- Retirement

-

For other uses, see Retirement (disambiguation).

Finance Government spending:

Government final consumption expenditure

Warrant of payment

Government operations

Redistribution of wealth

Transfer payment

Government revenue:

Taxation

Deficit spending

Government budget

Government budget deficit

Government debt

Non-tax revenueProfessional certification in financial services

Accounting scandalsRetirement is the point where a person stops employment completely.[1][2] A person may also semi-retire by reducing work hours.

Many people choose to retire when they are eligible for private or public pension benefits, although some are forced to retire when physical conditions don't allow the person to work any more (by illness or accident) or as a result of legislation concerning their position.[3] In most countries, the idea of retirement is of recent origin, being introduced during the 19th and 20th centuries. Previously, low life expectancy and the absence of pension arrangements meant that most workers continued to work until death. Germany was the first country to introduce retirement in the 1880s.

Nowadays most developed countries have systems to provide pensions on retirement in old age, which may be sponsored by employers and/or the state. In many poorer countries, support for the old is still mainly provided through the family. Today, retirement with a pension is considered a right of the worker in many societies, and hard ideological, social, cultural and political battles have been fought over whether this is a right. In many western countries this right is mentioned in national constitutions.

Contents

Retirement in specific countries

A person may retire at whatever age they please. However, a country's tax laws and/or state old-age pension rules usually mean that in a given country a certain age is thought of as the "standard" retirement age.

The "standard" retirement age varies from country to country but it is generally between 50 and 70 (according to latest statistics, 2011). In some countries this age is different for males and females, although this has recently been challenged in some countries (e.g., Austria), and in some countries the ages are being brought into line.[4] The table below shows the variation in eligibility ages for public old-age benefits in the United States and many European countries, according to the OECD.

Country Early retirement age Normal retirement age Employed, 55–59 Employed, 60–64 Employed, 65–69 Employed, 70+ Austria 60 (57) 65 (60) 39% 7% 1% 0% Belgium 60 65 45% 12% 1% 0% Cambodia 50 55 ? ? ? ? Denmark none 65 77% 35% 9% 3% France 62* 65* 51% 12% 1% 0% Germany 65 67 64% 23% 3% 0% Greece 55 65 31% 18% 4% 0% Italy 57 60 26% 12% 1% 0% Netherlands 60 65 53% 22% 3% 0% Norway 62 67 74% 33% 7% 1% Spain 60** 65** 46% 22% 0% 0% Sweden 61 65 78% 58% 5% 1% Switzerland 63 (61), [58] 65 (64) 77% 46% 7% 2% Thailand 50 60 ? ? ? ? United Kingdom none 65 69% 40% 10% 2% United States 62 67 66% 43% 20% 5% Notes: Parentheses indicate eligibility age for women when different. Sources: Cols. 1–2: OECD Pensions at a Glance (2005), Cols. 3–6: Tabulations from HRS, ELSA and SHARE. Square brackets indicate early retirement for some public employees.

In the United States, while the normal retirement age for Social Security, or Old Age Survivors Insurance (OASI), historically has been age 65 to receive unreduced benefits, it is gradually increasing to age 67. For those turning 65 in 2008, full benefits will be payable beginning at age 66.[5] Public servants are often not covered by Social Security but have their own pension programs. Police officers in the United States are typically allowed to retire at half pay after only 20 years of service or three-quarter pay after 30 years, allowing people to retire in their early forties or fifties.[6] Military members of the US Armed Forces may elect to retire after 20 years of active duty. Their retirement pay (not a pension since they can be involuntarily called back to active duty at any time) is calculated on total number of years on active duty, their final pay grade and the retirement system in place when they entered service. Allowances such as housing and subsistence are not used to calculate a member's retired pay. Members awarded the Medal of Honor qualify for a separate stipend, regardless of the years of service. Military members in the reserve and US National Guard have their retirement based on a point system.[citation needed]

* In France, the retirement age has been extended to 62 and 67 respectively, over the next eight years.[7]

** In Spain, the retirement age will be extended to 63 and 67 respectively, this increase will be progressively done from 2013 to 2027 at a rate of 1 month during the first 6 years and 2 months during the other 9.[8]

India

In India - there are three sets of pension benefits. They are really good although the value may have now eroded:

1. Gratuity - at the end of service @ of 15 days salary (basic only) multiplied by number of years of service. 2. Superannuation - Varies from company to company - good companies provide Group Annuity Schemes 3. Employees Providend Fund and Family Pension - Employee Contributed at 12 % of salary per annum.

