- Royalties

-

Not to be confused with Royal family.

Royalty cheque.

Royalty cheque.

Royalties (sometimes, running royalties, or private sector taxes) are usage-based payments made by one party (the "licensee") to another (the "licensor") for the right to ongoing use of an asset, sometimes an intellectual property (IP). Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.[1][2][3][4][5][6][7] A royalty interest is the right to collect a stream of future royalty payments, often used in the oil industry and music industry to describe a percentage ownership of future production or revenues from a given leasehold, which may be divested from the original owner of the asset.[8]

A license agreement defines the terms under which a resource or property such as petroleum, minerals, patents, trademarks, and copyrights are licensed by one party to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchise agreements have comparable provisions.

Non-renewable resource royalties

The owner of petroleum and mineral resources may licence a party to extract those resources while paying a resource rent, or a royalty on the value or the resultant profits. When a government is the owner of the resource the terms of the licence and the royalty rate are typically legislated or regulated. An example from Canada's North is the federal Frontier Lands petroleum royalty regime. The royalty rate is determined as an incremental rate from 1–5% of gross revenues until costs have been recovered, at which point the royalty rate increases to 30% of net revenues or 5% of gross revenues. In this manner risks and profits are shared between the government of Canada (as resource owner) and the petroleum developer. This attractive royalty rate is intended to encourage oil and gas exploration in the remote Canadian frontier lands where costs and risks are higher than other locations.

In many jurisdictions oil and gas royalty interests are considered real property under the NAICS classification code and qualify for a 1031 like-kind exchange.[3]

Patent royalties

A patent[4][5] gives the owner an exclusive right to prevent others from practicing the patented technology in the country issuing the patent for the term of the patent. The right may be enforced in a lawsuit for monetary damages and/or imprisonment for violation on the patent. In accordance with a patent license, royalties are paid to the patent owner in exchange for the right to practice one or more of the four basic patent rights: to manufacture with, to use, to sell, or to advertise for sale of a patented technology.

Patent rights may be divided and licensed out in various ways, on an exclusive or nonexclusive basis. The license may be subject to limitations as to time or territory. A license may encompass an entire technology or it may involve a mere component or improvement on a technology. In the United States, "reasonable" royalties may be imposed, both after-the-fact and prospectively, by a court as a remedy for infringement.

Patent royalty rates

Patent royalty rates are influenced by the importance of the patent and its value to the products. Some realms of business have conventions regarding royalty rates and other license terms. Royalties are often computed as a percentage of the value of the finished product made by using the patent. To illustrate, the following are prevalent rates for gross sales within the United States pharmaceutical industry:[9]

-

- a pending patent on a strong business plan, royalties of the order of 1%

- issued patent, 1%+ to 2%

- the pharmaceutical with pre-clinical testing, 2–3%

- with clinical trials, 3–4%

- proven drug with US FDA approval, 5–7%

- drug with market share, 8–10%

Royalty rates may also be affected by whether a patent is strong (i.e. broadly written, seemingly valid) or weak; whether it is a fundamental patent or merely a slight improvement on a known technology; whether substitute technologies are available or an ability to work around the patent; the extent of the contribution of the patented technology to the value of the final product and whether there are other patents that must also be licensed (in which case there is a practical limit on how much royalty can be paid to license each).

With regards to the actual rates of royalty payments in the industry, the Licensing Economics Review,[10][11] reported in 2002 that in a review of 458 license agreements, over a 16-year period, it found that an average royalty rate of 7.0%. However, the range extended from 0% to 50%. All of these agreements may not have been at "arms length".

In the Arab countries, it may be found, that a royalty as a percentage of sales may be difficult to transact; a flat fee may be preferred as percentages may be interpreted as percentage of profit.[12]

Know-how royalties

In addition to licensing the applicable patents, a company may need to learn how to manufacture a product. This knowledge, standing alone or together with a patent license, may be obtained through a know-how license. Know-how is trade secret information in combination with data, techniques, or human and intellectual expertise, that helps a company exploit a licensed technology. Know-how may help a company achieve better operational efficiency, manufacturing productivity, or product/system quality. Know-how royalties may be stated as distinct from patent royalties since their periods of validity vary. The rates vary widely.

Trademark royalties

Trademarks are words, logos, slogans, sounds, or other distinctive expressions that distinguish the source, origin, or sponsorship of a good or service (in which they are generally known as service marks). Trademarks offer the public a means of identifying and assuring themselves of the quality of the good or service. They may bring consumers a sense of security, integrity, belonging, and a variety of intangible appeals. The value that inures to a trademark in terms of public recognition and acceptance is known as goodwill.

A trademark right is an exclusive right to sell or market under that mark within a geographic territory. The rights may be licensed to allow a company other than the owner to sell goods or services under the mark. A company may seek to license a trademark it did not create in order to achieve instant name recognition rather than accepting the cost and risk of entering the market under its own brand that the public does not necessarily know or accept. Licensing a trademark allows the company to take advantage of already-established goodwill and brand identification.

Like patent royalties, trademark royalties may be assessed and divided in a variety of different ways, and are expressed as a percentage of sales volume or income, or a fixed fee per unit sold. When negotiating rates, one way companies value a trademark is to assess the additional profit they will make from increased sales and higher prices (sometimes known as the "relief from royalty") method.

Trademark rights and royalties are often tied up in a variety of other arrangements. Trademarks are often applied to an entire brand of products and not just a single one. Because trademark law has as a public interest goal the protection of a consumer, in terms of getting what they are paying for, trademark licenses are only effective if the company owning the trademark also obtains some assurance in return that the goods will meet its quality standards. When the rights of trademark are licensed along with a know-how, supplies, pooled advertising, etc., the result is often a franchise relationship. Franchise relationships may not specifically assign royalty payments to the trademark license, but may involve monthly fees and percentages of sales, among other payments.

Trademark royalty rates

In a long-running dispute in the United States involving the valuation of the DHL trademark of DHL Corporation,[13] it was reported that experts employed by the IRS surveyed a wide range of businesses and found a broad range of royalties for trademark use from a low of 0.7% to a high of 15%.

Franchises

While a payment to employ a trademark licence is a royalty, it is accompanied by a "guided usage manual", the use of which may be audited from time to time. However, this becomes a supervisory task when the mark is used in a franchise agreement for the sale of goods or services carrying the reputation of the mark. For a franchise, it is said, a fee is paid, even though it comprises a royalty element.

To be a franchise, the agreement must be a composite of three items: sugan

-

-

- the right to use a trademark to offer, sell or distribute goods or services (the trademark element)

- payment of a required royalty or fee (the fee element)

- significant assistance or control with respect to the franchisee’s business (the supervisory element)

-

One of the above three items must not apply for the franchise agreement to be considered a trademark agreement (and its laws and conventions). In a franchise, for which there is no convention, laws apply concerning training, brand support, operating systems/support and technical support in a written format ("Disclosure").[14]

Copyright

Copyright law gives the owner the right to prevent others from copying, creating derivative works, or publicly performing their works. Copyrights, like patent rights, can be divided in many different ways, by the right implicated, by specific geographic or market territories, or by more specific criteria. Each may be the subject of a separate license and royalty arrangements.

Copyright royalties are often very specific to the nature of work and field of endeavor. With respect to music, royalties for performance rights in the United States are set by the Library of Congress' Copyright Royalty Board. Mechanical rights to recordings of a performance are usually managed by one of several performance rights organizations. Payments from these organizations to performing artists are known as residuals. Royalty free music provides more direct compensation to the artists. In 1999, recording artists formed the Recording Artists' Coalition to repeal supposedly "technical revisions" to American copyright statutes which would have classified all "sound recordings" as "works for hire", effectively assigning artists' copyrights to record labels.[15][16]

Book authors may sell their copyright to the publisher. Alternatively, they might receive as a royalty a certain amount per book sold. It is common in the UK for example, for authors to receive a 10% royalty on book sales.

