- Federal Reserve Bank of New York

-

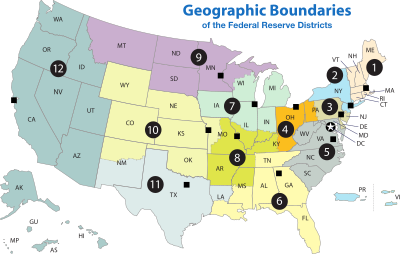

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Place, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U. S. Virgin Islands. Working within the Federal Reserve System, the New York Fed implements monetary policy, supervises and regulates financial institutions[1] and helps maintain the nation's payment systems.[2]

Among the other regional banks, New York Fed and its president are considered first among equals.[3][4] It is by far the largest (by assets), most active (by volume) and most influential of the 12 regional Federal Reserve Banks.

Contents

Largest regional Federal Reserve Bank

Since the founding of the Federal Reserve banking system, the Federal Reserve Bank of New York in Manhattan's Financial District has been the place where monetary policy in the United States is implemented, although policy is decided in Washington, D.C. by the Board of Governors of the Federal Reserve System. The New York Federal reserve is a private bank and the largest in terms of assets of the twelve regional banks. Operating in the financial capital of the U.S., the New York Fed is responsible for conducting open market operations, the buying and selling of outstanding U.S. Treasury securities. The Trading Desk is the office at the Federal Reserve Bank of New York that manages the FOMC Directive to sell or buy bonds.[5] Note that the responsibility for issuing new U.S. Treasury securities lies with the Bureau of the Public Debt. In 2003, Fedwire, the Federal Reserve's system for transferring balances between it and other banks, transferred $1.8 trillion a day in funds, of which about $1.1 trillion originated in the Second District. It transferred an additional $1.3 trillion a day in securities, of which $1.2 trillion originated in the Second District. The New York Fed is also responsible for carrying out exchange rate policy by buying and selling dollars at the discretion of the United States Treasury Department. The New York Federal Reserve is the only regional bank with a permanent vote on the Federal Open Market Committee and its president is traditionally selected as the Committee's vice chairman. The current president is William C. Dudley. The New York Fed opened for business on November 16, 1914, under the leadership of Benjamin Strong Jr., who was previously president of the Bankers Trust Company. He led the Bank until his death in 1928. The Bank grew rapidly during the early years, bringing about the need for a new home.[6] The New York Fed's three-class Board of Directors, bank membership, and organization and legal status are the same in structure, for the New York region, as those of the other eleven Fed districts, which collectively cover the rest of the country.

33 Liberty Street

A public competition for design of the building was held and the architectural firm of York and Sawyer submitted the winning design. The bank moved to its current location in 1924.[6] The Federal Reserve Bank of New York maintains a vault that lies 80 feet below street level and 50 feet below sea level,[7] resting on Manhattan bedrock. By 1927, the vault contained ten percent of the world's official gold reserves.[6] Currently, it is reputedly the largest gold repository in the world (though this cannot be confirmed as Swiss banks do not report their gold stocks) and holds approximately 7,000 metric tons of gold bullion ($415 billion as of October 2011), more than Fort Knox. The gold is owned by many foreign nations, central banks and international organizations such as the IMF. The Federal Reserve Bank does not own the gold but serves as guardian of the precious metal, which it stores at no charge to the owners, but charging a 1.75$ (in 2008) per bar to move the gold. Moving the bars requires special footwear for the staff, to protect their feet in the case that they drop a 28 pound bar on their feet. The vault is open to tourists.[8]

Current Board of Directors

The following people serve on the board of directors as of 2011:[9] All terms expire December 31.[9]

Class A

Class A Name Title Term Expires Charles V. Wait President, Chief Executive Officer, and Chairman

The Adirondack Trust Company

Saratoga Springs, New York2011 Jamie Dimon Chairman and Chief Executive Officer

JPMorgan Chase & Co.

New York City2012 Richard Carrión Chairman, President and Chief Executive Officer

Popular, Inc.

San Juan, Puerto Rico2013 Class B

Class B Name Title Term Expires Glenn H. Hutchins Co-Founder and Co-Chief Executive Silver Lake 2012 Terry J. Lundgren Chairman, President and Chief Executive Officer Macy's, Inc. 2011 James S. Tisch President and Chief Executive Officer

Loews Corporation

New York, New York2013 Class C

Class C Name Title Term Expires Emily K. Rafferty President

Metropolitan Museum of Art

New York, New York2011 Lee C. Bollinger (Chair)

President

Columbia University

New York, New York2012 Kathryn S. Wylde (Deputy Chair)

President and Chief Executive Officer

Partnership for New York City

New York, New York2013 Former Board members

Indra K. Nooyi, Chairman and Chief Executive Officer, PepsiCo. Inc., left the Board when her term expired in 2009, and Kindler now fills the seat. Bollinger's and Dimon's three-year terms were renewed in 2009. Tisch and Wylde filled partial-term vacancies, the latter for Stephen Friedman's seat, in the year.[10][11]

