- Bank of America

-

Not to be confused with First Bank of the United States, Second Bank of the United States, or Bank of United States.

Bank of America Corporation

Type Public Traded as NYSE: BAC, TYO: 8648

Dow Jones Component

S&P 500 ComponentIndustry Banking, Financial services Predecessor Bank of America

NationsBankFounded 1904[1] Headquarters Bank of America Corporate Center, Uptown Charlotte,

Charlotte, North Carolina, U.S.Area served Worldwide Key people Brian Moynihan

(President & CEO)

Charles Holliday (Chairman)Products Credit cards, consumer banking, corporate banking, finance and insurance, investment banking, mortgage loans, private banking, private equity, wealth management Revenue  US$ 134.194 billion (2010)[2]

US$ 134.194 billion (2010)[2]Net income  US$ 2.238 billion (2010)[2]

US$ 2.238 billion (2010)[2]Total assets  US$ 2.264 trillion (2010)[2]

US$ 2.264 trillion (2010)[2]Total equity  US$ 228.248 billion (2010)[2]

US$ 228.248 billion (2010)[2]Employees 288,000 (2010)[2] Subsidiaries Bank of America Home Loans, Bank of America Merrill Lynch, Merrill Lynch, U.S. Trust Corporation Website BankofAmerica.com References: [3]  Bank of America Corporate Center, located in the heart of Uptown Charlotte.

Bank of America Corporate Center, located in the heart of Uptown Charlotte.

Bank of America Corporation (NYSE: BAC), an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets,[4] and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina. Bank of America serves clients in more than 150 countries and has a relationship with 99% of the U.S. Fortune 500 companies and 83% of the Fortune Global 500. The company is a member of the Federal Deposit Insurance Corporation (FDIC) and a component of both the S&P 500 Index and the Dow Jones Industrial Average.[5][6][7]

As of 2010, Bank of America is the 5th largest company in the United States by total revenue,[8] as well as the second largest non-oil company in the U.S. (after Walmart). In 2010, Forbes listed Bank of America as the 3rd biggest company in the world.[9]

The bank's 2008 acquisition of Merrill Lynch made Bank of America the world's largest wealth management corporation and a major player in the investment banking market.[10]

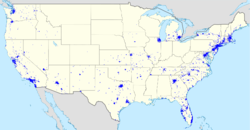

The company holds 12.2% of all bank deposits in the United States, as of August 2009,[11] and is one of the Big Four banks in the United States, along with Citigroup, JPMorgan Chase and Wells Fargo—its main competitors.[12][13] According to its 2010 Annual Report, Bank of America operates "in all 50 states, the District of Columbia and more than 40 non-U.S. countries". It has a "retail banking footprint" that "covers approximately 80 percent of the U.S. population." it serves "approximately 57 million consumer and small business relationships" at "5,900 banking centers" and "18,000 ATMs".[14]

Corporate history

Bank of Italy

Main article: Bank of Italy (USA)The history of Bank of America dates back to 1904, when Amadeo Giannini founded the Bank of Italy in San Francisco in an effort to cater to immigrants denied service by other banks.[15] Giannini was raised by the Fava/Stanghellini family, as his father was shot while trying to collect on a $10.00 debt.[citation needed] When the 1906 San Francisco earthquake struck, Giannini was able to scavenge all deposits out of the bank building and away from the fires. Because San Francisco's banks were in smoldering ruins and unable to open their vaults, Giannini was able to use the rescued funds to commence lending within a few days of the disaster. From a makeshift desk consisting of a few planks over two barrels, he lent money to anyone who was willing to rebuild. Later in life, he took great pride in the fact that all of these loans were repaid.

In 1922, Giannini established Bank of America and Italy in Italy by buying Banca dell'Italia Meridionale, the latter established in 1918.[16]

On March 7, 1927, Giannini consolidated his Bank of Italy (101 branches) with the newly formed Liberty Bank of America (175 branches). The result was the Bank of Italy National Trust & Savings Association with capital of $30 Billion, and resources of $115 Billion.

In 1928, A. P. Giannini merged with Bank of America, Los Angeles and consolidated it with his other bank holdings to create what would become the largest banking institution in the country. He renamed the Bank of Italy on November 3, 1930, calling it Bank of America. The resulting company was headed by Giannini with Orra E. Monnette serving as co-Chair.

Growth in California

Giannini sought to build a national bank, expanding into most of the western states as well as into the insurance industry, under the aegis of his holding company, Transamerica Corporation. In 1953, regulators succeeded in forcing the separation of Transamerica Corporation and Bank of America under the Clayton Antitrust Act.[17] The passage of the Bank Holding Company Act of 1956 prohibited banks from owning non-banking subsidiaries such as insurance companies. Bank of America and Transamerica were separated, with the latter company continuing in the insurance business. However, federal banking regulators prohibited Bank of America's interstate banking activity, and Bank of America's domestic banks outside California were forced into a separate company that eventually became First Interstate Bancorp, later acquired by Wells Fargo and Company in 1996. It was not until the 1980s with a change in federal banking legislation and regulation that Bank of America was again able to expand its domestic consumer banking activity outside California.

New technologies also allowed credit cards to be linked directly to individual bank accounts. In 1958, the bank introduced the BankAmericard, which changed its name to Visa in 1975.[18] A consortium of other California banks introduced Master Charge (now MasterCard) to compete with BankAmericard.

Expansion outside California

Following the passage of the Bank Holding Company Act of 1956, BankAmerica Corporation was established for the purpose of owning and operation of Bank of America and its subsidiaries.

BankAmerica expanded outside California in 1983 with its acquisition of Seafirst Corporation of Seattle, Washington, as well as its wholly owned banking subsidiary, Seattle-First National Bank. Seafirst was at risk of seizure by the federal government after becoming insolvent due to a series of bad loans to the oil industry. BankAmerica continued to operate its new subsidiary as Seafirst rather than Bank of America until the 1998 merger with NationsBank.

BankAmerica experienced huge losses in 1986 and 1987 by the placement of a series of bad loans in the Third World, particularly in Latin America. The company fired its CEO, Sam Armacost. Though Armacost blamed the problems on his predecessor, A.W. (Tom) Clausen, Clausen was appointed to replace Armacost. The losses resulted in a huge decline of BankAmerica stock, making it vulnerable to a hostile takeover. First Interstate Bancorp of Los Angeles (which had originated from banks once owned by BankAmerica), launched such a bid in the fall of 1986, although BankAmerica rebuffed it, mostly by selling operations. It sold its FinanceAmerica subsidiary to Chrysler and the brokerage firm Charles Schwab and Co. back to Mr. Schwab. It also sold Bank of America and Italy to Deutsche Bank. By the time of the 1987 stock market crash, BankAmerica's share price had fallen to $8, but by 1992 it had rebounded mightily to become one of the biggest gainers of that half-decade.

The Bank of America Tower in New York City.

The Bank of America Tower in New York City.

BankAmerica's next big acquisition came in 1992. The company acquired its California rival, Security Pacific Corporation and its subsidiary Security Pacific National Bank in California and other banks in Arizona, Idaho, Oregon, and Washington (which Security Pacific had acquired in a series of acquisitions in the late 1980s). This was, at the time, the largest bank acquisition in history. Federal regulators, however, forced the sale of roughly half of Security Pacific's Washington subsidiary, the former Rainier Bank, as the combination of Seafirst and Security Pacific Washington would have given BankAmerica too large a share of the market in that state. The Washington branches were divided and sold off to West One Bancorp (now U.S. Bancorp) and KeyBank.[19] Later that year, BankAmerica expanded into Nevada by acquiring Valley Bank of Nevada.

In 1994, BankAmerica acquired the Continental Illinois National Bank and Trust Co. of Chicago, which had become federally owned as part of the same oil industry debacle emanating from Oklahoma City's Penn Square Bank, that had brought down numerous financial institutions including Seafirst. At the time, no bank possessed the resources to bail out Continental, so the federal government operated the bank for nearly a decade. Illinois at that time regulated branch banking extremely heavily, so Bank of America Illinois was a single-unit bank until the 21st century. BankAmerica moved its national lending department to Chicago in an effort to establish a financial beachhead in the region.

These mergers helped BankAmerica Corporation to once again become the largest U.S. bank holding company in terms of deposits, but the company fell to second place in 1997 behind fast-growing NationsBank Corporation, and to third in 1998 behind North Carolina's First Union Corp.

On the capital markets side, the acquisition of Continental Illinois helped BankAmerica to build a leveraged finance origination and distribution business (Continental Illinois had extensive leveraged lending relationships) which allowed the firm’s existing broker-dealer, BancAmerica Securities (originally named BA Securities), to become a full-service franchise.[20][21] In addition, in 1997, BankAmerica acquired Robertson Stephens, a San Francisco-based investment bank specializing in high technology for $540 million. Robertson Stephens was integrated into BancAmerica Securities and the combined subsidiary was renamed BancAmerica Robertson Stephens.[22]

Merger of NationsBank and BankAmerica

In 1997, BankAmerica lent D. E. Shaw & Co., a large hedge fund, $1.4 billion in order to run various businesses for the bank. However, D.E. Shaw suffered significant loss after the 1998 Russia bond default. BankAmerica was acquired by NationsBank of Charlotte in October 1998 in what was the largest bank acquisition in history at that time.

