- National Stock Exchange of India

-

National Stock Exchange राष्ट्रीय शेअर बाज़ार

Location of National Stock Exchange in India

Location of National Stock Exchange in IndiaType Stock Exchange Location Mumbai, India Coordinates 19°3′37″N 72°51′35″E / 19.06028°N 72.85972°E Founded 1992 Owner National Stock Exchange of India Limited Key people Ravi Narain (MD) Currency Indian rupee (  )

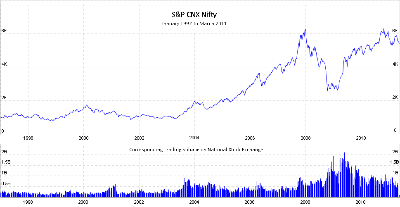

)No. of listings 1,552 MarketCap US$1.59 trillion (Dec 2010)[1] Indexes S&P CNX Nifty

CNX Nifty Junior

S&P CNX 500Website www.nseindia.com The National Stock Exchange (NSE) (Hindi: राष्ट्रीय शेअर बाज़ार Rashtriya Śhare Bāzaār) is a stock exchange located at Mumbai, Maharashtra, India. It is the 9th largest stock exchange in the world by market capitalization and largest in India by daily turnover and number of trades, for both equities and derivative trading.[2] NSE has a market capitalization of around US$1.59 trillion and over 1,552 listings as of December 2010.[3] Though a number of other exchanges exist, NSE and the Bombay Stock Exchange are the two most significant stock exchanges in India, and between them are responsible for the vast majority of share transactions. The NSE's key index is the S&P CNX Nifty, known as the NSE NIFTY (National Stock Exchange Fifty), an index of fifty major stocks weighted by market capitalisation.

NSE is mutually-owned by a set of leading financial institutions, banks, insurance companies and other financial intermediaries in India but its ownership and management operate as separate entities.[4] There are at least 2 foreign investors NYSE Euronext and Goldman Sachs who have taken a stake in the NSE.[5] As of 2006[update], the NSE VSAT terminals, 2799 in total, cover more than 1500 cities across India.[6] NSE is the third largest Stock Exchange in the world in terms of the number of trades in equities.[7] It is the second fastest growing stock exchange in the world with a recorded growth of 16.6%.[8]

Contents

Origins

The National Stock Exchange of India was promoted by leading Financial institutions at the behest of the Government of India, and was incorporated in November 1992 as a tax-paying company. In April 1993, it was recognized as a stock exchange under the Securities Contracts (Regulation) Act, 1956. NSE commenced operations in the Wholesale Debt Market (WDM) segment in June 1994. The Capital market (Equities) segment of the NSE commenced operations in November 1994, while operations in the Derivatives segment commenced in June 2000.

Innovations

NSE pioneering efforts include:

- Being the first national, anonymous, electronic limit order book (LOB) exchange to trade securities in India. Since the success of the NSE, existent market and new market structures have followed the "NSE" model.

- Setting up the first clearing corporation "National Securities Clearing Corporation Ltd." in India. NSCCL was a landmark in providing innovation on all spot equity market (and later, derivatives market) trades in India.

- Co-promoting and setting up of National Securities Depository Limited, first depository in India[9]

- Setting up of S&P CNX Nifty.

- NSE pioneered commencement of Internet Trading in February 2000, which led to the wide popularization of the NSE in the broker community.

- Being the first exchange that, in 1996, proposed exchange traded derivatives, particularly on an equity index, in India. After four years of policy and regulatory debate and formulation, the NSE was permitted to start trading equity derivatives

- Being the first and the only exchange to trade GOLD ETFs (exchange traded funds) in India.

- NSE has also launched the NSE-CNBC-TV18 media centre in association with CNBC-TV18.

- NSE.IT Limited, setup in 1999 , is a 100% subsidiary of the National Stock Exchange of India. A Vertical Specialist Enterprise, NSE.IT offers end-to-end Information Technology (IT) products, solutions and services.

- NSE (National Stock Exchange) was the first exchange in the world to use satellite communication technology for trading, using a client server based system called National Exchange for Automated Trading (NEAT). For all trades entered into NEAT system, there is uniform response time of less than one second.

Markets

Currently, NSE has the following major segments of the capital market:

- Equity

- Futures and Options

- Retail Debt Market

- Wholesale Debt Market

- Currency futures

- Mutual Fund

- Stocks lending and borrowing

August 2008 Currency derivatives were introduced in India with the launch of Currency Futures in USD INR by NSE. Currently it has also launched currency futures in EURO, POUND & YEN. Interest Rate Futures was introduced for the first time in India by NSE on 31 August 2009, exactly after one year of the launch of Currency Futures.

