- Dot-com bubble

-

The dot-com bubble (also referred to as the Internet bubble and the Information Technology Bubble[1]) was a speculative bubble covering roughly 1995–2000 (with a climax on March 10, 2000, with the NASDAQ peaking at 5132.52 in intraday trading before closing at 5048.62) during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more recent Internet sector and related fields. While the latter part was a boom and bust cycle, the Internet boom is sometimes meant to refer to the steady commercial growth of the Internet with the advent of the world wide web, as exemplified by the first release of the Mosaic web browser in 1993, and continuing through the 1990s.

During the mid-to-late 1990s, Cisco Systems, Dell, Intel, and Microsoft were known as "the Four Horsemen of the NASDAQ" because of their dominant market capitalizations. As the bursting of the Internet bubble approached, Cisco Systems, EMC, Sun Microsystems, and Oracle were known as "the Four Horsemen of the Internet."

The period was marked by the founding (and, in many cases, spectacular failure) of a group of new Internet-based companies commonly referred to as dot-coms. Companies were seeing their stock prices shoot up if they simply added an "e-" prefix to their name and/or a ".com" to the end, which one author called "prefix investing".[2]

A combination of rapidly increasing stock prices, market confidence that the companies would turn future profits, individual speculation in stocks, and widely available venture capital created an environment in which many investors were willing to overlook traditional metrics such as P/E ratio in favor of confidence in technological advancements.

Contents

Bubble growth

Venture capitalists saw record-setting growth as dot-com companies experienced meteoric rises in their stock prices and therefore moved faster and with less caution than usual, choosing to mitigate the risk by starting many contenders and letting the market decide which would succeed. The low interest rates in 1998–99 helped increase the start-up capital amounts. Although a number of these new entrepreneurs had realistic plans and administrative ability, many more of them lacked these characteristics but were able to sell their ideas to investors because of the novelty of the dot-com concept.[citation needed]

A canonical "dot-com" company's business model relied on harnessing network effects by operating at a sustained net loss to build market share (or mind share). These companies offered their services or end product for free with the expectation that they could build enough brand awareness to charge profitable rates for their services later. The motto "get big fast" reflected this strategy.

During the loss period the companies relied on venture capital and especially initial public offerings of stock to pay their expenses while having no source of income at all. The novelty of these stocks, combined with the difficulty of valuing the companies, sent many stocks to dizzying heights and made the initial controllers of the company wildly rich on paper. This combined with a period of relative wealth, with many "ordinary" people with spare cash investing and day-trading, which caused a lot of money to chase the available investment opportunities.

Soaring stocks

In financial markets, a stock market bubble is a self-perpetuating rise or boom in the share prices of stocks of a particular industry. The term may be used with certainty only in retrospect when share prices have since crashed. A bubble occurs when speculators note the fast increase in value and decide to buy in anticipation of further rises, rather than because the shares are undervalued. Typically many companies thus become grossly overvalued. When the bubble "bursts," the share prices fall dramatically, and many companies go out of business.

The dot-com model was inherently flawed: a vast number of companies all had the same business plan of monopolizing their respective sectors through network effects, and it was clear that even if the plan were sound, there could only be one network-effects winner in each sector, and therefore that most companies with this business plan would fail. In fact, many sectors could not support even one company powered entirely by network effects.[citation needed] American news media, including respected business publications such as Forbes and the Wall Street Journal, encouraged the public to invest in risky companies, despite many of the companies' disregard for basic financial and even legal principles.[3]

In spite of this, however, a few company founders made vast fortunes when their companies were bought out at an early stage in the dot-com stock market bubble. These early successes made the bubble even more buoyant. An unprecedented amount of personal investing occurred during the boom, and the press reported the phenomenon of people quitting their jobs to become full-time day traders.[4][5][6]

Free spending

According to dot-com theory, an Internet company's survival depended on expanding its customer base as rapidly as possible, even if it produced large annual losses. For instance, Google and Amazon did not see any profit in their first years. Amazon was spending on expanding customer base and alerting people to its existence and Google was busy spending on creating more powerful machine capacity to serve its expanding search engine.[citation needed] The phrase "Get large or get lost" was the wisdom of the day.[7] At the height of the boom, it was possible for a promising dot-com to make an initial public offering (IPO) of its stock and raise a substantial amount of money even though it had never made a profit — or, in some cases, earned any revenue whatsoever.[citation needed] In such a situation, a company's lifespan was measured by its burn rate: that is, the rate at which a non-profitable company lacking a viable business model ran through its capital served as the metric.

