- World economy

-

Economy of the world

During 2003 unless otherwise statedPopulation 7,000,000,000 (October 31, 2011)[1] GDP Currency: US$61.96 trillion, €55.8 trillion (2010 est.)[2]

PPP: US$74.00 trillion, €60 trillion (2010 est.)[2]GDP growth Per capita (PPP): -0.8% (2009 est.) GDP per capita Currency: US$7,178, €5,000

PPP: US$10,500, €7,500Millionaires (US$) ~10 million i.e. ~0.15% (2009) Unemployment 30% combined unemployment and underemployment in many non-industrialized countries. Developed countries typically 4-12% unemployment. Billionaires (US$) 1,011 (2010)[3] People paid below US$2 per day ~3.25 billion (~50%) Trailing-ten-years. Most numbers are from the UNDP from 2002, some numbers exclude certain countries for lack of information.

See also: Economy of the world – Economy of Africa – Economy of Asia – Economy of Europe – Economy of North America – Economy of Oceania – Economy of South AmericaThe world economy, or global economy, generally refers to the economy, which is based on economies of all of the world's countries, national economies. Also global economy can be seen as the economy of global society and national economies – as economies of local societies, making the global one. It can be evaluated in various kind of ways. For instance, depending on the model used, the valuation that is arrived at can be represented in a certain currency, such as 2006 US dollars or 2005 euros.

It is inseparable from the geography and ecology of Earth, and is therefore somewhat of a misnomer, since, while definitions and representations of the "world economy" vary widely, they must at a minimum exclude any consideration of resources or value based outside of the Earth. For example, while attempts could be made to calculate the value of currently unexploited mining opportunities in unclaimed territory in Antarctica, the same opportunities on Mars would not be considered a part of the world economy—even if currently exploited in some way—and could be considered of latent value only in the same way as uncreated intellectual property, such as a previously unconceived invention.

Beyond the minimum standard of concerning value in production, use, and exchange on the planet Earth, definitions, representations, models, and valuations of the world economy vary widely.

It is common to limit questions of the world economy exclusively to human economic activity, and the world economy is typically judged in monetary terms, even in cases in which there is no efficient market to help valuate certain goods or services, or in cases in which a lack of independent research or government cooperation makes establishing figures difficult. Typical examples are illegal drugs and other black market goods, which by any standard are a part of the world economy, but for which there is by definition no legal market of any kind.

However, even in cases in which there is a clear and efficient market to establish a monetary value, economists do not typically use the current or official exchange rate to translate the monetary units of this market into a single unit for the world economy, since exchange rates typically do not closely reflect worldwide value, for example in cases where the volume or price of transactions is closely regulated by the government.

Rather, market valuations in a local currency are typically translated to a single monetary unit using the idea of purchasing power. This is the method used below, which is used for estimating worldwide economic activity in terms of real US dollars or euros. However, the world economy can be evaluated and expressed in many more ways. It is unclear, for example, how many of the world's 6.8 billion people have most of their economic activity reflected in these valuations.

In 2011, the largest economies in the world with more than $2 trillion, €1.25 trillion by nominal GDP are the United States, China, Japan, Germany, France, the United Kingdom, Brazil, and Italy. The largest economies in the world with more than $2 trillion, €1.25 trillion by GDP (PPP) are the United States, China, Japan, India, Germany, Russia, the United Kingdom, Brazil, and France.

Contents

Economy – overview

1980 – 1990 - United States and Japan lead expansion

At exchange rates, the economic output of 112 markets expanded by $10.7 trillion from 1980 to 1990. The economic output of 34 markets contracted by $276.9 billion from 1980 to 1990. The five largest contributors to global output contraction are Argentina at 24%, Saudi Arabia at 17%, Nigeria at 11%, Venezuela at 8%, and Vietnam at 8%. At purchasing power parity, the economic output of 145 markets expanded by $12.1 trillion from 1980 to 1990. The economic output of 2 markets contracted by $3.5 billion from 1980 to 1990. The two contributors to global output contraction are Lebanon at 70% and Libya at 30%. The following two tables are lists of twenty largest economies by incremental GDP from 1980 to 1990 by International Monetary Fund.

