- Tithe

-

A tithe (

/ˈtaɪð/; from Old English: teogoþa "tenth") is a one-tenth part of something, paid as a (usually) voluntary contribution or as a levy or tax-like payment (technically not a tax as it is not paid to a level of government), usually to support a religious organization. Today, tithes (or tithing) are normally voluntary and paid in cash, cheques, or stocks, whereas historically tithes were required and paid in kind, such as agricultural products (that grown of the land, or fruit of the tree). Several European countries operate a formal process linked to the tax system allowing some churches to assess tithes.

/ˈtaɪð/; from Old English: teogoþa "tenth") is a one-tenth part of something, paid as a (usually) voluntary contribution or as a levy or tax-like payment (technically not a tax as it is not paid to a level of government), usually to support a religious organization. Today, tithes (or tithing) are normally voluntary and paid in cash, cheques, or stocks, whereas historically tithes were required and paid in kind, such as agricultural products (that grown of the land, or fruit of the tree). Several European countries operate a formal process linked to the tax system allowing some churches to assess tithes."Tithing" also has unrelated economic and juridical senses, dating back to the Early Middle Ages. See "Tithing (country subdivision)".

Traditional Jewish law and practice has included various forms of tithing since ancient times. Traditional Jews commonly practice ma'aser kesafim (tithing 10% of their income to charity) and take challah. In modern Israel, Jews continue to follow the laws of agricultural tithing, e.g., terumah, ma'aser rishon, terumat ma'aser, and ma'aser sheni. In Christianity, some interpretations of Biblical teachings conclude that although tithing was practiced extensively in the Old Testament, it was never practiced or taught within the first-century Church. Instead the New Testament scriptures are seen as teaching the concept of "freewill offerings" as a means of supporting the church: 1 Corinthians 16:2, 2 Corinthians 9:7. Also, some of the earliest groups sold everything they had and held the proceeds in common to be used for the furtherance of the Gospel: Acts 2:44-47, Acts 4:34-35. Further, Acts 5:1-20 contains the account of a man and wife (Ananias and Sapphira) who were living in one of these groups. They sold a piece of property and donated only part of the selling price to the church but claimed to have given the whole amount and immediately fell down and died when confronted by the apostle Peter over their dishonesty.

Tithes were mentioned in councils at Tours in 567 and at Mâcon in 585. They were formally recognized under Pope Adrian I in 787.

Ancient Near East

The Esretu — the standard Babylonian one-tenth tax

Hebrew is a Semitic language, related to Akkadian, the lingua franca of that time. An Akkadian noun that Abraham was most likely familiar with given his Babylonian background was esretu, meaning "one-tenth". By the time of Abraham, this phrase was used to refer to the "one-tenth tax," or "tithe". Listed below are some specific instances of the Mesopotamian tithe, taken from The Assyrian Dictionary of the Oriental Institute of the University of Chicago, Vol. 4 "E":

[Referring to a ten per cent tax levied on garments by the local ruler:] "the palace has taken eight garments as your tithe (on 85 garments)"

- "…eleven garments as tithe (on 112 garments)"

- "...(the sun-god) Shamash demands the tithe..."

- "four minas of silver, the tithe of [the gods] Bel, Nabu, and Nergal..."

- "...he has paid, in addition to the tithe for Ninurta, the tax of the gardiner"

- "...the tithe of the chief accountant, he has delivered it to [the sun-god] Shamash"

- "...why do you not pay the tithe to the Lady-of-Uruk?"

- "...(a man) owes barley and dates as balance of the tithe of the **years three and four"

- "...the tithe of the king on barley of the town..."

- "...with regard to the elders of the city whom (the king) has **summoned to (pay) tithe..."

- "...the collector of the tithe of the country Sumundar..."

- "...(the official Ebabbar in Sippar) who is in charge of the tithe..."

Because of this standard one-tenth tax in Babylon, Abraham of the Genesis account was most likely familiar with the concept of giving up ten percent of goods as tax.

Hebrew Bible

In the time of Abraham

According to the Genesis account, Abram, returning from a battle by the Dead Sea, was hailed by Melchizedek, king of Salem (Jerusalem) who was also the priest of El Elyon ("the Most High God") (Genesis 14:18):

-

- 18. And Melchizedek king of Salem brought forth bread and wine: and he was the priest of the most high God.

- 19. And he blessed him, and said, Blessed be Abram of the most high God, possessor of heaven and earth:

- 20. And blessed be the most high God, which hath delivered thine enemies into thy hand. And he gave him tithes of all.

-

-

- (Genesis 14:18-20, Holy Bible, King James Version)

-

-

When Melchizedek appeared and offered Abram bread and wine and blessed him in the name of God, tithes were exchanged. While the biblical text is not precise in naming who actually gave the tithes, most believe Abram gave the tithes to Melchizedek. The verse records, "…and he gave him a tenth of everything;" the "he" could stand for either Melchizedek or Abram, or perhaps El Elyon Himself. A reference found in Hebrews 7:2 expresses the tradition that Abram gave Melchizedek the tithes, and this is the belief that is held by most Christians. Hebrews 7:4 indicates that Abram gave a tenth of the spoils and not necessarily all of his personal wealth. Also, this was the only reference of Abram tithing. Abram had every right to keep the rest, but Abram gave it all back. He used a part to feed his army and he allowed three men to keep their share. Abram didn’t give a "full tithe" of ten per cent. Abram gave it all away!

"I will take nothing from a thread to a sandal strap, and that I will not take anything that is yours, lest you should say, ‘I have made Abram rich.’" (Gen. 14:23)

There is nothing here to indicate Abram gave a tenth of his personal possessions. Note Abram said, "I will take nothing that is yours." This shows he did not tithe his own possessions.

Later, in (Genesis 28:22), Abraham's grandson Jacob also made a commitment to give God back a tenth of his increase if God would fulfill certain conditions like God would be with him and will watch over him on this journey Jacob was taking and would give him food to eat and clothes to wear, so that I return safely to my father’s household (Genesis 28:20-22). There was no record of Jacob actually paid his tithe in the Bible but if he indeed had, it would have been after 20 years when he returned to his father's house.

