- Emerging markets

-

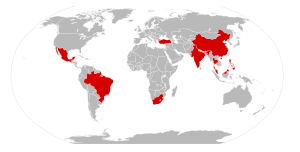

Emerging markets are nations with social or business activity in the process of rapid growth and industrialization. Based on data from 2006, there are around 28 emerging markets in the world[citation needed] (data from 2010 says there are 40 emerging markets[citation needed]). The economies of China and India are considered to be the largest.[1] According to The Economist many people find the term outdated, but no new term has yet to gain much traction.[2] Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion.[3]

The ASEAN–China Free Trade Area, launched on January 1, 2010, is the largest regional emerging market in the world.[4]

Contents

Terminology

Developing countries that are neither part of the least developed countries, nor of the newly industrialized countries

Developing countries that are neither part of the least developed countries, nor of the newly industrialized countriesIn the 1970s, "less economically developed countries" (LEDCs) was the common term for markets that were less "developed" (by objective or subjective measures) than the developed countries such as the United States, Western Europe, and Japan. These markets were supposed to provide greater potential for profit, but also more risk from various factors. This term was felt by some to be not positive enough so the emerging market label was born. This term is misleading in that there is no guarantee that a country will move from "less developed" to "more developed"; although that is the general trend in the world, countries can also move from "more developed" to "less developed".

Originally brought into fashion in the 1980s by then World Bank economist Antoine van Agtmael,[5] the term is sometimes loosely used as a replacement for emerging economies, but really signifies a business phenomenon that is not fully described by or constrained to geography or economic strength; such countries are considered to be in a transitional phase between developing and developed status. Examples of emerging markets include Indonesia, Iran, some countries of Latin America, some countries in Southeast Asia, most countries in Eastern Europe, Russia, some countries in the Middle East, and parts of Africa. Emphasizing the fluid nature of the category, political scientist Ian Bremmer defines an emerging market as "a country where politics matters at least as much as economics to the markets".[6]

The research on emerging markets is diffused within management literature. While researchers including C. K. Prahalad, George Haley, Hernando de Soto, Usha Haley, and several professors from Harvard Business School and Yale School of Management have described activity in countries such as India and China, how a market emerges is little understood.

In the 2008 Emerging Economy Report,[7] the Center for Knowledge Societies defines Emerging Economies as those "regions of the world that are experiencing rapid informationalization under conditions of limited or partial industrialization." It appears that emerging markets lie at the intersection of non-traditional user behavior, the rise of new user groups and community adoption of products and services, and innovations in product technologies and platforms.

Newly industrialized countries as of 2010. This is an intermediate category between fully developed and developing.

Newly industrialized countries as of 2010. This is an intermediate category between fully developed and developing.

The term "rapidly developing economies" is being used to denote emerging markets such as The United Arab Emirates, Chile and Malaysia that are undergoing rapid growth.

In recent years, new terms have emerged to describe the largest developing countries such as BRIC that stands for Brazil, Russia, India, and China,[8] along with BRICET (BRIC + Eastern Europe and Turkey), BRICS (BRIC + South Africa), BRICM (BRIC + Mexico), BRICK (BRIC + South Korea), Next Eleven (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey, and Vietnam) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa).[9] These countries do not share any common agenda, but some experts believe that they are enjoying an increasing role in the world economy and on political platforms.

It is difficult to make an exact list of emerging (or developed) markets; the best guides tend to be investment information sources like ISI Emerging Markets and The Economist or market index makers (such as Morgan Stanley Capital International). These sources are well-informed, but the nature of investment information sources leads to two potential problems. One is an element of historicity; markets may be maintained in an index for continuity, even if the countries have since developed past the emerging market phase. Possible examples of this are South Korea[10] and Taiwan. A second is the simplification inherent in making an index; small countries, or countries with limited market liquidity are often not considered, with their larger neighbours considered an appropriate stand-in.

In an Opalesque.TV video, hedge fund manager Jonathan Binder discusses the current and future relevance of the term "emerging markets" in the financial world. Binder says that in the future investors will not necessarily think of the traditional classifications of "G10" (or G7) versus "emerging markets". Instead, people should look at the world as countries that are fiscally responsible and countries that are not. Whether that country is in Europe or in South America should make no difference, making the traditional "blocs" of categorization irrelevant.