Data sets

Recent advances in data collection have vastly improved our ability to understand important relationships between retirement and factors such as health, wealth, employment characteristics and family dynamics, among others. The most prominent study for examining retirement behavior in the United States is the ongoing Health and Retirement Study (HRS), first fielded in 1992. The HRS is a nationally representative longitudinal survey of adults in the U.S. ages 51+, conducted every two years, and contains a wealth of information on such topics as labor force participation (e.g., current employment, job history, retirement plans, industry/occupation, pensions, disability), health (e.g., health status and history, health and life insurance, cognition), financial variables (e.g., assets and income, housing, net worth, wills, consumption and savings), family characteristics (e.g., family structure, transfers, parent/child/grandchild/sibling information) and a host of other topics (e.g., expectations, expenses, internet use, risk taking, psychosocial, time use).[9]

2002 and 2004 saw the introductions of the English Longitudinal Study of Ageing (ELSA) and the Survey of Health, Ageing and Retirement in Europe (SHARE), which includes respondents from 14 continental European countries plus Israel. These surveys were closely modeled after the HRS in sample frame, design and content. A number of other countries (e.g., Japan, South Korea) also now field HRS-like surveys, and others (e.g., China, India) are currently fielding pilot studies. These data sets have expanded the ability of researchers to examine questions about retirement behavior by adding a cross-national perspective.

Study First wave Eligibility age Representative year/last wave Sample size: households Sample size: individuals Health and Retirement Study (HRS) 1992 51+ 2006 12,288 18,469 Mexican Health and Aging Study (MHAS) 2001 50+ 2003 8,614 13,497 English Longitudinal Study of Ageing (ELSA) 2002 50+ 2006 6,484 9,718 Survey of Health, Ageing and Retirement in Europe (SHARE) 2004 50+ 2006 22,255 32,442 Korean Longitudinal Study of Aging (KLoSA) 2006 45+ 2006 6,171 10,254 Japanese Health and Retirement Study (JHRS) 2007 45-75 2007 Est. 10,000 WHO Study on Global Ageing and Adult Health (SAGE) 2007 50+/18-49 2007 Est. 5,000/1,000 Chinese Health and Retirement Study (CHARLS) pilot 2008 45+ 2008 Est. 1,500 Est. 2,700 Longitudinal Aging Study in India (LASI) pilot 2009 45+ 2009 Est. 2,000 Notes: MHAS discontinued in 2003; ELSA numbers exclude institutionalized (nursing homes). Source: Borsch-Supan et al., eds. (November 2008). Health, Ageing and Retirement in Europe (2004–2007): Starting the Longitudinal Dimension.

Factors affecting retirement decisions

Many factors affect people's retirement decisions. Social Security clearly plays an important role. In countries around the world, people are much more likely to retire at the early and normal retirement ages of the public pension system (e.g., ages 62 and 65 in the U.S.).[10] This pattern cannot be explained by different financial incentives to retire at these ages since typically retirement benefits at these ages are approximately actuarially fair; that is, the present value of lifetime pension benefits (pension wealth) conditional on retiring at age a is approximately the same as pension wealth conditional on retiring one year later at age a+1.[11] Nevertheless a large literature has found that individuals respond significantly to financial incentives relating to retirement (e.g., to discontinuities stemming from the Social Security earnings test or the tax system).[12][13][14]

Greater wealth tends to lead to earlier retirement, since wealthier individuals can essentially "purchase" additional leisure. Generally the effect of wealth on retirement is difficult to estimate empirically since observing greater wealth at older ages may be the result of increased saving over the working life in anticipation of earlier retirement. However, a number of economists have found creative ways to estimate wealth effects on retirement and typically find that they are small. For example, one paper exploits the receipt of an inheritance to measure the effect of wealth shocks on retirement using data from the HRS.[15] The authors find that receiving an inheritance increases the probability of retiring earlier than expected by 4.4 percentage points, or 12 percent relative to the baseline retirement rate, over an eight-year period.