According to the New Testament, tithes are received by priests and high priests according to Hebrews 7:5. This may reflect the practice in the Second Temple period following Ezra's decree penalizing the Levites for their failure to return to Israel en masse. The Hebrew Scriptures state that there is a distinct difference between priests, the sons of Aaron, and the Levites, the rest of the sons of Levi. The sons of Aaron were appointed to be priests and the tribe of Levi were appointed to minister to the priests and help in sacred matters (Numbers 18:1-7). The Children of Israel were commanded by God to give first-fruits of fields and flocks) Numbers 18:11-24 and Terumah (gift offerings) Exodus 25:1-27 to the kohanim (priests) and tithes to the Levites. (These first two offering traditions are distinct from the tithe and should not be confused, as some modern Christian revisionists do, as setting tithing/offering rules and expectations for Christian believers.) As to the tithe offerings, the Levites were commanded by God to give a tithe (a tenth) of the tithes they received to a priest. Numbers 18:26

In the time of Moses and under Mosaic law

The tithe is specifically mentioned in the Book of Leviticus, the Book of Numbers and also in the Book of Deuteronomy. The tithing system was organized in a 7 year cycle, corresponding to the Shemittah cycle. Every year, Bikkurim, Terumah, Ma'aser Rishon and Terumat Ma'aser were separated from the grain, wine and oil (as regards other fruit and produce, the Biblical requirement to tithe is a source of debate). Deuteronomy 14:22 Unlike other offerings which were restricted to consumption within the tabernacle, the yearly tithe to the Levites could be consumed anywhere (Numbers 18:31). On years one, two, four and five of the Shemittah cycle, God commanded the Children of Israel to take a second tithe that was to be brought to the city of Jerusalem. Deuteronomy 14:23 The owner of the produce was to separate and bring 1/10 of his finished produce to Jerusalem after separating Terumah and the first tithe, but if the family lived too far from Jerusalem, the tithe could be redeemed upon coins. Deuteronomy 14:23Then, the Bible required the owner of the redeemed coins to spend the tithe "to buy whatever you like: cattle, sheep, wine or other fermented drink, or anything you wish." Deuteronomy 14:22-27 Implicit in the commandment was an obligation to spend the coins on items meant for human consumption. According to the Hebrew Scriptures, the second tithe could be brought to Jerusalem any time of the year and there was no specific obligation to bring the second tithe to Jerusalem for the Festival of Sukkot. The only time restriction was a commandment to remove all the tithes from one's house in the end of the third year. Deuteronomy 14:28

The third year was called "the year of tithing" Deuteronomy 26:12-14 in which the Israelites set aside 10% of the increase of the land, they were to give this tithe to the Levites, strangers, orphans, and widows. These tithes were in reality more like taxes for the people of Israel and were mandatory, not optional giving. This tithe was distributed locally "within thy gates" Deuteronomy 14:28 to support the Levites and assist the poor.

The Levites, also known as the tribe of Levi, were descendants of Levi. They were assistants to the Israelite priests (who were the children of Aaron and, therefore, a subset of the Tribe of Levi) and did not own or inherit a territorial patrimony Numbers 18:21-28. Their function in society was that of temple functionaries, teachers and trusted civil servants who supervised the weights and scales and witnessed agreements. The goods donated from the other Israeli tribes were their source of sustenance. They received from "all Israel" a tithe of food or livestock for support, and in turn would set aside a tenth portion of that tithe for the Aaronic priests in Jerusalem.

In the time of the Israelite Kings

LMLK seals may represent the oldest archaeological evidence of tithing. About 10 percent of the storage jars manufactured during Hezekiah's reign (circa 700 BC) were stamped (Grena, 2004, pp. 376–8). See 2 Chronicles 29–31 for a record of this early worship reformation.

The book of Nehemiah also talks about the collection of tithes to Leviim and distribution of Terumah to the priests: Nehemiah 13:5. People were actually appointed to collect mandatory tithes and place them in specially designated chambers which eventually came to be known as storehouses: Nehemiah 12:44.

Books of the (Minor) Prophets

The book of Malachi has some of the most quoted Biblical verses on tithing, Malachi 3:8-12. Jews, Catholic, Orthodox, and Protestant Christians who tithe, understand that no man may outdo God in the act of charity. These verses talk about the supposed cause and effect of tithing. If one gives to God, they are to be blessed, where if one refuses to give they will be cursed. They also refer back to the storehouses mentioned in Malachi 3:8-12:

- 8 Will man rob God? Yet you are robbing me. But you say, ‘How are we robbing thee?’ In your tithes and offerings.

- 9 You are cursed with a curse, for you are robbing me; the whole nation of you.

- 10 Bring the full tithes into the storehouse, that there may be food in my house; and thereby put me to the test, says the Lord of hosts, if I will not open the windows of heaven for you and pour down for you an overflowing blessing.

- 11 I will rebuke the devourer for you, so that it will not destroy the fruits of your soil; and your vine in the field shall not fail to bear, says the Lord of hosts.

- 12 Then all nations will call you blessed, for you will be a land of delight, says the Lord of hosts.

- Revised Standard Edition

The Book of Tobit (1:6–8) provides an example of all three classes of tithes practiced during the Babylonian exile:

But I alone went often to Jerusalem at the feasts, as it was ordained unto all the people of Israel by an everlasting decree, having the firstfruits and tenths of increase, with that which was first shorn; and them gave I at the altar to the priests the children of Aaron. The first tenth part of all increase I gave to the sons of Aaron, who ministered at Jerusalem: another tenth part I sold away, and went, and spent it every year at Jerusalem: And the third I gave unto them to whom it was meet, as Debora my father's mother had commanded me…In Judaism

Orthodox Jews continue to follow the laws of Terumah and Ma'aser as well as the custom of tithing 10% of one's earnings to charity (ma'aser kesafim). Due to doubts concerning the status of persons claiming to be Kohanim or Levi'im arising after severe Roman/Christian persecutions and exile, the Hebrew Bible tithe of 10% for the Levites, and "tithe of the tithe" (Nehemiah 10:38) of 10% of 10% (1%) for the priests are dealt with in accordance with Jewish Law. However the Mishnah and Talmud contain analysis of the first tithe, second tithe and poor tithe.