Public awareness campaigns were one of the ways in which dot-coms sought to expand their customer bases. These included television ads, print ads, and targeting of professional sporting events. Many dot-coms named themselves with onomatopoeic nonsense words that they hoped would be memorable and not easily confused with a competitor. Super Bowl XXXIV in January 2000 featured 17 dot-com companies that each paid over $2 million for a 30-second spot. By contrast, in January 2001, just three dot-coms bought advertising spots during Super Bowl XXXV. In a similar vein, CBS-backed iWon.com gave away $10 million to a lucky contestant on an April 15, 2000 half-hour primetime special that was broadcast on CBS.

Not surprisingly, the "growth over profits" mentality and the aura of "new economy" invincibility led some companies to engage in lavish internal spending, such as elaborate business facilities and luxury vacations for employees. Executives and employees who were paid with stock options instead of cash became instant millionaires when the company made its initial public offering; many invested their new wealth into yet more dot-coms.

Cities all over the United States sought to become the "next Silicon Valley" by building network-enabled office space to attract Internet entrepreneurs. Communication providers, convinced that the future economy would require ubiquitous broadband access, went deeply into debt to improve their networks with high-speed equipment and fiber optic cables. Companies that produced network equipment like Nortel Networks were irrevocably damaged by such over-extension; Nortel declared bankruptcy in early 2009. Companies like Cisco, which did not have any production facilities, but bought from other manufacturers, were able to leave quickly and actually do well from the situation as the bubble burst and products were sold cheaply.

In the struggle to become a technology hub, many cities and states used tax money to fund technology conference centers, advanced infrastructure, and created favorable business and tax law to encourage development of the dot com industry in their locale. Virginia's "Technology Corridor" is a prime example of this activity. Large quantities of high speed fiber links were laid, and the State and local governments gave tax exemptions to technology firms. Many of these buildings can be viewed along I-495, after the burst, as vacant office buildings.

Similarly, in Europe the vast amounts of cash the mobile operators spent on 3G licences in Germany, Italy, and the United Kingdom, for example, led them into deep debt. The investments were far out of proportion to both their current and projected cash flow, but this was not publicly acknowledged until as late as 2001 and 2002. Due to the highly networked nature of the IT industry, this quickly led to problems for small companies dependent on contracts from operators.

The bubble bursts

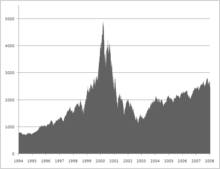

The technology-heavy NASDAQ Composite index peaked at 5,048 in March 2000, reflecting the high point of the dot-com bubble.

The technology-heavy NASDAQ Composite index peaked at 5,048 in March 2000, reflecting the high point of the dot-com bubble.

Over 1999 and early 2000, the U.S. Federal Reserve increased interest rates six times,[8] and the economy began to lose speed. The dot-com bubble burst, numerically, on Friday, March 10, 2000, when the technology heavy NASDAQ Composite index, peaked at 5,048.62 (intra-day peak 5,132.52), more than double its value just a year before.[citation needed] The NASDAQ fell slightly after that, but this was attributed to correction by most market analysts; the actual reversal and subsequent bear market may have been triggered by the adverse findings of fact in the United States v. Microsoft case which was being heard in federal court.[citation needed] The findings, which declared Microsoft a monopoly, were widely expected in the weeks before their release on April 3.[citation needed] The following day, April 4, the NASDAQ fell from 4,283 points to 3,649 and rebounded back to 4,223, forming an intraday chart that looked like a stretched V.

On March 20, 2000, after the NASDAQ had lost more than 10 percent from its peak, financial magazine Barron's shocked the market with its cover story "Burning Up". Sean Parker stated: "During the next 12 months, scores of highflying Internet upstarts will have used up all their cash. If they can't scare up any more, they may be in for a savage shakeout. An exclusive survey of the likely losers." The article pointed out: "America's 371 publicly traded Internet companies have grown to the point that they are collectively valued at $1.3 trillion, which amounts to about 8% of the entire U.S. stock market."[9]

By 2001 the bubble was deflating at full speed. A majority of the dot-coms ceased trading after burning through their venture capital, many having never made a ″net″ profit. Investors often referred to these failed dot-coms as "dot-bombs."