Resignation of Stephen Friedman, Chair

Stephen Friedman resigned as Chair of the Federal Reserve Bank of New York on Thursday, May 7, 2009 effective immediately.[12] Friedman, former CEO of Goldman Sachs and then-chairman of Stone Point Capital, LLC, Greenwich, Conn., was criticized for seemingly benefiting from his role as Chair of the New York Fed branch due to the US Government's aid to Goldman Sachs in recent months. He had "remain[ed] on the board of Goldman even as he was supposedly regulating [Goldman]; in order to rectify the problem, he applied for, and got, a conflict of interest waiver from the government. Friedman was also supposed to divest himself of his Goldman stock after Goldman became a bankholding company, but thanks to the waiver, he was allowed to go out and buy 52,000 additional shares in his old bank, leaving him $3 million richer," as one report put it.[1] Friedman's resignation announcement came within an hour of the government's release of the stress tests for 19 US banks. Denis Hughes, formerly Deputy Chair, was designated as Interim Chair following Friedman's resignation.

Presidents

Main article: List of Presidents of the Federal Reserve Bank of New York-

1. Strong (1914–1928)

Branches

The Federal Reserve Bank of New York Buffalo Branch used to be the only branch of the Federal Reserve Bank of New York, but it was closed on October 31, 2008.[13]

See also

- Economy of New York City

- Federal Reserve Act

- Federal Reserve System

- Federal Reserve Districts

- Federal Reserve Branches

- Federal Reserve Bank of New York Buffalo Branch

- Official gold reserves

- Structure of the Federal Reserve System

References

- ^ a b "The Great American Bubble Machine" p. 6 of 7, by Matt Taibbi, Rolling Stone, July 13, 2009 1:49 PM. Retrieved 2010-03-30.

- ^ "About the Fed." New York Federal Reserve Web page. Footnote upgraded/confirmed 2010-03-30.

- ^ The New York Times. http://topics.nytimes.com/topics/reference/timestopics/organizations/f/federal_reserve_bank_of_new_york/index.html.

- ^ http://www.slate.com/id/2217811/

- ^ http://www.ny.frb.org/aboutthefed/fedpoint/fed32.html

- ^ a b c "History". New York Federal Reserve Web page. Retrieved 2010-03-30.

- ^ "The Key to the Gold Vault". The Federal Reserve Bank of New York. http://www.newyorkfed.org/education/addpub/goldvault.pdf. Retrieved 18 September 2010.

- ^ http://abcnews.go.com/Business/story?id=5835433&page=1

- ^ a b "Directors of Federal Reserve Banks and Branches". The Federal Reserve. May 24, 2011. http://www.federalreserve.gov/generalinfo/listdirectors/default.cfm.

- ^ Board of Directors current membership. New York Federal Reserve Web page. Retrieved 2010-03-30.

- ^ Board of Directors '09 activity, membership. New York Federal Reserve Web page pdf. Retrieved 2010-03-30.

- ^ "Resignation Letter of Stephen Friedman, Chair of the Federal Reserve Bank of New York". The Federal Reserve. The Federal Reserve Bank of New York. May 7, 2009. http://www.newyorkfed.org/newsevents/news/aboutthefed/2009/oa090507.pdf. Retrieved 2009-05-07.

- ^ http://www.ny.frb.org/aboutthefed/annual/annual08/directors.pdf

External links

- Federal Reserve Bank of New York

- "World's Greatest Treasure Cave" Popular Mechanics, January 1930, pp.34-38

- "How Uncle Sam Guards His Millions", March 1931, Popular Mechanics article showing the upgrades for gold storage at the New York Federal Reserve Bank

Coordinates: 40°42′30″N 74°0′31″W / 40.70833°N 74.00861°W

Federal Reserve System Federal Open Market Committee · Chairman of the Federal Reserve · Federal Reserve Bank Banknotes Reports Federal funds History Federal Reserve Banks Boston · New York · Philadelphia · Cleveland · Richmond · Atlanta · Chicago · St. Louis · Minneapolis · Kansas City · Dallas · San FranciscoNew York Branches Buffalo (closed) · East Rutherford Operations CenterCleveland Branches Cincinnati · PittsburghRichmond Branches Baltimore · CharlotteAtlanta Branches Birmingham · Jacksonville · Miami · Nashville · New OrleansChicago Branches DetroitSt Louis Branches Little Rock · Louisville · MemphisMinneapolis Branches HelenaKansas City Branches Denver · Oklahoma City · OmahaDallas Branches El Paso · Houston · San AntonioSan Francisco Branches Los Angeles · Portland · Salt Lake City · SeattleCategories:- Federal Reserve Banks

- Economy of New York City

-

Wikimedia Foundation. 2010.