While NationsBank was the nominal survivor, the merged bank took the name Bank of America Corporation, with Bank of America NT&SA changing its name to Bank of America, N.A. as the remaining legal bank entity. The combined bank still operates under Federal Charter 13044, which was granted to Giannini's Bank of Italy on March 1, 1927. However, SEC filings before 1998 are listed under NationsBank, not BankAmerica. Bank of America possessed combined assets of $570 billion, as well as 4,800 branches in 22 states. Despite the mammoth size of the two companies, federal regulators insisted only upon the divestiture of 13 branches in New Mexico, in towns that would be left with only a single bank following the combination.(Branch divestitures are only required if the combined company will have a larger than 25% FDIC deposit market share in a particular state or 10% deposit market share overall.) In addition, the combined broker-dealer, created from the integration of BancAmerica Robertson Stephens and NationsBanc Montgomery Securities, was renamed Banc of America Securities in 1998.[23]

History since 2001

In 2001, Bank of America CEO and chairman Hugh McColl stepped down and named Ken Lewis as his successor.

In 2004, Bank of America announced it would purchase Boston-based bank FleetBoston Financial for $47 billion in cash and stock.[24] By merging with Bank of America, all of its banks and branches were given the Bank of America logo. At the time of merger, FleetBoston was the seventh largest bank in United States with $197 billion in assets, over 20 million customers and revenue of $12 billion.[24] Hundreds of FleetBoston workers lost their jobs or were demoted, according to the Boston Globe.

On June 30, 2005, Bank of America announced it would purchase credit card giant MBNA for $35 billion in cash and stock. The Federal Reserve Board gave final approval to the merger on December 15, 2005, and the merger closed on January 1, 2006. The acquisition of MBNA provided Bank of America a leading domestic and foreign credit card issuer . The combined Bank of America Card Services organization, including the former MBNA, had more than 40 million U.S. accounts and nearly $140 billion in outstanding balances. Under Bank of America the operation was renamed FIA Card Services.

In May 2006, Bank of America and Banco Itaú (Investimentos Itaú S.A.) entered into an acquisition agreement through which Itaú agreed to acquire BankBoston's operations in Brazil and was granted an exclusive right to purchase Bank of America's operations in Chile and Uruguay. A deal was signed in August 2006 under which Itaú agreed to purchase Bank of America's operations in Chile and Uruguay. Prior to the transaction, BankBoston's Brazilian operations included asset management, private banking, a credit card portfolio, and small, middle-market, and large corporate segments. It had 66 branches and 203,000 clients in Brazil. BankBoston in Chile had 44 branches and 58,000 clients and in Uruguay it had 15 branches. In addition, there was a credit card company, OCA, in Uruguay, which had 23 branches. BankBoston N.A. in Uruguay, together with OCA, jointly served 372,000 clients. While the BankBoston name and trademarks were not part of the transaction, as part of the sale agreement, they cannot be used by Bank of America in Brazil, Chile or Uruguay following the transactions. Hence, the BankBoston name has disappeared from Brazil, Chile and Uruguay. The Itaú stock received by Bank of America in the transactions has allowed Bank of America's stake in Itaú to reach 11.51%. Banco de Boston de Brazil had been founded in 1947.

On November 20, 2006, Bank of America announced the purchase of The United States Trust Company for $3.3 billion, from the Charles Schwab Corporation. US Trust had about $100 billion of assets under management and over 150 years of experience. The deal closed July 1, 2007.[25]

On September 14, 2007, Bank of America won approval from the Federal Reserve to acquire LaSalle Bank Corporation from Netherlands's ABN AMRO for $21 billion. With this purchase, Bank of America possessed 1.7 trillion in assets. A Dutch court blocked the sale until it was later approved in July. The acquisition was completed on October 1, 2007.

The deal increased Bank of America's presence in Illinois, Michigan, and Indiana by 411 branches, 17,000 commercial bank clients, 1.4 million retail customers, and 1,500 ATMs. Bank of America became the largest bank in the Chicago market with 197 offices and 14% of the deposit share, surpassing JPMorgan Chase.

LaSalle Bank and LaSalle Bank Midwest branches adopted the Bank of America name on May 5, 2008.[26]

Ken Lewis resigned as of December 31, 2009, in part due to controversy and legal investigations concerning the purchase of Merrill Lynch, and Brian Moynihan became President and CEO effective January 1, 2010. After Moynihan assumed control, credit card charge offs and delinquencies declined in January. Bank of America also repaid the $45 billion it had received from the Troubled Assets Relief Program.[27][28]

Acquisition of Countrywide Financial

On August 23, 2007, the company announced a $2 billion repurchase agreement for Countrywide Financial. This purchase of preferred stock was arranged to provide a return on investment of 7.25% per annum and provided the option to purchase common stock at a price of $18 per share.[29]

On January 11, 2008, Bank of America announced they would buy Countrywide Financial for $4.1 billion.[30] In March 2008, it was reported that the FBI was investigating Countrywide for possible fraud relating to home loans and mortgages.[31] This news did not hinder the acquisition, which was completed in July 2008,[32] giving the bank a substantial market share of the mortgage business, and access to Countrywide's resources for servicing mortgages.[33] The acquisition was seen as preventing a potential bankruptcy for Countrywide. Countrywide, however, denied that it was close to bankruptcy. Countrywide provided mortgage servicing for nine million mortgages valued at $1.4 trillion as of December 31, 2007.[34]

This purchase made Bank of America Corporation the leading mortgage originator and servicer in the U.S., controlling 20–25% of the home loan market.[35] The deal was structured to merge Countrywide with the Red Oak Merger Corporation, which Bank of America created as an independent subsidiary. It has been suggested that the deal was structured this way to prevent a potential bankruptcy stemming from large losses in Countrywide hurting the parent organization by keeping Countrywide bankruptcy remote.[36] Countrywide Financial has changed its name to Bank of America Home Loans.

Acquisition of Merrill Lynch

On September 14, 2008, Bank of America announced its intentions to purchase Merrill Lynch & Co., Inc. in an all-stock deal worth approximately $50 billion. Merrill Lynch was at the time within days of collapse, and the acquisition effectively saved Merrill from bankruptcy.[37] Around the same time Bank of America was reportedly also in talks to purchase Lehman Brothers, however a lack of government guarantees caused the bank to abandon talks with Lehman.[38] Lehman Brothers filed for bankruptcy the same day Bank of America announced its plans to acquire Merrill Lynch.[39] This acquisition made Bank of America the largest financial services company in the world.[40] Temasek Holdings, the largest shareholder of Merrill Lynch & Co., Inc., briefly became one of the largest shareholders of Bank of America,[41] with a 3% stake. However, taking a loss Reuters estimated at $3 billion, the Singapore sovereign wealth fund sold its whole stake in Bank of America in the first quarter of 2009.[42]

Shareholders of both companies approved the acquisition on December 5, 2008, and the deal closed January 1, 2009.[43] Bank of America had planned to retain various members of Thain's management team after the merger.[44] However, after Thain was removed from his position, most of his allies left. The departure of Nelson Chai, who had been named Asia-Pacific president, left just one of Thain's hires in place: Tom Montag, head of sales and trading.[45]

The Bank, in its January 16, 2009 earnings release, revealed massive losses at Merrill Lynch in the fourth quarter, which necessitated an infusion of money that had previously been negotiated[46] with the government as part of the government-persuaded deal for the Bank to acquire Merrill. Merrill recorded an operating loss of $21.5 billion in the quarter, mainly in its sales and trading operations, led by Tom Montag. The Bank also disclosed it tried to abandon the deal in December after the extent of Merrill's trading losses surfaced, but was compelled to complete the merger by the U.S. government. The Bank's stock price sank to $7.18, its lowest level in 17 years, after announcing earnings and the Merrill mishap. The market capitalization of Bank of America, including Merrill Lynch, was then $45 billion, less than the $50 billion it offered for Merrill just four months earlier, and down $108 billion from the merger announcement.

Bank of America CEO Kenneth Lewis testified before Congress[10] that he had some misgivings about the acquisition of Merrill Lynch, and that federal officials pressured him to proceed with the deal or face losing his job and endangering the bank's relationship with federal regulators.[47]

Lewis' statement is backed up by internal emails subpoenaed by Republican lawmakers on the House Oversight Committee.[48] In one of the emails, Richmond Federal Reserve President Jeffrey Lacker threatened that if the acquisition did not go through, and later Bank of America were forced to request federal assistance, the management of Bank of America would be "gone". Other emails, read by Congressman Dennis Kucinich during the course of Lewis' testimony, state that Mr. Lewis had foreseen the outrage from his shareholders that the purchase of Merrill would cause, and asked government regulators to issue a letter stating that the government had ordered him to complete the deal to acquire Merrill. Lewis, for his part, states he didn't recall requesting such a letter.