A great deal of attention has surrounded how the financial crisis is affecting retirement decisions, with the conventional wisdom saying that fewer people will retire since their savings have been depleted; however recent research suggests that the opposite may happen. Using data from the HRS, researchers examined trends in defined benefit (DB) vs. defined contribution (DC) pension plans and found that those nearing retirement had only limited exposure to the recent stock market decline and thus are not likely to substantially delay their retirement.[16] At the same time, using data from the Current Population Survey (CPS), another study estimates that mass layoffs are likely to lead to an increase in retirement almost 50% larger than the decrease brought about by the stock market crash, so that on net retirements are likely to increase in response to the crisis.[17]

More information tells of how many who retire will continue to work, but not in the career they have had for the majority of their life. Job openings will increase in the next 5 years due to retirements of the baby boomer generation. The Over 50 population is actually the fastest growing labor groups in the US. This might have something to do with the economy, or the fact that this generation is outliving any previous generation and needs a job to entertain them!

A great deal of research has examined the effects of health status and health shocks on retirement. It is widely found that individuals in poor health generally retire earlier than those in better health. This does not necessarily imply that poor health status leads people to retire earlier, since in surveys retirees may be more likely to exaggerate their poor health status to justify their earlier decision to retire. This justification bias, however, is likely to be small.[18] In general, declining health over time, as well as the onset of new health conditions, have been found to be positively related to earlier retirement.[19]

Most people are married when they reach retirement age; thus, spouse's employment status may affect one's decision to retire. On average, husbands are three years older than their wives in the U.S., and spouses often coordinate their retirement decisions. Thus, men are more likely to retire if their wives are also retired than if they are still in the labor force, and vice versa.[20][21]

Saving for retirement

Retired workers then support themselves either through pensions or savings. In most cases the money is provided by the government, but sometimes granted only by private subscriptions to mutual funds. In this latter case, subscriptions might be compulsory or voluntary. In some countries an additional "bonus" is granted una tantum (once only) in proportion to the years of work and the average wages; this is usually provided by the employer.

The financial weight of provision of pensions on a government's budget is often heavy and is the reason for political debates about the retirement age. The state might be interested in a later retirement age for economic reasons.

The cost of health care in retirement is large, because people tend to be ill more frequently in later life. Most countries provide universal health insurance coverage for seniors, although in the United States many people retire before they become eligible for Medicare at age 65. In 2006, Medicare Part D went into effect, expanding benefits to include prescription drug coverage.

On a personal level, the rising cost of living during retirement is a serious concern to many older adults.

Retirement calculators

A useful and straightforward calculation can be done if we assume that interest, after expenses, taxes and inflation is zero. Assume that in real (after-inflation) terms, your salary never changes during your w years of working life. During your p years of pension, you have a living standard which costs a replacement ratio R times as much as your living standard in your working life. Your working life living standard is your salary less the proportion of salary Z that you need to save. Calculations are per unit salary, e.g. assume salary =1.

Then after w years work, retirement age accumulated savings= wZ. To pay for pension for p years, necessary savings at retirement=Rp(1-Z)

Equate these: wZ=Rp(1-Z) and solve to give z= Rp/ (w + Rp). For example, if w=35, p=30 and R=0.65 we find that we need to save a proportion z=35.78% of our salary.

Retirement calculators generally accumulate a proportion of salary up to retirement age, as illustrated in the clickable 'nut accumulation' example on the left. This shows a straightforward case which nonetheless could be practically useful for optimistic people hoping to work for only as long as they are likely to be retired: more information about this is at retirement calcs

For more complicated situations, there are several online retirement calculators on the Internet. Many retirement calculators project how much an investor needs to save, and for how long, to provide a certain level of retirement expenditures. Some retirement calculators, appropriate for safe investments, assume a constant, unvarying rate of return. Monte Carlo retirement calculators take volatility into account, and project the probability that a particular plan of retirement savings, investments and expenditures will outlast the retiree. Retirement calculators vary in the extent to which they take taxes, social security, pensions, and other sources of retirement income and expenditures into account.

The assumptions keyed into a retirement calculator are critical. One of the most important assumptions, is the assumed rate of real (after inflation) investment return. A conservative return estimate could be based on the real yield of Inflation-indexed bonds offered by some governments, including the United States, Canada, and the United Kingdom. The TIP$TER retirement calculator projects the retirement expenditures that a portfolio of inflation-linked bonds, coupled with other income sources like Social Security, would be able to sustain. Current real yields on United States Treasury Inflation Protected Securities (TIPS) are available at the US Treasury site. Current real yields on Canadian 'Real Return Bonds' are available at the Bank of Canada's site. As of June, 2010, US Treasury inflation-linked bonds (TIPS) were yielding about 1.5% real per annum.

