- Royal Bank of Scotland

-

This article is about the retail bank. For its holding company, see Royal Bank of Scotland Group.Not to be confused with Bank of Scotland.

The Royal Bank of Scotland plc

Banca Rìoghail na h-Alba

Type Public1 Industry Finance and insurance Founded 1727 Headquarters Edinburgh, Scotland, United Kingdom Key people Stephen Hester, Group CEO Products Finance and insurance

Consumer Banking

Corporate BankingEmployees 141,0002 Parent Royal Bank of Scotland Group Website www.rbs.co.uk References: 1 Wholly owned subsidiary of RBS Group.

2 RBS Group total.The Royal Bank of Scotland plc (Scottish Gaelic: Banca Rìoghail na h-Alba[1]) is one of the retail banking subsidiaries of the Royal Bank of Scotland Group plc, and together with NatWest and Ulster Bank, provides branch banking facilities throughout the British Isles. Royal Bank of Scotland has around 700 branches, mainly in Scotland though there are branches in many larger towns and cities throughout England and Wales. The Royal Bank of Scotland and its parent, the Royal Bank of Scotland Group, are completely separate from the fellow Edinburgh based bank, the Bank of Scotland, which pre-dates the Royal Bank of Scotland by 32 years. The Bank of Scotland was effective in raising funds for the Jacobite Rebellion and as a result, The Royal Bank of Scotland was established to provide a bank with strong Hanoverian and Whig ties.

Contents

History

Foundation

Dundas House, designed by Sir William Chambers and built in 1774 for Sir Lawrence Dundas and acquired by the bank in 1821.[2] Registered Head Office of the Royal Bank of Scotland Group in St Andrew Square, Edinburgh.

Dundas House, designed by Sir William Chambers and built in 1774 for Sir Lawrence Dundas and acquired by the bank in 1821.[2] Registered Head Office of the Royal Bank of Scotland Group in St Andrew Square, Edinburgh.

The bank traces its origin to the Society of the Subscribed Equivalent Debt which was set up by investors in the failed Company of Scotland to protect the compensation they received as part of the arrangements of the 1707 Acts of Union. The Equivalent Society became the Equivalent Company in 1724, and the new company wished to move into banking. The British government received the request favourably as the "Old Bank", the Bank of Scotland, was suspected of having Jacobite sympathies. Accordingly the "New Bank" was chartered in 1727 as the Royal Bank of Scotland, with Archibald Campbell, Lord Ilay appointed as its first governor.

In 1728, the Royal Bank of Scotland became the first bank in the world to offer an overdraft facility.

Competition with the Bank of Scotland

Competition between the Old and New Banks was fierce and centred on the issue of banknotes. The policy of the Royal Bank was to either drive the Bank of Scotland out of business or take it over on favourable terms.

The Royal Bank built up large holdings of the Bank of Scotland's notes, which it acquired in exchange for its own notes, and then suddenly presented them to the Bank of Scotland for payment. To pay for these notes the Bank of Scotland was forced to call in its loans and, in March 1728, to suspend payments. The suspension relieved the immediate pressure on the Bank of Scotland at the cost of substantial damage to its reputation, and gave the Royal Bank a clear space to expand its own business, although the Royal Bank's increased note issue also made it more vulnerable to the same tactics.

Despite talk of a merger with the Bank of Scotland, the Royal Bank did not possess the wherewithal to complete the deal. By September 1728, the Bank of Scotland was able to start redeeming its notes again, with interest, and in March 1729, it restarted lending. To prevent similar attacks in the future, the Bank of Scotland put an "option clause" on its notes, giving it the right to make the notes interest-bearing while delaying payment for six months; the Royal Bank followed suit. Both banks eventually decided that the policy they had followed was mutually self-destructive and a truce was arranged, but it still took until 1751 before the two banks agreed to accept each other's notes.

