- Student loan

-

A student loan is designed to help students pay for university tuition, books, and living expenses. It may differ from other types of loans in that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in education. It also differs in many countries in the strict laws regulating re-negotiating and bankruptcy.

Contents

United States

In the United States, there are three types of student loans: two of them are federally subsidized and unsubsidized sponsored by the federal government and the other type is private student loans.[1]The unsubsidized program allows students to borrow money with interest accruing during school and subsidized loans allow them to defer interest accrual until they are no longer in school. Student loans may be offered as part of a total financial aid package that may also include grants, scholarships, and/or work study opportunities. Private lenders are also currently guaranteed a return on their investment due to legislatively enacted changes in 2005, prohibiting the discharge of any student loan, unless the debtor is able to demonstrate "undue hardship."[2]

Income Based Repayment

The Income Based Repayment plan is an alternative to paying back student loans, which allow the borrower to pay back the loan based on how much he/she makes, and not based how much money is actually owed.[3]

Qualification

Most college students in the United States qualify for some type of student loan, although the amount they can borrow may vary based on several factors. Income level, parents' income level, and other financial considerations are all weighed to determine the amount they are eligible to borrow under the federal student loan program.

Repayment

A student loan has major differences over conventional loans - 6% interest rates (higher than most home loans) and inability to negotiate. The interest rate on a student loan will generally be at least two percentage points lower than the going market rate for conventional loans, but this will vary somewhat.

Repayment typically begins anywhere from six to twelve months after a student leaves school, regardless of whether or not they complete their degree program. In some cases, repayment begins if course load drops to half time or less, so it is important to check the exact terms and conditions of any student loan.

The student may have multiple options for extending the repayment period, although an extension of the loan term will likely reduce the monthly payment, it will also increase the amount of total interest paid on the principle balance during the life of the loan. Extension options include extended payment periods offered by the original lender and federal loan consolidation. There are also other extension options including income sensitive repayment plans and hardship deferments. Extensions and consolidation will also add to the principle, many times the unpaided interest and penalties becomes capitalized.

The Master Promissory Note is an agreement between the lender and the borrower that promises to repay the loan. It is a binding legal contract. Direct student loans can be obtained by filling out the government FAFSA form, and each school will determine eligibility of a student for direct federal loans.[citation needed]

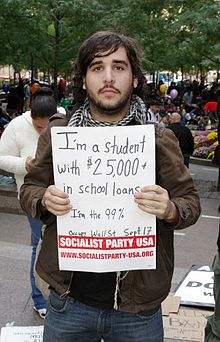

Criticism

In coverage through established media outlets, many borrowers have expressed feelings of victimization by the student loan corporations.[4][5][6] There is a comparison between these accounts and the college credit card trend in America during the 2000s, though the amounts owed by students on their student loans are almost always higher than the amount owed on credit cards.[7] Many anecdotal accounts of the hardships caused by excessive student loan debt levels are chronicled by the organization Student Loan Justice which is founded and led by consumer rights advocate and author, Alan Collinge. [8]

The legislation which covers repayment of student loans is 11 U.S.C. § 523. This legislation directs that student loans are not discharged in any bankruptcy proceeding unless the bankrupt can demonstrate "undue hardship" which is left to the sole discretion of the particular judge hearing the case. [9] There are many documented cases of Americans committing extreme actions because of large student loan balances. This seems particularly true in the case of private loan balances.[10] After the passage of the bankruptcy reform bill of 2005, even private student loans are not discharged during bankruptcy. This provided a credit risk free loan for the lender, averaging 7 percent a year. [11]

In 2007, the Attorney General of New York State, Andrew Cuomo, led an investigation into lending practices and anti-competitive relationships between student lenders and universities. Specifically, many universities steered student borrowers to "preferred lenders" which resulted in those borrowers incurring higher interest rates. Some of these "preferred lenders" allegedly rewarded university financial aid staff with "kick backs." This has led to changes in lending policy at many major American universities. Many universities have also rebated millions of dollars in fees back to affected borrowers.[12][13]

The biggest lenders, Sallie Mae and Nelnet, are frequently criticized by borrowers. Despite the fact that Representative and Speaker of the U.S. House John Boehner is one of their biggest political allies,[14] these lenders often find themselves embroiled in lawsuits, the most serious of which was filed in 2007. The False Claims Suit was filed on behalf of the federal government by former Department of Education researcher, Dr. Jon Oberg, against Sallie Mae, Nelnet, and other lenders. Oberg argued that the lenders overcharged the U.S. Government and defrauded taxpayers of millions and millions of dollars. In August of 2010, Nelnet settled the lawsuit and paid $55 million. [15]

The New York Times recently published an editorial endorsing the return of bankruptcy protections for private student loans in response to the economic downturn and universally increasing tuition at all colleges and graduate institutions. [16]

Australia

Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. The debt does not attract normal interest, but grows with CPI inflation. Discounts are available for early repayment. The scheme is available to citizens and permanent residents. Means-tested scholarships for living expenses are also available. Special assistance is available to indigenous students.[17]

There has been criticism that the HECS-HELP scheme creates an incentive for people to leave the country after graduation, because those who do not file an Australian tax return do not make any repayments.

