- National Energy Program

-

The National Energy Program (NEP) was an energy policy of the Government of Canada. It was created under the Liberal government of Prime Minister Pierre Trudeau by Minister of Energy Marc Lalonde in 1980, and administered by the Department of Energy, Mines and Resources.

Contents

Description

The NEP was introduced in the wake of the energy crises of the 1970s. Because of high oil prices, several economic problems that were beginning to manifest themselves through the 1970s were accelerated and magnified. Inflation was most commonly between 9 and 10 percent annually[1] and prime interest rates over 10 percent.[2] Unemployment was epidemic in the eastern provinces.[3] The NEP was designed to promote oil self-sufficiency for Canada, maintain the oil supply, particularly for the industrial base in eastern Canada, promote Canadian ownership of the energy industry, promote lower prices, promote exploration for oil in Canada, promote alternative energy sources, and increase government revenues from oil sales through a variety of taxes and agreements.[4] The NEP's Petroleum Gas Revenue Tax (PGRT) instituted a double-taxation mechanism that did not apply to other commodities, such as gold and copper (see "Program details" item (c), below). The program would "... redistribute revenue from the [oil] industry and lessen the cost of oil for Eastern Canada..." in an attempt to insulate the Canadian economy from the shock of rising global oil prices[5] (see "Program details" item (a), below). By keeping domestic oil prices below world market prices, the NEP was essentially mandating provincial generosity and subsidizing all Canadian consumers of fuel.[6]

Federal energy policy background

At this point in Canada's history the federal government (more specifically, the National Energy Board or NEB) set the price of oil and natural gas in Canada. The producers neither were charged full world prices for the resource, nor were the consumers.[7] These subsidies had a number of side effects, including larger trade deficits, larger federal budget deficits, higher 'real' interest rates and higher inflation.[7]

Program details

The National Energy Program "... had three principles: (1) security of supply and ultimate independence from the world market, (2) opportunity for all Canadians to participate in the energy industry, particularly oil and gas, and to share in the benefits of its expansion, and (3) fairness, with a pricing and revenue-sharing regime which recognizes the needs and rights of all Canadians."[8]

"The main elements of the program included:

(a) a blended or 'made-in-Canada' price of oil, an average of the costs of imported and domestic oil, which will rise gradually and predictably but will remain well below world prices and will never be more than 85 per cent of the lower of the price of imported oil or of oil in the US, and which will be financed by a Petroleum Compensation Charge levied on refiners...;

(b) natural gas prices which will increase less quickly than oil prices, but which will include a new and rising federal tax on all natural gas and gas liquids;

(c) a petroleum and gas revenue tax of 8 per cent applied to net operating revenues before royalty and other expense deductions on all production of oil and natural gas in Canada...;

(d) the phasing out of the depletion allowances for oil and gas exploration and development, which will be replaced with a new system of direct incentive payments, structured to encourage investment by Canadian companies, with added incentives for exploration on Canada Lands;

(e) a federal share of petroleum production income at the wellhead which will rise from about 10 per cent in recent years to 24 per cent over the 1980-83 period, with the share of the producing provinces falling from 45 to 43 per cent that of the industry falling from 45 to 33 per cent over the same period;

(f) added incentives for energy conservation and energy conversion away from oil, particularly applicable to Eastern Canada, including the extension of the natural gas pipe-line system to Quebec City and the maritimes, with the additional transport charges being passed back to the producer; and

(g) a Canadian ownership levy to assist in financing the acquisition of the Canadian operations of one or more multinational oil companies, with the objective of achieving at least 50 per cent Canadian ownership of oil and gas production by 1990, Canadian control of a significant number of the major oil and gas corporations, and an early increase in the share of the oil and gas sector owned by the Government of Canada."[9]

The net effect of the change to the percentage shares of income at the wellhead (item e) combined with the Petroleum Compensation Charge (item a) meant that by 1983 the share distribution would be "more substantially" shifted to the federal government. The federal government's share would rise to 36 per cent from 10 per cent, while the provincial share and the industry share would go from 45 per cent each down to 36 per cent and 28 per cent respectively.[6] Thus, a province would receive 20 percent less and industry would receive 40 per cent less.

