- Chase (bank)

-

For the building, see Chase Tower (Chicago)

Chase  The 2005–present logo

The 2005–present logoType Subsidiary Industry Banking Founded 1799[1] Headquarters Chase Tower, Chicago Loop,

Chicago, Illinois, United StatesKey people Todd Maclin

(CEO of Commercial, Personal and Business Banking)Products Financial services Revenue $58.716 billion (2009) Net income $857 million (2009) Employees 143,216 (2010) Parent JPMorgan Chase Divisions Retail Financial Services, Card Services, Commercial Banking Website Chase.com JPMorgan Chase Bank, N.A., doing business as Chase, is a national bank that constitutes the consumer and commercial banking subsidiary of financial services firm JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000.[1] Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Bank of the Manhattan Company in 1955.[2] The bank is headquartered in Chicago, since its merger with Bank One Corporation in 2004.[3] In 2008, the bank acquired the deposits and most assets of Washington Mutual.

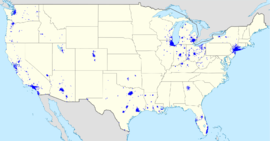

Chase offers more than 5,100 branches and 16,100 ATMs nationwide.

JP Morgan Chase, through its Chase subsidiary, is one of the Big Four banks of the United States.[4][5]

Contents

History

Aaron Burr, 3rd Vice President of the United States and founder of The Manhattan Company.John D. Rockefeller, Jr. and the Rockefeller family were the largest shareholders of Chase National Bank.

Aaron Burr, 3rd Vice President of the United States and founder of The Manhattan Company.John D. Rockefeller, Jr. and the Rockefeller family were the largest shareholders of Chase National Bank.The Manhattan Company

Main article: Bank of the Manhattan CompanyChase traces its history back to the founding of The Manhattan Company by Aaron Burr on September 1, 1799, in a house at 40 Wall Street:[1]

After an epidemic of yellow fever in 1798, during which coffins had been sold by itinerant vendors on street corners, Aaron Burr established the Manhattan Company, with the ostensible aim of bringing clean water to the city from the Bronx River but in fact designed as a front for the creation of New York's second bank, rivaling Alexander Hamilton's Bank of New York.In addition to being fierce political and personal rivals, Aaron Burr and Alexander Hamilton competed in business, with Burr's Bank of the Manhattan Company competing against Hamilton's Bank of New York. In 1804, their rivalry erupted into a duel, leading to the death of Alexander Hamilton. The dueling pistols are owned by the successor company of Chase Manhattan. They are currently on display in the lobby of the first floor of the JP Morgan Chase building at 383 Madison Ave in New York City.

Over two centuries after their duel, it can be said that the Bank of the Manhattan Company ultimately won the "business" side of the rivalry. In 2006, the modern-day Chase bought the retail banking division of the Bank of New York, who then only months later merged with Pittsburgh-based Mellon Financial to form the present-day BNY Mellon.

Chase National Bank

Chase National Bank was formed in 1877 by John Thompson.[1] It was named after former United States Treasury Secretary and Chief Justice Salmon P. Chase,[2] although Chase did not have a connection with the bank.[1]

The Chase National Bank acquired a number of smaller banks in the 1920s, through its Chase Securities Corporation. In 1926, for instance, it acquired Mechanics and Metals National Bank.

Its most significant acquisition though was the Equitable Trust Company of New York in 1930, the largest stockholder of which was John D. Rockefeller, Jr.[7] This made it the largest bank in America and indeed, the world.

Chase was primarily a wholesale bank, dealing with other prominent financial institutions and major corporate clients, such as General Electric, which had, through its RCA affiliate, leased prominent space and become a crucial first tenant of Rockefeller Center, rescuing that major project in 1930. The bank is also closely associated with and has financed the oil industry, having longstanding connections with its board of directors to the successor companies of Standard Oil, especially ExxonMobil, which are also Rockefeller holdings.

Merger as Chase Manhattan Bank

In 1955, Chase National Bank and The Manhattan Company merged to create Chase Manhattan Bank.[1] As Chase was a much larger bank, it was first intended that Chase acquire the "Bank of Manhattan", as it was nicknamed, but it transpired that Burr's original charter for the Manhattan Company had not only included the clause allowing it to start a bank with surplus funds, but another requiring unanimous consent of shareholders for the bank to be taken-over. The deal was therefore structured as an acquisition by the Bank of the Manhattan Company of Chase National, with John J. McCloy becoming chairman of the merged entity. This avoided the need for unanimous consent by shareholders.

