- Fiat money

-

Fiat money is money that has value only because of government regulation or law. The term derives from the Latin fiat, meaning "let it be done", as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used.

Fiat money originated in 11th century China,[1] and its use became widespread during the Yuan and Ming dynasties.[2] The Nixon Shock of 1971 ended the direct convertibility of the United States dollar to gold. Since then all reserve currencies have been fiat currencies, including the dollar and the euro.[3]

Contents

Characteristics

The term fiat money has been defined variously as:

- any money declared by a government to be legal tender.[4]

- state-issued money which is neither convertible by law to any other thing, nor fixed in value in terms of any objective standard.[5]

- money without intrinsic value.[6][7]

While specie-backed representative money entails the legal requirement that the bank of issue redeem it in fixed weights of specie, fiat money's value is unrelated to the value of any physical quantity. Even a coin containing valuable metal may be considered fiat currency if its face value is higher than its market value as metal.

A feature of all fiat money is its acceptability to the government for payment of taxes and charges.

Fiat money is not essential for large countries, nor is it always used. An economy may function on banknotes issued by commercial banks, which are not legal tender, and hence not fiat money. This was the situation in the United States during periods prior to 1862, before the first United States Notes were created and declared by the government to be legal tender.

History

Early history

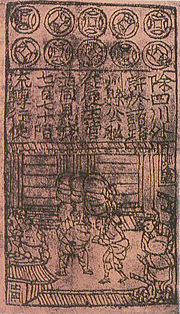

The Song Dynasty in China was the first to issue paper money, jiaozi, around the 10th century AD. Although the notes were valued at a certain exchange rate for gold, silver, or silk, conversion was never allowed in practice. The notes were initially to be redeemed after three years' service, to be replaced by new notes for a 3% service charge, but, as more of them were printed without notes being retired, inflation became evident. The government made several attempts to support the paper by demanding taxes partly in currency and making other laws, but the damage had been done, and the notes fell out of favor.[8]

The successive Yuan Dynasty was the first dynasty in China to use paper currency as the predominant circulating medium. The founder of the Yuan Dynasty, Kublai Khan, issued paper money known as Chao in his reign. The original notes during the Yuan Dynasty were restricted in area and duration as in the Song Dynasty. However, in the later course of the dynasty, facing massive shortages of specie to fund their ruling in China, the Yuan Dynasty began printing paper money without restrictions on duration. This eventually caused hyperinflation. By 1455, in an effort to rein in economic expansion and end hyperinflation, the new Ming Dynasty ended the use of paper money.

18th and 19th century

An early form of fiat currency were "bills of credit."[9] Provincial governments produced notes which were fiat currency, with the promise to allow holders to pay taxes in those notes. The notes were issued to pay current obligations and could be called by levying taxes at a later time. Since the notes were denominated in the local unit of account, they were circulated from man to man in non-tax transactions. These types of notes were issued in the British colonies in America, particularly in Pennsylvania, Virginia and Massachusetts. Such money was sold at a discount of silver, which the government would then spend, and would expire at a fixed point in time later. Bills of credit were controversial when they were first issued, and have remained controversial to this day. Those who have wanted to highlight the dangers of inflation have focused on the colonies where the bills of credit depreciated most dramatically – New England and the Carolinas. Those who have wanted to defend the use of bills of credit in the colonies have focused on the middle colonies, where inflation was practically nonexistent.[9]

Colonial powers consciously introduced fiat currencies backed by taxes, e.g. hut taxes or poll taxes, to mobilise economic resources in their new possessions, at least as a transitional arrangement.

The repeated cycle of deflationary hard money, followed by inflationary paper money continued through much of the 18th and 19th centuries. Often nations would have dual currencies, with paper trading at some discount to specie backed money. Examples include the “Continental” issued by the U.S. Congress before the Constitution; paper versus gold ducats in Napoleonic era Vienna, where paper often traded at 100:1 against gold; the South Sea Bubble, which produced bank notes not backed by sufficient reserves; and the Mississippi Company scheme of John Law.

During the American Civil War, the Federal Government issued United States Notes, a form of paper fiat currency popularly known as 'greenbacks'. Their issue was limited by Congress at a little over $340 million. During the 1870s, withdrawal of the notes from circulation was opposed by the United States Greenback Party. The term 'fiat money' was used in the resolutions of an 1878 party convention.[10]

20th century

By World War I most nations had a legalized government monopoly on bank notes and the legal tender status thereof. In theory, governments still promised to redeem notes in specie on demand. However, the costs of the war and the massive expansion afterward made governments suspend redemption in specie. Since there was no direct penalty for doing so, governments were not immediately responsible for the economic consequences of printing more money, which led to hyperinflation – for example in Weimar Germany.

Attempts were made to reassert currency stability by anchoring it to wholesale gold bullion rather than making it payable in specie. This money combined pure fiat currency, in that the currency was limited to central bank notes and token coins that were current only by government fiat, with a form of convertibility, via gold bullion exchange, or via exchange into US dollars which were convertible into gold bullion, under the 1945 Bretton Woods system.