Aftermath

On January 11, 2001, America Online, a favorite of dot-com investors and pioneer of dial-up Internet access, merged with Time Warner, the world's largest media company, in the second-largest M&A transaction worldwide.[10] The transaction has been described as "the worst in history".[11] Within two years, boardroom disagreements drove out both of the CEOs who made the deal, and in October 2003 AOL Time Warner dropped "AOL" from its name.

Several communication companies could not weather the financial burden and were forced to file for bankruptcy. One of the more significant players, WorldCom, was found practicing illegal accounting practices to exaggerate its profits on a yearly basis. WorldCom's stock price fell drastically when this information went public, and it eventually filed the third-largest corporate bankruptcy in U.S. history. Other examples include NorthPoint Communications, Global Crossing, JDS Uniphase, XO Communications, and Covad Communications. Companies such as Nortel, Cisco and Corning were at a disadvantage because they relied on infrastructure that was never developed which caused the stock of Corning to drop significantly.

Many dot-coms ran out of capital and were acquired or liquidated; the domain names were picked up by old-economy competitors or domain name investors. Several companies and their executives were accused or convicted of fraud for misusing shareholders' money, and the U.S. Securities and Exchange Commission fined top investment firms like Citigroup and Merrill Lynch millions of dollars for misleading investors. Various supporting industries, such as advertising and shipping, scaled back their operations as demand for their services fell. A few large dot-com companies, such as Amazon.com and eBay, survived the turmoil and appear assured of long-term survival, while others such as Google have become industry-dominating mega-firms.

The stock market crash of 2000–2002 caused the loss of $5 trillion in the market value of companies from March 2000 to October 2002.[12] The 9/11 terrorist destruction of the World Trade Center's Twin Towers, killing almost 700 employees of Cantor-Fitzgerald, accelerated the stock market drop; the NYSE suspended trading for four sessions. When trading resumed, some of it was transacted in temporary new locations.

More in-depth analysis shows that 50% of the dot-coms companies survived through 2004[citation needed]. With this, it is safe to assume that the assets lost from the Stock Market do not directly link to the closing of firms. More importantly, however, it can be concluded that even companies who were categorized as the "small players" were adequate enough to endure the destruction of the financial market during 2000-2002.[13] Additionally, retail investors who felt burned by the burst transitioned their investment portfolios to more cautious positions.

Nevertheless, laid-off technology experts, such as computer programmers, found a glutted job market. University degree programs for computer-related careers saw a noticeable drop in new students. Anecdotes of unemployed programmers going back to school to become accountants or lawyers were common.

List of companies significant to the bubble

For discussion and a list of dot-com companies outside the scope of the dot-com bubble, see dot-com company.

- Boo.com, spent $188 million in just six months[14] in an attempt to create a global online fashion store. Went bankrupt in May 2000.[15]

- Startups.com was the "ultimate dot-com startup." Went out of business in 2002.

- e.Digital Corporation (EDIG): Long term unprofitable OTCBB traded company founded in 1988 previously named Norris Communications. Changed its name to e.Digital in January 1999 when stock was at $0.06 level. The stock rose rapidly in 1999 and went from closing price of $2.91 on December 31, 1999 to intraday high of $24.50 on January 24, 2000. It quickly retraced and has traded between $0.07 and $0.165 in 2010 .[16]

- Freeinternet.com – Filed for bankruptcy in October 2000, soon after canceling its IPO. At the time Freeinternet.com was the fifth largest ISP in the United States, with 3.2 million users.[17] Famous for its mascot Baby Bob, the company lost $19 million in 1999 on revenues of less than $1 million.[18][19]

- GeoCities, purchased by Yahoo! for $3.57 billion in January 1999. Yahoo! closed GeoCities on October 26, 2009.[20]

- theGlobe.com – Was a social networking service, that went live in April 1995 and made headlines by going public on November 1998 and posting the largest first day gain of any IPO in history up to that date. The CEO became in 1999 a visible symbol of the excesses of dot-com millionaires.

- GovWorks.com – the doomed dot-com featured in the documentary film Startup.com.

