- Currency war

-

Brazilian Finance Minister Guido Mantega, who made headlines when he raised the alarm about a Currency War in September 2010. In July 2011 he told the Financial Times that in his opinion the war is "absolutely not over."[1]

Brazilian Finance Minister Guido Mantega, who made headlines when he raised the alarm about a Currency War in September 2010. In July 2011 he told the Financial Times that in his opinion the war is "absolutely not over."[1]

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a particular currency falls, so to does the real price of exports from the country. Imports become more expensive too, so domestic industry, and thus employment, receives a boost in demand both at home and abroad. However, the price increase in imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.

Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency; have been content to allow its value to be set by the markets or have participated in systems of managed exchanges rates. An exception was the episode of currency war which occurred in the 1930s. The period is considered to have been an adverse situation for all concerned, with all participants suffering as unpredictable changes in exchange rates reduced international trade.

According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other financial journalists and government officials from around the world. Other senior policy makers and journalists have suggested the phrase "currency war" overstates the extent of hostility, though they agree that a risk of further escalation exists.

States engaging in competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries have experienced undesirable upward pressure on their exchange rates and taken part in the on-going arguments, the most notable dimension has been the rhetorical conflict between the United States and China over the valuation of the yuan.[2][3] The episode which began in the early 21st century is being pursued by different mechanisms than was the case in the 1930s, and opinions among economists have been divided as to whether it will have a net negative effect on the global economy. By April 2011 journalists had began to report that the currency war had subsided; though Guido Mantega has continued to assert that the conflict is still on-going.

Contents

Background

Reasons for intentional devaluation

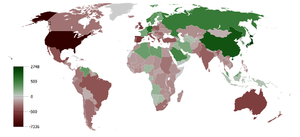

Cumulative current account balance 1980-2008 (US$ Billions) based on International Monetary Fund data – for an interactive overview of global imbalances and other macro trends, over the past 2 decades and also future proejections, visit the OECD Data visualization

Cumulative current account balance 1980-2008 (US$ Billions) based on International Monetary Fund data – for an interactive overview of global imbalances and other macro trends, over the past 2 decades and also future proejections, visit the OECD Data visualization

Devaluation, with its adverse consequences, has historically rarely been a preferred strategy. According to economist Richard N. Cooper, writing in 1971, a substantial devaluation is one of the most "traumatic" policies a government can adopt – it almost always results in cries of outrage and calls for the government to be replaced.[4] Devaluation can lead to a reduction in citizens' standard of living as their purchasing power is reduced both when they buy imports and when they travel abroad. It also can add to inflationary pressure. Devaluation can make interest payments on international debt more expensive if those debts are denominated in a foreign currency, and it can discourage foreign investors. At least until the 21st century, a strong currency was commonly seen as a mark of prestige while devaluation was associated with weak governments.[5]

However, when a country is suffering from high unemployment or wishes to pursue a policy of export led growth, a lower exchange rate can be seen as advantageous. From the early 1980s the International Monetary Fund (IMF) has proposed devaluation as a potential solution for developing nations that are consistently spending more on imports than they earn on exports. A lower value for the home currency will raise the price for imports while making exports cheaper.[6] This tends to encourage more domestic production, which raises employment and gross domestic product (GDP) – though the effect may not be immediate due to the Marshall–Lerner condition. Devaluation can be seen as an attractive solution to unemployment when other options, like increased public spending, are ruled out due to high public debt, or when a country has a balance of payments deficit which a devaluation would help correct. A reason for preferring devaluation common among emerging economies is that maintaining a relatively low exchange rate helps them build up their foreign exchange reserves, which can protect them against future financial crises.[7][8][9]

Mechanism for devaluation

A state wishing to devalue, or at least check the appreciation of its currency, must work within the constraints of the prevailing International monetary system. During the 1930s, countries had relatively more direct control over their exchange rates through the actions of their central banks. Following the collapse of the Bretton Woods system in the early 1970s, markets substantially increased in influence, with market forces largely setting the exchange rates for an increasing number of countries. However, a state's central bank can still intervene in the markets to effect a devaluation – if it sells its own currency to buy other currencies[10] then this will cause the value of its own currency to fall – a practice common with states that have a managed exchange rate regime. Less directly, quantitative easing (common in 2009 and 2010), tends to lead to a fall in the value of the currency even if the central bank does not directly buy any foreign assets.

A third method is for authorities simply to talk down the value of their currency by hinting at future action to discourage speculators from betting on a future rise, though sometimes this has little discernible effect. Finally, a central bank can effect a devaluation by lowering its base rate of interest, however this sometimes has limited effect, and, since the end of World War II, most central banks have set their base rate according to the needs of their domestic economy.[11][9]

If a country's authorities wish to devalue or prevent appreciation against market forces exerting upwards pressure on the currency, and retain control of interest rates, as is usually the case, they will need capital controls in place—due to conditions that arise from the impossible trinity trilemma.[12]

Quantitative easing

Quantitative easing (QE) is the practice where a central bank tries to mitigate a potential or actual recession by increasing the money supply for their home economy. This can be done by creating money and injecting it into the domestic economy with open market operations. There may be a promise to destroy any newly created money once the economy improves, so as to avoid inflation.

