- Shanghai Stock Exchange

-

Shanghai Stock Exchange 上海证券交易所Type Stock Exchange Location Shanghai, China Founded 1891 Key people Geng Liang (Chairman)

Zhang Yujun (President)Currency RMB No. of listings 900 (Feb 2011) MarketCap US$2.7 trillion (Dec 2010)[1] Volume US$0.5 trillion (Dec 2009) Indexes SSE Composite

SSE 180

SSE 50Website www.sse.com.cn The Shanghai Stock Exchange (SSE) (simplified Chinese: 上海证券交易所; traditional Chinese: 上海證券交易所; pinyin: Shànghǎi Zhèngquàn Jiāoyìsuǒ), abbreviated as 上证所/上證所 or 上交所, is a stock exchange that is based in the city of Shanghai, China. It is one of the two stock exchanges operating independently in the People's Republic of China, the other is the Shenzhen Stock Exchange. Shanghai Stock Exchange is the world's 5th largest stock market by market capitalization at US$2.7 trillion as of Dec 2010.[1] Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors [2] due to tight capital account controls exercised by the Chinese mainland authorities.[3]

The current exchange was re-established on November 26, 1990 and was in operation on December 19 of the same year. It is a non-profit organization directly administered by the China Securities Regulatory Commission (CSRC).

Contents

History

The formation of the International Settlement (foreign concession areas) in Shanghai was the result of the Treaty of Nanking of 1842 (which ended the First Opium War) and subsequent agreements between the Chinese and foreign governments were crucial to the development of foreign trade in China and of the foreign community in Shanghai. The market for securities trading in Shanghai begins in the late 1860s. The first shares list appeared in June 1866 and by then Shanghai's International Settlement had developed the conditions conducive to the emergence of a share market: several banks, a legal framework for joint-stock companies, and an interest in diversification among the established trading houses (although the trading houses themselves remained partnerships).

In 1891 during the boom in mining shares, foreign businessmen founded the "Shanghai Sharebrokers' Association" headquartered in Shanghai as China's first stock exchange. In 1904 the Association applied for registration in Hong Kong under the provision of the Companies ordinance and was renamed as the "Shanghai Stock Exchange". The supply of securities came primarily from local companies. In the early days, banks dominated private shares but, by 1880, only the Hong Kong and Shanghai local banks remained.

Later in 1920 and 1921, "Shanghai Securities & Commodities Exchange" and "Shanghai Chinese Merchant Exchange" started operation respectively. An amalgamation eventually took place in 1929, and the combined markets operated thereafter as the "Shanghai Stock Exchange". Shipping, insurance, and docks persisted to 1940 but were overshadowed by industrial shares after the Treaty of Shimonoseki of 1895, which permitted Japan, and by extension other nations which had treaties with China, to establish factories in Shanghai and other treaty ports. Rubber plantations became the staple of stock trading beginning in the second decade of the 20th century.

By the 1930s, Shanghai had emerged as the financial center of the Far East, where both Chinese and foreign investors could trade stocks, debentures, government bonds, and futures. The operation of Shanghai Stock Exchange came to an abrupt halt after Japanese troops occupied the Shanghai International Settlement on December 8, 1941. In 1946, Shanghai Stock Exchange resumed its operations before closing again 3 years later in 1949, after the Communist revolution took place.

After the Cultural Revolution ended and Deng Xiaoping rose to power, China was re-opened to the outside world in 1978. During the 1980s, China's securities market evolved in tandem with the country's economic reform and opening up and the development of socialist market economy. On 26 November 1990, Shanghai Stock Exchange was re-established and operations began a few weeks later on 19 December.[4]

Chronology

- 1866 - The first share list appeared in June.

- 1871 - Speculative bubble burst triggered by monetary panic.

- 1883 - Credit crisis resulted speculation in Chinese companies.

- 1890 - Bank crisis started from Hong Kong.

- 1891 - "Shanghai Sharebrokers Association" established.

- 1895 - Treaty of Shimonoseki opened Chinese market to foreign investors.

- 1904 - Renamed to "Shanghai Stock Exchange".

- 1909-1910 - Rubber boom.

- 1911 - Revolution and the abdication of the Qing Dynasty. Founding of the Republic of China.

- 1914 - Market closed for a few months due to the Great War (World War I).

- 1919 - Speculation in cotton shares.

- 1925 - Second rubber boom.