Scottish expansion

The bank opened its first branch office outside Edinburgh in 1783 when the first Glasgow branch opened. Further branches were opened in Dundee, Rothesay, Dalkeith, Greenock, Port Glasgow and Leith during the early 19th century.

In 1821, the bank moved from its original head office in Edinburgh's Old Town to Dundas House, on St Andrew Square in the New Town. The building as seen along George Street forms the eastern end point of the New Town's central vista. It was designed for Sir Lawrence Dundas by Sir William Chambers as a Palladian mansion, completed in 1774. An axial banking hall (Telling Room) added behind the building, designed by John Dick Peddie, was built in 1857. It features a domed roof, painted blue internally, with gold star-shaped coffers.[2] The banking hall continues in use as a branch of the bank, and Dundas House remains the bank's registered head office to this day.

The rest of the 19th century saw the bank pursue mergers with other Scottish banks, mainly in a response to failing institutions. The assets and liabilities of the Western Bank were acquired following its collapse in 1857 and in 1864 the Dundee Banking Co. was acquired. By 1910, the bank had 158 branches and around 900 staff.

In 1969, the bank merged with the National Commercial Bank of Scotland to become the largest clearing bank in Scotland.

Expansion into England

The expansion of the British Empire in the latter half of the 19th century saw the emergence of London as the world's largest financial centre, attracting the Scottish banks to expand south into England. The first London branch of the Royal Bank of Scotland opened in 1874. However, the English banks moved to prevent further expansion by the Scottish banks in England, and after a government committee was set up to examine the matter, the Scottish banks decided to drop their expansion plans. An agreement was reached whereby English banks would not open branches in Scotland; and Scottish banks would not open branches in England outside London. This agreement remained in place until the 1960s, although various cross border acquisitions were permitted.

The Royal Bank's English expansion plans were resurrected after World War I, when it acquired various small English banks, including London based Drummonds Bank in 1924; and Williams Deacon's Bank based in North West England in 1930; and Glyn, Mills & Co. in 1939. The latter two were merged in 1970 to form Williams and Glyn's Bank; and later rebranded as the Royal Bank of Scotland in 1985. Following the financial crisis of 2007–2010, the RBS Group has unveiled plans to resurrect the Williams and Glyn's brand name in preparation for a programme of divestment of its RBS retail banking business in England and its NatWest equivalent in Scotland.[3] However, The Royal Bank subsequently announced plans to sell these branches to Spanish bank Santander. It is anticipated that Santander will integrate the branches under the Santander brand, rather than Williams and Glyn.

Recent history

Main article: Royal Bank of Scotland Group#HistoryOn 20 January 2011, RBS were fined £28.58 million for having engaged in anti-competitive practices with Barclays in relation to the pricing of loan products to large professional services firms.[4]

RBS has recently prevented Basic Account holders from using the ATMs of rival banks.[5]

In October 2011, Moody's Analytics downgraded the credit rating of 12 UK financial firms including RBS blaming financial weakness.[6]

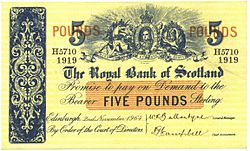

Banknotes

Up until the middle of the 19th century, privately owned banks in Great Britain and Ireland were permitted to issue their own banknotes, and money issued by provincial Scottish,[7] English, Welsh and Irish banking companies circulated freely as a means of payment.[8] While the Bank of England eventually gained a monopoly for issuing banknotes in England and Wales, Scottish banks retained the right to issue their own banknotes and continue to do so to this day. The Royal Bank of Scotland, along with Clydesdale Bank and Bank of Scotland, still prints its own banknotes

Notes issued by Scottish banks circulate widely and may be used as a means of payment throughout Scotland and the rest of the United Kingdom; although they do not have the status of legal tender they are accepted as promissory notes. It should be noted that no paper money is legal tender in Scotland, even that issued by the Bank of England (which is legal tender in England and Wales).

