- Money creation

-

Types of banksCentral bank

Advising bank · Commercial bank

Community development bank

Cooperative bank · Credit union

Custodian bank · Depository bank

Export credit agency

Investment bank · Industrial bank

Merchant bank · Mutual savings bank

National bank · Offshore bank

Postal savings system

Private bank · Retail Bank

Savings and loan association

Savings bank · Universal bank

more...Bank cardsBanking termsLoan · Money creation

Automatic teller machine

Bank regulation · Anonymous banking

Islamic banking · Private banking

Ethical bankingIn economics, money creation is the process by which the money supply of a country or a monetary region (such as the Eurozone) is increased. There are two principal stages of money creation. First, the central bank introduces new money into the economy (termed 'expansionary monetary policy') by purchasing financial assets or lending money to financial institutions. Second, the new money introduced by the central bank is multiplied by commercial banks through fractional reserve banking; this expands the amount of broad money (i.e. cash plus demand deposits) in the economy so that it is a multiple (known as the money multiplier) of the amount originally created by the central bank.

Central banks monitor the amount of money in the economy by measuring monetary aggregates such as M2. The effect of monetary policy on the money supply is indicated by comparing these measurements on various dates. For example, in the United States, money supply measured as M2 grew from $6407.3bn in January 2005, to $8318.9bn in January 2009.[1]

Contents

Money creation by the central bank

Within almost all modern nations, special institutions exist (such as the Federal Reserve System in the United States, the European Central Bank (ECB), and the People's Bank of China) which have the task of executing the monetary policy and often acting independently of the executive. In general, these institutions are called central banks and often have other responsibilities such as supervising the smooth operation of the financial system. There are several monetary policy tools available to a central bank to expand the money supply of a country: decreasing interest rates by fiat; increasing the monetary base; and decreasing reserve requirements. All have the effect of expanding the money supply.

The primary tool of monetary policy is open market operations. This entails managing the quantity of money in circulation through the buying and selling of various financial assets, such as treasury bills, government bonds, or foreign currencies. Purchases of these assets result in currency entering market circulation (while sales of these assets remove money from circulation).

Usually, the short term goal of open market operations is to achieve a specific short term interest rate target. In other instances, monetary policy might instead entail the targeting of a specific exchange rate relative to some foreign currency, the price of gold, or indices such as Consumer Price Index. For example, in the case of the USA the Federal Reserve targets the federal funds rate, the rate at which member banks lend to one another overnight. The other primary means of conducting monetary policy include: (i) Discount window lending (as lender of last resort); (ii) Fractional deposit lending (changes in the reserve requirement); (iii) Moral suasion (cajoling certain market players to achieve specified outcomes); (iv) "Open mouth operations" (talking monetary policy with the market). The conduct and effects of monetary policy and the regulation of the banking system are of central concern to monetary economics.

Quantitative easing

Quantitative easing involves the creation of a significant amount of new base money by a central bank by the buying of assets that it usually does not buy. Usually, a central bank will conduct open market operations by buying short-term government bonds or foreign currency. However, during a financial crisis, the central bank may buy other types of financial assets as well. The central bank may buy long-term government bonds, company bonds, asset backed securities, stocks, or even extend commercial loans. The intent is to stimulate the economy by increasing liquidity and promoting bank lending, even when interest rates cannot be pushed any lower.

Quantitative easing increases reserves in the banking system (i.e. deposits of commercial banks at the central bank), giving depository institutions the ability to make new loans. Quantitative easing is usually used when lowering the discount rate is no longer effective because interest rates are already close to or at zero. In such a case, normal monetary policy cannot further lower interest rates, and the economy is in a liquidity trap.

Physical currency

In modern economies, relatively little of the money supply is in physical currency. For example, in December 2010 in the U.S., of the $8853.4 billion in broad money supply (M2), only $915.7 billion (about 10%) consisted of physical coins and paper money.[2] The manufacturing of new physical money is usually the responsibility of the central bank, or sometimes, the government's treasury.

