- HSBC

-

HSBC Holdings plc

Type Public limited company Traded as LSE: HSBA SEHK: 005 NYSE: HBC Euronext: HSB BSX: 1077223879 Industry Banking, Financial services Founded 1991[1]

(HSBC Holdings plc)

1865[2]

(The Hongkong and Shanghai Banking Corporation Limited)Founder(s) Sir Thomas Sutherland Headquarters 8 Canada Square,

Canary Wharf,

London, United Kingdom[3]Number of locations 7,500 offices in 87 countries & territories[4] Area served Worldwide Key people Douglas Flint

(Group Chairman)

Stuart Gulliver

(Group Chief Executive)Products Credit cards, Consumer banking, corporate banking, finance and insurance, investment banking, mortgage loans, private banking, wealth management Revenue  US$ 98.918 billion (2010)[5]

US$ 98.918 billion (2010)[5]Operating income  US$ 19.037 billion (2010)[5]

US$ 19.037 billion (2010)[5]Profit  US$ 13.159 billion (2010)[5]

US$ 13.159 billion (2010)[5]Total assets  US$ 2.454 trillion (2010)[5]

US$ 2.454 trillion (2010)[5]Total equity  US$ 147.667 billion (2010)[5]

US$ 147.667 billion (2010)[5]Employees 295,995 (2011)[5] Subsidiaries HSBC Bank plc

The Hongkong and Shanghai Banking Corporation

HSBC GLT India

HSBC Bank USA

HSBC Bank Middle East

HSBC Mexico

HSBC Bank Brazil

HSBC FinanceWebsite hsbc.com HSBC Holdings plc is a global banking and financial services company headquartered in Canary Wharf, London, United Kingdom.[3] As of 2011[update] it is the world's second-largest banking and financial services group and second-largest public company[6] according to a composite measure by Forbes magazine.[7][8] It has around 7,500 offices in 87 countries and territories across Africa, Asia, Europe, North America and South America and around 100 million customers.[4][9] As of 30 June 2010, it had total assets of $2.418 trillion, of which roughly half were in Europe, a quarter in the Americas and a quarter in Asia.[5]

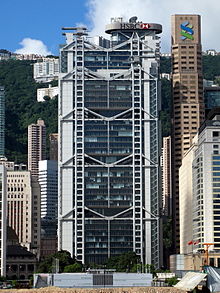

HSBC Holdings plc was founded in London in 1991 by The Hongkong and Shanghai Banking Corporation to act as a new group holding company and to enable the acquisition of UK-based Midland Bank.[1] The origins of the bank lie in Hong Kong and Shanghai, where branches were first opened in 1865.[2] Today, HSBC remains the largest bank in Hong Kong, and recent expansion in mainland China, where it is now the largest international bank, has returned it to that part of its roots.[9][10]

HSBC is a universal bank and is organised within four business groups: Commercial Banking; Global Banking and Markets (investment banking); Personal Financial Services (retail banking); and Private Banking.[11]

HSBC's primary listing is on the London Stock Exchange and it is a constituent of the FTSE 100 Index. It has secondary listings on the Hong Kong Stock Exchange (where it is a constituent of the Hang Seng Index), the New York Stock Exchange, Euronext Paris and the Bermuda Stock Exchange. As of October 2011, it was the second most highly capitalised company listed on the London Stock Exchange, with a market capitalisation of £93 billion.[12]

Contents

History

For the history of HSBC prior to the founding of HSBC Holdings in 1991, see The Hongkong and Shanghai Banking Corporation.Development of the bank

HSBC (abbreviation origin: the "Hongkong and Shanghai Banking Corporation") was founded in the former British colony of Hong Kong (in March 1865) and Shanghai (one month later) by Scotsman Sir Thomas Sutherland (1834–1922). HSBC Holdings plc established in 1990 became the parent company to The Hongkong and Shanghai Banking Corporation in preparation for its purchase of Midland Bank in the United Kingdom and restructuring of ownership domicile for the impending transfer of sovereignty of Hong Kong to China. HSBC Holdings acquisition of Midland Bank gave HSBC Group a substantial market presence in the United Kingdom which was completed in 1992. As part of the takeover conditions for the purchase of Midland Bank, HSBC Holdings plc was required to relocate its world headquarters from Hong Kong to London in 1993.

