that the Israelis had exclusively received only a decade earlier.

Growing security concerns

The Soviet invasion of Afghanistan was only part of the growing security destabilization in the Middle East, most obviously seen in the increased sale of American weapons, technology, and outright military presence. Saudi Arabia and Iran became increasingly dependent on bi-lateral American security assurances to combat both external and internal threats, including increased military competition between these states because of the increased oil revenues. Both states were seemingly competing for preeminence in the Persian Gulf and using increased revenues on disproportionately powerful military forces. By 1979, Saudi weapon purchases from the United States were in excess of five times the amount that Israel was purchasing annually.[52] Following the failure of the Shah during January 1979 to maintain control of Iran, the Saudis were forced to deal with the prospect of internal destabilization via Islamic fundamentalism, a reality which would quickly be revealed in the seizure of the Grand Mosque in Mecca by Wahhabi extremists during November and a Shia revolt in al-Hasa during December.[53][54]

Conclusions

Growing fears about eventual Western energy independence, various security threats, and the absence of a Western rival in the geo-political competition over the Middle-East led the Arab states in a more dependent relationship with the West. This is most explicit in Saudi Arabia's consistent policy of price and production moderation in an effort to reduce the chances of Western alienation and the opportunity costs for alternative energy production.[55] The exchange for Western moderation in Arab-Israeli affairs ultimately led to a reshaping of the Middle-Eastern geo-political landscape that was significantly less advantageous than prior to 1973.

Impact on motor industry

West Europe

The motor industry was one of Western Europe's most affected industries in the wake of the 1973 oil crisis.

After the Second World War most West European countries applied heavy taxes to motor fuel because it was imported, and as a result most cars made in Europe were small and economical. However by the late sixties as wealth increased car sizes were rising despite heavy fuel taxes, although some of the more upmarket brands were building cars that could take lead-free fuel, and there were still a number of "economy" cars in production at this time.

But the oil crisis gradually saw many West European car buyers move away from larger, less economical cars. The most notable result of this transition in the car market was the rise in popularity of compact hatchbacks.

The only notable small hatchbacks built in Western Europe at the time of the oil crisis were the Peugeot 104, Renault 5 and Fiat 127. By the end of the decade, the market had massively expanded with the introduction of the Ford Fiesta, Opel Kadett (sold as the Vauxhall Astra in Great Britain), Chrysler Sunbeam and Citroën Visa.

Buyers looking for larger cars were increasingly drawn to medium sized hatchbacks that were virtually unknown in Europe in 1973, but by the end of the decade were gradually replacing saloons as the mainstay of this sector. Between 1973 and 1980, the following medium sized hatchbacks were launched across Europe: the Chrysler/Simca Horizon, Fiat Ritmo (Strada in the UK), Ford Escort MK3, Renault 14, Volvo 340 / 360, Opel Kadett and Volkswagen Golf. These cars offered new standard of fuel economy, which were much needed in the aftermath of the oil crisis.

The new cars launched in the wake of the oil crisis were considerably more economical than the traditional saloons they were taking the place of, and even attracted a considerable number of buyers who would have otherwise chosen cars in the next sector. Their success continued into the 1980s and by the later part of the decade, some 15 years after the oil crisis, hatchbacks almost monopolised most European small and medium car markets, and had gained a substantial share of the large family car market.

U.S.

As in Western Europe, U.S. automakers were significantly impacted by the 1973 oil embargo and energy crisis. Before the energy crisis, large, heavy, and powerful cars were the standard in the U.S. By 1971, the standard engine in a Chevrolet Caprice was a 400-cubic inch (6.5 liter) V8. The wheelbase of this car was 121.5 inches (3,090 mm), and Motor Trend's 1972 road test of the similar Chevrolet Impala logged no more than 15 miles per gallon on the highway.

After the energy crisis, however, gasoline cost more and reduced the demand for large cars.[33] The Toyota Corona, the Toyota Corolla, the Datsun B210, the Datsun 510, the Honda Civic, the Mitsubishi Galant (a captive import from Chrysler sold as the Dodge Colt), the Subaru DL, and later the Honda Accord all had four cylinder engines that were more fuel efficient in comparison to the typical V8 and six cylinder engines found in North American vehicles. From Europe, the Volkswagen Beetle, the Volkswagen Fastback, the Renault 8, the Renault LeCar, and the Fiat Brava were also offered. As buyers began exchanging large cars for the smaller imported ones, Detroit responded with the Ford Pinto, the Ford Maverick, the Chevrolet Vega, the Chevrolet Nova, the Plymouth Valliant, and the Plymouth Volaré.