List of Economies by Incremental Nominal GDP from 1980 to 1990[4] List of Economies by Incremental GDP (PPP) from 1980 to 1990[5] Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 11,472.974 100.00% —  European Union

European Union3,390.679 29.55% 1  United States

United States3,012.375 26.26% 2  Japan

Japan1,987.042 17.32% 3  Germany

Germany720.884 6.28% 4  Italy

Italy674.913 5.88% 5  France

France557.067 4.86% 6  United Kingdom

United Kingdom475.340 4.14% 7  Brazil

Brazil345.169 3.01% 8  Canada

Canada313.846 2.74% 9  Spain

Spain296.214 2.58% 10  South Korea

South Korea206.020 1.80% 11  China

China187.820 1.64% 12  Australia

Australia162.357 1.42% 13  India

India142.111 1.24% 14  Switzerland

Switzerland128.368 1.12% 15  Taiwan

Taiwan122.749 1.07% 16  Netherlands

Netherlands114.563 1.00% 17  Sweden

Sweden111.469 0.97% 18  Turkey

Turkey108.118 0.94% 19  Finland

Finland86.180 0.75% 20  Austria

Austria85.041 0.74% — Remaining Countries 1,635.328 14.25% Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 12,167.955 100.00% —  European Union

European Union3,179.570 26.13% 1  United States

United States3,012.375 24.76% 2  Japan

Japan1,349.389 11.09% 3  Germany

Germany684.548 5.63% 4  China

China663.033 5.45% 5  France

France494.476 4.06% 6  United Kingdom

United Kingdom476.685 3.92% 7  Italy

Italy465.212 3.82% 8  India

India458.522 3.77% 9  Brazil

Brazil338.756 2.78% 10  Spain

Spain279.151 2.29% 11  Mexico

Mexico275.781 2.27% 12  Canada

Canada270.732 2.22% 13  South Korea

South Korea247.859 2.04% 14  Turkey

Turkey175.159 1.44% 15  Indonesia

Indonesia169.242 1.39% 16  Australia

Australia158.145 1.30% 17  Taiwan

Taiwan137.332 1.13% 18  Netherlands

Netherlands132.426 1.09% 19  Iran

Iran130.678 1.07% 20  Thailand

Thailand113.166 0.93% — Remaining Countries 2,135.288 17.55% 1990 – 2000 - United States dominates expansion

At exchange rates, the economic output of 122 markets expanded by $10.7 trillion from 1990 to 2000. The economic output of 29 markets contracted by $94.2 billion from 1990 to 2000. The five largest contributors to global output contraction are Italy at 37%, Finland at 18%, Bulgaria at 9%, Algeria at 8%, and the Democratic Republic of Congo at 5%.

At purchasing power parity, the economic output of 148 markets expanded by $16.9 trillion from 1990 to 2000. The economic output of 3 markets contracted by $17.8 billion from 1990 to 2000. The three contributors to global output contraction are Bulgaria at 64%, the Democratic Republic of Congo at 29% and Sierra Leone at 7%.

List of Economies by Incremental Nominal GDP from 1990 to 2000[6] List of Economies by Incremental GDP (PPP) from 1990 to 2000[7] Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 10,033.659 100.00% 1  United States

United States4,150.950 41.37% 2  Japan

Japan1,609.410 16.04% —  European Union

European Union1,453.165 14.48% 3  China

China808.200 8.05% 4  United Kingdom

United Kingdom462.735 4.61% 5  Mexico

Mexico384.126 3.83% 6  Germany

Germany344.908 3.44% 7  South Korea

South Korea262.980 2.62% 8  Taiwan

Taiwan161.188 1.61% 9  India

India152.823 1.52% 10  Argentina

Argentina143.142 1.43% 11  Canada

Canada142.179 1.42% 12  Brazil

Brazil134.634 1.34% 13  Poland

Poland109.179 1.09% —  Hong Kong

Hong Kong92.231 0.92% 14  Netherlands

Netherlands90.960 0.91% 15  France

France83.886 0.84% 16  Australia

Australia73.788 0.74% 17  Saudi Arabia

Saudi Arabia71.915 0.72% 18  Israel

Israel69.805 0.70% 19  Venezuela

Venezuela68.760 0.69% 20  Turkey

Turkey64.063 0.64% — Remaining Countries 551.797 5.50% Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 18,778.927 100.00% 1  United States

