- Stamp Act 1765

-

Duties in American Colonies Act 1765

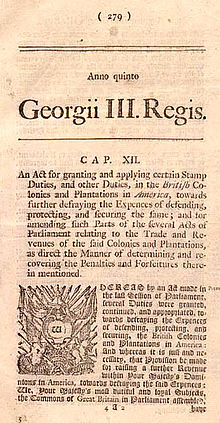

Parliament of Great BritainLong title An act for granting and applying certain stamp duties, and other duties, in the British colonies and plantations in America, towards further defraying the expences of defending, protecting, and securing the same; and for amending such parts of the several acts of parliament relating to the trade and revenues of the said colonies and plantations, as direct the manner of determining and recovering the penalties and forfeitures therein mentioned. Statute book chapter 5 George III, c. 12 Introduced by The Rt. Hon. George Grenville, MP

Prime Minister, Chancellor of the Exchequer & Leader of the House of CommonsTerritorial extent Dates Royal Assent 22 March 1765 Commencement 1 November 1765 Repeal date 17 March 1766 Other legislation Related legislation Declaratory Act Repealing legislation Act Repealing the Stamp Act 1766 Status: Repealed  American newspapers reacted to the Stamp Act with anger and predictions of the demise of journalism.

American newspapers reacted to the Stamp Act with anger and predictions of the demise of journalism.The Stamp Act of 1765 (short title Duties in American Colonies Act 1765; 5 George III, c. 12) was a direct tax imposed by the British Parliament specifically on the colonies of British America. The act required that many printed materials in the colonies be produced on stamped paper produced in London, carrying an embossed revenue stamp.[1][2] These printed materials were legal documents, magazines, newspapers and many other types of paper used throughout the colonies. Like previous taxes, the stamp tax had to be paid in valid British currency, not in colonial paper money.[3] The purpose of the tax was to help pay for troops stationed in North America after the British victory in the Seven Years' War. The British government felt that the colonies were the primary beneficiaries of this military presence, and should pay at least a portion of the expense.

The Stamp Act met great resistance in the colonies. The colonies sent no representatives to Parliament, and therefore had no influence over what taxes were raised, how they were levied, or how they would be spent. Many colonists considered it a violation of their rights as Englishmen to be taxed without their consent—consent that only the colonial legislatures could grant. Colonial assemblies sent petitions and protests. The Stamp Act Congress held in New York City, reflecting the first significant joint colonial response to any British measure, also petitioned Parliament and the King. Local protest groups, led by colonial merchants and landowners, established connections through correspondence that created a loose coalition that extended from New England to Georgia. Protests and demonstrations initiated by the Sons of Liberty often turned violent and destructive as the masses became involved. Very soon all stamp tax distributors were intimidated into resigning their commissions, and the tax was never effectively collected.[4]

Opposition to the Stamp Act was not limited to the colonies. British merchants and manufacturers, whose exports to the colonies were threatened by colonial economic problems exacerbated by the tax, also pressured Parliament. The Act was repealed on March 18, 1766 as a matter of expedience, but Parliament affirmed its power to legislate for the colonies “in all cases whatsoever” by also passing the Declaratory Act. This incident increased the colonists' concerns about the intent of the British Parliament that helped the growing movement that became the American Revolution.[5][6]

Contents

Background

The British victory in the Seven Years' War (1756–1763), known in British America as the French and Indian War, had been won only at a great financial cost. During the war, the British national debt nearly doubled, rising from £72,000,000 in 1755 (equal to £8,918,706,522 today) to almost £130,000,000 by 1764, equal to £15,002,493,671 today.[7] Post-war expenses were expected to remain high because the Bute ministry decided in early 1763 to keep ten thousand British regular soldiers in the American colonies, which would cost about £225,000 per year, equal to £28,759,937 today.[8] The primary reason for retaining such a large force was that demobilizing the army would put 1,500 officers, many of whom were well-connected in Parliament, out of work.[9] This made it politically prudent to retain a large peacetime establishment, but because Britons were averse to maintaining a standing army at home, it was necessary to garrison the troops elsewhere.[10]

Stationing most of the army in North America made strategic sense because Great Britain had acquired the vast territory of New France in the 1763 peace treaty, and troops would be needed to maintain control of the new empire. The outbreak in May 1763 of Pontiac's Rebellion, an American Indian uprising against Anglo-American occupation and expansion, reinforced the logic of this decision.[11] Some older accounts claimed that Pontiac's Rebellion prompted the decision to garrison 10,000 troops in North America, but the Bute ministry had already made the decision before Pontiac's uprising.[12]

