- Australia and New Zealand Banking Group

-

Australia and New Zealand Banking Group Limited

Type Public (ASX: ANZ) Industry Banking Founded (1835) Headquarters Docklands, Melbourne, Australia Key people Michael Smith, (CEO)

John Morschel, (Chairman)Products Banking, financial and related services Profit  A$4.51 billion (2010)

A$4.51 billion (2010)Total assets  A$531.739 billion (2010)

A$531.739 billion (2010)Employees 46,917 Website ANZ.com The Australia and New Zealand Banking Group Limited (ASX: ANZ, NZX: ANZ), commonly called ANZ, is the fourth largest bank in Australia, after the Commonwealth Bank, Westpac Banking Corporation and the National Australia Bank. Australian operations make up the largest part of ANZ's business, with commercial and retail banking dominating. ANZ is also the largest bank in New Zealand, where the legal entity became known as ANZ National Bank Limited in 2004 and where it operates two brands, ANZ and the National Bank of New Zealand.

In addition to operations throughout Australia and New Zealand, ANZ also extends to twenty-five other nations.[1]

ANZ was named the most sustainable bank globally in the 2008 Dow Jones Sustainability Index making it the 2nd year in a row ANZ has been granted the title. In 2007 the title was shared with another Australian bank, Westpac, which had held the title for the previous five years.[2]

Contents

History

19th century

- 1835: ANZ began in London when The Bank of Australasia was established under Royal Charter

- 1837: The Union Bank of Australia was established. This was an Anglo-Australian bank

- 1852: The English, Scottish and Australian Bank (ES&A) was established in 1852. This was an Anglo-Australian bank

1950-60s

- 1951: The Bank of Australasia merges with the Union Bank of Australia to form ANZ Bank

- 1963: Establishes first computer systems in new data processing centre in Melbourne, Australia

- 1966: Starts operations in Honiara, Solomon Islands

- 1968: Opens office in New York, USA

- 1969: Establishes representative office in Tokyo, Japan

1970s

- 1970:

- In what was then the largest merger in Australian banking history, ANZ merged with the English, Scottish and Australian Bank Limited to form the present organisation, Australia and New Zealand Banking Group Limited

- Starts operations in Vanuatu

- 1971: Opens representative office in Malaysia

- 1976: ANZ (PNG) established

- 1977: ANZ incorporated in Australia (transfer from UK)

- 1979: Acquires the Bank of Adelaide

1980s

- 1980: Singapore and New York representative offices upgraded to branch status

- 1984: Purchases Grindlays Bank

- 1985:

- 1988:

- Opens branch in Rarotonga, Cook Islands

- Opens branch office in Paris, France

- 1989: Purchases PostBank from New Zealand Government

1990s

ANZ World Headquarters. Designed by Peddle Thorp Architects, the building is affectionately known as Gothic Tower due to its architecture. Queen Street, Melbourne.

ANZ World Headquarters. Designed by Peddle Thorp Architects, the building is affectionately known as Gothic Tower due to its architecture. Queen Street, Melbourne.

- 1990:

- Acquires National Mutual Royal Bank Limited

- Acquires Lloyds’ operations in Papua New Guinea

- Acquires Bank of New Zealand’s operations in Fiji

- Acquires Town and Country Building Society in Western Australia

- 1991:

- Acquires 75 per cent of Bank of Western Samoa

- Opens representative office in the Philippines

- 1993:

- New world headquarters built in Melbourne, Australia

- Joint venture established with PT Panin Bank, Indonesia

- Opens a branch in Hanoi and a representative office in Ho Chi Minh City, Vietnam

- Opens a branch in Shanghai and a representative office in Guangzhou, China

- Starts operations in Tonga

- Sold Canadian operations to HSBC Bank Canada

- 1995:

- Opens a commercial banking branch in Manila, Philippines, the first Australian and New Zealand bank to do so

- 1996:

- www.anz.com launched

- ANZ opens its second Vietnamese branch at Ho Chi Minh City

- 1997:

- John McFarlane appointed Chief Executive Officer

- ANZ Phone Banking launched

- Official opening of Beijing branch, China

- Bank of Western Samoa changes its name to ANZ Bank (Samoa)

- 1998: Acquires stake in PT Panin Bank, Indonesia

- 1999:

- ANZ Internet Banking launched

- ANZ announces strategic alliance with E*Trade Australia for online share trading service

- Purchases Amerika Samoa Bank (Approved 2000) [3]