Some photographers and musicians may choose to publish their works for a one-time payment. This is known as a royalty-free license.

Book publishing royalties

Except in the rarity of cases where book writers can demand high advances and royalties, an author's royalty rate is dictated by their publisher. All book-publishing royalties are paid by the publisher.

For the predominant case, the publishers advance an amount (part of the royalty) which can constitute the bulk of the author’s total income plus whatever little flows from the "running royalty" stream. Some costs may be attributed to the advance paid, which depletes further advances to be paid or from the running royalty paid. The author and the publisher can independently draw up the agreement that binds them or alongside an agent representing the author. There are many risks for the author – definition of cover price, the retail price, "net price", the discounts on the sale, the bulk sales on the POD (publish on demand) platform, the term of the agreement, audit of the publishers accounts in case of impropriety, etc. which an agent can provide.

The following illustrates the income to an author on the basis chosen for royalty, particularly in POD which minimizes losses from inventorying and is based on computer technologies.

-

-

-

-

Book-publishing Royalties - "Net" and "Retail" Compared Retail Basis Net Basis Cover Price 15.00 15.00 Discount to Booksellers 50% 50% Wholesale Price, $ 7.50 7.50 Printing Cost,$ (200 pp Book)

3.50 3.50 Net Income,$ 4.00 4.00 Royalty Rate 20% 20% Royalty Calcn. 0.20x15 0.20x4 Royalty,$ 3.00 0.80

-

-

-

Hardback royalties on the published price of trade books usually range from 10% to 12.5%, with 15% for more important authors. On paperback it is usually 7.5% to 10%, going up to 12.5% only in exceptional cases. All the royalties displayed below are on the "cover price". Paying 15% to the author can mean that the other 85% of the cost pays for editing and proof-reading, printing and binding, overheads, and the profits (if any) to the publisher.

The publishing company pays no royalty on bulk purchases of books since the buying price may be a third of the cover price sold on an singles basis.

In the US there is no "maximum retail price" for books (whereas there is in the UK) which can serve as a calculation basis.

Music royalties

Unlike other forms of intellectual property, music royalties have a strong linkage to individuals – composers (score), songwriters (lyrics) and writers of musical plays – in that they can own the exclusive copyright to created music and can license it for performance independent of corporates. Recording companies and the performing artists that create a "sound recording" of the music enjoy a separate set of copyrights and royalties from the sale of recordings and from their digital transmission (depending on national laws).

With the advent of pop music and major innovations in technology in the communication and presentations of media, the subject of music royalties has become a complex field with considerable change in the making.

A musical composition obtains protection in copyright law immediate to its reduction to tangible form – a score on paper or a taping; but it is not protected from infringed use unless registered with the copyright authority; for instance, the Copyright Office in the United States, administered by the Library of Congress. No person or entity, other than the copyright owner, can use or employ the music for gain without obtaining a license from the composer/songwriter.

Inherently, as copyright, it confers on its owner, a distinctive "bundle" of five exclusive rights:

- (a) to make copies of the songs through print or recordings

- (b) to distribute them to the public for profit

- (c) to the "public performance right"; live or through a recording

- (d) to create a derivative work to include elements of the original music; and

- (e) to "display" it (not very relevant in context).

Where the score and the lyric of a composition are contributions of different persons, each of them is an equal owner of such rights.

These exclusivities have led to the evolution of distinct commercial terminology used in the music industry.

They take four forms:

- (1) royalties from "print rights"

- (2) mechanical royalties from the recording of composed music on CDs and tape

- (3) performance royalties from the performance of the compositions/songs on stage or television through artists and bands, and

- (4) synch (for synchronization) royalties from using or adapting the musical score in the movies, television advertisements, etc. and

With the advent of the internet, an additional set of royalties has come into play: the digital rights from simulcasting, webcasting, streaming, downloading, and online "on-demand service".

In the following the terms "composer" and "songwriter" (either lyric or score) are synonymous.

Print rights in music

Brief history

While the focus here is on royalty rates pertaining to music marketed in the print form or "sheet music", its discussion is a prelude to the much more important and larger sources of royalty income today from music sold in media such as CDs, television and the internet.

Sheet music is the first form of music to which royalties were applied, which was then gradually extended to other formats. Any performance of music by singers or bands requires that it be first reduced to its written sheet form from which the "song" (score) and its lyric are read. Otherwise, the authenticity of its origin, essential for copyright claims will be lost as has been the case with folk songs and American "westerns" propagated by the aural tradition.

The ability to print music arises from a series of technological developments in print and art histories over a long span of time (from the 11th to the 18th century) of which two will be highlighted.

The first, and commercially successful, invention was the development of the "movable type" printing press, the Gutenberg press in the 15th century. It was used to print the well-known Gutenberg bible and later the printing system enabled printed music. Printed music, till then, tended to be one line chants. The difficulty in using movable type for music is that all the elements must align – the note head must be properly aligned with the staff, lest it have an unintended meaning.

Musical notation was well developed by then, originating around 1025. Guido d'Arezzo developed a system of pitch notation using lines and spaces. Until this time, only two lines had been used. Guido expanded this system to four lines, and initiated the idea of ledger lines by adding lines above or below these lines as needed. He used square notes called neumes. This system eliminated any uncertainty of pitch which existed at that time. Guido also developed a system of clefs, which became the basis for our clef system: bass clef, treble clef, and so on. (Co-existing civilizations used other forms of notation).

In Europe, the major consumers of printed music in the 17th and 18th centuries were the royal courts for both solemn and festive occasions. Music was also employed for entertainment, both by the courts and the nobility. Composers made their livings from commissioned work, and worked as conductors, performers and tutors of music or through appointments to the courts. To a certain extent, music publishers also paid composers for rights to print music, but this was not royalty as it is generally understood today.

The European Church was also a large user of music, both religious and secular. However, performances were largely based on hand-written music or aural training.

American contribution: The Origins of Music Copyright and Royalties

Till the mid-18th century American popular music largely consisted of songs from the British Isles, whose lyric and score were sometimes available in engraved prints. Mass production of music was not possible till the movable type was introduced. Music with this type was first printed in the US in 1750.[17] At the beginning the type consisted of the notehead, stem and staff which were combined into a single font. Later the fonts were made up of the notehead, stems and flags attached to the staff line. Prints till that time existed only on engraved plates.

The first federal law on copyright was enacted in the US Copyright Act of 1790 which made it possible to give protection to original scores and lyrics.

America's most prominent contribution is jazz and all the music styles which preceded and co-exist with it – its variations on church music, African-American work songs, cornfield hollers, wind bands in funeral procession, blues, rag, etc. – and of innovations in church music, rhythmic variations, stamping, tapping of feet, strutting, shuffling, wailing, laments and spiritual ecstasy.

Until its recent sophistication, jazz was not amenable to written form, and thus not copyrightable, due to its improvisational element and the fact that many of the creators of this form could not read or write music.[18] It was its precursor, minstrelsy which came to be written and royalties were paid for the use of popular music.