United States4,150.950 22.10% —  European Union

European Union3,829.220 20.39% 2  China

China2,104.502 11.21% 3  Japan

Japan886.513 4.72% 4  India

India826.837 4.40% 5  Germany

Germany697.450 3.71% 6  United Kingdom

United Kingdom554.819 2.95% 7  France

France503.128 2.68% 8  Mexico

Mexico452.924 2.41% 9  Brazil

Brazil451.897 2.41% 10  South Korea

South Korea440.124 2.34% 11  Italy

Italy425.005 2.26% 12  Spain

Spain348.795 1.86% 13  Canada

Canada345.817 1.84% 14  Taiwan

Taiwan250.858 1.34% 15  Indonesia

Indonesia224.138 1.19% 16  Australia

Australia222.367 1.18% 17  Turkey

Turkey221.496 1.18% 18  Netherlands

Netherlands191.528 1.02% 19  Iran

Iran188.268 1.00% 20  Poland

Poland173.232 0.92% — Remaining Countries 5,118.279 27.26% 2000 – 2010 – Rise of Developing and Emerging Economies

2000 – 2006 – United States still leads, but China is catching up

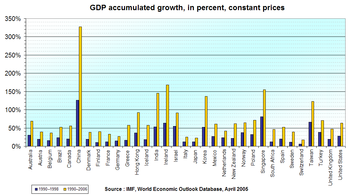

At exchange rates, the economic output of 176 markets expanded by $17.4 trillion from 2000 to 2006. The five largest contributors to global output expansion are the United States at 20%, China at 9%, Germany at 6%, the United Kingdom at 6%, and France at 5%. The economic output of 4 markets contracted by $94.2 billion from 2000 to 2006. The three largest contributors to global output contraction are Japan at 80%, Argentina at 19%, and the Uruguay at 1%.

At purchasing power parity, the economic output of 180 markets expanded by $19.2 trillion from 2000 to 2006. The five largest contributors to global output expansion are the United States at 18%, China at 17%, India at 6%, Japan at 5%, and Russia at 4%.

2007 – China leads expansion

The economic output by nominal GDP of 183 markets expanded by $6.4 trillion during 2007. China accounted for 12% while the United States accounted for 10%, Germany accounted for 6%, and the United Kingdom accounted for 6% of the global output expansion.

2008 – credit crisis begins

The economic output of 171 markets expanded by $5.8 trillion during 2008. China accounted for one-sixth of the global output expansion. The economic output of 11 markets contracted by $267 billion during 2008. The United Kingdom accounted for one-half while South Korea accounted for two-fifth of the global output contraction. Though the crisis first affected most countries in 2008, it was not yet deep enough to reverse growth.

2009 – credit crisis spreads

At exchange rates, the economic output of 127 markets contracted by $4.1 trillion during 2009. The United Kingdom was the largest victim accounting for 12% while Russia accounted for 11% and Germany accounted for 8% of the global output contraction. The economic output of 56 markets expanded by $767.1 billion during 2009. China accounted for 61% while Japan accounted for 20% and Indonesia accounted for 4% of the global output expansion.

At purchasing power parity, the economic output of 79 markets contracted by $1.4 trillion during 2009. The United States was the largest victim accounting for 18% while Japan accounted for 17% and Russia accounted for 10% of the global output contraction. The economic output of 104 markets expanded by $1.5 trillion during 2009. China accounted for 56% while India accounted for 17% and Indonesia accounted for 3% of the global output expansion.