21st century

- 2000:

- ANZ sells its Grindlays businesses in the Middle East and South Asia, and associated Grindlays Private Banking business, to Standard Chartered

- Granted local currency (Renminbi) licence from the People’s Bank of China

- 2001:

- Acquires 75 per cent of Bank of Kiribati

- ANZ Timor Leste opens

- Establishes cards business in Hong Kong

- 2002:

- Forms joint venture with ING Group for funds management and life insurance business in Australia and New Zealand

- One millionth customer registers for ANZ Internet Banking in Australia

- 2003: Acquires National Bank of New Zealand

- 2005: Establishes ANZ Royal Bank in Cambodia, a joint venture with the Cambodian-based Royal Group company

- 2006: New world headquarters announced for Melbourne Docklands near the headquarters of the National Australia Bank

- 2007:

- ANZ wins Money Magazine "Bank of the Year" award again after having been ousted by the National Australia Bank in 2006

- ANZ acquires E*Trade Australia[4]

- Mike Smith, formerly of HSBC, assumes the role of CEO with the retirement of John McFarlane on 1 October 2007[5]

- ANZ acquires Citizen Securities Bank (Guam)

- ANZ takes over from telecommunications company Telstra as naming rights sponsor for Sydney's Stadium Australia.

- 2009:

- 25 September 2009 Announced it will buy out ING Group's 51% stake of the JV, ING Australia giving ANZ 100% control of ING Australia.

- 12 November 2009 ANZ opens new ANZ Centre headquarters in Docklands, Melbourne

- 1 December 2009 ANZ officially gain full ownership of ING Australia.

- 2010:

- November 2010, ING Australia renamed OnePath

- ANZ acquires RBS (Royal Bank of Scotland)'s interests in Hong Kong, Taiwan, Singapore and Indonesia,[6][7][8] which were part of and traded as ABN-AMRO prior to RBS' acquisition of the Dutch bank in 2009.

Organisational structure

Australia

- Retail Products

- Retail Distribution

- Commercial Banking

- Wealth (including ETrade in Australia and OnePath)

New Zealand

- ANZ National Bank Limited

- ANZ New Zealand

- The National Bank of New Zealand

- UDC Finance

- Eftpos New Zealand

- Bonus Bonds

- Direct Broking - Share trading

- ING Group New Zealand

Institutional Banking

- Institutional Banking

- Corporate Finance

- Markets

- Working Capital

- Corporate Banking

- Economics@ANZ

Asia and Pacific

- International Partnerships

Asia-Pacific

ANZ is one of the leading Australian banks in the Asia-Pacific region. It has been aggressive in its expansion into the emerging markets of China, Vietnam and Indonesia. ANZ is also a leading bank in New Zealand as well as several Pacific Island Nation where it competes in many markets with fellow Australian bank, Westpac. ANZ's arm in New Zealand is operated through a subsidiary company ANZ National Bank.

In March 2005, it formed a strategic alliance with Vietnam's Sacombank involving an acquisition of 10% of Sacombank’s share capital. As part of the strategic alliance, ANZ will provide technical assistance in the areas of risk management and retail and small business banking.

ANZ has followed a similar strategy in China, where it acquired a 20% share in Tianjin City Commercial Bank in July 2006. It also negotiated a similar deal with Shanghai Rural Commercial Bank.

In August, ANZ purchased RBS's retail units in Taiwan, Singapore, Indonesia and Hong Kong, as well as RBS's institutional banking businesses in Taiwan, the Philippines and Vietnam. It was purchased for the price of A$687 million.

In 2008 ANZ was awarded Deal of the Year - Project Finance Deal of the Year at the 2008 ALB Hong Kong Law Awards.[9]

Offshoring of jobs

ANZ have been progressively increasing work output from offshore offices. ANZ's Bangalore office has been operational since 1989, making it one of the first organisations to employ IT staff based in India. ANZ employs around 4,800 staff in Bangalore, India.[10] 1500 IT positions, 2000 positions in Payments and Institutional Operations and International and High Value Services and 1300 positions in Operations Personal Banking have been shifted from Melbourne to India. In 2006, ANZ predicted that by 2010, over 2000 jobs would have been shifted from Australia to Bangalore.[11]

Advertising

In 2005 an advertisement included two famous robots: Lost in Space robot, and a Dalek from Doctor Who, although the Dalek was replaced in subsequent versions of the ad.