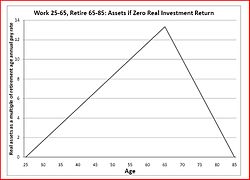

Many individuals use 'retirement calculators' on the Internet to determine the proportion of their pay which they should be saving in a tax advantaged-plan (e.g. IRA or 401-K in the US, RRSP in Canada, personal pension in the UK, superannuation in Australia). After expenses and any taxes, a reasonable (though arguably pessimistic) long-term assumption for a safe real rate of return is zero. So in real terms, interest doesn't help the savings grow. Each year of work must pay its share of a year of retirement. For someone planning to work for 40 years and to be retired for 20 years, each year of work pays for itself and for half a year of retirement. Hence 33.33% of pay must be saved and 66.67% can be spent when earned. After 40 years of saving 33.33% of pay we have accumulated assets of 13.33 years of pay, as in the graph. In the graph to the right, the lines are straight, which is appropriate given the assumption of a zero real investment return.

The graph above can be compared with those generated by many retirement calculators. However, most retirement calculators use nominal (not 'real' dollars), and therefore require a projection of both the expected inflation rate and the expected nominal rate of return. One way to work around this limitation is to, for example, enter '0% return, 0% inflation' inputs into the calculator. The Bloomberg retirement calculator gives the flexibility to specify, for example, zero inflation and zero investment return and to reproduce the graph above. The MSN retirement calculator in 2010 cannot be changed from an assumed 3% per annum inflation rate, so one would set an investment return assumption of 3%.

Ignoring tax, someone wishing to work for a year and to then relax for a year on the same living standard needs to save 50% of pay. Similarly, someone wishing to work from age 25 to 55 and to be retired for 30 years till 85 needs to save 50% of pay if government and employment pensions are not a factor, and if it is considered appropriate to assume a zero real investment return. The problem that the lifespan is not known in advance can be reduced in some countries by the purchase at retirement of an inflation-indexed life annuity.

Retirement calculations

For most people, employer pensions, government pensions and the tax situation in their country are important factors, typically taken account of in calculations by actuaries. Ignoring those significant nation-specific factors but not necessarily assuming zero real interest rates, a 'not to be relied upon' calculation of required personal savings rate zprop can be made using a little mathematics.[22] It helps to have a dimly-remembered acquaintance with geometric series, maybe in the form

- 1 + r + r2 + r3 + ... + rn−1 = (1 − rn)/(1 − r)

You work for w years, saving a proportion zprop of pay at the end of each year. So the after-savings purchasing power is (1-zprop) of pay while you are working. You need a pension for p years. Let's say that at retirement you are earning S per year and require to replace a ratio Rrepl of your pre-retirement living standard. So you need a pension of (1 – zprop ) Rrepl S, indexed to price inflation.

Let's assume that the investments, after price inflation fprice, earn a real rate ireal in real terms where

(1+ ireal ) = ((1+inominal))/((1+fprice ) ) (Ret-01)

Let's assume that the investments, after wage inflation fpay, earn a real rate i rel to pay where

(1+ i rel to pay ) = ((1+inominal))/((1+fpay ) ) (Ret-02)

Size of lump sum required

To pay for your pension, assumed for simplicity to be received at the end of each year, and taking discounted values in the manner of a net present value calculation, you need a lump sum available at retirement of:

(1 – zprop ) R repl S {(1+ ireal ) −1+(1+ ireal ) −2 +… ….+ (1+ ireal ) -p}

= (1-zprop ) R repl S {(1 – (1+ireal)-p )/ireal}

Above we have used the standard mathematical formula for the sum of a geometric series. (Or if ireal =0 then the series in braces sums to p since it then has p equal terms). As an example, assume that S=60,000 per year and that it is desired to replace Rrepl=0.80, or 80%, of pre-retirement living standard for p=30 years. Assume for current purposes that a proportion z prop=0.25 (25%) of pay was being saved. Using ireal=0.02, or 2% per year real return on investments, the necessary lump sum is given by the formula as (1-0.25)*0.80*60,000*annuity-series-sum(30)=36,000*22.396=806,272 in the nation's currency in 2008–2010 terms. To allow for inflation in a straighforward way, it is best to talk of the 806,272 as being '13.43 years of retirement age salary'. It may be appropriate to regard this as being the necessary lump sum to fund 36,000 of annual supplements to any employer or government pensions that are available. It is common to not include any house value in the calculation of this necessary lump sum, so for a homeowner the lump sum pays primarily for non-housing living costs.