Blackface minstrelsy, in which white men parodied black music of the day with blackened faces was the first distinctly theatrical form. In the 1830s and 1840s, it was at the core of the rise of an American music industry. For several decades it provided the means through which white America saw black America. The blackfaces were not products of the American South, but first prevailed in the midwest and the north, starting in low-level white establishments, and later moving to upscale theaters. White, working-class northerners could identify with the characters portrayed in early performances with images of "white slavery" and "wage slavery".[19]

In 1845, the blackfaces purged their shows of low humor. Christy's Minstrels, formed by C.F. Christy, among the major minstrels of that time, was to epitomize the songs of its most renknowned composer, Stephen Foster.

Stephen Foster was the pre-eminent songwriter in the United States of that time. His songs, such as "Oh! Susanna", "Camptown Races", "My Old Kentucky Home", "Beautiful Dreamer" and "Swanee River") remain popular 150 years after their composition and have worldwide appreciation.[20]

Foster had little formal music training. While he was able to publish several songs before he was twenty, his sophistication came from Henry Kleber and Dan Rice. Kleber was a classically trained German immigrant, and Rice was a popular blackface performer who befriended Foster. But it was his joining the Christy Minstrels – which made him and his songs, North American favorites.

W.C. Peters was the first major publisher of Foster’s works, but Foster saw very little of the profits. "Oh, Susanna" was an overnight success and a Goldrush favorite but Foster received just $100 from his publisher for it, in part due to his lack of interest in money and the free gifts of music he gave to him. Foster's first love lay in writing music and its success. Foster did later contract with Christy, with $15 each for "Old Folks at Home" and "Farewell my Lilly Dear". "Oh, Susanna" also led Foster to two New York publishers, Firth, Pond and Co. and F.D. Benson who contracted with him to pay royalty at 2 cents for every printed copy sold by them.[21]

Minstrelsy slowly gave way to songs generated by the American Civil War, followed by the rise of Tin Pan Alley and Parlour music,[22] both of which led to an explosion of sheet music, greatly aided by the emergence of the player piano. While the player piano was to make inroads deep into the 20th century, more and more music was reproduced through radio and the phonograph, leading to new forms of royalty payments, but leading to the decline of sheet music.

American innovations in church music also provided royalties to its creators. While Stephen Foster is often credited as the originator of print music in America, William Billings is the real father of American music. In 1782, of the 264 music compositions in print, 226 were his church-related compositions. Similarly, Billings was the composer of a quarter of the 200 anthems published till 1810. He, or his family, saw no royalties although the Copyright Act of 1790 was in place by then.

Church music plays a significant part in American print royalties. When the Lutheran Church split from the Catholic Church in the 16th century, more than religion changed. Martin Luther wanted his entire congregation to take part in the music of his services, not just the choir. This new chorale style finds its way in both present church music and jazz.

Print royalties (music)

The royalty rate for printing a book, or its download,(a novel, lyrics or music) for sale varies from 8–20% of the suggested retail sales value, typically 12–14%, for a new writer. The payment is made by the publisher and corresponds to the agreement (license) between the writer and the publisher as with other music royalties. The agreement is typically non-exclusive to the publisher and the term may vary from 3–5 years. Established writers favor certain publishers and usually receive higher royalties.

All of the royalty does not accrue to the writer. It is shared with the publisher on of book sales income on a 50:50 basis. Publishing encompasses the whole area of administering, exploiting and promotion of the musical work, not just the print rights; in forms as piano and vocal arrangements, as folios, movies and obtaining foreign publication, etc.

If a book involved is a play, it might be dramatized. The right to dramatize is a separate right – known as a grand right. This income is shared by the many personalities and organizations who come together to offer the play: the playwright, composer of the music played, producer, director of the play and so forth. There is no convention to the royalties paid for grand rights and it is freely negotiated between the publisher and the mentioned participants.

If the writer’s work is only part of a publication, then the royalty paid is pro-rata, a facet which is more often met in a book of lyrics or in a book of hymns and sometimes in an anthology.

Church music – that is, music that is based on written work – is important particularly in the Americas and in some other countries of Europe. Examples are hymns, anthems and songbooks. Unlike novels and plays, hymns are sung with regularity. Very often, the hymns and songs are sung from lyrics in a book, or more common nowadays, from the work projected on computer screen.

When the lyrics from a song are so projected, the same copyright laws apply as if sheet music or the hymn books have been purchased. A lyric reprint license is required by Federal copyright law to compensate the songwriter for using their work. By license the author exempts the songs sung in worship; however, songs sung (even in worship) from reproductions as photocopies or from projections are subject to license. In the US, the Christian Copyright Licensing Incorporated is the collection agency for royalties but song or hymn writers have to be registered with them and the songs identified.[23]

Foreign publishing

Viewed from a US perspective, foreign publishing involves two basic types of publishing – sub-publishing and co-publishing occurrences in one or more territories outside that of basic origin. Sub-publishing, itself, is one of two forms: sub-publishers who merely license out the original work or those which make and sell the products which are the subject of the license, such as print books and records (with local artists performing the work).

Sub-publishers who produce and market a product retain 10–15% of the marked retail price and remit the balance to the main publisher with whom they have the copyright license. Those sub-publishers who merely license out the work earn between 15–25%.[24]

Co-publishing takes place when there is more than one publisher and it arises usually when there is more than one writer on a work. Each writer then has his or her own publishing company who together then become Co-publishers.

Mechanical royalties

The term "mechanical" and mechanical license has its origins in the "piano rolls" on which music was recorded in the early part of the 20th Century. Although its concept is now primarily oriented to royalty income from sale of compact discs (CDs), its scope is wider and covers any copyrighted audio composition that is rendered mechanically; that is, without human performers:

The United States treatment of mechanical royalties is in sharp contrast to international practice.

In the United States, while the right to use copyrighted music for making records for public distribution (for private use) is an exclusive right of the composer, the Copyright Act provides that once the music is so recorded, anyone else can record the composition/song without a negotiated license but on the payment of the statutory compulsory royalty. Thus, its use by different artists could lead to several separately-owned copyrighted "sound recordings".

The following is a partial segment of the compulsory rates as they have applied from 1998 to 2007 in the United States.[25] The royalty rates in the table comprise of two elements: (i) a minimum rate applies for a duration equivalent to 5 minutes, or less, of a musical composition/song and (ii) a per-minute rate if the composition exceeds it, whichever is greater.

-

-

Compulsory Mechanical Royalty Rates - United States Period Royalty Rate 01-01-1998 – 12-31-1999 7.10 cents or 1.35 cents/min 01-01-2000 – 12-31-2001 7.55 cents or 1.43 cents/min 01-01-2002 – 12-31-2003 8.00 cents or 1.55 cents/min 01-01-2004 – 12-31-2005 8.50 cents or 1.65 cents/min 01-01-2006 – 12-31-2007 9.10 cents or 1.75 cents/min

-

In the predominant case, the composer assigns the song copyright to a publishing company under a "publishing agreement" which makes the publisher exclusive owner of the composition. The publisher's role is to promote the music by extending the written music to recordings of vocal, instrumental and orchestral arrangements and to administer the collection of royalties (which, as will shortly be seen, is in reality done by specialized companies). The publisher also licenses 'subpublishers' domestically and in other countries to similarly promote the music and administer the collection of royalties.

In a fair publishing agreement, every 100 units of currency that flows to the publisher gets divided as follows: 50 units go to the songwriter and 50 units to the publisher minus operating and administrative fees and applicable taxes. However, the music writer obtains a further 25 units from the publisher's share, if the music writer retains a portion of the music publishing rights (as a co-publisher). In effect, the co-publishing agreement is a 50/50 share of royalties in favor of the songwriter if administrative costs of publishing are disregarded. This is near international practice.

When a company (recording label) records the composed music, say, on a CD master, it obtains a distinctly separate copyright to the sound recording, with all the exclusivities that flow to such copyright. The main obligation of the recording label to the songwriter and her publisher is to pay the contracted royalties on the license received.