Major acquisitions in South America started with the purchase of the Banco Bamerindus of Brazil for $1bn in March 1997[13] and the acquisition of Roberts SA de Inversiones of Argentina for $600m in May 1997.[14]

In 1980, HSBC acquired a 51% shareholding in Marine Midland Bank, which it extended to full ownership in 1987. In May 1999, HSBC continued its US acquisitions with the purchase of Republic National Bank of New York for $10.3bn.[15]

Expansion into Continental Europe took place in April 2000 with the acquisition of Crédit Commercial de France, a large French bank for £6.6bn.[16]

In July 2001 HSBC bought Demirbank, an insolvent Turkish bank.[17] In July 2002, Arthur Andersen announced that HSBC USA, Inc., through a new subsidiary, Wealth and Tax Advisory Services USA Inc. (WTAS), would purchase a portion of Andersen's tax practice. The new HSBC Private Client Services Group would serve the wealth and tax advisory needs of high net worth individuals. Then in August 2002 HSBC acquired Grupo Financiero Bital, SA de CV, Mexico's third largest retail bank for $1.1bn.[18]

The new headquarters of HSBC Holdings at 8 Canada Square, London officially opened in April 2003.[19]

Then in September 2003 HSBC bought Polski Kredyt Bank SA of Poland for $7.8m.[20]

In June 2004 HSBC expanded into China buying 19.9% of the Bank of Communications of Shanghai.[21]

In the United Kingdom HSBC acquired Marks & Spencer Retail Financial Services Holdings Ltd for £763m in December 2004.[22]

Acquisitions in 2005 included Metris Inc, a US credit card issuer for $1.6bn in August[23] and 70.1% of Dar Es Salaam Investment Bank of Iraq in October.[24]

In April 2006 HSBC bought the 90 branches in Argentina of Banca Nazionale del Lavoro for $155m.[25]

In December 2007 HSBC acquired The Chinese Bank in Taiwan.[26]

In May 2008 HSBC acquired IL&FS Investment, an Indian retail broking firm.[27]

Subprime crisis

In November 2002 HSBC expanded further in the United States. Under the chairmanship of Sir John Bond, it spent £9bn (US$15.5000bn) to acquire Household Finance Corporation (HFC), a US credit card issuer and subprime lender.[28] In a 2003 cover story, The Banker noted "when banking historians look back, they may conclude that [it] was the deal of the first decade of the 21st century".[29] Under the new name of HSBC Finance, the division was the second largest subprime lender in the US.[30]

In March 2009, HSBC announced that it would shut down the branch network of its HSBC Finance arm in the U.S., leading to nearly 6,000 job losses and leaving only the credit card business to continue operating.[31][32]

Chairman Stephen Green stated, "HSBC has a reputation for telling it as it is. With the benefit of hindsight, this is an acquisition we wish we had not undertaken.";[33] analyst Colin Morton said, "the takeover was an absolute disaster".[32][34]

Although it was at the centre of the subprime storm, the wider group has weathered the financial crisis of 2007–2010 better than other global banks. According to Bloomberg, "HSBC is one of world’s strongest banks by some measures."[35] When HM Treasury required all UK banks to increase their capital in October 2007, the group transferred £750 million to London within hours, and announced that it had just lent £4 billion to other UK banks.[36] In March 2009, it announced that it had made US$9.3bn of profit in 2008 and announced a £12.5bn (US$17.7bn; HK$138bn) rights issue to enable it to buy other banks that were struggling to survive.[37] However, uncertainty over the rights' issue's implications for institutional investors caused volatility in the Hong Kong stock market: on 9 March 2009 HSBC's share price fell 24.14%, with 12 million shares sold in the last few seconds of trading.[38]

2010 to present

On 11th May 2011 the new chief executive Stuart Gulliver announced that HSBCs would refocus its business strategy and that a large-scale retrenchment of operations, particularly in respect of the retail sector, was planned. HSBC would no longer seek to be 'the world's local bank', as costs associated with this were spiralling and US$3.5bn needed to be saved by 2013, with the aim of bringing overheads down from 55% of revenues to 48%. Gulliver stated that HSBC would focus on the business of wealth management in dynamic and developing markets, principally in the UK and far east. Immediate judgement was passed on this plan, with the share price shrinking 1.5%. Gulliver also added that a decision on whether or not to relocate its head office out of the UK tax domain would be made at the end of the year. In 2010, then-chairman Stephen Green planned to depart HSBC to accept a government appointment in the Trade Ministry. Group Chief Executive Michael Geoghegan was expected to become the next chairman. However, while many current and former senior employees supported the tradition of promoting the chief executive to chairman, many shareholders instead pushed for an external candidate. Geoghegan's detractors noted that while he was effective at getting things done, they argued that his blunt style was unsuited to leading the board and representing HSBC with heads of government, and his appointment as chairman would also flout UK governance guidance that barred chief executives becoming chairman. Geoghegan had reportedly threatened to quit if he was passed over in favour of former Goldman Sachs President John Thornton.[39][40] HSBC's board of directors had reportedly been split over the succession planning, and investors were alarmed that this row would damage the company.[41]