- pets.com - a former dot-com enterprise that sold pet supplies to retail customers before entering bankruptcy in 2000.

- Hotmail – founder Sabeer Bhatia sold the company to Microsoft for $400 million;[21] at that time Hotmail had 9 million members.[22]

- open.com - Was a big software security producer, reseller and distributor, declared in bankruptcy in 2001.

- InfoSpace – In March 2000 this stock reached a price $1,305 per share,[23] but by April 2001 its price had crashed down to $22 a share.[23]

- lastminute.com, whose IPO in the U.K. coincided with the bursting of the bubble.

- The Learning Company, bought by Mattel in 1999 for $3.5 billion, sold for $27.3 million in 2000.[24]

- Think Tools AG, one of the most extreme symptoms of the bubble in Europe: market valuation of CHF 2.5 billion in March 2000, no prospects of having a substantial product (investor deception), followed by a collapse.[25]

- Webvan, an online grocer that operated on a "credit and delivery" system; the original company went bankrupt in 2001. It was later resurrected by Amazon.

- WorldCom, a long-distance telephone and internet-services provider that became notorious for using fraudulent accounting practices to increase their stock price. The company filed for bankruptcy in 2002 and former CEO Bernard Ebbers was convicted of fraud and conspiracy.

- Xcelera.com, a Swedish investor in start-up technology firms.[26] "Greatest one-year rise of any exchange-listed stock in the history of Wall Street." [27]

See also

Terminology

- Bankruptcy

- Digital Revolution

- E-commerce

- Irrational exuberance

- The Long Tail

- South Sea Company

- Stock market bubble

- Tulip mania

- Techno-utopianism

- Technology hype

- Web 2.0

- E-learning

- Dark fiber

Media

- e-Dreams

- SatireWire

- Startup.com

- ebay.com

Venture capital

Economic downturn

- Financial crisis of 2007-2010

- Subprime mortgage crisis

- United States housing bubble

Also see

- 2000s commodities boom

- Uranium bubble of 2007

- Worldcom

- Enron

References

- ^ James K. Galbraith and Travis Hale (2004). Income Distribution and the Information Technology Bubble. University of Texas Inequality Project Working Paper

- ^ Nanotech Excitement Boosts Wrong Stock, The Market by Mike Maznick, Techdirt.com, Dec 4, 2003

- ^ Origins of the Crash: The Great Bubble and Its Undoing, Roger Lowenstein, Penguin Books, 2004, ISBN 1594200033, 9781594200038 page 114-115.

- ^ Kadlec, Daniel (1999-08-09). "Day Trading: It's a Brutal World". Time. http://www.time.com/time/magazine/article/0,9171,991726,00.html. Retrieved 2007-10-09.

- ^ Johns, Ray (1999-03-04). "Daytrader Trend". Online Newshour: Forum. PBS. http://www.pbs.org/newshour/forum/february99/daytraders.html. Retrieved 2007-10-09.

- ^ Cringely, Robert X. (1999-12-16). "There's a Sucker Born Every 60,000 Milliseconds". I, Cringely. PBS. http://www.pbs.org/cringely/pulpit/1999/pulpit_19991216_000634.html. Retrieved 2007-10-09.

- ^ How to Start a Startup, March 2005, Paul Graham

- ^ "FRB: Monetary Policy, Open Market Operations". http://www.federalreserve.gov/fomc/fundsrate.htm. Retrieved 2009-07-01.

- ^ Burning Up, By JACK WILLOUGHBY, March 20, 2000, Barrons

- ^ Worldwide Mergers & Acquisitions, Statistics on Mergers & Acquisitions (M&A)

- ^ Time Warner, without Aol, tops forecasts on money.cnn.com

- ^ Fears of Dot-Com Crash, Version 2.0

- ^ Goldfarb, Brent D., Kirsch, David and Miller, David A., "Was There Too Little Entry During the Dot Com Era?" (April 24, 2006). Robert H. Smith School Research Paper No. RHS 06-029 Available at SSRN: http://ssrn.com/abstract=871210

- ^ "INTERNATIONAL BUSINESS; Fashionmall.com Swoops In for the Boo.com Fire Sale". The New York Times. June 2, 2000. http://query.nytimes.com/gst/fullpage.html?res=9F05E4DB103CF931A35755C0A9669C8B63. Retrieved May 1, 2010.