Quantitative easing was widely used as a response to the financial crises that began in 2007, especially by the United States and the United Kingdom, and, to a lesser extent, the Eurozone.[13] The Bank of Japan was the first central bank to claim to have used such a policy.[14][15][16]

Although the US administration has denied that devaluing their currency was part of their objectives for implementing quantitative easing, the practice can act to devalue a country's currency in two indirect ways. Firstly, it can encourage speculators to bet that the currency will decline in value. Secondly, the large increase in the domestic money supply will lower domestic interest rates, often they will become much lower than interest rates in countries not practising quantitative easing. This creates the conditions for a carry trade, where market participants can engage in a form of arbitrage, borrowing in the currency of the country practising quantitative easing, and lending in a country with a relatively high rate of interest. Because they are effectively selling the currency being used for quantitative easing on the international markets, this can increase the supply of the currency and hence push down its value. By October 2010 expectations in the markets were high that the US, UK and Japan would soon embark on a second round of QE, with the prospects for the Eurozone to join them less certain.[17]

In early November 2010 the US launched QE2 — the expected second round of quantitative easing. The Federal Reserve made an additional USD$600 billion available for the purchase of financial assets. This prompted widespread criticism, especially from China, Germany and Brazil, that the US was using QE2 to try to devalue its currency without consideration to the effect the resulting capital inflows might have on emerging economies.[18][19][20] Some leading figures from the critical countries, such as Zhou Xiaochuan, governor of the People's Bank of China, have said the QE2 is understandable given the challenges facing the US. Wang Jun, the Chinese vice-Finance Minister suggested QE2 could "help the revival of the global economy tremendously."[21] Barrack Obama, President of the US, has defended QE2, saying it would help the US economy to grow, which would be "good for the world as a whole".[22] Japan also launched a second round of quantitative easing though to a lesser extent than the US; Britain and the Eurozone did not launch any additional QE in 2010.

International conditions required for currency war

For a widespread currency war to occur a large proportion of significant economies must wish to devalue their currencies at once. This has so far only happened during a global economic downturn.

An individual currency devaluation has to involve a corresponding rise in value for at least one other currency. The corresponding rise will generally be spread across all other currencies[23] and so unless the devaluing country has a huge economy and is substantially devaluing, the offsetting rise for any individual currency will tend to be small or even negligible. In normal times other countries are often content to accept a small rise in the value of their own currency or at worst be indifferent to it. However if much of the world is suffering from a recession, from low growth or are pursuing strategies which depends on a favourable balance of payments, then nations can begin competing with each other to devalue. In such conditions, once a small number of countries begin intervening this can trigger corresponding interventions from others as they strive to prevent further deterioration in their export competitiveness.[24]

Trade barriers

Tariffs · Non-tariff barriers

Import quotas · Tariff-rate quotas

Quota share · Import licenses

Customs duties · Export subsidies

Technical barriers · Bribery

Exchange rate controls · Embargo

Safeguards

Countervailing duties

Anti-dumping duties

Voluntary export restraintsOrganizationsBy CountryHistorical overview

Up to 1930

For centuries, governments have slowly devalued their currencies by reducing its intrinsic value. Methods have included reducing the percentage of gold in coins or substituting less precious metals for gold. However until the 19th century,[25] the proportion of the world's trade that occurred between nations was very low, so exchanges rates were not generally a matter of great concern.[26] Rather than being seen as a means to help exporters, the debasement of currency was motivated by a desire to increase the domestic money supply and the ruling authorities' wealth through seigniorage, especially when they needed to finance wars or pay debts. A notable example is the substantial devaluations which occurred during the Napoleonic wars. When nations wished to compete economically they typically practiced mercantilism – this still involved attempts to boost exports while limiting imports, but rarely by means of devaluation.[27] A favoured method was to protect home industries using current account controls such as tariffs. From the late 18th century, and especially in Great Britain which for much of the 19th century was the world's largest economy, mercantilism became increasingly discredited by the rival theory of free trade, which held that the best way to encourage prosperity would be to allow trade to occur free of government imposed controls. The intrinsic value of money became formalised with a gold standard being widely adopted from about 1870–1914, so while the global economy was now becoming sufficiently integrated for competitive devaluation to occur there was little opportunity. Following the end of WWI, many countries other than the US experienced recession and few immediately returned to the gold standard, so several of the conditions for a currency war were in place. However currency war did not occur as Great Britain was trying to raise the value of her currency back to its pre-war levels, effectively cooperating with the countries that wished to devalue against the market.[28] By the mid 1920s many former members of the gold standard had rejoined, and while the standard did not work as successfully at it had pre war, there was no widespread competitive devaluation.[29]

Currency War in the Great Depression

During the Great Depression of the 1930s, most countries abandoned the gold standard, resulting in currencies that no longer had intrinsic value. With widespread high unemployment, devaluations became common. Effectively, nations were competing to export unemployment, a policy that has frequently been described as "beggar thy neighbour".[30] However, because the effects of a devaluation would soon be counteracted by a corresponding devaluation by trading partners, few nations would gain an enduring advantage. On the other hand, the fluctuations in exchange rates were often harmful for international traders, and global trade declined sharply as a result, hurting all economies.

