- Tepper School of Business

-

David A. Tepper School of Business

Established 1949 by William Larimer Mellon Type Private Business School Endowment $113 Million[1] Dean Robert Dammon Academic staff 107[2] Undergraduates 349[2] Postgraduates 851[2] Doctoral students 105[2] Location Pittsburgh, PA, United States Campus Urban Website Tepper School of Business The Tepper School of Business is a private business school located on Carnegie Mellon University’s 140-acre (0.57 km2) campus in Pittsburgh, Pennsylvania, USA.

The school consistently ranks highly among the top business schools in the U.S., as well as in a wide range of specializations, such as finance, entrepreneurship, operations management and information technology.[3][4] The school offers degrees from the undergraduate through doctoral levels, in addition to executive education programs.

Prior to the founding of the Tepper School, management education typically used the case method approach popularized at the Harvard Business School, based upon widely accepted examples from successful companies and microeconomic theory.[5] Although the Tepper School did not entirely abandon those traditional models and theories, it has focused on management science, or decision making based on quantitative models and an analytical approach to decision making and problem solving. Today, the Tepper School is known for its strong emphasis on quantitative skills and its continued teaching of courses based upon the science of management. A number of Nobel Prize winning economists have been affiliated with the school, including Herbert Simon, Franco Modigliani, Merton Miller, Robert Lucas, Edward Prescott, Finn Kydland, Oliver Williamson, and Dale Mortensen.

The Tepper School of Business was originally known as The Graduate School of Industrial Administration (GSIA), which was founded in 1949 by William Larimer Mellon. In March 2004, the school received a record $55 million gift from alumnus David Tepper.[6] In recognition of this gift, the school was named the David A. Tepper School of Business at Carnegie Mellon.

Contents

History

In 1946, economist George Bach was hired by the Carnegie Institute of Technology (predecessor of Carnegie Mellon University) to restart the school’s economics department. Bach had previously been working at the Federal Reserve during World War II. He added William W. Cooper from the field of Operations Research (which had increased its visibility during the war) and Herbert Simon, a political scientist who was to direct the undergraduate business program. The beginnings of the Cold War were applying pressure on the academic community to increase US managerial ability, and when William Larimer Mellon gave a $6 million grant to found a school of industrial administration, Bach became the first dean, bringing along the entire economics department.[7]

Under Bach’s leadership, the school was credited with several educational innovations that have now become standard at other prominent business schools. Specifically, in 1958, the school's Management Game was the first to use computer simulations for experiential learning of business roles; such simulations have subsequently been adopted by other institutions.[8] Additionally, in 1989, the school's Financial Analysis and Security Trading Center (FAST) was the first educational institution to successfully replicate the live international data feeds and sophisticated software of Wall Street trading firms.[9]

Several faculty members have won acclaim for research in the areas of business and economics. As an example, the school has produced seven Nobel Prize winners in Economics: Robert Lucas, Jr., Merton Miller, Franco Modigliani, Herb Simon, Oliver E. Williamson, Edward Prescott and Finn Kydland.[10] Lucas was awarded the prize for developing and applying the theory of rational expectations, an econometric hypothesis that directly challenged Keynesian orthodoxy.[11] Modigliani's prize recognized his life-cycle hypothesis, which attempts to explain the level of saving in the economy. Modigliani proposed that consumers would aim for a stable level of income throughout their lifetime, for example by saving during their working years and spending during their retirement.[12] Miller's prize was awarded in recognition of his contributions to corporate finance. The results of his research—in collaboration with Franco Modigliani—are now taught in every business school in the country.[10][13] Simon's prize was given for his development of the idea of bounded rationality in economics, described as "pioneering research into the decision-making process within economic organizations".[14] In 2004, Kydland and Prescott received the Nobel Prize for "their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles".[15]

It is also important to note that the school's impact has been so significant on Carnegie Mellon's campus that two other colleges: the School of Computer Science and the Heinz College were actually spin-offs by business school's faculty.