2010 – recovery

At exchange rates, the economic output of 148 markets expanded by $5.3 trillion during 2010. The five largest contributors to global output expansion are China at 17%, the United States at 10%, Brazil at 9%, Japan at 8%, and India at 5%. The economic output of 35 markets contracted by $338.5 billion during 2010. The five largest contributors to global output contraction are France at 22%, Italy at 18%, Spain at 17%, Venezuela at 10%, and Germany at 7%.

At purchasing power parity, the economic output of 169 markets expanded by $4.2 trillion during 2010. The five largest contributors to global output expansion are China at 25%, the United States at 13%, India at 10%, Japan at 5%, and Brazil at 4%. The economic output of 14 markets contracted by $17.8 billion during 2010. The five largest contributors to global output contraction are Greece at 67%, Venezuela at 19%, Romania at 5%, Haiti at 3%, and Croatia at 2%.

IMF's economic outlook for 2010 noted that banks faced a "wall" of maturing debt, which presents important risks for the normalization of credit conditions. There has been little progress in lengthening the maturity of their funding and, as a result, over $4 trillion in debt is due to be refinanced in the next 2 years.[8]`

The following two tables are lists of twenty largest economies by incremental GDP from 2000 to 2010 by International Monetary Fund.

List of Economies by Incremental Nominal GDP from 2000 to 2010[9] List of Economies by Incremental GDP (PPP) from 2000 to 2010[10] Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 30,694.784 100.00% —  European Union

European Union7,746.655 25.24% 1  China

China4,679.779 15.25% 2  United States

United States4,575.075 14.91% 3  Brazil

Brazil1,447.896 4.72% 4  Germany

Germany1,394.517 4.54% 5  France

France1,230.874 4.01% 6  Russia

Russia1,220.123 3.98% 7  India

India1,155.620 3.76% 8  Italy

Italy954.551 3.11% 9  Canada

Canada852.126 2.78% 10  Australia

Australia836.375 2.72% 11  Spain

Spain827.569 2.70% 12  Japan

Japan791.349 2.58% 13  United Kingdom

United Kingdom769.682 2.51% 14  Indonesia

Indonesia541.231 1.76% 15  South Korea

South Korea481.097 1.57% 16  Turkey

Turkey469.048 1.53% 17  Netherlands

Netherlands394.138 1.28% 18  Mexico

Mexico362.379 1.18% 19  Iran

Iran310.942 1.01% 20  Poland

Poland298.138 0.97% — Remaining Countries 7,102.275 23.14% Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 32,120.264 100.00% 1  China

China7,104.468 22.12% —  European Union

European Union4,644.825 14.46% 2  United States

United States4,575.075 14.24% 3  India

India2,486.325 7.74% 4  Russia

Russia1,110.081 3.46% 5  Japan

Japan1,108.850 3.45% 6  Brazil

Brazil944.114 2.94% 7  Germany

Germany800.073 2.49% 8  South Korea

South Korea690.370 2.15% 9  United Kingdom

United Kingdom665.196 2.07% 10  France

France600.626 1.87% 11  Indonesia

Indonesia531.966 1.66% 12  Mexico

Mexico499.665 1.56% 13  Spain

Spain472.438 1.47% 14  Turkey

Turkey455.658 1.42% 15  Iran

Iran455.302 1.42% 16  Canada

Canada445.591 1.39% 17  Italy

Italy381.207 1.19% 18  Taiwan

Taiwan372.688 1.16% 19  Australia

Australia356.136 1.11% 20  Poland

Poland326.560 1.02% — Remaining Countries 7,737.875 24.09% 2010 – 2016 The BRICs lead economic growth.

At exchange rates, the economic output of the world is expected to expand by US$28.7 trillion, €20 trillion from 2010 to 2016.[11] At purchasing power parity, the economic output of 183 markets is expected to expand by US$29.1 trillion, €25 trillion from 2010 to 2016.[12] The following two tables are predictive lists of forty largest economies by incremental GDP from 2010 to 2016 by International Monetary Fund.