Some buyers lamented the small size of the first compacts that came from Japan, and both Toyota and Nissan (known as Datsun during the 1970s) introduced larger cars called the Toyota Corona Mark II, replaced by the Toyota Cressida, the Mazda 616, and Datsun 810 which gave buyers increased passenger space and some luxury amenities, such as air conditioning, power steering, AM-FM radios, and even power windows and central locking without increasing the price of the vehicle. These larger compacts were at the very limit of Japanese government regulations concerning size and engine displacement so that they could still be affordable in the Japanese Domestic Market, yet offer export buyers larger cars that sacrificed fuel economy for passenger accommodation and a higher price. Toyota also sold the Toyota Crown from 1965 to 1974 with very limited amount of sales.

Compact trucks were also introduced to the USA, with the Toyota Hilux and the Datsun Truck, followed by the Mazda Truck also sold as the Ford Courier, with Isuzu selling their compact truck as the Chevrolet LUV.

An increase in imported cars into North America forced the Big Three (General Motors, Ford, and Chrysler) to introduce smaller and fuel-efficient models for domestic sales.[33] The Dodge Omni / Plymouth Horizon from Chrysler, the Ford Fiesta, and the Chevrolet Chevette all had four-cylinder engines and room for at least four passengers by the late '70s. By 1985, the average American vehicle received 17.4 miles per gallon, compared to 13.5 miles per gallon in 1970.[33] The improvements stayed even though the price of a barrel of oil remained constant at $12 from 1974 to 1979.[33]

While at the same time these new imports were major inroads in the American market, sales of large sedans for most makes (except Chrysler products) recovered within two model years of the 73’ Oil Crisis. Sales of models such as the Cadillac DeVille, Buick Electra, Oldsmobile 98, Lincoln Continental, Mercury Marquis, and various other luxury oriented sedans became popular again in the mid-70s. The only full-size models to see permanent reductions in sales were the lower price models; such as the Chevrolet Impala, and Ford Galaxie 500. At the same time, slightly smaller, if not entirely more fuel efficient mid-size models such as the Oldsmobile Cutlass, Chevrolet Monte Carlo, Ford Thunderbird and various other models sold well.

This led to the somewhat odd juxtaposition of small economical imports introducing themselves as major elements of the market, while at the same time heavy, expensive, largely impractical vehicles (with 7 mpg; Lincoln sold 80,321 Mark Vs in 77) selling alongside the new imports in equally impressive numbers. In 1976; Toyota, with an average weight around 2,100 lbs sold 346,920 cars in the United States, while Cadillac with an average weight around 5,000 lbs sold 309,139 cars.

Federal safety standards, such as NHTSA Federal Motor Vehicle Safety Standard 215 (pertaining to safety bumpers), and compacts like the 1974 Mustang II were a prelude to the DOT "downsize" revision of vehicle categories.[56] By 1977, GM's full-sized cars reflected on the 1973 oil crisis and preceded later DOT downsizing.[57] By 1979, virtually all the big "full size" American cars were "downsized", featuring smaller engines and smaller dimensions outside. Chrysler Corporation ended production of their full-sized luxury sedans at the end of the 1981 model year, moving instead to a full front wheel drive lineup for 1982 (except for the M-body Dodge Diplomat/Plymouth Gran Fury and Chrysler New Yorker Fifth Avenue sedans).

It has been suggested[by whom?] that if mass production of overdrive transmissions had been introduced, there would not have actually been any vehicle downsizing. But since this has actually happened it turns out not to be true.[57]

See also

- Hubbert peak theory

- Supply shock

- 1967 Oil Embargo

- 1970s Energy Crisis

- 1990 spike in the price of oil

- 2000s energy crisis

References

- ^ a b "Office of the Historian". State.gov. http://www.state.gov/r/pa/ho/time/dr/96057.htm. Retrieved 2011-09-03.[dead link]

- ^ Barsky, R.; Kilian, L.. "Oil and the Macroeconomy Since the 1970s" (PDF). CEPR Discussion Paper No. 4496 1001: 48109–1220. http://www.sais-jhu.edu/faculty/sandleris/Macro/Readings/R_Oil_and_the_Macroeconomy.pdf

- ^ Perron, P.; University, Princeton; Program, Econometric Research (1988) (PDF). The Great Crash, the Oil Price Shock and the Unit Root Hypothesis. Econometric Research Program, Princeton University Princeton, New Jersey. http://www.econ.princeton.edu/ERParchives/archivepdfs/M338.pdf[dead link]

- ^ Hammes, David. and Douglas Wills. "Black Gold: The End of Bretton Woods and the Oil-Price Shocks of the 1970s," The Independent Review, v. IX, n. 4, Spring 2005. pp. 501-511.