The "Ilay" series (1987)

The current series of Royal Bank of Scotland notes was originally issued in 1987. On the front of each note is a picture of Lord Ilay (1682–1761), the first governor of the bank. The image is based on a portrait of Lord Ilay painted in 1744 by the Edinburgh artist Allan Ramsay.[9]

The front of the notes also include an engraving of the facade of Sir Laurence Dundas's mansion in St. Andrew Square, Edinburgh, which was built by Sir William Chambers in 1774 and later became the bank's headquarters, the bank's coat of arms and the 1969 arrows logo and branding. The background graphic on both sides of the notes is a radial star design which is based on the ornate ceiling of the banking hall in the old headquarters building, designed by John Dick Peddie in 1857.[10][11]

On the back of the notes are images of Scottish castles, with a different castle for each denomination:[10]

Current issue in circulation are:

- 1 pound note featuring Edinburgh Castle

- 5 pound note featuring Culzean Castle

- 10 pound note featuring Glamis Castle

- 20 pound note featuring Brodick Castle

- 50 pound note featuring Inverness Castle (introduced in 2005)

- 100 pound note featuring Balmoral Castle

Commemorative banknotes

Occasionally the Royal Bank of Scotland issues special commemorative banknotes to mark particular occasions or to celebrate famous people. The Royal Bank was the first British bank to print commemorative banknotes in 1992, and followed with several subsequent special issues. These notes are much sought-after by collectors and they rarely remain long in circulation. Examples to date have included:[12][13]

- a £1 note to mark the meeting of the Council of the European Union in Holyrood Palace during the UK's Presidency of the Council of the European Union (1992)

- a £1 note to mark the 100th Anniversary of the death of Robert Louis Stevenson (1994)

- a £1 note to mark the 150th Anniversary of the birth of Alexander Graham Bell (1997)

- a £20 note for the 100th birthday of Queen Elizabeth, the Queen Mother (2000)

- a £5 note honouring veteran golfer Jack Nicklaus in his last competitive Open Championship at St Andrews (2005).

- a £1 note to mark the opening of the Scottish Parliament, depicting the General Assembly Hall of the Church of Scotland, the temporary home of the parliament, and a diagram of the floorplan of the new parliament building, designed by Enric Miralles (1999)

Branding

RBS branding on a branch in Jersey

RBS branding on a branch in Jersey

The RBS Group uses branding developed for the Bank on its merger with the National Commercial Bank of Scotland in 1969.[14] The Group's logo takes the form of an abstract symbol of four inward-pointing arrows known as the "Daisy Wheel" and is based on an arrangement of 36 piles of coins in a 6 by 6 square,[14] representing the accumulation and concentration of wealth by the Group.[14] The Daisy Wheel logo was later adopted by RBS subsidiaries Worldpay, Ulster Bank in Ireland and Citizens Financial Group in the United States.

Since 2006, the brand has moved away from referring to both the Group brand and its retail banking brand as the "Royal Bank of Scotland", instead using the "RBS" initialism. This is intended to support the positioning of the bank as a Global financial services player as opposed to its roots as a national bank. An example of the current branding can be found in the Six Nations Championship in rugby union, which it sponsors as the RBS 6 Nations. However, "Royal Bank of Scotland" is still used alongside the RBS initialism, with both appearing on bank signage.

RBS sponsored the Williams F1 team from 2005 until the end of 2010.[15] They also were the title sponsor for the Canadian Grand Prix from 2005 until the end of 2008. They have supported tennis player Andy Murray since he was aged 13.[16]

References

- ^ Token and symbolic use of the Scottish Gaelic name occurs on some Royal Bank of Scotland plc buildings and customer stationery such as cheque books. Gaelic is not used on the RBS website, for contracts or on their banknotes.

- ^ a b "Dundas Mansion, Edinburgh, RBS branch, headquarters, Scotland". http://www.edinburgharchitecture.co.uk/dundas_mansion.htm. Retrieved 2009-05-21.

- ^ Dey, Iain (2009-09-13). "RBS to relaunch historic Williams & Glyn's brand after 24 year absence". London: The Times. http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article6832279.ece. Retrieved 2009-09-29.