Predictive List of Economies by Incremental Nominal GDP from 2010 to 2016[13] Predictive List of Economies by Incremental GDP (PPP) from 2010 to 2016[14] Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 28,664.160 100.00% 1  China

China5,901.722 20.59% —  European Union

European Union4,808.275 16.77% 2  United States

United States3,724.097 12.99% 3  Russia

Russia1,608.236 5.61% 4  India

India1,394.939 4.87% 5  Japan

Japan1,324.140 4.62% 6  Brazil

Brazil1,282.701 4.47% 7  United Kingdom

United Kingdom973.522 3.40% 8  France

France704.864 2.46% 9  Indonesia

Indonesia674.918 2.35% 10  South Korea

South Korea671.361 2.34% 11  Germany

Germany642.659 2.24% 12  Australia

Australia571.037 1.99% 13  Canada

Canada528.798 1.84% 14  Mexico

Mexico470.710 1.64% 15  Italy

Italy421.204 1.47% 16  Turkey

Turkey397.580 1.39% 17  Spain

Spain353.651 1.23% 18  Taiwan

Taiwan337.235 1.18% 19  Sweden

Sweden325.283 1.13% 20  Saudi Arabia

Saudi Arabia288.458 1.01% 21  Switzerland

Switzerland237.156 0.83% 22  Poland

Poland224.310 0.78% 23  Iran

Iran222.480 0.78% 24  Thailand

Thailand219.045 0.76% 25  Netherlands

Netherlands187.052 0.65% 26  Argentina

Argentina179.994 0.63% 27  Kazakhstan

Kazakhstan177.049 0.62% 28  South Africa

South Africa171.913 0.60% 29  United Arab Emirates

United Arab Emirates162.645 0.57% 30  Nigeria

Nigeria156.766 0.55% 31  Belgium

Belgium154.013 0.54% 32  Colombia

Colombia141.267 0.49% 33  Norway

Norway132.653 0.46% —  Hong Kong

Hong Kong130.731 0.46% 34  Romania

Romania127.647 0.45% 35  Pakistan

Pakistan126.254 0.44% 36  Malaysia

Malaysia123.778 0.43% 37  Egypt

Egypt123.282 0.43% 38  Austria

Austria118.493 0.41% 39  Ukraine

Ukraine117.496 0.41% 40  Singapore

Singapore115.901 0.40% — Remaining Countries 2,717.120 9.48% Rank Country Incremental GDP (billions of US$) Share of Global Incremental GDP — World 29,103.681 100.00% 1  China

