- National Savings and Investments

-

National Savings and Investments

Type An Executive Agency of the Chancellor of the Exchequer Industry Financial Services Founded 1861 Headquarters 1 Drummond Gate,

London SW1V 2QXProducts Savings and Investments Website nsandi.com For other uses, see National Savings Bank.National Savings and Investments (NS&I), formerly called the Post Office Savings Bank and National Savings, is a state-owned savings bank in the United Kingdom. It is an executive agency of the Chancellor of the Exchequer.[1] The aim of NS&I is to attract funds from individual savers in the UK for the purposes of funding the government’s public sector borrowing requirement (i.e., the funds in excess of taxation that the government requires to fund its activities). NS&I attracts savers through offering saving products with tax free elements on some products, and a 100% guarantee from HM Treasury on all deposits. However, its rates are often low.

Contents

History

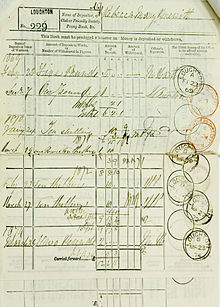

National Savings and Investments was founded by the British government in 1861 as the Post Office Savings Bank, the world's first postal savings system. The aim of the bank was to allow workers "to provide for themselves against adversity and ill-health", and to provide the government with access to debt funding. In 1969 the bank was transferred from the Post Office to the Treasury and its name was changed to National Savings.[2] The name was changed again in 2002 to National Savings and Investments.[3]

Role

NS&I manages around £98 billion in savings[2], 9% of the UK savings market. This accounts for 16% of the UK's national debt.[4] As funds from NS&I are a relatively cheap source of government borrowing, the bank sets interest rates both to attract savers and provide low-cost finance for the government.

Operations

NS&I's head office is in Pimlico, London, with operational sites in Blackpool, Glasgow and Durham. However, its entire back office operation is contracted out to a French company, Atos IT Solutions and Services It was up intill the 1st of july 2011 ran by Siemens IT and Solutions. It offers many of its services through post offices, and was founded in 1861 as a postal savings system.

Current products

NS&I offers a wide range of savings and investment products, specialising in tax-free and income generating products. Besides the very popular Premium Bond, NS&I's range of products includes:

- Premium Bonds

- Individual Savings Account (ISAs) (Direct ISA or Cash ISA)

- Inflation Index-Linked Savings Certificates

- Fixed Interest Savings Certificates

- Income Bonds

- Guaranteed Growth Bonds

- Guaranteed Equity Bonds

- Children's Bonus Bonds

- Direct Saver Account

- Investment Account

- Easy Access Savings Account

NS&I's most popular product, Premium Bonds, celebrated its 50th anniversary in November 2006 when a special 5× £1m jackpot draw was announced. A second 5× £1m jackpot anniversary draw in June 2007 celebrated 50 years since the very first prize draw.

Old products

Products which are no longer on sale with NS&I include:

- Cash ISA

- TESSA-only ISA

- Fixed Rate Savings Bonds

- Pensioners Bonds and Capital Bonds

- Ordinary Account/Treasurer's Account/SAYE/Yearly Plan/Deposit Bonds

- FIRST Option Bonds

- National Savings Stamps and Gift Tokens

Government guarantee

All savings and investment products are 100% backed by HM Treasury.

See also

References

External links

Her Majesty's Treasury Headquarters: 1, Horse Guards Road Ministers

Executive agencies Asset Protection Agency · National Savings and Investments · Office of Tax Simplification · Royal Mint · UK Debt Management OfficeCategories:- HM Treasury

- Banks of the United Kingdom

- Executive agencies of the United Kingdom government

Wikimedia Foundation. 2010.