- ^ "RBS fined £28m for price fixing with Barclays", Banking Times, 2011-01-20, http://www.bankingtimes.co.uk/2011/01/20/rbs-fined-28m-for-price-fixing-with-barclays/, retrieved 2011-01-20

- ^ "Bank customers face rival ATM ban". 18 August 2011. http://www.google.com/hostednews/ukpress/article/ALeqM5h5pVfo9EyXkfEu2LbpJut_vyhUpQ?docId=N0443801313595746468A. Retrieved 18 August 2011.

- ^ UK financial firms downgraded by Moody's rating agency, BBC (7 October 2011)

- ^ "Bank of Scotland 'family tree'". HBOS History. http://www.hbosplc.com/abouthbos/History/BoS_family_tree.asp. Retrieved 2007-10-08.

- ^ "British Provincial Banknotes". pp. 1–6. http://homepage.ntlworld.com/trev.rh/Notes/prov.htm. Retrieved 2007-10-08.

- ^ "Allan Ramsay: Archibald Campbell, 3rd Duke of Argyll, 1682 - 1761. Statesman". National Galleries of Scotland - Scottish National Portrait Gallery. 2008. http://www.nationalgalleries.org/index.php/collection/on_loan/4:318/results/50/1756/. Retrieved 2008-10-14.

- ^ a b "Our Banknotes - The Ilay Series". The Royal Bank of Scotland Group. 2008. http://www.rbs.com/about-rbs/g2/heritage/our-banknote/banknote-history/banknote-issues.ashx. Retrieved 2010-01-20.

- ^ "Dundas Mansion, Edinburgh". Edinburgh Architecture. http://www.edinburgharchitecture.co.uk/dundas_mansion.htm. Retrieved 2008-10-14.

- ^ "Royal Bank Commemorative Notes". Rampant Scotland. http://www.rampantscotland.com/SCM/royalcomm.htm. Retrieved 2008-10-14.

- ^ "Scottish Parliament Commemorative Bank Note". Rampant Scotland. http://www.rampantscotland.com/SCM/may12.htm. Retrieved 2008-10-15.

- ^ a b c RBS.com | About Us| Our History | Exhibition Feature | Building the Brand

- ^ Bose, Mihir (2009-02-25). "RBS cutbacks to hit British sport". BBC News. http://news.bbc.co.uk/sport1/hi/motorsport/formula_one/7911039.stm.

- ^ Bose, Mihir (2009-02-25). "RBS cutbacks to hit British sport". BBC News. http://news.bbc.co.uk/sport1/hi/motorsport/formula_one/7911039.stm.

External links

- Royal Bank of Scotland Website

- Royal Bank of Scotland companies grouped at OpenCorporates

- Website of the Year 2007 - Winner Best Finance Site

Royal Bank of Scotland Group Banking: Adam & Company · Child & Co. · Citizens Bank · Coutts & Co. · Drummonds Bank · First Active · Isle of Man Bank · Mint · National Westminster Bank · Royal Bank of Scotland · Royal Bank of Scotland International · The One account · Ulster Bank · X-iteInsurance and Motoring: Churchill Insurance · Devitt Insurance · Direct Line · Finsure · Green Flag · Jamjarcars · Lombard Direct · NIG · Privilege · Tracker · UKI PartnershipsCorporate and Payment Services: RBS Aviation Capital · RBS Securities · RBS WorldPayAnnual Group Revenue: £25.8 billion GBP ( £24.1 billion FY 2008) · Employees: 199,500 · Stock Symbol: LSE: RBS · Website: www.rbs.com

£24.1 billion FY 2008) · Employees: 199,500 · Stock Symbol: LSE: RBS · Website: www.rbs.comLinks to related articles Banks of Scotland Adam and Company · Airdrie Savings Bank · Bank of Scotland · Clydesdale Bank · Halifax · Intelligent Finance · Lloyds TSB Scotland · Royal Bank of Scotland · Tesco Bank

