- BB&T

-

Not to be confused with Basal Body Temperature.Not to be confused with Blakinger, Byler & Thomas, P.C..

BB&T Corporation

Type Public (NYSE: BBT)

S&P 500 ComponentIndustry Finance, Investments, and Insurance Founded 1872 Headquarters Winston-Salem, North Carolina, United States Area served North Carolina, South Carolina, Virginia, Maryland, West Virginia, Kentucky, Tennessee, Georgia, Florida, Alabama, Indiana, Texas, Washington, D.C. Key people Kelly S. King

(Chairman and CEO)Products Commercial banking, Investment banking Revenue  US$11.1B (FY 2010)[1]

US$11.1B (FY 2010)[1]Net income  US$816M (FY 2010)[1]

US$816M (FY 2010)[1]Total assets  US$157B (FY 2010)[2]

US$157B (FY 2010)[2]Total equity  US$16.5B (FY 2010)[2]

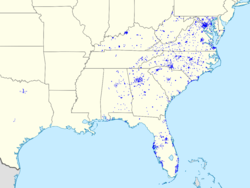

US$16.5B (FY 2010)[2]Employees 31,603 Website www.bbt.com BB&T Corporation (Branch Banking & Trust) (NYSE: BBT) is an American bank with assets of $157 billion (March 2011), offering full-service commercial and retail banking services along with other financial services like insurance, investments, retail brokerage, mortgage, corporate finance, consumer finance, payment services, international banking, leasing and trust. Based in Winston-Salem, North Carolina, BB&T operates more than 1,850 financial centers in the United States of North Carolina, South Carolina, Virginia, Maryland, West Virginia, Kentucky, Tennessee, Georgia, Florida, Alabama, Indiana, Texas, and in Washington, D.C..

It is also notable for certain ideological stances taken by its management, and for its financial support of academic programs teaching the philosophy of Ayn Rand.[3]

In June 2009, its chairman, John A. Allison IV delivered a keynote address to a meeting of the center-right Competitive Enterprise Institute, where he said government regulation caused the 2007-2009 financial collapse.[4] The bank had been forced to accept $3.1 billion in bailout money through the U.S. Treasury's Troubled Asset Relief Program.[5]

Earlier, in 2006, BB&T said it wouldn't lend money for commercial projects on property acquired through eminent domain. This was a reaction to the United States Supreme Court's decision in Kelo v. New London in 2005 that such transfers are permissible.

Contents

History

BB&T headquarters in Winston-Salem, North Carolina

BB&T headquarters in Winston-Salem, North Carolina

Typical branch office. Located in Lexington, North Carolina

Typical branch office. Located in Lexington, North Carolina

BB&T's beginnings date back to 1872, when Alpheus Branch and Thomas Jefferson Hadley founded the "Branch and Hadley" merchant bank in their small hometown of Wilson, North Carolina. After many transactions, mostly with local farmers, Branch bought out Hadley's shares in 1887 and renamed the company to "Branch and Company, Bankers". Two years later, Branch, his father-in-law Gen. Joshua Barnes, Hadley, and three other men, secured a charter from the North Carolina General Assembly to operate the "Wilson Banking and Trust Company". After numerous additional name changes, the company finally settled on the name "Branch Banking and Company". Branch remained an active member in the company until his death in 1893.

In 1900, all of Branch's banking companies consolidated as Branch Banking and Company, allowing the institution to expand its services. In 1902 a savings department was created and in 1907 a trust department was authorized; this made Branch's company the first in the state to engage in trust activities. The bank made its final name change in 1913 to "Branch Banking and Trust", or BB&T, to reflect its new activities.

BB&T sold Liberty Bonds during World War I and grew to have more than $4 million in assets by 1923. An insurance division was added in 1922, followed by a mortgage division in 1923. As banks across the nation failed as a result of the 1929 Stock Market Crash, BB&T survived; it was the only one to do so in the town of Wilson.

World War II revived BB&T. BB&T's prosperity continued into the 1960s, as mergers and acquisitions grew the company to $343 million in assets with new branches in 35 cities. By 1994, BB&T had become North Carolina's largest bank with $10.5 billion in assets and 263 offices in 138 cities in the Carolinas, though it has since slipped to second behind Bank of America.

In 1995, BB&T and Southern National Bank, another bank with roots in the eastern part of the state, completed a "merger of equals." In an unusual arrangement, the holding company retained the Southern National name for a few years, but all of its banks took the BB&T name. This gave the new BB&T 437 branches in 220 cities in the Carolinas and Virginia. The bank continued to expand nationwide through the 1990s, purchasing Fidelity Federal Bankshares, First Financial of Petersburg, Maryland Federal Bancorp and Franklin Bancorporation in the Virginia/Maryland area. In 1999, BB&T acquired MainStreet Financial Corp. of Martinsville, and Mason-Dixon Bancshares of Westminster, and further expanded into Georgia and West Virginia after purchasing First Liberty of Macon and Matewan Bancshares. The latter deal made BB&T the largest bank in West Virginia, a position it has held on to since.[6]

From 2000 to 2005, BB&T acquired numerous smaller banks, expanding into Tennessee, Kentucky, and even Florida. By Dec. 31, 2005, BB&T Corporation had secured $109.2 billion in assets; operated more than 1,500 banking offices in 11 states and the District of Columbia; and had more than 28,000 employees.

In early 2007 BB&T acquired Coastal Federal Bank which is primarily located in Myrtle Beach, South Carolina. It has been one of the Carolina's fastest growing banks. After BB&T's announcement of an opportunity for a "merger of equals" it was speculated that it would be a merger with either Regions Financial of Birmingham or Fifth Third of Cincinnati.