Programs

Undergraduate Business

Tepper offers a traditional four-year undergraduate degree in business administration. The program's coursework has a global focus and places an emphasis on quantitative decision making and analytical problem solving. The structure of the undergraduate program is distinctly different from the Master of Business Administration (MBA) program, emphasizing that students receive breadth of academic experience over focused professionally oriented courses.[16] Students major in business administration and choose one of the following tracks to specialize in:[17]

- Computing and Information Technology

- Finance

- General Management

- Graphic Media Management

- International Management

- Manufacturing Management and Consulting

- Marketing

- Entrepreneurship

For the academic year ending in May 2007, there were 475[18] total students enrolled in the undergraduate program.

Undergraduate Economics

The Undergraduate Economics Program is jointly administered by the Tepper School of Business and the Dietrich College of Humanities and Social Sciences. It has been designed to prepare students for careers as economic analysts in either the private or public sector, for advanced professional studies in business, law and public policy, as well as for entry into PhD programs in Economics, Finance, and related fields.[19]

MBA

The Tepper School's primary MBA degree is a two-year, full-time program, during which most students complete an internship in the summer between the first and second year of study. Students have the option of waiving the summer internship and taking classes, which allows full-time students to complete their studies in 16 months. Working professionals in the Pittsburgh area may also complete the MBA degree in the evening as members of the flex-time program.[20]

The mini-semester system is half the length of a traditional academic semester, creating four mini-semesters per academic year. Each mini-semester is 7.5 weeks long, and students typically take 5 different courses each mini-semester. This system, which was pioneered by the Tepper School, allows students to take more than 32 different courses while enrolled in the MBA program. The Tepper School prefers this structure as students can gain exposure to a greater breadth of topics, as well as several electives.[20]

The MBA curriculum is designed to increase in complexity and application throughout students' time at the Tepper School. The first year builds a fundamental skill set in the core disciplines, including Finance, Operations, Marketing, Strategy, Organizational Behavior and Technology. Year two advances the theories and analytical framework developed in the first year to provide breadth and depth in areas that support corporate strategy and general management as students complete three to four concentrations in specific functional areas. In lieu of selecting three to four general management concentrations, second year students may complete courses in satisfaction of specialized MBA Tracks.[21]

The Don Jones Center for Entrepreneurship at Tepper holds an annual Venture Competition every spring in three tracks: Technology, Life Sciences, and Sustainable Technology. Teams from many universities and countries compete for cash prizes and venture startup assistance. Entrepreneurship education was pioneered at the school in the 1970s, under the leadership of Dr. Jack Thorne.

The Management Game was first introduced by Carnegie Mellon in 1958 and has been adopted by many other leading business schools as an effective business simulation model. Tepper students work with an external board of directors to manage a multinational corporation, guiding the organization through a wide range of issues including global expansion, labor negotiations, operations, market share, shifting economies and financial performance.[22]

The Barco Law Building: Home of the University of Pittsburgh School of Law. The JD/MBA program is the only Tepper School joint degree taught partially outside of Carnegie Mellon.

The Barco Law Building: Home of the University of Pittsburgh School of Law. The JD/MBA program is the only Tepper School joint degree taught partially outside of Carnegie Mellon.

They also have a Capstone project, which is like a culmination of all the students work at Tepper. It is akin to a final year project where the students work with various firms on real world problems.

The General Management MBA Track, the Core MBA degree, serves as an umbrella academic option due to the flexibility associated with multiple concentrations. The General Management MBA Track complements the eight other Tepper MBA Tracks: Analytical Marketing Strategy, Biotechnology, Entrepreneurship in Organizations, Global Enterprise Management, Management of Innovation & Product Development, Technology Leadership, Operations Research, and Investment Strategy.[23]

Tepper also offers the following joint and dual MBA degrees:[24]

- Computational Finance

- Software Engineering

- Civil and Environmental Engineering

- Juris Doctor (Law) with the University of Pittsburgh

- Public Policy and Management with the Heinz College

- Healthcare Policy and Management with the Heinz College

For the academic year ending in May 2007, there were 302[25] total students enrolled in the full time MBA program.