The acquisition made Bank of America the number one underwriter of global high-yield debt, the third largest underwriter of global equity and the ninth largest adviser on global mergers and acquisitions.[49] As the credit crisis eased, losses at Merrill Lynch subsided, and the subsidiary generated 3.7 billion of Bank of America's 4.2 billion in profit by the end of quarter one in 2009, and over 25% in quarter 3 2009.[50][51]

Bonus settlement

On August 3, 2009, Bank of America agreed to pay a $33 million fine, without admission or denial of charges, to the U.S. Securities and Exchange Commission (SEC) over the non-disclosure of an agreement to pay up to $5.8 billion of bonuses at Merrill. The bank approved the bonuses before the merger but did not disclose them to its shareholders when the shareholders were considering approving the Merrill acquisition, in December 2008. The issue was originally investigated by New York State Attorney General Andrew Cuomo, who commented after the suit and announced settlement that "the timing of the bonuses, as well as the disclosures relating to them, constituted a 'surprising fit of corporate irresponsibility'" and "our investigation of these and other matters pursuant to New York's Martin Act will continue." Congressman Kucinich commented at the same time that "This may not be the last fine that Bank of America pays for how it handled its merger of Merrill Lynch."[52] A federal judge, Jed Rakoff, in an unusual action, refused to approve the settlement on August 5.[53] A first hearing before the judge on August 10 was at times heated, and he was "sharply critic[al]" of the bonuses. David Rosenfeld represented the SEC, and Lewis J. Liman, son of Arthur L. Liman, represented the bank. The actual amount of bonuses paid was $3.6 billion, of which $850 million was "guaranteed" and the rest was shared amongst 39,000 workers who received average payments of $91,000; 696 people received more than $1 million in bonuses; at least one person received a more than $33 million bonus.[54]

On September 14, the judge rejected the settlement and told the parties to prepare for trial to begin no later than February 1, 2010. The judge focused much of his criticism on the fact that the fine in the case would be paid by the bank's shareholders, who were the ones that were supposed to have been injured by the lack of disclosure. He wrote, "It is quite something else for the very management that is accused of having lied to its shareholders to determine how much of those victims’ money should be used to make the case against the management go away," ... "The proposed settlement," the judge continued, "suggests a rather cynical relationship between the parties: the S.E.C. gets to claim that it is exposing wrongdoing on the part of the Bank of America in a high-profile merger; the bank's management gets to claim that they have been coerced into an onerous settlement by overzealous regulators. And all this is done at the expense, not only of the shareholders, but also of the truth."[55]

While ultimately deferring to the SEC, in February, 2010, Judge Rakoff approved a revised settlement with a $150 million fine "reluctantly", calling the accord "half-baked justice at best" and "inadequate and misguided". Addressing one of the concerns he raised in September, the fine will be "distributed only to Bank of America shareholders harmed by the non-disclosures, or 'legacy shareholders', an improvement on the prior $33 million while still "paltry", according to the judge. Case: SEC v. Bank of America Corp., 09-cv-06829, United States District Court for the Southern District of New York.[56]

Investigations also were held on this issue in the United States House Committee on Oversight and Government Reform,[55] under chairman Edolphus Towns (D-NY)[57] and in its investigative Domestic Policy Subcommittee under Kucinich.[58]

Municipal bonds fraud

In 2010, the bank was accused by the U.S. government of defrauding schools, hospitals, and dozens of state and local government organizations via misconduct and illegal activities involving the investment of proceeds from municipal bond sales. As a result, the bank agreed to pay $137.7 million, including $25 million to the Internal Revenue service and $4.5 million to state attorney general, to the affected organizations to settle the allegations.[59]

Former bank official Douglas Campbell pleaded guilty to antitrust, conspiracy and wire fraud charges. As of January 2011, other bankers and brokers are under indictment or investigation.[60]

2011 to 2014 downsizing

During 2011, Bank of America began conducting personnel reductions of an estimated 36,000 people, contributing to intended savings of $5 billion per year by 2014.[61]

Federal TARP

Bank of America received $20 billion in the federal bailout from the U.S. government through the Troubled Asset Relief Program (TARP) on January 16, 2009, along with a guarantee of $118 billion in potential losses at the company.[62] This was in addition to the $25 billion given to them in the Fall of 2008 through TARP. The additional payment was part of a deal with the U.S. government to preserve Bank of America's merger with the troubled investment firm Merrill Lynch.[63] Since then, members of the U.S. Congress have expressed considerable concern about how this money has been spent, especially since some of the recipients have been accused of misusing the bailout money.[64] Then CEO Ken Lewis was quoted as claiming "We are still lending, and we are lending far more because of the TARP program." Members of the U.S. House of Representatives, however, were skeptical and quoted many anecdotes about loan applicants (particularly small business owners) being denied loans and credit card holders facing stiffer terms on the debt in their card accounts.

According to a March 15, 2009, article in The New York Times, Bank of America received an additional $5.2 billion in government bailout money, channeled through American International Group.[65]

As a result of its federal bailout and management problems, The Wall Street Journal reported that the Bank of America was operating under a secret "memorandum of understanding" (MOU) from the U.S. government that requires it to "overhaul its board and address perceived problems with risk and liquidity management". With the federal action, the institution has taken several steps, including arranging for six of its directors to resign and forming a Regulatory Impact Office. Bank of America faces several deadlines in July and August and if not met, could face harsher penalties by federal regulators. Bank of America did not respond to The Wall Street Journal story.[66]

On December 2, 2009, Bank of America announced it would repay the entire $45 billion it received in TARP and exit the program, using $26.2 billion of excess liquidity along with $18.6 billion to be gained in "common equivalent securities" (Tier 1 capital). The bank announced it had completed the repayment on December 9. Bank of America's Ken Lewis said during the announcement, "We appreciate the critical role that the U.S. government played last fall in helping to stabilize financial markets, and we are pleased to be able to fully repay the investment, with interest... As America's largest bank, we have a responsibility to make good on the taxpayers' investment, and our record shows that we have been able to fulfill that commitment while continuing to lend."[67][68]

Lawsuits

Bank of America was sued for $10 billion by American International Group Inc. in August 2011. Another lawsuit filed September 2011 concerns a total of $57.5 billion in mortgage-backed securities Bank of America sold to Fannie Mae and Freddie Mac.[69]

Bank of America divisions

Bank of America generates 90% of its revenues in its domestic market and continues to buy businesses in the U.S. The core of Bank of America's strategy is to be the number one bank in its domestic market. It has achieved this through key acquisitions.[70]

Consumer

Global Consumer and Small Business Banking (GC&SBB) is the largest division in the company, and deals primarily with consumer banking and credit card issuance. The acquisition of FleetBoston and MBNA significantly expanded its size and range of services, resulting in about 51% of the company's total revenue in 2005. It competes primarily with the retail banking arms of America's three other megabanks: Citigroup, JPMorgan Chase, and Wells Fargo. The GC&SBB organization includes over 6,100 retail branches and over 18,700 ATMs across the United States.

Bank of America is a member of the Global ATM Alliance, a joint venture of several major international banks that allows customers of the banks to use their ATM card or check card at another bank within the Global ATM Alliance without access fees when traveling internationally. Other participating banks are Barclays (United Kingdom), BNP Paribas (France), Ukrsibbank (Ukraine), China Construction Bank (China), Deutsche Bank (Germany), Santander Serfin (Mexico), Scotiabank (Canada) and Westpac (Australia and New Zealand).[71] This feature is restricted to withdrawals using a debit card, though credit card withdrawals are still subject to cash advance fees and foreign currency conversion fees. Additionally, some foreign ATMs use Smart Card technology and may not accept non-Smart Cards.

Bank of America offers banking and brokerage products as a result of the acquisition of Merrill Lynch. Savings programs such as "Add it Up"[72] and "Keep the Change" have been well received and are a reflection of the product development banks have taken during the 2008 recession.

Bank of America, N.A is a nationally chartered bank, regulated by the Office of the Comptroller of the Currency, Department of the Treasury.

Corporate

Before Bank of America's acquisition of Merrill Lynch, the Global Corporate and Investment Banking (GCIB) business operated as Banc of America Securities LLC. The bank's investment banking activities operate under the Merrill Lynch subsidiary and provided mergers and acquisitions advisory, underwriting, capital markets, as well as sales & trading in fixed income and equities markets. Its strongest groups include Leveraged Finance, Syndicated Loans, and mortgage-backed securities. It also has one of the largest research teams on Wall Street. Bank of America Merrill Lynch is headquartered in New York City.

Investment management

Global Wealth and Investment Management manages assets of institutions and individuals. It is among the 10 largest U.S. wealth managers (ranked by private banking assets under management in accounts of $1 million or more as of June 30, 2005). In July 2006, Chairman Ken Lewis announced that GWIM's total assets under management exceeded $500 billion. GWIM has five primary lines of business: Premier Banking & Investments (including Bank of America Investment Services, Inc.), The Private Bank, Family Wealth Advisors, and Bank of America Specialist.

Bank of America has recently spent $675 million building its U.S. investment banking business and is looking to become one of the top five investment banks worldwide. "Bank of America already has excellent relationships with the corporate and financial institutions world. Its clients include 98% of the Fortune 500 companies in the U.S. and 79% of the Global Fortune 500. These relationships, as well as a balance sheet that most banks would kill for, are the foundations for a lofty ambition."[73]

Bank of America has a new headquarters for its New York City operations. The skyscaper is located on 42nd Street and Avenue of the Americas, at Bryant Park, and features state-of-the-art, environmentally friendly technology throughout its 2.1 million square feet (195,096 m²) of office space. The building is the headquarters for the company's investment banking division, and also hosts most of Bank of America's New York-based staff.

International operations

In 2005, Bank of America acquired a 9% stake in China Construction Bank, China's second largest bank, for $3 billion.[74] It represented the company's largest foray into China's growing banking sector. Bank of America currently has offices in Hong Kong, Shanghai, and Guangzhou and is looking to greatly expand its Chinese business as a result of this deal. In 2008, Bank of America was awarded Project Finance Deal of the Year at the 2008 ALB Hong Kong Law Awards.[75]

For the fiscal year ending March 31, 2006, Bank of America reported an 80% increase in net profit.[76]

Bank of America operated under the name BankBoston in many other Latin American countries, including Brazil. In 2006, Bank of America sold BankBoston's operations to Brazilian bank Banco Itaú, in exchange for Itaú shares. The BankBoston name and trademarks were not part of the transaction and, as part of the sale agreement, cannot be used by Bank of America. ( exhausting the BankBoston brand.)