The exact starting date of the 1930s currency war is open to debate.[24] The three principal parties were Great Britain, France, and the United States. For most of the 1920s the three generally had coinciding interests, both the US and France supported Britain's efforts to raise Sterling's value against market forces. Collaboration was aided by strong personal friendships among the nations' central bankers, especially between Britain's Montagu Norman and America's Benjamin Strong until the latter's early death in 1928. Soon after the Wall Street Crash of 1929, France lost faith in Sterling as a source of value and begun selling it heavily on the markets. From Britain's perspective both France and the US were no longer playing by the rules of the gold standard. Instead of allowing gold inflows to increase their money supplies (which would have expanded those economies but reduced their trade surpluses) France and the US began sterilising the inflows, building up hoards of gold. These factors contributed to the Sterling crises of 1931; in September of that year Great Britain substantially devalued and took the pound off the gold standard. For several years after this global trade was disrupted by competitive devaluation. The currency war of the 1930s is generally considered to have ended with the Tripartite monetary agreement of 1936.[24][31][32][33][34]

Bretton Woods era

From the end of World War II until about 1971, the Bretton Woods system of semi-fixed exchange rates meant that competitive devaluation was not an option, which was one of the design objectives of the systems' architects. Additionally, global growth was generally very high in this period, so there was little incentive for currency war even if it had been possible.[35]

1973 to 2000

While some of the conditions to allow a currency war were in place at various points throughout this period, countries generally had contrasting priorities and at no point were there enough states simultaneously wanting to devalue to for a currency war to break out.[36] On several occasions countries were desperately attempting not to cause a devaluation but to prevent one. In these instances states were striving not against other countries but against market forces that were exerting undesirable downwards pressure on their currencies. Examples include Great Britain during Black Wednesday and various tiger economies during the Asian crises of 1997. During the mid 1980s the US did desire to devalue significantly, but they were able to secure the cooperation of other major economies with the Plaza accord agreement. As free market influences approached their zenith during the 1990s advanced economies and increasingly transition and even emerging economies moved to the view that it was best to leave the running of their economies to the markets and not to intervene even to correct a substantial current account deficit.[37][35]

2000 to 2008

During the 1997 Asian crisis several Asian economies ran critically low on foreign reserves, leaving them forced to accept harsh terms from the IMF and, often, to accept low prices for the forced sale of their assets. This shattered faith in free market thinking among emerging economies, and from about 2000 they generally began intervening to keep the value of their currencies low.[38] This enhanced their ability to pursue export led growth strategies while at the same time building up foreign reserves so they would be better protected against further crises. No currency war resulted because on the whole advanced economies accepted this strategy—in the short term it had some benefits for their citizens who could buy cheap imports and thus enjoy a higher material standard of living. The current account deficit of the US grew substantially but, until about 2007, the consensus view among free market economists and policy makers like Alan Greenspan, then Chairman of the Federal Reserve, and Paul O'Neill, US Treasury secretary, was that the deficit was not a major reason for worry.[39][40]

This is not say there was no popular concern; by 2005 for example a chorus of US executives along with trade union and mid-ranking government officials had been speaking out about what they perceived to be unfair trade practices by China.[41] These concerns were soon partially allayed. With global economy doing well, China was able to abandon her dollar peg in 2005, allowing a substantial appreciation of the Yuan up to 2007, while still increasing her exports. The dollar peg was re-established as the financial crises began to reduce China's export orders.

Economists such as Michael P. Dooley, Peter M. Garber, and David Folkerts-Landau described the new economic relationship between emerging economies and the US as Bretton Woods II.[42][43]

Competitive devaluation after 2009

Main article: Currency War of 2009–2011 As the world's leading Reserve currency the US dollar has been central to the recent outbreak of currency war.

As the world's leading Reserve currency the US dollar has been central to the recent outbreak of currency war.

By 2009 some of the conditions required for a currency war had returned, with a severe economic downturn seeing global trade in that year decline by about 12%. There was a widespread concern among advanced economies concerning the size of their deficits; they increasingly joined emerging economies in viewing export led growth as their ideal strategy. In March 2009, even before international co-operation reached its peak with the 2009 G-20 London Summit Economist Ted Truman became one of the first to warn of the dangers of competitive devaluation breaking out. He also coined the phrase competitive non-appreciation.[44][45][46]

On 27 September 2010, Brazilian Finance Minister Guido Mantega announced that the world is "in the midst of an international currency war." [47][48] Numerous financial journalists agreed with Mantega's view, such as the Financial Times' Alan Beattie and The Telegraph's Ambrose Evans-Pritchard. Journalists linked Mantega's announcement to recent interventions by various countries seeking to devalue their exchange rate including China, Japan, Colombia, Israel and Switzerland.[49][50][51][52][53]

Other analysts such as Goldman Sach's Jim O'Neill asserted that fears of a currency war were exaggerated.[54] In September, senior policy makers such as Dominique Strauss-Kahn, then Managing Director of the IMF, and Tim Geithner, US Secretary of the Treasury, were reported as saying the chances of a genuine currency war breaking out were low; however by early October, Strauss-Kahn was warning that the risk of a currency war was real. He also suggested the IMF could help resolve the trade imbalances which could be the underlying casus belli for conflicts over currency valuations. Mr Strauss-Kahn said that using currencies as weapons "is not a solution [and] it can even lead to a very bad situation. There’s no domestic solution to a global problem."[55]

Considerable attention had been focused on the US, due to its quantitative easing programmes, and on China. For much of 2009 and 2010, China has been under pressure from the US to allow the yuan to appreciate. Between June and October 2010, China allowed a 2% appreciation of the yuan, but there are concerns from Western observers that China only relaxes her intervention when under heavy pressure. The fixed peg was not abandoned until just before the June G20 meeting, after which the yuan appreciated by about 1%, only to devalue slowly again, until further US pressure in September when it again appreciated relatively steeply, with the imminent September US Congressional hearings to discuss measures to force a revaluation.[56]

Reuters suggested that both China and the United States were "winning" the currency war, holding down their currencies while pushing up the value of the Euro, the Yen, and the currencies of many emerging economies.[57]