The Bute ministry decided to station troops in North America, but it was George Grenville—who became prime minister in April 1763—who had to find a way to pay for this large peacetime army. Raising taxes in Britain was out of the question, since there had been virulent protests in England against the Bute ministry's 1763 cider tax, with Bute being hanged in effigy.[13] The Grenville ministry therefore decided that Parliament would raise this revenue by taxing the American colonists. This was something new: Parliament had previously passed measures to regulate trade in the colonies, but it had never before directly taxed the colonies to raise revenue.[14]

Politicians in London had always expected American colonists to contribute to the cost of their own defense. So long as a French threat existed, there was little trouble convincing colonial legislatures to provide assistance. Such help was normally provided through the raising of colonial militias, which were funded by taxes raised by colonial legislatures. Also, the legislatures were sometimes willing to help maintain regular British units defending the colonies. So long as this sort of help was forthcoming there was little reason for the British Parliament to impose its own taxes on the colonists. But after the peace of 1763, however, colonial militias were quickly stood down. Militia officers, tired of the disdain shown to them by regular British officers and frustrated by the near-impossibility of obtaining regular British commissions, were unwilling to remain in service once the war was over. Colonial legislators were unwilling to maintain militias bereft of qualified officers in the absence of an obvious military threat and balked at requests to help maintain regular British troops since they disputed the need for their presence (at least in terms of the numbers stationed). This caused politicians in London to increasingly believe the colonists were shirking their duty to help pay for the cost of colonial defense.[citation needed]

The first tax in Grenville's program to raise a revenue in America was the Sugar Act of 1764, which was a modification of the Molasses Act of 1733. The Molasses Act had imposed a tax of 6 pence per gallon (equal to £3.75 today) on foreign molasses imported into British colonies. The purpose of the Molasses Act was not to actually raise revenue, but instead to make foreign molasses so expensive that it effectively gave a monopoly to molasses imported from the British West Indies.[15] It did not work: colonial merchants avoided the tax by smuggling or, more often, bribing customs officials.[16] The Sugar Act reduced the tax to 3 pence per gallon (equal to £1.44 today) with the hope that the lower rate would increase compliance and thus increase the amount of tax collected.[17] The act also taxed additional imports and included measures to make the customs service more effective.[18]

American colonists initially objected to the Sugar Act for economic reasons, but before long they recognized that there were constitutional issues involved.[19] The British Constitution guaranteed that British subjects could not be taxed without their consent, which came in the form of representation in Parliament. The colonists elected no members of Parliament, and so for Parliament to tax them was seen as a violation of the British Constitution. There was little time to raise this issue in response to the Sugar Act, but it came to be a major objection to the Stamp Act the following year.

British decision-making

Parliament announced in April 1764 when the Sugar Act was passed that they would also consider a stamp tax in the colonies.[20] Although opposition to this possible tax from the colonies was soon forthcoming, there was little expectation in Britain, either by members of Parliament or American agents in Great Britain such as Benjamin Franklin, of the intensity of the protest that the tax would generate.[21]

Stamp acts had been a very successful method of taxation within Great Britain. It generated over one hundred thousand pounds in tax revenue with very little in collection expenses. By requiring an official stamp on most legal documents, the system was almost self-regulating – a document without the required stamp would be null and void under British law. Imposition of such a tax on the colonies had been considered twice before the Seven Years' War and once again in 1761. Grenville had actually been presented with drafts of colonial stamp acts in September and October 1763, but the proposals lacked the specific knowledge of colonial affairs to describe adequately the documents subject to the stamp. At the time of the passage of the Sugar Act in April 1764, Grenville made it clear that the right to tax the colonies was not in question, and that additional taxes, including a stamp tax, might follow.[22]

The Glorious Revolution had established the principle of parliamentary supremacy. Control of colonial trade and manufactures extended this principle across the ocean. Although this belief had never been tested on the issue of colonial taxation, the British assumed that the interests of the thirteen colonies were too disparate to make joint colonial action against such a tax likely – an assumption that had its genesis in the failure of the Albany Conference in 1754. By the end of December 1764 the arrival from the colonies of pamphlets and petitions protesting both the Sugar Act and the proposed stamp tax provided the first warnings of serious colonial opposition.[23]

For Grenville, the first issue was the amount of the tax. Soon after his announcement of the possibility of a tax, he had told American agents that he was not opposed to the Americans suggesting an alternative way of raising the money themselves. However the only other alternative would be to requisition each colony and allow them to determine how to raise their share. This had never worked before, even during the French and Indian War, and there was no political mechanism in place that would have ensured the success of such cooperation. On February 2, 1765 Grenville met with Benjamin Franklin, Jared Ingersoll from Philadelphia, Richard Jackson the agent for Connecticut, and Charles Garth the agent for South Carolina (Jackson and Garth were also members of Parliament) to discuss the tax. These colonial representatives had no specific alternative to present; they simply suggested that the determination be left to the colonies. Grenville replied that he wanted to raise the money "by means the most easy and least objectionable to the Colonies" and Thomas Whately, who had drafted the Stamp Act, said the delay in implementation had been "out of Tenderness to the colonies" and the tax was judged as "the easiest, the most equal and the most certain."[24]