Christianity

New Testament

According to Catholics, as those who serve at the altar should live by the altar, 1Cor 9:13 it became necessary for provision of some kind to be made for the sacred ministers.

In the beginning this was supplied by the spontaneous offerings of the faithful. In the course of time, however, as the Church expanded and various institutions arose, it became necessary to make laws which would ensure the proper and permanent support of the clergy.

Many Christians (both Catholic and Protestant) support their churches and pastors with monetary contributions of one sort or another. Frequently these monetary contributions are called tithes whether or not they actually represent ten percent of anything. Some claim that as tithing was an ingrained Jewish custom by the time of Jesus, no specific command to tithe per se is found in the New Testament. However, this view overlooks the fact that Israel's tithes were of an agricultural nature, not financial.[1] According to Strong's Concordance, there are four references to tithing in the New Testament.[2]

For Catholics, the payment of tithes was adopted from the Old Law, and early writers[3] speak of it as a divine ordinance and an obligation of conscience, rather than any direct command by Jesus Christ.

Some Protestant denominations cite Matthew 23:23 as support for tithing.

- Away with you, you pettifogging Pharisee lawyers! You give to God a tenth of herbs, like mint, dill, and cumin, but the important duties of the Law — judgement, mercy, honesty — you have neglected. Yet these you ought to have performed, without neglecting the others.

- (Albright & Mann, Matthew, Anchor Bible, Vol. 26 (1971))

and its parallel Luke 11:42

- Woe to you, Pharisees! You tithe mint and rue and every edible herb but disregard justice and the love of God. These were rather the things one should practice, without neglecting the others.

- (Fitzmyer, Luke, Anchor Bible, Vol. l, 28A (1985)).

Because of Jesus' specific mention of the tithe in this passage, those who support the tithe believe that he gave his endorsement to the practice of tithing in general. Some scholars disagree, however, pointing out that Jesus was simply obeying Mosaic law as an obedient Jew and telling Pharisees they ought to have tithed as they claimed they were living under that law. Also tithing is not the primary subject in these 2 passages and Jesus considered tithing to be a less central aspect of the law.

The final mention of tithing in the New Testament is Hebrews 7:1-10. This refers back to the tithe Abram paid to Melchizedek.

Most New Testament discussion promotes giving and does not mention tithing. 2 Corinthians 9:7 talks about giving cheerfully; 2 Corinthians 8:12 encourages giving what you can afford; 1 Corinthians 16:2 discusses giving weekly (although this is a saved amount for Jerusalem); 1 Timothy 5:18 exhorts supporting the financial needs of Christian workers; Acts 11:29 promotes feeding the hungry wherever they may be; and James 1:27 states that pure religion is to help widows and orphans.

Tithing in the Middle Ages

Farmers had to offer a tenth of their harvest, while craftsmen had to offer a tenth of their production.[citation needed]

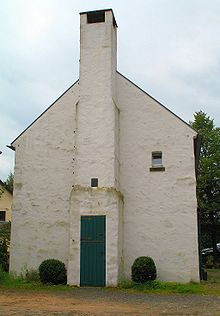

In Europe, special barns were built in villages order to store the tithe (tithe barn, in German Zehntscheunen).[citation needed] The priest or the collector (decimator) collected the tithe, though usually tithers delivered their tithe to a collection point themselves. Villages or homesteads were documented as owing tithe.[citation needed] A requirement to tithe was usually acquired by purchase, donation to the church, or when the settlement was founded.[clarification needed]

The Ebstorf Abbey in the Lüneburger Heathlands, for example, was owed tithe from over 60 villages.[citation needed]

In the Middle Ages the tithe from the Old Testament was expanded, through a differentiation between a Great Tithe and a Little Tithe.[citation needed]

- The Great Tithe was analogous to the tithe in the Bible where one had to tithe on grain and large farm animals.

- The Little Tithe added fruits of the field: kitchen herbs, fruit, vegetables and small farm animals. Exactly what was tithable varied from place to place.

In 1188 A.D. an obligatory tithe called the Saladin tithe was instituted throughout England and portions of France to raise money for the Third Crusade. This was in response to the capture of Jerusalem by Saladin the year prior in 1187 A.D.

Other tithes appeared that varied from location to location[citation needed]:

- Wine tithe (also called the wet tithe) upon wine cellars

- Hay tithe upon harvest hay

- Wood tithe upon cut wood

- Meat or blood tithe upon slaughtered animals or animal products such as eggs and milk

- Cleared-land tithe upon land that had been newly cleared for farming

After the Reformation the tithe was increasingly taken over from the church by the state. In countries such as Germany and Switzerland, this remained the case until the 19th century, when the tithe was abolished. In England, church tithes remained until the 19th century and in some cases to this day voluntary tithes are paid by the devout. In some cases the abolition of the tithe was accompanied by a one-time tax upon the farmers. This led many farmers into debt.[citation needed]

Christian practice today

In recent years, tithing has been taught in Christian circles as a form of stewardship that God requires of Christians. The primary argument is that God has never formally "abolished" the tithe, and thus Christians should pay the tithe (traditionally calculated at 10% of income, but in practice the percentage can be lower than 10%), although at the Council of Jerusalem the Apostles did not include it in the letter to the Gentile believers (Acts 15:29) and some Christians believe that Old Covenant laws have been abrogated, that is to say, nullified, or superseded by the New Covenant of Grace. The tithe is usually given to the local congregation, though some teach that a part of the tithe can go to other Christian ministries, so long as total giving is at least 10 percent. Some conservative Christians make statements that strongly imply that God will ensure that those who tithe receive raises or other material blessings that will at least make up for the amount of money they donate to the Church, and showcase the testimonies of church members who received raises at work, rebates on purchases, or other evidence of what they see as God's provision - these Christians stop short of overtly promising that their flocks will receive these same blessings if they tithe, however. Some holding to prosperity theology doctrines go even further, teaching that God will bless those who tithe and curse those who do not. When Christians who tithe lose their jobs or suffer financial setbacks, advocates[who?] of tithing often blame their misfortune on lack of faith, un-confessed sin, or other moral failures on the part of the financially-challenged individuals.