While the compulsory rates remain unaffected, recording companies, in the U.S., will, typically, negotiate to pay not more than 75% of the compulsory rate where the songwriter is also the recording artist[26] and will further (in the U.S.) extend that to a maximum of 10 songs, even though the marketed recording may carry more than that number. This 'reduced rate' results from the incorporation of a "controlled composition" clause in the licensing contract[27] since the composer as recording artist is seen to control the content of the recording.

Mechanical royalties for music produced outside of the United States are negotiated – there being no compulsory licensing – and royalty payments to the composer and her publisher for recordings are based on the wholesale, retail, or "suggested retail value" of the marketed CDs.

Recording artists earn royalties only from the sale of CDs and tapes and, as will be seen later, from sales arising from digital rights. Where the song-writer is also the recording artist, royalties from CD sales add to those from the recording contract.

In the U.S., recording artists earn royalties amounting to 10%–25% (of the suggested retail price of the recording[28] depending on their popularity but such is before deductions for "packaging", "breakage", "promotion sales" and holdback for "returns", which act to significantly reduce net royalty incomes.

In the U.S., the Harry Fox Agency, HFA, is the predominant licensor, collector and distributor for mechanical royalties, although there are several small competing organizations. For its operations, it charges about 6% as commission. HFA, like its counterparts in other countries, is a state-approved quasi-monopoly and is expected to act in the interests of the composers/song-writers – and thus obtains the right to audit record company sales. Additional third party administrators such as RightsFlow provide services to license, account and pay mechanical royalties and are growing. RightsFlow is paid by the licensees (artists, labels, distributors, online music services) and in turn does not extract a commission from the mechanical royalties paid out.[29]

In the UK the Mechanical-Copyright Protection Society, MCPS (now in alliance with PRS), acts to collect (and distribute) royalties to composers, songwriters and publishers for CDs and for digital formats. It is a not-for-profit organization which funds its work through a commissions on aggregate revenues. The royalty rate for licensing tracks is 6.5% of retail price (or 8.5% of the published wholesale price).

In Europe, the major licensing and mechanical royalty collection societies are:

SACEM acts collectively for "francophone" countries in Africa. The UK society also has strong links with English-speaking African countries.

Mechanical societies for other countries can be found at the main national collection societies.[33]

The mechanical royalty rate paid to the publisher in Europe is about 6.5% on the PPD (published price to dealers).[34]

Record companies are responsible for paying royalties to those artists who have performed for a recording based on the sale of CDs by retailers.

Performance royalties

"Performance" in the music industry can include any of the following:

-

- a performance of a song or composition – live, recorded or broadcast

- a live performance by any musician

- a performance by any musician through a recording on physical media

- performance through the playing of recorded music

- music performed through the web (digital transmissions)

It is useful to treat these royalties under two classifications:

- (a) those associated with conventional forms of music distribution which have prevailed for most part of the 20th Century, and

- (b) those from emerging 'digital rights' associated with newer forms of communication, entertainment and media technologies (from 'ring tones' to 'downloads' to 'live internet streaming'.

In the United Kingdom, the Church of England is specifically exempted from performance royalties for music performed in services because it is a state-established church. Traditionally, American music publishers have not sought performance royalties for music sung and played in church services–the license to perform being implied by distributors of church sheet music. ASCAP, BMI, and SESAC exempt church worship services from performance royalties, but church-hosted concerts are still subject to them.

Conventional forms of royalty payment

In the conventional context, royalties are paid to composers and publishers and record labels for public performances of their music on vehicles such as the jukebox, stage, radio or TV. Users of music need to obtain a "performing rights license" from music societies – as will be explained shortly – to use the music. Performing rights extend both to live and recorded music played in such diverse areas as cafés, skating rinks, etc.

Licensing is generally done by music societies called "Performing Rights Organizations" (PROs), some of which are government-approved or government-owned, to which the composer, the publisher, performer (in some cases) or the record label have subscribed.

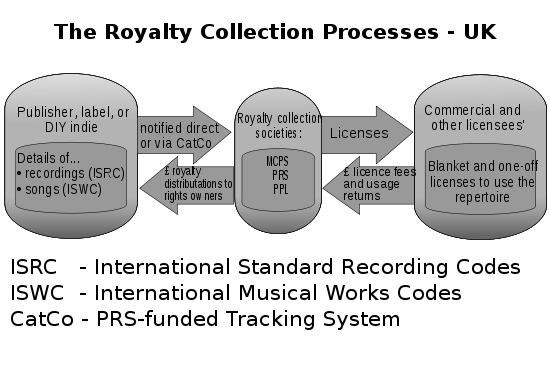

The diagram on the right titled "The Performance Rights Complex"[35] shows the general sequences by which a song or a composition gets to be titled a "performance" and which brings royalties to song-writers/publishers, performing artists and record labels. How, and to whom, royalties are paid is different in the United States from what it is, for example, in the UK. Most countries have "practices" more in common with the UK than the US.

In the United Kingdom there are three principal organizations:

- (i) PPL (for Phonographic Performance Ltd)

- (ii) PRS (for Performing Rights Society), and

- (iii) MCPS (for Mechanical Copyright Protection Society)

who license music (to music-users) and act as royalty collection and distribution agencies for their members.

PPL – which is claimed to be the largest in the world[36] – issues performance licenses to all UK radio, TV and broadcast stations, as also to such diverse users as clubs and bars who employ sound recordings (tapes, CDs), in entertaining the public and collects and distributes royalties to the "record label" for the sound recording and to "featured UK performers" in the recording. Performers do not earn from sound recordings on video and film.

PRS, which is now in alliance with MCPS,[37] collects royalties from music-users and distributes them directly to "song-writers" and "publishers" whose works are performed live, on radio or on TV on a 50:50 basis. MCPS licenses music for broadcast in the range 3 to 5.25% of net advertising revenues.[38]

MCPS also collects and disburses mechanical royalties to writers and publishers in a manner similar to PRS. Although allied, they serve, for now, as separate organizations for membership.

The next diagram shows the sequences in the licensing of performances and the royalty collection and distribution process in the UK.[35] Every song or recording has a unique identity by which they are licensed and tracked. Details of songs or recordings are notified to the PROs directly, or through Catco, an electronic tracking system. It needs to be clarified that while blanket licenses are commonly issued to music-users, the latter are responsible for "usage returns" – the actual frequency of performances under the license – which then becomes the basis for the PRO to apportion royalties to writers, publishers and record labels. ("DIY indies" are "do-it-yourself" independent song-writers – and, often, the performers as well – who record and publish under their own labels). In the UK, music is licensed (and royalties paid on it) at the track level.

There is also a separate organization in the UK called VPL, which is the collecting society set up by the record industry in 1984 to grant licenses to users of music videos, e.g. broadcasters, program-makers, video jukebox system suppliers.[39] The licensing income collected from users is paid out to the society's members after administrative costs are deducted.

There are different models for royalty collection in the European countries. In some of them, mechanical and performing rights are administered jointly. SACEM (France), SABAM (Belgium), GEMA (Germany) and JASRAC (Japan) work that way.

In the United States, in contrast, the ASCAP, BMI (Broadcast Music, Inc) and SESAC (Society of European Stage Authors & Composers) are the three principal Performance Rights Organizations (PROs), although smaller societies exist. The royalty that is paid to the composer and publisher is determined by the method of assessment used by the PRO to gage the utilization of the music, there being no external metrics as in mechanical royalties or the reporting system used in the UK. Very basically, a PRO aggregates the royalties that are due to all of the composers/songwriters "who are its members" and each composer and publisher is paid royalties based on the assessed frequency of the music’s performance, post deductions of charges (which are many). The PROs are audited agencies. They "directly" pay the songwriter and the publisher their respective shares. (If part of the publisher's share is retained by the songwriter, the publisher pays the songwriter that part of the publisher's share).