For Chase Manhattan Bank's new logo, Chermayeff & Geismar designed a stylized octagon in 1961, which remains part of the bank's logo today.[8] The Chase logo is a stylized representation of the primitive water pipes laid by the Manhattan Company, which were made by nailing together wooden planks.[9]

Under McCloy's successor, George Champion, the bank relinquished its antiquated 1799 state charter for a modern one. In 1969, under the leadership of David Rockefeller, the bank became part of a bank holding company, the Chase Manhattan Corporation.[2]

Merger with Chemical, J.P. Morgan

In July 1996, Chemical Bank of New York purchased Chase Manhattan Bank. Chemical's previous acquisitions included Manufacturers Hanover Corporation, in 1991, and Texas Commerce Bank, in 1987. Although Chemical was the nominal survivor, the merged company retained the Chase name since it was better known (particularly outside the United States).

In December 2000, the combined Chase Manhattan completed the acquisition of J.P. Morgan & Co., one of the largest banking mergers to date. The combined company was renamed JPMorgan Chase & Co. In 2004, the bank acquired Bank One, making Chase the largest credit card issuer in the US. JPMorgan Chase added Bear Stearns & Co. and Washington Mutual to its acquisitions in 2009. After closing nearly 400 overlapping branches of the combined company, less than 10% of the total, Chase will have approximately 5,410 branches in 23 states as of the closing date of the acquisition.[10][11] According to data from SNL Financial (data as of June 30, 2008), this places Chase third behind Wells Fargo and Bank of America in terms of total U.S. retail bank branches. In October 2010, Chase was named in two lawsuits alleging manipulation of the silver market.[12] The suits allege that by managing giant positions in silver futures and options, the banks influenced the prices of silver on the New York Stock Exchange's Comex Exchange since early 2008.

Chase branch located in Athens, Ohio

The following is an illustration of the company's major mergers and acquisitions and historical predecessors to 1995 (this is not a comprehensive list):

Chase Manhattan Bank

(merged 1995)Chemical Bank

(merged 1991)Chemical Bank

(merged 1986)The Chemical Bank

of New York

(est. 1823)Texas Commerce Bank

(est. 1866)Manufacturers Hanover

(merged 1961)Manufacturers

Trust Company

(est. 1905)Hanover Bank

(est. 1873)Chase Manhattan Bank

(merged 1955)Bank of the

Manhattan Company

(est. 1799)Chase National Bank

of the City of New York

(est. 1877)Bank One Corporation

Main article: Bank One CorporationIn 2004, JPMorgan Chase merged with Chicago-based Bank One Corp., bringing on board its current chairman and CEO Jamie Dimon as president and COO and designating him as CEO William B. Harrison, Jr.'s successor. Dimon's pay was pegged at 90% of Harrison's. Dimon quickly made his influence felt by embarking on a cost-cutting strategy and replaced former JPMorgan Chase executives in key positions with Bank One executives—many of whom were with Dimon at Citigroup. Dimon became CEO in January 2006 and Chairman in December 2006 after Harrison's resignation.

Bank One Corporation was formed upon the 1998 merger between Banc One of Columbus, Ohio and First Chicago NBD. These two large banking companies were themselves created through the merger of many banks. JPMorgan Chase completed the acquisition of Bank One in Q3 2004. The merger between Bank One and JPMorgan Chase meant that corporate headquarters were now in New York City while the retail bank operations of Chase were consolidated in Chicago.[13]

The following is an illustration of the Bank One's major mergers and acquisitions and historical predecessors (this is not a comprehensive list):

Bank One

(merged 1998)Banc One Corp

(merged 1968)City National Bank

& Trust Company (Columbus, Ohio)Farmers Saving

& Trust CompanyFirst Chicago NBD

(merged 1995)First Chicago Corp

(est. 1863)NBD Bancorp

(Formerly National Bank of Detroit)

(est. 1933)Louisiana’s First

Commerce Corp.Washington Mutual

Main article: Washington MutualOn September 25, 2008, JPMorgan Chase bought most banking operations of Washington Mutual from the receivership of the Federal Deposit Insurance Corporation (FDIC). That night, the Office of Thrift Supervision, in what was by far the largest bank failure in American history, seized Washington Mutual Bank and placed it into receivership. The FDIC sold the bank's assets, secured debt obligations and deposits to JPMorgan Chase & Co. for $1.836 billion, which re-opened the bank the following day. As a result of the takeover, Washington Mutual shareholders lost all their equity.[14] Through the acquisition, JPMorgan became owner the former accounts of Providian Financial, a credit card issuer WaMu acquired in 2005. The company completed rebranding of Washington Mutual branches to Chase in late 2009.

Other recent acquisitions

In the first-quarter of 2006, CHASE purchased Collegiate Funding Services, a portfolio company of private equity firm Lightyear Capital, for $663 million. CFS was used as the foundation for the Chase Student Loans, previously known as Chase Education Finance.[15]

In April of that same year, CHASE swapped its corporate trust unit for The Bank of New York Co.'s retail and small business banking network. The swap valued The Bank of New York business at $3.1 billion and JPMorgan's trust unit at $2.8 billion and gave Chase access to 338 additional branches and 700,000 new customers in New York, New Jersey, and Indiana.

