- Oil megaprojects

-

Oil megaprojects are large oil field projects.

Contents

Summary of megaprojects

Megaprojects predicted for individual years

Overview 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 New supply addition per country from oil megaprojects

Volumes shown are in thousand barrels per day. The summary table below is produced by a Perl script parsing each annual table. This script is not run every day so some discrepancies may appear (last update: 18-JAN-2010).

Country 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total 3172 2747 3776 3845 2950 4468 4957 4950 3214 2475 2495 2220 2530 1385 462 130 OPEC Total OPEC 917 1570 1175 1795 905 2000 2670 3260 1419 1475 920 1110 1425 300 300 Algeria 70 80 50 50 70 170 40 Angola 90 250 325 425 455 200 170 235 325 235 140 115 Ecuador 52 30 Iran 95 85 190 150 200 570 115 95 120 110 35 540 545 Iraq 150 110 1940 115 150 350 Kuwait 65 300 60 60 50 50 50 190 Libya 115 150 10 50 30 Nigeria 195 225 390 350 215 105 384 350 230 140 Qatar 70 45 130 180 445 230 170 130 Saudi Arabia 300 690 300 610 1430 670 30 365 300 300 UAE 90 290 135 170 75 60 120 200 Venezuela 180 70 200 200 Non-OPEC Total Non-OPEC 2255 1177 2601 2050 2045 2468 2287 1690 1795 1000 1575 1110 1105 1085 162 130 Australia 40 200 85 100 105 80 20 65 55 30 100 Azerbaijan 325 750 260 100 200 Brazil 70 250 300 340 640 220 465 250 380 100 530 100 300 Cameroon 20 Canada 255 90 45 260 100 225 125 140 60 210 210 235 162 130 Chad 225 60 China 62 100 200 295 20 200 Denmark 20 East Timor 20 25 Egypt 40 Eq. Guinea 110 60 Equatorial Guinea 50 Gabon 20 10 20 Ghana 120 20 India 40 175 25 Indonesia 40 200 20 50 34 25 125 50 Italy 50 Côte d'Ivoire 65 Kazakhstan 150 250 285 160 560 120 850 Malaysia 105 120 45 100 40 Mauritania 75 Mexico 730 310 50 70 200 New Zealand 40 25 Norway 389 176 45 120 135 70 215 130 105 Oman 40 155 Papua New Guinea 40 Peru 50 Philippines 15 15 Republic of Congo 60 Republic of the Congo 90 Russia 380 250 80 155 570 250 585 150 60 120 15 South Africa 30 80 Sudan 250 285 50 Syria 30 Thailand 40 10 12 Trinidad 60 UK 40 30 60 305 25 40 20 25 75 USA 279 282 210 95 255 329 285 230 135 50 260 200 Vietnam 70 65 110 30 20 25 Yemen 25 30 30 Application to oil supply forecasting

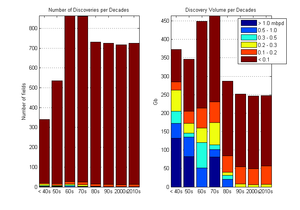

Number of oil fields discovered per decades grouped by average flow rates (left) and corresponding oil volumes (right) in giga-barrels (Gb). Data taken from the annexe B of "Twilight in the Desert" by Matthew Simmons.[1]

Number of oil fields discovered per decades grouped by average flow rates (left) and corresponding oil volumes (right) in giga-barrels (Gb). Data taken from the annexe B of "Twilight in the Desert" by Matthew Simmons.[1]

A series of project tabulations and analyses by Chris Skrebowski, editor of Petroleum Review, have presented a more pessimistic picture of future oil supply. In a 2004 report,[2] based on an analysis of new projects over 100,000 barrels per day (16,000 m3/d), he argued that although ample supply might be available in the near-term, after 2007 "the volumes of new production for this period are well below likely requirements." By 2006,[3] although "the outlook for future supply appears somewhat brighter than even six months ago", nonetheless, if "all the factors reducing new capacity come into play, markets will remain tight and prices high. Only if new capacity flows into the system rather more rapidly than of late, will there be any chance of rebuilding spare capacity and softening prices."

The smallest fields, even in aggregate, do not contribute a large fraction of the total. For example, a relatively small number of giant and super-giant oilfields are providing almost half of the world production.[1]

Decline rates

Main article: Oil depletionThe most important variable is the average decline rate for Fields in Production (FIP) which is difficult to assess.[4][5][6]

Further reading

- "Oil and Gas Projects Database". Gulfoilandgas.com. viewed July 2, 2010. http://www.gulfoilandgas.com/webpro1/Projects/main.asp.

- "Major Oil & Gas Fields". Triple Diamond Energy Corporation. December 2007. http://www.majoroilfields.com/worldfields.asp.

- "Industry Projects". Offshore Technology. viewed December 5, 2007. http://www.offshore-technology.com/projects/.

See also

- Energy law

- List of largest oil fields

- Giant oil and gas fields

- List of Russian megaprojects

References

- ^ a b Simmons, Matthew (2005). Twilight in the desert : the coming Saudi oil shock and the world economy. Wiley. ISBN 978-0-471-73876-3.

- ^ "Oil field mega projects". 2004. http://www.odac-info.org/bulletin/documents/MEGAPROJECTSREPORT.pdf.

- ^ "Prices holding steady, despite massive planned capacity additions". http://sydneypeakoil.com/downloads/PR_APR06_Megaprojects.pdf.

- ^ Lawrence Eagles (2006). "Medium Term Oil Market Report". OECD/International Transport Forum Roundtable. http://www.internationaltransportforum.org/jtrc/RoundTables/RTOilNov07Eagles.pdf.

- ^ John Gerdes (2007). "Modest Non-OPEC Supply Growth Underpins $60+ Oil Price". SunTrust Robinson Humphrey. http://gerdes-group.com/energy-insight/Non-OPECSupply20070206.pdf.

- ^ Peter M. Jackson (2007). "Finding the Critical Numbers: What Are the Real Decline Rates for Global Oil Production?". CERA. http://www.cera.com/aspx/cda/client/report/reportpreview.aspx?CID=8958&KID=165.

Categories:- Oil megaprojects

- Oil fields

Wikimedia Foundation. 2010.