Martin Wolf, an economics leader writer with the Financial Times, has suggested there may be advantages in western economies taking a more confrontational approach against China, which in recent years has been by far the biggest practitioner of competitive devaluation. Though he suggests that rather than using protectionist measures that may spark a trade war, a better tactic would be to use targeted capital controls against China to prevent them buying foreign assets in order to further devalue the yuan, as previously suggested by Daniel Gros, Director of the Centre for European Policy Studies.[58][59]

A contrasting view was published on October 19, with a paper from Chinese economist Yiping Huang arguing that the US did not win the last "currency war" with Japan,[60] and has even less of a chance against China; but should focus instead on broader "structural adjustments" at the November 2010 G-20 Seoul summit.[61]

Discussion over currency war and imbalances dominated the 2010 G-20 Seoul summit, but little progress was made in resolving the issue.[62][63][64][65][66]

In the first half of 2011 analysts and the financial press widely reported that the currency war had ended or at least entered a lull,[67] [68] [69] [70] though speaking in July 2011 Guido Mantega told the Financial Times that the conflict was still ongoing.[1]

As investor confidence in the global economic outlook fell in early August, Bloomberg suggested the currency war had entered a new phase. This followed renewed talk of a possible third round of quantitative easing by the US and interventions over the first three days of August by Switzerland and Japan to push down the value of their currencies.[71][72]

In September, as part of her opening speech for the 66th United Nations Debate , and also in an article for the Financial Times , Brazilian president Dilma Rousseff called for the currency war to be ended by increased use of floating currencies and greater cooperation and solidarity among major economies, with exchange rate policies set for the good of all rather than having individual nations striving to gain an advantage for themselves. [73] [74]

Comparison between 1930s and 2000s

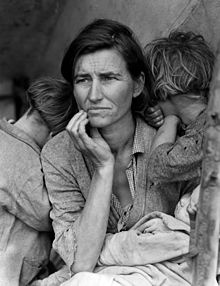

Migrant Mother by Dorothea Lange (1936). This portrait of a 32 year-old farm-worker with seven children became an iconic photograph symbolising defiance in the face of adversity. A currency war contributed to the world wide economic hardship of the 1930s Great Depression.

Migrant Mother by Dorothea Lange (1936). This portrait of a 32 year-old farm-worker with seven children became an iconic photograph symbolising defiance in the face of adversity. A currency war contributed to the world wide economic hardship of the 1930s Great Depression.

Both the 1930s episode and the outbreak of competitive devaluation that began in 2009 occurred during global economic downturns. An important difference with the 2010s period is that international traders are much better able to hedge their exposures to exchange rate volatility due to more sophisticated financial markets. A second difference is that during the later period devaluations have invariably been effected by nations expanding their money supplies—either by creating money to buy foreign currency, in the case of direct interventions, or by creating money to inject into their domestic economies, with quantitative easing. If all nations try to devalue at once, the net effect on exchange rates could cancel out leaving them largely unchanged, but the expansionary effect of the interventions would remain. So while there has been no collaborative intent, some economists such as Berkeley's Barry Eichengreen and Goldman Sachs's Dominic Wilson have suggested the net effect will be similar to semi-co-ordinated monetary expansion which will help the global economy.[50][75][76] James Zhan of the United Nations Conference on Trade and Development (UNCTAD) however warned in October 2010 that the fluctuations in exchange rates were already causing corporations to scale back their international investments.[77]

Comparing the situation in 2010 with the currency war of the 1930s, Ambrose Evans-Pritchard of the Daily Telegraph suggested a new currency war may be beneficial for countries suffering from trade deficits, noting that in the 1930s it was the big surplus countries that were severely impacted once competitive devaluation began. He also suggested that overly confrontational tactics may backfire on the US as they may damage the status of the dollar as a global reserve currency.[78]

Ben Bernanke, chairman of the US Federal Reserve, also drew a comparison with competitive devaluation in the inter-war period, referring to the sterilisation of gold inflows by France and America which helped them sustain large trade surpluses, but which also caused deflationary pressure on their trading partners, contributing to the Great Depression. Bernanke has stated the example of the 1930s implies that the "pursuit of export-led growth cannot ultimately succeed if the implications of that strategy for global growth and stability are not taken into account."[79]

Other uses

The term "currency war" is sometimes used with meanings that are not related to competitive devaluation.

In the 2007 book, Currency Wars by Chinese economist Song Hongbing, the term is sometimes used in a somewhat contrary sense, to refer to an alleged practice where unscrupulous bankers lend to emerging market countries and then speculate against the emerging state's currency by trying to force it down in value against the wishes of that states' government.[80][81]

In another book of the same name, John Cooley uses the term to refer to the efforts of a state's monetary authorities to protect its currency from forgers, whether they are simple criminals or agents of foreign governments trying to devalue a currency and cause excess inflation against the home government's wishes.[82]