Typically, the PRO negotiates blanket licenses with radio stations, television networks and other "music users", each of whom receives the right to perform any of the music in the repertoire of the PRO for a set sum of money.

PROs use different types of surveys to determine the frequency of usage of a composition/song. ASCAP uses random sampling, SESAC utilizes cue sheets for TV performances and ‘digital pattern recognition’ for radio performances while BMI employs more scientific methods.

In the United States only the composer and the publisher are paid performance royalties and not performing artists (digital rights being a different matter). Likewise, the record label, whose music is used in a performance, is not entitled to royalties in the US on the premise that performances lead sales of records.

Where a performance has co-writers along with the composer/songwriter – as in a musical play – they will share the royalty.

Royalties in digital distribution

The term "digital music" typically applies to Internet and wireless (mobile) technologies. Digital music files can be identified by serial numbers embedded in the data ('watermarking') or natural patterns in the data ("fingerprinting"). Digital music have begun to give music a different direction by their capacities to internationally distribute the music for instant hearing or storage by private and public persons. Digital music is generally expected to become the predominant form by which music is 'used' in the longer term.

Nonetheless, compact discs will continue to be the major form of musical reach and storage for the present. For example, revenues from the sales of CDs in the US in 2007 far outweighed that from digital downloads, representing some 85% of music sales, or 81 million units per quarter.[40] Also, as the following data illustrates, the amount of music (tracks) available on CDs (stored music) is extremely large compared to what is available in digital format:[41]

In contrast to:

-

- RealNetworks license 60,000 albums for home entertainment services.

- The USA digital jukebox suppliers license about 200,000 tracks.

- There are over 2 million on XM Satellite Radio (Sirius has over 500,000).

- UK Inspired Broadcast Network jukebox THE music offers 2 million tracks.

- RedDotNet’s kiosk system has over 2.5 million tracks online.

- There are about 6 million retail tracks on iTunes Music Store.

- Kazaa[43] has about 1 million tracks.

- Last.fm[44] has a music-discovery database of 60 million titles.

Nonetheless, there has been a decline in CD sales since 2000 in the US (perhaps less so in the EU). At the same time, digital tracks legally downloaded from the internet continue to be a growing force, track downloads totalling 417.3 million units in the first half of 2007 – a 48.5% increase over the corresponding period last year according to Nielsen SoundScan.[45] Apple Inc's sale of over 100 million iPods and the strong presence of iTunes and eMusic (a subscription service) in the US, and now in EU and in other 18 countries, testify to the strong emergence of digital music. This is further emphasized by the large presence of internet broadcasts of live and internet-only radio stations ("streamed music"). They represent the "buy" and "listen" choices.

US regulatory provisions

Regulatory provisions in the US, EU and elsewhere is in a state of flux, continuously being challenged by developments in technology; thus almost any regulation stated here exists in a tentative format.

The US Copyright Act of 1976 identified “musical works” and “sound recordings” eligible for copyright protection. The term “musical work” refers to the notes and lyrics of a song or a piece of music, while a “sound recording” results from its fixation on physical media. Copyright owners of musical works are granted exclusive rights to license over-the-air radio and TV broadcasts, entitling them royalties, which are, as said earlier, collected and distributed by the PROs. Under the Act, record companies and recording artists are, presently, not entitled to royalties from radio and TV broadcasts of their music, except in the case of digital services and webcasts where copyright owners and performers obtain royalties (see later). This is in contrast to international standards where performers also obtain royalties from over-the-air and digital broadcasting.

In 1995, the Congress introduced the Digital Performance Right in Sound Recordings Act (DPRA), which became effective Feb 1, 1996. This Act granted owners of sound recordings the exclusive license to perform the copyrighted work publicly by means of digital audio transmissions but it exempted non-subscription services (and some other services). Where the rights owner could not voluntarily reach agreement with the broadcaster, it could avail of compulsory licensing provisions. Under the Act, the compulsory royalty (the royalty schedule follows) was to be shared in the manner: 50% to the record companies, 45% to featured artists, 2½ % to non-featured musicians through American Federation of Musicians (AFM) in the United States and Canada[46] and 2½% for non-featured vocalists through American Federation of Television and Radio Artists (AFTRA).[47] United States Congress also created a new compulsory license for certain subscription digital audio services, which transmit sound recordings via cable television and Direct-broadcast satellite (DBS) on a non-interactive basis in the absence of a voluntary negotiation and agreement.

In 1998, the Congress amended DPRA to create the Digital Millennium Copyright Act (DMCA) by redefining the above-noted subscription services of DPRA as “preexisting subscription services” and expanded the statutory license to include new categories of digital audio services that may operate under the license. In effect, DMCA created three categories of licensees:

- pre-existing satellite digital audio radio services

- new subscription services, and

- eligible non-subscription transmission services.

In addition to the above, a fourth license was created permit webcasters to make “ephemeral recordings” of a sound recording (temporary copies) to facilitate streaming but with a royalty to be paid.

Non-subscription webcasting royalties have also to be shared between record companies and performers in the proportions set out under DPRA.

The Table below titled SUMMARY OF STATUTORY ROYALTY RATES FOR DIGITAL WEBCASTING - UNITED STATES encapsulates the royalties set for non-interactive webcasting.

To qualify for compulsory licensing under non-subscription services, the webcasting needs to fit the following six criteria:

-

- it is non-interactive

- it does not exceed the sound recording performance complement

- it is accompanied by information on the song title and recording artist

- it does not publish a program schedule or specify the songs to be transmitted

- it does not automatically switch from one program channel to another, and

- it does not allow a user to request songs to be played particularly for that user.

An inter-active service is one which allows a listener to receive a specially created internet stream in which she dictates the songs to be played by selecting songs from the website menu. Such a service would take the website out from under the compulsory license and require negotiations with the copyright owners.

However, a service is non-interactive if it permits people to request songs which are then played to the public at large. Nonetheless, several rules apply such as, within any three-hour period, three cuts from a CD, but no more than two cuts consecutively can be played, or a site can play four songs from any singer from a boxed CD-set, but no more than three cuts consecutively.

The SoundExchange, a non-profit organization, is defined under the legislation to act on behalf of record companies (including the majors) to license performance and reproduction rights and negotiate royalties with the broadcasters. It is governed by a board of artist and label representatives. Services include track level accounting of performances to all members and collection and distribution of foreign royalties to all members.[48]

In the absence of a voluntary agreement between the SoundExchange and the broadcasters, Copyright Arbitration Royalty Panel (CARP) was authorized to set the statutory rates as could prevail between a "willing buyer" and "willing sellers". SoundExchange handles only the collection of royalties from "compulsory licenses" for non-interactive streaming services that use satellite, cable or internet methods of distribution.

To recap, under the law three types of licenses are required for streaming of musical recordings:

- (a) a performance license applicable for underlying words( lyrics) and music (score)

- (b) a performance license applicable to the streaming the sound recording

- (c) a storage license for the passage of a sound recording through a file server

The royalties for the first of the above two licenses are obtained from SoundExchange and the third from the PROs. Failure to make required payments constitutes copyright infringement and is subject to statutory damages.

Both broadcasters involved in webcasting and pure-Internet non-broadcasters are required to pay these royalties under the rules framed under the Act. All webcasters are also required to be registered with the United States Copyright Office.

