- Diminishing returns

-

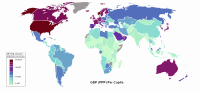

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal In economics, diminishing returns (also called diminishing marginal returns) is decrease in the marginal (per-unit) output of a production process as the amount of a single factor of production is increased, ceteris paribus.

The law of diminishing returns (also law of diminishing marginal returns or law of increasing relative cost) states that in all productive processes, adding more of one factor of production, while holding all others constant, will at some point yield lower per-unit returns.[1] The law of diminishing returns does not imply that adding more of a factor will decrease the total production, a condition known as negative returns, though in fact this is common.

For example, the use of fertilizer improves crop production on farms and in gardens; but at some point, adding more and more fertilizer improves the yield less and less, and excessive quantities can even reduce the yield. A common sort of example is adding more workers to a job, such as assembling a car on a factory floor. At some point, adding more workers causes problems such as getting in each other's way, or workers frequently find themselves waiting for access to a part. In all of these processes, producing one more unit of output per unit of time will eventually cost increasingly more, due to inputs being used less and less effectively.

The law of diminishing returns is one of the most famous laws in all of economics.[1] It plays a central role in production theory.

Contents

History

The concept of diminishing returns can be traced back to the concerns of early economists such as Johann Heinrich von Thünen, Turgot, Thomas Malthus and David Ricardo. However, classical economists such as Malthus and Ricardo attributed the successive diminishment of output to the decreasing quality of the inputs. Neoclassical economists assume that each "unit" of labor is identical = perfectly homogeneous. Diminishing returns are due to the disruption of the entire productive process as additional units of labor are added to a fixed amount of capital.

Karl Marx developed a version of the law of diminishing returns in his theory of the tendency of the rate of profit to fall, described in Volume III of Capital.

Examples

Suppose that one kilogram of seed applied to a plot of land of a fixed size produces one ton of crop. You might expect that an additional kilogram of seed would produce an additional ton of output. However, if there are diminishing marginal returns, that additional kilogram will produce less than one additional ton of crop (ceteris paribus). For example, the second kilogram of seed may only produce a half ton of extra output. Diminishing marginal returns also implies that a third kilogram of seed will produce an additional crop that is even less than a half ton of additional output, say, one quarter of a ton. In a real ecological system diminishing returns occur due to Liebig's Law and the depletion of natural capital.

In economics, the term "marginal" is used to mean on the edge of productivity in a production system. The difference in the investment of seed in these three scenarios is one kilogram — "marginal investment in seed is one kilogram." And the difference in output, the crops, is one ton for the first kilogram of seeds, a half ton for the second kilogram, and one quarter of a ton for the third kilogram. Thus, the marginal physical product (MPP) of the seed will fall as the total amount of seed planted rises. In this example, the marginal product (or return) equals the extra amount of crop produced divided by the extra amount of seeds planted.

A consequence of diminishing marginal returns is that as total investment increases, the total return on investment as a proportion of the total investment (the average product or return) decreases. The return from investing the first kilogram is 1 t/kg. The total return when 2 kg of seed are invested is 1.5/2 = 0.75 t/kg, while the total return when 3 kg are invested is 1.75/3 = 0.58 t/kg.

This particular example of Diminishing Marginal Returns in formulaic terms: Where D = Diminished Marginal Return, X = seed in kilograms, and

= crop yield in tons gives us:

= crop yield in tons gives us:

Substituting 3 for X and expanding yields:

Another example is a factory that has a fixed stock of capital, or tools and machines, and a variable supply of labor. As the firm increases the number of workers, the total output of the firm grows but at an ever-decreasing rate. This is because after a certain point, the factory becomes overcrowded and workers begin to form lines to use the machines. The long-run solution to this problem is to increase the stock of capital, that is, to buy more machines and to build more factories.

Returns and costs

There is an inverse relationship between returns of inputs and the cost of production. Suppose that a kilogram of seed costs one dollar, and this price does not change; although there are other costs, assume they do not vary with the amount of output and are therefore fixed costs. One kilogram of seeds yields one ton of crop, so the first ton of the crop costs one extra dollar to produce. That is, for the first ton of output, the marginal cost (MC) of the output is $1 per ton. If there are no other changes, then if the second kilogram of seeds applied to land produces only half the output of the first, the MC equals $1 per half ton of output, or $2 per ton. Similarly, if the third kilogram produces only ¼ ton, then the MC equals $1 per quarter ton, or $4 per ton. Thus, diminishing marginal returns imply increasing marginal costs. This also implies rising average costs. In this numerical example, average cost rises from $1 for 1 ton to $2 for 1.5 tons to $3 for 1.75 tons, or approximately from 1 to 1.3 to 1.7 dollars per ton.

In this example, the marginal cost equals the extra amount of money spent on seed divided by the extra amount of crop produced, while average cost is the total amount of money spent on seeds divided by the total amount of crop produced.

Cost can also be measured in terms of opportunity cost. In this case the law also applies to societies; the opportunity cost of producing a single unit of a good generally increases as a society attempts to produce more of that good. This explains the bowed-out shape of the production possibilities frontier.

Returns to scale

The marginal returns discussed apply to cases when only one of the many inputs is increased (for example, the quantity of seed increases, but the amount of land remains constant). If all inputs are increased in proportion, the result is generally constant or increased output.

As such, explaining exactly why this law holds true, when people make investments in their firms, has proven problematic. The idea that Adam Smith iterated regarding increasing productivity from the division of labor, in fact contradicts the theory, as in practice actions such as "division of labor" (or other organizational or technological improvement) will always come with an additional increase in a specific factor of production. The manager of a company is likely to add those improvements, or factors of production, which ultimately leads to greater returns. As a thought experiment, it is difficult to imagine in reality why only one factor of production (e.g. hammers) would be added in the making of a specific product, without other factors that would be needed to increase marginal productivity (e.g. labor to use the extra hammers). And, since it is hardly an occurrence in the world, the "law of diminishing returns" can be modeled graphically but it has very few examples in practice. As has been understood from the time of Smith and Mill,[2] and further explained by more recent economists such as Paul Romer,[3] "increasing returns" is more likely to occur when companies invest on a factor of production, as they do not hold everything else constant. This is how companies such as Wal-Mart and Microsoft can become more profitable as they grow in size.

As a firm in the long-run increases the quantities of all factors employed, all other things being equal, initially the rate of increase in output may be more rapid than the rate of increase in inputs, later output might increase in the same proportion as input, then ultimately, output will increase less proportionately than input.

See also: economies of scaleSee also

- Accelerating returns

- Learning curve and Experience curve effects

- Diseconomies of scale, does not assume fixed inputs, thus differing from 'diminishing returns'

- Diminishing marginal utility, also not to be mistaken for 'diminishing returns'

- Increasing returns

- Marginal value theorem

- Moore's law

- Opportunity cost

- Tendency of the rate of profit to fall

References

- ^ a b Samuelson & Nordhaus. Microeconomics. 17th ed. page 110. McGraw Hill 2001.

- ^ J.S. Mill. Principles of Political Economy. London: John W. Parker, 1848. Bk 1, ch. 7.

- ^ Romer, Paul Michael (1986). "Increasing Returns and Long-Run Growth". The Journal of Political Economy 94 (5): 1002–37. doi:10.1086/261420. JSTOR 1833190.

Sources

- Case, Karl E. & Fair, Ray C. (1999). Principles of Economics (5th ed.). Prentice-Hall. ISBN 0-13-961905-4.

Categories:- Economics laws

- Production and organizations

- Production economics

Wikimedia Foundation. 2010.