- Government budget deficit

-

This article is about government budget deficits. For trade deficits, see Balance of trade. For balance of payments deficits, see Balance of payments.

Part of a series on Government Public finance  Tax policy · Budgetary policy

Tax policy · Budgetary policy

Revenue · Spending · Budget

Deficit or Surplus · Deficit spending

Debt (External · Internal)

Finance ministry · Fiscal unionTariff · Non-tariff barrier

Balance of trade · Gains from trade

Trade creation · Trade diversion

Protectionism · Free trade

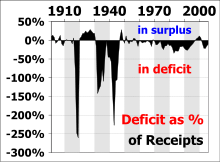

Commerce ministry · Trade blocReformA government budget deficit is the amount by which some measure of government revenues falls short of some measure of government spending.

If a government is running a positive budget deficit, it is also said to be running a negative budget surplus (and conversely, a positive budget surplus is a negative budget deficit).

Contents

Primary deficit, total deficit, and debt

Main article: Primary deficitThe meaning of 'deficit' differs from that of 'debt', which is an accumulation of yearly deficits. Deficits occur when a government's expenditures exceed the revenue that it generates. The deficit can be measured with or without including the interest payments on the debt as expenditures. The primary deficit is defined as the difference between current government spending on goods and services and total current revenue from all types of taxes net of transfer payments. The total deficit (which is often called the fiscal deficit or just the 'deficit') is the primary deficit plus interest payments on the debt.[1]

Therefore, if t is a timeframe, Gt is government spending and Tt is tax revenue for the respective timeframe, then the primary deficit is

If Dt − 1 is last year's debt, and r is the interest rate, then the total deficit is

Finally, this year's debt can be calculated from last year's debt and this year's total deficit, as follows:[citation needed]

Economic trends can influence the growth or shrinkage of fiscal deficits in several ways. Increased levels of economic activity generally lead to higher tax revenues, while government expenditures often increase during economic downturns because of higher outlays for social insurance programs such as unemployment benefits. Changes in tax rates, tax enforcement policies, levels of social benefits, and other government policy decisions can also have major effects on public debt. For some countries, such as Norway, Russia, and members of the Organization of Petroleum Exporting Countries (OPEC), oil and gas receipts play a major role in public finances.

Inflation reduces the real value of accumulated debt. If investors anticipate future inflation, however, they will demand higher interest rates on government debt, making public borrowing more expensive.

Structural deficits, cyclical deficits, and the fiscal gap

Main article: Structural deficitA government deficit can be thought of as consisting of two elements, structural and cyclical.

At the lowest point in the business cycle, there is a high level of unemployment. This means that tax revenues are low and expenditure (e.g. on social security) high. Conversely, at the peak of the cycle, unemployment is low, increasing tax revenue and decreasing social security spending. The additional borrowing required at the low point of the cycle is the cyclical deficit. By definition, the cyclical deficit will be entirely repaid by a cyclical surplus at the peak of the cycle.

The structural deficit is the deficit that remains across the business cycle, because the general level of government spending exceeds prevailing tax levels. The observed total budget deficit is equal to the sum of the structural deficit with the cyclical deficit or surplus.

Some economists have criticized the distinction between cyclical and structural deficits, contending that the business cycle is too difficult to measure to make cyclical analysis worthwhile.

The fiscal gap, a measure proposed by economists Alan Auerbach and Laurence Kotlikoff, measures the difference between government spending and revenues over the very long term, typically as a percentage of Gross Domestic Product. The fiscal gap can be interpreted as the percentage increase in revenues or reduction of expenditures necessary to balance spending and revenues in the long run. For example, a fiscal gap of 5% could be eliminated by an immediate and permanent 5% increase in taxes or cut in spending or some combination of both.[2] It includes not only the structural deficit at a given point in time, but also the difference between promised future government commitments, such as health and retirement spending, and planned future tax revenues. Since the elderly population is growing much faster than the young population in many countries, many economists argue that these countries have important fiscal gaps, beyond what can be seen from their deficits alone.

National budget deficits

Data are for 2004[3]

National Government Budgets for 2004 (in billions of US$) Nation GDP Revenue Expenditure Exp/GDP Budget Surplus (or Deficit)[4] Deficit/GDP[4] US (federal) 11700 1862 2338 19.98% -25.56% -4.07% US (state) - 900 850 7.6% +5% +0.4% Japan 4600 1400 1748 38.00% -24.86% -7.57% Germany 2700 1200 1300 48.15% -8.33% -3.70% United Kingdom 2100 835 897 42.71% -7.43% -2.95% France 2000 1005 1080 54.00% -7.46% -3.75% Italy 1600 768 820 51.25% -6.77% -3.25% China 1600 318 349 21.81% -9.75% -1.94% Spain 1000 384 386 38.60% -0.52% -0.20% Canada (federal) 900 150 144 16.00% +4.00% +0.67% South Korea 600 150 155 25.83% -3.33% -0.83% Early deficits

Before the invention of bonds, the deficit could only be financed with loans from private investors or other countries. A prominent example of this was the Rothschild dynasty in the late 18th and 19th century, though there were many earlier examples.