Some scholars cite that since the account of Abram giving tithe to the high priest occurred before the law was given to Moses at the Biblical Mount Sinai, the tithe does not fit into Mosaic Law and therefore is irrelevant today.

Proponents (see Biblical law in Christianity#Torah Submissive view) argue that one cannot throw out the Law in the name of "fulfillment" because that also would cause the argument that Christians are no longer obligated to live a holy lifestyle according to the Ten Commandments, which scholars agree is not the intention of Jesus' teachings that He came to "fulfill" the Law. See also Expounding of the Law and Antinomianism.

Because the New Testament explicitly directs Christians to give voluntarily as each person has determined in their hearts (2 Corinthians 9:7) and condemns those who make a show of their donations to organized religion (Mark 12:41-44, Matt. 6:3), the arguments for tithing as a Biblical practice seem to violate the basic principles of Biblical interpretation used by most conservative Protestants. These Christians usually stress the plain meaning of the text, and regard the New Testament above the Old Testament as the authoritative word of God. One reason why the practice is so vigorously promoted by conservative Protestant leaders, aside from the financial benefits of tithing for their institutions, may be that people who tithe or make other large sacrifices for the Church gain a positive reputation for their devotion.[citation needed] Christians may also feel that they've earned God's favor through their sacrifice.[4] Opponents of tithing note that the Bible explicitly condemns making public sacrifices as a means of enhancing one's reputation (Matt. 6:3), so the public testimonies of tithing advocates actually run the risk of being sin. (Galatians 5:4)

A minister created a program called 4T—Tithing of Time, Talent, and Treasure,[5] which is used in many Unity Churches.[citation needed]

Tithing is commonly taught in conservative Protestant denominations such as the Southern Baptist Convention, Free Methodists, Baptist General Conference, the Seventh-day Adventist Church, Assemblies of God, and most Pentecostal groups and independent fundamentalists, as well as among Mormon groups like The Church of Jesus Christ of Latter-day Saints and the related Community of Christ denomination (which encourages a modified form of tithe). Despite the emphasis placed on tithing by the leaders of these and other denominations, the practice is seldom observed by the laity. According to surveys conducted in 2002 by the Barna Group, only three percent of American adults donated 10 percent or more of their income to churches.[6] Only six percent of those who self-identified as born-again Christians tithed. Barna noted the softer American economy at the end of the booming 1990s, and the 9-11 attacks as a cause for the waning practice.

Some Christians see tithing simply as a way of supporting the church(es) they attend, rather than as a religious duty. They may treat the practice as similar to the other donations they make to nonprofit organizations. This approach to tithing is sometimes encouraged by religious leaders who speak about how the tithes are used by the church (for example, for building repairs, feeding programs, etc.).

Islam

Zakat (Arabic: زكاة [zækæːh], sometimes "Zakāt"[7]) or "alms giving", one of the Five Pillars of Islam, is the giving of a small percentage of one's income to charity. It serves principally as the welfare contribution to poor and deprived Muslims, although others may have a rightful share. It is the duty of an Islamic state not just to collect zakat but to distribute it fairly as well. Another mechanism for voluntary charity and support for religious organization in the Islamic States (in the old days) was to take one-tenth of the income or product, which is called ushar (1/10th in Arabic) and give it to a Mosque. To date this ushar strictly goes to the local mosques in Islamic countries, such as Afghanistan and the most qualified person for the ushar is considered to be the Imam and his students (Talib). In most villages the Imam gets the ushar from the landowners and sometimes it amounts to large sum of money. In other words, the idea of ushar in Islam is a direct continuation of the Judaeo-Christian idea of tethi or 1/10th. In fact, during the Taliban rule in Afghanistan, the government (who also considered themselves as protector of the state as well as religious students) collected the ushar from the people in villages and towns, thus reviving an old tradition of alms giving in the Islamic States of the past.

Zakat is payable on three kinds of assets: wealth, production, and animals. The more well-known zakat on wealth is 2.5% of accumulated wealth, beyond one's personal needs. Production (agricultural, industrial, renting, etc.), is subject to a 10% or 5% zakat (also known as Usher, or "one-tenth"), using the rule that if both labor and capital are involved, 5% rate is applied, if only one of the two are used for production, then the rate is 10%. For any earnings, that require neither labor nor capital, like finding underground treasure, the rate is 20%. The rules for zakat on animal holdings are specified by the type of animal group and tend to be fairly detailed. (Source: The book Meezan, by Javed Ahmed Ghamidi, published by Al-Mawrid, 2002, Lahore, Pakistan)

Muslims fulfill this religious obligation by giving a fixed percentage of their surplus wealth. Zakat has been paired with such a high sense of righteousness that it is often placed on the same level of importance as performing the five-daily repetitive ritualised prayer (salat).[8] Muslims see this process also as a way of purifying themselves from their greed and selfishness and also safeguarding future business.[8] In addition, Zakat purifies the person who receives it because it saves him from the humiliation of begging and prevents him from envying the rich.[9] Because it holds such a high level of importance the "punishment" for not paying when able is very severe. In the 2nd edition of the Encyclopaedia of Islam it states, "...the prayers of those who do not pay zakat will not be accepted".[8] This is because without Zakat a tremendous hardship is placed on the poor which otherwise would not be there. Besides the fear of their prayers not getting heard, those who are able should be practicing this third pillar of Islam because the Koran states that this is what believers should do. [10]

Sikhism

In Sikhism, dasvand (Punjabi: ਦਸਵੰਦ) literally means a tenth part and refers the act of donating ten percent of one's harvest, both financial and in the form of time and service such as seva to the Gurdwara and anywhere else. It falls into Guru Nanak Dev's concept of kirat karo. This was done during the time of Guru Arjan Dev and many Sikhs still do it up to this day. The concept of dasvandh was implicit in Guru Nanak’s own line: “ghali khai kichhu hathhu dei, Nanak rahu pachhanahi sei—He alone, O Nanak, knoweth the way who eats out of what he earneth by his honest labour and yet shareth part of it with others” (GG, 1245). The idea of sharing and giving was nourished by the institutions of sangat (holy assembly) and langar (community kitchen) the Guru had established.