SUMMARY OF STATUTORY ROYALTY RATES FOR DIGITAL WEBCASTING - UNITED STATES[49]

1. Webcaster DMCA Compliant Service Performance Fee (per performance) Ephemeral Licence Fee (a)Simultaneous internet retransmission of over-the-air AM or FM radio broadcasts 0.07¢ 9% of performance fees due (b)All other internet transmission 0.14¢ 9% of performance fees due 2. Commercial Broadcaster DMCA Compliant Service Performance Fee (per performance) Ephemeral Licence Fee (a)Simultaneous internet retransmission of over-the-air AM or FM radio broadcasts 0.07¢ 9% of performance fees due (b)All other internet transmission 0.14¢ 9% of performance fees due 3. Non-CPB, non-commercial broadcasts: DMCA Compliant Service Performance Fee (per performance) Ephemeral Licence Fee (a)Simultaneous internet retransmission of over-the-air AM or FM radio broadcasts 0.02¢ 9% of performance fees due (b)All other internet transmission 0.05¢ 9% of performance fees due 4. Business Establishment Service: DMCA Compliant Service Performance Fee (per performance) Ephemeral Licence Fee (a)Simultaneous internet retransmission of over-the-air AM or FM radio broadcasts Statutorily Exempt 10% of gross proceeds Minimum Fee All Cases $500 per year for each licensee UK legislation

The United Kingdom adopted the European Copyright Directive (EUCD) in 2003 and the meaning of broadcast performance was broadened to cover "communicating to the public". This then included music distribution through the internet and the transmission of ringtones to mobiles. Thus a music download was a "copy" of proprietary music and hence required to be licensed.

After a prolonged battle on royalties between online music companies such as AOL, Napster and the recording companies (but not all of them), represented by the British Phonographic Industry (BPI), and organizations representing the interests of songwriters (MCPS and PRS) a compromise was reached, leading to a subsequent 3-year interim legislation (2007) adopted by the UK Copyright Tribunal under the Copyright, Designs and Patents Act 1988.[50] The legislation, referring to a new JOL (Joint Online License), applies only to music purchased within UK.

The applicable royalties are given in the Table below which, interestingly, also includes music downloads and music services through mobile devices. This path-breaking legislation is expected to become the model for EU (which is yet to develop comprehensive legislation), and perhaps even extend to the US.

Note that the new legislation includes the distinction between downloads of musical tracks from iTunes and other stores, which were considered "sales" and the webcasts considered "performances".

In brief, the compromise reached is that songwriters will receive 8% of gross revenues (definition follows), less VAT, as royalty for each track downloaded bridging the demand of the artists demanding a 12% royalty rate (what was, otherwise, the norm for a CD) and music companies holding out for 6.5%, slightly higher than the 5.7% paid for a 79p track sold by iTunes.[51] A minimum of four pence will be paid, in the new legislation, if tracks are discounted.

The terms used in the legislated Table are explained following it.

Digital Royalties - Interim Settlement, United Kingdom - 2007 Service Royalty Rate Minimum Permanent Download 8% £0.04 per download - reducing by degrees for larger bundles of tracks, or certain older tracks, to £0.02 (in respect of a bundle 0f 30 tracks+) Limited Download or On Demand Service 8% Mobile subscription: £0.60/subscriber/month PC subscription: £0.40/subscriber/month Limited Subscription: £0.20/subscriber/month All others: £0.0022 per musical work communicated to the public

Special Webcasting (premium or interactive service where 50%+ of content is by single band/artist)

8% Subscription: £0.0022 per musical work (if not subscription); if the service is subscription, minimum to be negotiated

Premium or interactive webcasting 6.5% Subscription: £0.22/subscriber/month;otherwise, £0.00085 per musical work communicated to the public Pure webcasting 6.5% Subscription £0.22/subscriber/month; otherwise 0.0006/musical work communicated to the public Service Royalty Rate and Minimum Mobile or Permanent downloads and other mobile services Rates and minima as per services above, except that: For mobile Permanent Downloads, revenue is reduced by 15% For all other Mobile services revenue is reduced by 7.5%

The above reductions to apply until prices converge with non-mobile services.

Not all music providers in the UK were part of the compromise that led to the legislation. For those not participating - principally, AOL, Yahoo! and RealNetworks - the Tribunal set the royalty rate for pure webcasting at 5.75%.

UK legislation recognizes the term online as referring to downloading digital files from the internet and mobile network operators. Offline is the term used for the delivery of music through physical media such as a CD or a DVD.

A stream is a file of continuous music listened to through a consumer’s receiving device with no playable copy of the music remaining.

Permanent Downloads are transfers (sale) of music from a website to a computer or mobile telephone for permanent retention and use whenever the purchaser wishes, analogous to the purchase of a CD.

A Limited Download is similar to a permanent download but differs from it in that the consumer’s use of the copy is in some way restricted by associated technology; for instance, becomes unusable when the subscription ends (say, through an encoding, such as DRM, of the downloaded music).

On-demand streaming is music streamed to the listener on the computer or mobile to enable her to listen to the music once, twice or a number of times during the period of subscription to the service.

Pure Webcasting is where the user receives a stream of pre-programmed music chosen "by the music service provider". It is non-interactive to the extent that even pausing or skipping of tracks is not possible.

Premium and Interactive Webcasting are personalized subscription services intermediate between pure webcasting and downloading.

Special webcasting is a service where the user can choose a stream of music, the majority of which comprises works from one source – an artist, group or particular concert.

Simulcasting, although not in the Table above, is the simultaneous re-transmission by a licensed transmission of the program of a radio or TV station over the internet of an otherwise traditional broadcast. The person receiving the simulcast normally makes no permanent copy of it. It is defined in the legislation as an offline service.

’Gross Revenue’, which is comprehensively defined in the legislation, summarized here, means, all revenue received (or receivable) by the licensee from Users, all revenue received through advertisements associated with the music service, sponsorship fees, commissions from third parties and revenue arising from barter or contra deals. No deductions are permitted except for refunds of unused music due to technical faults.

The advertising revenue which is shared between the artist and music provider is defined as:

- when the advertising is in-stream;

- when the music offered forms the only content of a page featuring advertising (excluding the advertisement itself); and

- when the music offered forms more than 75% of a page featuring advertising (excluding the advertisement itself).

Synchronization royalties

The term synchronization comes from the early days of the talkies when music was first synchronized with film. The terminology originated in US industry but has now spread worldwide.

Because it would be impractical to join music to film or images without making a "copy" of the music, it is clear that some sort of license is needed – but the legal argument is difficult to construct. In the UK and elsewhere, with the exception of the US,, there is apparently no legal prohibition to the combination of audio and visual images and no explicit statutory right for the collection of synch royalties. In the US, however, the Copyright Act defines the audiovisual format as that of combining images with music for use in machines but there is no explicit rate set such as the "compulsory royalty rate" for copying music but there are instances of courts implying the synchronization right,[52] fuller version at[53] but even so, it is an amorphous colloquial commercial term of acceptance.

Synchronization royalties("synch licenses") are paid for the use of copyrighted music in (largely) audiovisual productions, such as in DVDs, movies, and advertisements. Music used in news tracks are also synch licenses. Synchronization can extend to live media performances, such as plays and live theatre. They become extremely important for new media - the usage of music in the form of mp3, wav, flac files and for usage in webcasts, embedded media in microchips (e.g. karaoke), etc. but the legal conventions are yet to be drawn.

Synchronization royalties are due to the composer/song-writer or his/her publisher. They are strictly contractual in nature and vary greatly in amount depending on the subjective importance of the music, the mode of production and the media used. The royalty payable is that of mutual acceptance but is conditioned by industry practice.

