- Rabobank

-

This article is about the Dutch bank. For the cycling team sponsored by this company, see Rabobank (cycling team). For the arena in Bakersfield, California, see Rabobank Arena.

Rabobank Groep N.V.

Type Private/Cooperative Industry Banking Founded 1972 Headquarters Utrecht, the Netherlands,

52°5′11″N 5°6′34″E / 52.08639°N 5.10944°ENumber of locations 911 location in the Netherlands

682 locations outside the Netherlands[1]Key people drs. Piet Moerland, Chairman of the Board

Bert Bruggink, CFO

Piet van Schijndel

Berry Marttin

Sipko Schat

Gerlinde SilvisProducts Banking

Insurance

Leasing

Real estateEmployees approx. 58.000(2010-I) Website www.rabobank.com Rabobank (Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A.) is a financial services provider with offices worldwide. Their main location is in the Netherlands. They are a global leader in Food and Agri financing and in sustainability-oriented banking. The group comprises 141 independent local Dutch Rabobanks, a central organization (Rabobank Nederland), and a large number of specialized international offices and subsidiaries. Food & Agribusiness is the prime international focus of the Rabobank Group.[2]

The bank has a AAA credit rating from the rating agencies Moody's (since 1981), Standard & Poor's (since 1981) and DBRS (since 2001), which makes it the only private bank in the world with a triple-A rating. Global Finance currently ranks Rabobank 6th in its survey of “the world’s safest banks”.[3]

Contents

History

Rooted in agriculture, Rabobank is set up as a federation of local credit unions, which offer services to the local markets. The central organisation is the daughter organisation of the local branches, rather than the parent organisation, as is the case with most banks.

The bank is rooted in the ideas of Friedrich Wilhelm Raiffeisen, the founder of the cooperative movement of credit unions who in 1864 created the first farmers' bank in Germany. Being a countryside mayor he was confronted with the abject poverty of the farmers and their families. He tried to alleviate this need through a variety of charitable activities. He soon realised, however, that self-reliance had more potential in the long run than charitable aid. He therefore converted his charitable foundations into a farmers' bank in 1864. In doing so he created the Darlehnskassen-Verein, it collected the savings of the countryside dwellers and provided the enterprising but needy farmers with loans.

This model found a lot of interest in the Netherlands at the end of the 19th century. One of the first of Raiffeisen's followers was father Gerlacus van den Elsen who stood at the basis of a number of local farmers' banks in the south of the Netherlands. The model caught on being championed by the clergy and the countryside elites. The mission of the farmers' lending banks was an idealistic one but they always operated using strict business principles. Controversially, a founding principle of Rabobank's co-operative style was to co-operate in the interests of "warding off the Shylock". The cooperative bank model assured a tight bond between invested capital and the community.

The bank's traditional headquarters are Utrecht and Eindhoven. In 1898 two cooperative bank conglomerates were formed:

- Coöperatieve Centrale Raiffeisen-Bank in Utrecht

- Coöperatieve Centrale Boerenleenbank in Eindhoven

The first was formed as a cooperation of 6 local banks and the latter as a cooperation of 22 local banks. These two existed side by side for three quarters of a century despite their obvious similarities. The reasons for this owed in part to legal disagreements. The most important difference, however, was cultural. The Eindhoven based Boerenleenbank had a decidedly Catholic signature while the Raiffeisen-Bank had a Protestant background. In the past the Netherlands underwent a process of pillarisation or verzuiling, which in practice meant that members of different religious congregations and political movements essentially lived side by side each other without contact between the two. The religious backgrounds found their way to the organisational structure as well; the Eindhoven organisation stressed a highly centralised structure while the Utrecht organisation promoted local autonomy.

By 1940 the two organisations cooperated with each other, albeit on a limited scale. Three major developments caused a further tightening of the bonds between the two:

- Increasing number of offices - leading to increased local competition

- A gradual fading of the confessional differences between the two

- An increasing demand for capital in the Dutch industry, which in turn led to higher concentration in the banking business

In 1972 the two organisation merged. The name Rabobank is a portmanteau of Raiffeisen-Boerenleenbank. The organisation chose Amsterdam to be its statutory headquarter due to the historical neutrality in relation to the founding organisations. As of 1980 the central organisation is referred to as Rabobank Nederland.

Starting in 1980 Rabobank expanded its international activities as part of its mission of financing global agriculture. In 1994 it purchased Primary Industry Bank of Australia (PIBA) which had operations in Australia and New Zealand, renaming it Rabobank Australia Limited in 2003. In 1997 it purchased New Zealand based Wrightson Farmers Finance Limited and renamed it Rabobank New Zealand in 1999. Rabobank became a significant lender to the rural sector in the New Zealand with this purchase and used this as a base to expand its lending business further.