MS Computational Finance

Carnegie Mellon's intensive, Master of Science in Computational Finance (MSCF) is considered by many to be the top quantitative finance program in the country.[26][27] The MSCF degree is primary granted through a sixteen month full-time program. The Tepper School also offers a thirty-three month part-time degree program and four non-degree certificate programs. Certificate students focus on one "stream" of the MSCF degree curriculum: Mathematics, Statistics or Financial Computing.[28]

The MSCF degree was created in 1994 to fill a perceived gap in the market between traditional MBA students and PhDs. At the time of its creation, MBAs were perceived to have too little math skills, while the PhDs traditionally hired as quantitative analysts were deemed to have too little experience in finance. The purpose of the MSCF curriculum was to give students the correct balance of math and finance to enable them to fill the gap created in the market between MBAs and PhDs.[29] The program is a collaboration between the Tepper School, the Heinz College, the Department of Statistics, and the Department of Mathematical Sciences.

The current curriculum consists of courses in finance, traditional finance theories of equity and bond portfolio management, the stochastic calculus models on which derivative trading is based, the application of these models in both fixed income markets and equity markets, computational methods including Monte Carlo simulation and finite difference approximations of partial differential equations, and statistical methodologies including regression and time series, culminating with courses on statistical arbitrage, risk management and dynamic asset management. Early in the program, students are taught C++, which enables them to build the computational financial models necessary for their finance courses. The program's capstone is a sophisticated financial computing course.[28]

Twenty full-time faculty instruct 40 full-time students in Pittsburgh and 51 full and part-time students in the financial district of New York City.[28] The primary method of instruction for the New York campus is live, interactive video. Lectures are recorded and made immediately available to students via the internet. Faculty teach twice every seven weeks in New York at which times the students are invited to join the professor for lunch after class.[28]

MS Quantitative Economics

In the fall of 2003, the Quantitative Economics (MSQE) program began enrolling students. This degree is currently offered only to Carnegie Mellon undergraduates. The MSQE is designed to differ from a traditional M.A. in Economics based upon the program's emphasis on rigorous analytical coursework. The Tepper School reports that the MSQE coursework is as advanced and as quantitative as any PhD. program in the United States.[30]

Doctoral Program

The doctoral degree is organized around a preliminary set of courses in the core disciplines of Economics, Organization Behavior and Theory, and Operations Research. The foundational knowledge and methodologies that students in the doctoral program learn form the basis for further study and research either in one of the core disciplines, or in one (or more) of the remaining functional areas of business: Accounting, Financial Economics, Information Systems, Marketing, or Manufacturing and Operating Systems.[31]

The school also offers PhD degrees jointly with other colleges in the University:

- Algorithms, Combinatorics, and Optimization (joint with Mathematics and Computer Science)

- Economics and Public Policy (joint with the Heinz College)

- Management of Manufacturing and Automation (joint with the Robotics Institute)

- Mathematical Finance (joint with Mathematics)

All doctoral candidates receive full tuition, plus a stipend for three years, through the William Larimer Mellon Fund.[32]

Executive Education[33]

In addition to customizable executive programs, the Tepper School offers three executive education events for the 2007 calendar year:

- The Operations Executive Series is three focused executive education programs that offer coverage of the people, process and technology management capabilities that drive effective operations.

- Global Leadership Executive Summer Forum, offered in conjunction with the Carnegie Bosch Institute, is a four week program addressing issues of strategy and leadership while also presenting topics of broad economic and international scope.

- Management in Technology Organizations teaches best practices in managing technology professionals, enhancing leadership skills and driving innovation.

