- List of U.S. minimum wages

-

See also: Minimum wage in the United States

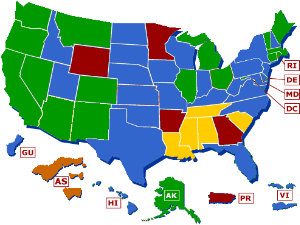

Minimum Wage by U.S. state and U.S. territory (American Samoa, Guam, Puerto Rico, Virgin Islands), as of Jan. 1, 2011.

Minimum Wage by U.S. state and U.S. territory (American Samoa, Guam, Puerto Rico, Virgin Islands), as of Jan. 1, 2011. States with minimum wage rates higher than the Federal rateStates and territories with minimum wage rates the same as the Federal rateStates with no state minimum wage lawStates and territories with minimum wage rates lower than the Federal rateTerritory with varied minimum wage rates lower than the Federal rate

States with minimum wage rates higher than the Federal rateStates and territories with minimum wage rates the same as the Federal rateStates with no state minimum wage lawStates and territories with minimum wage rates lower than the Federal rateTerritory with varied minimum wage rates lower than the Federal rateThis is a list of the minimum wages (per hour) in each state and territory of the United States, for jobs covered by federal minimum wage laws. If the job is not subject to the federal Fair Labor Standards Act, then state, city, or other local laws may determine the minimum wage. A common exemption to the federal minimum wage is a company having revenue of less than $500,000 per year while not engaging in any interstate commerce. Under the federal law, workers that receive a portion of their salary from tips, such as wait staff, are required only to have their total compensation, including tips, meet the minimum wage. Thus, often, their hourly wage, before tips, is less than the minimum wage.[1] Oregon does not allow tips to be credited towards the minimum however, and so tipped jobs are otherwise subject to the full state hourly minimum (currently $8.50).[2] Additional exemptions to the minimum wage include many seasonal employees, student employees, and certain disabled employees as specified by the FLSA.[3]

In addition, some counties and/or cities within states may observe a higher minimum wage than the rest of the state in which they are located; sometimes this higher wage will apply only to businesses that are under contract to the local government itself, while in other cases the higher minimum will be enforced across the board.

Contents

Minimum wage levels

Federal

Federal Level (USD/h) Notes Federal $7.25 The Fair Labor Standards Act sets. The Fair Minimum Wage Act of 2007, which was signed into law on May 25, 2007,[4] increased the minimum wage by $2.10 over two years. State

Note: The following tables can be sorted alphabetically or numerically using the

icon.