NSE became the first stock exchange to get approval for Interest rate futures as recommended by SEBI-RBI committee, on 31 August 2009, a futures contract based on 7% 10 Year GOI bond (NOTIONAL) was launched with quarterly maturities.[10]

Hours

NSE's normal trading sessions are conducted from 9:15 am India Time to 3:30 pm India Time on all days of the week except Saturdays, Sundays and Official Holidays declared by the Exchange (or by the Government of India) in advance.[11] The exchange, in association with BSE (Bombay Stock Exchange Ltd.), is thinking of revising its timings from 9.00 am India Time to 5.00 pm India Time.

There were System Testing going on and opinions, suggestions or feedback on the New Proposed Timings are being invited from the brokers across India. And finally on 18 November 2009 regulator decided to drop their ambitious goal of longest Asia Trading Hours due to strong opposition from its members.

On 16 December 2009, NSE announced that it would advance the market opening to 9:00 am from 18 December 2009. So NSE trading hours will be from 9.00 am till 3:30 pm India Time.

However, on 17 December 2009, after strong protests from brokers, the Exchange decided to postpone the change in trading hours till 4 Jan 2010.

NSE new market timing from 4 Jan 2010 is 9:00 am till 3:30 pm India Time.

Milestones

- November 1992 Incorporation

- April 1993 Recognition as a stock exchange

- May 1993 Formulation of business plan

- June 1994 Wholesale Debt Market segment goes live

- November 1994 Capital Market (Equities) segment goes live

- March 1995 Establishment of Investor Grievance Cell

- April 1995 Establishment of NSCCL, the first Clearing Corporation

- June 1995 Introduction of centralised insurance cover for all trading members

- July 1995 Establishment of Investor Protection Fund

- October 1995 Became largest stock exchange in the country

- April 1996 Commencement of clearing and settlement by NSCCL

- April 1996 Launch of S&P CNX Nifty

- June 1996 Establishment of Settlement Guarantee Fund

- November 1996 Setting up of National Securities Depository Limited, first depository in India, co-promoted by NSE

- November 1996 Best IT Usage award by Computer Society of India

- December 1996 Commencement of trading/settlement in dematerialised securities

- December 1996 Dataquest award for Top IT User

- December 1996 Launch of CNX Nifty Junior

- February 1997 Regional clearing facility goes live

- November 1997 Best IT Usage award by Computer Society of India

- May 1998 Promotion of joint venture, India Index Services & Products Limited (IISL)

- May 1998 Launch of NSE's Web-site: www.nse.co.in

- July 1998 Launch of NSE's Certification Programme in Financial Market

- August 1998 CYBER CORPORATE OF THE YEAR 1998 award

- February 1999 Launch of Automated Lending and Borrowing Mechanism

- April 1999 CHIP Web Award by CHIP magazine

- October 1999 Setting up of NSE.IT

- January 2000 Launch of NSE Research Initiative

- February 2000 Commencement of Internet Trading

- June 2000 Commencement of Derivatives Trading (Index Futures)

- September 2000 Launch of 'Zero Coupon Yield Curve'

- November 2000 Launch of Broker Plaza by Dotex International, a joint venture between NSE.IT Ltd. and i-flex Solutions Ltd.

- December 2000 Commencement of WAP trading

- June 2001 Commencement of trading in Index Options

- July 2001 Commencement of trading in Options on Individual Securities

- November 2001 Commencement of trading in Futures on Individual Securities

- December 2001 Launch of NSE VaR for Government Securities

- January 2002 Launch of Exchange Traded Funds (ETFs)

- May 2002 NSE wins the Wharton-Infosys Business Transformation Award in the Organization-wide Transformation category

- October 2002 Launch of NSE Government Securities Index

- January 2003 Commencement of trading in Retail Debt Market

- June 2003 Launch of Interest Rate Futures

- August 2003 Launch of Futures & options in CNXIT Index

- June 2004 Launch of STP Interoperability

- August 2004 Launch of NSE’s electronic interface for listed companies

- March 2005 ‘India Innovation Award’ by EMPI Business School, New Delhi

- June 2005 Launch of Futures & options in BANK Nifty Index

- December 2006 'Derivative Exchange of the Year', by Asia Risk magazine

- January 2007 Launch of NSE – CNBC TV 18 media centre

- March 2007 NSE, CRISIL announce launch of IndiaBondWatch.com

- June 2007 NSE launches derivatives on Nifty Junior & CNX 100

- October 2007 NSE launches derivatives on Nifty Midcap 50

- January 2008 Introduction of Mini Nifty derivative contracts on 1 January 2008

- March 2008 Introduction of long term option contracts on S&P CNX Nifty Index

- April 2008 Launch of India VIX

- April 2008 Launch of Securities Lending & Borrowing Scheme

- August 2008 Launch of Currency Derivatives

- August 2009 Launch of Interest Rate Futures

- November 2009 Launch of Mutual Fund Service System

- December 2009 Commencement of settlement of corporate bonds

- February 2010 Launch of Currency Futures on additional currency pairs

- October 2010 Launch of 15-minute special pre-open trading session, a mechanism under which investors can bid for stocks before the market opens.[12]