Bank of America's Global Corporate and Investment Banking spans the Globe with divisions in United States, Europe, and Asia. The U.S. headquarters are located in New York, European headquarters are based in London, and Asian headquarters are based in Hong Kong.[77]

Board of directors

- Susan Bies, former Governor of the Federal Reserve Board[78]

- William Boardman, former Chairman of Visa International Inc.[78]

- Frank P. Bramble Sr, former Executive Officer, MBNA Corporation

- Virgis W. Colbert, (69), senior advisor, MillerCoors Company[79]

- Charles K. Gifford, former Chairman, Bank of America Corporation

- Charles O. Holliday, Chairman, Bank of America Corporation, former Chairman and CEO of DuPont[80]

- D. Paul Jones, lawyer and former CEO of Compass Bancshares, a Birmingham, Alabama bank now part of Banco Bilbao Vizcaya Argentaria SA[78][81]

- Brian T. Moynihan, President and Chief Executive Officer, Bank of America Corporation

- Monica C. Lozano, Publisher and Chief Executive Officer of La Opinión

- Walter E. Massey, former Chairman, Bank of America Corporation, President Emeritus, Morehouse College

- Thomas J. May, Chairman, President and Chief Executive Officer, NSTAR

- Donald E. Powell, former Chairman of the Federal Deposit Insurance Corp.[78]

- Charles O. Rossotti, (68) senior advisor, The Carlyle Group[79]

- Thomas M. Ryan, President and Chief Executive Officer, CVS Caremark Corporation

- Robert W. Scully, former member, Office of the Chairman of Morgan Stanley

Historical data

Individual Shares held Brian T. Moynihan (President and CEO) 481,806 Thomas K. Montag (President, Global Banking and Markets) 351,952 Bruce R. Thompson (CFO) 267,804 Terrence (Terry) P. Laughlin (Legacy Asset Servicing Executive) 106,309 Robert Scully (Independent Director) 90,716 Institutions Shares held % held State Street Corp 460,496,575 4.54 Vanguard Group 375,365,877 3.70 BlackRock Institutional Trust Company,N.A. 256,552,573 2.53 JP Morgan Chase & Co 204,909,812 2.02 Wellington Management Co 161,691,214 1.60 Capital Research Global Investors 131,327,985 1.30 Bank of New York Mellon Corp 116,396,174 1.15 Capital World Investors 112,200,000 1.11 Northern Trust Corp. 111,873,089 1.10 Franklin Resources Inc. 111,852,815 1.10 - Capital Research Global Investors and Capital World Investors are both owned by parent company Capital Group Companies

Data from Yahoo! Finance as of October 4, 2011

Other individuals

Jonathan Finger, whose Houston-based family owns more than 1 million shares of stock and has pressed for boardroom changes.[78][83]

Warren Buffett, in August 2011, agreed to invest $5 billion for 50,000 preferred shares that will pay a 6 percent annual dividend. The bank has the option to buy back the shares for a 5 percent premium.[84]

Social responsibility

In addition to its new eco-friendly office tower in Manhattan, Bank of America has pledged to spend billions on commercial lending and investment banking for projects that it considers "green". The corporation supplied all of its employees with cash incentives to buy hybrid vehicles, and began providing mortgage loan breaks for customers whose homes qualified as energy efficient.[85] In 2007, Bank of America partnered with Brighter Planet to offer an eco-friendly credit card, and later a debit card, which help build renewable energy projects with each purchase.[86] The corporation recently completed the new 1 Bank of America Center in Uptown Charlotte. The tower, and accompanying hotel, will be a LEED-certified building.

Bank of America has also donated money to help health centers in Massachusetts[87] and made donations to help homeless shelters in Miami.[88]

In 2004, the bank pledged $750 billion over a ten-year period for community development lending and investment. The company had delivered more than $230 billion against a ten-year commitment of $350 billion made in 1998 to provide affordable mortgage, build affordable housing, support small business and create jobs in disadvantaged neighborhoods.

Controversy

Parmalat controversy

Parmalat SpA is a multinational Italian dairy and food corporation. Following Parmalat's 2003 bankruptcy, the company sued Bank of America for $10 billion, alleging the bank profited from its knowledge of Parmalat's financial difficulties. The parties announced a settlement in July 2009, resulting in Bank of America paying Parmalat $98.5 million in October 2009.[89][90] In a related case, on April 18, 2011, an Italian court acquitted Bank of America and three other large banks, along with their employees, of charges they assisted Parmalat in concealing its fraud, and of lacking sufficient internal controls to prevent such frauds. Prosecutors did not immediately say whether they would appeal the rulings. In Parma, the banks were still charged with covering up the fraud.[91]

Consumer credit controversies

In January 2008, Bank of America began notifying some customers without payment problems that their interest rates were more than doubled, up to 28%. The bank was criticized for raising rates on customers in good standing, and for declining to explain why it had done so.[92][93] In September 2009, a Bank of America credit card customer, Ann Minch, posted a video on YouTube criticizing the bank for raising her interest rate. After the video went viral, she was contacted by a Bank of America representative who lowered her rate. The story attracted national attention from television and internet commentators.[94][95][96] More recently, the bank has been criticized for allegedly seizing three properties that were not under their ownership, apparently due to incorrect addresses on their legal documents.[97]

WikiLeaks

In October 2009, WikiLeaks representative Julian Assange reported that his organization possessed a 5 gigabyte hard drive formerly used by a Bank of America executive and that Wikileaks intended to publish its contents.[98]

In November 2010, Forbes published an interview with Assange in which he stated his intent to publish information which would turn a major U.S. bank "inside out".[99] In response to this announcement, Bank of America stock dropped 3.2%.[100]

In December 2010, Bank of America announced that it would no longer service requests to transfer funds to WikiLeaks,[101] stating that "Bank of America joins in the actions previously announced by MasterCard, PayPal, Visa Europe and others and will not process transactions of any type that we have reason to believe are intended for WikiLeaks… This decision is based upon our reasonable belief that WikiLeaks may be engaged in activities that are, among other things, inconsistent with our internal policies for processing payments."[102]

In late December it was announced that Bank of America had bought up more than 300 Internet domain names in a would-be attempt to preempt bad publicity that might be forthcoming in the anticipated WikiLeaks release. The domain names were such as BrianMoynihanBlows.com and BrianMoynihanSucks.com as well as similar names for other top executives of the bank.[103][104][105][106] Nick Baumann of Mother Jones ridiculed this effort, stating: "If I owned stock in Bank of America, this would not give me confidence that the bank is prepared for whatever Julian Assange is planning to throw at it."[107]

Anonymous

On March 14, 2011, one or more members of the decentralized collective Anonymous began releasing emails it said were obtained from Bank of America. According to the group, the emails document "corruption and fraud", and relate to the issue of improper foreclosures. They say that the source is a former employee from Balboa Insurance, a firm which used to be owned by the bank.[108] [109] [110][111][112]

Bank of America corporate buildings

- Bank of America Tower in Phoenix, Arizona

- Bank of America Center in Los Angeles

- 555 California Street, formerly the Bank of America Center and world headquarters, in San Francisco

- Bank of America Plaza in Fort Lauderdale, Florida

- Bank of America Tower in Jacksonville, Florida

- Bank of America Tower in Miami, Florida

- Bank of America Center in Orlando, Florida

- Bank of America Tower in St. Petersburg, Florida

- Bank of America Plaza in Tampa, Florida

- Bank of America Plaza in Atlanta, Georgia (the tallest U.S. building outside of NYC and Chicago)

- Bank of America Building, formerly the LaSalle Bank Building in Chicago, Illinois

- One City Center, often called the Bank of America building due to signage rights, in Portland, Maine

- Bank of America Building in Baltimore, Maryland

- Bank of America Plaza in St Louis, Missouri

- Bank of America Tower in Albuquerque, New Mexico

- Bank of America Tower in New York City

- Bank of America Corporate Center in Charlotte, North Carolina (The corporate headquarters)

- Bank of America Plaza in Charlotte, North Carolina

- Bank of America Building in Providence, Rhode Island

- Bank of America Plaza in Dallas, Texas

- Bank of America Center in Houston, Texas

- Bank of America Tower in Midland, Texas

- Bank of America Fifth Avenue Plaza in Seattle, Washington

- Columbia Center in Seattle, Washington

- Bank of America Tower in Hong Kong

See also

- Bank of America Canada

- Bank of America (Asia)

- BAML Capital Partners

- Calibuso, et al. v. Bank of America Corp., et al.

- List of bank mergers in United States

References

- ^ "Bank of America Corporation". Encyclopædia Britannica. Retrieved October 21, 2011.

- ^ a b c d e "2010 Form 10-K, Bank of America". Hoover's. http://www.hoovers.com/company/Bank_of_America_Corporation/hxccci-1-1njea5.html.

- ^ Key people: Son, Hugh (August 20, 2011). "BofA expects 3,500 job cuts". The News Journal (New Castle, DE: Gannett). http://www.delawareonline.com/article/20110820/BUSINESS/108200309/-1/NLETTER01/BofA-expects-3-500-job-cuts. Retrieved August 20, 2011.

- ^ Rappaport, Liz; Fitzpatrick, Dan (October 19, 2011). "Pain Spreads to Biggest Banks". The Wall Street Journal. http://online.wsj.com/article/SB10001424052970204479504576638653920110530.html?mod=WSJ_hp_MIDDLETopStories.

- ^ "Bank of America: About". Bank of America. http://www.bankofamerica.com/index.cfm?page=about.

- ^ "List of companies in the S&P 500". Yahoo! Finance. http://finance.yahoo.com/q/cp?s=%5EGSPC.

- ^ "Dow Jow Indexes". http://www.djindexes.com/mdsidx/index.cfm?event=components&symbol=DJI. Retrieved October 17, 2010.