It is useful to note in this connection the concept of the "needle drop" (now laser drop) in that the synch royalty becomes payable every time the needle drops 'on the record player' in a public performance! All openings and closings, every cut to advertisements, every cut back from ads, all re-runs shown by every TV company, in every country in the world generates a "synchro", although a single payment may be renegotiable in advance.[54]

There is a category of royalty free music in the field of synchronization. This refers to the use of music in a "library" for which a one-time royalty has been negotiated. It is an alternative to needle-drop negotiation.

In terms of numbers, royalties can range from, say. $500–2000 for a "festival-use license" to $250,000 or more for a movie film score. For low budget films, which are deemed less than $2 million, the royalties range from 3%–6%[55] or could be per song per usage.

Audio Home Recording Act of 1992

In the US, the Audio Home Recording Act became effective law in October 1992 and established a historic compromise between the consumer electronics industry (devices) and the music industry (content) after a long period of contention on how royalties should be applied.[56]

This is an additional royalty payment to the print, mechanical, performance and synchronization royalties discussed in other sections of this coverage.

In brief, the Act confirms the consumers' right to use (noncommercial use) and retailers' retailers right to sell all digital audio formats without fear of copyright infringement lawsuits. Also no copyright lawsuit may be based on the manufacture, importation, distribution, or sale of digital or analog recording devices or media. As part of this compromise, however, digital audio recording devices must include a system that prohibits serial copying and manufacturers or importers must pay a modest royalty on new digital audio recording devices and media.

The Serial Copy Management System (SCMS) or its alternatives, permits first-generation digital-to-digital copies of prerecorded music and other audio works but prohibits multi-generation or "serial" copies of those copies. SCMS is automatically implemented in DAT, MiniDisc and DCC recorders.

U.S. manufacturers and importers must make payments as follows: for digital audio recording devices, 2% of the wholesale price, with a floor of $1 royalty payment per device and a ceiling of $8 per device, and 3% of the wholesale price for media.

Only the first person to manufacture and distribute or to import and distribute must pay the royalty. The law does not impose any royalty on consumers or retailers.

The Act applies only to "digital audio recording devices", defined as devices that are designed or marketed primarily for making digital audio recordings for private use (whether or not incorporated in some other device).

Royalty payments from digital audio recording technology are divided into two funds:

– two-thirds of the royalties paid goes into a Sound Recordings Fund with a small percentages of this fund earmarked for non-featured artists and backup musicians, 40% of the remainder for featured artists and the balance to record companies.

– one-third goes into a Musical Works Fund, to be split 50/50 between songwriters and publishers.

Royalty payments are administered through the US Music Industry. Featured Artist and Sound Recording Copyright Owner(Record Label) royalties are administered by the Alliance of Artists and Recording Companies. Non-Featured Artist royalties are administered by the AFM/AFTRA Intellectual Property Rights Distribution Fund. Writer royalties are administered through ASCAP, BMI, and SESAC. Publisher royalties are administered through Harry Fox. Although technically these royalties are claimed at the United States Copyright Office by an Interested Copyright Party, the Copyright Office has no way to administer or calculate the royalties to the earning parties, thus the royalties have been claimed by the aforementioned organizations since 1992 on behalf of the music industry then independently administer these funds. Royalty payments are calculated based on methodologies by the administering company, on sales data only.

Art royalties

Resale royalty or droit de suite

Gone – or almost gone – is the time when the art collector was the focal point of a painting. The artist is now not satisfied with recognition by the value his/her artwork gets by increasing value but wants to receive a part of that resale of increase- known as droit de suite – whilst alive or for his heirs, thus obtaining a moral right implied by the copyright claim otherwise legal in a musical creation or in the sale of a book.

As of May 2011 the scheme is ,at a national level, restricted to the EU. The European commissions ec.europa webpage on Resale royalty states that,under the heading 'Indicative list of third countries (Article 7.2)' : 'A letter was sent to Member States on March 1, 2006 requesting that they provide a list of third countries which meet these requirements and that they also provide evidence of application. To date the Commission has not been supplied with evidence for any third country which demonstrates that they qualify for inclusion on this list.'[57] [The emphasis is from the European commission web page.] Whether 'resale royalties' exist as a meaningful encyclopedia whole world classification category class is a bit doubtful; Should this droit de suite section be retitled to something more specific to the EU?

There are very few common facets to the various national schemes. Some prescribe a minimum amount that the artwork must receive before the artist can invoke resale rights (the hammer price or equivalent). Some countries prescribe and others such as Australia, do not prescribe, the maximum royalty that can be received. Most do prescribe the calculation basis of the royalty. Some country's make the usage of the royalty compulsory. Some country's prescribe a sole monopoly collection service agency, while others like the UK and France, allow multiple agencies. Some schemes involve varying degrees of retrospective application and other schemes such as Australia's are not retrospective at all. In some cases, for example Germany, a openly tax-like use is made of the "royalties"; Half of the money collected is redistributed to fund public programs. Whether this German levy on the resale of art can be called a "royalty" is open to question.The New Zealand and Canadian governments have not proceeded with any sort of artist resale scheme. The Australian scheme is not retrospective and individual usage of the right (by Australian artists) is not compulsory. Details of the Australian scheme can be gotten from[58] the website of the sole appointed Australian agency; The "Copyright Agency Limited".

The UK scheme is in the context of common-law countries an oddity; No other common-law country has mandated an individual economic right where actual usage of the right is a compulsory duty for the individual right holder. Whether the common law conception of an individual economic right as an "individual right of control of usage" is compatible with the Code Civil origins of droit de suite is open to question.

The payment agency may be a collection society whom pays the artist after costs and a fixed commission. Or It may be collected by the individual artist as she/he sees fit.

The UK is a recent member of the Group and prescribes a sliding scale for the calculation of royalty as follows:

The portion of the sale price Royalty Rate[59]

-

- From € 0 to 50,000 a royalty rate of 4%

- From € 50,000.01 to 200,000, 3%

- From € 200,000.01 to 350,000, 1%

- From € 350,000.01 to 500,000, 0.5%

- Exceeding €500,000 0.25%

- Maximum royalty paid, the € equivalent of Sterling 12, 500.

In the UK, only living artists have this right now. Heirs will receive royalties as prescribed by the EU Directive only from 2012. France, which introduced this right in 1920, the living artist or heirs receive royalty 70 years of the death of the artist. In California law, heirs receive royalty for 20 years.

The royalty applies to any work of graphic or plastic art such as a ceramic, collage, drawing, engraving, glassware, lithograph, painting, photograph, picture, print, sculpture, tapestry. However, a copy of a work is not to be regarded as a work unless the copy is one of a limited number made by the artist or under the artist's authority. In Christieon the resale of a work bought directly from the artist and then resold within 3 years for a value of €10,000 or less.

The artist retains the copyright unless the artist is commissioned, or is an employee as with magazine illustrators or book cover artists when the publisher is assigned the ownership of the copyright. In the UK an artist cannot waive their resale rights; nor can they agree to share or repay resale royalties, for example, to their dealer or a client of their dealer's. In Australia artists have a case by case right (under clause 22/23 of the Act) to refuse consent to the usage of the right by the appointed collection society and in Australia artists may make payments to other citizens as they see fit . An artist cannot assign their resale right to anyone else, except to a qualifying body under the regulations, such as a charity.