On 23 September 2010, Geoghegan announced he would step down as chief executive of HSBC. [42] He was succeeded as chief executive of HSBC by Stuart Gulliver, while Green was succeeded as Chairman by Douglas Flint; Flint was serving as HSBC's finance director (chief financial officer). August 2011: Further to CEO Stuart Gulliver's plan to cut $3.5 billion in costs over the next 2 years, HSBC announced that it will cut 25,000 jobs and exit from 20 countries by 2013 in addition to 5,000 job- cuts announced earlier in the year. The consumer banking division of HSBC will focus on the UK, Hong Kong, high-growth markets such as Mexico, Singapore, Turkey and Brazil, and smaller countries where it has a leading market share.[43][44]

August 1, 2011 "to align our U.S. business with our global network and meet the local and international needs of domestic and overseas clients", HSBC Holding Plc, agreed to sell 195 branches in New York and Connecticut for around $1 billion to First Niagara Financial Group Inc. HSBC will also close 13 branches in Connecticut and New Jersey in 2012. The rest of HSBC's U.S. network will only be about half from a total 470 branches before divestments.[45] On August 9, 2011, [Capital One Financial Corp.] agreed to acquire HSBC's U.S. credit card business for $2.6 billion[46], netting HSBC Holdings an estimated after-tax profit of $2.4 billion[47]. In September was announced that HSBC seeks to sell its general insurance business for around $1 billion. This is a part of Chief Executive Officer Stuart gulliver's plan to divest some assets.

Operations

Corporate profile

In February 2008, HSBC was named the world's most valuable banking brand by The Banker magazine.[48][49] Not known for marked fluctuations in securities exchanges around the world relative to its rivals, HSBC is more well known in banking circles for its conservative and risk-averse approach in its business operations – a company tradition going back to the 19th century.[50] In its technical management, however, HSBC has recently suffered a series of headline-making incidents in which some customer data were allegedly leaked or simply went missing. Although the consequences turned out to be small, the embarrassing effect on the group's image did not go unnoticed.[51]

As of 2 April 2008, according to Forbes magazine, HSBC was the fourth largest bank in the world in terms of assets ($2,348.98 billion), the second largest in terms of sales ($146.50 billion) and the largest in terms of market value ($180.81 billion). It was also the most profitable bank in the world with $19.13 billion in net income in 2007 (compared to Citigroup's $3.62 billion and Bank of America's $14.98 billion in the same period).[52]

HSBC is the largest bank both in the United Kingdom and in Hong Kong and prints most of Hong Kong's local currency in its own name. Since the end of 2005, HSBC has been rated the largest banking group in the world by Tier 1 capital.[53]

The HSBC Group has a significant presence in each of the world's major financial markets, with the Americas, Asia Pacific and Europe each representing around one third of the business. With around 8,000 offices in 87 countries & territories, 210,000 shareholders, 300,000 staff and 128 million customers worldwide, HSBC arguably has the most international presence among the world's multinational banking giants.[4]

The HSBC Group operates as a number of local banks around the world, which explains its advertising tagline "The World's Local Bank." In response to ongoing discussions about the survival strategies for banks, and the suggestion of "Living Wills" HSBC explains its structure as "separately incorporated and capitalised" the structure is based on a lead bank in each region, which has responsibility for the group's operations in that area, as listed below.[54] For details of other group companies see Category:HSBC.

HSBC is currently audited by one of the Big Four auditors, KPMG. The HSBC and KPMG headquarters are adjacent to one another, with KPMG occupying 15 Canada Square.[55] HSBC Main Building, Hong Kong where the CEO office is, also adjacent to KPMG office locate in Prince's Building.

Head office

The head office is in 8 Canada Square in Canary Wharf, London.[56] On Friday 25 September 2009 the company stated that while its head office would remain in London and the main regulator would continue to be the Financial Services Authority, the CEO would move from London to Hong Kong beginning on February 2010.[57]

Latin America

· HSBC Mexico SA

HSBC Mexico SA

· HSBC Bank Brazil SA, Banco Multiplo

HSBC Bank Brazil SA, Banco Multiplo

· HSBC Bank Argentina SA

HSBC Bank Argentina SAAsia Pacific

· The Hongkong and Shanghai Banking Corporation Ltd

The Hongkong and Shanghai Banking Corporation Ltd

· Hang Seng Bank Ltd

Hang Seng Bank Ltd

· HSBC Bank (China) Company Ltd

HSBC Bank (China) Company Ltd

· HSBC Bank Malaysia Berhad

HSBC Bank Malaysia Berhad

· HSBC Bank Australia Limited

HSBC Bank Australia LimitedMiddle East

· HSBC Bank Middle East Ltd

HSBC Bank Middle East Ltd

· HSBC Bank Egypt SAE

HSBC Bank Egypt SAE

· The Saudi British Bank

The Saudi British BankNorth America

· HSBC Bank USA Inc

HSBC Bank USA Inc

· HSBC Finance Corporation

HSBC Finance Corporation

· HSBC Bank Canada

HSBC Bank CanadaEurope

· HSBC Bank plc

HSBC Bank plc

· HSBC France

HSBC France

· HSBC Trinkaus und Burkhardt AG

HSBC Trinkaus und Burkhardt AG

· HSBC Bank Malta plc

HSBC Bank Malta plc

· HSBC Private Bank (UK) Ltd

HSBC Private Bank (UK) LtdGlobal product lines and programmes

Group Service Centres

As a cost saving measure HSBC is offshoring processing work to lower cost economies in order to reduce the cost of providing services in developed countries. These locations take on work such as data processing and customer service, but also internal software engineering at Pune (India), Hyderabad (India), Vishakhapatnam (India), Kolkata (India), Guangzhou (China), Curitiba (Brazil) and Kuala Lumpur (Malaysia).