- 1929 - "Shanghai Securities & Commodities Exchange" and "Shanghai Chinese Merchant Exchange" were merged into the existing Shanghai Stock Exchange.

- 1931 - Incursion of Japanese forces into northern China.

- 1930s - The market was dominated by the rubber share price movements.

- 1941 - The market closed on Friday 5 December. Japanese troops occupied Shanghai.

- 1946-1949 - Temporary resumption of the Shanghai Stock Exchange until the communist revolution. Founding of the People's Republic of China in 1949.

- 1978 - Deng Xiaoping emerged as the dominant figure in China's leadership, thus beginning a period of 'opening up' to the rest of the world.

- 1981 - Trading in treasury bonds were resumed.

- 1984 - Company stocks and corporate bonds emerged in Shanghai and a few other cities.

- 1990 - The present Shanghai Stock Exchange re-opened on November 26 and began operation on December 19.

- 2001-2005 - A four-year market slump which saw Shanghai's market value halved, after reaching a peak in 2001. A ban on new IPOs was put in April 2005 to curb the slump and allow more than US$200 billion of mostly state-owned equity to be converted to tradable shares.

- 2006 - The SSE resumed full operation as the yearlong ban on IPOs was lifted in May. The world's second largest (US$21.9 billion) IPO by the Industrial and Commercial Bank of China (ICBC) was launched in both Shanghai and Hong Kong stock markets.[5]

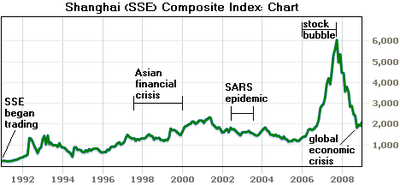

- 2007-2008 - A "stock market frenzy" as speculative traders rush into the market, making China's stock exchange temporarily the world's second largest in terms of turnover.[6][7][8] After reaching an all-time high of 6,124.044 points on October 16, 2007,[9] the benchmark Shanghai Composite Index ended 2008 down a record 65%[10] mainly due to the impact of the global economic crisis which started in mid-2008.

- 2010 - Agricultural Bank of China completed the world's largest IPO to date worth US$22.1 billion.[11]

Structure

See also: Qualified Foreign Institutional InvestorShanghai Stock Exchange Chinese 上海证券交易所 Transcriptions Mandarin - Hanyu Pinyin Shànghǎi Zhèngquàn Jiāoyìsuǒ - Wade–Giles Shang-hai Chen-ch'üan Chiao-i-so - IPA [ʂɑ̂ŋxàɪ tʂɤ̂ŋtɕʰwân tɕjɑ́ʊyɨ̂swɔ̀] - Yale Romanization Shànghǎi Jèngchywàn Jyāuyìswǒ The securities listed at the SSE include the three main categories of stocks, bonds, and funds. Bonds traded on SSE include treasury bonds (T-bond), corporate bonds, and convertible corporate bonds. SSE T-bond market is the most active of its kind in China. There are two types of stocks being issued in the Shanghai Stock Exchange: "A" shares and "B" shares. A shares are priced in the local renminbi yuan currency, while B shares are quoted in U.S. dollars. Initially, trading in A shares are restricted to domestic investors only while B shares are available to both domestic (since 2001) and foreign investors. However, after reforms were implemented in December 2002, foreign investors are now allowed (with limitations) to trade in A shares under the Qualified Foreign Institutional Investor (QFII) program which was officially launched in 2003. Currently, a total of 98 foreign institutional investors have been approved to buy and sell A shares under the QFII program. Quotas under the QFII program are currently US$30 billion.[12] There has been a plan to eventually merge the two types of shares in the future.[13]

The SSE is open for trading every Monday to Friday. The morning session begins with centralized competitive pricing from 09:15 to 09:25, and continues with consecutive bidding from 09:30 to 11:30. This is followed by the afternoon consecutive bidding session, which starts from 13:00 to 15:00. The market is closed on Saturday and Sunday and other holidays announced by the SSE.[14]

Holiday Schedule

Shanghai Stock Exchange 2010Holiday From To No. of days (excluding Saturday and Sunday) New Year 1 January 2010 (Friday) 1 January 2010 (Friday) 1 DAY