- ^ Top 10 dot-com flops – CNET.com

- ^ Historical prices of EDIG stock

- ^ Another One Bites the Dust – FreeInternet.com Files for Bankruptcy – Addlebrain.com

- ^ InternetNews Realtime IT News – Freeinternet.com Scores User Surge

- ^ ISP-Planet – News – Freei Files for Bankruptcy

- ^ [1][dead link]

- ^ BW Online | September 14, 2000 | Hotmail's Creator Is Starting Up Again, and Again, and

- ^ Microsoft buys Hotmail – CNET News.com

- ^ a b "The two faces of InfoSpace 1998-2001". The Seattle Times. http://seattletimes.nwsource.com/art/news/business/infospace/infospaceTimelineDay1_2_intro.swf.

- ^ Abigail Goldman (2002-12-06). "Mattel Settles Shareholders Lawsuit For $122 Million". Los Angeles Times. http://securities.stanford.edu/news-archive/2002/20021206_Settlement05_Goldman.htm.

- ^ Don't Think Twice: Think Tools is Overvalued, The Wall Street Journal Europe, October 30, 2000

- ^ Xcelera's FAQ's

- ^ Xcelera.com, GeorgeNichols.com

- Notes

- Aharon, D.Y., I. Gavious and R. Yosef, 2010. Stock market bubble effects on mergers and acquisitions. The Quarterly Review of Economics and Finance, 50(4): p. 456-470.

Further reading

- Cassidy, John. Dot.con: How America Lost its Mind and Its Money in the Internet Era (2002)

- Daisey, Mike. 21 Dog Years Free Press. ISBN 0-7432-2580-5.

- Goldfarb, Brent D., Kirsch, David and Miller, David A., "Was There Too Little Entry During the Dot Com Era?" (April 24, 2006). Robert H. Smith School Research Paper No. RHS 06-029 Available at SSRN: http://ssrn.com/abstract=899100

- Kindleberger, Charles P., Manias, Panics, and Crashes: A History of Financial Crises (Wiley, 2005, 5th edition)

- Kuo, David dot.bomb: My Days and Nights at an Internet Goliath ISBN 0-316-60005-9 (2001)

- Lowenstein, Roger. Origins of the Crash: The Great Bubble and Its Undoing. (Penguin Books, 2004) ISBN 0-14-303467-7

- Wolff, Michael. Burn Rate: How I Survived the Gold Rush Years on the Internet

- Abramson, Bruce (2005). Digital Phoenix; Why the Information Economy Collapsed and How it Will Rise Again. MIT Press. ISBN 978-0-262-51196-4.

External links

- Top 10 dot-com flops – CNet's list of ten most notable failed dot-com companies

- Startup Dot Com Movie – documentary of a failing company.

- Warren Buffett: 'I told you so' – BBC article, 13 March 2001.

- Time Flies Dept.: Dot-com craze peaked 10 years ago

Stock market crashes 1701–1800 Panic of 1792 · Panic of 1796–17971801–1900 1901–2000 Panic of 1901 · Panic of 1907 · Depression of 1920–21 · Wall Street Crash of 1929 · Recession of 1937–1938 · 1973–1974 stock market crash · Silver Thursday (1980) · Souk Al-Manakh stock market crash (1982) · Japanese asset price bubble (1986–1991) · Black Monday (1987) · Friday the 13th mini-crash (1989) · Black Wednesday (1992) · Dot-com bubble (1995–2000) · 1997 Asian financial crisis · October 27, 1997 mini-crash · 1998 Russian financial crisis2001–present Economic effects arising from the September 11 attacks (2001) · Stock market downturn of 2002 · Chinese stock bubble of 2007 · Late-2000s financial crisis · United States bear market of 2007–2009 · Dubai 2009 debt standstill · European sovereign debt crisis (2009–2011) · 2010 Flash Crash · August 2011 stock markets fallCategories:- Dot-com

- Economic bubbles

- Electronic commerce

- Information technology management

- Internet terminology

- Economic disasters in the United States

- History of the United States (1991–present)

- 1990s economic history

- 2000s economic history

- 1990s fads and trends

- History of the Internet

Wikimedia Foundation. 2010.