Banknotes of the pound sterling England and Wales Scotland - Bank of Scotland

- Royal Bank of Scotland

- Clydesdale Bank

Northern Ireland British Crown Dependencies British Overseas Territories

(at parity with Sterling)See also Investment banks Divisions of

universal banksBank of America Merrill Lynch · Barclays Capital · Citi Institutional Clients Group · Credit Suisse · Deutsche Bank Corporate and Investment Bank · J.P. Morgan & Co. (J.P. Morgan Cazenove) · UBS Investment BankOtherBMO Capital Markets · BOC International · BNP Paribas Corporate and Investment Banking · Brown Shipley · CIBC World Markets · CITIC Securities · Commerzbank Corporates & Markets · Crédit Agricole Corporate and Investment Bank (CLSA) · Daiwa Securities Capital Markets · Harris Williams & Co. · HSBC Global Banking and Markets · ING Commercial Banking · KBC Bank · Korea Development Bank (Daewoo Securities) · Lloyds Bank Corporate Markets · Mitsubishi UFJ Securities · Mizuho Corporate Bank · Morgan Keegan & Company · Natixis · Nomura Securities · RBC Capital Markets · RBS Global Banking & Markets · Société Générale Corporate & Investment Bank · Standard Chartered · TD Securities · UniCredit Corporate & Investment Banking · VTB Capital · Wells Fargo SecuritiesIndependents OtherAllen & Company · Blackstone Group · Brewin Dolphin · BTG Pactual · Centerview Partners · China International Capital Corporation · Close Brothers Group · Evercore Partners · FBR Capital Markets · Greenhill & Co. · Houlihan Lokey · Investec Bank · Jefferies & Company · Keefe, Bruyette & Woods · Lazard · Macquarie Group · Mediobanca · Moelis & Company · N M Rothschild & Sons · Oppenheimer & Co. · Perella Weinberg Partners · Piper Jaffray · Raymond James Financial · Renaissance Capital · ROTH Capital Partners · Sandler O'Neill and Partners · Stifel Nicolaus · Troika Dialog · William Blair & Company Category ·