- ^ "Fortune 500". CNN Money. http://money.cnn.com/magazines/fortune/fortune500/2010/full_list/.

- ^ "The Global 2000". Forbes. March 1, 2010. http://www.forbes.com/lists/2010/18/global-2000-10_The-Global-2000_Rank.html. Retrieved October 17, 2010.

- ^ a b Cohan, William D. (September 2009), "An offer he couldn't refuse", The Atlantic

- ^ Fitzpatrick, Dan (July 28, 2009). "BofA Plans to Cut 10% of Branches". The Wall Street Journal. http://online.wsj.com/article/SB124874668619485699.html.

- ^ "Citigroup posts 4th straight loss; Merrill loss widens". USA Today. Associated Press. October 16, 2008. http://www.usatoday.com/money/companies/earnings/2008-10-16-citigroup_N.htm. Retrieved December 17, 2009.

- ^ Dash, Eric (August 23, 2007). "4 Major Banks Tap Fed for Financing". The New York Times. http://www.nytimes.com/2007/08/23/business/23discount.html. Retrieved December 17, 2009.

- ^ Moynihan, Brian T. (2011). Bank of America 2010 Annual Report. Charlotte, NC: Bank of America. p. 28. http://thomson.mobular.net/thomson/7/3171/4426/.

- ^ "Who Made America? – Innovators – A.P. Giannini". PBS.org. http://www.pbs.org/wgbh/theymadeamerica/whomade/giannini_hi.html. Retrieved December 17, 2009.

- ^ In 1918 the Bank of Italy opened a Delegation in New York in order to follow American political, economic and financial affairs more closely; together with the London Delegation, this was the first permanent overseas office opened by the Bank, at a time when the foundations were being laid for the restructuring of the international money market.

- ^ Transamerica Corporation, a corporation of Delaware, has petitioned this court to review an order of the Board of Governors of the Federal Reserve System entered against it under Section 11 of the Clayton Act, 15 U.S.C.A. § 21, to enforce compliance with Section 7 of the Act, 15 U.S.C.A. § 18.

- ^ "The History of Visa". Visa Inc.. http://www.visalatam.com/e_aboutvisa/acerca_historia.jsp. Retrieved October 29, 2007.

- ^ Matassa Flores, Michele (April 2, 1992). "Key Bank, West One Finalize Purchases". Seattle Times. http://community.seattletimes.nwsource.com/archive/?date=19920402&slug=1484315. Retrieved September 27, 2008.

- ^ BA Securities, Inc. Changes to BancAmerica Securities, Inc.. Business Wire, January 16, 1997

- ^ BankAmerica Adds 4 Traders To Its High-Yield Bond Sector. American Banker, June 17, 1996

- ^ BankAmerica to Buy Robertson, Stephens Investment Company. New York Times, June 9, 1997

- ^ Montgomery name disappears, as Banc of America Securities debuts. Investment Dealers' Digest, May 17, 1999

- ^ a b "US banking mega-merger unveiled". BBC News. October 27, 2003. http://news.bbc.co.uk/2/low/business/3217803.stm.

- ^ "Bank of America To Buy U.S. Trust". Forbes. November 20, 2006. http://www.forbes.com/markets/2006/11/20/bank-of-america-markets-equity-cx_jl_1120markets12.html. Retrieved August 22, 2007.[dead link]

- ^ Tom, Henderson (April 14, 2008). "BOA to 'paint the town red' with LaSalle name change". Crain's Detroit Business (Crain Communications Inc.). http://www.crainsdetroit.com/apps/pbcs.dll/article?AID=/20080414/SUB/804140331. Retrieved May 5, 2008.

- ^ Fitzpatrick, Dan; Lublin, Joann S. (October 2, 2009). "Bank of America Chief Resigns Under Fire". The Wall Street Journal. http://online.wsj.com/article/SB125434715693053835.html. Retrieved March 29, 2010.

- ^ La Monica, Paul R. (February 24, 2010). "BofA: No longer hated on Wall Street". The Buzz (CNNMoney.com). http://money.cnn.com/2010/02/24/markets/thebuzz/index.htm. Retrieved March 29, 2010.

- ^ Salas, Caroline; Church, Steven (August 23, 2007). "Countrywide Gives Bank of America $447 million Gain". Bloomberg L.P.. http://www.bloomberg.com/apps/news?pid=20601087&sid=aqHmmBljF9Ok&refer=home. Retrieved October 29, 2007.

- ^ "Bank of America to buy Countrywide for $4 billion". Reuters (via Yahoo! News). January 11, 2008. http://news.yahoo.com/s/nm/20080111/bs_nm/countrywide_bankofamerica_dc_14. Retrieved January 11, 2008.[dead link]

- ^ "Countrywide FBI Investigation". CNNMoney.com. March 10, 2008. http://money.cnn.com/2008/03/08/news/companies/countrywide_FBI/index.htm. Retrieved March 10, 2008.

- ^ Arena, Kelli (September 24, 2008), "FBI probing bailout firms", CNNMoney.com. Retrieved March 8, 2010.

- ^ Bauerlein, Valerie; Hagerty, James S. (January 12, 2008). "Behind Bank of America's Big Gamble". The Wall Street Journal: pp. A1, A5. http://online.wsj.com/article/SB120005404048583617.html. Retrieved January 15, 2008.

- ^ "Countrywide Financial Corporation Thirteen Month Statistical Data for the period ended December 31, 2007". Archived from the original on January 13, 2008. http://web.archive.org/web/20080113103647/http://about.countrywide.com/PressRelease/PressRelease.aspx?rid=1093858. Retrieved January 15, 2008.

- ^ "BofA completes deal for Countrywide Financial". Associated Press. July 1, 2008. http://www.orlandosentinel.com/business/sns-ap-bank-of-america-countrywide,0,1423871.story. Retrieved July 2, 2008.

- ^ "Bank of America May Not Guarantee Countrywide's Debt". Bloomberg News. May 2, 2008. http://www.bloomberg.com/apps/news?pid=20601103&sid=aEtv5YOYSFwY&refer=us. Retrieved August 3, 2008.

- ^ Zach Lowe (September 15, 2008). "Wachtell, Shearman, Cravath on Bank of America-Merrill Deal". Law.com. http://www.law.com/jsp/article.jsp?id=1202424529176. Retrieved October 17, 2010.

- ^ Popper, Margaret (September 14, 2008). "Bank of America Said to Walk Away From Lehman Talks (Update1)". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601087&sid=aiu6I5m66pcw&refer=home. Retrieved October 17, 2010.

- ^ Sorkin, Andrew Ross (September 15, 2008). "Lehman Files for Bankruptcy; Merrill Is Sold". The New York Times. http://www.nytimes.com/2008/09/15/business/15lehman.html. Retrieved March 31, 2010.

- ^ "Lehman Brothers files for Bankruptcy". BBC News. September 16, 2008. http://news.bbc.co.uk/1/hi/business/7615931.stm. Retrieved October 17, 2010.

- ^ "AFP: Temasek could profit on Merrill takeover: economists". Google. September 15, 2008. http://afp.google.com/article/ALeqM5i2utZN9Et0f-U1kZR8zBMw51evaA. Retrieved October 17, 2010.

- ^ Lim, Kevin & Azhar, Saeed (May 22, 2009), "Singapore's Temasek defends costly Bank of America exit", Reuters, retrieved August 3, 2009

- ^ "Bank of America Completes Merrill Lynch Purchase". prnewswire.com for Bank of America. January 1, 2009. http://news.prnewswire.com/DisplayReleaseContent.aspx?ACCT=104&STORY=/www/story/01-01-2009/0004948222&EDATE=.

- ^ Keoun, Bradley; Trowbridge, Poppy (December 18, 2008), "Bank of America Moves Chai; Berkery Said to Depart", Bloomberg L.P., http://www.bloomberg.com/apps/news?pid=20601080&sid=a8FKrqSTGhNU&refer=asia, retrieved November 17, 2009

- ^ Farrell, Greg; Guerrera, Francesco (February 3, 2009), "BofA Asia head and Thain ally leaves", Financial Times, http://www.ft.com/cms/s/0/d4def908-f241-11dd-9678-0000779fd2ac.html?nclick_check=1, retrieved November 17, 2009

- ^ Dash, Eric; Story, Louise (January 16, 2009). "Bank of America to Receive Additional $20 billion". The New York Times. http://www.nytimes.com/2009/01/16/business/16merrill.html. Retrieved April 26, 2010.

- ^ LOUISE STORY and JO BECKER (June 11, 2009). "Bank Chief Tells of U.S. Pressure to Buy Merrill Lynch". New York Times. http://www.bloomberg.com/apps/news?pid=20601110&sid=a5A4F5W_PygQ. Retrieved June 13, 2009.

- ^ BARBARA BARRETT (June 10, 2009). "BofA documents, e-mails show pressure to buy Merrill Lynch". Miami Herald. http://www.miamiherald.com/business/nation/story/1091482.html. Retrieved June 13, 2009.[dead link]

- ^ "Bank of America Buys Merrill Lynch Creating Unique Financial Services Firm" (Press release). Bank of America. September 15, 2008. http://www.bankofamerica.com/merrill/index.cfm?template=press_release.[dead link]

- ^ "Debt overshadows US bank's profit". BBC News. April 20, 2009. http://news.bbc.co.uk/2/hi/business/8008158.stm. Retrieved March 31, 2010.

- ^ Mildenberg, David (October 5, 2009). "Merrill Bringing Down Lewis Gives Bank 30% Profits as 'a Steal'". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601109&sid=au3YrxK8NS2s. Retrieved December 12, 2009.