Student life

Dodgeball at the University Center, which houses the majority of Carnegie Mellon’s indoor recreational facilities as well as space for assemblies, dining, and student organizations[34]

Dodgeball at the University Center, which houses the majority of Carnegie Mellon’s indoor recreational facilities as well as space for assemblies, dining, and student organizations[34]

The Tepper School places a strong emphasis on developing a sense of community and encourages students to get to know one another. There are dozens of student clubs organized around various aspects of business: functional, cultural and social. These clubs organize speakers, trips to various corporations and plants, as well as internal and external case competitions. Students participate in numerous case competitions and design case studies of their own. On the undergraduate level, there are various clubs and organizations that support the needs and interests of business administration students, including but not limited to the Undergraduate Marketing Organization (UMO), Financial Frontline Society (FFS), the Undergraduate Finance Association (UFA), Students in Free Enterprise (SIFE), the Carnegie Mellon Business Association (CMBA), the Undergraduate Consulting Club (UCC), and the Undergraduate Entrepreneurship Association (UEA). Students have also created and supported clubs that help with specific networking areas such as the Tepper Women in Business, the Black Business Association, the Asian Business Association and the Latin American Business Club.

The Tepper School has its own, irreverent, weekly student newspaper – Robber Barrons. Additionally, students gather every Friday at Posner Hall to socialize and discuss their experiences with classmates, significant others, faculty, administrators and occasionally alumni. School-related functions include the annual social, holiday parties, Pirate games and whitewater rafting. Others events are more functional, like business etiquette and leadership workshops.

Tepper School students have access to a variety of athletic facilities, including tennis courts near the school’s main entrance, the university gymnasium across the street from the business school and the University Center. Students organize intramural softball and volleyball teams and compete in basketball and golf tournaments with other business schools. In particular, MBA students are active participants in Duke's MBA games.[35]

Career development

The Tepper School facilitates their students' employment through the Career Opportunities Center (COC). The COC provides assistance during the employment search through workshops, employment "treks", career fairs, and corporate presentations. They also provide individualized training for resume presentation and interviewing skills."[36]

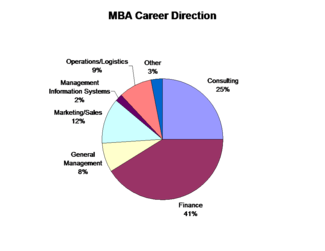

Top Hiring Employers (MBA)[37]

- Bank of America

- Booz & Company

- A.T. Kearney

- Deloitte Consulting

- Amazon.com

- Deutsche Bank

- McKinsey & Company

- Morgan Stanley

- Citigroup

- IBM Consulting

- PNC Financial Services

- Diamond Management & Technology Consultants

- Alcoa

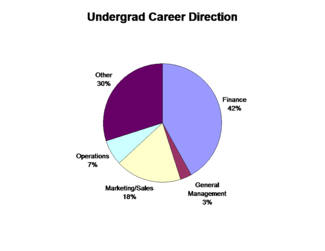

Top Hiring Employers (Undergraduate)[38] International study

Carnegie Bosch Institute

The Carnegie Bosch Institute for Applied Studies in International Management (CBI) is an alliance between the Tepper School of Business at Carnegie Mellon and the Bosch Group, a leading German-based multinational corporation with long-standing operations in North America. The institute was founded in the summer of 1990 to form a link between management and academia in the field of international management research.[39] The CBI was established through a donation made by the Robert Bosch Corporation.[40]

Global Study Abroad[41]

The International Management MBA Track features an eight-week global experience in which students travel to Western and Eastern Europe to study emerging, transitional and competitive economies. During study abroad, students experience real-world aspects of classroom work through manufacturing tours, presentations at financial institutions, meetings with government and non-governmental organizations as well as the experience of living in an international setting. This program operates in partnership with the WHU-Otto Beisheim School of Management.

Undergraduate business students are also encouraged to explore opportunities to learn about different cultures in which to live and work. Each year students travel abroad as part of a capstone educational experience.

Research centers

From its outset, academic research has been one of the primary focuses of the Tepper School.[7][42] When speaking of the school's founders, one author stated "Research was their fundamental engine of progress".[43] The Tepper School has established 16 different research centers to continue the emphasis on research established at the school's founding.