In 2006 the company started a TV campaign with a series of ads featuring their new mascot - the Falcon, a bird trained to stop credit card thieves, illustrating the company's measures in prevention of Credit card fraud.

The headquarters in the Melbourne Docklands, inaugurated 2009

The headquarters in the Melbourne Docklands, inaugurated 2009

Currently, the company is running an ad campaign parodying common banking scenarios with a fictional character known as 'Barbara who lives in Bank World', a middle-aged, rude, sarcastic and unhelpful bank manager. The adverts have received acclaim for wit and humour, but also criticism for stereotyping bank managers. Barbara is portrayed by Australian comedian Genevieve Morris.[12]

New headquarters

In September 2006, plans were unveiled for ANZ's new world headquarters to be located in Melbourne's Docklands precinct. The complex features a vast low rise office building, shops, car and bicycle parking facilities. The new complex will enable 6,500 ANZ staff to work in one integrated area, however the company will maintain its flagship building, 100 Queen Street Melbourne. The new headquarters is the largest office complex in Australia at 84,500 m² NLA, 130,000 sqm GFA and an accredited 6 Green Star Building. Construction commenced in late 2006 and the building opened in late 2009. The building is located at 833 Collins Street. It has been designed by HASSELL & Lend Lease Design - fronting the Yarra River.

In 2006, it was expected to cost A$478 million to build,[13] but ended up costing $750 million by the time it was complete in 2009.[14]

The building was one of the winners at the 2010 World Architecture Festival in the category "Interiors and Fit Out of the Year".[15]

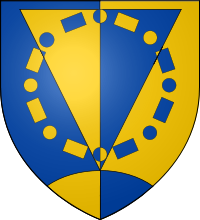

Arms

Arms of the Australia and New Zealand Banking Group Arms of Australia and New Zealand Banking GroupNotes The arms of the Australia and New Zealand Banking Group consist of:[16]

Crest Upon a helm with a wreath of the colours an antelope and a unicorn both armed and crined Or and gorged with a collar Gules supporting saltirewise a key Gold and a sword Proper quillons hilt and pommel Gold.Escutcheon Per pale Azure and Or a pile couped and per pale its point on a mound issuing in base also per pale eight roundels and as many billets in circle all counterchanged.Supporters On the dexter side a kangaroo Or and on the sinister side a kiwi Azure beaked and legged Gold.Compartment Desert and grass proper.Motto Tenacious of purpose.Badge Four mullets crosswise each of six points Argent dimidiating a like mullet Gules fimbriated Argent between them in circle a plate between two bezants.References

- Notes

- ^ "About ANZ". Australia and New Zealand Banking Group. http://www.anz.com.au/australia/aboutanz/default.asp. Retrieved 17 November 2011.

- ^ http://www.investordaily.com.au/cps/rde/xchg/id/style/4951.htm?rdeCOQ=SID-3F579BCE-FAF630CF

- ^ "FRB: Press Release - Approval of application of Australia & New Zealand Banking Group". Federal Reserve Board. 7 August 2000. http://www.federalreserve.gov/boarddocs/press/bhc/2000/20000807/. Retrieved 17 November 2011.

- ^ http://www.anz.com/australia/support/library/mr/mr20070516.pdf

- ^ "ANZ Chairman announces successor to CEO". Australia and New Zealand Banking Group. http://www.anz.com/aus/shares/services/New_chairman.asp. Retrieved 17 November 2011.

- ^ "ANZ acquires RBS' Hong Kong businesses". news.ninemsn.com.au. 22 March 2010. http://news.ninemsn.com.au/article.aspx?id=1030505. Retrieved 17 November 2011.

- ^ "ANZ acquires RBS in Singapore". International Business Times. 17 May 2010. http://au.ibtimes.com/articles/23810/20100517/anz-banking-rbs-royal-bank-of-scotland.htm. Retrieved 17 November 2011.

- ^ "ANZ completes RBS purchases in Indonesia". Financial Review. 14 June 2010. http://afr.com/p/business/financial_services/anz_completes_rbs_purchases_in_indonesia_aJUkMwnitiKsiRfR4KZ9hO. Retrieved 17 November 2011.

- ^ www.legalbusinessonline.com.au

- ^ "ANZ - KEEP OUR JOBS HERE! - Finance Sector Union". Finance Sector Union. 28 November 2006. http://www.fsunion.org.au/news/public/1164680136_24400.html. Retrieved 17 November 2011.

- ^ Financial Services Union of Australia, 2006. Bank Check, Spotlight on the ANZ Bank, retrieved 8 December 2009.