The Big Emerging Market (BEM) economies are (alphabetically ordered): Brazil, China, Egypt, India, Indonesia, Mexico, Philippines, Poland, Russia, South Africa, South Korea[10] and Turkey.[11]

Newly industrialized countries are emerging markets whose economies have not yet reached first world status but have, in a macroeconomic sense, outpaced their developing counterparts.

Individual investors can invest in emerging markets either through ADRs (American depositor Receipts - stocks of foreign companies that trade on US stock exchanges) or through exchange traded funds (exchange traded funds or ETFs hold basket of stocks). The exchange traded funds can be focused on a particular country (e.g., China, India) or region (e.g., Asia-Pacific, Latin America).

FTSE list

The FTSE Group distinguishes between Advanced and Secondary Emerging markets on the basis of their national income and the development of their market infrastructure. The Advanced Emerging markets are classified as such because they are upper or lower middle income GNI countries with advanced market infrastructures or high income GNI countries with lesser developed market infrastructures.[12][13]

The Advanced Emerging markets are:

Brazil

Brazil Czech Republic

Czech Republic Hungary

Hungary Malaysia

Malaysia Mexico

Mexico Poland[14]

Poland[14] South Africa

South Africa Taiwan[14]

Taiwan[14] Turkey

TurkeyThe Secondary Emerging markets include some low income, lower middle, upper middle and high income GNI countries with reasonable market infrastructures and significant size and some upper middle income GNI countries with lesser developed market infrastructures. The secondary emerging markets are:

Chile

Chile China

China Colombia

Colombia Egypt

Egypt India

India Indonesia

Indonesia Morocco

Morocco Pakistan

Pakistan Peru

Peru Philippines

Philippines Russia

Russia Thailand[15]

Thailand[15] UAE

UAEMSCI list

As of May 2010, MSCI Barra classified the following 21 countries as emerging markets:[16]

The list tracked by The Economist is the same, except with Hong Kong, Singapore and Saudi Arabia included (MSCI classifies the first two as developed markets and the third one as a frontier market).

S&P list

As of 31 December 2010, Standard and Poor's classified the following 19 countries as emerging markets[17]:

The

United Arab Emirates,

United Arab Emirates,  Qatar, and

Qatar, and  Jordan are currently under review for being upgraded to the status of emerging market by S&P.[18]

Jordan are currently under review for being upgraded to the status of emerging market by S&P.[18]Dow Jones list

As of May 2010, Dow Jones classified the following 35 countries as emerging markets:[19]

Frontier Strategy Group (F10) list

In July 2011, Frontier Strategy Group released the F-10, a list of the top 10 emerging markets Western multinational senior executives at Fortune 500 companies are tracking globally.[20]

The F-10 emerging market list is as follows:

BBVA Research

In November 2010, BBVA Research introduced a new economic concept, to identify a key emerging markets.[21] This classification is divided in two set of developing economies.

EAGLEs (Emerging and Growth-Leading Economies): Expected Incremental GDP in the next 10 years to be larger than the average of the G7 economies, excluding the US.

NEST: Expected Incremental GDP in the next decade to be lower than the average of the G6 economies(G7 excluding the US) but higher than Italy’s.

Emerging Markets Index

The Emerging Markets Index is a list of the top 65 cities in emerging markets. The following countries had cities featured on the list (as of 2008):

Among the lists

If we plot the lists above to table below, there are only 3 countries always appear in every list (Next Eleven/BRIC, CIVETS, FTSE, MSCI, The Economist, S&P, Dow Jones). They are Indonesia, Turkey, and Egypt. Indonesia and Turkey, which have been categorized as four emerging markets. Egypt, since January 25, 2011, has been affected by protests and is now in a transition process. There are also several countries to only appear on one list. They are Iran (Next 11), Hong Kong, Singapore, Saudi Arabia (The Economist), Bahrain, Bulgaria, Estonia, Jordan, Kuwait, Latvia, Lithuania, Mauritius, Oman, Qatar, Romania, Slovakia and Sri Lanka (Dow Jones).

