- Gold reserve

-

Part of a series on Government Public finance  Tax policy · Budgetary policy

Tax policy · Budgetary policy

Revenue · Spending · Budget

Deficit or Surplus · Deficit spending

Debt (External · Internal)

Finance ministry · Fiscal unionTariff · Non-tariff barrier

Balance of trade · Gains from trade

Trade creation · Trade diversion

Protectionism · Free trade

Commerce ministry · Trade blocReformA gold reserve is the gold held by a central bank or nation intended as a store of value and as a guarantee to redeem promises to pay depositors, note holders (e.g., paper money), or trading peers, or to secure a currency.

Today, gold reserves are almost exclusively, albeit rarely, used in the settlement of international transactions.[citation needed]

At the end of 2004, central banks and investment funds held 19% of all above-ground gold as bank reserve assets.[1]

It has been estimated that all the gold mined by the end of 2009 totaled 165,000 tonnes.[2] At a price of US$1900/oz., reached in September 2011, one ton of gold has a value of approximately US$60.8 million. The total value of all gold ever mined would exceed US$9.2 trillion at that valuation.[note 1]

Contents

IMF gold holdings

As of June 2009, the International Monetary Fund held 3,217 tons (103.4 million oz.) of gold,[3][4] which had been constant for several years. In Fall 2009, the IMF announced that it will sell one eighth of its holdings, a maximum of 12,965,649 fine troy ounces (403.3 t) based on a new income model agreed upon in April 2008, and subsequently announced the sale of 200 tonnes to India,[5] 10 tonnes to Sri Lanka,[6] a further 10 Metric tonnes of Gold was also sold to Bangladesh Bank in September 2010 and 2 tonnes to the Bank of Mauritius.[7] These gold sales were conducted in stages at prevailing market prices.

The IMF maintains an internal book value of its gold that is far below market value. In 2000, this book value was XDR 35, or about US$47 per troy ounce.[8] An attempt to revalue the gold reserve to today's value has met resistance for different reasons. For example, Canada is against the idea of revaluing the reserve, as it may be a prelude to selling the gold on the open market and therefore depressing gold prices.[9]

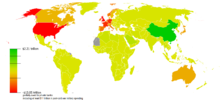

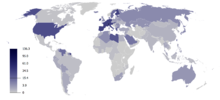

Officially reported gold holdings

The International Monetary Fund regularly maintains statistics of national assets as reported by various countries. These data are used by the World Gold Council to periodically rank and report the gold holding of countries and official organizations.[10]

The gold listed for each of the countries in the table may not be physically stored in the country listed, as central banks generally have not allowed independent audits of their reserves.

World official gold holding (December 2010)[10] Rank Country/Organization Gold

(tonnes)Gold's share

of national

forex reserves (%)[10]1  USA

USA8,133.5 74.7% 2  Germany

Germany3,401.0 71.7% 3  Italy

Italy2,451.8 71.4% 4  France

France2,435.4 66.1% 5  China

China1,054.1 01.7% 6  Switzerland

Switzerland1,040.1 16.4% 7  Qatar

Qatar950.3 07.1% 8  Russia

Russia775.2 06.7% 9  Japan

Japan765.2 03.0% 10  Netherlands

Netherlands615.5 59.4% 11  India

India614.8 08.1% 12  Republic of China (Taiwan)