Category ·  List

ListMembers of Euro Banking Association Austria Allgemeine Sparkasse Oberösterreich · Bank für Tirol und Vorarlberg AG · BKS Bank AG · Erste Group Bank AG · Oberbank AG · Oesterreichische Nationalbank · Raiffeisen Zentralbank Österreich AG · Raiffeisenlandesbank Oberösterreich AG · Raiffeisen-Landesbank Tirol Aktiengesellschaft · Steiermärkische Bank und Sparkassen AGBelgium Cyprus Denmark Amagerbanken A/S · Arbejdernes Landsbank A/S · Danske Andelskassers Bank A/S · Danske Bank A/S · DiBa Bank A/S · Djurslands Bank A/S · Jyske Bank A/S · Nordjyske Bank A/S · Nørresundby Bank · Østjydsk Bank A/S · Ringkjøbing Landbobank · Roskilde Bank A/S · Skjern Bank · Spar Nord Bank · Sparekassen Sjælland · Sydbank A/S · Vestfyns Bank A/S · Vestjysk BankFinland Aktia Bank PLC · Bank of Åland PLC · Nordea Bank Finland PLC · Pohjola Bank PLC · S-Bank LTD. · Tapiola Bank LTDFrance Banque Michel Inchauspé - BAMI · Banque Palatine · BNP Paribas SA · BPCE · BRED Banque Populaire · Crédit Agricole SA · Crédit Coopératif · Crédit du Nord · Crédit Mutuel Arkéa · Credit Mutuel CIC Banque · HSBC France · La Banque Postale · Natixis · Société GénéraleGermany Berenberg Bank · BHF Bank · Bremer Landesbank · Commerzbank AG · Deutsche Bank AG · Deutsche Bundesbank · Deutsche Postbank · DZ Bank AG · Europe Arab Bank Frankfurt · Hamburger Sparkasse AG · J.P. Morgan Chase Bank AG · Landesbank Baden-Württemberg · Landesbank Berlin Holding · Landesbank Hessen-Thüringen · Oldenburgische Landesbank · SECB Swiss EURO CLEARING Bank GmbH · The Bank of New York Mellon, Frankfurt Branch · VTB Bank (Deutschland) AG · WestLB AGGreece Hungary Ireland Italy Banca Agricola Popolare di Ragusa · Banca del Fucino · Banca del Piemonte · Banca delle Marche S.p.A. · Banca di Imola S.p.A. · Banca di Romagna S.p.A. · Banca d'Italia · Monte dei Paschi di Siena · Banca Monte Parma · Banca Nazionale del Lavoro · Banca Popolare del Lazio · Banca Popolare dell'Emilia Romagna · Banca Popolare di Milano · Banca Popolare di Sondrio · Banca Popolare di Spoleto · Banca Popolare di Vicenza · Banca Sella · Bancaperta S.p.A. · Banco Popolare Società Cooperativa · Cassa di Risparmio della Provincia di Chieti S.p.A. · Cassa di Risparmio della Provincia di Teramo S.p.A. · Cassa di Risparmio di Cesena S.p.A. · Cassa di Risparmio di Fermo S.p.A. · Cassa di Risparmio di Ferrara S.p.A. · Cassa di Risparmio di Loreto S.p.A. · Cassa di Risparmio di Ravenna S.p.A. · Credito Emiliano S.p.A. · ICCREA Banca · Intesa Sanpaolo · Istituto Centrale delle Banche Popolari Italiane · Raiffeisen Landesbank Südtirol – Cassa Centrale Raiffeisen dell'Alto Adige · Südtiroler Volksbank – Banca Popolare dell'Alto Adige · UBI Banca · UGF Banca · UniCredit · Veneto BancaLuxembourg Banque et Caisse d'Épargne de l'État · Banque Raiffeisen · Dexia Banque Internationale à Luxembourg SA · KBL European Private Bankers S.A. · Société Générale Bank & TrustNetherlands Poland Portugal Banco BPI SA · Banco Comercial Português · Banco Espírito Santo · Caixa Central de Crédito Agrícola Mutuo · Caixa Geral de DepósitosSlovenia Spain Banco Bilbao Vizcaya Argentaria SA · Banco Cooperativo Español SA · Banco Sabadell · Banco Español de Credito · Banco Pastor SA · Banco Popular Español SA · Banco Santander, SA · Bankinter SA · Bilbao Bizkaia Kutxa · Caixa de Aforros de Galicia, Vigo, Ourense e Pontevedra (NovaCaixaGalicia) · Caixa d'Estalvis de Catalunya, Tarragona i Manresa · Caixa d'Estalvis i Pensions de Barcelona (La Caixa) · Caja de Ahorros del Mediterráneo · Caja Gipuzkoa San Sebastian · Caja Laboral Popular Coop. de Credito · Caja Madrid · Confederacion Española de Cajas de Ahorros · Ipar Kutxa RuralSweden United Kingdom Bank of America NA · Bank of Tokyo-Mitsubishi UFJ Ltd. · Barclays Bank PLC · Citibank NA · HSBC Bank PLC · Kookmin Bank International Ltd. · Lloyds TSB Bank PLC · National Australia Bank Limited · National Westminster Bank PLC · Royal Bank of Scotland PLC · Standard Chartered Bank · UBS AG · Wells Fargo Bank NANon-EU Categories:- Royal Bank of Scotland Group

- Companies based in Edinburgh

- Banknote issuers of the United Kingdom

- Early Modern Scotland

- Government-owned companies in the United Kingdom

- Banks established in 1727

- William Chambers buildings

- British brands

- Scottish brands

- 1727 establishments in Scotland

Wikimedia Foundation. 2010.