Contrary to popular belief, money creation in a modern economy does not directly involve the manufacturing of new physical money, such as paper currency or metal coins. Instead, when the central bank expands the money supply through open market operations (e.g. by purchasing government bonds), it credits the accounts that commercial banks hold at the central bank (termed high powered money). Commercial banks may draw on these accounts to withdraw physical money from the central bank. Commercial banks may also return soiled or spoiled currency to the central bank in exchange for new currency.[3]

Money creation through the fractional reserve system

Through fractional-reserve banking, the modern banking system expands the money supply of a country beyond the amount initially created by the central bank.[4] There are two types of money in a fractional-reserve banking system, currency originally issued by the central bank, and bank deposits at commercial banks:[5][6]

- central bank money (all money created by the central bank regardless of its form, e.g. banknotes, coins, electronic money)

- commercial bank money (money created in the banking system through borrowing and lending) - sometimes referred to as checkbook money[7]

When a commercial bank loan is extended, new commercial bank money is created. As a loan is paid back, more commercial bank money disappears from existence than was created (assuming an interest rate above zero). Since loans are continually being issued in a normally functioning economy, the amount of broad money in the economy remains relatively stable. Because of this money creation process by the commercial banks, the money supply of a country is usually a multiple larger than the money issued by the central bank; that multiple is determined by the reserve ratio or other financial ratios (primarily the capital adequacy ratio that limits the overall credit creation of a bank) set by the relevant banking regulators in the jurisdiction.

Re-lending

An early table, featuring reinvestment from one period to the next and a geometric series, is found in the tableau économique of the Physiocrats, which is credited as the "first precise formulation" of such interdependent systems and the origin of multiplier theory.[8]

Money multiplier

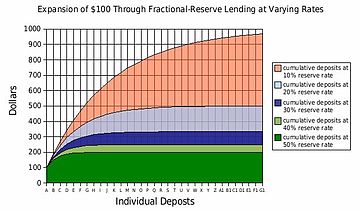

The most common mechanism used to measure this increase in the money supply is typically called the money multiplier. It calculates the maximum amount of money that an initial deposit can be expanded to with a given reserve ratio – such a factor is called a multiplier. As a formula, if the reserve ratio is R, then the money multiplier m is the reciprocal, m = 1 / R, and is the maximum amount of money commercial banks can legally create for a given quantity of reserves.

In the re-lending model, this is alternatively calculated as a geometric series under repeated lending of a geometrically decreasing quantity of money: reserves lead loans. In endogenous money models, loans lead reserves, and it is not interpreted as a geometric series. In practice, because banks often have access to lines of credit, and the money market, and can use day time loans from central banks, there is often no requirement for a pre-existing deposit for the bank to create a loan and have it paid to another bank.[9][10]

The money multiplier is of fundamental importance in monetary policy: if banks lend out close to the maximum allowed, then the broad money supply is approximately central bank money times the multiplier, and central banks may finely control broad money supply by controlling central bank money, the money multiplier linking these quantities; this was the case in the United States from 1959 through September 2008.

If, conversely, banks accumulate excess reserves, as occurred in such financial crises as the Great Depression and the Financial crisis of 2007–2010 – in the United States since October 2008, then this equality breaks down, and central bank money creation may not result in commercial bank money creation, instead remaining as unlent (excess) reserves.[11] However, the central bank may shrink commercial bank money by shrinking central bank money, since reserves are required – thus fractional-reserve money creation is likened to a string, since the central bank can always pull money out by restricting central bank money, hence reserves, but cannot always push money out by expanding central bank money, since this may result in excess reserves, a situation referred to as "pushing on a string".

Alternative theories

The above gives the mainstream economics theory of money creation. There are also a number of alternative heterodox theories of how money is created. Most notably post-Keynesian economics emphasizes endogenous money – that money is created by the internal workings of the financial system, rather than by external forces, such as policy actions of the central bank.

Heterodox theories of money creation include:

- Chartalism, which holds that money is created by government deficit spending, and emphasizes (and advocates) fiat money.

- Circuitist money theory, held by some post-Keynesians, which argues that money is created endogenously by the banking system, rather than exogenously by central bank lending. Further, they argue that money is not neutral – a credit money system is fundamentally different from a barter system, and money and banks must be an integral part of economic models.