- ^ Kouwe, Zachery (August 3, 2009), "BofA Settles S.E.C. Suit Over Merrill Deal" DealBook blog, The New York Times, Retrieved August 3, 2009.

- ^ "Judge blocks Bank of America-SEC bonus settlement" by Jonathan Stempel, Reuters, 8/6/09. Retrieved 8/7/09.

- ^ Story, Louise (August 10, 2009), "Judge Attacks Merrill Pre-Merger Bonuses", The New York Times, (p. B1, August 11, 2009 NY ed.), retrieved August 11, 2009

- ^ a b "Judge Rejects Settlement Over Merrill Bonuses" by Louise Story, The New York Times, September 14, 2009. Retrieved September 14, 2009.

- ^ Glovin, David (February 22, 2010), "Bank of America $150 million SEC Accord Is Approved", Bloomberg.com, retrieved March 2, 2010

- ^ "Executive Compensation: How Much is Too Much?" Hearing, with statements, October 28, 2009. Retrieved October 30, 2011.

- ^ "Kucinich on new NY AG fraud charges against Bank of America and SEC settling charges against BofA for misleading shareholders" Press release, February 4, 2010. Retrieved March 2, 2010.

- ^ , "BoA fined $137 million for fraud", Washington Post, December 8, 2010

- ^ Selway, William, & Braun, Martin Z. (January 2011), "The Men who Rigged the Muni Market", Bloomberg Markets, pp. 79–84

- ^ "Bank of America ending 30K more jobs". Philadelphia Business Journal (American City Business Journals). September 13, 2011. Archived from the original on September 15, 2011. http://www.bizjournals.com/philadelphia/morning_roundup/2011/09/bank-of-america-ending-30k-more-jobs.html. Retrieved September 15, 2011.

- ^ "US gives Bank of America 20 billion dollars in capital injection". Breitbart.com. January 15, 2009. http://www.breitbart.com/article.php?id=CNG.38849e166a876fe3b800838530d14243.e31&show_article=1. Retrieved October 17, 2010.

- ^ Giannone, Joseph A. (February 5, 2009). "U.S. pushed Bank of America to complete Merrill buy: report". Reuters. http://uk.reuters.com/article/americasDealsNews/idUKTRE5140OA20090205.

- ^ Ellis, David (February 11, 2009). "Bank CEOs flogged in Washington". CNNMoney.com. http://money.cnn.com/2009/02/11/news/companies/congress_banks/index.htm?postversion=2009021117. Retrieved March 31, 2010.

- ^ Walsh, Mary Williams (March 15, 2009), "A.I.G. Lists Firms It Paid With Taxpayer Money", The New York Times. Retrieved March 31, 2009.

- ^ "US Regulators to B of A: Obey or Else", The Wall Street Journal, July 16, 2009

- ^ Bank of America to Repay Entire $45 billion in TARP to U.S. Taxpayers, PR Newswire, December 2, 2009

- ^ "Bank of America Completes US TARP Repayment". October 12, 2009. http://www.google.com/hostednews/afp/article/ALeqM5hVDH-K0l9zbGcavAHfSrw1-Pn6og. Retrieved December 12, 2009.

- ^ Connelly, Eileen AJ (October 13, 2011). "Fitch may downgrade BofA, Morgan Stanley, Goldman". Seattle Post-Intelligencer. Associated Press. http://www.seattlepi.com/business/article/Fitch-may-downgrade-BofA-Morgan-Stanley-Goldman-2217414.php. Retrieved October 13, 2011.

- ^ "Awards for Excellence 2007 Best Bank: Bank of America". Euromoney. July 13, 2007. http://www.euromoney.com/article.asp?ArticleID=1391932.

- ^ "Five big banks form Global ATM Alliance", ATMmarketplace.com. January 9, 2002. Retrieved June 22, 2007.

- ^ Henry. "Bank of America – Add it Up". Interest Savings Accounts. http://www.interestsavingsaccounts.net/2009/04/bank-of-americas-add-it-up-savings.html. Retrieved October 27, 2009.

- ^ "Bank of America's next step forward". Euromoney. July 13, 2007. http://www.euromoney.com/article.asp?ArticleID=1391226.

- ^ "Bank of America invests in China". BBC. June 17, 2005. http://news.bbc.co.uk/2/hi/business/4102670.stm. Retrieved August 22, 2007.

- ^ "ALB Asia – legal deals, law deals, law firm deals, lawyer deals". Legalbusinessonline.com.au. http://www.legalbusinessonline.com.au. Retrieved October 17, 2010.

- ^ "Bank of America's India operations have reported an 80 per cent jump in net profit". indiadaily.com. June 15, 2006. http://www.indiadaily.com/editorial/9739.asp.

- ^ "Asia Pacific | Global Regions | Bank of America Merrill Lynch". Corp.bankofamerica.com. http://corp.bankofamerica.com/public/public.portal?_pd_page_label=products/regions/asia/contact. Retrieved October 17, 2010.

- ^ a b c d e Mildenberg, David (August 1, 2009), "Bank of America Says Three Directors Quit as Exodus Totals 10", Bloomberg.com, retrieved August 1, 2009

- ^ a b Company Web page Retrieved 8/2/09.

- ^ Kamalakaran, Ajay (September 21, 2009). "UPDATE 1-BofA board adds DuPont's Holliday". www.reuters.com. http://www.reuters.com/article/marketsNews/idCNN2132126020090921?rpc=44. Retrieved September 22, 2009.

- ^ Jarvis, Crystal (April 18, 2008), "Former Compass CEO Jones returns to Balch and Bingham", retrieved August 2, 2009

- ^ "Money Economics Top 10 Banks Project". Moneyeconomics.com. http://www.moneyeconomics.com/index.php?option=com_content&view=article&id=150:-top-10-by-total-asset-bank-of-america&catid=42:saving-rates&Itemid=106. Retrieved 2011-11-03.

- ^ Barr, Greg (April 28, 2009). "Houston investors set for BofA showdown Houston Business Journal". Houston.bizjournals.com. http://houston.bizjournals.com/houston/stories/2009/04/27/daily12.html. Retrieved October 17, 2010.

- ^ Protess, Ben; Craig, Susanne (August 25, 2011). "Buffett Invests $5 Billion in Bank of America". The New York Times. http://dealbook.nytimes.com/2011/08/25/buffett-to-invest-5-billion-in-bank-of-america/?partner=rss&emc=rss.

- ^ "Bank vows $20 billion for green projects". msnbc. February 6, 2008. http://www.msnbc.msn.com/id/17500301/.

- ^ Cui, Carolyn (November 30, 2007). "Credit Cards' Latest Pitch: Green Benefits". Wall Street Journal. http://online.wsj.com/article/SB120225763311445823.html. Retrieved 8-7-09.

- ^ Kowalczyk, Liz (March 10, 2007). "Bank to aid health centers". The Boston Globe. http://www.boston.com/business/globe/articles/2007/03/10/bank_to_aid_health_centers/. Retrieved August 22, 2007.

- ^ Freer, Jim (March 9, 2007). "BofA donates $1M to Camillus House". South Florida Business Journal. Archived from the original on October 12, 2007. http://web.archive.org/web/20071012193017/http://phoenix.bizjournals.com/southflorida/stories/2007/03/05/daily40.html. Retrieved August 22, 2007.

- ^ "BofA settles with Parmalat for $100M". Charlotte Business Journal. July 28, 2009. http://charlotte.bizjournals.com/charlotte/stories/2009/07/27/daily21.html. Retrieved June 19, 2011.

- ^ "Italy/US: Parmalat receives Bank of America settlement". Aroq Ltd.. October 5, 2009. http://www.just-food.com/news/parmalat-receives-bank-of-america-settlement_id108270.aspx?lk=fs. Retrieved June 19, 2011.

- ^ Sylvers, Eric (April 18, 2011). "Judge Clears Banks in Parmalat Case". The New York Times. http://dealbook.nytimes.com/2011/04/18/judge-clears-banks-in-parmalat-case/. Retrieved June 19, 2011.

- ^ Berner, Robert (February 7, 2008), A Credit Card You Want to Toss", Bloomberg BusinessWeek. Retrieved March 1, 2010.

- ^ Palmer, Kimberly (February 28, 2008), Mortgage Woes Boost Credit Card Debt, U.S. News & World Report. Retrieved March 1, 2010.

- ^ Delaney, Arthur (September 21, 2009, updated November 21, 2009), "Ann Minch Triumphs In Credit Card Fight", The Huffington Post. Retrieved March 1, 2010.

- ^ Ferran, Lee (September 29, 2009), "Woman Boycotts Bank of America, Wins", Good Morning America, ABC News. Retrieved March 1, 2010.

- ^ Pepitone, Julianne (September 29, 2009), "YouTube credit card rant gets results". Retrieved March 1, 2010.

- ^ Gomstyn, Alice (January 25, 2010). "No Mortgage, Still Foreclosed? Bank of America Sued for Seizing Wrong Homes". ABC News. http://abcnews.go.com/Business/bank-america-sued-foreclosing-wrong-homes/story?id=9637897. Retrieved March 4, 2010.

- ^ Nystedt, Dan (October 9, 2009). "Wikileaks plans to make the Web a leakier place". Computerworld. IDG. http://www.computerworld.com/s/article/9139180/Wikileaks_plans_to_make_the_Web_a_leakier_place. Retrieved December 19, 2010.

- ^ Andy Greenberg (November 29, 2010). "WikiLeaks’ Julian Assange Wants To Spill Your Corporate Secrets". Forbes. http://blogs.forbes.com/andygreenberg/2010/11/29/wikileaks-julian-assange-wants-to-spill-your-corporate-secrets. Retrieved December 19, 2010.