These loans became popular when private financiers had amassed enough capital to provide them, and when governments were no longer able to simply print money, with consequent inflation, to finance their spending.

However, large long-term loans had a high element of risk for the lender and consequently gave high interest rates. Governments later began to issue bonds that were payable to the bearer, rather than the original purchaser. This meant that someone who lent the state money could sell on the debt to someone else, reducing the risks involved and reducing the overall interest rates. Examples of this are British Consols and American Treasury bill bonds.

Deficit spending

Main article: Deficit spendingAccording to some economists, during recessions, the government can stimulate the economy by intentionally running a deficit.

Ricardian equivalence

The Ricardian equivalence hypothesis, named after the English political economist and Member of Parliament David Ricardo, states that because households anticipate that current public deficit will be paid through future taxes, those households will accumulate savings now to offset those future taxes. If households acted in this way, a government would not be able to use tax cuts to stimulate the economy. The Ricardian equivalence result requires several assumptions. These include households acting as if they were infinite-lived dynasties as well as assumptions of no uncertainty and no liquidity constraints. Also, for Ricardian equivalence to apply, the deficit spending would have to be permanent. In contrast, a one-time stimulus through deficit spending would suggest a lesser tax burden annually than the one-time deficit expenditure. Thus temporary deficit spending is still expansionary. Empirical evidence on Ricardian equivalence effects has been mixed.

Crowding Out Hypothesis

The crowding out hypothesis is the assumption that when a government experiences a deficit, the choice to borrow to offset that deficit draws on the pool of resources available for investment and private investment gets crowded out. This crowding out effect is induced by changes in the interest rate. When the government wishes to borrow, their demand for credit increases and the interest rate, or price of credit, increases. This increase in the interest rate makes private investment more expensive as well and less of it is used.[5]

Potential Policy Solutions for Unintended Deficits

Increase Taxes or Reduce Government Spending

If a reduction in a structural deficit is desired, either revenue must increase, spending must decrease, or both. Taxes may be increased for everyone/every entity across the board or lawmakers may decide to assign that tax burden to specific groups of people (higher-income individuals, businesses, etc.). Lawmakers may also decide to cut government spending. Like with taxes, they could decide to cut the budgets every government agency/entity by the same percentage or they may decide to give a greater budget cut to specific agencies. Many, if not all, of these decisions made by lawmakers are based on political ideology, popularity with their electorate, or popularity with their donors.

Changes in Tax Code

Similar to increasing taxes, changes can be made to the tax code that increases tax revenue. Closing tax loopholes and allowing fewer deductions are different from the act of increasing taxes but essentially have the same effect.

Reduce Debt Service Liability

Every year, the federal government must pay debt service payments on their overall public debt. These payments include principal and interest payments. Occasionally, the federal government has the opportunity to refinance some of their public debt to afford them lower debt service payments. Doing this would allow the federal government to cut expenditures without cutting government spending.[6]

See also

- Balance of payments

- Balance of trade

- Current account

- Fiscal policy

- Generational accounting

- Government spending

- Government debt

- Government budget

- List of countries by current account balance

- Public finance

- Tax

- US-specific

- Fiscal policy in the United States

- National debt by U.S. presidential terms

- Deficit hawk

- Starve-the-beast

- United States federal budget

- United States public debt

References

- ^ Michael Burda and Charles Wyplosz (1995), European Macroeconomics, 2nd ed., Ch. 3.5.1, p. 56. Oxford University Press, ISBN 0198774680.

- ^ http://www.aarp.org/research/blueprint/overstatedproblem/the_fiscal_gap.html AARP article on the fiscal gap

- ^ Data on the United States' federal debt can be found at U.S. Treasury website. Data on U.S. state government finances can be found at the National Association of State Budget Officers website. Data for most advanced countries can be obtained from the Organization for Economic Cooperation and Development (OECD) website. Data for most other countries can be found at the International Monetary Fund (IMF) website.

- ^ a b In this column, a negative number represents a deficit, and a positive number represents a surplus.

- ^ Harvey S. Rosen (2005), Public Finance, 7th Ed., Ch. 18 p. 464. McGraw-Hill Irwin, ISBN 0072876484

- ^ Steven A. Finkler (2005), Financial Management For Public, Health And Not-For-Profit Organizations, 2nd Ed., Ch. 11 pp. 442-443. Pearson Education, Inc, ISBN 0131471988.

External links

- United States

- U.S. Government Net Saving - Graph of Historical U.S. Government Net Savings

- Death and Taxes: 2009 A graphical representation of the 2009 United States federal discretionary budget, including the public debt.

- United States - Deficit versus Savings rate from 1981 Historical graphical representation of the 12 month rolling Fiscal deficit versus the Savings rate of the United States. (since 1981)

- Government deficit calculator from AARP

- Hong Kong

- Finland

Categories:

Wikimedia Foundation. 2010.