- Carnegie Bosch Institute for Applied Studies in International Management

- The Carnegie Mellon Electricity Industry Center

- Center for Analytical Research in Technology

- Center for Behavioral Decision Research

- Center for Business Communication

- Center for Business Solutions

- Center for E-Business Innovation

- Center for Financial Markets

- Center for Interdisciplinary Research on Teams

- Center for International Corporate Responsibility

- Center for the Management of Technology

- Center for Organizational Learning, Innovation and Performance

- Donald H. Jones Center for Entrepreneurship

- The Gailliot Center for Public Policy

- Green Design Institute

- Teaching Innovation Center

Alexander Henderson Award

The Alexander Henderson Award is presented to the student at the Tepper School of Business at Carnegie Mellon University who displays the best work in the field of economic theory. A large proportion of the winners of the award has later made contributions to economics that have changed the practice of the field. Since its inception, four recipients have already been awarded the Nobel Memorial Prize in Economics. Among the deceased award winners are John Muth, known as "the father of the rational expectations revolution"; Albert Ando, among the very pioneers of overlapping-generations models; and Jan Mossin who derived the Capital Asset Pricing Model.

Rankings

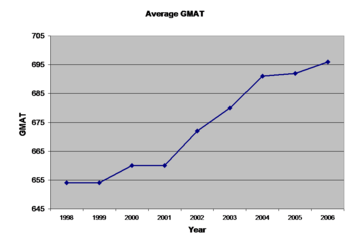

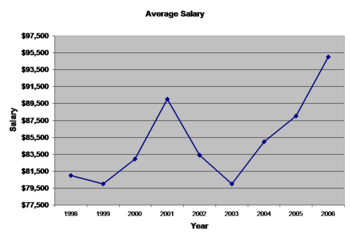

The ranking of MBA programs[44] has been discussed in articles and on academic Web sites.[45] One study found that objectively ranking MBA programs by a combination of graduates' starting salaries and average student Graduate Management Admissions Test (GMAT) score can reasonably duplicate the top 20 list of the national publications.[46] The study concluded that a truly objective ranking would be individualized to the needs of each prospective student.[47]

Below are the most recent Tepper School rankings for undergraduate and MBA programs. As MBA rankings are driven largely from average GMAT scores and starting salaries, these statistics are provided for the past 9 years.

Wall Street Journal Rankings - 2007

- #5 Business School (MBA) National[48]

- #2 Top School - Operations Management

- #2 Top School - Information Technology

- #4 Top School - Finance

- #6 Top School - Entrepreneurship

- #6 Top School - Strategy

- #9 Top School - General Management

- #8 Top School - For Recruiting Minorities

- #9 Top School - For Recruiting MBAs With High Ethical Standards

- #5 Management Consulting Industry Ranking

- #6 Health Care Products and Services Industry Ranking

- #7 Energy and Industrial Products and Services Industry Ranking

- #8 Technology/Telecommunications/Internet Industry Ranking

Business Week Graduate Rankings – 2010

- #7 MBA - Part-Time MBA

- #15 MBA - Overall National Ranking

Business Week Undergraduate Rankings – 2011

- #3 Starting Salaries

- #4 Academic Quality

- #9 MBA Feeder School

- #21 Undergraduate Business Program

U.S. News & World Report - 2012 (Graduate)

- #2 Top School - Information Systems

- #2 Top School - Production/Operations Management

- #3 Top School - Supply Chain/Logistics

- #7 Top School - Part-Time MBA

- #13 Top School - Finance

- #18 Graduate Business School (MBA)

- #19 Economics (PhD)

U.S. News & World Report - 2011 (Undergraduate)

- #2 Management Information Systems

- #2 Quantitative Analysis

- #2 Production/Operations Management

- #5 Supply Chain Management/Logistics

- #5 Supply Chain Management/Logistics

- #7 Undergraduate Business School

- #9 Finance

- #18 Entrepreneurship

- #24 Management

Forbes – 2005

- #8 Part-time MBA

- #16 Business School (Full-Time MBA)

Financial Times – 2010

- #10 International Doctoral Program

- #19 Business School in the U.S. (MBA)

- #32 Research (MBA)

- #43 International Business School(MBA)

See also

- List of United States business school rankings

- List of business schools in the United States

- List of Carnegie Mellon University people

- Business School

Notes

- ^ a b c "School Profile". Business Week. http://www.businessweek.com/@@Spvix4YQbvcKZiAA/bschools/06/full_time_profiles/carnegiemellon1.htm. Retrieved 3 March 2007.