The debate in Parliament began soon after this meeting. Petitions submitted by the colonies were officially ignored by Parliament. In the debate Charles Townshend said, "...and now will these Americans, children planted by our care, nourished up by our Indulgence until they are grown to a degree of strength and opulence, and protected by our arms, will they grudge to contribute their mite to relieve us from heavy weight of the burden which we lie under?"[25] This led to Colonel Isaac Barré’s response:

They planted by your care? No! Your oppression planted ‘em in America. They fled from your tyranny to a then uncultivated and unhospitable country where they exposed themselves to almost all the hardships to which human nature is liable, and among others to the cruelties of a savage foe, the most subtle, and I take upon me to say, the most formidable of any people upon the face of God’s earth. …They nourished by your indulgence? They grew by your neglect of ‘em. As soon as you began to care about ‘em, that care was exercised in sending persons to rule over 'em, in one department and another, who were perhaps the deputies of deputies to some member of this house, sent to spy out their liberty, to misrepresent their actions and to prey upon 'em; men whose behaviour on many occasions has caused the blood of those sons of liberty to recoil within them … .

They protected by your arms? They have nobly taken up arms in your defence, have exerted a valour amidst their constant and laborious industry for the defence of a country whose frontier while drenched in blood, its interior parts have yielded all its little savings to your emolument. …The people I believe are as truly loyal as any subjects the king has, but a people jealous of their liberties and who will vindicate them if ever they should be violated; but the subject is too delicate and I will say no more."[26]Details of tax

The Stamp Act was passed by Parliament on March 22, 1765 with an effective date of November 1, 1765. It passed 205-49 in the House of Commons and unanimously in the House of Lords.[27] Historians Edmund and Helen Morgan describe the specifics of the tax:

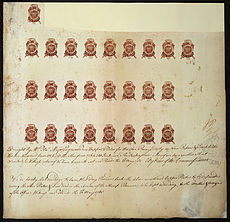

The highest tax, £10, was placed … on attorney licenses. Other papers relating to court proceedings were taxed in amounts varying from 3d. to 10s. Land grants under a hundred acres were taxed 1s. 6d., between 100 and 200 acres 2s., and from 200 to 320 acres 2s. 6d., with an additional 2s 6d. for every additional 320 acres (1.3 km2). Cards were taxed a shilling a pack, dice ten shillings, and newspapers and pamphlets at the rate of a penny for a single sheet and a shilling for every sheet in pamphlets or papers totaling more than one sheet and fewer than six sheets in octavo, fewer than twelve in quarto, or fewer than twenty in folio (in other words, the tax on pamphlets grew in proportion to their size but ceased altogether if they became large enough to qualify as a book).[28]The high taxes on lawyers and college students were designed to limit the growth of a professional class in the colonies.[29]The stamps had to be purchased with sterling, which was scarce, not in colonial currency. So as not to drain currency out of the colonies the revenues were to all be expended in America, especially for supplies and salaries of the new units of British Army units who would be stationed there.[30]

Two features of the Act involving the courts attracted special attention. The tax on court documents specifically included courts "exercising ecclesiastical jurisdiction." These type of courts did not currently exist in the colonies and no bishops, who would preside over the courts, were currently assigned to the colonies. Many colonists or their ancestors had fled England specifically to escape the influence and power of such state-sanctioned religious institutions, and they feared this was the first step to reinstating the old ways in the colonies. Some Anglicans in the northern colonies were already openly advocating the appointment of such bishops, but they were opposed by both southern Anglicans and the non-Anglicans who made up the majority in the northern colonies.[31]

The Act also, following the example established by the Sugar Act, allowed admiralty courts to have jurisdiction for trying violators. However admiralty courts had traditionally been limited to cases involved with the high seas . While the Sugar Act seemed to fall within this precedent, the Stamp Act did not, and the colonists saw this as a further attempt to replace their local courts with courts controlled by England.[32]

Colonial opposition

Political responses

Grenville started appointing Stamp Distributors almost immediately after the Act passed Parliament. Applicants were not hard to come by because of the anticipated income that the positions promised, and he appointed Americans in each of the thirteen colonies. Benjamin Franklin even suggested the appointment of John Hughes as the agent for Pennsylvania, indicating that even Franklin was not aware of the turmoil and impact on American-British relations that the tax was going to generate or that these distributors would become the focus of colonial resistance.[33]