NEP and the federal budget

The 1980 federal government budget introduced by Minister of Finance Allan MacEachen projected a reduction of federal deficits from $14.2 billion in 1980 to $11.8 billion in fiscal 1984 due primarily to substantial increases in revenues from the oil and gas sector while maintaining expenditures.[10] Some economists speculated the NEP would discourage large-scale oil investment projects and thus reduce these projected revenues.[10] Whether or not the NEP itself was the cause, the program failed to deliver the anticipated revenues and, by 1983, the Department of Finance had concluded that the federal government had established a structural deficit[11] of $29.7 billion, an increase from 3.5 per cent of GNP in 1980 to 6.2 per cent of GNP in 1983.[12]

NEP and falling energy prices

The energy price declines of the early 1980s prompted the federal and provincial governments to update their revenue sharing agreements.[13] The amended agreements allowed for $4.2 billion in higher revenues ($1.7 billion federal government, $1.2 billion each for provincial government and industry),[14] which was 30 per cent of the increase that would have been gained from going to world prices.[14] Interestingly, under the NEP industry was in fact not significantly exposed to the declining global oil prices but rather the largest part of direct revenue losses accrued to governments,[15] meaning that the industry operated throughout the period of the NEP under relatively similar oil prices, the 'made-in-Canada' price of oil (see item (a) in National Energy Program Details, above).

Reaction in Western Canada

The program was extremely unpopular in Western Canada, especially in Alberta where most of Canada's oil is produced. With natural resources falling constitutionally within the domain of provincial jurisdictions, many Albertans viewed the NEP as a detrimental intrusion by the federal government into the province's affairs.[16] In Western Canada – and Alberta especially – the NEP was perceived to be at their expense in benefiting the eastern provinces.[17] Particularly vilified was Prime Minister Pierre Trudeau, whose Liberals didn't hold a seat west of Manitoba. Ed Clark, a senior bureaucrat in the Trudeau Liberal government, helped develop the National Energy Program earning himself the moniker 'Red Ed' in the Alberta oil industry. Shortly after Brian Mulroney took office, Clark was fired.[18]

Petro-Canada, the government-established oil company headquartered in Calgary, was made responsible for implementing much of the Program. Petro-Canada was backronymed to "Pierre Elliott Trudeau Rips Off Canada" by opponents of the National Energy Program, and the Petro-Canada Centre in Calgary became known as "Red Square." The popular western slogan during the NEP – appearing on many bumper stickers – was "Let the Eastern bastards freeze in the dark".[19]

Premier of Alberta Peter Lougheed went on national television to announce that oil shipments to the rest of Canada would be halted, forcing the federal government to import more expensive crude. Lougheed also stopped development on several oil sands projects.[19] After negotiations between Trudeau and Lougheed, the NEP was revised so that the price of so called "new" Canadian oil (discovered after December 31, 1980) would eventually rise to the world price but existing "old" oil would still be capped at 75% of the world price.[20]

Impact in Western Canada

The key areas of GDP, per capita federal contributions (since this was a federal program), housing prices and bankruptcy rates during the years of the NEP (1980–1985) are examined in this section. For housing prices and bankruptcy rates, the experience of Alberta in particular is contrasted to the other regions of the country in an attempt to see whether the problems experienced due to the early 1980s recession were worse in Alberta perhaps due to the NEP.