- ^ a b c d "Carnegie Mellon Quick Facts" (PDF). CMU Website. http://www.cmu.edu/ira/QuickFacts/index.html. Retrieved 24 July 2011.

- ^ "America's Best Graduate Schools 2007". U.S. News and World Report. http://www.usnews.com/usnews/edu/grad/rankings/mba/brief/mbarank_brief.php. Retrieved 2007-03-03.

- ^ "2005 National Rankings". Wall Street Journal Online. http://www.careerjournal.com/reports/bschool/20050921-table-national.html. Retrieved 2007-03-03.

- ^ "Our Approach". School's Website. Archived from the original on 2007-02-05. http://web.archive.org/web/20070205215027/http://business.tepper.cmu.edu/tepper/press_our.aspx. Retrieved 2007-03-03.

- ^ "Announcing a Transformational Gift". School’s Website. Archived from the original on 2007-02-05. http://web.archive.org/web/20070205214631/http://business.tepper.cmu.edu/tepper/index.aspx. Retrieved 2007-04-05.

- ^ a b Mintzburg, Henry. "Managers Not MBAs: A hard look at the soft practice of managing and management development", Berrett-Koehler Publishers, Inc., San Francisco, California, 2004.

- ^ "School Timeline". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=142904. Retrieved 2007-04-05.

- ^ "The "FAST" Center". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=142130. Retrieved 2007-04-05.

- ^ a b "Tepper History". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141107. Retrieved 2007-03-03.

- ^ "Robert Lucas Biography". The History of Economic Through Website. http://cepa.newschool.edu/het/home.htm. Retrieved 2007-04-05.

- ^ "Franco Modigliani- Autobiography". Nobelprize.org. http://nobelprize.org/nobel_prizes/economics/laureates/1985/modigliani-autobio.html. Retrieved 2007-04-11.

- ^ "Merton Miller- Autobiography". Nobelprize.org. http://nobelprize.org/nobel_prizes/economics/laureates/1990/miller-autobio.html. Retrieved 11 April 2007.

- ^ "Economics 1978". Nobelprize.org. http://nobelprize.org/nobel_prizes/economics/laureates/1978/. Retrieved 2007-04-05.

- ^ "Economics 2004". Nobelprize.org. http://nobelprize.org/nobel_prizes/economics/laureates/2004/index.html. Retrieved 2007-04-05.

- ^ "CMU's Strategy for Well-Rounded B-Schoolers". Business Week Online. http://www.businessweek.com/bschools/content/oct2006/bs20061023_800545.htm. Retrieved 2007-03-07.

- ^ "Business Administration Tracks". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=141946. Retrieved 2007-03-07.

- ^ "Undergraduate Overview". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=140995. Retrieved 2007-03-03.

- ^ "Undergraduate Economics". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142801. Retrieved 2007-03-03.

- ^ a b "MBA Program Structure". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=141559. Retrieved 2007-04-05.

- ^ "MBA Curriculum". Tepper School of Business website. http://www.tepper.cmu.edu/mba/mba-programs-coursework/mba-tracks/index.aspx. Retrieved 2009-09-01.

- ^ "Consulting Career Track" (PDF). Tepper School of Business website. http://business.tepper.cmu.edu/files/consulting_strategy.pdf. Retrieved 2007-04-03.

- ^ "MBA Tracks". Tepper School of Business website. http://www.tepper.cmu.edu/mba/mba-programs-coursework/mba-tracks/index.aspx. Retrieved 2009-09-01.

- ^ "MBA Duel Degrees". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142035. Retrieved 2007-03-03.

- ^ "Class Profiles". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141605. Retrieved 2007-04-06.

- ^ "Carnegie Mellon's Computational Finance Program". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142109. Retrieved 2007-04-05.

- ^ "Wall Street Seeks Grads in Financial Engineering". WSJ.com. http://www.collegejournal.com/mbacenter/mbatrack/20061115-alsop.html. Retrieved 2007-04-05.