Indices

NSE also set up as index services firm known as India Index Services & Products Limited (IISL) and has launched several stock indices, including:[13]

- S&P CNX Nifty(Standard & Poor's CRISIL NSE Index)

- CNX Nifty Junior

- CNX 100 (= S&P CNX Nifty + CNX Nifty Junior)

- S&P CNX 500 (= CNX 100 + 400 major players across 72 industries)

- CNX Midcap (introduced on 18 July 2005 replacing CNX Midcap 200)

Exchange Traded Funds on NSE

NSE has a number of exchange traded funds. These are typically index funds and GOLD ETFs. Some of the popular ETF's available for trading on NSE are:

- NIFTYBEES - ETF based on NIFTY index

- GoldBees - ETF based on Gold prices. Tracks the price of Gold. Each unit is equivalent to 1 gm of gold and bears the price of 1gm of gold.

- BankBees - ETF that tracks the CNX Bank Index.

Certifications

NSE also conducts online examination and awards certification, under its programmes of NSE's Certification in Financial Markets (NCFM)[1]. Currently, certifications are available in 19 modules, covering different sectors of financial and capital markets. Branches of the NSE are located throughout India. NSE, in collaboration with reputed colleges and institutes in India, has been offering a short-term course called NSE Certified Capital Market Professional (NCCMP) since August 2009, in the campuses of the respective colleges/ institutes.[14]

See also

- Companies listed on the National Stock Exchange of India

- List of South Asian stock exchanges

- Mahurat trading

- Clause 49

- Share bazaar

- Bombay Stock Exchange

References

- ^ World-exchanges.org

- ^ "National Stock Exchange". Nasscom.in. 2006-07-12. http://www.nasscom.in/Nasscom/templates/NormalPage.aspx?id=28461. Retrieved 2010-08-26.

- ^ "NSE likely to overtake BSE in marketcap". The Financial Express. http://www.financialexpress.com/news/NSE-likely-to-overtake-BSE-in-marketcap/499964/. Retrieved 2009-08-11.

- ^ "Personal website of R.Kannan". Geocities.com. 2004-08-22. Archived from the original on 2009-10-28. http://web.archive.org/web/20091028014118/http://geocities.com/kstability/student/illiquid/illiquid2.html. Retrieved 2010-08-26.

- ^ India’s SEBI raises exchange ownership cap to 15%

- ^ "NSE - About Us - Facts & Figures". Nse-india.com. http://www.nse-india.com/content/us/us_factsfigures.htm. Retrieved 2010-08-26.

- ^ "World Federation of Exchanges (2007)"[dead link]

- ^ "Now, NSE 2nd fastest growing stock exchange". Expressindia.com. 2007-08-29. http://www.expressindia.com/news/fullstory.php?newsid=91524. Retrieved 2010-08-26.

- ^ "NSDL". NSDL. 2010-12-11. http://www.nsdl.co.in/. Retrieved 2010-12-15.

- ^ "Interest rate futures: NSE, MCX-SX set to fight it out - Business News - News - MSN India". News.in.msn.com. http://news.in.msn.com/business/article.aspx?cp-documentid=3114180. Retrieved 2010-12-15.

- ^ National Stock Exchange of India via Wikinvest

- ^ "BSE, NSE launch pre-open trade today". business.rediff.com. http://business.rediff.com/report/2010/oct/18/fifteen-min-call-auction-window-from-today.htm. Retrieved 18 Oct 2010.

- ^ "NSE - Major indices". Nse-india.com. 2005-07-18. http://www.nse-india.com/content/indices/ind_majorindices.htm. Retrieved 2010-08-26.