- ^ "Bank Of America Shares Fall On WikiLeaks Fears". Associated Press. NPR. November 30, 2010. http://www.npr.org/templates/story/story.php?storyId=131706053. Retrieved December 19, 2010.

- ^ Lundin, Leigh (February 20, 2011). "WikiLicks". Crime. Orlando: Criminal Brief. http://criminalbrief.com/?p=15747.

- ^ Schwartz, Nelson D. (December 18, 2010). "Bank of America Suspends Payments Made to WikiLeaks". The New York Times. http://www.nytimes.com/2010/12/19/business/global/19bank.html. Retrieved December 19, 2010.

- ^ "Bank of America Wants You to Know Its Executives Don’t Suck". Domain Name Wire. December 20, 2010. http://domainnamewire.com/2010/12/20/bank-of-america-wants-you-to-know-its-executives-dont-suck/. Retrieved February 22, 2011.

- ^ Tiku, Nitasha (December 22, 2010). "Bank of America Prepares to Get WikiLeaked by Buying Up Negative Domain Names". New York. http://nymag.com/daily/intel/2010/12/wikileaks_newest_ally_gorbache.html. Retrieved January 2, 2011.

- ^ Kapne, Suzanne (December 23, 2010). "Hundreds of anti-BofA websites registered". Financial Times. http://www.ft.com/cms/s/0/3993f69e-0e2b-11e0-86e9-00144feabdc0.html#axzz19tXSHwD4. Retrieved January 2, 2011.

- ^ Rothacker, Rick (December 23, 2010). "Bank of America buys up critical domain names". Charlotte Observer. http://www.charlotteobserver.com/2010/12/23/1929263/its-getting-harder-to-call-bofa.html. Retrieved January 2, 2011.

- ^ Baumann, Nick (2011-01-04) Bank of America's WikiLeaks Defense Fail, Mother Jones

- ^ "Hacker group plans BofA e-mail release Monday". Reuters. March 14, 2011. http://ca.reuters.com/article/technologyNews/idCATRE72C3QA20110314.

- ^ Rothacker, Rick (2011-03-14). "BofA might face another leak threat | CharlotteObserver.com & The Charlotte Observer Newspaper". Charlotteobserver.com. http://www.charlotteobserver.com/2011/03/14/2139763/bofa-might-face-another-leak-threat.html. Retrieved 2011-11-03.

- ^ "Hacker group Anonymous says it will release Bank of America emails". Herald Sun. 2011-03-14. http://www.heraldsun.com.au/news/breaking-news/hacker-group-anonymous-says-it-will-release-bank-of-america-emails/story-e6frf7jx-1226020941770. Retrieved 2011-11-03.

- ^ Katya Wachtel (2011-03-14). "Anonymous Hackers Release Trove Of Emails That Allegedly Show Bank Of America Committed Mortgage Fraud". Businessinsider.com. http://www.businessinsider.com/anonymous-hackers-bank-of-america-wikileaks-emails-documents-2011-3. Retrieved 2011-11-03.

- ^ "Corruption, fraud: Hackers plan to out Bank of America". The Sydney Morning Herald. March 14, 2011. http://www.smh.com.au/business/world-business/corruption-fraud-hackers-plan-to-out-bank-of-america-20110314-1btpk.html.

Further reading

- Bonadio, Felice A. (1994). A.P. Giannini: Banker of America. Berkeley, California: University of California Press. ISBN 0520082494.

- Hector, Gary (1988). Breaking the Bank: The Decline of BankAmerica. Boston: Little, Brown. ISBN 0316353922.

- James, Marquie; James, Bessie (1954). Biography of a Bank: The Story of Bank of America N.T.&S.A.. New York: Harper and Brothers.

- Johnston, Moira (1990). Roller Coaster: The Bank of America and the Future of American Banking. New York: Ticknor & Fields.

- Josephson, Matthew (1972). The Money Lords; the great finance capitalists, 1925–1950. New York: Weybright and Talley.

- Lampert, Hope (1986). Behind Closed Doors: Wheeling and Dealing in the Banking World. New York: Atheneum.

- Light, Larry (October 1, 2007). "Cover Story – Money for the Masses". Forbes Magazine.

- Monnette, Orra Eugene. Personal Papers Collection. Los Angeles, California: Los Angeles Public Library.

- Nash, Gerald G. (1992). A.P. Giannini and the Bank of America. Norman, Oklahoma: University of Oklahoma Press.

- Yockey, Ross (1999). McColl: The Man with America's Money. Atlanta: Longstreet Press.

- Ahmed, Azam; Demirjian, Karoun (February 15, 2007). "Credit offered to illegal residents". Chicago Tribune.

External links

Articles and topics related to Bank of America Late-2000s financial crisis - Late-2000s recession

- 2008 G-20 Washington summit

- APEC Peru 2008

- 2009 G-20 London Summit

- 2009 G-20 Pittsburgh summit

- APEC Singapore 2009

- 2010 G-20 Toronto summit

- 2010 G-20 Seoul summit

Specific issues - 2000s energy crisis (2008 Central Asia energy crisis)

- 2007–2008 world food price crisis

- 2008–2009 Keynesian resurgence

- 2008–10 California budget crisis

- 2008–2011 Irish banking crisis

- Automotive industry crisis of 2008–2010

- Effects of the financial crisis of 2007–2010 on museums

- European sovereign debt crisis (timeline)

- Future of newspapers

- January 2008 Société Générale trading loss incident

- List of entities involved in 2007–2008 financial crises (acquired or bankrupt banks; business failures)

- Subprime mortgage crisis (timeline; writedowns)

- United States housing market correction

By country (or region) - Belgium

- Greece

- Iceland

- Ireland

- Latvia

- Russia

- Spain

- Ukraine

- Africa

- Americas

- United States

- Asia

- Europe

- Oceania

Legislation and policy responses Banking and finance

stability and reform- Banking (Special Provisions) Act 2008

- Commercial Paper Funding Facility

- Emergency Economic Stabilization Act of 2008

- Troubled Asset Relief Program

- Term Asset-Backed Securities Loan Facility

- Temporary Liquidity Guarantee Program

- 2008 United Kingdom bank rescue package

- China–Japan–South Korea trilateral summit

- Anglo Irish Bank Corporation Act 2009

- 2009 G-20 London Summit

- Irish emergency budget, 2009

- National Asset Management Agency

- Irish budget, 2010

- Dodd–Frank Wall Street Reform and Consumer Protection Act

Bank stress tests- EU

- US

Stimulus and recovery - National fiscal policy response to the late 2000s recession

- Housing and Economic Recovery Act of 2008

- Economic Stimulus Act of 2008

- Chinese economic stimulus program

- 2008 European Union stimulus plan

- American Recovery and Reinvestment Act of 2009

- Fraud Enforcement and Recovery Act of 2009

- Green New Deal

Companies and banking institutions Companies in bankruptcy,

reorganization, administration,

or other insolvency proceedings

(listed alphabetically)- Air America Radio

- Allco Finance Group

- American Freedom Mortgage

- American Home Mortgage

- Arena Football League

- Babcock & Brown

- BearingPoint

- Bernard L. Madoff Investment Securities LLC

- BI-LO (United States)

- Borders Group

- Charter Communications

- Chrysler (Chapter 11 reorganization)

- Circuit City Stores

- CIT Group

- Citadel Broadcasting

- Conquest Vacations

- DSB Bank

- Eddie Bauer

- FairPoint Communications

- Friendly's Ice Cream

- General Growth Properties

- General Motors (Chapter 11 reorganization)

- Great Southern Group

- Icesave

- Kaupthing Singer & Friedlander

- Lehman Brothers (bankruptcy)

- Linens 'n Things

- Mervyns

- Midway Games

- Movie Gallery

- NetBank

- New Century

- Nortel

- Petters Group Worldwide

- R. H. Donnelley

- Rothstein Rosenfeldt Adler

- Saab Automobile

- Sbarro

- Sentinel Management Group

- Silicon Graphics

- Stanford Financial Group

- Sun-Times Media Group

- Terra Securities (scandal)

- Thornburg Mortgage

- Tribune Company

- Tweeter Opco, LLC

- Uno Chicago Grill

- Washington Mutual

- Waterford Wedgwood

- Woolworths Group

- Yamato Life

Government interventions,

rescues, and acquisitions

(listed alphabetically)- ACC Capital Holdings

- Allied Irish Banks

- American International Group

- Anglo Irish Bank (nationalisation)

- Bank of America

- Bank of Antigua

- Bank of Ireland

- Bear Stearns

- Bradford & Bingley

- Chrysler

- Citigroup

- CL Financial

- Dexia

- Fannie Mae (takeover)

- Fortis

- Freddie Mac (takeover)

- General Motors

- Glitnir

- HBOS

- Hypo Real Estate

- IndyMac Federal Bank

- ING Group

- Kaupthing Bank

- Landsbanki

- Northern Rock (nationalisation)

- Parex Bank

- Royal Bank of Scotland Group

- Straumur Investment Bank

- U.S. Central Credit Union

Company acquisitions

(listed alphabetically)- Alliance & Leicester

- Ameriquest Mortgage

- Barnsley Building Society

- Bear Stearns

- Blockbuster Inc.

