- European System of Central Banks

-

European Union

This article is part of the series:

Politics and government of

the European UnionPolicies and issuesThe European System of Central Banks (ESCB) is composed of the European Central Bank (ECB) and the national central banks (NCBs) of all 27 European Union (EU) Member States.

Contents

Functions

Since not all the EU states have joined the euro, the ESCB could not be used as the monetary authority of the eurozone. For this reason the Eurosystem (which excludes all the NCBs which have not adopted the euro) became the institution in charge of those tasks which in principle had to be managed by the ESCB. In accordance with the treaty establishing the European Community and the Statute of the European System of Central Banks and of the European Central Bank, the primary objective of the Eurosystem is to maintain price stability (in other words control inflation). Without prejudice to this objective, the Eurosystem shall support the general economic policies in the Community and act in accordance with the principles of an open market economy.

The basic tasks to be carried out by the Eurosystem are:

- to define and implement the monetary policy of the eurozone;

- to conduct foreign exchange operations;

- to hold and manage the official foreign reserves of the Member States; and

- to promote the smooth operation of payment systems.

In addition, the Eurosystem contributes to the smooth conduct of policies pursued by the competent authorities relating to the prudential supervision of credit institutions and the stability of the financial system. The ECB has an advisory role vis-à-vis the Community and national authorities on matters which fall within its field of competence, particularly where Community or national legislation is concerned. Finally, in order to undertake the tasks of the ESCB, the ECB, assisted by the NCBs, has the task of collecting the necessary statistical information either from the competent national authorities or directly from economic agents.

Organisation

The process of decision-making in the Eurosystem is centralised through the decision-making bodies of the ECB, namely the Governing Council and the Executive Board. As long as there are Member States which have not adopted the euro, a third decision-making body, the General Council, shall also exist. The NCBs of the Member States which do not participate in the euro area are members of the ESCB with a special status – while they are allowed to conduct their respective national monetary policies, they do not take part in the decision-making with regard to the single monetary policy for the euro area and the implementation of such decisions.

The Governing Council comprises all the members of the Executive Board and the governors of the NCBs of the Member States without a derogation, i.e. those countries which have adopted the euro. The main responsibilities of the Governing Council are:

- to adopt the guidelines and take the decisions necessary to ensure the performance of the tasks entrusted to the Eurosystem;

- to formulate the monetary policy of the euro area, including, as appropriate, decisions relating to intermediate monetary objectives, key interest rates and the supply of reserves in the Eurosystem, and

- to establish the necessary guidelines for their implementation.

The Executive Board comprises the President, the Vice-President and four other members, all chosen from among persons of recognized standing and professional experience in monetary or banking matters. They are appointed by common accord of the governments of the Member States at the level of the Heads of State or Government, on a recommendation from the Council of Ministers after it has consulted the European Parliament and the Governing Council of the ECB (i.e. the Council of the European Monetary Institute (EMI) for the first appointments). The main responsibilities of the Executive Board are:

- to implement monetary policy in accordance with the guidelines and decisions laid down by the Governing Council of the ECB and, in doing so, to give the necessary instructions to the NCBs; and

- to execute those powers which have been delegated to it by the Governing Council of the ECB.

The General Council comprises the President and the Vice-President and the governors of the NCBs of all 27 Member States. The General Council performs the tasks which the ECB took over from the EMI and which, owing to the derogation of one or more Member States, still have to be performed in Stage Three of Economic and Monetary Union (EMU). The General Council also contributes to:

- the ECB's advisory functions;

- the collection of statistical information;

- the preparation of the ECB's annual reports;

- the establishment of the necessary rules for standardising the accounting and reporting of operations undertaken by the NCBs;

- the taking of measures relating to the establishment of the key for the ECB's capital subscription other than those already laid down in the Treaty;

- the laying-down of the conditions of employment of the members of staff of the ECB; and

- the necessary preparations for irrevocably fixing the exchange rates of the currencies of the Member States with a derogation against the euro.

The Eurosystem is independent. When performing Eurosystem-related tasks, neither the ECB, nor an NCB, nor any member of their decision-making bodies may seek or take instructions from any external body. The Community institutions and bodies and the governments of the Member States may not seek to influence the members of the decision-making bodies of the ECB or of the NCBs in the performance of their tasks. The Statute of the ESCB makes provision for the following measures to ensure security of tenure for NCB governors and members of the Executive Board:

- a minimum renewable term of office for national central bank governors of five years;

- a minimum non-renewable term of office for members of the Executive Board of eight years (a system of staggered appointments was used for the first Executive Board for members other than the President in order to ensure continuity); and

- removal from office is only possible in the event of incapacity or serious misconduct; in this respect the Court of Justice of the European Communities is competent to settle any disputes.

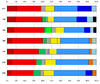

The ECB's capital amounts to €5 billion. The NCBs are the sole subscribers to and holders of the capital of the ECB. The subscription of capital is based on a key established on the basis of the EU Member States' respective shares in the GDP and population of the Community. It has, thus far, been paid up to an amount just over €4 billion. The euro area NCBs have paid up their respective subscriptions to the ECB's capital in full. The NCBs of the non-participating countries have to pay up 7% of their respective subscriptions to the ECB's capital as a contribution to the operational costs of the ECB. As a result, the ECB was endowed with an initial capital of just under €4 billion.