- ^ Energy Insights: News: Oil price - speculation and international politics at play Archived July 23, 2011 at the Wayback Machine

- ^ Smith, William. D. "Price Quadruples for Iranian Crude Oil at Auction", New York Times 12 Dec 1973.

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 2008), p. 587.

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 2008), p. 589.

- ^ a b Lenczowski, George (1990). American Presidents and the Middle East. Duke University Press. p. 130. ISBN 978-0-8223-0972-7.

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 2008), p. 590.

- ^ Lenczowski, p130

- ^ a b c d e f g Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. p. 318. ISBN 978-0-465-04195-4.

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 1991), p. 597.

- ^ Editorial Note: this conflicts somewhat with the 70% price increase to $5.11, noted by a cited reference, in the paragraph above.

- ^ "The price of oil - in context". CBC News. http://www.cbc.ca/news/background/oil/. Retrieved 2007-05-29.

- ^ Licklider, Roy (1988). "The Power of Oil: The Arab Oil Weapon and the Netherlands, the United Kingdom, Canada, Japan, and the United States". International Studies Quarterly (International Studies Quarterly, Vol. 32, No. 2) 32 (2): 205–226 [p. 206]. doi:10.2307/2600627. JSTOR 2600627

- ^ Paust, Jordan J. & Blaustein, Albert P. (1974). "The Arab Oil Weapon—A Threat to International Peace". The American Journal of International Law (The American Journal of International Law, Vol. 68, No. 3) 68 (3): 410–439 [p. 411]. doi:10.2307/2200513. JSTOR 2200513

- ^ Licklider (1988), p. 217.

- ^ Licklider (1988), pp. 217, 219.

- ^ Barsky, Robert B. & Kilian, Lutz (2004). "Oil and the Macroeconomy since the 1970s". The Journal of Economic Perspectives 18 (4): 115–134 [p. 115]. doi:10.1257/0895330042632708

- ^ Ikenberry, G. John (1986). "The Irony of State Strength: Comparative Responses to the Oil Shocks in the 1970s". International Organization 40 (1): 105–137 [p. 107]. doi:10.1017/S0020818300004495

- ^ Ikenberry (1986), p. 109.

- ^ Hirsch, Robert L. (1987). "Impending United States Energy Crisis". Science 235 (4795): 1467–1473 [p. 1467]. doi:10.1126/science.235.4795.1467. PMID 17775008

- ^ a b c d Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. p. 313. ISBN 978-0-465-04195-4.

- ^ Slavin, Barbara; Freudenheim, Milt; Rhoden, Willian C. (1982-01-24). "The World; British Miners Settle for Less". New York Times. http://query.nytimes.com/gst/fullpage.html?res=9E01E1DB1E38F937A15752C0A964948260&sec=health&spon=&pagewanted=print. Retrieved April 20, 2010.

- ^ Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. p. 319. ISBN 978-0-465-04195-4.

- ^ "Oil Price Controls: A Counterproductive Effort" (PDF). Federal Reserve Bank of St. Louis Review. November 1975. http://research.stlouisfed.org/publications/review/75/11/Controls_Nov1975.pdf.

- ^ Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. pp. 312–313. ISBN 978-0-465-04195-4.

- ^ a b c d e Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. p. 320. ISBN 978-0-465-04195-4.

- ^ "Gas Fever: Happiness Is a Full Tank". Time Magazine. 1974-02-18. http://www.time.com/time/magazine/article/0,9171,942763,00.html.

- ^ "Spotty Local Starts". Time Magazine. 1974-02-25. http://www.time.com/time/printout/0,8816,879272,00.html.

- ^ "Rationing Coupons Shredded". New York Times. 1984-06-02. http://query.nytimes.com/gst/fullpage.html?res=9F06E0DD153BF931A35755C0A962948260&sec=&spon=&pagewanted=print.

- ^ a b c d e f Frum, David (2000). How We Got Here: The '70s. New York: Basic Books. pp. 321–322. ISBN 978-0-465-04195-4.

- ^ Ad Council - Don't be Fuelish. January 1975. http://www.webcitation.org/5jWimLA89. Retrieved 2009-08-23.