Chief Operating Officer Alan Jebson said in March 2005 that he would be very surprised if fewer than 25,000 people were working in the centres over the next three years: “I don’t have a precise target but I would be surprised if we had less than 15 (global service centres) in three years’ time.” He went on to say that each centre cost the bank from $20m to $30m to set up, but that for every job moved the bank saves about $20,000 (£10,400).[59]

Trade unions, particularly in the US and UK, blame these centres for job losses in developed countries, and also for the effective imposition of wage caps on their members.[59]

Currently, HSBC operates centres out of eight countries, including Brazil (Curitiba), The Czech Republic (Ostrava), India (Kolkata, Hyderabad, Bangalore, Visakhapatnam, Mumbai, Gurgaon and Pune), China (Shanghai, Guangzhou and Shenzhen), Malaysia (Kuala Lumpur), Poland (Krakow), Sri Lanka (Rajagiriya) and Philippines (Manila). The Malta trial for a UK high value call centre has resulted in a growing operation that country. An option under consideration is reported to be a processing centre in Vietnam to access the French skills of the population and therefore cut costs in the bank’s French operations.

On 27 June 2006, HSBC reported that a "small number" of customers had suffered from fraud totalling £233,000 after an employee at the Bangalore call centre supplied confidential customer information to fraudsters.[60]

HSBC Private Bank

HSBC Private Bank[61] is the group's private banking operation, providing private banking and trustee services to wealthy individuals and their families worldwide. The Private Bank has in excess of 60 offices worldwide, with the major centres being Miami, New York, London, Geneva and Hong Kong.

HSBC Premier

HSBC Premier[62] is the group's premium financial services product. The exact benefits and qualification criteria vary depending on country, but typically require deposits and investments of at least $100,000, £50,000, or €100,000. Alternatively those who have an individual annual income of at least £100,000 paid into their HSBC Premier Bank Account and are a customer of the bank's Independent Financial Advisory Service. Customers have a dedicated Premier Relationship Manager, global 24 hour access to call centres, free banking services and preferential rates. A HSBC Premier customer receives the HSBC Premier services in all countries that offer HSBC Premier, without having to meet that country's qualifying criteria.

HSBC Advance

HSBC Advance[63] is the group's product aimed at working professionals. The exact benefits and qualifications vary depending on country, but typically require a transfer of Salary of USD 1,500 or more every month or Maintain USD 25,000 of deposits in a Savings/Current Account or investments. Advantages include and may vary depending on country this include day-to-day banking services included but not limited to Platinum Credit Card, Advance ATM Card, Current Account and Savings Account. Protection plans and Financial Planning Services. A HSBC Advance customer enables the customer to open accounts in another country and transfer their credit history.

HSBC Bank International

HSBC Bank International[64] is the offshore banking arm of the HSBC Group, focusing on providing offshore solutions and cross border services to expatriates and migrants. It provides a full range of multi-currency personal banking services to a range of customer segments, including a full internet banking and telephone banking service. Sometimes referred to as "HSBC Offshore", the business also offers independent financial planning, and has representative offices all over the world, often working alongside local HSBC operations in those regions.

HSBC Bank International originated from the business started by Midland Bank and is based in the Channel Islands with further operations on the Isle of Man. Its operations in the Channel Islands are centred around its registered headquarters on the seafront in St Helier, Jersey. Named 'HSBC House', the building comprises departments such as Premier, Global Funds & Investments, e-Business and a 24 hour 'Direct Banking Centre'.

HSBCnet

HSBCnet[65] is a global service that caters to local business needs by offering specialised functionality for different regions worldwide.

The system provides access to transaction banking functionality – ranging from payments and cash management to trade services features – as well as to research and analytical content from HSBC. It also includes foreign exchange and money markets trading functionality.

The system is used widely by HSBC's high-end corporate and institutional clients served variously by the bank's global banking and markets, commercial banking and global transaction banking divisions.

HSBCnet is also the brand under which HSBC markets its global e-commerce proposition to its corporate and institutional clients.

HFC Bank (UK Operation) is a wholly owned subsidiary, with 135 High Street branches in the UK selling loans to the "sub-prime" market. During 2007 and 2008, it has been trying to fend off a union recognition campaign by the Trade Union Unite.