icon.State Level (USD/h) Notes Alabama None Federal minimum applies.[5] Alaska $7.75 In 2009, a state law was passed to keep the state minimum wage 50 cents above the federal level.[6][7] Arizona $7.35[8] Raised pursuant to FMWA.[9] Previous rate pursuant to Arizona Proposition 202. This rate will be automatically adjusted annually based on the U.S. Consumer Price Index. This rate increase does not affect student workers in places such as libraries and cafeterias because those positions are given by universities, which are State entities.[10] The state minimum wage was increased 10 cents to $7.35 on January 1, 2011.[11] The state tipped also increased 10 cents to $4.35 per hour. Arkansas $6.25[8] Applicable to employers of 4 or more employees. California $8.00[12] San Francisco $9.92.[13] The Minimum Wage Ordinance states that exempt employees must make at least twice the state minimum wage. Colorado $7.36[14] Set to increase or decrease according to yearly changes in inflation.[15] The state wage was increased to $7.36 per hour on January 1, 2011. The tipped wage increased to $4.34 per hour.[16] The state wage will be increased to $7.64 per hour on January 1, 2012. The tipped wage increases to $4.62 per hour.[17] Connecticut $8.25 This rate was increased by 25 cents to $8.25 on January 1, 2010. Tipped employees earn $5.69 per hour, which is a tipped rate that is 69% of the state minimum wage. Connecticut will raise the minimum wage in 2012 to $8.50 - $8.95 varies by store.[18] Delaware $7.25 Raised pursuant to FMWA. Florida $7.31 Raised pursuant to FMWA. If and when it is below the federal rate, it rises with inflation. $4.29 per hour for tipped employees.[19] Georgia $5.15[8] [20] Only applicable to employers of 6 or more employees. If less than 6 then there is no minimum at all. Tipped employees earn $2.13. The State law excludes from coverage any employment that is subject to the Federal Fair Labor Standards Act when the Federal rate is greater than the State rate.[21] Hawaii $7.25 Tipped employees earn $7.00 (25 cents less than the current state minimum wage).[22] Idaho $7.25 Raised pursuant to FMWA. Illinois $8.25 Employers may pay anyone under the age of 18 fifty cents less. Tipped employees earn $4.95 (employers may claim credit for tips, up to 40% of wage[23]). Indiana $7.25 Raised pursuant to FMWA. Iowa $7.25[24] Most small retail and service establishments grossing less than 300,000 annually are not required to pay the minimum wage. Tipped employees can be paid 60% of the minimum wage, which is currently $4.35. Kansas $7.25[25] For many years, the minimum wage was set to $2.65, the lowest in the nation. The state wage was increased to match the federal level on January 1, 2010. Kentucky $7.25 Raised pursuant to FMWA. Louisiana None Federal minimum applies. Maine $7.50 Tipped employees earn $3.75 (one-half of the current state minimum wage).[26] Maryland $7.25 Raised pursuant to FMWA. Tipped employees earn $3.63.[27] Massachusetts $8.00[28] $2.63 for service (tipped) employees, $1.60 for agricultural employees. With time-and-a-half on Sundays (for retail workers only) the Sunday minimum wage is $12.00/hr. Michigan $7.40 $2.65 for service (tipped) employees. Minors 16–17 years of age may be paid 85% of the minimum hourly wage rate (currently a rate of $6.29 per hour). Training wage for new employees ages 16 to 19 of $4.25 per hour for first 90 days of employment.[29] Minnesota $7.25 Small employers, whose annual receipts are less than $625,000 and who do not engage in interstate commerce, can pay their employees $5.25 per hour.[30] (Note: The federal minimum wage for all employers grossing more than $500,000 is $7.25 an hour as of July 24, 2009, so the Minnesota large-employer rate of $6.15 an hour is obsolete as of that date.)[31] Mississippi None Federal minimum applies. Missouri $7.25 Raised pursuant to FMWA. This rate is automatically adjusted annually based on the U.S. Consumer Price Index rounded to the nearest five cents. In September 2010, the Missouri Department of Labor announced that the state minimum wage would not increase in 2011.[32] Montana $7.35 Raised pursuant to FMWA. This rate is automatically adjusted annually based on the U.S. Consumer Price Index. Tip income may not be applied as an offset to an employee's pay rate. The minimum pay is $4/hour for business with less than $110,000 in annual sales.[8] The indexed minimum wage was increased 10 cents to $7.35 per hour on January 1, 2011.[33][34] Nebraska $7.25 Raised pursuant to FMWA. Nevada $8.25 Rises with inflation.[35] The minimum wage increased to $8.25 on July 1, 2010. Employers who offer health benefits can pay employees $7.25.[36] In April 2011, Nevada's Labor Commissioner Michael Tanchek announced that the minimum wage would remain at $8.25 per hour for the July 2011-July 2012 period.[37] New Hampshire $7.25 In June 2011, media reported that state lawmakers approved legislation that repeals the state minimum wage law and aligns it with federal law.[38] The new law does not affect the tipped wage rate, which will remain at $3.27 per hour. New Jersey $7.25 Raised pursuant to FMWA. New Mexico $7.50 $9.85 in Santa Fe [39] (now covering all employees, since expansion to employers with less than 25 employees, as of January 1, 2008).[40][41] (This wage was previously tied with San Francisco as the highest in the country.) Albuquerque's minimum wage is $7.50 per hour (employers who provide health care or child care benefits can pay employees $6.50 per hour).[42] New York $7.25 Raised pursuant to FMWA. New York also has a minimum for exempt employees $536.10 per week as of January 1, 2007. North Carolina $7.25 Raised pursuant to FMWA. North Dakota $7.25 Raised pursuant to FMWA. Ohio $7.40 This rate is adjusted annually on January 1 based on the U.S. Consumer Price Index.[43] and will increase to $7.70 on January 1, 2012. $3.70 plus tips for tipped employees ($3.85 plus tips in 2012); $7.25 for employees under 16 years old and employees whose employers gross less than $273,000 per year ($281,000 in 2012).[44] Oklahoma $7.25 Raised pursuant to FMWA. Federal minimum wage used as reference; no actual amounts written in law.[8] $2.00 per hour for work not covered by federal minimum wage (OK Statutes 40-197.5). Oregon $8.50 Rises with inflation. The wage will increase 30 cents to $8.80 on January 1, 2012. [45] Pennsylvania $7.25 Raised pursuant to FMWA. Rhode Island $7.40 $2.89 for employees receiving tips. South Carolina None Federal minimum applies. South Dakota $7.25 Raised pursuant to FMWA. Tennessee None Federal minimum applies. The state does have a promised wage law whereby the employers are responsible for paying to the employees the wages promised by the employer. Texas $7.25 Raised pursuant to FMWA. Federal minimum wage used as reference; no actual amounts written in law.[8][46] Utah $7.25 Raised pursuant to FMWA. Federal minimum wage used as reference after legislative action; no actual amounts written in law. Current rate took effect on September 8, 2007. $2.13 an hour for tipped employees. [8] Vermont $8.15 Rises with inflation.[8] Tipped employees are paid $3.95.[47] Virginia $7.25 Raised pursuant to FMWA. Federal minimum wage used as reference.[8] Washington $8.67 Employees aged 14 or 15 may be paid 85% of the minimum wage, which is $7.37 as of January 1, 2011. Minimum wage increases annually by a voter-approved cost-of-living adjustment based on the federal Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The wage will increase 37 cents to $9.04 on January 1, 2012. West Virginia $7.25 Applicable to employers of 6 or more employees at one location not involved in interstate commerce.[8] Wisconsin $7.25 Raised pursuant to FMWA. Tipped employees are paid $2.33.[48] Wyoming $5.15 $2.13 for employees receiving tips. FMWA. Territory