Rabo purchased Lend Lease Agro Business, an Australian based company, in 2003.

In 2006 it launched a new internet only savings bank called RaboPlus. This was launched first in Ireland under the name of RaboDirect, and then as RaboPlus in Belgium, New Zealand and two years later in Australia. The advertising campaigns used to promote the savings business in Ireland and New Zealand raised the profile of Rabobank generally in those countries resulting in not only an increase in savings business but also its lending businesses. In 2010 Rabo decided to use same name in all four countries for the savings bank and replaced RaboPlus with RaboDirect in all these countries.

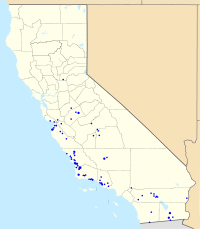

Rabobank completed the acquisition of Mid-State Bank & Trust on May 1, 2007, which allows Rabo to expand its services to the Central Coast region of California. In 2010, it also acquired Pacific State Bank, expanding into the Central Valley of California.

Development

Right from the start the cooperative banks prospered. They managed to perform the key tasks of a banking organisation i.e. bringing excess capital and capital shortages together. These moneylenders stood close to the farmers and were better in judging the creditworthiness of individual farmers than the city banks. This allowed the banks to offer lower interest rates. The local banks were self-governed by members of the cooperation. They adhered to the principle of non-remunerated management and elected the board and the commissioners from among themselves. Only the cashier received a small salary. This has of course changed by now, but even as recently as in late 1950s the local bank office was nothing more than the cashier's living room, he generally performed his administrative duties besides another regular job. Much later, in the 1960s the most local banks moved into new and modern offices that reflected their new-found professionalism. The position cashier was replaced by a local bank director. Since 1998 the local bank director is an appointed professional banker and he presides over a board of directors which is chosen from among the members.

Local presence and local autonomy were always important but this hasn't stopped a wave of concentration of the local banks. The major rationale behind this was the need to attain economies of scale in the fields of payments, transaction, processing, staff and of course capital. Increasing customer demand for standardized and widely available products also played a significant part in this development. Currently the motto is:

As large as is necessary, as small as possible.

this of course applies to the size of the local bank offices.

Traditionally the bank served mostly farmers and small businesses. Since the introduction of consumer salary accounts in the 1960s the number of retail clients grew exponentially. This has led to Rabobank being a prominent player in the field of savings accounts, checking accounts and mortgages in the Netherlands.

Rabobank has been awarded the Triple A (AAA) credit status by the major ratings agencies, making it the only privately owned bank in the world with such a status.

Rabobank Group

Branch of Rabobank in Amsterdam

Branch of Rabobank in Amsterdam

The Rabobank Group consists of a network of local banks, Rabobank Nederland and several daughter organisations. Formally the local Rabobanks are the mother organisation of Rabobank Nederland, their central organisation. The local banks are facilitated by Rabobank Nederland to serve their customers and not the other way around as is often the case with traditional banking organisations. Employees of the group do not routinely speak of a headquarters but prefer to speak of Rabobank Nederland, which is their daughter organisation.

The central organisation does occasionally overrule the autonomy of the local bank organisations. In accordance with Dutch regulations in the field of credit and financial services Rabobank Nederland oversees that the local banks maintain a required level of prudency and professionalism while selling financial products. This has grown to be especially important in view of recent developments and international standards such as Sarbanes-Oxley Act, Basel II and IFRS. This leads to an interesting and rather unusual phenomenon within international business: the mother companies and the much larger daughter are essentially forced to coexist together in order to function properly. This has led to a very ambivalent relationship between the two over the years.

At the time of the merger there were five management instruments within Rabobank Nederland:

- Algemene Vergadering - general assembly. The boards of all local banks within the cooperation were represented here.

- De Centrale Kringvergadering - advisoryboard manned by representatives of clusters of local banks.

- De Hoofddirectie - general management. Theoretically they were an autonomous management organ, but in practice, they had to pay 'serious consideration' to what the 4th organ; Raad van Beheer; thought about the course of action for the organisation.

- Raad van Beheer - management council. An independent advisory council whose chairman also attended the meetings of De Hoofddirectie.

- Raad van Toezicht - supervisory board.