Alberta GDP

It has been estimated by a number of different scholars that Alberta lost between $50 billion and $100 billion because of the NEP,[21][22] and that the cost to the average Albertan was about $18,000.[23]

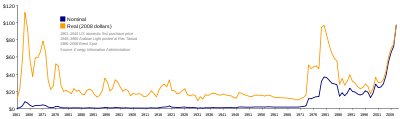

Alberta GDP was between $60 billion and $80 billion annually through the years of the NEP, 1980 to 1986. While it is unclear whether the estimates took into account the decline in world crude oil prices that began only a few months after the NEP came into force, the graph of long-term oil prices show that prices adjusted for inflation did not drop below pre-1980s levels until 1985. Given that the program was cancelled in 1986, the NEP was active for five years which are amongst the most expensive for oil prices on record and the NEP prevented Alberta's economy from fully realising those prices.[20]

Provincial per capita federal contributions

In inflation adjusted 2004 dollars, the year the NEP took effect (1980) per capita fiscal contributions by Alberta to the federal government increased 77% over 1979 levels - from $6,578 in 1979 to $11,641 in 1980.[24] In the five years prior to the NEP (1975–1979), the per capita contributions by Alberta had approximated the fluctuations in the price of oil (see graph Fluctuations: Oil Prices & Alberta Per Capita Federal Contributions 1975-1981). In 1980, however, the inflation adjusted average price of oil was only 5% higher than the previous year yet the per capita contributions from Alberta rose 77%[24] (see graph Fluctuations: Oil Prices & Alberta Per Capita Federal Contributions 1975-1981). Again in inflation adjusted 2004 dollars, the year the NEP was terminated (1986) per capita contributions to the federal government by Alberta collapsed to $680, a mere 10% of 1979 levels.[24]

During the NEP years, 1980–1985, only one other province was a net contributor per capita to the federal government. It was Saskatchewan, another oil producer. In 1980 and 1981 Saskatchewan was a net per capita contributor to the federal government with their peak in 1981 at a mere $514 in comparison to Alberta's peak of $12,735 that same year, both values being 2004 inflation adjusted dollars.[24] Thus, during the NEP years from 1980-1985 the province of Alberta was the sole overall net contributor to the federal government while all other provinces enjoyed being net recipients.

North American housing prices

As cited in a report by Phillips, Hager and North, the U.S. Office of the Federal Housing Oversight (OFHEO) reported overall declines in real estate prices of between 10% and 15% from 1980 through 1985, the years of the NEP.[25] That same report presents information from the Canadian Real Estate Association (CREA) showing that during those years (1980–1985) most eastern Canadian markets fell 10%-15% and the Toronto market held relatively steady.[26] In contrast, the CREA historical data shows a decline from 1980 through to 1985 of approximately 20% for Vancouver, Saskatoon and Winnipeg while the drop approached 40% in the oil dominated economies of Edmonton and Calgary,[27] yet through those years oil prices were still historically high (see figure Long-Term Oil Prices, 1861–2007).

Bankruptcies in Canada

For the period 1980 through 1985, government statistics show that while the overall number of bankruptcies per 1,000 businesses in Canada peaked at 50% above the 1980 rate.[28] During that same time the bankruptcy rate in Alberta's economy rose by 150% after the NEP took effect[29] despite those years being amongst the most expensive for oil prices on record (see figure Long-Term Oil Prices, 1861–2007).

Comparing with other oil-based economies during the NEP years

North Sea Oil Prices and Norway's Trade Balance, 1975-2000. Source: Statistics Norway

North Sea Oil Prices and Norway's Trade Balance, 1975-2000. Source: Statistics Norway

In around 1970 Norway started to become an oil dominated export economy comparable to Alberta. As with most of the world's manufacturing economies, Norway's manufacturing experienced recession beginning in the 1970s. However, in the late 1970s the rise in oil prices saw Norway's oil exports grow and provide the nation with a trade surplus (see figure North Sea Oil Prices and Norway's Trade Balance, 1975–2000).