Size of lump sum saved

Will you have saved enough at retirement? Use our necessary but unrealistic assumption of a constant after-pay-rises rate of interest. At retirement you have accumulated

zprop S {(1+ i rel to pay )w-1+(1+ i rel to pay )w-2 +… ….+ (1+ i rel to pay )+ 1 }

= zprop S ((1+i rel to pay)w- 1)/i rel to pay

Equate and derive necessary saving proportion

To make the accumulation match with the lump sum needed to pay your pension:

zprop S (((1+i rel to pay )) w - 1)/i rel to pay = (1-zprop ) R repl S (1 – ((1+i real)) -p )/i real

Bring zprop to the left hand side to give our answer, under this rough and unguaranteed method, for the proportion of pay that we should be saving:zprop = R repl (1 – ((1+i real )) -p )/i real / [(((1+i rel to pay )) w - 1)/i rel to pay + R repl (1 – ((1+i real )) -p )/i real ] (Ret-03)

You are encouraged to download the use-at-your-own-financial-risk spreadsheet. The results in the spreadsheet can be seen to make sense. For example, working for 5 years and drawing a pension for 5 years requires you to save almost half your pay, with interest helping only a little.

Note that the special case i rel to pay =0 = i real means that we instead sum the geometric series by noting that we have p or w identical terms and hence z prop = p/(w+p). This corresponds to our graph above with the straight line real-terms accumulation.

Sample results

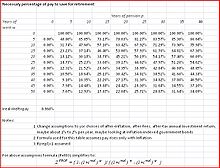

The result for the necessary zprop given by (Ret-03) depends critically on the assumptions that you make. As an example, you might assume that price inflation will be 3.5% per year forever and that your pay will increase only at that same rate of 3.5%. If you assume a 4.5% per year nominal rate of interest, then (using 1.045/1.035 in real terms ) your pre-retirement and post-retirement net interest rates will remain the same, irel to pay = 0.966 percent per year and ireal = 0.966 percent per year. These assumptions may be reasonable in view of the market returns available on inflation-indexed bonds, after expenses and any tax. Equation (Ret-03) is readily coded in Excel and with these assumptions gives the required savings rates in the accompanying picture.

Monte Carlo: Better allowance for randomness

Finally, a newer method for determining the adequacy of a retirement plan is Monte Carlo Simulation. This method has been gaining popularity and is now employed by many financial planners.[23] Monte Carlo retirement calculators[24][25] allow users to enter savings, income and expense information and run simulations of retirement scenarios. The simulation results show the probability that the retirement plan will be successful.

Early retirement

Early retirement can be at any age, but is generally before the age (or tenure) needed for eligibility for support and funds from government or employer-provided sources. Thus, early-retirees rely on their own savings and investments to be initially self-supporting, until they start receiving such external support. Early retirement is also a euphemistic term for accepting termination of employment before retirement age as part of the employer's labor force rationalization. In this case, a monetary inducement may be involved.

Savings needed for early retirement

While conventional wisdom has it that one can retire and take 7% or more out of a portfolio year after year, this would not have worked very often in the past.[26][27] When making periodic inflation-adjusted withdrawals from retirement savings,[28] can make meaningless many assumptions that are based on long term average investment returns.

The chart at the right shows the year-to-year portfolio balances after taking $35,000 (and adjusting for inflation) from a $750,000 portfolio every year for 30 years, starting in 1973 (red line), 1974 (blue line), or 1975 (green line).[29] While the overall market conditions and inflation affected all three about the same (since all three experienced exactly the same conditions between 1975 and 2003), the chance of making the funds last for 30 years depended heavily on what happened to the stock market in the first few years.

Those contemplating early retirement will want to know if they have enough to survive possible bear markets such as the one that sent the 1973 retiree back to work after 20 years.