Jim Rickards, in his 2011 book "Currency Wars: The Making of the Next Global Crisis," argues that the consequences of the Fed’s attempts to prop up economic growth could be devastating for American national security.[83] In their review of the book, Publisher's Weekly said: "Rickards's first book is an outgrowth of his contributions and a later two-day war game simulation held at the Applied Physics Laboratory's Warfare Analysis Laboratory. He argues that a financial attack against the U.S. could destroy confidence in the dollar. In Rickards's view, the Fed's policy of quantitative easing by lessening confidence in the dollar, may lead to chaos in global financial markets."[84] Kirkus Reviews said: "In Rickards’ view, the world is currently going through a third currency war (“CWIII”) based on competitive devaluations. CWII occurred in the 1960s and ’70s and culminated in Nixon's decision to take the dollar off the gold standard. CWI followed WWI and included the 1923 German hyperinflation and Roosevelt's devaluation of the dollar against gold in 1933. Rickards demonstrates that competitive devaluations are a race to the bottom, and thus instruments of a sort of warfare. CWIII, he writes, is characterized by the Federal Reserve's policy of quantitative easing, which he ascribes to what he calls “extensive theoretical work” on depreciation, negative interest rates and stimulation achieved at the expense of other countries. He offers a view of how the continued depreciation and devaluation of the dollar will ultimately lead to a collapse, which he asserts will come about through a widespread abandonment of a worthless inflated instrument. Rickards also provides possible scenarios for the future, including collaboration among a variety of currencies, emergence of a world central bank and a forceful U.S. return to a gold standard through an emergency powers–based legal regime. The author emphasizes that these questions are matters of policy and choice, which can be different."[85]

Historically, the term has been used to refer to the competition between Japan and China for their currencies to be used as the preferred tender in parts of Asia in the years leading up to Second Sino-Japanese War.[86]

See also

Notes and citations

- ^ a b Chris Giles and John Paul Rathbone (2011-07-07). "Currecny wars not over, says Brazil". The Financial Times. http://www.ft.com/cms/s/0/36ee3298-a731-11e0-b6d4-00144feabdc0.html#axzz1R8wD1vb0. Retrieved 2011-05-07.

- ^ "Possible "currency war" to hamper int'l economy recovery". xinhua. 2010-10-17. http://news.xinhuanet.com/english2010/business/2010-10/17/c_13561641.htm. Retrieved 2010-12-27.

- ^ Bagchi, Indrani (2010-11-14). "US-China currency war a power struggle". The Times of India. http://timesofindia.indiatimes.com/india/US-China-currency-war-a-power-struggle/articleshow/6922415.cms. Retrieved 2010-12-27.

- ^ Cooper 1971, p.3

- ^ Kirshner 2002, p.264

- ^ Owen 2005, p.3

- ^ Sloman 2004, pp. 965-1034

- ^ Wolf 2009, pp. 56, 57

- ^ a b Owen 2005, pp. 1-5, 98-100

- ^ In practice this chiefly means purchasing assets such as government bonds that are denominated in other currencies

- ^ Wilmott 2007, p. 10

- ^ Burda 2005, pp. 248 , 515 , 516

- ^ James Mackintosh (2010-09-28). "Currency War". The Financial Times. http://www.ft.com/cms/s/0/7610475e-cb45-11df-95c0-00144feab49a.html. Retrieved 2010-10-11.

- ^ The original meaning of this expression is, however, different, and refers to the expansion in credit creation, as coined by Richard Werner in 1994 – See origin section in quantitative easing.

- ^ To practice quantitative easing on a wide scale it helps to have a reserve currency, as do the US, Japan, UK and Eurozone, otherwise there is a risk of market speculators triggering runaway devaluation to a far greater extent than would be helpful to the country.

- ^ Theoretically, money could be shared out among the entire population, though, in practice, the new money is often used to buy assets from financial institutions. The idea is that the extra money will help banks restore their balance sheets, and will then flow from there to other areas of the economy where it is needed, boosting spending and investment. As of November 2010 however, credit availability has remained tight in countries that have undertaken QE, suggesting that money is not flowing freely from the banks to the rest of the economy.

- ^ Gavyn Davies (2010-10-04). "The global implications of QE2". The Financial Times. http://www.ft.com/cms/s/0/4e74bd74-cfb9-11df-a51f-00144feab49a.html. Retrieved 2010-10-04.

- ^ Alan Beattie in Washington, Kevin Brown in Singapore and Jennifer Hughes in London (2010-11-04). "Backlash against Fed’s $600bn easing". The Financial Times. http://www.ft.com/cms/s/0/981ca8f4-e83e-11df-8995-00144feab49a.html. Retrieved 2010-11-08.

- ^ Ambrose Evans-Pritchard (2010-11-01). "QE2risks currency wars and the end of dollar hegemony". London: The Daily Telegraph. http://www.telegraph.co.uk/finance/currency/8103462/QE2-risks-currency-wars-and-the-end-of-dollar-hegemony.html. Retrieved 2010-11-01.

- ^ Michael Forsythe (2010-11-08). China Says Fed Easing May Flood World With 'Hot Money'. Bloomberg L.P.. http://www.bloomberg.com/news/2010-11-08/fed-easing-may-flood-world-economy-with-hot-money-chinese-official-says.html. Retrieved 2010-11-09.

- ^ Alan Beattie in Washington, Kathrin Hille in Beijing and Ralph Atkins in Frankfurt (2010-11-07). "Asia softens criticism of US stance". The Financial Times. http://www.ft.com/cms/s/0/f34b2026-eab3-11df-b28d-00144feab49a.html#axzz14gPapinY. Retrieved 2010-11-08.

- ^ Ed Luce and James Lamont in New Delhi (2010-11-08). "Obama defendsQE2ahead of G20". The Financial Times. http://www.ft.com/cms/s/0/b416ccae-eb1a-11df-811d-00144feab49a.html#axzz14hBIOVWk. Retrieved 2010-11-08.