"Norway saw deindustrialization at a more rapid pace than most of her largest trading partners. Due to the petroleum sector, however, Norway experienced high growth rates in all the three last decades of the twentieth century, bringing Norway to the top of the world GDP per capita list at the dawn of the new millennium."[30]

Thus, not all oil based economies suffered as Alberta did during the global slowdown of the early 1980s. Norway experienced an economic boom during the NEP years thanks to the historically high oil prices (see figure Long-Term Oil Prices, 1861–2007). The economic boom of the early 1980s in Norway lasted until the price of oil collapsed in late 1985 just before the NEP was terminated (see figure North Sea Oil Prices and Norway's Trade Balance, 1975–2000).

End of the NEP

The rationale for the program weakened when world oil prices began to slowly decline in the early 1980s and then collapsed in late 1985 (see figure Long-Term Oil Prices, 1861–2007). A phased shutdown was commenced by Jean Chrétien while he was Minister of Energy, Mines and Resources.

In the 1984 election the Progressive Conservative Party of Brian Mulroney was elected to a majority in the House of Commons with the support of Western Canada after campaigning against the NEP. However, Mulroney did not eliminate the last vestiges of the program until two and a half years later, at which time world oil prices had dropped below pre-1980s levels (as adjusted for inflation - see figure Long-Term Oil Prices, 1861–2007). The conservative government's delay was a contributing factor to the creation of a new political party, Western Canada's Reform Party of Canada.

Impact

The economic effect of the program is debated. After it was implemented, Canada, along with all of the economies of Europe (except for Norway due to their petroleum industry[31]) and the economy of the United States, fell into a worldwide recession. It would turn out to be the worst economic downturn since the Great Depression.

Given that bankruptcies[28] and real estate prices[26] did not fare as negatively in Central Canada as in the rest of Canada and the United States[25] during the NEP, it is possible that the NEP had a positive effect in Central Canada.

However, given that bankruptcies[29] and real estate[27] did much worse in Alberta than in other parts of Canada and the United States, petroleum exporting economies like Norway performed well,[31] coupled with the estimated loss of between $50 and $100 billion in provincial GDP [19] (at the time, this was an entire year's GDP for the province) due to the NEP during this period, it is plausible the NEP had a negative effect in Alberta.

Perhaps the greatest impact was the NEP's failure to deliver the revenues forecast originally in the 1980 federal budget. Federal deficits had been expected to decrease primarily due to substantial increases in revenues from the oil and gas sector.[10] Instead, by 1983 the Department of Finance had concluded that the federal government had established a structural deficit[11] of 6.2 per cent of GNP ($29.7 billion).[12]

Finally, politically the NEP heightened distrust of the federal government in Western Canada, especially in Alberta where many Albertans believed that the NEP was an intrusion of the federal government into an area of provincial jurisdiction.[16]

See also

References

- ^ Bank of Canada data <http://www.bankofcanada.ca/en/rates/inflation_calc.html>

- ^ Bank of Canada data <http://canadabubble.com/charts/bank-of-canada-interest-rate-history.html>

- ^ “Uncertain Country.” Canada: A People’s History. CBC Television. Prod & Dir: Susan Dando. Aired: TVO: CICI, Toronto. January 10, 2005.

- ^ “National Energy Program.” The Canadian Encyclopedia. Historica Foundation of Canada. N.d. January 2005. <http://www.thecanadianencyclopedia.com/index.cfm?PgNm=TCE&Params=J1ARTJ0005618>

- ^ “The National Energy Program: Canada and the United States” Carman Neustaedter, University of Calgary. March 2001. <http://pages.cpsc.ucalgary.ca/~carman/courses/nep.html>

- ^ a b Canadian Public Policy “The Federal Budget and Energy Program, October 28th, 1980: A Review” Brian L. Scarfe, Department of Economics, the University of Alberta. Winter 1981. <http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf> page 8

- ^ a b Canadian Public Policy “The Federal Budget and Energy Program, October 28th, 1980: A Review” Brian L. Scarfe, Department of Economics, the University of Alberta. Winter 1981. <http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf> pages 2 - 5