The history of the US stock market shows that one would need to live on about 4% of the initial portfolio per year to ensure that the portfolio is not depleted before the end of the retirement.[30] This allows for increasing the withdrawals with inflation to maintain a consistent spending ability throughout the retirement, and to continue making withdrawals even in dramatic and prolonged bear markets.[31] (The 4% figure does not assume any pension or change in spending levels throughout the retirement.)

When retiring prior to age 59½, there is a 10% IRS penalty on withdrawals from a retirement plan such as a 401(k) plan or a Traditional IRA. Exceptions apply under certain circumstances. At age 59 and six months, the penalty-free status is achieved and the 10% IRS penalty no longer applies.

To avoid the 10% penalty prior to age 59½ a person should consult a lawyer about the use of IRS rule 72 T. This rule must be applied for with the IRS. It allows the distribution of a IRA account prior to age 59½ in equal amounts of a period of either 5 years or until the age of 59½ which ever is the longest time period without a 10% penalty. Taxes still must be paid on the distributions.

Calculations using actual numbers

Although the 4% initial portfolio withdrawal rate described above can be used as a rough gauge, it is often desirable to use a retirement planning tool that accepts detailed input and can render a result that has more precision. Some of these tools model only the retirement phase of the plan while others can model both the savings or accumulation phase as well as the retirement phase of the plan.

The effects of making inflation-adjusted withdrawals from a given starting portfolio can be modeled with a downloadable spreadsheet[32] that uses historical stock market data to estimate likely portfolio returns. Another approach is to employ a retirement calculator[33] that also uses historical stock market modeling, but adds provisions for incorporating pensions, other retirement income, and changes in spending that may occur during the course of the retirement.

Life after retirement

Retirement might coincide with important life changes; a retired worker might move to a new location, for example a retirement community, thereby having less frequent contact with their previous social context and adopting a new lifestyle. Often retirees volunteer for charities and other community organizations. Tourism is a common marker of retirement and for some becomes a way of life, such as for so called grey nomads.

Often retirees are called upon to care for grandchildren and occasionally aged parents. For many it gives them more time to devote to a hobby or sport such as golf or sailing. On the other hand, many retirees feel restless and suffer from depression as a result of their new situation. Although it is not scientifically possible to directly show that retirement either causes or contributes to depression, the newly retired are one of the most vulnerable societal groups when it comes to depression most likely due to confluence of increasing age and deteriorating health status.[34] Retirement coincides with deterioration of one's health that correlates with increasing age and this likely plays a major role in increased rates of depression in retirees. Longitudinal and cross-sectional studies have shown that healthy elderly and retired people are as happy or happier and have an equal quality of life as they age as compared to younger employed adults, therefore retirement in and of itself is not likely to contribute to development of depression.

Many people in the later years of their lives, due to failing health, require assistance, sometimes in extremely expensive treatments – in some countries – being provided in a nursing home. Those who need care, but are not in need of constant assistance, may choose to live in a retirement home.

See also

- Simple living

- Downshifting

- Pension

- AARP

- Ageing

- Mandatory retirement

- Gerontology

- Social security

- Retirement spend down

- Asset/liability modeling

- Retirement in Europe

References

- ^ "Retire: To withdraw from one's occupation, business, or office; stop working." American Heritage Dictionary

- ^ "Retire: Leave one's job and cease to work, especially because one has reached a particular age. Compact Oxford Dictionary

- ^ For example, in the United States, a person holding the rank of general or admiral must retire after 40 years of service unless he or she is reappointed to serve longer. (10 USC 636 Retirement for years of service: regular officers in grades above brigadier general and rear admiral (lower half))

- ^ OECD (2005). Ageing and Employment Policies: Austria.

- ^ Normal retirement age (NRA)

- ^ Michael Bucci (November 1992). "Police and firefighter pension plans". Monthly Labor Review 115 (11). http://findarticles.com/p/articles/mi_m1153/is_n11_v115/ai_13262436. Retrieved 2007-08-03.

- ^ "Pension rallies hit French cities". BBC News. September 7, 2010. http://www.bbc.co.uk/news/world-europe-11204528.

- ^ "Spain to Raise Retirement Age to 67". The New York Times. January 27, 2011. http://www.nytimes.com/2011/01/28/world/europe/28iht-spain28.html.

- ^ Juster, F. Thomas; Suzman, Richard (1995). "An Overview of the Health and Retirement Study". The Journal of Human Resources 30 (Special Issue on the Health and Retirement Study: Data Quality and Early Results): S7–S56. doi:10.2307/146277. JSTOR 146277.