United Kingdom

See also

- College tuition in the United States

- EdFund

- Free education

- Higher Education Price Index

- Post-secondary education

- Private university

- Student benefit

- Student debt

- Student loans in the United States

- Tuition agency

- Tuition center

- Tuition fees

- Tuition freeze

References

- ^ Kantrowitz, Mark (2010-03-26). "Student Loans - The New York Times". Nytimes.com. http://www.nytimes.com/info/student-loans/?inline=nyt-classifier. Retrieved 2010-09-07.

- ^ http://www.studentloanborrowerassistance.org/bankruptcy/

- ^ http://studentaid.ed.gov/PORTALSWebApp/students/english/IBRPlan.jsp

- ^ "Student Loan Stories . NOW on PBS". Pbs.org. http://www.pbs.org/now/shows/525/student-loan-stories.html. Retrieved 2010-09-07.

- ^ "Anderson Cooper 360: Blog Archive - Student Loan Nightmare: Help Wanted « - CNN.com Blogs". Ac360.blogs.cnn.com. http://ac360.blogs.cnn.com/2009/03/30/student-loan-nightmare-help-wanted/. Retrieved 2010-09-07.

- ^ Fetterman, Mindy (2006-11-22). "Young people struggle to deal with kiss of debt". Usatoday.Com. http://www.usatoday.com/money/perfi/credit/2006-11-19-young-and-in-debt-cover_x.htm. Retrieved 2010-09-07.

- ^ by Kurt SollerFebruary 17, 2009 (2009-02-17). "Credit Card Issuers Still Target College Students". Newsweek. http://www.newsweek.com/id/185210. Retrieved 2010-09-07.

- ^ http://www.studentloanjustice.org/

- ^ "Liz Pulliam Weston: Good and bad student loan debt - MSN Money". Articles.moneycentral.msn.com. http://articles.moneycentral.msn.com/CollegeAndFamily/CutCollegeCosts/weston-stuck-with-student-loans-for-life.aspx?ucpg=7. Retrieved 2010-09-07.

- ^ "College grads take extreme measures to repay student loans". http://www.walletpop.com. http://www.walletpop.com/2010/05/03/repaying-student-loans-leads-college-grads-to-extreme-steps/. Retrieved 2011-4-15.

- ^ Collinge, Alan. The student loan scam : the most oppressive debt in U.S. history, and how we can fight back. Boston, MA : Beacon Press, c2009. ISBN 9780807042298 http://lccn.loc.gov/2008012230

- ^ "Cuomo: School loan corruption widespread". U.S.A. Today. April 10, 2007. http://www.usatoday.com/money/industries/banking/2007-04-10-cuomo-student-loan-probe_N.htm. Retrieved 2008-04-08.

- ^ Lederman, Doug (May 15, 2007). "The First Casualty". Inside Higher Education. http://www.insidehighered.com/news/2007/05/15/texas. Retrieved 2008-04-08.

- ^ http://www.washingtonpost.com/wp-dyn/content/article/2006/01/28/AR2006012801009.html

- ^ Field, Kelly (August 15, 2010). "Nelnet to Pay $55 Million to Resolve Whistle Blower Lawsuit". The Chronicle of Higher Education. http://chronicle.com/article/Nelnet-to-Pay-55-Million-to/123912/. Retrieved 2011-14-07.

- ^ "Relief for Student Debtors". The New York Times. 2011-08-26. http://www.nytimes.com/2011/08/27/opinion/relief-for-student-debtors.html?_r=1&scp=1&sq=student%20loans&st=Search.

- ^ "Paying for your studies (HELP loans)". Goingtouni.gov.au. http://www.goingtouni.gov.au/Main/Quickfind/PayingForYourStudiesHELPLoans/Default.htm. Retrieved 2010-09-07.

Further reading

- Manning, Robert D. (1999). “Credit Cards on Campus: The Social Costs and Consequences of Student Debt.” Washington, D.C.: Consumer Federation of America.

- Schemo, Diana Jean, "Private Loans Deepen a Crisis in Student Debt", The New York Times, June 10, 2007

- "New Default Rate Data for Federal Student Loans: 44% of Defaulters Attended For-Profit Institutions", The Pew Charitable Trusts, Project on Student Debt, Berkeley, California, December 15, 2009

External links

- "UNITED NATIONS: Education Policy and Reform"

- "Big Money On Campus". U.S. News & World Report. October 19, 2003.

- "College, Inc.", PBS FRONTLINE documentary, May 4, 2010

- "Federal Loan Consolidation"

Categories:- Student loan systems by country

- Debt

- Education finance

Wikimedia Foundation. 2010.