HSBC Direct

HSBC Direct is a telephone/online direct banking operation which attracts customers through mortgages, accounts and savings. It was first launched in the USA[66] in November 2005 and is now available in Britain, Canada,[67] Taiwan,[68] South Korea[69] and France. Poland is launching business direct in September 2009. In the US, HSBC Direct is now part of HSBC Advance[70]

Brand and advertising

The group announced in November 1999 that the HSBC brand and the hexagon symbol would be adopted as the unified brand in all the markets where HSBC operates, with the aim of enhancing recognition of the group and its values by customers, shareholders and staff throughout the world.

Logo

The hexagon symbol was originally adopted by The Hongkong and Shanghai Banking Corporation as its logo in 1983. It was developed from the bank’s house flag, a white rectangle divided diagonally to produce a red hourglass shape. Like many other Hong Kong company flags that originated in the 19th century, and because of its founder's nationality, the design was based on the cross of Saint Andrew. The logo was designed by graphic artist Henry Steiner.

Sponsorship

Having sponsored the Jaguar Racing Formula One team since the days of Stewart Grand Prix, HSBC ended its relationship with the sport when Red Bull purchased Jaguar Racing from Ford. HSBC has now switched its focus to golf, taking title sponsorship of events such as the HSBC World Match Play Championship, HSBC Women's World Match Play Championship (now defunct), HSBC Champions and HSBC Women's Champions.

In football HSBC sponsors French club AS Monaco and Mexican club C.F. Pachuca, and in rugby league, HSBC sponsors Telford Raiders in the Rugby League Conference. In Australia, HSBC sponsors the New South Wales Waratahs rugby team in the Super 15 rugby union competition, as well as the Hawthorn Football Club in the Australian Football League.

HSBC’s other sponsorships are mainly in the area of education, health and the environment. In November 2006, HSBC announced a $5 million partnership with SOS Children as part of Future First.[71]

HSBC sponsors the Great Canadian Geography Challenge, which has had around 2 million participants in the past 12 years. Since 2001, HSBC has sponsored the Celebration of Light, an annual musical fireworks competition in Vancouver, British Columbia, Canada. In 2007 HSBC announced it would be a sponsor of the National Hockey League's Vancouver Canucks and Calgary Flames. HSBC has also sponsored a professional gaming team that was disbanded late 2007.

HSBC sponsored the 2009 British and Irish Lions tour to South Africa.[72]

HSBC is the official banking partner of the Wimbledon Tennis Championships, providing banking facilities on site and renaming the Road to Wimbledon junior event, as The HSBC Road to Wimbledon National 14 and Under Challenge.[73]

HSBC was named the 'Official Banking Partner' of The Open Championship, in a five year deal announced in 2010.[74]

Customer groups

HSBC splits its business into four distinct groups:

Retail Banking and Wealth Management

HSBC provides more than 100 million customers worldwide with a full range of personal financial services, including current and savings accounts, mortgage loans, car financing, insurance, credit cards, loans, pensions and investments.

Retail Banking and Wealth Management was previously referred to as Personal Financial Services. This rename was announced during HSBC's 2011 Investor Day.[75]

Commercial banking

HSBC provides financial services to small, medium-sized and middle-market enterprises. The group has more than 3 million of such customers, including sole proprietors, partnerships, clubs and associations, incorporated businesses and publicly quoted companies.

Global banking and markets

Global Banking and Markets is the investment banking arm of HSBC. It provides investment banking and financing solutions for corporate and institutional clients, including corporate banking, investment banking, trade services, payments and cash management, and leveraged acquisition finance. It provides services in credit and rates, foreign exchange, money markets and securities services, in addition to asset management services.

Global Banking and Markets has offices in more than 60 countries and territories worldwide, and describes itself as "emerging markets-led and financing-focused".[76]

Global Banking and Markets is currently being led by former fixed-income trader Samir Assaf, who was promoted from global head of markets on 10 December 2010.[77]

Private banking

Main article: HSBC Private BankHSBC Private Bank is the marketing name for the private banking business conducted by the principal private banking subsidiaries of the HSBC Group worldwide. HSBC Private Bank, together with the private banking activities of HSBC Trinkaus, known collectively as Group Private Banking, provides services to high net worth individuals and their families through 93 locations in some 42 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. As of December 2007, profits before tax were US$1,511 million and combined client assets under management were US$494 billion.

In September 2008, HSBC announced that it would combine its two Swiss private banks under one brand name in 2009, with HSBC Guyerzeller and HSBC Private Bank to be merged into one legal entity, under the newly appointed CEO of HSBC Private Bank, Alexandre Zeller.[78]

See also

- HSBC Buildings

- List of banks in the United Kingdom

- List of buildings and structures in Hong Kong

- Primary dealers

Notes

- ^ a b "Group history 1980–1999". HSBC Holdings plc. http://www.hsbc.com/1/2/!ut/p/kcxml/04_Sj9SPykssy0xPLMnMz0vM0Y_QjzKLN4o39DQGSYGYxqb6kShCBvGOCJEgfW99X4_83FT9AP2C3NCIckdHRQA4sRMO/delta/base64xml/L3dJdyEvd0ZNQUFzQUMvNElVRS82XzJfMUlT. Retrieved 4 September 2010.

