- Discount rate

-

For the interest rate charged to banks for borrowing short-term funds directly from the Federal Reserve, see discount window.

- For the fees charged to merchants for accepting credit cards, see Discount Rate under Merchant Account.

- For discount rate as a term in investment financing, see Discounted cash flow

The discount rate can mean

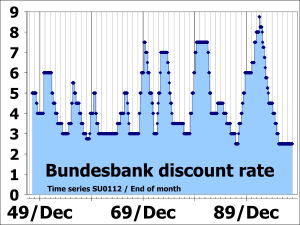

- an interest rate a central bank charges depository institutions that borrow reserves from it, for example for the use of the Federal Reserve's discount window.

- the same as interest rate; the term "discount" does not refer to the common meaning of the word, but to the meaning in computations of present value, e.g. net present value or discounted cash flow

- the annual effective discount rate, which is the annual interest divided by the capital including that interest; this rate is lower than the interest rate; it corresponds to using the value after a year as the nominal value, and seeing the initial value as the nominal value minus a discount; it is used for Treasury Bills and similar financial instruments

Contents

Annual effective discount rate

The annual effective discount rate is the annual interest divided by the capital including that interest, which is the interest rate divided by 100% plus the interest rate. It is the annual discount factor to be applied to the future cash flow, to find the discount, subtracted from a future value to find the value one year earlier.

For example, suppose there is a government bond that sells for $95 and pays $100 in a year's time. The discount rate according to the given definition is

The interest rate is calculated using 95 as its base:

For every annual effective interest rate, there is a corresponding annual effective discount rate, given by the following formula:

or inversely,

where the approximations apply for small i and d; in fact i - d = id.

See also notation of interest rates.

Business calculations

Businesses need to consider the discount rate when deciding whether to spend some of their profits on buying a new piece of equipment, or whether to give the profit back to their shareholders. In an ideal world, they would only buy a piece of equipment if the shareholders would get a bigger profit later. The amount of extra profit that a shareholder requires in the future in order to prefer that the company buy the equipment rather than giving them the profit now is based on the shareholder's discount rate. There is a widely used way of estimating shareholder's discount rates using share price data. It is known as the capital asset pricing model. Businesses normally apply this discount rate to their decisions about purchasing equipment by calculating the net present value of the decision

See also

- Discounting

- Social discount rate

- Ramsey growth model

- Compare and contrast with federal funds

References

External links

- Definition of the "Discount Rate" from the Federal Reserve Board's official site

- Using the Build Up procedure for equity discount rate calculation.

- World Interest Rates

Categories:- Mathematical finance

- Economics terminology

- Interest rates

- Monetary policy

- Financial economics

- Federal Reserve

Wikimedia Foundation. 2010.