Emerging Markets by Each Group of Analysts Country Next-11/BRIC CIVETS FTSE MSCI THE ECONOMIST S&P DOW JONES EAGLEs/Nest  Argentina

Argentina. .  Bahrain

Bahrain.  Bangladesh

Bangladesh. .  Brazil

Brazil. . . . . . . .  Bulgaria

Bulgaria.  Chile

Chile. . . . .  China

China. . . . . . . .  Colombia

Colombia. . . . . .  Czech Republic

Czech Republic. . . . .  Egypt

Egypt. . . . . . . .  Estonia

Estonia.  Hong Kong

Hong Kong.  Hungary

Hungary. . . . .  India

India. . . . . . . .  Indonesia

Indonesia. . . . . . . .  Iran

Iran.  Jordan

Jordan.  Kuwait

Kuwait.  Latvia

Latvia.  Lithuania

Lithuania.  Malaysia

Malaysia. . . . . .  Mauritius

Mauritius.  Mexico

Mexico. . . . . . .  Morocco

Morocco. . . . .  Nigeria

Nigeria. .  Oman

Oman.  Pakistan

Pakistan. . . .  Peru

Peru. . . . . .  Philippines

Philippines. . . . . . .  Poland

Poland. . . . . .  Qatar

Qatar.  Romania

Romania.  Russia

Russia. . . . . . . .  Saudi Arabia

Saudi Arabia.  Singapore

Singapore.  Slovakia

Slovakia.  South Africa

South Africa. . . . . . .  Sri Lanka

Sri Lanka.  South Korea

South Korea. . . .  Taiwan

Taiwan. . . . .  Thailand

Thailand. . . . . .  Turkey

Turkey. . . . . . . .  UAE

UAE. .  Vietnam

Vietnam. . . Global Growth Generators

"Global Growth Generators", or 3G (countries), is an alternative classification determined by Citigroup analysts as being countries with the most promising growth prospects for 2010-2050. These consist of Indonesia, Egypt (but not Turkey), seven other emerging countries, and two countries not previously listed before, specifically Iraq and Mongolia. The only country to appear in all emerging market lists or groups is Indonesia.[22]

Six major emerging economies

According to World Bank issued at May 2011, BRIC countries plus South Korea and Indonesia will lead the world's economy with more than a half of all global growth by 2025.[23]

See also

- Next Eleven

- Emerging market debt

- Pre-emerging markets

- Developed market

- Frontier markets

- North-South divide

- Emerging Markets Index

- Tehran Stock Exchange

- Emerging and Growth-Leading Economies

References

- ^ "Emerging Economies and the Transformation of International Business" By Subhash Chandra Jain. Edward Elgar Publishing, 2006 p.384

- ^ "Acronyms BRIC out all over". The Economist (The Economist). September 18, 2008. http://www.economist.com/specialreports/displaystory.cfm?story_id=12080703. Retrieved April 14, 2011.

- ^ http://www.investoo.co.uk/emerging-markets-hedge-funds-at-record-levels/

- ^ "China-ASEAN FTA prompts growing trade among border cities". channelnewsasia.com (Singapore: MediaCorp). January 5, 2010. http://www.channelnewsasia.com/stories/economicnews/view/1028537/1/.html. Retrieved April 14, 2011.

- ^ FT.com / Columnists / John Authers - The Long View: How adventurous are emerging markets?

- ^ [1]

- ^ Emerging Economy Report

- ^ Five Years of China’s WTO Membership. EU and US Perspectives on China’s Compliance with Transparency Commitments and the Transitional Review Mechanism, Legal Issues of Economic Integration, Kluwer Law International, Volume 33, Number 3, pp. 263-304, 2006. by Paolo Farah

- ^ "After BRICs, look to CIVETS for growth - HSBC CEO"

- ^ a b Classified by FTSE as a developed market.

- ^ Yale University Library: Emerging Markets - The Big Ten Countries

- ^ See FTSE Country Classification, September 2010

- ^ http://www.ftse.com/Research_and_Publications/FTSE_Glossary.jsp

- ^ a b Possible promotion to Developed.

- ^ Promoted to Advanced Emerging from March 2012.

- ^ MSCI Emerging markets.

- ^ The S&P Global Broad Market Index, 31 December 2010; p. 2.