China8,547.378 29.37% 2  United States

United States3,724.097 12.80% —  European Union

European Union3,080.774 10.59% 3  India

India2,861.687 9.83% 4  Russia

Russia809.035 2.78% 5  Brazil

Brazil787.335 2.71% 6  Japan

Japan744.838 2.56% 7  Indonesia

Indonesia609.759 2.10% 8  Germany

Germany538.678 1.85% 9  South Korea

South Korea538.172 1.85% 10  Mexico

Mexico514.450 1.77% 11  United Kingdom

United Kingdom488.910 1.68% 12  France

France430.078 1.48% 13  Taiwan

Taiwan362.361 1.25% 14  Turkey

Turkey353.993 1.22% 15  Iran

Iran313.617 1.08% 16  Canada

Canada306.830 1.05% 17  Argentina

Argentina273.311 0.94% 18  Australia

Australia256.857 0.88% 19  Saudi Arabia

Saudi Arabia254.129 0.87% 20  Spain

Spain246.887 0.85% 21  Thailand

Thailand244.185 0.84% 22  Poland

Poland231.544 0.80% 23  Italy

Italy225.945 0.78% 24  Nigeria

Nigeria210.561 0.72% 25  Egypt

Egypt190.444 0.65% 26  Malaysia

Malaysia186.781 0.64% 27  Pakistan

Pakistan180.020 0.62% 28  Colombia

Colombia176.371 0.61% 29  South Africa

South Africa176.073 0.60% 30  Vietnam

Vietnam166.087 0.57% 31  Philippines

Philippines160.398 0.55% 32  Bangladesh

Bangladesh151.617 0.52% 33  Peru

Peru144.616 0.50% —  Hong Kong

Hong Kong134.821 0.46% 34  Netherlands

Netherlands126.172 0.43% 35  Ukraine

Ukraine119.600 0.41% 36  Singapore

Singapore113.837 0.39% 37  Chile

Chile111.057 0.38% 38  Sweden

Sweden109.062 0.37% 39  Kazakhstan

Kazakhstan106.157 0.36% 40  Iraq

Iraq103.853 0.36% — Remaining Countries 2,772.078 9.52% Statistical indicators

Economy

- GDP (GWP) (gross world product): (purchasing power parity exchange rates) – $59.38 trillion (2005 est.), $51.48 trillion (2004), $23 trillion (2002)

- GDP (GWP) (gross world product):[15] (market exchange rates) – $60.69 trillion (2008)

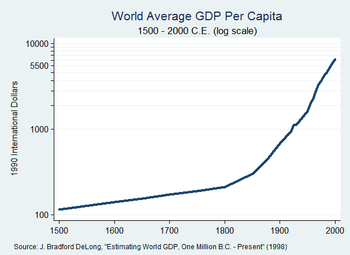

- GDP – real growth rate: 3.2% (2008), 3.1% p.a. (2000–07), 2.4% p.a. (1990–99), 3.1% p.a. (1980–89)

- GDP – per capita: purchasing power parity – $9,300, €7,500 (2005 est.), $8,200, €6,800 (92) (2003), $7,900, €5,000 (2002)

- World median income: purchasing power parity $1,041, €950 (1993)[16]

- GDP – composition by sector: agriculture: 4%; industry: 32%; services: 64% (2004 est.)

- Inflation rate (consumer prices): developed countries 1% to 4% typically; developing countries 5% to 60% typically; national inflation rates vary widely in individual cases, from declining prices in Japan to hyperinflation in several Third World countries (2003)

- Derivatives OTC outstanding notional amount: $601 trillion (Dec 2010) ([12])

- Derivatives exchange traded outstanding notional amount: $82 trillion (June 2011) ([13])

- Global debt issuance: $5.187 trillion, €3 trillion (2004), $4.938 trillion, €3.98 trillion (2003), $3.938 trillion (2002) (Thomson Financial League Tables)

- Global equity issuance: $505 billion, €450 billion (2004), $388 billion. €320 billion (2003), $319 billion, €250 trillion (2002) (Thomson Financial League Tables)

Employment

- Unemployment rate: 8.7% (2009 est.). 30% (2007 est.) combined unemployment and underemployment in many non-industrialized countries; developed countries typically 4%–12% unemployment.

Industries

- Industrial production growth rate: 3% (2002 est.)

Energy

- Yearly electricity – production: 15,850,000 GWh (2003 est.), 14,850,000 GWh (2001 est.)

- Yearly electricity – consumption: 14,280,000 GWh (2003 est.), 13,930,000 GWh (2001 est.)

- Oil – production: 79,650,000 bbl/d (12,663,000 m3/d) (2003 est.), 75,460,000 barrels per day (11,997,000 m3/d) (2001)

- Oil – consumption: 80,100,000 bbl/d (12,730,000 m3/d) (2003 est.), 76,210,000 barrels per day (12,116,000 m3/d) (2001)

- Oil – proved reserves: 1.025 trillion barrel (163 km³) (2001 est.)

- Natural gas – production: 2,569 km³ (2001 est.)

- Natural gas – consumption: 2,556 km³ (2001 est.)

- Natural gas – proved reserves: 161,200 km³ (1 January 2002)

Cross-border

- Yearly exports: $12.4 trillion, €8.75 trillion (2009 est.)

- Exports – commodities: the whole range of industrial and agricultural goods and services

- Exports – partners: US 12.7%, Germany 7.1%, China 6.2%, France 4.4%, Japan 4.2%, UK 4.1% (2008)

- Yearly imports: $12.29 trillion, €9 trillion (2009 est.)