In the time of Guru Amar Das, Nanak III, a formal structure for channelizing Sikh religious giving was evolved. He set up 22 manjis or districts in different parts of the country. Each of these "manji's" was placed under the charge of a pious Sikh (both male and female) who, besides preaching Guru Nanak’s word, looked after the sangats within his/her jurisdiction and transmitted the disciple’s offerings to the Guru. As the digging of the sacred pool at Amritsar, and the erection in the middle of it of the shrine, Harimander, began under Guru Ram Das resulting in a large amount of expenditure, the Sikhs were encouraged to set aside a minimum of ten per cent (dasvandh) of their income for the common cause and the concept of Guru Ki Golak "Guru's treasury" was coined. Masands, i.e. ministers and the tithe-collectors, were appointed to collect "kar bhet" (sewa offerings) and dasvandh from the Sikhs in the area they were assigned to, and pass these on to the Guru.

The custom of dasvandh is found in documents called rahitnamas, manuals of Sikh conduct, written during the lifetime of Guru Gobind Singh or soon after. For example, Bhai Nand Lal’s Tankhahnama records these words of Gobind Singh: “Hear ye Nand Lal, one who does not give dasvandh and, telling lies, misappropriates it, is not at all to be trusted.” The tradition has been kept alive by chosen Sikhs who to this day scrupulously fulfil this injunction. The institution itself serves as a means for the individual to practice personal piety as well as to participate in the ongoing history of the community, the Guru Panth ("Guru's path").

SGGS Page 1245 Full Shabad One who works for what he eats, and gives some of what he has - O Nanak, he knows the Path. (1) Church collection of religious offerings and taxes

England

The right to receive tithes was granted to the English churches by King Ethelwulf in 855. The Saladin tithe was a royal tax, but assessed using ecclesiastical boundaries, in 1188. Tithes were given legal force by the Statute of Westminster of 1285. The Dissolution of the Monasteries led to the transfer of many tithe rights from the Church to secular landowners and the Crown. Adam Smith criticized the system in The Wealth of Nations (1776), arguing that a fixed rent would encourage peasants to farm more efficiently.

See below for a fuller description and history, until the reforms of the 19th century, written by Sir William Blackstone and edited by other learned lawyers of the period.

The system ended with the Tithe Commutation Act 1836, which replaced tithes with a rent charge decided by a Tithe Commission. The records of land ownership, or Tithe Files, made by the Commission are now a valuable resource for historians.

At first this commutation reduced problems to the ultimate payers by folding tithes in with rents (however, it could cause transitional money supply problems by raising the transaction demand for money). Later the decline of large landowners led tenants to become freeholders and again have to pay directly; this also led to renewed objections of principle by non-Anglicans.

The rent charges paid to landowners were converted by the Tithe Commutation Act to annuities paid to the state through the Tithe Redemption Commission. The payments were transferred in 1960 to the Board of Inland Revenue, and finally terminated by the Finance Act 1977.

Tithe redemption

The Tithe Acts of 1936 and 1951 established the compulsory redemption of English tithes by the state where the annual amounts payable were less than £1, so abolishing the bureaucracy and costs of collecting small sums of money.

-

1955 redemption notice for property in East Dundry, just south of Bristol

France

In France, the tithes—called "la dîme" -- were a land tax. Originally a voluntary tax, in 1585 the "dîme" became mandatory. In principle, unlike the taille, the "dîme" was levied on both noble and non-noble lands. The dîme was divided into a number of types, including the "grosses dîmes" (grains, wine, hay), "menues" or "vertes dîmes" (vegetables, poultry), "dîmes de charnage" (veal, lamb, pork). Although the term "dîme" comes from the Latin decima [pars] ("one tenth", with the same origin as that of the U.S. coin, the dime), the "dîme" rarely reached this percentage and (on the whole) it was closer to 1/13th of the agricultural production.

The "dîme" was originally meant to support the local parish, but by the 16th century many "dîmes" went directly to distant abbeys, monasteries, and bishops, leaving the local parish impoverished, and this contributed to general resentment. In the Middle Ages, some monasteries also offered the "dîme" in homage to local lords in exchange for their protection (see Feudalism) (these are called "dîmes inféodées"), but this practice was forbidden by the Lateran Council of 1179.

All religious taxes were constitutionally abolished in 1790, in the wake of the French revolution.

Greece

There has never been a church tax or mandatory tithe on Greek citizens. The state pays the salaries of the clergy of the established Church of Greece, in return for use of real estate, mainly forestry, owned by the church. The remainder of church income comes from voluntary, tax-deductible donations from the faithful. These are handled by each diocese independently.

Ireland

Tithes were introduced after the Norman conquest of 1169-1172, and were specified in the papal bull Laudabiliter as a duty to: ...pay yearly from every house the pension of one penny to St Peter, and to keep and preserve the rights of the churches in that land whole and inviolate. However, collection outside the Norman area of control was sporadic.

From the English Reformation in the 16th century, most Irish people chose to remain Roman Catholic and had by now to pay tithes valued at about 10% of an area's agricultural produce, to maintain and fund the established state church, the Anglican Church of Ireland, to which only a small minority of the population converted. Irish Presbyterians and other minorities like the Quakers and Jews were in the same situation.

The collection of tithes was violently resisted in the period 1831-36, known as the Tithe War. Thereafter, tithes were reduced and added to rents with the passing of the Tithe Commutation Act in 1836. With the disestablishment of the Church of Ireland in 1869, tithes were abolished.