- ^ Canadian Public Policy “The Federal Budget and Energy Program, October 28th, 1980: A Review” Brian L. Scarfe, Department of Economics, the University of Alberta. Winter 1981. <http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf> pages 5 - 6

- ^ Canadian Public Policy “The Federal Budget and Energy Program, October 28th, 1980: A Review” Brian L. Scarfe, Department of Economics, the University of Alberta. Winter 1981. <http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf> page 6

- ^ a b c Canadian Public Policy “The Federal Budget and Energy Program, October 28th, 1980: A Review” Brian L. Scarfe, Department of Economics, the University of Alberta. Winter 1981. <http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf> page 10

- ^ a b “The Federal Deficit: Some Economic Fallacies” Marion Wrobel, Senior Analyst, Depository Services Program, Canada. February 1986. <http://dsp-psd.tpsgc.gc.ca/Collection-R/LoPBdP/BP/bp144-e.htm>

- ^ a b “The Federal Deficit in Perspective” Department of Finance, Canada. April 1983, p. 64. Table 1 Inflation-Adjusted Federal Government Budget Balances (National Accounts Basis)<http://dsp-psd.tpsgc.gc.ca/Collection-R/LoPBdP/BP/bp144-e.htm>

- ^ Canadian Public Policy “The National Energy Program Meets Falling World Oil Prices” John F. Helliwell, Mary E. MacGregor and Andre Plourde, Department of Economics, the University of British Columbia. 1983. <http://economics.ca/cgi/jab?journal=cpp&view=v09n3/CPPv09n3p284.pdf> page 284

- ^ a b Canadian Public Policy “The National Energy Program Meets Falling World Oil Prices” John F. Helliwell, Mary E. MacGregor and Andre Plourde, Department of Economics, the University of British Columbia. 1983. <http://economics.ca/cgi/jab?journal=cpp&view=v09n3/CPPv09n3p284.pdf> page 290

- ^ Canadian Public Policy “The National Energy Program Meets Falling World Oil Prices” John F. Helliwell, Mary E. MacGregor and Andre Plourde, Department of Economics, the University of British Columbia. 1983. <http://economics.ca/cgi/jab?journal=cpp&view=v09n3/CPPv09n3p284.pdf> page 294

- ^ a b McKenzie, Helen. Ed. Current Issues System: Western Alienation in Canada. Ottawa: Research Branch, Library of Parliament, Government of Canada, 1981.

- ^ Scarfe, Brian L. (Winter 1981). "The Federal Budget and Energy Program, October 28th, 1980: A Review". Canadian Public Policy VII (1). http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p001.pdf. Retrieved July 20, 2011.

- ^ Sinclair Stewart, Tara Perkins. "The Power of Persuasion". www.globeadvisor.com. http://www.globeadvisor.com/servlet/ArticleNews/story/gam/20090514/RTD14ART1940. Retrieved 2009-05-24.

- ^ a b c Vicente, Mary Elizabeth. “The National Energy Program.” Canada’s Digital Collections. Heritage Community Foundation. N.d. January 2005. <http://www.abheritage.ca/abpolitics/events/issues_nep.html>

- ^ a b Nickle's Energy Group. “Trudeau, Lougheed Sign Agreement” Daily Oil Bulletin. September 2, 1981. <http://www.nickles.com/history/article.asp?article=history%5Chistory_1116.html>

- ^ Vicente, Mary Elizabeth (2005). "The National Energy Program". Canada’s Digital Collections. Heritage Community Foundation. http://www.abheritage.ca/abpolitics/events/issues_nep.html. Retrieved 2008-04-26.

- ^ Mansell, Robert; Schlenker, Ronald (1995). "The Provincial Distribution of Federal Fiscal Balances". Canadian Business Economics (Canadian Association of Business Economics). http://www.cabe.ca/jmv1/index.php?option=com_docman&task=doc_download&gid=124&Itemid=38. Retrieved 2010-09-24.