- ^ a b "Group history 1865–1899". HSBC Holdings plc. http://www.hsbc.com/1/2/about/history/1865-1899. Retrieved 4 September 2010.

- ^ a b "Group Structure" HSBC website

- ^ a b c "International network". HSBC Holdings plc. http://www.hsbc.com/1/2/about/network. Retrieved 4 September 2010.

- ^ a b c d e f g "2010 Form 10-K, HSBC Holdings plc". Hoover's. http://www.hoovers.com/company/HSBC_Holdings_plc/crksif-1-1njea5.html.

- ^ "HSBC". Forbes. http://www.forbes.com/companies/hsbc-holdings/. Retrieved 6 June 2011.

- ^ "The World's Biggest Public Companies". Forbes. http://www.forbes.com/global2000/. Retrieved 6 June 2011.

- ^ "HSBC tops Forbes 2000 list of world's largest companies," HSBC website, 4 April 2008

- ^ a b "Annual Review 2009". HSBC Holdings plc. http://www.2009.annualreview.hsbc.com/annualreview/downloads/annual_review_2009.pdf. Retrieved 4 September 2010.

- ^ Vidya Ram, "HSBC Gets Back In Touch With Its Roots" Forbes, 03.10.08

- ^ "About HSBC". HSBC Holdings plc. http://www.hsbc.com/1/2/about. Retrieved 7 March 2011.

- ^ "FTSE All-Share Index Ranking". stockchallenge.co.uk. http://www.stockchallenge.co.uk/ftse.php. Retrieved 12 August 2010.

- ^ "HSBC Buys Bamerindus, Brazil Bank, For Billion". The New York Times. 28 March 1997. http://query.nytimes.com/gst/fullpage.html?res=9504E6D9143AF93BA15750C0A961958260.

- ^ "HSBC". UK Business Park. http://www.ukbusinesspark.co.uk/hsbcaaaa.htm. Retrieved 18 April 2011.

- ^ "Bank Group to Buy Republic New York". The New York Times. 11 May 1999. http://query.nytimes.com/gst/fullpage.html?res=9A06EFDC153FF932A25756C0A96F958260.

- ^ Garfield, Andrew (3 April 2000). "HSBC leads the way into euro zone with £6.6bn French bank takeover". The Independent (London). http://www.independent.co.uk/news/business/news/hsbc-leads-the-way-into-euro-zone-with-pound66bn-french-bank-takeover-719601.html.

- ^ "HSBC buys insolvent Turkish bank". BBC News. 20 July 2001. http://news.bbc.co.uk/1/hi/business/1449170.stm.

- ^ "HSBC buys Mexico's biggest retail bank". BBC News. 21 August 2002. http://news.bbc.co.uk/1/hi/business/2207891.stm.

- ^ "HSBC HQ, Canary Wharf" (PDF). http://www.arup.com/_assets/_download/C27CDFAE-FA3D-3093-217B92CB1498B02C.pdf. Retrieved 18 April 2011.

- ^ Timmons, Heather (12 September 2003). "HSBC Gets Approval To Acquire Polish Bank". The New York Times. http://query.nytimes.com/gst/fullpage.html?res=9D04E7D7103BF931A2575AC0A9659C8B63.

- ^ "HSBC 'buys stake in Chinese bank'". BBC News. 24 June 2004. http://news.bbc.co.uk/1/hi/business/3835585.stm.

- ^ "M&S faces OFT inquiry into HSBC deal". The Independent (London). 12 September 2004. http://www.independent.co.uk/news/business/news/mamps-faces-oft-inquiry-into-hsbc-deal-545850.html.

- ^ [1][dead link]

- ^ "HSBC closes in on Iraqi bank deal". BBC News. 2 October 2005. http://news.bbc.co.uk/1/hi/business/4302742.stm.

- ^ "HSBC acquires Banca Nazionale del Lavoro SA from BNP Paribas SA". Alacrastore.com. 28 April 2006. http://www.alacrastore.com/storecontent/Thomson_M&A/HSBC_Holdings_PLCHSBC_acquires_Banca_Nazionale_del_Lavoro_SA_from_BNP_Paribas_SA-1730119040. Retrieved 18 April 2011.

- ^ Treanor, Jill (15 December 2007). "Taiwan gives HSBC £750m to take on Chinese bank". The Guardian (London). http://www.guardian.co.uk/business/2007/dec/15/hsbcholdingsbusiness.banking.

- ^ HSBC Buys 73.21 percent Stake in IL&FS[dead link]

- ^ "HSBC pays £9bn for credit card group". BBC News. 14 November 2002. http://news.bbc.co.uk/1/hi/business/2471827.stm.