United States

While the federal government has never collected a church tax or mandatory tithe on its citizens, states collected a tithe into the early 19th century. Today, such a tax is prohibited by the First Amendment (specifically the Establishment Clause) to the US Constitution. The United States and its governmental subdivisions also exempt most churches from payment of income tax (under Section 501(c)(3) of the Internal Revenue Code and similar state statutes, which also allows donors to claim the donations as an income tax itemized deduction). Also, churches may be permitted exemption from other state and local taxes such as sales and property taxes, either in whole or in part. However, churches are required to withhold Federal and state income tax from their employees along with the employee's share of Social Security and Medicare taxes, and pay the employer's share of the latter two taxes, unless the employee is an ordained, licensed, or commissioned minister.

Religious organizations

Actual collection procedures vary from church to church, from the common, strictly voluntary practice of "passing the plate" in Catholic and mainline Protestant churches, to formal, church-mediated tithing[clarification needed] in some conservative Protestant churches (as well as LDS Church), to membership fees as practiced in many Jewish congregations. There is no government involvement in church collections (though some contributions are considered tax-exempt as charity donations), but because of less-strict income and tax reporting requirements for religious groups, some churches have been placed under legal and media scrutiny for their spending habits.

Spain and Latin America

Casa de los Diezmos, Canillas de Aceituno, Málaga, Spain

Casa de los Diezmos, Canillas de Aceituno, Málaga, Spain

Both the tithe (diezmo), a tax of 10% on all agricultural production, and "first fruits" (primicias), an additional harvest tax, were collected in Spain throughout the medieval and early modern periods for the support of local Catholic parishes.

The tithe crossed the Atlantic with the Spanish Empire; however, the Indians who made up the vast majority of the population in colonial Spanish America were exempted from paying tithes on native crops such as corn and potatoes that they raised for their own subsistence. After some debate, Indians in colonial Spanish America were forced to pay tithes on their production of European agricultural products, including wheat, silk, cows, pigs, and sheep.

The tithe was abolished in several Latin American countries, including Mexico, soon after independence from Spain (which started in 1810); others, including Argentina and Peru still collect tithes today for the support of the Catholic Church. The tithe was abolished in Spain itself in 1841.

Governmental collection of religious offerings and taxes

Austria

In Austria a colloquially called church tax (Kirchensteuer, officially called Kirchenbeitrag, i.e. church contribution) has to be paid by members of the Catholic and Protestant Church. It is levied by the churches themselves and not by the government. The obligation to pay church tax can just be evaded by an official declaration to cease church membership. The tax is calculated on the basis of personal income. It amounts to about 1.1% (Catholic church) and 1.5% (Protestant church).

Denmark

All members of the Church of Denmark pay a church tax, which varies between municipalities. The tax is generally around 1% of the taxable income.

Finland

Members of state churches pay a church tax of between 1% and 2.25% of income, depending on the municipality. Church taxes are integrated into the common national taxation system.

Germany

Germany levies a church tax, on all persons declaring themselves to be Christians, of roughly 8–9% of the income tax, which is effectively (very much depending on the social and financial situation) typically between 0.2% and 1.5% of the total income. The proceeds are shared amongst Catholic, Lutheran, and other Protestant Churches. In 1933 Hitler had the entry "church tax" added to the official tax card, which meant that the tax could now be deducted by the employer like any of the other taxes.

Some believe that the church taxation system was established or started through the Concordat of 1933 signed between the Holy See and the Third Reich. This is a simple misunderstanding or misrepresentation of §13 of the Appendix (The Supplementary Protocol) of the Concordat (Schlußprotokoll, §13). The article reads: „Es besteht Einverständnis darüber, daß das Recht der Kirche, Steuern zu erheben, gewährleistet bleibt.“, (refer to External Links). In English, this translates to: It is understood that the Church retains the right to levy Church taxes, (refer to External Links). Notice that §13 states that the Church "retains the right" or, in German, "gewährleistet bleibt". The church tax (Kirchensteuer) actually traces its roots back as far as the Reichsdeputationshauptschluss of 1803. Today its legal basis is §140 of the Grundgesetz (the German "constitution") in connection with article 137 of the Weimar constitution.

Church tax (Kirchensteuer) is compulsory in Germany for those confessing members of a particular religious group. It is deducted at the PAYE level. The duty to pay this tax theoretically starts on the day one is christened. Anyone who wants to stop paying it has to declare in writing, at their local court of law (Amtsgericht) or registry office, that they are leaving the Church. They are then crossed off the Church registers and can no longer receive the sacraments. This process is also used by members of "free churches" (e.g. Baptists) to stop paying the church tax, from which the free churches do not benefit, in order to support their own church directly.

Greece

There has never been a church tax or mandatory tithe on Greek citizens. The state pays the salaries of the clergy of the established Church of Greece, in return for use of real estate, mainly forestry, owned by the church. The remainder of church income comes from voluntary, tax-deductible donations from the faithful. These are handled by each diocese independently.

Italy

Originally the Italian government of Benito Mussolini, under the Lateran treaties of 1929 with the Holy See, paid a monthly salary to Catholic clergymen. This salary was called the congrua. The eight per thousand law was created as a result of an agreement, in 1984, between the Italian Republic and the Holy See.

Under this law Italian taxpayers are able to declare that 0.8% ('eight per thousand') of their taxes go to a religious confession or, alternatively, to a social assistance program run by the Italian State. This declaration is made on the IRPEF form. People are not required to declare a recipient; in that case the law stipulates that this undeclared amount be distributed among the normal recipients of such taxes in proportion to what they have already received from explicit declarations. Only the Catholic Church and the Italian State have agreed to take this undeclared portion of the tax.

The last official statement of Italian Ministry of Finance made in respect of the year 2000 singles out seven beneficiaries: the Italian State, the Catholic Church, the Waldenses, the Jewish Communities, the Lutherans, the Seventh-day Adventist Church and the Assemblies of God in Italy.

The tax was divided up as follows:

- 87.17% Catholic Church

- 10.35% Italian State

- 1.21% Waldenses

- 0.46% Jewish Communities

- 0.32% Lutherans

- 0.28% Adventists of the Seventh Day

- 0.21% Assemblies of God in Italy

In 2000, the Catholic Church raised almost a billion euros, while the Italian State received about €100 million euros.