- ^ Gruber, Jonathan and David Wise, eds. (1999). Social Security and Retirement around the World. University of Chicago Press.

- ^ Gustman, Alan and Thomas Steinmeier (2003). "Retirement Effects of Proposals by the President's Commission to Strengthen Social Security." NBER Working Paper No. 10030

- ^ Feldstein, Martin and Jeffrey B. Liebman (2002). "Social Security," in Handbook of Public Economics, Vol. 4, Elsevier Press

- ^ Friedberg, Leora (2000). "The Labor Supply Effects of the Social Security Earnings Test." Review of Economics and Statistics, Vol. 82, No. 1, pp. 48–63

- ^ Liebman, Jeffrey B., Erzo F.P. Luttmer and David G. Seif (2008). "Labor Supply Responses to Marginal Social Security Benefits: Evidence from Discontinuities." NBER Working Paper No. 14540

- ^ Brown, Jeffrey R., Courtney Coile and Scott J. Weisbenner (2006). "The Effect of Inheritance Receipt on Retirement." NBER Working Paper No. 12386

- ^ Gustman, Alan, Thomas Steinmeier and Jahid Tabatabai (2009). "How Do Pension Changes Affect Retirement Preparedness? The Trend to Defined Contribution Plans and the Vulnerability of the Retirement Age Population to the Stock Market Decline of 2008–2009." Presented at 11th Annual Joint Conference of the Retirement Research Consortium, August 10–11, 2009, National Press Club, Washington, DC

- ^ Coile, Courtney B. and Phillip B. Levine (2009). "The Market Crash and Mass Layoffs: How the Current Economic Crisis May Affect Retirement," presented at NBER Summer Institute Workshop on Aging, July 21–25, 2009.

- ^ Dwyer, Debra and Olivia Mitchell (1999). "Health problems as determinants of retirement: Are self-rated measures endogenous?" Journal of Health Economics, Vol. 18, No. 2, pp. 173–193

- ^ Dwyer, Debra and Jianting Hu (2000). "Retirement Expectations and Realizations: the Role of Health Shocks and Economic Factors," in Forecasting Retirement Needs and Retirement Wealth, Mitchell, Olivia, P. Brett Hammond and Anna Rappaport, eds.

- ^ Blau, David M. (1998). "Labor Force Dynamics of Older Married Couples." Journal of Labor Economics, Vol. 16, No. 3, pp. 595–629

- ^ Gustman, Alan and Thomas Steinmeier (2000). "Retirement in Dual Career Families: A Structural Model." Journal of Labor Economics, Vol. 18, No. 3, pp. 503–545

- ^ Broverman, Samuel A., Mathematics of Investment and Credit, 3rd. Edition, Section 2.3.1 Actex Publications, Inc, Winsted CT, (2004)

- ^ A SURE BET? (Wealth Manager).

- ^ Retirement Calculator by VestingPoint.com

- ^ Online Monte Carlo Retirement Planner.

- ^ Clements, Jonathan (May 21, 2006). "Make Sure Your Money Lasts as Long as You". The Wall Street Journal. http://online.wsj.com/public/article/SB114816694417158844-T3PaTbKIVYPPZkTOfOkzo8zKevY_20060531-search.html?KEYWORDS=firecalc&COLLECTION=wsjie/6month.

- ^ SC:Lynch #2

- ^ http://firecalc.com/intro.php volatility

- ^ FIRECalc: Why another retirement calculator?

- ^ Dallas Morning News | News for Dallas, Texas | Scott Burns: Columns 2006

- ^ Retire Early's Safe Withdrawal Rates in Retirement

- ^ http://retireearlyhomepage.com/re60.html downloadable spreadsheet

- ^ FIRECalc: A different kind of retirement calculator.

- ^ http://www.retirementjoy.com/ avoiding depression after retirement

Further reading

- Schultz, Ellen E., RETIREMENT HEIST: How Companies Plunder and Profit from the Nest Eggs of American Workers", Penguin Publishing, 2011

External links

- "Historical Development", Social Security Administration

- Short, Joanna, "Economic History of Retirement in the U.S.", 2010-02-01, Augustana College, Rock Island, Illinois

Categories:

Wikimedia Foundation. 2010.