- ^ Though not necessarily evenly: in the late 20th and early 21st century countries would often devalue specifically against the dollar, so while the devaluing currency would lower its exchange rate against all currencies, a corresponding rise against the global average might be confined largely just to the dollar and any currencies currently governed by a dollar peg. A further complication is that the dollar is often effected by such huge daily flows on the foreign exchange that the rise caused by a small devaluation may be offset by other transactions.

- ^ a b c Joshua E Keating (2010-10-14). "Why do currency wars start". Foreign Policy magazine. http://www.foreignpolicy.com/articles/2010/10/14/how_will_we_know_when_the_currency_war_starts. Retrieved 2011-04-21.

- ^ Despite global trade growing substantially in the 17th and 18th centuries

- ^ Ravenhill 2005, p.7

- ^ Devaluation could however be used as a last resort by mercantilist nations seeking to correct an adverse trade balance – see for example chapter 23 of Keynes' General Theory

- ^ This was against the interests of British workers and industrialists who preferred devaluation, but was in the interests of the financial sector, with government also influenced by a moral argument that they had the duty to restore the value of the pound as many other countries had used it as a reserve currency and trusted GB to maintain its value.

- ^ Ravenhill 2005, pp. 7–22, 177–204

- ^ Rothermund 1996, pp. 6-7

- ^ Ravenhill 2005, pp. 9-12, 177–204

- ^ Mundell 2000, p. 284

- ^ Ahamed 2009, esp chp1; pp. 240, 319-321 ; chp 1-11

- ^ Olivier Accominotti (2011-04-23). "China’s Syndrome: The "dollar trap" in historical perspective". Voxeu.org. http://www.voxeu.org/index.php?q=node/3490. Retrieved 2011-04-27.

- ^ a b Ravenhill 2005, pp. 12-15, 177–204

- ^ Though a few commentators have asserted the Nixon shock was in part an act of currency war, and also the pressure exerted by the US in the months leading up to the Plaza accords.

- ^ Though developing economies were encouraged to pursue export led growth – see Washington Consensus.

- ^ Some had been devaluing from as early as the 1980s, but it was only after 1999 that it became common, with the developing world as a whole running a CA surplus instead of a deficit from 1999. (e.g. see Wolf (2009) p31 – 39)

- ^ There were exceptions to this: Kenneth Rogoff and Maurice Obstfeld began warning that the developing record imbalances was a major issue from as early as 2001, joined by Nouriel Roubini in 2004.

- ^ Reinhart 2010, pp. 208-212

- ^ Neil C. Hughes (2005-07-01). "A Trade War with China". Foreign Affairs. http://www.foreignaffairs.com/articles/60825/neil-c-hughes/a-trade-war-with-china. Retrieved 2010-12-27.

- ^ Michael P. Dooley, David Folkerts-Landau, Peter Garber (September 2003). "An Essay on the Revived Bretton Woods System". National Bureau of Economic Research. http://www.nber.org/papers/w9971.

- ^ Michael P. Dooley, David Folkerts-Landau, Peter Garber (February 2009). "Bretton Woods II Still Defines the International Monetary System". National Bureau of Economic Research. http://ideas.repec.org/p/nbr/nberwo/14731.html.

- ^ Brown 2010, p. 229

- ^ Tim Geithner (2010-10-06). "Treasury Secretary Geithner on IMF, World Bank Annual Meetings". United States Department of the Treasury. http://www.america.gov/st/texttrans-english/2010/October/20101006104251su0.0641247.html. Retrieved 2010-12-27.

- ^ Ted Truman (2009-03-06). "Message for the G20: SDR Are Your Best Answer". Voxeu.org. http://www.voxeu.org/index.php?q=node/3208. Retrieved 2010-12-27.

- ^ Martin Wolf (2010-09-29). "Currencies clash in new age of beggar-my-neighbour". The Financial Times. http://www.ft.com/cms/s/0/9fa5bd4a-cb2e-11df-95c0-00144feab49a.html. Retrieved 2010-09-29.

- ^ Tim Webb (2010-09-28). "World gripped by 'international currency war'". London: The Guardian. http://www.guardian.co.uk/business/2010/sep/28/world-in-international-currency-war-warns-brazil. Retrieved 2010-12-27.

- ^ Jonathan Wheatley in São Paulo and Peter Garnham in London (2010-09-27). "Brazil in 'currency war' alert". The Financial Times. http://www.ft.com/cms/s/0/33ff9624-ca48-11df-a860-00144feab49a.html. Retrieved 2010-09-29.

- ^ a b Alan Beattie (2010-09-27). "Hostilities escalate to hidden currency war". The Financial Times. http://www.ft.com/cms/s/0/8beeb262-ca56-11df-a860-00144feab49a.html. Retrieved 2010-09-29.

- ^ Ambrose Evans-Pritchard (2010-09-29). "Capital controls eyed as global currency wars escalate". London: The Daily Telegraph. http://www.telegraph.co.uk/finance/economics/8031203/Capital-controls-eyed-as-global-currency-wars-escalate.html. Retrieved 2010-09-29.

- ^ West inflates EM 'super bubble'. The Financial Times. 2010-09-29. http://video.ft.com/v/620158442001/West-inflates-EM-super-bubble-. Retrieved 2010-09-29.

- ^ Russell Hotten (2010-10-07). "Currency wars threaten global economic recovery". BBC. http://www.bbc.co.uk/news/business-11484532. Retrieved 2010-11-17.