Scotland

In Scotland teinds were the tenths of certain produce of the land appropriated to the maintenance of the Church and clergy. At the Reformation most of the Church property was acquired by the Crown, nobles and landowners. In 1567 the Privy Council of Scotland provided that a third of the revenues of lands should be applied to paying the clergy of the reformed Church of Scotland. In 1925 the system was recast by statute and provision was made for the standardisation of stipends at a fixed value in money. The Court of Session acted as the Teind Court. Teinds were finally abolished by the Abolition of Feudal Tenure etc. (Scotland) Act 2000.

Sweden

Until the year 2000, Sweden had a mandatory church tax, to be paid if one did belong to the Church of Sweden, which had been funneling about $500 million annually to the church. Because of change in legislation, the tax was withdrawn in year 2000. However, the Swedish government has agreed to continue collecting from individual taxpayers the annual payment that has always gone to the church. But now the tax will be an optional checkoff box on the tax return. The government will allocate the money collected to Catholic, Muslim, Jewish and other faiths as well as the Lutherans, with each taxpayer directing where his or her taxes should go.

Switzerland

There is no official state church in Switzerland; however, all the 26 cantons (states) financially support at least one of the three traditional denominations--Roman Catholic, Old Catholic, or Protestant--with funds collected through taxation. Each canton has its own regulations regarding the relationship between church and state. In some cantons, the church tax (up to 2.3%) is voluntary but in others an individual who chooses not to contribute to church tax may formally have to leave the church. In some cantons private companies are unable to avoid payment of the church tax.

Juridical sense

The non-economic, juridical sense of "tithing" is in reference to the Anglo-Norman practice of dividing the population into groups of ten men who were responsible for policing each other; if one broke the law, the other nine were responsible for chasing him down, or would face legal punishment themselves. In his 1595 essay A View of the Present State of Ireland, Edmund Spenser, best known for his colossal poem The Faerie Queen, recommended that the Anglo-Norman practice of tithing be revived and implemented in the rebellious territories of Ireland. The Anglo-Norman practice of tithing was also linked to the evolution of the juridical concept of murder; the penalties for killing a Norman were four times as great as the penalties for killing anyone else. It was presumed that any person murdered should be considered as if he were Norman, unless it could be proven otherwise. The higher communal payment of blood money (wergild) for killing a Norman bore the special designation murdrum, from which the modern English word "murder" is derived.

Tithes and tithe law in England before reform

Excerpts from: Sir William Blackstone, Commentaries on the Laws of England, Collins & Hannay, New York 1832[11]

Definition and classification and those liable to pay tithes

. . . tithes are defined to be the tenth part of the increase, yearly arising and renewing from the profits of lands, the stock upon lands, and the personal industry of the inhabitants:

- the first species being usually called predial,[12] as of corn, grass, hops, and wood:

- the second mixed, as of wool, milk, pigs, &c., consisting of natural products, but nurtured and preserved in part by the care of man; and of these the tenth must be paid in gross;

- the third personal, as of manual occupations, trades, fisheries, and the like ; and of these only the tenth part of the clear gains and profits is due.

- In addition to this triple distinction, all tithes have been otherwise divided into two classes, great or small; the former, in general, comprehending the tithes of corn, peas and beans, hay and wood ; the latter, all other predial, together with all personal and mixed tithes. Tithes are great or small, according to the nature of the things which yield the tithe without reference to the quantity.

History

The first mention of them in any written English law, is in a constitutional decree, made in a synod held A.D. 786, wherein the payment of tithes in general is strongly enjoined. This canon, or decree, which at first bound not the laity, was effectually confirmed by two kingdoms of the heptarchy, in their parliamentary conventions of estates, respectively consisting of the kings of Mercia and Northumberland, the bishops, dukes, senators, and people. Which was a very few years later than the time that Charlemagne established the payment of them in France, and made that famous division of them into four parts ; one to maintain the edifice of the church, the second to support the poor, the third the bishop, and the fourth the parochial clergy.

Beneficiaries

Upon their first introduction (as hath formerly been observed), though every man was obliged to pay tithes in general, yet he might give them to what priests he pleased; which were called arbitrary consecrations of tithes: or he might pay them into the hands of the bishop, who distributed among his diocesan clergy the revenues of the church, which were then in common. But, when dioceses were divided into parishes, the tithes of each parish were allotted to its own particular minister; first by common consent, or the appointment of lords of manors, and afterwards by the written law of the land. It is now universally held that tithes are due, of common right, to the parson of the parish, unless there be a special exemption. this parson of the parish, we have formerly seen may be either the actual incumbent, or else the appropriator of the benefice, appropriations being a method of endowing monasteries, which seems to have been devised by the regular clergy, by way of substitution to arbitrary consecrations of tithes.

Exemptions

We observed that tithes are due to the parson of common right unless by special exemption; let us therefore see, thirdly, who may be exempted or discharged from the payment of tithes, either in part or totally; first by a real composition; or secondly, by custom or prescription. A discharge by custom or prescription, is where time out of mind such persons or such lands have been, either partially or totally, discharged from the payment of tithes. And this immemorial usage is binding upon all parties; as it is in its nature an evidence of universal consent and acquiescence, and with reason supposes a real composition to have been formerly made. This custom or prescription is either de modo decimandi, or de non decimando. A modus decimandi, commonly called by the simple name of a modus only, is where there is by custom a particular manner of tithing allowed, different from the general law of taking tithes in kind, which are the actual tenth part of the annual increase. This is sometimes a pecuniary compensation, as two-pence an acre for the tithe of land : sometimes it is a compensation in work and labour, as that the parson shall have only the twelfth cock of hay, and not the tenth, in consideration of the owner's making it for him: sometimes, in lieu of a large quantity of crude or imperfect tithe, the parson shall have a less, quantity, when arrived to greater maturity, as a couple of fowls in lieu of tithe eggs ; and the like. Any means, in short, whereby the general law of tithing is altered, and a new method of taking them is introduced, is called a modus decimandi, or special manner of tithing. The king by his prerogative is discharged from all tithes. So a vicar shall pay no tithes to the rector, nor the rector to the vicar. see Glebe But these personal privileges (not arising from or being annexed to the land) are personally confined to both the king and the clergy ; for their tenant or lessee shall pay tithes, though in their own occupation their lands are not generally titheable. And, generally speaking, it is an established rule, that, in lay hands, modus de non decimando non valet. But spiritual persons or corporations, as monasteries, abbots, bishops, and the like, were always capable of having their lands totally discharged of tithes by various ways; as