In 2002 this rather cumbersome structure was simplified. The Raad van Beheer was disbanded. De Hoofddirectie received an integral authority over the banking business. It was also renamed to Raad van Bestuur or board of directors. They have an added task compared to a traditional board i.e. they are expected to look out for the specific interests of the members (local banks and their certificate holders). The Raad van Toezicht was renamed to county commission and now held an independent supervisory role. The chairman of this board also presides over the Centrale Kringvergadering. The latter is the most distinguishing organ as compared to other financial institutions in the Netherlands and abroad.

Market Position

Rabobank is traditionally a farmers' bank and it still holds an 85%-90% market share in the agrarian sector in the Netherlands. Throughout the years, the company has also started targeting small and medium sized companies. By the mid 1970s the market share in this sector reached some 30% and currently amounts to approximately 40%. In 1987, an important milestone was reached; the total outstanding loans in sectors other than agriculture exceeded those in the agricultural sector for the first time. By 2005 the agricultural credits amounted to some 8% of total outstanding credit.

Rabobank also holds some 40% of the total outstanding sums on Dutch savings accounts and they account for approximately 30% of all private consumer mortgages in the Netherlands.

The Rabobank Group currently consists of the following divisions:

- Rabobank Nederland - the facilitary and staff organisation that serves the local banks. It currently performs the following core activities:

- Market (staff) support for the domestic retail banking business

- Group functions i.e. ICT, Legal and other facilitary departments

- Wholesale banking and international rural and retail banking

- Local Banks - Approximately 141 independent and cooperative local banks in the Netherlands

- Rabo International - Rabobank's investment banking wing

- Rabo Vastgoed Groep - Project developer, real estate

- Robeco - Investment management

- De Lage Landen - Vendor finance, leasing and trade finance

- Schretlen & Co - Asset management, private banking sector

- Obvion - mortgage intermediary

- FGH Bank - Dutch real estate bank

- ACCBank - Agricultural Credit Corporation, Ireland

- Bank BGZ - Retail bank, Poland

- Rabobank N.A. - California-based financial services corporation, formerly VIB corp.

- Rabo Mobiel, a mobile virtual network operator in the Netherlands.

- Rabo Development, with advisory services and minority participations in various international markets, including: Tanzania, Zambia, Rwanda, Mozambique, China, Brazil and Paraguay.

RaboDirect

RaboDirect, formerly RaboPlus in some locations is the brand name for online-only services offered by Rabobank. RaboDirect operates in the Republic of Ireland, Belgium, Australia, and New Zealand, offering savings accounts, term deposits and managed funds.

Ireland

RaboDirect Ireland is an online bank. RaboDirect is part of the Rabobank Group.

In 2009, RaboDirect ran the Life's more interesting when you tell the truth marketing campaign that included TV commercials which featured staff confessing truths about themselves, and a microsite called Truthbank [4] where customers could "confess" their own truths.[5]

RaboDirect is also the current sponsor of rugby union's Celtic League, featuring teams from Ireland, Italy, Scotland and Wales. The deal, announced in June 2011, will run for four seasons, during which time the league will be known as the RaboDirect Pro12.[6]

New Zealand

RaboDirect, originally known as RaboPlus, was launched in Feb 2006 and is the only bank in New Zealand whose parent company is rated Triple A by Standard & Poor's.[7] All money deposited with RaboDirect is re-invested back into the New Zealand food and agriculture sector.[8]

The bank originally advertised to customers as "Your significant other bank". By Aug 2006, six months after its launch, it had gathered over $500 million in deposits.[9] In 2010, this figure stands at over $2.2 billion.[citation needed]

In July 2010 the bank was rebranded as RaboDirect to bring it in line with other countries where Rabo operated such services. This was followed by a new advertising campaign, using the slogan “It pays to focus”,[10] and highlighting RaboDirect’s links with New Zealand agribusiness, its focus on savings and investments as well as Rabobank’s origins, and their focus on online security.

Australia

On 23 May 2007, Rabobank opened a RaboPlus Internet bank in Australia. On 20 May 2010, the services were rebranded to RaboDirect. RaboDirect are the major partner of the Melbourne Rebels Super Rugby side.

References

- ^ Rabobank Group Annual Report 2010 (Report). 2010. p. 5. http://www.rabobank.com/content/images/Annual_Report_2010_Rabobank_Group_complete_tcm43-144982.pdf.

- ^ RaboBank Group Profile

- ^ Global Finance names the World’s 50 Safest Banks 2011

- ^ Truthbank - Got something on your mind?

- ^ Business & Leadership News Article

- ^ "Celtic League unveils new sponsor RaboDirect". BBC Sport. 8 June 2011. http://news.bbc.co.uk/sport2/hi/rugby_union/13693548.stm. Retrieved 8 June 2011.