- Cheshire Building Society

- Countrywide Financial

- Derbyshire Building Society

- Dunfermline Building Society

- HBOS

- Merrill Lynch

- National City Corp. (acquisition by PNC)

- Scarborough Building Society

- Sovereign Bank

- Wachovia

- Washington Mutual

Other topics Alleged frauds

and fraudsters- Nicholas Cosmo

- Fairfield Greenwich Group

- Seán FitzPatrick (Anglo Irish Bank hidden loans controversy)

- Paul Greenwood

- Angelo Mozilo

- Arthur Nadel

- Kazutsugi Nami (Enten controversy)

- Stanford Financial Group (Allen Stanford; James M. Davis; Laura Pendergest-Holt)

- Barry Tannenbaum

- UBS

- Stephen Walsh

Proven or admitted

frauds and fraudsters- Marc Stuart Dreier

- Joseph S. Forte

- Norman Hsu

- Du Jun

- Bernard Madoff (Madoff investment scandal; Frank DiPascali; David G. Friehling)

- Tom Petters

- Raj Rajaratnam (Galleon Group)

- Scott W. Rothstein

- Mahindra Satyam (Satyam scandal; Byrraju Ramalinga Raju)

Related entities - Federal Deposit Insurance Corporation

- Federal Home Loan Banks

- Federal Housing Administration

- Federal Housing Finance Agency

- Federal Housing Finance Board

- Federal Reserve System

- Government National Mortgage Association

- Office of Federal Housing Enterprise Oversight

- Office of Financial Stability

- UK Financial Investments Limited

- United States Consumer Financial Protection Bureau

Securities involved

and financial marketsRelated topics - 2008 Greek riots

- 2009 California college tuition hike protests

- 2009 Icelandic financial crisis protests

- 2009 May Day protests

- 2010 French pension reform strikes

- 2010 UK student protests

- 2010–2011 Greek protests

- 2011 United Kingdom anti-austerity protests

- 2011 United States public employee protests

- Arab Spring

- Bailout

- Bank run

- Capitalism: A Love Story

- Credit crunch

- Dot-com bubble

- Economic bubble

- Financial contagion

- Financial crisis

- Great Depression

- Impact of the Arab Spring

- Inside Job

- Interbank lending market

- Jon Stewart's 2009 criticism of CNBC

- Liquidity crisis

- PIIGS

- Tea Party protests

- Occupy movement

- United States housing bubble

- Wall Street: Money Never Sleeps

50 largest banks / bank holding companies in the United States as of September 30, 2011 - Ally

- American Express

- Associated

- BancWest*

- Bank of America

- Bank of New York Mellon

- BB&T

- BBVA Compass*

- BOK Financial

- Capital One

- CIT

- Citigroup

- Citizens Financial Group*

- City National (California)

- Comerica

- Commerce

- Discover

- East West Bank

- Fifth Third

- First Citizens

- First Horizon

- First Niagara

- Goldman Sachs

- BMO Harris*

- Hancock

- HSBC Bank USA*

- Huntington

- JPMorgan Chase

- Key

- M&T

- MetLife

- Morgan Stanley

- New York Community

- Northern Trust

- PNC

- Popular

- RBC*

- Regions

- Silicon Valley

- State Street

- SunTrust

- Synovus

- Taunus*

- TCF

- TD*

- U.S. Bank

- UnionBanCal*

- Utrecht-America*

- Wells Fargo

- Zions

* indicates the U.S. subsidiary of a non-U.S. bank. Inclusion on this list is based on U.S. assets only.Components of the Dow Jones Industrial Average Current 3M · Alcoa · American Express · AT&T · Bank of America · Boeing · Caterpillar · Chevron · Cisco Systems · The Coca-Cola Company · DuPont · ExxonMobil · General Electric · Hewlett-Packard · The Home Depot · Intel · IBM · Johnson & Johnson · JPMorgan Chase · Kraft Foods · McDonald's · Merck & Co. · Microsoft · Pfizer · Procter & Gamble · The Travelers Companies · United Technologies Corporation · Verizon Communications · Walmart · The Walt Disney CompanySelected former Altria Group · American International Group · American Tobacco Company · Bethlehem Steel · Citigroup · Colorado Fuel and Iron · Kodak · General Foods · General Motors · Goodyear Tire and Rubber Company · Honeywell · International Harvester · International Paper · Johns Manville · Nash Motors · Navistar International · North American Company · Owens-Illinois · Sears, Roebuck and Company · Union Carbide · United States Rubber Company · U.S. Steel · F. W. Woolworth CompanyMembers of Euro Banking Association Austria Allgemeine Sparkasse Oberösterreich · Bank für Tirol und Vorarlberg AG · BKS Bank AG · Erste Group Bank AG · Oberbank AG · Oesterreichische Nationalbank · Raiffeisen Zentralbank Österreich AG · Raiffeisenlandesbank Oberösterreich AG · Raiffeisen-Landesbank Tirol Aktiengesellschaft · Steiermärkische Bank und Sparkassen AGBelgium Cyprus Denmark Amagerbanken A/S · Arbejdernes Landsbank A/S · Danske Andelskassers Bank A/S · Danske Bank A/S · DiBa Bank A/S · Djurslands Bank A/S · Jyske Bank A/S · Nordjyske Bank A/S · Nørresundby Bank · Østjydsk Bank A/S · Ringkjøbing Landbobank · Roskilde Bank A/S · Skjern Bank · Spar Nord Bank · Sparekassen Sjælland · Sydbank A/S · Vestfyns Bank A/S · Vestjysk BankFinland Aktia Bank PLC · Bank of Åland PLC · Nordea Bank Finland PLC · Pohjola Bank PLC · S-Bank LTD. · Tapiola Bank LTDFrance Banque Michel Inchauspé - BAMI · Banque Palatine · BNP Paribas SA · BPCE · BRED Banque Populaire · Crédit Agricole SA · Crédit Coopératif · Crédit du Nord · Crédit Mutuel Arkéa · Credit Mutuel CIC Banque · HSBC France · La Banque Postale · Natixis · Société GénéraleGermany Berenberg Bank · BHF Bank · Bremer Landesbank · Commerzbank AG · Deutsche Bank AG · Deutsche Bundesbank · Deutsche Postbank · DZ Bank AG · Europe Arab Bank Frankfurt · Hamburger Sparkasse AG · J.P. Morgan Chase Bank AG · Landesbank Baden-Württemberg · Landesbank Berlin Holding · Landesbank Hessen-Thüringen · Oldenburgische Landesbank · SECB Swiss EURO CLEARING Bank GmbH · The Bank of New York Mellon, Frankfurt Branch · VTB Bank (Deutschland) AG · WestLB AGGreece Hungary Ireland Italy Banca Agricola Popolare di Ragusa · Banca del Fucino · Banca del Piemonte · Banca delle Marche S.p.A. · Banca di Imola S.p.A. · Banca di Romagna S.p.A. · Banca d'Italia · Monte dei Paschi di Siena · Banca Monte Parma · Banca Nazionale del Lavoro · Banca Popolare del Lazio · Banca Popolare dell'Emilia Romagna · Banca Popolare di Milano · Banca Popolare di Sondrio · Banca Popolare di Spoleto · Banca Popolare di Vicenza · Banca Sella · Bancaperta S.p.A. · Banco Popolare Società Cooperativa · Cassa di Risparmio della Provincia di Chieti S.p.A. · Cassa di Risparmio della Provincia di Teramo S.p.A. · Cassa di Risparmio di Cesena S.p.A. · Cassa di Risparmio di Fermo S.p.A. · Cassa di Risparmio di Ferrara S.p.A. · Cassa di Risparmio di Loreto S.p.A. · Cassa di Risparmio di Ravenna S.p.A. · Credito Emiliano S.p.A. · ICCREA Banca · Intesa Sanpaolo · Istituto Centrale delle Banche Popolari Italiane · Raiffeisen Landesbank Südtirol – Cassa Centrale Raiffeisen dell'Alto Adige · Südtiroler Volksbank – Banca Popolare dell'Alto Adige · UBI Banca · UGF Banca · UniCredit · Veneto BancaLuxembourg Banque et Caisse d'Épargne de l'État · Banque Raiffeisen · Dexia Banque Internationale à Luxembourg SA · KBL European Private Bankers S.A. · Société Générale Bank & TrustNetherlands Poland Portugal Banco BPI SA · Banco Comercial Português · Banco Espírito Santo · Caixa Central de Crédito Agrícola Mutuo · Caixa Geral de DepósitosSlovenia Spain Banco Bilbao Vizcaya Argentaria SA · Banco Cooperativo Español SA · Banco Sabadell · Banco Español de Credito · Banco Pastor SA · Banco Popular Español SA · Banco Santander, SA · Bankinter SA · Bilbao Bizkaia Kutxa · Caixa de Aforros de Galicia, Vigo, Ourense e Pontevedra (NovaCaixaGalicia) · Caixa d'Estalvis de Catalunya, Tarragona i Manresa · Caixa d'Estalvis i Pensions de Barcelona (La Caixa) · Caja de Ahorros del Mediterráneo · Caja Gipuzkoa San Sebastian · Caja Laboral Popular Coop. de Credito · Caja Madrid · Confederacion Española de Cajas de Ahorros · Ipar Kutxa RuralSweden United Kingdom Bank of America NA · Bank of Tokyo-Mitsubishi UFJ Ltd. · Barclays Bank PLC · Citibank NA · HSBC Bank PLC · Kookmin Bank International Ltd. · Lloyds TSB Bank PLC · National Australia Bank Limited · National Westminster Bank PLC · Royal Bank of Scotland PLC · Standard Chartered Bank · UBS AG · Wells Fargo Bank NANon-EU Categories:- Companies listed on the New York Stock Exchange

- Companies listed on the Tokyo Stock Exchange

- Bank of America

- 1998 establishments in the United States