- Imports – commodities: the whole range of industrial and agricultural goods and services

- Imports – partners: China 10.3%, Germany 8.6%, US 8.1%, Japan 5% (2008)

- Debt – external: $56.9 trillion, €40 trillion (31 December 2009 est.)

Gift economy

- Yearly economic aid – recipient: Official Development Assistance (ODA) $50 billion, €39.5 billion

Communications

Telephones – main lines in use: 843,923,500 (2007)

4,263,367,600 (2008)- Telephones – mobile cellular: 3,300,000,000 (Nov. 2007)[17]

- Internet Service Providers (ISPs): 10,350 (2000 est.)

- Internet users: 1,311,050,595 (January 18, 2008 [14] est.), 1,091,730,861 (December 30, 2006 [15] est.), 604,111,719 (2002 est.)

Transport

Transportation infrastructure worldwide includes:

- Airports

- Total: 49,973 (2004)

- Roadways (in kilometres)

- Total: 32,345,165 km

- Paved: 19,403,061 km

- Unpaved: 12,942,104 km (2002)

- Railways

- Total: 1,122,650 km includes about 190,000 to 195,000 km of electrified routes of which 147,760 km are in Europe, 24,509 km in the Far East, 11,050 km in Africa, 4,223 km in South America, and 4,160 km in North America.

Military

- Military expenditures – dollar figure: aggregate real expenditure on arms worldwide in 1999 remained at approximately the 1998 level, about $750 billion, about 1/2 of which was the United States (1999)

- Military expenditures – percent of GDP: roughly 2% of gross world product (1999).

Economic Studies

To promote exports, many government agencies publish on the web economic studies by sector and country. Among these agencies include the USCS (US DoC) and FAS (USDA) in the United States, EDC and AAFC in Canada, Ubifrance in France, UKTI in the UK, HKTDC and JETRO in Asia, Austrade and NZTE in Oceania. Through Partnership Agreements, The Federation of International Trade Associations publishes studies from several of these agencies (USCS, FAS, AAFC, UKTI, HKTDC), as well as other non-governmental organizations on its website GlobalTrade.net.

See also

- Economic history of the world

- Common Wealth: Economics for a Crowded Planet (book)

- Global workforce

- Globality

- Globalization

- Trade route

- World Trade Report

- The World Economy: Historical Statistics

Regional economies:

- Economy of Africa

- Economy of Asia

- Economy of Europe

- Economy of North America

- Economy of Oceania

- Economy of South America

Events:

- 2007–2008 world food price crisis

- Late 2000s recession

- Oil price increases since 2003

Lists:

- List of countries by GDP sector composition

- List of world's largest economies (nominal) – based on current currency market exchange rates

- List of world's largest economies (PPP) – based on purchasing power parity

- Historical list of world's largest economies (nominal) – for the years between 1998 and 2003

- Historical list of world's largest economies (PPP) – for the years between 1 and 1998

- List of world production

References

- ^ [1]

- ^ a b [2]

- ^ [3]

- ^ [4] IMF nominal GDP Data (September 2011)

- ^ [5] IMF GDP (PPP) Data (September 2011)

- ^ [6] IMF nominal GDP Data (September 2011)

- ^ [7] IMF GDP (PPP) Data (September 2011)

- ^ p.11

- ^ [8] IMF nominal GDP Data (September 2011)

- ^ [9] IMF GDP (PPP) Data (September 2011)

- ^ IMF GDP Data (September 2011)

- ^ IMF World GDP Data (September 2011)

- ^ [10] IMF nominal GDP Data (September 2011)

- ^ [11] IMF GDP (PPP) Data (September 2011)

- ^ IMF World Economic Outlook, Crisis and Recovery, April 2009

- ^ B. Milanovic (January 2002). "True World Income Distribution, 1988 and 1993: First Calculation Based on Household Surveys Alone". http://siteresources.worldbank.org/INTDECINEQ/Resources/trueworld.pdf. Retrieved 13 May 2011.

- ^ global cellphone penetration reaches 50 percent

External links

Categories:- Economies

- World economy

Wikimedia Foundation. 2010.