In late 2008 the bank accepted $3.1 billion in bailout money through the sale of its preferred shares to the U.S. Treasury's Troubled Asset Relief Program. The bank said in June 2009 that it had received approval to repurchase the shares.[7] Also in June 2009, its chairman, John A. Allison IV delivered a keynote address to a meeting of the Competitive Enterprise Institute, where he claimed to show how government regulation caused the 2007-2009 financial collapse.[4]

On August 15, 2009, it was announced that the deposits and loan accounts of the Colonial Bank were being transferred to BB&T as part of Colonial Bank's receivership by the FDIC.[8] This acquisition added over 340 branches in Alabama, Florida, Georgia, Nevada and Texas along with approximately $26 billion in assets. This moved BB&T Corporation to the 8th largest commercial bank in the United States based on deposits. BB&T quickly flipped the Nevada branch to U.S. Bancorp (dropping it to 10th overall), but hung on to its Texas branches, despite the Texas branches being outside of its historical footprint. As of November 1, 2011, In acquiring BankAtlantic, BB&T will acquire approximately $2.1 billion in loans and assume approximately $3.3 billion in deposits.

Donations

- BB&T donated $3 million to fund the establishment of BB&T Program of Free Enterprise at the Florida State University.[9]

- The company donated $2 million to fund research on Ayn Rand's work, which she called Objectivism, at the University of Texas.[10]

- The company donated $600,000 to Florida Gulf Coast University for the growth of programs at the Lutgert College of Business.

- The company donated $350,000 to fund the teaching of "The Moral Foundations of Capitalism" at the Loyola College in Maryland.[11]

- The company donated $1.5 million to the University of Georgia to "expand teaching and research into the foundations of capitalism and free market economies". [12]

- The company donated $1 million to the University of Central Florida to create the BB&T Program for Business Ethics and fund the teaching of "The Moral Foundations of Capitalism"

- The company donated $1.75 million to West Virginia University's College of Business and Economics.The funds will establish a BB&T Chair in Free Market Thought and enhance the school's free market research and teaching programs.[14]

References

- ^ a b BB&T (BBT) annual SEC income statement filing via Wikinvest.

- ^ a b BB&T (BBT) annual SEC balance sheet filing via Wikinvest.

- ^ "Ayn Rand Studies on Campus, Courtesy of BB&T," NPR News, by Clark Davis

- ^ a b By Lydia DePillis (2009-06-12). "How one think tank adapted when the debate moved on from its favorite issue. - By Lydia DePillis — Slate Magazine". Slate.com. http://www.slate.com/id/2220297/. Retrieved 2009-12-07.

- ^ "Give BB&T Liberty, but Not a Bailout". NYTimes.com. 2009-08-02. http://www.nytimes.com/2009/08/02/business/02bbt.html. Retrieved 2009-08-02.

- ^ http://www.nyjobsource.com/bbt.html

- ^ "BB&T — News Releases". Bbt.mediaroom.com. 2009-06-09. http://bbt.mediaroom.com/index.php?s=43&item=749. Retrieved 2009-12-07.

- ^ http://www.colonialbank.com/ accessed 15 Aug 2009

- ^ BB&T Donates $3 Million for BB&T Program of Free Enterprise at The Florida State University

- ^ BB&T Donates $2 Million for Ayn Rand Research at The University of Texas at Austin

- ^ BB&T Gives $350,000 grant to Loyola College

- ^ "Gift creates support fund for the study of capitalism and market economies at UGA’s Terry College of Business". Terry.uga.edu. http://www.terry.uga.edu/news/releases/2010/bbt_gift.html. Retrieved 2011-03-15.

- ^ Orlando Business Journal (2008-11-07). "BB&T funds UCF business ethics program | Orlando Business Journal". Bizjournals.com. http://www.bizjournals.com/orlando/stories/2008/11/03/daily56.html. Retrieved 2011-03-15.

- ^ "College Receives $1.75 Million". Be.wvu.edu. http://www.be.wvu.edu/news_events/freemarket/. Retrieved 2011-03-15.

External links

- Welcome to BB&T - Branch Banking & Trust Company

- In July 2007 BB&T Insurance Services, Inc. was ranked eighth in Business Insurance's world's largest brokers list.

- In July 2010 BB&T Insurance Services, Inc. was ranked sixth in Business Insurance's world's largest brokers list.

- Yahoo! - BB&T Corporation Company Profile

50 largest banks / bank holding companies in the United States as of September 30, 2011 Ally • American Express • Associated • BancWest* • Bank of America • Bank of New York Mellon • BB&T • BBVA Compass* • BOK Financial • Capital One • CIT • Citigroup • Citizens Financial Group* • City National (California) • Comerica • Commerce • Discover • East West Bank • Fifth Third • First Citizens • First Horizon • First Niagara • Goldman Sachs • BMO Harris* • Hancock • HSBC Bank USA* • Huntington • JPMorgan Chase • Key • M&T • MetLife • Morgan Stanley • New York Community • Northern Trust • PNC • Popular • RBC* • Regions • Silicon Valley • State Street • SunTrust • Synovus • Taunus* • TCF • TD* • U.S. Bank • UnionBanCal* • Utrecht-America* • Wells Fargo • Zions

* indicates the U.S. subsidiary of a non-U.S. bank. Inclusion on this list is based on U.S. assets only.Categories:- Companies listed on the New York Stock Exchange

- Banks based in North Carolina

- Companies based in Winston-Salem, North Carolina

- Wilson, North Carolina

- Banks established in 1872

- Mutual fund families

Wikimedia Foundation. 2010.