See also

References

- ^ a b c d e f The History of JPMorgan Chase & Co.. JPMorgan Chase & Co.. 2008. http://www.jpmorganchase.com/corporate/About-JPMC/document/shorthistory.pdf. Retrieved 2011-10-14.

- ^ a b c "J.P. Morgan Chase & Co.". International Directory of Company Histories. St. James Press. 2001. http://www.fundinguniverse.com/company-histories/JP-Morgan-Chase-amp;-Co-Company-History.html. Retrieved 2007-11-04.

- ^ "History of Our Firm". JPMorgan Chase & Co.. http://www.jpmorganchase.com/corporate/About-JPMC/jpmorgan-history.htm. Retrieved 2011-10-14.

- ^ Tully, Shawn (February 27, 2009). "Will the banks survive?". Fortune Magazine/CNN Money. http://money.cnn.com/2009/02/27/news/economy/tully_banks.fortune/index.htm?source=yahoo_quote. Retrieved 17 December 2009.

- ^ "Citigroup posts 4th straight loss; Merrill loss widens". USA Today. Associated Press. 16 October 2008. http://www.usatoday.com/money/companies/earnings/2008-10-16-citigroup_N.htm. Retrieved 2009-12-17.

- ^ Gerard T. Koppell (16 March 2000). "Soaking the poor". The Economist (economist.com). http://www.economist.com/node/330993. Retrieved 2011-10-14.

- ^ David Rockefeller (15 October 2002). David Rockefeller: Memoirs. New York: Random House. p. 124–25. ISBN 978-0679405887.

- ^ "Chase Manhattan Bank". Chermayeff & Geismar. http://cgstudionyc.com/identities/chase. Retrieved 2011-10-14.

- ^ Gillian Tett (12 May 2009). Fool's Gold: How the Bold Dream of a Small Tribe at J.P. Morgan Was Corrupted by Wall Street Greed and Unleashed a Catastrophe. New York: Free Press. p. 82. ISBN 978-1416598572.

- ^ Jef Feeley and Steven Church (27 September 2008). "WaMu lists debt of $8B in bankruptcy". Bloomberg News (Bloomberg.com). http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a_WW5ZH_P_A0&refer=home. Retrieved 2011-10-14.

- ^ "Q&A What former WaMu customers can expect". Seattle Post-Intelligencer (Houston Chronicle.com). 26 September 2008. http://www.chron.com/disp/story.mpl/headline/biz/6026107.html. Retrieved 2011-10-14.

- ^ David Benoit (27 October 2010). "J.P. Morgan, HSBC sued for silver manipulation". MarketWatch. http://www.marketwatch.com/story/jp-morgan-hsbc-sued-for-silver-manipulation-2010-10-27. Retrieved 2011-10-14.

- ^ "JPMorgan Chase, Bank One complete merger" (Press release). JPMorgan Chase. 1 July 2004. http://investor.shareholder.com/jpmorganchase/releasedetail.cfm?releaseid=144508. Retrieved 2011-10-14.

- ^ David Ellis and Jeanne Sahadi (25 September 2008). "JPMorgan buys WaMu". CNNMoney.com. http://money.cnn.com/2008/09/25/news/companies/JPM_WaMu/index.htm?postversion=2008092519. Retrieved 2011-10-14.

- ^ "Chase to Acquire Collegiate Funding Services". Business Wire. 15 December 2005. http://findarticles.com/p/articles/mi_m0EIN/is_2005_Dec_15/ai_n15949015. Retrieved 2011-10-14.

Further reading

- Bird, Kai (1992). The Chairman: John J. McCloy, the Making of the American Establishment. New York: Simon & Schuster. ISBN 9780671454159. OCLC 25026508.

- Koeppel, Gerard T. (2000). Water for Gotham: A History. Princeton, NJ: Princeton Univ. Press. ISBN 9780691011394. OCLC 247735191. http://books.google.com/books?id=xPylbJLgq1UC&printsec=frontcover&cad=0#v=onepage&q=&f=false.

- Rockefeller, David (2002). Memoirs. New York: Random House. ISBN 9780679405887. OCLC 231967677.

- Wilson, John Donald (1986). The Chase: The Chase Manhattan Bank, N.A., 1945–1985. Boston, Mass: Harvard Business School Press. ISBN 9780875841342. OCLC 13581810.

External links

- Official website

- Chase mobile banking

- An Evolutionary View of Internationalization: Chase Manhattan Bank, 1917 to 1996. A Financial Institutions Center study (PDF) completed in 2002.

Categories:- Banks based in Illinois

- Banks based in New York City

- Banks established in 1799

- Companies based in Chicago, Illinois

- House of Morgan

- JPMorgan Chase

- Online brokerages

- Rockefeller family

- 1799 establishments in the United States

Wikimedia Foundation. 2010.