- 1. By real composition :

- 2. By the pope's bull of exemption :

- 3. By unity of possession ; as when the rectory of a parish, and lands in the same parish, both belonged to a religious house, those lands were discharged of tithes by this unity of possession :

- 4. By prescription ; having never been liable to tithes, by being always in spiritual hands :

- 5. By virtue of their order; as the Knights Templars, Cistercians, and others, whose lands were privileged by the pope with a discharge of tithes. Though upon the dissolution of abbeys by Henry VIII. most of these exemptions from tithes would have fallen with them, and the lands become titheable again had they not been supported and upheld by the statute 31 Hen. Vlll 'e. which enacts, that all persons who should come to the possession of the lands of any abbey then dissolved, should hold them free and discharged of tithes, in as large and ample a manner as the abbeys themselves formerly held them. And from this original have sprung all the lands, which, being in lay hands, do at present claim to be tithe-free: for, if a man can shew his lands to have been such abbey-lands, and also immemorially discharged of tithes by any of the means before mentioned, this is now a good prescription, de non decimando. But he must shew both these requisites ; for abbey-lands, without a special ground of discharge, are not discharged of course ; neither will any prescription de non decimando avail in total discharge of tithes, unless it relates to such abbeylands.

-

The Tithe Barn, Abbotsbury, Dorset (scene of the sheep-shearing in Thomas Hardy's Far from the Madding Crowd)

-

Tithe Barn at Bradford on Avon, West Wiltshire

-

Coggeshall near Braintree Essex, the timber has been dated to between 1130 and 1270

See also

- Church of the Tithes in Kiev

- Council on the Disposition of the Tithes

- Peter's Pence

- Status of religious freedom by country

- Tithe: A Modern Faerie Tale novel by Holly Black

- Tithings

- Zakat the Islamic concept of tithing and alms

Notes

- ^ [http://thetithe.org[dead link] "The Tithe"]. http://thetithe.org[dead link].[unreliable source?]

- ^ blueletterbible.org Strong's G586

- ^ Plowden, Francis (1806). The Principles and Law of Tithing. p. 7.

- ^ Bailey, Ronald (2008-10-07). "Does Religion Make People Nicer? Only if they think Big Sky Brother is watching". Reason. http://www.reason.com/news/show/129304.html.

- ^ http://www.4tprosperity.com/[self-published source?]

- ^ Hansen, Collin (2008-08-08). "The Ancient Rise and Recent Fall of Tithing". christianity Today. http://www.christianitytoday.com/ch/news/2003/jun6.html.

- ^ The reason for the ending -t has to do with Arabic orthography and grammar; see Tāʾ marbūṭa for more information. The Arabic word zakat literally means "cleansing of purification". So, by giving alms, one purifies the remainder of his/her wealth, product, or animals which are subject to zakat if they go beyond a certain limit. As a loan word in the languages of non-Arabic speaking Muslims, it is often pronounced with the ending -t in all instances.[citation needed]

- ^ a b c Zysow, A. "Zakāt (a.)." Encyclopaedia of Islam, Second Edition. Edited by: P. Bearman , Th. Bianquis , C.E. Bosworth , E. van Donzel and W.P. Heinrichs. Brill, 2009. Brill Online. Augustana. 27 April 2009 <http://www.brillonline.nl/subscriber/entry?entry=islam_COM-1377>

- ^ Robinson, Neal. Islam; A Concise Introduction. Richmond; Curzon Press. 1999

- ^ Chapter 2 verse 155, "be sure we shall test you with something of fear and hunger, some loss on goods, lives, and fruits. But give glad tidings to those who patiently persevere."

- ^ A second species of incorporeal hereditaments is that of tithes . . . [1]

- ^ from praedium, a farm

References

- Albright, W. F. and Mann, C. S. Matthew, The Anchor Bible, Vol. 26. Garden City, New York, 1971.

- The Assyrian Dictionary of the Oriental Institute of the University of Chicago, Vol. 4 "E." Chicago, 1958.

- Fitzmyer, Joseph A. The Gospel According to Luke, X-XXIV, The Anchor Bible, Vol. 28A. New York, 1985.

- Grena, G.M. (2004). LMLK--A Mystery Belonging to the King vol. 1. Redondo Beach, California: 4000 Years of Writing History. ISBN 0-9748786-0-X.

- Speiser, E. A. Genesis, The Anchor Bible, Vol.1. Garden City, New York, 1964.

- Kelly, Russell Earl, "Should the Church Teach Tithing? A Theologian's Conclusions about a Taboo Doctrine," IUniverse, 2001.

- Matthew E. Narramore, "Tithing: Low-Realm, Obsolete & Defunct" - April 2004 - (ISBN 0–9745587–02)

- Croteau, David A. "You Mean I Don't Have to Tithe?: A Deconstruction of Tithing and a Reconstruction of Post-Tithe Giving" (McMaster Theological Studies)

External links

- Theologian Russell Kelly on tithing

- Tithing at the Open Directory Project

- Tithe A biblical study why Christians need not tithe.

- Arguments for and against Tithing

- Q & A On Tithing By Russ Kelly

- Articles By New Testament Scholar Dr. David Croteau

- The Tithe Debate

- A brief history of tithes in England

Topics related to charity Main topics Organization types Additional topics Categories:- Christian law

- Personal taxes

- Religious behaviour and experience

- Giving

- Religious terminology

Wikimedia Foundation. 2010.