Republic of China (Taiwan)466.9 04.6% 13  Portugal

Portugal421.6 81.1% 14  Venezuela

Venezuela401.1 52.4% 15  Saudi Arabia

Saudi Arabia322.9 03.0% 16  Islamic Republic of Iran

Islamic Republic of Iran320[11] 00.0% 17  United Kingdom

United Kingdom310.3 16.8% 18  Lebanon

Lebanon300 27.6% 19  Spain

Spain281.6 38.6% 20  Austria

Austria280.0 56.2% 21  Belgium

Belgium227.5 36.8% 22  Pakistan

Pakistan184.4 19.2% 23  Philippines

Philippines175.9 14.0% 24  Algeria

Algeria173.6 04.5% 25  Libya

Libya143.8 05.6% 26  Singapore

Singapore127.4 02.5% 27  Sweden

Sweden125.7 11.1% 28  South Africa

South Africa124.9 12.2% 29  Turkey

Turkey116.1 06.0% 30  Greece

Greece111.7 78.7% 31  Romania

Romania103.7 09.1% 32  Poland

Poland102.9 04.5% 33  Mexico

Mexico100.1[12] 03.8% 34  Thailand

Thailand99.5 02.5% 35  Australia

Australia79.9 08.1% 36  Kuwait

Kuwait79.0 13.5% 37  Egypt

Egypt75.6 08.7% 38  Indonesia

Indonesia73.1 03.6% 39  Kazakhstan

Kazakhstan67.3 10.0% 40  Denmark

Denmark66.5 03.3% 41  Argentina

Argentina54.7 4.5% 42  Finland

Finland49.1 20.6% 43  Bulgaria

Bulgaria39.9 09.9% 44  Malaysia

Malaysia36.4 01.5% 45  Peru

Peru34.7 03.6% 46  Belarus

Belarus32 24.5% 47  Brazil

Brazil33.6 00.5% 48  Slovakia

Slovakia31.8 65.4% 49  Bolivia

Bolivia28.3 13.4% 50  Ukraine

Ukraine27.2 03.5% 51  Ecuador

Ecuador26.3 31.0% 52  Syria

Syria25.8 00.0% 53  Morocco

Morocco22.0 04.2% 54  Nigeria

Nigeria21.4 00.0% 55  Sri Lanka

Sri Lanka17.5 11.9% 56  South Korea

South Korea14.4 00.2% 57  Cyprus

Cyprus13.9 50.8% 58  Bangladesh

Bangladesh13.5 05.2% 59  Serbia

Serbia13.1 4.2% 60  Netherlands Antilles

Netherlands Antilles13.1 36.3% 61  Jordan

Jordan12.8 04.3% 62  Czech Republic

Czech Republic12.7 01.2% 63  Cambodia

Cambodia12.4 14.4% 64  Laos

Laos8.8 36.5% 65  Latvia

Latvia7.7 04.0% 66  El Salvador

El Salvador7.3 10.6% 67  Guatemala

Guatemala6.9 05.3% 68  Colombia

Colombia6.9 01.1% 69  Former Yugoslav Republic of Macedonia

Former Yugoslav Republic of Macedonia6.8 12.7% 70  Tunisia

Tunisia6.8 00.0% 71  Ireland

Ireland6.0 11.8% 72  Lithuania

Lithuania5.8 03.8% 73  Bahrain

Bahrain4.7 00.0% 74  Mauritius

Mauritius3.9 06.8% 75  Canada

Canada3.4 00.2% 76  Tajikistan

Tajikistan3.3 00.0% 77  Slovenia

Slovenia3.2 13.4% 78  Aruba

Aruba3.1 17.7% 79  Hungary

Hungary3.1 00.3% 80  Kyrgyzstan

Kyrgyzstan2.6 06.5% 81  Luxembourg

Luxembourg2.2 11.7% 82  Hong Kong

Hong Kong2.1 00.0% 83  Suriname

Suriname2.0 11.4% 84  Iceland

Iceland2.0 01.6% 85  Papua New Guinea

Papua New Guinea2.0 02.9% 86  Trinidad and Tobago

Trinidad and Tobago1.9 00.8% 87  Albania

Albania1.6 02.8% 88  Yemen

Yemen1.6 01.1% 89  Cameroon

Cameroon0.9 01.2% 90  Mongolia

Mongolia0.9 02.4% 91  Honduras

Honduras0.7 00.0% 92  Paraguay

Paraguay0.7 00.7% 93  Dominican Republic

Dominican Republic0.6 01.0% 94  Gabon

Gabon0.4 00.8% 95  Malawi

Malawi0.4 06.2% 96  Central African Republic

Central African Republic0.3 08.4% 97  Chad

Chad0.3 02.4% 98  Republic of the Congo

Republic of the Congo0.3 00.4% 99  Uruguay

Uruguay0.3 00.1% 100  Fiji

Fiji0.2 00.0% 101  Estonia

Estonia0.2 00.3% 102  Chile

Chile0.2 00.0% 103  Malta

Malta0.2 01.6% 104  Costa Rica

Costa Rica0.1 00.1% 105  Haiti

Haiti0.0 00.1% 106  Burundi

Burundi0.0 00.5% 107  Oman

Oman0.0 00.0% 108  Comoros

Comoros0.0 00.0% 109  Kenya

Kenya0.0 00.0% Privately held gold

As of October 2009, gold exchange-traded funds held 1,750 tonnes of gold for private and institutional investors.[13]