Territory Level (USD/h) Notes American Samoa $2.68-$4.69 Varies by industry.[49] Planned increases to $7.25 by 2014.[50] On September 30, 2010, President Obama signed legislation that delays scheduled wage increases for 2010 and 2011. Annual wage increases of $0.50 will recommence on September 30, 2012.[51] District of Columbia $8.25 Raised pursuant to FMWA. This rate is automatically set at $1 above the Federal minimum wage rate if the District of Columbia rate is lower.[52] The tipped wage in Washington, DC is $2.77 per hour.[53] Guam $7.25[8] Northern Mariana Islands $3.55 Since July 23, 2007. Planned increases to $7.25 by 2015.[50] Puerto Rico $4.10[8] Employers covered by the Federal Fair Labor Standards Act (FLSA) are subject only to the Federal minimum wage and all applicable regulations. Employers not covered by the FLSA will be subject to a minimum wage that is at least 70 percent of the Federal minimum wage or the applicable mandatory decree rate, whichever is higher. The Secretary of Labor and Human Resources may authorize a rate based on a lower percentage for any employer who can show that implementation of the 70 percent rate would substantially curtail employment in that business. Puerto Rico also has minimum wage rates that vary according to the industry. These rates range from a minimum of $4.25 to $7.25 per hour.

U.S. Virgin Islands $7.25 Except businesses with gross annual receipts of less than $150,000, then $4.30. (In practice, the Virgin Islands adopts the Federal per hour rate) See also

References

- ^ "Employee Rights Under the Fair Labor Standards Act". US Department of Labor - Wage and Hour Division. Accessed: September 3, 2010. http://www.dol.gov/whd/regs/compliance/posters/minwage.pdf.

- ^ "Oregon Minimum Wage Standard". State of Oregon Bureau of Labor and Industry. http://www.oregon.gov/BOLI/TA/docs/OregonMinimumWage_Eng_2010.pdf?ga=t.

- ^ "Exemptions to the Minimum Wage and the FLSA". Minimum-Wage.org. Accessed: May 25, 2011. http://www.minimum-wage.org/minimum-wage-exemptions.asp.

- ^ "US minimum wage to get $2 boost". May 25, 2007. BBC News.

- ^ "FAQs". State of Alabama Department of Labor. Accessed August 6, 2010. http://www.alalabor.state.al.us/faq.htm.

- ^ Alaska State Senate Majority Caucus Press Release

- ^ "Minimum Wage Standard and Overtime Hours". Alaska Division of Labor Standards and Safety. Accessed November 8, 2010. http://labor.alaska.gov/lss/whact.htm.

- ^ a b c d e f g h i j k l Minimum Wage Laws in the States. From the United States Department of Labor, Employment Standards Administration - Wage and Hour Division. The source page has a clickable US map with current and projected state-by-state minimum wage rates for each state.