- Credit Theory of Money. This approach was founded by Joseph Schumpeter.[12] Credit theory asserts the central role of banks as creators and allocators of money supply, and distinguishes between 'productive credit creation' (allowing non-inflationary economic growth even at full employment, in the presence of technological progress) and 'unproductive credit creation' (resulting in inflation of either the consumer- or asset-price variety).[13]

See also

- Fractional-reserve banking

- Central bank

- Federal Reserve

- Fiat currency

- Quantitative easing

- Inflation

- Money

- Money supply

- National bank

- Open market operations

- Reserve requirements

- Chartalism

References

- ^ US Federal Reserve historical statistics June 11, 2009

- ^ Federal Reserve Statistic February 17, 2011

- ^ Mankiw, N. Gregory (2002). Macroeconomics (5th ed.). Worth. pp. 81–107.

- ^ Modern Money Mechanics

- ^ Bank for International Settlements - The Role of Central Bank Money in Payment Systems. See page 9, titled, "The coexistence of central and commercial bank monies: multiple issuers, one currency": http://www.bis.org/publ/cpss55.pdf A quick quote in reference to the 2 different types of money is listed on page 3. It is the first sentence of the document: "Contemporary monetary systems are based on the mutually reinforcing roles of central bank money and commercial bank monies."

- ^ European Central Bank - Domestic payments in Euroland: commercial and central bank money: http://www.ecb.int/press/key/date/2000/html/sp001109_2.en.html One quote from the article referencing the two types of money: "At the beginning of the 20th almost the totality of retail payments were made in central bank money. Over time, this monopoly came to be shared with commercial banks, when deposits and their transfer via checks and giros became widely accepted. Banknotes and commercial bank money became fully interchangeable payment media that customers could use according to their needs. While transaction costs in commercial bank money were shrinking, cashless payment instruments became increasingly used, at the expense of banknotes"

- ^ Chicago Fed - Our Central Bank: http://www.chicagofed.org/consumer_information/the_fed_our_central_bank.cfm

- the reference is found in the "Money Manager" section:

- "the Fed works to control money at its source by affecting the ability of financial institutions to "create" checkbook money through loans or investments. The control lever that the Fed uses in this process is the "reserves" that banks and thrifts must hold."

- the reference is found in the "Money Manager" section:

- ^ The multiplier theory, by Hugo Hegeland, 1954, p. 1

- ^ "Disyatat, P. 2010 The bank lending channel revisited.". Bank for International Settlements. http://www.bis.org/publ/work297.pdf. "Page 2. the concept of the money multiplier is flawed and uninformative in terms of analyzing the dynamics of bank lending. Page 7 When a loan is granted, banks in the first instance create a new liability that is issued to the borrower. This can be in the form of deposits or a cheque drawn on the bank, which when redeemed, becomes deposits at another bank. A well functioning interbank market overcomes the asynchronous nature of loan and deposit creation across banks. Thus loans drive deposits rather than the other way around."

- ^ "Paul Tucker, Money and credit: Banking and the Macroeconomy". Bank of England. http://www.bankofengland.co.uk/publications/speeches/2007/speech331.pdf. " banks....in the short run.....lever up their balance sheets and expand credit at will....Subject only but crucially to confidence in their soundness, banks extend credit by simply increasing the borrowing customer's current account.....This 'money creation' process is constrained by their need to manage the liquidity risk from the withdrawal of deposits and the drawdown of backup lines to which it exposes them."

- ^ (Samuelson 1948, pp. 353–354): By increasing the volume of their government securities and loans and by lowering Member Bank legal reserve requirements, the Reserve Banks can encourage an increase in the supply of money and bank deposits. They can encourage but, without taking drastic action, they cannot compel. For in the middle of a deep depression just when we want Reserve policy to be most effective, the Member Banks are likely to be timid about buying new investments or making loans. If the Reserve authorities buy government bonds in the open market and thereby swell bank reserves, the banks will not put these funds to work but will simply hold reserves. Result: no 5 for 1, “no nothing,” simply a substitution on the bank’s balance sheet of idle cash for old government bonds.

- ^ see Richard A. Werner. (2005), New Paradigm in Macroeconomics, Basingstoke: Palgrave Macmillan

- ^ Richard A. Werner (2005), New Paradigm in Macroeconomics, Basingstoke: Palgrave Macmillan

- Samuelson, Paul (1948), Economics

External links

- Reserve Requirements - Fedpoints - Federal Reserve Bank of New York

- Bank for International Settlements - The Role of Central Bank Money in Payment Systems

Categories:- Monetary policy

- Money

- Economics terminology

Wikimedia Foundation. 2010.