- ^ "List of registered banks in New Zealand". Reserve Bank of New Zealand. http://www.rbnz.govt.nz/nzbanks/0091622.html. Retrieved 2008-03-18.

- ^ "*ActiveMoney - Issue 4, September 2006". http://www.raboplus.co.nz/Landing/ActiveMoneyIssue4/content.aspx?groupID=2&pageID=0&lid=h2&IDMContactID=&IDMActionID=&MDBPersonID=&SID=&MailID=&FirstName=&LastName=&Gender=. Retrieved 2007-11-08.

- ^ "Smart money going to RaboPlus as deposits top $500 million in record time". Media Release. RaboPlus. http://www.raboplus.co.nz/info/press_releases/20061508SmartMoneyDeposits.asp. Retrieved 2007-11-08.

- ^ "RaboDirect's new television advertising campaign on YouTube". Television adverts. RaboDirect. http://www.youtube.com/user/RaboDirectNZ. Retrieved 2010-10-27.

External links

- Rabobank Group homepage

- Rabobank Netherlands homepage

- Rabobank Belgium homepage

- RaboDirect Ireland homepage

- RaboDirect Australia homepage

- RaboDirect New Zealand homepage

- Rabobank careers homepage

Financial services companies of the Netherlands Bancassurance: Banks: ABN Amro · Alex · ASN Bank · Amsterdam Trade Bank · Bank Nederlandse Gemeenten · Binck · De Lage Landen · Direktbank · ELQ Hypotheken · Friesland Bank · NIBC Bank · Postbank · SNS Bank · Sparck · Triodos Bank · Van Lanschot BankiersPrivate banks & asset management Bank Insinger de Beaufort · Kempen & Co · MeesPierson · Oyens & van Eeghen · Robeco · Schretlen & Co · Staalbankiers · Theodoor Gilissen BankiersInsurance: Aegon · Achmea · Ageas · Allianz · Atradius · AXA Nederland · Cardif · Centraal Beheer · Conservatrix · Delta Lloyd · Eureko · De Goudse Verzekeringen · FBTO · Interpolis · Klaverblad Verzekeringen · Monuta · Nationale Nederlanden · Ohra · TVM · Univé · Uvit · VVAA · ZwitserlevenHealth insurance: Azivo · AZVZ · CZ Groep · De Friesland · Menzis · ONVZ Zorgverzekeringen · PNO Ziektenkosten · Salland Verzekeringen · DSW Zorgverzekeringen · Zorg en Zekerheid50 largest banks / bank holding companies in the United States as of September 30, 2011 - Ally

- American Express

- Associated

- BancWest*

- Bank of America

- Bank of New York Mellon

- BB&T

- BBVA Compass*

- BOK Financial

- Capital One

- CIT

- Citigroup

- Citizens Financial Group*

- City National (California)