- ^ "State Minimum Wage Rates". Labor Law Center. Accessed August 6, 2010. http://www.laborlawcenter.com/t-State-Minimum-Wage-Rates.aspx.

- ^ "Minimum Wage FAQs". Industrial Commission of Arizona. Accessed August 6, 2010. http://www.ica.state.az.us/Labor/Labor_MinWag_FAQs_English.aspx.

- ^ "Minimum wage up 10 cents to $7.35". Arizona Daily Star. January 1, 2011. http://azstarnet.com/business/local/article_231cc6a3-22e3-5f62-93d4-377ccee61bfa.html.

- ^ "Minimum wage". California Department of Industrial Relations. Accessed August 6, 2010. http://www.dir.ca.gov/dlse/FAQ_MinimumWage.htm.

- ^ "Minimum Wage Ordinance". San Francisco Labor Standards Enforcement. Accessed October 21, 2010. http://www.sfgsa.org/index.aspx?page=411.

- ^ "Minimum Wage". Colorado Department of Labor and Employment. Accessed August 6, 2010. http://www.colorado.gov/cs/Satellite/CDLE-LaborLaws/CDLE/1250083027822.

- ^ "Colorado's minimum wage becomes first in the country to drop". Syracuse Post-Standard. January 1, 2010. http://www.syracuse.com/news/index.ssf/2010/01/colorados_minimum_wage_becomes.html.

- ^ "Minimum wage set to rise by 11 cents". Denver Post. December 29, 2010. http://www.denverpost.com/business/ci_16961254.

- ^ "2012 Colorado State Minimum Wage". Colorado DOLE. Accessed October 10, 2011. http://www.colorado.gov/cs/Satellite/CDLE-LaborLaws/CDLE/1248095305416.

- ^ "CONNECTICUT MINIMUM WAGE RATES FOR SERVICE EMPLOYEES AS DEFINED* AND BARTENDERS". Connecticut Department of Labor. Accessed August 30, 2010. http://www.ctdol.state.ct.us/wgwkstnd/wage-hour/rest-gratchart.pdf.

- ^ "Ruling clears way for hike to minimum wage". Daytona Beach News-Journal. May 10, 2011. http://www.news-journalonline.com/business/jobs/2011/05/10/ruling-clears-way-for-hike-to-minimum-wage.html.

- ^ http://www.dol.state.ga.us/spotlight/sp_minimum_wage_change_2007.htm

- ^ http://www.lexisnexis.com/hottopics/gacode/Default.asp Go to Georgia Code Title 34, Chapter 4, § 34-4-3

- ^ "State Labor Poster". Hawaii Department of Labor and Industrial Relations. http://hawaii.gov/labor/legal/law/poster/2006/wage.pdf.

- ^ Illinois Department of Labor - Minimum Wage Law

- ^ "Wage and Hour Questions and Answers". Iowa Workforce Development. http://www.iowaworkforce.org/labor/wageandhourquestionsandanswers.pdf.

- ^ "Sebelius signs bill to raise Kansas minimum wage to $7.25 an hour". Kansas City Business Journal. April 23, 2009. http://www.bizjournals.com/kansascity/stories/2009/04/20/daily43.html.

- ^ "Minimum Wage Poster". Maine Department of Labor Standards. Accessed: September 3, 2010. http://www.maine.gov/labor/posters/minimumwage.pdf.

- ^ Maryland Department of Labor - Wage & Hour Fact Sheet

- ^ "Minimum Wage Program". Executive Office of Labor and Workforce Development. Accessed August 6, 2010. http://www.mass.gov/?pageID=elwdsubtopic&L=4&L0=Home&L1=Workers+and+Unions&L2=Wage+and+Employment+Related+Programs&L3=Minimum+Wage+Program&sid=Elwd.

- ^ "What is the Michigan Minimum Wage?". Michigan Department of Energy, Labor & Economic Growth. Accessed July 8, 2011. http://www.michigan.gov/lara/0,1607,7-154-27673_27909-140972--,00.html.

- ^ "How federal minimum-wage increase affects Minnesota businesses". Minnesota Department of Labor and Industry. http://www.dli.mn.gov/LS/FedMinWage.asp. Retrieved November 8, 2010.

- ^ Rate difference

- ^ "Minimum wage". Missouri Department of Labor. Accessed October 18, 2010. http://www.labor.mo.gov/DLS/WageAndHour/MinimumWage/.