- ^ "Sir John Bond lays bare HSBC’s strategy for gaining ground". Thebanker.com. 14 April 2011. http://www.thebanker.com/news/fullstory.php/aid/769/Sir_John_Bond_lays_bare_HSBC%92s_strategy_for_gaining_ground.html. Retrieved 18 April 2011.

- ^ HSBC hates subprime, FT Alphaville

- ^ HSBC bank closes its operations in the U.S.[dead link]

- ^ a b Jon Menon, HSBC Rues Household Deal, Halts U.S. Subprime Lending, Bloomberg L.P. 2 March 2009.

- ^ Neil Hume, Quote du jour – Stephen Green, FT Alphaville, 2 March 2009: "HSBC has a reputation for telling it as it is. With the benefit of hindsight, this is an acquisition we wish we had not undertaken."

- ^ HSBC bank closes its operations in the U.S..

- ^ Jon Menon 'HSBC to Raise $17.7 Billion as Subprime Cuts Profit', Bloomberg L.P., 2 March 2009

- ^ Seib, Christine (10 October 2008). "HSBC quick to comply with refinancing demands". The Times (London). http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4916681.ece.

- ^ Benjamin Scent HSBC seeking to build `war chest', The Standard, 4 March 2009.

- ^ Benjamin Scent 'Plunge probe' The Standard, 10 March 2009.

- ^ Wilson, Harry; Farrell, Sean; Aldrick, Philip (22 September 2010). "HSBC investors against Michael Geoghegan becoming chairman". The Daily Telegraph (London). http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/8019235/HSBC-investors-against-Michael-Geoghegan-becoming-chairman.html.

- ^ "HSBC chief Michael Geoghegan 'to quit' after failing to get top job". NewsCore. 24 September 2010. http://www.news.com.au/business/hsbc-chief-michael-geoghegan-to-quit-after-failing-to-get-top-job/story-e6frfm1i-1225928665163.

- ^ Wilson, Harry (23 September 2010). "Douglas Flint to be HSBC chairman, Michael Geoghegan to leave in radical reshuffle". The Daily Telegraph (London). http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/8021673/Douglas-Flint-to-be-HSBC-chairman-Michael-Geoghegan-to-leave-in-radical-reshuffle.html.

- ^ "Great HSBC reshuffle". http://www.euromoney.com/Article/2676783/Great-HSBC-reshuffle.html.Euromoney

- ^ HSBC Says it Plans to Cut an Additional 25,000 Jobs by 2013

- ^ HSBC significantly cutting staff and operations to save money

- ^ http://www.businessweek.com/news/2011-08-01/hsbc-to-sell-195-branches-to-first-niagara-for-1-billion.html

- ^ Capital One to Buy HSBC Card Unit for $2.6 Billion Premium retrieved on 2011-09-03.

- ^ HSBC to Reap $2.4 Billion Gain From Sale of U.S. Card Division retrieved on 2011-09-03.

- ^ "Hot Brands" The Banker, 4 March 2008

- ^ Fast Facts HSBC Website, 4 April 2008

- ^ Parmy Olson, "Better Safe Than Sorry" Forbes, 21 April 2008

- ^ Bowers, Simon (8 April 2008). "HSBC loses disk with policy details of 370,000 customers". The Guardian (London). http://www.guardian.co.uk/business/2008/apr/08/hsbcholdingsbusiness.banking.

- ^ "The Global 2000" Forbes, 2 April 2008

- ^ "The world's biggest banks". The Economist. 6 July 2006. http://www.economist.com/markets/indicators/displaystory.cfm?story_id=7141354. Retrieved 18 April 2011.

- ^ "Title]" (PDF). http://www.hsbc.com/1/PA_1_1_S5/content/assets/investor_relations/090929_mlconference.pdf. Retrieved 18 April 2011.

- ^ "Independent Auditor's Report to the Member of HSBC Bank plc, HSBC Holdings plc;" (PDF). http://www.hsbc.co.uk/1/PA_1_1_S5/content/uk/pdfs/en/annual_results2010_independent.pdf. Retrieved 28 October 2011.

- ^ "Contact us." HSBC. Retrieved on 12 September 2011. "Global HSBC Group Head OfficeHSBC Group Head Office - London Address: HSBC Holdings plc 8 Canada Square London E14 5HQ"

- ^ Slater, Steve and Michael Flaherty. "HSBC CEO moves to Hong Kong." Reuters. Friday 25 September 2009. Retrieved on 12 September 2011.

- ^ "HSBC GLT frontpage". http://www.hsbcglt.com/. Retrieved 22 August 2008.

- ^ a b "HSBC bank 'to offshore more jobs'". BBC News. 16 March 2005. http://news.bbc.co.uk/2/hi/business/4353423.stm.