- ^ "S&P reviewing UAE, Qatar, Jordan for emerging mkt status". Reuters. July 12, 2011. http://www.reuters.com/article/2011/07/12/gulf-upgrade-idUSL6E7IC06P20110712.

- ^ Dow Jones Total Stock Market index.

- ^ http://blog.frontierstrategygroup.com/2011/07/keeping-an-eye-on-latin-america-you%E2%80%99re-in-good-company

- ^ http://www.bbvaresearch.com/KETD/fbin/mult/EconomicWatchEM140211_i_tcm348-249020.pdf

- ^ BRICS is passe, time now for '3G' http://www.business-standard.com/india/printpage.php?autono=126725&tp=on

- ^ http://www.thejakartapost.com/news/2011/05/18/ri-may-become-one-six-major-economies.html

Investment Issues in Emerging Markets - Research Foundation of CFA Institute

Sources

- Goldman Sachs Paper No.134 BRIMC (English)

- CIVETS countries - Colombia Official Investment Portal (English)

- Michael Pettis, The Volatility Machine: Emerging Economies and the Threat of Financial Collapse (2001) ISBN 0-19-514330-2

- Julien Vercueil, Les pays émergents. Brésil Russie Inde Chine... mutations économiques et nouveaux défis ('Emerging Countries. Brazil Russia India China... : economic transformations and new challenges', in French). Paris : Bréal, 2010, 207 p. ISBN 978-2-7495-0957-0

External links

- What Are Emerging Markets? University of Iowa Center for International Finance and Development

- Emerging Markets Review Emerging Markets: A Review of Business and Legal Issues

- Emerging Markets & Hedge Funds Hedge Fund Strategy - Emerging Markets Fund

- Emerging Market Economies, Global Trade Imbalances, and the U.S. Dollar, Q&A with Pieter Bottelier (Johns-Hopkins-SAIS) on emerging markets and global imbalances

- Antoine Van Agtmael speaker biography and session description for the 2009 World Business Forum where Agtmael leads a panel discussion on Emerging Markets

- Emerging markets: leading the way to recovery Grant Thornton International Business Report

- Winning in Emerging Markets: Five Key Supply Chain Capabilities by Edgar E. Blanco. MIT Center for Transportation & Logistics.

- Emerging Money Education, trading analysis, and comprehensive views of global emerging markets.

- How multinationals and local companies can win in emerging markets

South-South cooperation and Third Worldism The Third World Emerging markets · Emerging Markets Index · Newly industrialized country · Landlocked developing countries · ACP countries · Least Developed Countries · Heavily Indebted Poor Countries · Fourth WorldOrganizations G-77 · G-15 · G-20 · G-24 · G-33 · G-11 · G90 · ASEAN · SAARC · African Union · Melanesian Spearhead Group · Polynesian Leaders Group · United Nations Industrial Development Organization · UNDP · United Nations Conference on Trade and Development · Arab Monetary Fund · Asian Clearing Union · Asian Development Bank · Bank of the South · South Centre · Third World NetworkGeopolitics Decolonization · Neocolonialism · Third World debt · Cold War · IBSA · BASIC · BRIC · Next Eleven · Global digital divide · Flying Geese Paradigm · World Conference against Racism · Durban Review Conference · Fair tradePower in international relations Types of power Economic power · Energy superpower · Food power · Hard power · National power · Political power (Machtpolitik · Realpolitik) · Smart power · Soft powerTypes of power status Small powers · Middle power · Regional power · Great power · Superpower (Potential superpowers) · HyperpowerGeopolitics Theory and history Balance of power (European balance of power) · Historical powers · Philosophy of power · Polarity · Power projection · Power transition theory · Second Superpower · Sphere of influence · Superpower collapse · Superpower disengagementStudies Organizations

and groupsAfrican Union · ANZUS · APEC · Arab League · ASEAN · BRICS · CIS · Commonwealth of Nations · CSTO · European Union · G7 · G8 · G8+5 · G20 · G77 · GCC · IBSA · MSG · Mercosur · N-11 · NATO · Non-Aligned Movement · OAS · OECD · PLG · SAARC · SCO · Union for the Mediterranean · Union of South American Nations · United NationsCategories:- Business terms

- Country classifications

- Economic development

- Investment

- Lists of countries

Wikimedia Foundation. 2010.