- Comerica

- Commerce

- Discover

- East West Bank

- Fifth Third

- First Citizens

- First Horizon

- First Niagara

- Goldman Sachs

- BMO Harris*

- Hancock

- HSBC Bank USA*

- Huntington

- JPMorgan Chase

- Key

- M&T

- MetLife

- Morgan Stanley

- New York Community

- Northern Trust

- PNC

- Popular

- RBC*

- Regions

- Silicon Valley

- State Street

- SunTrust

- Synovus

- Taunus*

- TCF

- TD*

- U.S. Bank

- UnionBanCal*

- Utrecht-America*

- Wells Fargo

- Zions

* indicates the U.S. subsidiary of a non-U.S. bank. Inclusion on this list is based on U.S. assets only.Members of Euro Banking Association Austria Allgemeine Sparkasse Oberösterreich · Bank für Tirol und Vorarlberg AG · BKS Bank AG · Erste Group Bank AG · Oberbank AG · Oesterreichische Nationalbank · Raiffeisen Zentralbank Österreich AG · Raiffeisenlandesbank Oberösterreich AG · Raiffeisen-Landesbank Tirol Aktiengesellschaft · Steiermärkische Bank und Sparkassen AGBelgium Cyprus Denmark Amagerbanken A/S · Arbejdernes Landsbank A/S · Danske Andelskassers Bank A/S · Danske Bank A/S · DiBa Bank A/S · Djurslands Bank A/S · Jyske Bank A/S · Nordjyske Bank A/S · Nørresundby Bank · Østjydsk Bank A/S · Ringkjøbing Landbobank · Roskilde Bank A/S · Skjern Bank · Spar Nord Bank · Sparekassen Sjælland · Sydbank A/S · Vestfyns Bank A/S · Vestjysk BankFinland Aktia Bank PLC · Bank of Åland PLC · Nordea Bank Finland PLC · Pohjola Bank PLC · S-Bank LTD. · Tapiola Bank LTDFrance Banque Michel Inchauspé - BAMI · Banque Palatine · BNP Paribas SA · BPCE · BRED Banque Populaire · Crédit Agricole SA · Crédit Coopératif · Crédit du Nord · Crédit Mutuel Arkéa · Credit Mutuel CIC Banque · HSBC France · La Banque Postale · Natixis · Société GénéraleGermany Berenberg Bank · BHF Bank · Bremer Landesbank · Commerzbank AG · Deutsche Bank AG · Deutsche Bundesbank · Deutsche Postbank · DZ Bank AG · Europe Arab Bank Frankfurt · Hamburger Sparkasse AG · J.P. Morgan Chase Bank AG · Landesbank Baden-Württemberg · Landesbank Berlin Holding · Landesbank Hessen-Thüringen · Oldenburgische Landesbank · SECB Swiss EURO CLEARING Bank GmbH · The Bank of New York Mellon, Frankfurt Branch · VTB Bank (Deutschland) AG · WestLB AGGreece Hungary Ireland Italy Banca Agricola Popolare di Ragusa · Banca del Fucino · Banca del Piemonte · Banca delle Marche S.p.A. · Banca di Imola S.p.A. · Banca di Romagna S.p.A. · Banca d'Italia · Monte dei Paschi di Siena · Banca Monte Parma · Banca Nazionale del Lavoro · Banca Popolare del Lazio · Banca Popolare dell'Emilia Romagna · Banca Popolare di Milano · Banca Popolare di Sondrio · Banca Popolare di Spoleto · Banca Popolare di Vicenza · Banca Sella · Bancaperta S.p.A. · Banco Popolare Società Cooperativa · Cassa di Risparmio della Provincia di Chieti S.p.A. · Cassa di Risparmio della Provincia di Teramo S.p.A. · Cassa di Risparmio di Cesena S.p.A. · Cassa di Risparmio di Fermo S.p.A. · Cassa di Risparmio di Ferrara S.p.A. · Cassa di Risparmio di Loreto S.p.A. · Cassa di Risparmio di Ravenna S.p.A. · Credito Emiliano S.p.A. · ICCREA Banca · Intesa Sanpaolo · Istituto Centrale delle Banche Popolari Italiane · Raiffeisen Landesbank Südtirol – Cassa Centrale Raiffeisen dell'Alto Adige · Südtiroler Volksbank – Banca Popolare dell'Alto Adige · UBI Banca · UGF Banca · UniCredit · Veneto BancaLuxembourg Banque et Caisse d'Épargne de l'État · Banque Raiffeisen · Dexia Banque Internationale à Luxembourg SA · KBL European Private Bankers S.A. · Société Générale Bank & TrustNetherlands Poland Portugal Banco BPI SA · Banco Comercial Português · Banco Espírito Santo · Caixa Central de Crédito Agrícola Mutuo · Caixa Geral de DepósitosSlovenia Spain Banco Bilbao Vizcaya Argentaria SA · Banco Cooperativo Español SA · Banco Sabadell · Banco Español de Credito · Banco Pastor SA · Banco Popular Español SA · Banco Santander, SA · Bankinter SA · Bilbao Bizkaia Kutxa · Caixa de Aforros de Galicia, Vigo, Ourense e Pontevedra (NovaCaixaGalicia) · Caixa d'Estalvis de Catalunya, Tarragona i Manresa · Caixa d'Estalvis i Pensions de Barcelona (La Caixa) · Caja de Ahorros del Mediterráneo · Caja Gipuzkoa San Sebastian · Caja Laboral Popular Coop. de Credito · Caja Madrid · Confederacion Española de Cajas de Ahorros · Ipar Kutxa RuralSweden United Kingdom Bank of America NA · Bank of Tokyo-Mitsubishi UFJ Ltd. · Barclays Bank PLC · Citibank NA · HSBC Bank PLC · Kookmin Bank International Ltd. · Lloyds TSB Bank PLC · National Australia Bank Limited · National Westminster Bank PLC · Royal Bank of Scotland PLC · Standard Chartered Bank · UBS AG · Wells Fargo Bank NANon-EU Categories:- Banks of the Netherlands

- Cooperatives in the Netherlands

- Cooperative banking

- Banks established in 1972

- Registered Banks of New Zealand

Wikimedia Foundation. 2010.