- ^ Oil crisis deja vu, Yomiuri Shimbun, 2000-12-03, English translation

- ^ Diminishing welfare: a cross-national study of social provision, by Marguerite G. Rosenthal, p. 305

- ^ At the Zenith of Solar Energy, Neal Sandler,BusinessWeek, March 26, 2008.

- ^ America, Russia, and the Cold War, 1945–1975, p. 280, Walter LaFeber, Wiley, 1975

- ^ Far Eastern Economic Review, v.84, Apr-Jun 1974, p. 8, Review Publishing, 1974

- ^ The New Tensions in Japan, Martin Collick, Richard Storry, p. 16, Institute for the Study of Conflict, 1974

- ^ Afshin Molavi, Obama, Gulf Oil and the Myth of America's Addiction, New America Foundation, The National (United Arab Emirates), January 21, 2009, http://www.newamerica.net/publications/articles/2009/obama_gulf_oil_and_myth_americas_addiction_10159. Accessed 2009-08-16. Archived 2009-08-21.

- ^ a b c The Power of Oil: The Arab Oil Weapon and the Netherlands, the United Kingdom, Canada, Japan, and the United States Roy Licklider International Studies Quarterly, Vol. 32, No. 2 (Jun., 1988), pp. 214.

- ^ The Power of Oil: The Arab Oil Weapon and the Netherlands, the United Kingdom, Canada, Japan, and the United States Roy Licklider International Studies Quarterly, Vol. 32, No. 2 (Jun., 1988), pp. 216.

- ^ Top Secret American Military Installations In Israel, Arutz7 News, - January 28, 2004, http://www.jonathanpollard.org/2005/012805.htm

- ^ a b Top Secret American Military Installations In Israel, Arutz7 News - January 28, 2004, http://www.jonathanpollard.org/2005/012805.htm

- ^ "EIA - 1000 Independence Avenue, SW, Washington, DC 20585". Eia.doe.gov. http://www.eia.doe.gov/emeu/cabs/OPEC_Revenues/OPEC.html. Retrieved 2011-09-03.[dead link]

- ^ Anderson, Patrick L. (1997-11-13). "Approx. PED of Various Products (U.S.)". Mackinac.org. http://www.mackinac.org/article.aspx?ID=1247. Retrieved 2011-09-03.

- ^ Richie Ovendale, The Origins Of The Arab-Israeli Wars (New York: Pearson Longman, 2004), p. 184-191 and 197

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 1991), p. 619-625

- ^ "World: Saudis Edge U.S. on Oil" in Washington Post Jan 3, 1980 pg. D2

- ^ Dusko Doder "Soviet Production of Gas, Oil Set Records Over 6 Months" in Washington Post Aug 14, 1980 pg. A24

- ^ George C. Wilson "U.S. Military Sales To Saudis 5 Times Total For Israelis" in Washington Post Oct. 11, 1979 pg. A24

- ^ Ian Rutledge Addicted To Oil: America's Relentless Drive For Energy Security (New York: I.B. Tauris, 2005), p. 47

- ^ Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power (New York: Simon and Shuster, 1991), p. 609

- ^ Rutledge, p. 49

- ^ "Designing Cars of the Seventies: Freedoms Lost". Collectible Automobile. February 2008.

- ^ a b . Collectible Automobile. March 2008.

Further reading

- Ammann, Daniel (2009). The King of Oil: The Secret Lives of Marc Rich. New York: St. Martin‘s Press. ISBN 978-0-312-57074-3.

- Alan S. Blinder, Economic Policy and the Great Stagflation (New York: Academic Press, 1979)

- Otto Eckstein, The Great Recession (Amsterdam: North-Holland, 1979)

- Mark E. Rupert and David P. Rapkin, "The Erosion of U.S. Leadership Capabilities"

- Paul M. Johnson and William R. Thompson, eds., Rhythms in Politics and Economics (New York: Praeger, 1985)

External links

- Saudi dove in the oil slick – Sheikh Ahmed Zaki Yamani, former oil minister of Saudi Arabia gives his personal account of the 1973 energy crisis.

- EIA presentation: 25th Anniversary of the 1973 Oil Embargo

- 35 Years After the Arab Oil Embargo

Categories:- Arab–Israeli conflict

- Energy crises

- History of the petroleum industry

- Inflation

- Petroleum economics and industry

- Petroleum politics

- Postwar Japan

- Presidency of Richard Nixon

- Resource conflict

- 1973 in economics

- 1973 in international relations

Wikimedia Foundation. 2010.