Chinese New Year 15 February 2010 (Monday) 19 February 2010 (Friday) 5 DAYS Qingming Festival 5 April 2010 (Monday) 5 April 2010 (Monday) 1 DAY Labor Day 3 May 2010 (Monday) 3 May 2010 (Monday) 1 DAY Duanwu Festival 14 June 2010 (Monday) 16 June 2010 (Wednesday) 3 DAYS Mid-Autumn Festival 22 September 2010 (Wednesday) 24 September 2010 (Friday) 3 DAYS National Day 1 October 2010 (Friday) 7 October 2010 (Thursday) 5 DAYS Note: The above dates are inclusive and all Saturdays and Sundays are non-trading days. Market Performance

As of February 2008, 861 companies were listed on the SSE and the total market capitalization of SSE reached RMB 23,340.9 billion (US$3,241.8 billion; US$1 = RMB 6.82).

Trading Summary for 2007

Data updated on 18 February 2008 Stock listings Market value

(billion yuan)Annual turnover value

(billion yuan)A shares 850 26,849.7 30,196.0 B shares 54 134.2 347.4 Total 904 26,983.9 30,543.4 Indices

Main article: SSE CompositeThe SSE Composite (also known as Shanghai Composite) Index is the most commonly used indicator to reflect SSE's market performance. Constituents for the SSE Composite Index are all listed stocks (A shares and B shares) at the Shanghai Stock Exchange. The Base Day for the SSE Composite Index is December 19, 1990. The Base Period is the total market capitalization of all stocks of that day. The Base Value is 100. The index was launched on July 15, 1991. At the end of 2006, the index reaches 2,675.47. Other important indexes used in the Shanghai Stock Exchanges include the SSE 50 Index and SSE 180 Index.

SSE's Top 10 Largest Stocks

Source: Shanghai Stock Exchange (market values in RMB/Chinese Yuan). Data arranged by market value. Updated on 19 March 2008

- PetroChina (3,656.20 billion)

- Industrial and Commercial Bank of China (1,417.93 billion)

- Sinopec (961.42 billion)

- Bank of China (894.42 billion)

- China Shenhua Energy Company (824.22 billion)

- China Life (667.39 billion)

- China Merchants Bank (352.74 billion)

- Ping An Insurance (272.53 billion)

- Bank of Communications (269.41 billion)

- China Pacific Insurance (256.64 billion)

Listing Requirements

According to the regulations of Securities Law of the People’s Republic of China and Company Law of the People’s Republic of China, limited companies applying for the listing of shares must meet the following criteria:

- The shares must have been publicly issued following approval of the State Council Securities Management Department.

- The company’s total share capital must not be less than RMB 30 million.

- The company must have been in business for more than 3 years and have made profits over the last three consecutive years. This requirement also applies to former state-owned enterprises reincorporating as private or public enterprises. In the case of former state-owned enterprises re-established according to the law or founded after implementation of the law and if their issuers are large and medium state owned enterprises, it can be calculated consecutively. The number of shareholders with holdings of values reaching in excess of RMB 1,000 must not be less than 1,000 persons. Publicly offered shares must be more than 25% of the company’s total share capital. For company whose total share capital exceeds RMB 400 million, the ratio of publicly offered shares must be more than 15%.

- The company must not have committed any major illegal activities or false accounting records in the last three years.

Other conditions stipulated by the State Council.

- China currently has a preference for domestic firms only to list onto their stock exchanges; India has similar rules. However, China is considering opening up their capital markets to foreign firms in 2010.

The conditions for applications for the listing of shares by limited companies involved in high and new technology are set out separately by the State Council.

See also

- China Securities Regulatory Commission

- Economy of the People's Republic of China

- Hong Kong Stock Exchange

- Shenzhen Stock Exchange

- Shanghai Metal Exchange

- SSE Composite

- Untraded shares

- Leading stock

Lists

- List of Chinese companies

- List of companies in the People's Republic of China

- List of stock exchanges

References

- ^ a b World-exchanges.org

- ^ China Briefing - Foreigners Now Allowed to List on Shanghai Stock Exchange - retrieved on January 21, 2009.

- ^ International Herald Tribune - China further loosens its capital controls - retrieved on January 21, 2009.

- ^ William Arthur Thomas, Western Capitalism in China: A History of the Shanghai Stock Exchange. Aldershot: Ashgate Pub Ltd (2001, hardcover). xii + 328 pp. ISBN 0-7546-0246-X.

- ^ BusinessWeek - China's ICBC: The World's Largest IPO Ever - retrieved on March 2, 2007.

