- DuPont analysis

-

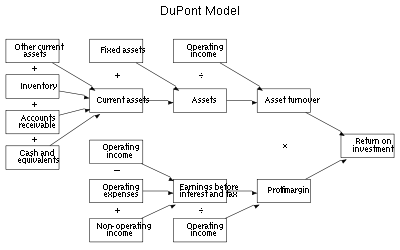

DuPont analysis (also known as the DuPont identity, DuPont equation, DuPont Model or the DuPont method) is an expression which breaks ROE (Return On Equity) into three parts.

The name comes from the DuPont Corporation that started using this formula in the 1920s.

Contents

Basic formula

ROE = (Profit margin)*(Asset turnover)*(Equity multiplier) = (Net profit/Sales)*(Sales/Assets)*(Assets/Equity)= (Net Profit/Equity)

- Operating efficiency (measured by profit margin)

- Asset use efficiency (measured by asset turnover)

- Financial leverage (measured by equity multiplier)

ROE analysis

The Du Pont identity breaks down Return on Equity (that is, the returns that investors receive from the firm) into three distinct elements. This analysis enables the analyst to understand the source of superior (or inferior) return by comparison with companies in similar industries (or between industries).

The Du Pont identity, however, is less useful for some industries, such as investment banking, that do not use certain concepts or for which the concepts are less meaningful. Variations may be used in certain industries, as long as they also respect the underlying structure of the Du Pont identity.

Du Pont analysis relies upon the accounting identity, that is, a statement (formula) that is by definition true.

Examples

High turnover industries

Certain types of retail operations, particularly stores, may have very low profit margins on sales, and relatively moderate leverage. In contrast, though, groceries may have very high turnover, selling a significant multiple of their assets per year. The ROE of such firms may be particularly dependent on performance of this metric, and hence asset turnover may be studied extremely carefully for signs of under-, or, over-performance. For example, same store sales of many retailers is considered important as an indication that the firm is deriving greater profits from existing stores (rather than showing improved performance by continually opening new stores).

High margin industries

Other industries, such as fashion, may derive a substantial portion of their competitive advantage from selling at a higher margin, rather than higher sales. For high-end fashion brands, increasing sales without sacrificing margin may be critical. The Du Pont identity allows analysts to determine which of the elements is dominant in any change of ROE.

High leverage industries

Some sectors, such as the financial sector, rely on high leverage to generate acceptable ROE. In contrast, however, many other industries would see high levels of leverage as unacceptably risky. Du Pont analysis enables the third party (relying primarily on the financial statements) to compare leverage with other financial elements that determine ROE among similar companies.

ROA and ROE ratio

The return on assets (ROA) ratio developed by DuPont for its own use is now used by many firms to evaluate how effectively assets are used. It measures the combined effects of profit margins and asset turnover.[1]

The return on equity (ROE) ratio is a measure of the rate of return to stockholders.[2] Decomposing the ROE into various factors influencing company performance is often called the Du Pont system.[3]

- Where

- Net profit = net profit after taxes

- Equity = shareholders' equity

- EBIT = Earnings before interest and taxes

- Sales = Net sales

This decomposition presents various ratios used in fundamental analysis.

- The company's tax burden is (Net profit ÷ Pretax profit). This is the proportion of the company's profits retained after paying income taxes. [NI/EBT]

- The company's interest burden is (Pretax profit ÷ EBIT). This will be 1.00 for a firm with no debt or financial leverage. [EBT/EBIT]

- The company's operating profit margin or return on sales (ROS) is (EBIT ÷ Sales). This is the operating profit per dollar of sales. [EBIT/Sales]

- The company's asset turnover (ATO) is (Sales ÷ Assets).

- The company's leverage ratio is (Assets ÷ Equity), which is equal to the firm's debt to equity ratio + 1. This is a measure of financial leverage.

- The company's return on assets (ROA) is (Return on sales x Asset turnover).

- The company's compound leverage factor is (Interest burden x Leverage).

ROE can also be stated as:[4]

-

- ROE = Tax burden x Interest burden x Margin x Turnover x Leverage

- ROE = Tax burden x ROA x Compound leverage factor

Profit margin is (Net profit ÷ Sales), so the ROE equation can be restated:

References

- ^ Groppelli, Angelico A.; Ehsan Nikbakht (2000). Finance, 4th ed. Barron's Educational Series, Inc.. pp. 444–445. ISBN 0764112759.

- ^ Groppelli, Angelico A.; Ehsan Nikbakht (2000). Finance, 4th ed. Barron's Educational Series, Inc.. p. 444. ISBN 0764112759.

- ^ Bodie, Zane; Alex Kane and Alan J. Marcus (2004). Essentials of Investments, 5th ed. McGraw-Hill Irwin. pp. 458–459. ISBN 0072510773.

- ^ Bodie, Zane; Alex Kane and Alan J. Marcus (2004). Essentials of Investments, 5th ed. McGraw-Hill Irwin. p. 460. ISBN 0072510773.

External links

Categories:- Financial ratios

- DuPont

Wikimedia Foundation. 2010.