- ^ a b c d "Degrees and Certificates". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142905. Retrieved 5 April 2007.

- ^ "What Sets MSCF Apart". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142409. Retrieved 2007-04-05.

- ^ "MSQE Program Comparisons". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141041. Retrieved 2007-04-04.

- ^ "PhD Fields of Study". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141158. Retrieved 2007-03-03.

- ^ "Financial Aid and Grant Information". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141051. Retrieved 2007-04-06.

- ^ "Tepper Executive Education". Tepper School of Business website. http://business.tepper.cmu.edu/default.aspx?id=141339. Retrieved 2007-03-03.

- ^ "University Center". Carnegie Mellon Website. http://www.cmu.edu/athletic/facilities/facilities_uc.htm. Retrieved 2007-04-07.

- ^ Student Life Summary; 2007 Prospective Student Hardcopy Brochure

- ^ "Events and Services for Students". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142906. Retrieved 2007-04-04.

- ^ a b c "School Profile". Business Week Online. http://www.businessweek.com/@@PIZs1ocQPgoKZiAA/bschools/06/full_time_profiles/carnegiemellon3.htm. Retrieved 2007-04-04.[dead link]

- ^ a b c "School Profile". Business Week Online. http://www.businessweek.com/bschools/07/undergrad/profiles/carnegiemellon3.htm. Retrieved 2007-03-03.

- ^ "Carnegie Bosch Institute". CBI Website. http://cbi.tepper.cmu.edu/about.htm. Retrieved 2007-04-06.

- ^ "Carnegie Bosch Institute". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142741. Retrieved 2007-04-06.

- ^ "Global Programs". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=142745. Retrieved 2007-03-03.

- ^ "Research Centers". School’s Website,. http://business.tepper.cmu.edu/default.aspx?id=141105. Retrieved 2007-02-26.

- ^ Robert E. Gleeson and Steven Schlossman, "George Leland Bach and the Rebirth of Graduate Management Education in the United States, 1945-1975." Selections: The Magazine of the Graduate Management Admission Council, 11, No. 3 (Spring 1995), 14.

- ^ "RANKINGS". School’s Website. http://business.tepper.cmu.edu/default.aspx?id=141012. Retrieved 2006-04-14.

- ^ "Caution and Controversy". University of Illinois at Urbana-Champaign. http://www.library.uiuc.edu/edx/rankoversy.htm. Retrieved 2005-09-06.

- ^ Schatz, Martin; Crummer, Roy E. (1993). "What's Wrong with MBA Ranking Surveys?". Management Research News 16 (7): 15–18. doi:10.1108/eb028322. http://mba.us.com/guide/rnkartcl.html.

- ^ "Official MBA Guide". http://mba.us.com/guide/. Retrieved 2007-04-11.

- ^ http://www.tepper.cmu.edu/news-multimedia/tepper-stories/2007-wall-street-journal-rankings/index.aspx

External links

Coordinates: 40°26′29″N 79°56′31″W / 40.4415°N 79.942°W

Carnegie Mellon University Academics Carnegie Institute of Technology (engineering) • College of Fine Arts • H. John Heinz III College • Dietrich College of Humanities and Social Sciences • Mellon College of Science • School of Computer Science • Tepper School of Business • Margaret Morrison Carnegie College (defunct)

Branch Campuses Student life Traditions • Greek Life • Kiltie Band • Scotch'n'Soda • Miller Gallery • The Tartan • WRCT • University Athletic AssociationResearch Pittsburgh Supercomputing Center • Software Engineering Institute • Robotics Institute • Human Computer Interaction Institute • Language Technologies Institute • Pittsburgh Life Sciences Greenhouse • Carnegie SchoolPeople Projects and legacies Brandeis (IBS) · Carnegie Mellon (Tepper) · Case Western (Weatherhead) · Chicago (Booth) · Emory (Goizueta) · NYU (Stern) · Rochester (Simon) · Washington (Olin)Categories:- Business schools in Pennsylvania

- Schools and departments of Carnegie Mellon

- Mellon family

- Educational institutions established in 1949

Wikimedia Foundation. 2010.