- ^ Thisismoney - China share turnover exceeds UK - retrieved on June 5, 2007.

- ^ BBC News - Share sale knocks Chinese market - retrieved on March 2, 2007.

- ^ MSNBC - China shares tumble as panic spreads - retrieved on June 4, 2007.

- ^ Financial Times on FT.com - Asian stock markets go into retreat - retrieved on January 20, 2009.

- ^ International Herald Tribune - Chinese shares end 2008 down 65 percent - retrieved on January 20, 2009.

- ^ "AgBank IPO officially the world's biggest". Financial Times. 13 August 2010. http://www.ft.com/cms/s/0/ff7d528c-a6bc-11df-8d1e-00144feabdc0.html?ftcamp=rss. Retrieved 14 August 2010.

- ^ "Legg Mason Seeks China License to Trade Yuan-Denominated Stocks". Bloomberg. 2009-03-10. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aM4E27602pNU. Retrieved 2009-03-10.

- ^ "Merger talk spurs B-shares". International Herald Tribune. 2006-09-18. http://www.iht.com/articles/2006/09/18/bloomberg/sxchib.php. Retrieved 2009-01-21.

- ^ Market Hours, Shanghai Stock Exchange via Wikinvest

External links

World Federation of Exchanges (WFE) Members Amman Stock Exchange · Athens Exchange · Australian Securities Exchange · Bermuda Stock Exchange · BM&F Bovespa · Bolsa de Comercio de Buenos Aires · Bolsa de Comercio de Santiago · Bolsa de Valores de Colombia · Bolsa de Valores de Lima · Bolsa Mexicana de Valores · Bolsas y Mercados Españoles · Bombay Stock Exchange · Borsa Italiana · Budapest Stock Exchange · Bursa Malaysia · Casablanca Stock Exchange · CBOE · CME Group · Colombo Stock Exchange · Cyprus Stock Exchange · Deutsche Börse · Egyptian Exchange · Hong Kong Exchanges and Clearing · Indonesia Stock Exchange · IntercontinentalExchange · International Securities Exchange · Irish Stock Exchange · Istanbul Stock Exchange · Johannesburg Stock Exchange · Korea Stock Exchange · Ljubljana Stock Exchange · London Stock Exchange · Luxembourg Stock Exchange · Malta Stock Exchange · Moscow Interbank Currency Exchange · NASDAQ OMX · NASDAQ OMX Armenia · NASDAQ OMX Copenhagen · NASDAQ OMX Helsinki · NASDAQ OMX Iceland · NASDAQ OMX Riga · Nasdaq OMX Stockholm · NASDAQ OMX Tallinn · NASDAQ OMX Vilnius · National Stock Exchange of India · NYSE Euronext Amsterdam · NYSE Euronext Brussels · NYSE Euronext Lisbon · NYSE Euronext New York · NYSE Euronext Paris · Osaka Securities Exchange · Oslo Børs · Philippine Stock Exchange · Saudi Stock Exchange · Shanghai Stock Exchange · Shenzhen Stock Exchange · Singapore Exchange · SIX Swiss Exchange · Stock Exchange of Mauritius · Stock Exchange of Thailand · Taiwan Stock Exchange · Tehran Stock Exchange · Tel Aviv Stock Exchange · TMX Group · Tokyo Stock Exchange · Warsaw Stock Exchange · Wiener Börse

Associates Depository Trust & Clearing Corporation · Financial Industry Regulatory Authority (FINRA) · LCH.Clearnet · Options Clearing Corporation · Takasbank

Affiliates Abu Dhabi Securities Exchange · Beirut Stock Exchange · Bucharest Stock Exchange · GreTai Securities Market · HoChiMinh Stock Exchange · Karachi Stock Exchange · Kazakhstan Stock Exchange · Muscat Securities Market · Nairobi Stock Exchange · Namibian Stock Exchange · National Stock Exchange · Nigerian Stock Exchange · RTS Exchange · Taiwan Futures Exchange · Zhengzhou Commodity Exchange