Gold Holdings Corp. a publicly listed gold company estimates that the amount of in-ground verified gold resources currently controlled by publicly traded gold mining companies is roughly 50,000 tonnes.[14]

Privately held gold (May 2011)[15] Rank Name Type Gold (Tonnes) 1 SPDR Gold Shares ETF 1,239 2 ETF Securities Gold Funds ETF 259.79 3 ZKB Physical Gold ETF 195.53 4 COMEX Gold Trust ETF 137.61 5 Julius Baer Physical Gold Fund ETF 93.50 6 Central Fund of Canada CEF 52.71[16] 7 NewGold ETF ETF 47.75 8 Sprott Physical Gold Trust CEF 32.27 9 ETFS Physical Swiss Gold Shares ETF 27.97 10 Bullionvault Bailment 37.1[17] 11 Central Gold Trust CEF 18.81[18] 12 GoldMoney Bailment 19.01[19] World gold holdings

World gold holdings (2008) (Source: World Gold Council[20]) Holding Percentage Jewelry 52% Central banks 18% Investment (bars, coins) 16% Industrial 12% Unaccounted 2% See also

- Foreign exchange reserves

- Sovereign wealth fund

- United States Bullion Depository

- Federal Reserve Bank of New York

- Gold as an investment

- Peak Gold

- Strategic Petroleum Reserve

- Silver reserve

- Moscow gold, the reserves of the Bank of Spain sent to the Soviet Union during the Spanish Civil War.

Notes

- ^ One tonne is 32,150.722 Troy Ounces.

References

- ^ Central Banks and Official Institutions World Gold Council

- ^ gold knowledge/frequently asked questions World Gold Council

- ^ "Gold in the IMF". International Monetary Fund. 2009-09-18. http://www.imf.org/external/np/exr/facts/gold.htm.

- ^ "Quarterly Gold and FX Reserves". World Gold Council. June 2009. http://www.gold.org/deliver.php?force=true&download=/value/stats/statistics/xls/Quarterly_Gold_and_FX_Reserves_June_2009.xls.

- ^ IMF Announces Sale of 200 metric tons of Gold to the Reserve Bank of India

- ^ IMF Announces Sale of 10 Metric Tons of Gold to the Central Bank of Sri Lanka

- ^ IMF Announces Sale of 2 Metric Tons of Gold to the Bank of Mauritius

- ^ "IMF completes off-market gold sales". 2000-04-07. http://www.imf.org/external/np/sec/nb/2000/nb0021.htm.

- ^ Gold falls on IMF sale concerns

- ^ a b c Reserve asset statistics

- ^ http://www.tabnak.ir/fa/news/191248/%D8%B0%D8%AE%D8%A7%DB%8C%D8%B1-%D8%B7%D9%84%D8%A7%DB%8C-%D8%A7%DB%8C%D8%B1%D8%A7%D9%86-%D8%A7%D8%B9%D9%84%D8%A7%D9%85-%D8%B4%D8%AF

- ^ "UPDATE 2-Mexico ramps up gold reserves at dollar's expense". Reuters. May 4, 2011. http://www.reuters.com/article/2011/05/04/mexico-gold-idUSLDE7431OZ20110504. Retrieved May 21, 2011.

- ^ Daily Gold ETF Monitor

- ^ Gold Holdings by Company

- ^ Reuters: FACTBOX-Precious metals holdings of exchange-traded products, 6 Jun 2011

- ^ [1]

- ^ Daily Audit - Allocated Gold Bar Lists And Bank Statements - BullionVault.com

- ^ [2]

- ^ Monthly Audit - Allocated Gold - GoldMoney.com

- ^ DollarDaze Economic Commentary Blog

Lists of countries by financial rankings Trade Investment Funds Forex reserves · Gold reserves · Sovereign wealth funds · Pension funds · List of sovereign states by external assetsBudget and debt Income and taxes Banking Central bank interest rate · Commercial bank prime lending rateCurrency Exchange rates to US$ · Inflation rateOther Lists of countries by GDP rankings · Lists by country · List of international rankings · List of top international rankings by countryCategories:

Wikimedia Foundation. 2010.