In addition, the NCBs of the Member States participating in the euro area have provided the ECB with foreign reserve assets of up to an amount equivalent to around €40 billion. The contributions of each NCB were fixed in proportion to its share in the ECB's subscribed capital, while in return each NCB was credited by the ECB with a claim in euro equivalent to its contribution. 15% of the contributions were made in gold, and the remaining 85% in US dollars and Japanese yen.

Member banks

The ESCB is composed of the following 27 NCBs and the ECB. The first section of this list comprises those ESCB banks that form the Eurosystem (those states that have adopted the euro, plus the ECB) which sets eurozone monetary policy. The second section contains those banks which maintain separate currencies.

Notes

- ^ Most common name for post, also used: President, Chairman or General Secretary

External links

- European Central Bank

- ECB – The General Council

- Central Bank Rates: ECB Key Rate, chart and data

- Organisation and operation of the ECB European NAvigator

Central banks of the European Union

Within Eurozone National Bank of Austria · National Bank of Belgium · Central Bank of Cyprus · Bank of Estonia · Bank of Finland · Banque de France · Deutsche Bundesbank · Bank of Greece · Central Bank and Financial Services Authority of Ireland · Banca d'Italia · Central Bank of Luxembourg · Central Bank of Malta · De Nederlandsche Bank · Bank of Portugal · National Bank of Slovakia · Bank of Slovenia · Bank of SpainOutside Eurozone Banking-related

EU institutionsCentral banks Global GlobalBank for International Settlements · Basel Committee on Banking Supervision · Financial Stability BoardBy continent AfricaBank of Central African States · Central Bank of West African States · Bank of Algeria · Central Bank of Angola · Bank of Botswana · Bank of the Republic of Burundi · Bank of Cape Verde · Central Bank of the Comoros · Central Bank of the Congo · Central Bank of Djibouti · Central Bank of Egypt · Bank of Eritrea · National Bank of Ethiopia · Central Bank of The Gambia · Bank of Ghana · Central Bank of the Republic of Guinea · Central Bank of Kenya · Central Bank of Lesotho · Central Bank of Liberia · Central Bank of Libya · Reserve Bank of Malawi · Bank of Mauritius · Bank Al-Maghrib · Bank of Namibia · Central Bank of Nigeria · Bank of Somaliland · South African Reserve Bank · Bank of South Sudan · Bank of Sudan · Central Bank of Swaziland · Bank of Tanzania · Central Bank of Tunisia · Bank of Uganda · Bank of Zambia · Reserve Bank of ZimbabweAmericasCentral Bank of Argentina · Central Bank of Aruba · Central Bank of The Bahamas · Central Bank of Barbados · Central Bank of Brazil · Bank of Canada · Central Bank of Chile · Bank of the Republic (Colombia) · Central Bank of Cuba · Central Bank of Curaçao and Sint Maarten · Eastern Caribbean Central Bank · Bank of the Republic of Haiti · Central Bank of Honduras · Bank of Jamaica · Bank of Mexico · Central Bank of Nicaragua · Central Reserve Bank of Peru · Central Bank of Suriname · Central Bank of Trinidad and Tobago · Federal Reserve System (United States) · Central Bank of VenezuelaAsiaDa Afghanistan Bank · Central Bank of Bahrain · Bangladesh Bank · Royal Monetary Authority of Bhutan · Brunei Currency and Monetary Board · National Bank of Cambodia · People's Bank of China · Hong Kong Monetary Authority · Reserve Bank of India · Bank Indonesia · Central Bank of the Islamic Republic of Iran · Central Bank of Iraq · Bank of Israel · Bank of Japan · Central Bank of Jordan · National Bank of Kazakhstan · National Bank of the Kyrgyz Republic · Bank of Korea · Central Bank of the Democratic People's Republic of Korea · Central Bank of Kuwait · Banque du Liban · Monetary Authority of Macao · Bank Negara Malaysia · Maldives Monetary Authority · Bank of Mongolia · Central Bank of Myanmar · Nepal Rastra Bank · Central Bank of Oman · State Bank of Pakistan · Palestine Monetary Authority · Bangko Sentral ng Pilipinas · Qatar Central Bank · Monetary Authority of Singapore · Central Bank of Sri Lanka · Central Bank of Syria · Central Bank of the Republic of China (Taiwan) · Bank of Thailand · Central Bank of the United Arab Emirates · Central Bank of Uzbekistan · State Bank of VietnamEuropeEuropean Central Bank (Eurosystem) · National Bank of the Republic of Abkhazia · Bank of Albania · Central Bank of Armenia · Central Bank of Azerbaijan · National Bank of the Republic of Belarus · Central Bank of Bosnia and Herzegovina · Bulgarian National Bank · Croatian National Bank · Czech National Bank · Danmarks Nationalbank · Bank of England · National Bank of Georgia · Hungarian National Bank · Central Bank of Iceland · Central Bank of Kosovo · National Bank of Latvia · Bank of Lithuania · National Bank of the Republic of Macedonia · National Bank of Moldova · Central Bank of Montenegro · Norges Bank · Central Bank of the Turkish Republic of Northern Cyprus · National Bank of Poland · National Bank of Romania · Central Bank of Russia · National Bank of Serbia · Sveriges Riksbank · Swiss National Bank · Central Bank of the Republic of Turkey · National Bank of UkraineOceaniaPolicies and implementation PoliciesImplementationBretton Woods system Lists Names in italics indicate non-sovereign (dependent) territories, former countries, or states with limited recognitionCategories:

Wikimedia Foundation. 2010.