Correspondents Bahrain Bourse · Baku Interbank Currency Exchange · Banja Luka Stock Exchange · Barbados Stock Exchange · Belgrade Stock Exchange · Bolsa de Comercio de Rosario · Bolsa de Valores de Panamá · Bolsa Nacional de Valores · Borse Dubai · Bourse des Valeurs Mobilières de Tunis · Bourse Régionale des Valeurs Mobiliéres · Bratislava Stock Exchange · Bulgarian Stock Exchange – Sofia · Cayman Islands Stock Exchange · Chittagong Stock Exchange · CNSX Markets · Ghana Stock Exchange · Kuwait Stock Exchange · Libyan Stock Market · Lusaka Stock Exchange · Montenegro Stock Exchange · Multi Commodity Exchange of India · Palestine Exchange · PFTS Stock Exchange · Port Moresby Stock Exchange · Qatar Exchange · Zagreb Stock Exchange

Economy of the People's Republic of China  Companies of China

Companies of ChinaHistory Industry and business Industry (history) · Beer · Biotechnology · Advanced materials · Automotive · Aviation · Aircraft · Aerospace · Mobile phone industry · Cement · Container transpo · Cotton · Electric motor · Electric power · Electronics · Film industry · Fishing · Internet · Online gaming · Video gaming · Made in China · Media · Mining (Gold mining) · Pharmaceuticals & Pharmacy · Publishing & Academic publishing · Sex toys · Silk · Software · Telecommunications · Television (Digital) & Radio · Railway (Equipment) · Real estate · Wine · Companies (Largest · The Hongs · National Innovative Enterprises) · Youth Business China

Mining (Gold mining) · Pharmaceuticals & Pharmacy · Publishing & Academic publishing · Sex toys · Silk · Software · Telecommunications · Television (Digital) & Radio · Railway (Equipment) · Real estate · Wine · Companies (Largest · The Hongs · National Innovative Enterprises) · Youth Business ChinaDevelopment Zones Suzhou Industrial Park · Dalian Software Park · Zhangjiang Hi-Tech Park · Metropolitan regions of ChinaEnergy Energy policy · Coal · Oil (Oil shale · Oil refineries) · Nuclear · Renewable (Wind · Solar · Geothermal)Trade and infrastructure Trade history · World Trade Center · Transport · Communications · Postal history · Tourism · Shipping · Illegal drug trade · Hong Kong Trade Development Council · Ports · Water supply and sanitation · Trading partnersTaxation and labor Finance and banking Financial system · Financial services · Chinese currency · Chinese yuan · Renminbi · China Banknote Printing and Minting Corporation · Banking (History · Central bank · Other banks) · Foreign exchange reserve · Beijing Financial Street · Stock Exchange Executive Council · Shanghai Stock Exchange (SSE Composite) · Shenzhen Stock Exchange · Dalian Commodity Exchange · Shanghai Metal Exchange · Zhengzhou Commodity Exchange · Hedge fund industry · Accounting in China

Accounting in ChinaInstitutions National Development and Reform Commission · Ministry of Finance · Ministry of Commerce · Ministry of Industry and Information Technology · SASAC · State Administration for Industry and Commerce · All-China Federation of Trade Unions · China Council for the Promotion of International Trade · General Administration of Customs · China Banking Regulatory Commission · China Securities Regulatory Commission · China Insurance Regulatory Commission · State Administration of Foreign Exchange · All-China Federation of Industry and Commerce · CITIC Group · China Investment Corporation · National Energy CommissionDevelopment International rankings · Special Economic Zones · Social welfare · Poverty · Corruption · Standard of living · Foreign aid · Urbanization · Internal migration · Emigration · Science and technology · Food safety · Intellectual property · Rural credit cooperativeRegional economic strategies Pearl River Delta Economic Zone · Bohai Economic Rim · China Western Development · Rise of Central China Plan · Northeast China Revitalization · Western Taiwan Straits Economic Zone · Yangtze River Delta Economic Zone · Beibu Gulf Economic Rim · Central Plains Economic ZoneEvents Related topics Agriculture · Demographics · Globalization · Globalization and women in China · Statistics · National Standards · China Compulsory Certificate · Closer Economic Partnership Arrangements (Hong Kong · Macau) · Chinese people by net worth · Chinese economistsSee also:  Category ·

Category ·  List of China-related topics · Economy of East AsiaCategories:

List of China-related topics · Economy of East AsiaCategories:- SSE 50 companies

- Companies listed on the Shanghai Stock Exchange

- 1990 establishments in China

- Economy of Shanghai

- Stock exchanges in Asia

- Stock exchanges in China

- Companies based in Shanghai

Wikimedia Foundation. 2010.