- ^ Jim O'Neill (economist) (2010-11-21). "Time to end the myth of currency wars". The Financial Times. http://www.ft.com/cms/s/0/ade4f5a6-f5a4-11df-99d6-00144feab49a,dwp_uuid=cc46dd96-caea-11df-bf36-00144feab49a.html#axzz1AkR5v2tu. Retrieved 2011-01-14.

- ^ "Currency Tensions May Be Curbed With IMF Help, Strauss-Kahn Says". Bloomberg L.P.. 2010-10-09. http://www.bloomberg.com/news/2010-10-08/global-currency-tensions-may-be-curbed-with-imf-reports-strauss-kahn-says.html. Retrieved 2010-12-27.

- ^ James Mackintosh (2010-09-27). Deep pockets support China's forex politics. The Financial Times. http://www.ft.com/cms/s/0/19f52ea0-ca7b-11df-a860-00144feab49a.html. Retrieved 2010-10-11.

- ^ "Who’s winning the currency wars?". Reuters. 2010-10-11. http://blogs.reuters.com/columns/2010/10/11/whos-winning-the-currency-wars/. Retrieved 2011-01-09.

- ^ Martin Wolf (2010-10-05). "How to fight the currency wars with stubborn China". The Financial Times. http://www.ft.com/cms/s/0/52b8a8e4-d0b0-11df-8667-00144feabdc0.html. Retrieved 2010-10-06.

- ^ Daniel Gros (2010-09-23). "How to Level the Capital Playing Field in the Game with China". CEPS. http://www.ceps.eu/book/how-level-capital-playing-field. Retrieved 2010-10-06.

- ^ Huang classes the conflicting opinions over the relative valuations of the US dollar and Japanese yen in the 1980s as a currency war, though the label was not widely used for that period.

- ^ Yiping Huang (2010-10-19). "A currency war the US cannot win". Voxeu.org. http://www.voxeu.org/index.php?q=node/5689. Retrieved 2010-12-27.

- ^ Chris Giles, Alan Beattie and Christian Oliver in Seoul (2010-11-12). "G20 shuns US on trade and currencies". The Financial Times. http://www.ft.com/cms/s/0/e65d6a44-ee2e-11df-8b90-00144feab49a,dwp_uuid=60a3db68-b177-11dd-b97a-0000779fd18c.html#axzz15XF7OoVU. Retrieved 2010-11-12.

- ^ EVAN RAMSTAD (2010-11-19). "U.S. Gets Rebuffed At Divided Summit". The Wall Street Journal. http://online.wsj.com/article/SB20001424052748704865704575610761647291510.html. Retrieved 2010-11-13.

- ^ Mohamed A. El-Erian (2010-11-17). "Three Reasons Global Talks Hit Dead End: Mohamed A. El-Erian". Bloomberg L.P.. http://www.bloomberg.com/news/2010-11-17/three-reasons-global-talks-hit-dead-end-mohamed-a-el-erian.html. Retrieved 2010-11-19.

- ^ Michael Forsythe and Julianna Goldman (2010-11-12). "Obama Sharpens Yuan Criticism After G-20 Nations Let China Off the Hook". Bloomberg L.P.. http://www.bloomberg.com/news/2010-11-12/obama-sharpens-yuan-criticism-after-g-20-nations-let-china-off-the-hook.html. Retrieved 2010-11-19.

- ^ Andrew Walker and other BBC staff (2010-11-12). "G20 to tackle US-China currency concerns". BBC. http://www.bbc.co.uk/news/business-11739748. Retrieved 2010-11-17.

- ^ "Currency Wars Retreat as Fighting Inflation Makes Emerging Markets Winners". Bloomberg L.P.. 2011-02-28. http://www.bloomberg.com/news/2011-02-28/currency-wars-retreat-as-fighting-inflation-makes-emerging-markets-winners.html. Retrieved 2010-04-12.

- ^ Steve Johnson (2011-03-06). "Currency war deemned over". The Financial Times. http://www.ft.com/cms/s/0/0eed8270-46ac-11e0-967a-00144feab49a.html#axzz1LqSIEXQ2. Retrieved 2011-05-13.

- ^ Stefan Wagstyl (2011-04-13). "Currency wars fade as inflation hits emerging world". The Financial Times. http://www.ft.com/cms/s/0/35055b74-65ef-11e0-9d40-00144feab49a.html#axzz1JCVmWoxp. Retrieved 2011-04-16.

- ^ Alan Beattie (2011-05-13). "TBig guns muffled as currency wars enter a lull". The Financial Times. http://www.ft.com/cms/s/0/26083d22-7cb4-11e0-994d-00144feabdc0.html#axzz1LqSIEXQ2. Retrieved 2011-05-13.

- ^ Shamim Adam (2011-08-04). "Currency Intervention Revived as Odds of Federal Reserve Easing Escalate". Bloomberg L.P.. http://www.bloomberg.com/news/2010-10-08/global-currency-tensions-may-be-curbed-with-imf-reports-strauss-kahn-says.html. Retrieved 2011-08-04.

- ^ Lindsay Whipp (2011-08-04). "Japan intervenes to force down yen". The Financial Times. http://www.ft.com/cms/s/0/1bae2db4-be40-11e0-bee9-00144feabdc0.html#axzz1TlWEwjSQ. Retrieved 2011-08-04.

- ^ Dilma Rousseff (2011-09-21). "2011 opening Satement by Dilma Rousseff to the UN General Assembly"]. United Nations. http://gadebate.un.org/66/brazil. Retrieved 2011-09-27.

