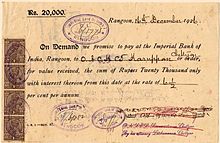

- Promissory note

-

A promissory note is a negotiable instrument, wherein one party (the maker or issuer) makes an unconditional promise in writing to pay a determinate sum of money to the other (the payee), either at a fixed or determinable future time or on demand of the payee, under specific terms.

Referred to as a note payable in accounting, or commonly as just a "note", it is internationally regulated by the Convention providing a uniform law for bills of exchange and promissory notes. Bank note is frequently referred to as a promissory note: a promissory note made by a bank and payable to bearer on demand.

Contents

Overview

The terms of a note usually include the principal amount, the interest rate if any, the parties, the date, the terms of repayment (which could include interest) and the maturity date. Sometimes, provisions are included concerning the payee's rights in the event of a default, which may include foreclosure of the maker's assets. Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days notice before the payment is due. For loans between individuals, writing and signing a promissory note are often instrumental for tax and record keeping.

International law

Definition and usage of promissory notes are internationally established by the Convention providing a uniform law for bills of exchange and promissory notes, signed in Geneva in 1930.[1] Article 75 of the treaty stated that a promissory note shall contain:

- the term "promissory note" inserted in the body of the instrument and expressed in the language employed in drawing up the instrument;

- an unconditional promise to pay a determinate sum of money;

- a statement of the time of payment;

- a statement of the place where payment is to be made;

- the name of the person to whom or to whose order payment is to be made;

- a statement of the date and of the place where the promissory note is issued;

- the signature of the person who issues the instrument (maker).

United States law

A promissory note issued by the Second Bank of the United States, December 15, 1840, for the amount of $1,000

A promissory note issued by the Second Bank of the United States, December 15, 1840, for the amount of $1,000

In the United States, a promissory note that meets certain conditions is a negotiable instrument regulated by article 3 of the Uniform Commercial Code. Negotiable promissory notes are used extensively in combination with mortgages in the financing of real estate transactions. Promissory notes, or commercial papers, are also issued to provide capital to businesses. However, Promissory Notes act as a source of Finance to the company's creditors.

The various State law enactments of the Uniform Commercial Code define what is and what is not a promissory note, in section 3-104(d):

“ § 3-104. NEGOTIABLE INSTRUMENT. ...

(d) A promise or order other than a check is not an instrument if, at the time it is issued or first comes into possession of a holder, it contains a conspicuous statement, however expressed, to the effect that the promise or order is not negotiable or is not an instrument governed by this Article.

” Thus, a writing containing such a disclaimer removes such a writing from the definition of negotiable instrument, instead simply memorializing a contract.

British law

“ § 83. BILLS OF EXCHANGE ACT 1882. Part IV.[2] ...

Promissory note defined

(1)A promissory note is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on demand or at a fixed or determinable future time, a sum certain in money, to, or to the order of, a specified person or to bearer.

(2)An instrument in the form of a note payable to maker’s order is not a note within the meaning of this section unless and until it is indorsed by the maker.

(3)A note is not invalid by reason only that it contains also a pledge of collateral security with authority to sell or dispose thereof.

(4)A note which is, or on the face of it purports to be, both made and payable within the British Islands is an inland note. Any other note is a foreign note.

” History

Common prototypes of bills of exchanges and promissory notes originated in China. Here, in the 8th century during the reign of the dynasty Tang used special instruments – feitsyan for the safe transfer of money over long distances. Later such document for money transfer used by Arab merchants, who had used the prototypes of bills of exchange – suftadja and hawala in 10–13th centuries, then such prototypes had used by Italian merchants in the 12th century. In Italy in 13–15th centuries bill of exchange and promissory note obtain their main features and further phases of its development have been associated with France (16–18th centuries, where the endorsement had appeared) and Germany (19th century, formalization of Exchange Law). In England (and later in the U.S.) Exchange Law was different from continental Europe because of different legal systems.[citation needed]

Historically, promissory notes have acted as a form of privately issued currency. The first evidence of a promissory note being issued is that which Ginaldo Giovanni Battista Stroxxi issued in Medina del Campo (Spain), against the city of Besançon in 1553.[3] However, there exists notice of promissory notes being in used in the Mediterranean commerce well before that date. Tradition has it that the first one ever was signed in Milan in 1325. There's constance of promissory notes being issued in 1384 between Genova and Barcelona, although the letters themselves are lost. The same happens for the ones issued in Valencia in 1371 by Bernat de Codinachs for Manuel d'Entença, a merchant from Huesca (then part of the Crown of Aragon), amounting a total of 100 florins.[4] In all these cases, the promissory notes were used as a rudimentary system of paper-money, for the amounts issued could not be easily transported in metal coins between the cities involved.

Difference from IOU

Promissiory notes differ from IOUs in that they contain a specific promise to pay, rather than simply acknowledging that a debt exists. In common speech, other terms, such as "loan," "loan agreement," and "loan contract" may be used interchangeably with "promissory note" but these terms do not have the same legal meaning.

Difference from loan contract

Whereas promissory notes are evidence of a loan, they are not loan contract. In fact the loan contract is legally distinct from promissory notes, and contains all the terms and conditions of the loan agreement.[5]

See also

- Bank note

- Treasury note

- Bond (finance)

- Credit card

- Letter of credit

- Student loan

- Warrant (of Payment)

References

- ^ http://www.jus.uio.no/english/services/library/treaties/09/9-03/bills-exchange-notes.xml

- ^ [1][2]

- ^ http://www.delsolmedina.com/La%20primera%20letra%20de%20cambio.htm)

- ^ As noted by Manuel Sanchis Guarner in La Ciutat de València. Ajuntament de València, València. Cinquena Edició 1989, plana 172. Quote in Catalan

Onorables senyors, nosaltres havem pres ací en Monsó, C florins de cambi de mossén Manuel d'Entença..., vos plàcia complir e donar aquí en València, per ell al honrat En Bernat de Codinachs, vista la present. Per la lletra que us enviam, vos fem saber aquells havíem ops. Plàtia-us, senyors, aquest cambi aja bon compliment.

- ^ [3], As explained here, loan agreements contain all the terms and conditions of the loan contract, making them legally distinct from the promissory note.

Categories:- Personal finance

- Real estate

- Legal documents

- Negotiable instrument law

- Securities

- Notes

Wikimedia Foundation. 2010.