- ^ "Man held in HSBC India scam probe". BBC News. 28 June 2006. http://news.bbc.co.uk/1/hi/business/5122886.stm.

- ^ HSBC Private Bank/

- ^ HSBC Premier/

- ^ HSBC Advance/

- ^ "HSBC Bank International Limited". http://offshore.hsbc.com/1/2/home. Retrieved 18 April 2011.

- ^ "HSBCnet". HSBCnet. http://www.hsbcnet.com. Retrieved 18 April 2011.

- ^ "Hsbc Usa". Hsbcdirect.com. 25 January 2010. http://www.hsbcdirect.com/usa. Retrieved 18 April 2011.

- ^ "HSBC Canada". Hsbcdirect.com. 25 January 2010. http://www.hsbcdirect.com/canada. Retrieved 18 April 2011.

- ^ "HSBC Taiwan". Hsbcdirect.com. 25 January 2010. http://www.hsbcdirect.com/taiwan. Retrieved 18 April 2011.

- ^ "HSBC South Korea". Hsbcdirect.com. 25 January 2010. http://www.hsbcdirect.com/southkorea. Retrieved 18 April 2011.

- ^ "HSBC South Korea". Hsbcdirect.com. 25 January 2010. http://www.us.hsbc.com/1/2/1/advance. Retrieved 18 April 2011.

- ^ "HSBC and SOS Children's Villages partnership". Soschildrensvillages.org.uk. 8 October 2005. http://www.soschildrensvillages.org.uk/sos-childrens-charity/our-partners/hsbc-sos-partnership.htm. Retrieved 18 April 2011.

- ^ "Official British & Irish Lions site". Lionsrugby.com. http://www.lionsrugby.com/. Retrieved 18 April 2011.

- ^ "Official Suppliers". wimbledon.org. http://www.wimbledon.org/en_GB/about/infosheets/officialsuppliers.html. Retrieved 12 November 2010.

- ^ "HSBC Named 'Official Banking Partner' of The Open". SponsorPitch. 15 October 2010. http://sponsorpitch.com/articles/1717. Retrieved 12 November 2010.

- ^ HSBC.com

- ^ "About Global Banking and Markets". Hsbcnet.com. http://www.hsbcnet.com/solutions/about-gbm. Retrieved 18 April 2011.

- ^ "Meet Samir Assaf, eFinancialNews". Efinancialnews.com. http://www.efinancialnews.com/story/2010-12-10/hsbc-samir-assaf-profile. Retrieved 18 April 2011.

- ^ Press Clippings, HSBC Guyerzeller website[dead link]

External links

- Business data

- HSBC Holdings plc at Google Finance

- HSBC Holdings plc at Yahoo! Finance

- HSBC Holdings plc at Hoover's

- HSBC Holdings plc at Reuters

- HSBC Holdings plc SEC filings at EDGAR Online

- HSBC Holdings plc SEC filings at the Securities and Exchange Commission

HSBC Group Corporate directors: - Douglas Flint (Group Chairman)

- Stuart Gulliver (Group CEO)

- Safra A. Catz

- Laura Cha

- Vincent Cheng

- Marvin Cheung

- John Coombe

- Rona Fairhead

- Sandy Flockhart

- James Hughes-Hallett

- Sam Laidlaw

- Rachel Lomax

- Iain Mackay

- Gwyn Morgan

- N. R. Narayana Murthy

- Sir Simon Robertson

- John L. Thornton

- Sir Brian Williamson

Brands: - First Direct

- Hang Seng Bank

- HSBC

- HSBC Bank International

- HSBC Premier

- HSBC Private Bank

- HSBC Trinkaus

- M&S Money

- Proa

- SABB

Principal local banks: - Argentina

- Brazil

- Canada

- People's Republic of China

- Egypt

- France

- Germany

- Hong Kong

- Malaysia

- Middle East

- Mexico

- Saudi Arabia

- Republic of China (Taiwan)

- United Kingdom

- United States

Minority stakes and joint ventures: - Bank of Communications (19%)

- HSBC Saudi Arabia (60%)

- British Arab Commercial Bank (47%)

- SABB (40%)

- Ping An Insurance (19.9%)

- Techcombank (15%)

- Bao Viet Holdings (18%)

- Bank of Shanghai (8%)

- Axis Bank (4.99%)

Categories:- Companies listed on the London Stock Exchange

- Companies listed on the Hong Kong Stock Exchange

- Companies listed on the New York Stock Exchange

- Companies listed on the Euronext exchanges

- Companies listed on the Bermuda Stock Exchange

- Hang Seng Index Constituent Stocks

- HSBC

- Banks established in 1865

- Callable Bull/Bear Contracts issued in Hong Kong Stock Exchange

- Companies of Hong Kong

- Credit cards

- Financial services companies based in London

- Investment banks

- Primary dealers

- Registered Banks of New Zealand

- Warrants issued in Hong Kong Stock Exchange

Wikimedia Foundation. 2010.