- ^ Dilma Rousseff (2011-09-21). "Time to end the Currency War / Brazil will fight back against the currency manipulators". The Financial Times. http://www.ft.com/cms/s/0/b504bd8c-e37c-11e0-8f47-00144feabdc0.html#axzz1Z2zBYnjG. Retrieved 2011-09-27.

- ^ Alan Beattie (2010-10-11). "G20 currency fist fight rolls into town". The Financial Times. http://www.ft.com/cms/s/0/ca286028-d550-11df-8e86-00144feabdc0.html. Retrieved 2010-10-13.

- ^ Not all economists agree that further expansionary policy would help even if it is co-ordinated, some fear it would cause excess inflation.

- ^ Jonathan Lynn (2010-10-14). "UPDATE 2-Currency war risk threatens investment recovery-UN". Reuters. http://www.reuters.com/article/2010/10/14/currencies-investment-idUSLDE69D0Y320101014. Retrieved 2011-04-21.

- ^ Ambrose Evans-Pritchard (2010-10-10). "Currency wars are necessary if all else fails". London: The Daily Telegraph. http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/8054066/Currency-wars-are-necessary-if-all-else-fails.html. Retrieved 2010-10-13.

- ^ Scott Lanman (2010-11-19). "Bernanke Takes Defense of Monetary Stimulus Abroad, Turns Tables on China". Bloomberg L.P.. http://www.bloomberg.com/news/2010-11-19/bernanke-takes-defense-of-monetary-stimulus-abroad-turns-tables-on-china.html. Retrieved 2010-11-29.

- ^ Neither the book nor its sequel Currency War 2 are available yet in English, but are best sellers in China and South East Asia.

- ^ McGregor, Richard (2007-09-25). "Chinese buy into conspiracy theory". http://www.ft.com/cms/s/70f2a23c-6b83-11dc-863b-0000779fd2ac,Authorised=false.html?_i_location=http%3A%2F%2Fwww.ft.com%2Fcms%2Fs%2F0%2F70f2a23c-6b83-11dc-863b-0000779fd2ac.html%3Fnclick_check%3D1&_i_referer=http%3A%2F%2Fen.wikipedia.org%2Fw%2Findex.php%3Ftitle%3DCurrency_wars%26rcid%3D288293260%26redirect%3Dno&nclick_check=1. Retrieved 2009-03-29.

- ^ John Cooley (2008). Currency Wars. Constable. ISBN 978-1845293697.

- ^ Jim Rickards (2011). Currency Wars: The Making of the Next Global Crisis. Portfolio/Penguin. ISBN 978-1591844495.

- ^ http://www.publishersweekly.com/9781591844495 Review of Currency Wars, Publisher's Weekly. 10/24/2011

- ^ http://www.kirkusreviews.com/book-reviews/james-rickards/currency-wars-next-global-crisis/ Kirkus Reviews: Currency Wars: The Making of the Next Global Crisis, October 15, 2011.

- ^ Shigru Akita and Nicholas J. White (2009). The International Order of Asia in the 1930s and 1950s. Ashgate. pp. 284. ISBN 0754653412.

References

- Liaquat Ahamed (2009). Lords of Finance. WindMill Books. ISBN 9780099493082.

- Gordon Brown (2010). Beyond the Crash. Simon & Schuster. ISBN 9780857202857.

- Michael C. Burda and Charles Wyplosz (2005). Macroeconomics: A European Text , 4th edition. Oxford University Press. ISBN 0199264961.

- Richard N. Cooper (1971). Currency devaluation in developing countries. Princeton University Press.

- Jonathan Kirshner, ed (2002). Monetary Orders: Ambiguous Economics, Ubiquitous Politics. Cornell University Press. ISBN 0801488400.

- Robert A. Mundell and Armand Clesse (2000). The Euro as a stabilizer in the international economic. Springer. ISBN 0792377559.

- James R Owen (2005). Currency devaluation and emerging economy export demand. Ashgate Publishing. ISBN 0754639630.

- John Ravenhill (editor) , Eirc Helleiner , Louis W Pauly , et al (2005). Global Political Economy. Oxford University Press. ISBN 0199265844.

- Carmen Reinhart and Kenneth Rogoff (2010). This Time Is Different: Eight Centuries of Financial Folly. Princeton University Press. ISBN 0199265844.

- Dietmar Rothermund (1996). The Global impact of the Great Depression 1929-1939. Routledge. ISBN 0415118190.

- John Sloman (2004). Economics. Prentice Hall. ISBN 0745013333.

- Paul Wilmott (2007). Paul Wilmott Introduces Quantitative Finance. Wiley. ISBN 0470319585.

- Martin Wolf (2009). Fixing Global Finance. Yale University Press. ISBN 0300142773.

External links

- Global economy: Going head to head article showing various international perspectives (Financial Times, Oct 2010)

- Data visualization from OECD, to see how imbalances have developed since 1990, select 'Current account imbalances' on the stories tab, then move the date slider. ( OECD 2010 )

- Why China's exchange rate is a red herring alternative view by the chairman of Intelligence Capital, Eswar Prasad, suggesting those advocating for China to appreciate are misguided (VoxEU, April 2010).

- Q. What is a 'currency war'? – view from a journalist in Korea, the hosts of the Nov 2010 G20 summit. (Korea Joongang, Oct 2010)

- Brazil's Currency wars – a 'real' problem – introductory article from a South American magazine (SoundsandColours.com, Oct 2010)

- What's the currency war about? introductory article from the BBC (Oct 2010)

Wikimedia Foundation. 2010.