- ^ Heliwell, John; McCrae, Robert (1981). "The National Energy Conflict". Canadian Public Policy (Canadian Economics Association). http://economics.ca/cgi/jab?journal=cpp&view=v07n1/CPPv07n1p015.pdf. Retrieved 2010-08-30.

- ^ a b c d Mansell, Robert; Schlenker, Ron; Anderson, John (2005) (PDF). Energy, Fiscal Balances and National Sharing. Institute for Sustainable Energy, Environment and Economy / University of Calgary. p. 11. Archived from the original on 2008-06-26. http://web.archive.org/web/20080626113516/http://www.iseee.ca/files/iseee/ISEEEResearchReportNov1805.pdf. Retrieved 2008-04-26.

- ^ a b Phillips, Hager and North Investment Management Ltd. “North American Real Estate: Bubble Trouble?” June 24, 2004. p.1 Chart 1: U.S. Real House Prices (Indexed to 1975 = 100). <https://www.phn.com/Portals/0/PDFs/Articles/North%20American%20Real%20Estate%20062504.pdf>

- ^ a b Phillips, Hager and North Investment Management Ltd. “North American Real Estate: Bubble Trouble?” June 24, 2004. p.6 Chart 10: Average House Prices (real terms), Eastern Canada (Indexed to 1980 = 100). <https://www.phn.com/Portals/0/PDFs/Articles/North%20American%20Real%20Estate%20062504.pdf>

- ^ a b Phillips, Hager and North Investment Management Ltd. “North American Real Estate: Bubble Trouble?” June 24, 2004. p.6 Chart 9: Average Annual House Prices (real terms), Western Canada (Indexed to 1980 = 100). <https://www.phn.com/Portals/0/PDFs/Articles/North%20American%20Real%20Estate%20062504.pdf>

- ^ a b Statistics Canada. “National and Regional Trends in Business Bankruptcies, 1980 to 2005” October 2006. p.20 Table A3 Number of bankruptcies per 1,000 businesses, Canada and regions, 1980 to 2005. <http://www.statcan.ca/english/research/11-624-MIE/11-624-MIE2006015.pdf>

- ^ a b Statistics Canada. “National and Regional Trends in Business Bankruptcies, 1980 to 2005” October 2006. p.12 Figure 4-2 Incidence of bankruptcies — Prairie provinces, 1980 to 2005. <http://www.statcan.ca/english/research/11-624-MIE/11-624-MIE2006015.pdf>

- ^ Grytten, Ola. "The Economic History of Norway". EH.Net Encyclopedia, edited by Robert Whaples. March 16, 2008. <http://eh.net/encyclopedia/article/grytten.norway>

- ^ a b Grytten, Ola. "The Economic History of Norway". EH.Net Encyclopedia, edited by Robert Whaples. March 16, 2008. <http://eh.net/encyclopedia/article/grytten.norway>

External links

- Discussions prior to NEP's creation

- Discussion of changes and dollar impact to NEP in 1981

- Dismantling the NEP

- Political Issues - National Energy Program

- “Energy Policy.” The Canadian Encyclopedia. Historical Foundation of Canada. N.d. January 2005.

- “Trudeau, Lougheed Attend Energy Conference.” Television News. Reporter: Don McNeill. CBC Television. CBC Archives. April 9, 1975. January 6, 2005.

- “National Energy Program.” The Canadian Encyclopedia. Historica Foundation of Canada. N.d. January 2005.

- “West Historically Exploited for Resources.” Radio Interview. John Crispo, interviewed. Sunday Magazine. CBC Radio. CBC Archives. December 9, 1973. January 6, 2005.

Categories:- Canadian federal departments and agencies

- Economic history of Canada

- History of Alberta

- Energy in Canada

Wikimedia Foundation. 2010.