- ^ http://www.nseindia.com/education/content/module_nccmp.htm

External links

- Official website

- NSE Holidays NSE Holidays 2011

Coordinates: 19°3′37″N 72°51′35″E / 19.06028°N 72.85972°E

World Federation of Exchanges (WFE) Members Amman Stock Exchange · Athens Exchange · Australian Securities Exchange · Bermuda Stock Exchange · BM&F Bovespa · Bolsa de Comercio de Buenos Aires · Bolsa de Comercio de Santiago · Bolsa de Valores de Colombia · Bolsa de Valores de Lima · Bolsa Mexicana de Valores · Bolsas y Mercados Españoles · Bombay Stock Exchange · Borsa Italiana · Budapest Stock Exchange · Bursa Malaysia · Casablanca Stock Exchange · CBOE · CME Group · Colombo Stock Exchange · Cyprus Stock Exchange · Deutsche Börse · Egyptian Exchange · Hong Kong Exchanges and Clearing · Indonesia Stock Exchange · IntercontinentalExchange · International Securities Exchange · Irish Stock Exchange · Istanbul Stock Exchange · Johannesburg Stock Exchange · Korea Stock Exchange · Ljubljana Stock Exchange · London Stock Exchange · Luxembourg Stock Exchange · Malta Stock Exchange · Moscow Interbank Currency Exchange · NASDAQ OMX · NASDAQ OMX Armenia · NASDAQ OMX Copenhagen · NASDAQ OMX Helsinki · NASDAQ OMX Iceland · NASDAQ OMX Riga · Nasdaq OMX Stockholm · NASDAQ OMX Tallinn · NASDAQ OMX Vilnius · National Stock Exchange of India · NYSE Euronext Amsterdam · NYSE Euronext Brussels · NYSE Euronext Lisbon · NYSE Euronext New York · NYSE Euronext Paris · Osaka Securities Exchange · Oslo Børs · Philippine Stock Exchange · Saudi Stock Exchange · Shanghai Stock Exchange · Shenzhen Stock Exchange · Singapore Exchange · SIX Swiss Exchange · Stock Exchange of Mauritius · Stock Exchange of Thailand · Taiwan Stock Exchange · Tehran Stock Exchange · Tel Aviv Stock Exchange · TMX Group · Tokyo Stock Exchange · Warsaw Stock Exchange · Wiener Börse

Associates Depository Trust & Clearing Corporation · Financial Industry Regulatory Authority (FINRA) · LCH.Clearnet · Options Clearing Corporation · Takasbank

Affiliates Abu Dhabi Securities Exchange · Beirut Stock Exchange · Bucharest Stock Exchange · GreTai Securities Market · HoChiMinh Stock Exchange · Karachi Stock Exchange · Kazakhstan Stock Exchange · Muscat Securities Market · Nairobi Stock Exchange · Namibian Stock Exchange · National Stock Exchange · Nigerian Stock Exchange · RTS Exchange · Taiwan Futures Exchange · Zhengzhou Commodity Exchange

Correspondents Bahrain Bourse · Baku Interbank Currency Exchange · Banja Luka Stock Exchange · Barbados Stock Exchange · Belgrade Stock Exchange · Bolsa de Comercio de Rosario · Bolsa de Valores de Panamá · Bolsa Nacional de Valores · Borse Dubai · Bourse des Valeurs Mobilières de Tunis · Bourse Régionale des Valeurs Mobiliéres · Bratislava Stock Exchange · Bulgarian Stock Exchange – Sofia · Cayman Islands Stock Exchange · Chittagong Stock Exchange · CNSX Markets · Ghana Stock Exchange · Kuwait Stock Exchange · Libyan Stock Market · Lusaka Stock Exchange · Montenegro Stock Exchange · Multi Commodity Exchange of India · Palestine Exchange · PFTS Stock Exchange · Port Moresby Stock Exchange · Qatar Exchange · Zagreb Stock Exchange

Economy of India Companies BSE SENSEX · S&P CNX Nifty · Government-owned companies · List of companies

Governance Ministry of Finance (Finance ministers) · Ministry of Commerce and Industry · Securities and Exchange Board of India · Planning Commission of India · Economic Advisory Council · Central Statistical Organisation · Taxation in India

Currency Financial services Banking (Banks) · Insurance · Bombay Stock Exchange · National Stock Exchange of India

History Economic liberalisation · Green revolution · Glossary · Government initiatives · Numbering system

People States Maharashtra · Uttar Pradesh · Andhra Pradesh · Tamil Nadu · Gujarat · West Bengal · Karnataka · Rajasthan · Kerala

Sectors Agriculture (Livestock · Fishing) · Construction · Education · Energy (Nuclear · Solar · Wind) · Forestry · Gambling · Healthcare · Internet · Manufacturing (Automotive · Pharmaceuticals) · Media (Cinema · Television) · Mining · Science and technology · Telecommunications · Tourism · Transport (Airlines)

Categories:- Stock exchanges in India

- Economy of Mumbai

- Stock exchanges in Asia

- Companies based in Mumbai

- Companies listed on the National Stock Exchange of India

- Companies established in 1992

Wikimedia Foundation. 2010.