Bretton Woods

Main article: Bretton Woods systemFrom 1944 to 1971, the Bretton Woods agreement fixed the value of 35 United States dollars to one troy ounce of gold.[11]

Other currencies were pegged to the U.S. dollar at fixed rates. The U.S. promised to redeem dollars in gold to other central banks. Trade imbalances were corrected by gold reserve exchanges or by loans from the International Monetary Fund. This system collapsed when the United States government ended the convertibility of the US dollar for gold in 1971, in what became known as the Nixon Shock.

Chartalism

Chartalism is a monetary theory that states the initial demand for a fiat currency is generated by its unique ability to extinguish tax liabilities. Goods and services are traded for fiat money due to the need to pay taxes in the money.

Loss of backing

A fiat-money currency generally loses value once the issuing government refuses to further guarantee its value through taxation, but this need not necessarily occur. For example, the so-called Swiss dinar continued to retain value in Kurdish Iraq even after its legal tender status was withdrawn by its issuer, Iraq's central government.[12][13]

Monetary economics

In monetary economics, fiat money is an intrinsically useless product, used as a means of payment.[14] In some micro-founded models of money, fiat money is created internally in a community making feasible trades that would not otherwise be possible, either because producers and consumers may not anonymously write IOUs, or because of physical constraints.[15][16]

See also

- Central Bank

- European Central Bank; Federal Reserve

- Friedman rule

- Hard currency

- Money illusion

- Money supply

- Seigniorage

- Tinkerbell effect

- Value Theory

- Veil of money

- Fractional-reserve banking

References

- ^ Selgin, George (2002), "Adaptive Learning and the Transition to Fiat Money", The Economic Journal 113 (484): 147–65.

- ^ Von Glahn, Richard (1996), Fountain of Fortune: Money and Monetary Policy in China, 1000–1700, Berkeley: University of California Press.

- ^ Scheurer, Vincent (1 July 2011). "Can our current system of fiat money survive in the long term?". The Magic of Money. The Motley Fool. http://www.fool.co.uk/news/investing/2011/07/01/the-magic-of-money.aspx. Retrieved 2 July 2011.

- ^ Montgomery Rollins (1917). Money and Investments. George Routledge & Sons. http://chestofbooks.com/finance/investments/Money-Investments/Farthing-Financial-Bill.html. "Fiat Money. Money which a government declares shall be accepted as legal tender at its face value;"

- ^ John Maynard Keynes (1965) [1930]. "1. The Classification of Money". A Treatise on Money. 1. Macmillan & Co Ltd. p. 7. "Fiat Money is Representative (or token) Money (i.e something the intrinsic value of the material substance of which is divorced from its monetary face value) - now generally made of paper except in the case of small denominations — which is created and issued by the State, but is not convertible by law into anything other than itself, and has no fixed value in terms of an objective standard."

- ^ N. Gregory Mankiw (2008-09-29). Principles of Economics. pp. 659. ISBN 9780324589979. http://books.google.com/?id=oRgQ2goeFzwC&pg=PA659&pg=PA659&q=fiat%20money%20. "Fiat money, such as paper dollars, is money without intrinsic value: It would be worthless if it were not used as money."

- ^ Shubik, Martin. (April 2000). The Theory of Money. Cowles Foundation for Research in Economics at Yale University. http://cowles.econ.yale.edu/P/cd/d12b/d1253.pdf

- ^ Ramsden, Dave (2004). "A Very Short History of Chinese Paper Money". James J. Puplava Financial Sense. http://www.financialsense.com/fsu/editorials/ramsden/2004/0617.html.

- ^ a b Michener, Ron (2003). "Money in the American Colonies". EH.Net Encyclopedia, edited by Robert Whaples.

- ^ "Fiat Money". Chicago Daily Tribune. May 24, 1878.

- ^ ""Bretton Woods" Federal Research Division Country Studies (Austria)". Library of Congress. http://lcweb2.loc.gov/frd/cs/austria/at_glos.html.

- ^ Foote, Christopher; Block, William; Crane, Keith & Gray, Simon (2004). "Economic Policy and Prospects in Iraq". The Journal of Economic Perspectives 18 (3): 47–70. doi:10.1257/0895330042162395..

- ^ Budget and Finance (2003). "Iraq Currency Exchange". The Coalition Provisional Authority. http://www.cpa-iraq.org/budget/IraqCurrencyExchange.html.

- ^ Walsh, Carl E. (2003). Monetary Theory and Policy. The MIT Press. ISBN 978-0-262-23231-9.

- ^ Kiyotaki, Nobuhiro & Wright, Randall (1989). "On Money as a Medium of Exchange". Journal of Political Economy 97 (4): 927–954. doi:10.1086/261634..

- ^ Lagos, Ricardo & Wright, Randall (2005). "A Unified Framework for Monetary Theory and Policy Analysis". Journal of Political Economy 113 (3): 463–484. doi:10.1086/429804..

Categories:

Wikimedia Foundation. 2010.