- ^ "Montana minimum wage going up 10 cents in January". Business Week. October 1, 2010. http://billingsgazette.com/news/state-and-regional/montana/article_8433ee82-3408-5c73-a9d0-b64fb6535d15.html.

- ^ "Montana's minimum wage climbs to $7.35". Billings Gazette. January 6, 2011. http://dli.mt.gov/media/releases/10012010minWage.pdf.

- ^ "Minimum Wage Rate Increasing". Las Vegas Review Journal. June 26, 2010. http://www.lvrj.com/business/minimum-wage-rate--increasing-97217949.html?ref=949.

- ^ "2010 Annual Minimum Wage Bulletin". Nevada Office of the Labor Commissioner. http://www.laborcommissioner.com/.

- ^ "Nevada’s Minimum Wage and Daily Overtime Rates Will Not Change". KOLO TV. April 4, 2011. http://www.kolotv.com/news/headlines/Nevadas_Minimum_Wage_and_Daily_Overtime_Rates_Will_Not_Change_119192204.html?ref=204.

- ^ "Lawmakers override vetoed minimum wage bill; bill ties NH to federal law". Associated Press. June 22, 2011. http://www.therepublic.com/view/story/d4b55c87d12e40f6931985780df1096e/NH-XGR--Minimum-Wage/.

- ^ "Living Wage". Santa Fe, NM - Official Website. http://www.santafenm.gov/index.aspx?NID=84.

- ^ "City's minimum pay requirement expands to small businesses; state minimum kicks in". By Julie Ann Grimm. December 31, 2007. The Santa Fe New Mexican.

- ^ Santa Fe Living Wage Network.

- ^ [www.cabq.gov/council/documents/minimum_wage/o_06_20.pdf City of Albuquerque - Minimum Wage Ordinance]

- ^ "Ohio minimum wage to go up 10 cents next week". Cleveland Plain Dealer. December 30, 2010. http://www.cleveland.com/business/index.ssf/2010/12/ohio_minimum_wage_to_go_up_10.html.

- ^ "Ohio 2009 Minimum Wage". Ohio Department of Commerce. http://www.com.ohio.gov/laws/docs/laws_2009MinimumWage.pdf.

- ^ "Oregon minimum wage gets 30-cent bump". The Oregonian. September 15, 2011. http://www.oregonlive.com/business/index.ssf/2011/09/oregon_minimum_wage_bumped_up.html.

- ^ "Texas Minimum Wage Law Summary". Texas Workforce. Last updated July 24, 2009. http://www.twc.state.tx.us/ui/lablaw/tmwsum.html.

- ^ "Vermont's minimum wage bumps up to $8.15 an hour". Burlington Free Press. January 4, 2011. http://www.burlingtonfreepress.com/article/20110104/NEWS01/110103025/Vermont-s-minimum-wage-bumps-up-to-8.15-an-hour.

- ^ "The Wisconsin's 2009 Minimum Wage Rates". Wisconsin Department of Workforce Development. Last updated July 24, 2009. http://dwd.wisconsin.gov/er/labor_standards_bureau/minimum_wage_rate.htm.

- ^ "Wage Rate in American Samoa". Department of Labor Wage and Hour Division. http://www.dol.gov/esa/minwage/americanSamoa/ASminwage.htm.

- ^ a b "Statement of Nikolao I. Pula, Acting Deputy Assistant Secretary of the Interior for Insular Affairs, Before the Senate Committee on Energy and Natural Resources, Regarding the Economic Effects of the Recently Increased Minimum Wage on American Samoa and the Commonwealth of the Northern Mariana Islands". Office of Insular Affairs (OIA). February 28, 2008. http://www.doi.gov/oia/press/2008/02282008.html.

- ^ "President Obama signs Minimum Wage delay into Law". Samoa News. October 1, 2010. http://www.samoanews.com/viewstory.php?storyid=19341.

- ^ "District of Columbia Official Code". District of Columbia Department of Employment Services. Accessed: September 3, 2010. http://www.does.dc.gov/does/cwp/view,a,1234,q,539346.asp.

- ^ "Minimum Wages for Tipped Employees (January 1, 2010)". U.S. Department of Labor - Wage and Hour Division. Accessed November 29, 2010. http://www.dol.gov/whd/state/tipped.htm.

Categories:

Wikimedia Foundation. 2010.