Whether resale royalties are of net economic benefit to artists is a highly contested area. Many economic studies have seriously questioned the assumptions underlying the argument that resale royalties have net benefits to artists. Many modelings have suggested that resale royalties could be actually harmful to living artists economic positions.[60] Australia's chief advocate for the adoption of artist resale royalties the collection society, Viscopy, commissioned in 2004 a report from Access Economics to model the likely impact of their scheme. In the resulting report, Access Economics warned that the claim of net benefit to artists was: "based upon extremely unrealistic assumptions, in particular the assumption that seller and buyer behaviour would be completely unaffected by the introduction of RRR [ARR]" and that, "Access Economics considers that the results of this analysis are both unhelpful and potentially misleading."[61]

Artwork royalties

An artwork is usually a copyrighted article which be mass produced for sale, such as greeting cards. They are both seasonal and on occasion. In the UK it is estimated that one billion pounds are spent on greeting cards every year, with the average person sending 55 cards per year. The royalty range is 2–5% with an ‘upfront royalty’.

Other artwork royalties are as under <http://www.nolo.com/legal-encyclopedia/article-30093.html>:

-

- Greeting cards and gift wrap: 2% to 5%

- Household items such as cups, sheets, towels: 3% to 8%

- Fabrics, apparel (T-shirts, caps, decals): 2% to 10%

- Posters and prints: 10% or more

- Toys and dolls: 3% to 8%

Software royalties

There is simply too much computer software to consider the royalties applicable to each. The following is a guide to royalty rates:

-

- *Computer Software: 10.5% (average), 6.8% (median)

- *Internet: 11.7% (average), 7.5% (median)

For the development of customer-specific software one will have to consider:

-

- * Total software development cost

- * Break-even cost (if the software can be sold to many agencies)

- * Ownership of code (if the client's, he bears the development cost)

- * Life of the software (usually short or requiring maintenance)

- * Risk in development (high, commanding A high price)

Normally, it is estimated that 55%–70% of total project cost is spent in development, especially in the initial version. This high proportion is because new products require "basic foundation development" (R&D, refining/defining business processes, etc.). Marketing software typically consumes 20%–40% of the budget. To estimate profit, it can be assumed that large companies will make a profit between 5–15%[62]

Other royalty arrangements

The term "royalty" also covers areas outside of IP and technology licensing, such as oil, gas, and mineral royalties paid to the owner of a property by a resources development company in exchange for the right to exploit the resource. In a business project the promoter, financier, LHS enabled the transaction but are no longer actively interested may have a royalty right to a portion of the income, or profits, of the business. This sort of royalty is often expressed as a contract right to receive money based on a royalty formula, rather than an actual ownership interest in the business. In some businesses this sort of royalty is sometimes called an override.

Alliances and partnerships

Royalties may exist in technological alliances and partnerships. The latter is more than mere access to secret technical or a trade right to accomplish an objective. It is, in the last decade of the past century, and the first of this one of the major means of technology transfer. Its importance for the licensor and the licensee lies in its access to markets and raw materials, and labor,when the international trend is towards globalization.

There are three main groups when it comes to technological alliances. They are Joint-ventures (sometimes abbreviated JV), the Franchises and Strategic Alliances (SA).[63][64]

Joint-ventures are usually between companies long in contact with a purpose. JVs are very formal forms of association, and depending on the country where they are situated, subject to a rigid code of rules, in which the public may or may not have an opportunity to participate in capital; partly depending on the size of capital required, and partly on Governmental regulations. They usually revolve around products and normally involve an inventive step.

Franchises revolve around services and they are closely connected with trademarks, an example of which is McDonald's. Although franchises have no convention like trademarks or copyrights they can be mistaken as a trademark-copyright in agreements. The franchisor has close control over the franchisee, which, in legal terms cannot be tie-ins such as frachisee located in an areas owned by the franchisor.

Strategic Alliances can involve a project (such as bridge building). a product or a service. As the name implies, is more a matter of 'marriage of convenience' when two parties want to associate to take up a particular (but modest) short-term task but generally are uncomfortable with the other. But the strategic alliance could be a test of compatibility for the forming of a joint venture company and a precedent step.

Note that all of these ventures s could be in a third county. JVs and franchises are rarely found formed within a county. They largely involve third countries.

On occasion, a JV or SA may be wholly oriented to research and development, typically involving multiple organizations working on an agreed form of engagement. The Airbus is an example of such.

Technical Assistance and Technical Service in technology transfer

Firms in developing countries often are asked by the supplier of know-how or patent licensing to consider Technical Service (TS)and Technical Assistance (TA) as elements of the technology transfer process and to pay "royalty" on them. TS and TA are associated with the IP (Intellectual Property) transferred – and, sometimes, dependent on its acquisition – but they are, by no means, IP.[65] TA and TS may also be the sole part of the transfer or the tranferor of the IP, their concurrent supplier. They are seldom met with in the developed countries, which sometimes view even know-how as similar to TS.

TS comprises services which are the specialized knowledge of firms or acquired by them for operating a special process. It is often a "bundle" of services which can by itself meet an objective or help in meeting it. It is delivered over time, at end of which the acquirer becomes proficient to be independent of the service. In this process, no consideration is given on whether the transfer of the proprietary element has been concluded or not.

On the other hand, Technical Assistance is a package of assistance given on a short timetable. It can range variously from procurement of equipment for a project, inspection services on behalf of the buyer, the training of buyer's personnel and the supply technical or managerial staff. Again, TA is independent of IP services.

The payment for these services is a fee, not a royalty. The TS fee is dependent on how many of the specialized staff of its supplier are required and over what period of time. Sometimes, the "learning" capacity to whom the TS is supplied is involved. In any case, the cost per Service-Hour should be calculated and evaluated. Note that in selecting a TS supplier (often the IP Supplier), experience and dependency are critical.

In the case of TA there is usually a plurality of firms and choice is feasible.

Approaches to royalty rate

Intellectual property

The rate of royalty applied in a given case is determined by various factors, the most notable of which are:

-

- Market drivers and demand structure

- Territorial extent of rights

- Exclusivity of rights

- Level of innovation and stage of development (see The Technology Life Cycle)

- Sustainability of the technology

- Degree and competitive availability of other technologies

- Inherent risk

- Strategic need

- The portfolio of rights negotiated

- Fundability

- Deal-reward structure (negotiation strength)

To correctly gauge royalty rates, the following criteria must be taken into consideration:

-

- The transaction is at "arms-length"

- There is a willing buyer and a willing seller

- The transaction is not under compulsion

Rate determination and illustrative royalties

There are three general approaches to assess the applicable royalty rate in the licensing of intellectual property. They are[66]

- The Cost Approach

- The Comparable Market Approach

- The Income Approach

For a fair evaluation of the royalty rate, the relationship of the parties to the contract should:

- – be at "arms-length" (related parties such as the subsidiary and the parent company need to transact as though they were independent parties)

- – be viewed as acting free and without compulsion

Cost approach

The Cost Approach considers the several elements of cost that may have been entered to create the intellectual property and to seek a royalty rate that will recapture the expense of its development and obtain a return that is commensurate with its expected life. Costs considered could include R&D expenditures, pilot-plant and test-marketing costs, technology upgrading expenses, patent application expenditure and the like.

The method has limited utility since the technology is not priced competitively on "what the market can bear" principles or in the context of the price of similar technologies. More importantly, by lacking optimization (through additional expense), it may earn benefits below its potential.

However, the method may be appropriate when a technology is licensed out during its R&D phase as happens with venture capital investments or it is licensed out during one of the stages of clinical trials of a pharmaceutical.

In the former case, the venture capitalist obtains an equity position in the company (developing the technology) in exchange for financing a part of the development cost (recovering it, and obtaining an appropriate margin, when the company gets acquired or it goes public through the IPO route).