- ^ "ANZ 'Barbara lives in Bank World' campaign launches this weekend via M&C Saatchi". Campaign Brief. 19 January 2010. http://www.campaignbrief.com/2010/01/anz-barbara-lives-in-bank-worl.html. Retrieved 17 November 2011.

- ^ Draper, Michelle (17 July 2007). "Lend Lease tipped for $100m Myer Docklands HQ". Brisbane Times. http://www.brisbanetimes.com.au/articles/2007/07/16/1184559739841.html. Retrieved 17 November 2011.

- ^ Engelen, John (8 March 2010). "ANZ Centre – Corporate HQ Docklands, Melbourne". Dedece Blog. http://www.dedeceblog.com/2010/03/08/anz-centre-corporate-hq-docklands-melbourne/. Retrieved 17 November 2011.

- ^ World Architecture Festival: ANZ Centre, retrieved 18 November 2010

- ^ New Zealand Armorist, 76, 2000, p. 19

External links

Australia and New Zealand Banking Group Brands Australia and New Zealand Banking Group · ANZ National Bank · National Bank of New Zealand · Bonus Bonds · ANZ Royal BankNotable people Mike Smith · Charles Goode S&P/ASX 50 companies of Australia

S&P/ASX 50 companies of AustraliaAGL Energy · Alumina · Amcor · AMP · ANZ · Asciano · ASX · BHP Billiton · BlueScope Steel · Brambles · CFS Retail Property Trust · Coca-Cola Amatil · Commonwealth Bank · Computershare · Crown · CSL · Fortescue Metals Group · Foster's Group · GPT · Incitec Pivot · Insurance Australia Group · Leighton Holdings · Lend Lease · Macquarie Group · MAp Airports · Mirvac · National Australia Bank · Newcrest Mining · News Corporation · Oil Search · Orica · Origin Energy · Qantas · QBE Insurance · Rio Tinto · Santos · Sonic Healthcare · Stockland · Suncorp-Metway · Tabcorp · Telstra · Toll · Transurban · Wesfarmers · Westfield · Westfield Retail Trust · Westpac · Woodside Petroleum · Woolworths · WorleyParsons

NZX 50 companies of New Zealand

NZX 50 companies of New ZealandAir New Zealand · AMP · AMP NZ Office · ANZ · APN News & Media · Argosy Property Trust · Auckland International Airport · Cavalier · Contact Energy · DNZ Property Fund · Ebos · Fisher & Paykel Appliances · Fisher & Paykel Healthcare · Fletcher Building · Freightways · Goodman Fielder · Goodman Property Trust · Guinness Peat Group · Hallenstein Glasson · Heartland New Zealand · Infratil · Kathmandu · Kiwi Income Property Trust · Mainfreight · Methven · Michael Hill International · New Zealand Oil & Gas · New Zealand Refining Company · Nuplex · NZX · PGG Wrightson · Port of Tauranga · Property For Industry · Pumpkin Patch · Rakon · Restaurant Brands · Ryman Healthcare · Sanford · Skellerup · Skycity Entertainment Group · Sky Network Television · South Port NZ · Steel & Tube Holdings · Telecom New Zealand · Telstra · Tower · TrustPower · Vector · Vital Healthcare Property Trust · The Warehouse Group · Westpac

Former NZX50 companiesAbano Healthcare · Lion Nathan · Pike River Coal · Tourism Holdings Limited

Banking in Australia Bank regulation Central bank Big Four Australia and New Zealand Banking Group · Commonwealth Bank of Australia · National Australia Bank · WestpacOther banks AMP · Bank of Melbourne (WBC) · Bank of Queensland · Bankwest (CBA) · Bendigo and Adelaide Bank · Macquarie Group · ME Bank · mecu · QT Mutual Bank · Rural Bank · Suncorp-Metway · St.George Bank (WBC)Foreign banks Arab Bank · Bank of China · Bank of Cyprus Australia · Citibank Australia · Beirut Hellenic Bank · HSBC Bank Australia · ING · Investec Bank · RabobankNon-bank lenders Category:Banks of Australia · List of banks in Australia · Financial system in Australia · Economy of AustraliaCategories:- Companies listed on the Australian Securities Exchange

- Companies listed on the New Zealand Stock Exchange

- Banks of Australia

- Companies based in Melbourne

- Registered Banks of New Zealand

- Australia and New Zealand Banking Group

Wikimedia Foundation. 2010.