Debate in the colonies over the Stamp Act had actually begun in the spring of 1764 when Parliament passed a resolution that contained the assertion, "That, towards further defraying the said Expences, it may be proper to charge certain Stamp Duties in the said Colonies and Plantations." Both the Sugar Act and the proposed Stamp Act were designed principally to raise revenue from the colonists. The Sugar Act was to a large extent a continuation of past legislation related primarily to the regulation of trade (termed an external tax), but its stated purpose to collect revenue directly from the colonists for a specific purpose was entirely new. The novelty of the Stamp Act was that it was the first internal tax (a tax based entirely on activities within the colonies) levied directly on the colonies by Parliament. Because of its potential wide application to the colonial economy, the Stamp Act was judged by the colonists to be the most dangerous.[34]

The theoretical issue that would soon hold center stage was the matter of taxation without representation. Benjamin Franklin had raised this as far back as 1754 at the Albany Congress when he wrote, "That it is suppos’d an undoubted Right of Englishmen not to be taxed but by their own Consent given thro’ their Representatives. That the Colonies have no Representatives in Parliament."[35] The counter to this argument was the theory of virtual representation. Thomas Whately enunciated this theory in a pamphlet that readily acknowledged that there could be no taxation without consent, but the facts were that at least 75% of British adult males were not represented in Parliament because of property qualifications or other factors. Since members of Parliament were bound to represent the interests of all British citizens and subjects, colonists, like those disenfranchised subjects in the British Isles, were the recipients of virtual representation in Parliament.[36] This theory, however, ignored a crucial difference between the unrepresented in Britain and the colonists. The colonists enjoyed actual representation in their own legislative assemblies, and the issue was whether these legislatures, rather than Parliament, were in fact the sole recipients of the colonists consent with regard to taxation.[37]

In May 1764, Samuel Adams of Boston drafted the following that stated the common American position:

For if our Trade may be taxed why not our Lands? Why not the Produce of our Lands & every thing we possess or make use of? This we apprehend annihilates our Charter Right to govern & tax ourselves – It strikes our British Privileges, which as we have never forfeited them, we hold in common with our Fellow Subjects who are Natives of Britain: If Taxes are laid upon us in any shape without our having a legal Representation where they are laid, are we not reduced from the Character of free Subjects to the miserable State of tributary Slaves.[38]Massachusetts appointed a five member Committee of Correspondence in June 1764 to coordinate action and exchange information regarding the Sugar Act, and in October 1764 Rhode Island formed a similar committee. This attempt at unified action represented a significant step forward in colonial unity and cooperation. The Virginia House of Burgesses in December 1764 sent a protest of the taxes to London, arguing that they did not have the specie required to pay the tax.[39] Massachusetts, New York, New Jersey, Rhode Island, and Connecticut also sent protest to England in 1764. While the content of the messages varied, they all emphasized that taxation of the colonies without colonial assent was a violation of their rights. By the end of 1765, all of the colonies except Georgia and North Carolina had sent some sort of protest passed by colonial legislative assemblies.[40]

The Virginia House of Burgesses reconvened in early May 1765 after news of the passage of the Act was received. By the end of May it appeared they would not consider the tax and many legislators, including George Washington, went home. Only 30 out of 116 Burgesses remained, but one of those remaining was Patrick Henry who was attending his first session. Henry led the opposition to the Stamp Act and his resolutions, proposed May 30, 1765, were passed in the form of the Virginia Resolves.[41] The Resolves stated:

Resolved, That the first Adventurers and Settlers of this his majesty's colony and Dominion of Virginia brought with them, and transmitted to their Posterity, and all other his Majesty's subjects since inhabiting in this his Majesty's said Colony, all the Liberties, privileges, Franchises, and Immunities that have at any Time been held, enjoyed, and possessed, by the People of Great Britain.Resolved, That by the two royal Charters, granted by King James the First, the Colonists aforesaid are declared entitled to all Liberties, Privileges, and Immunities of Denizens and natural Subjects, to all Intents and Purposes, as if they had been abiding and born within the Realm of England.

Resolved, That the Taxation of the People by themselves, or by Persons chosen by themselves to represent them, who could only know what Taxes the People are able to bear, or the easiest method of raising them, and must themselves be affected by every Tax laid on the People, is the only Security against a burdensome Taxation, and the distinguishing characteristick of British Freedom, without which the ancient Constitution cannot exist.

Resolved, That his majesty's liege people of this his most ancient and loyal Colony have without interruption enjoyed the inestimable Right of being governed by such Laws, respecting their internal Polity and Taxation, as are derived from their own Consent, with the Approbation of their Sovereign, or his Substitute; and that the same hath never been forfeited or yielded up, but hath been constantly recognized by the King and People of Great Britain.[42]On June 6, 1765 the Massachusetts Lower House proposed a meeting for the 1st Tuesday of October in New York City:

That it is highly expedient there should be a Meeting as soon as may be, of Committees from the Houses of Representatives or Burgesses in the several Colonies on this Continent to consult together on the present Circumstances of the Colonies, and the difficulties to which they are and must be reduced by the operation of the late Acts of Parliament for levying Duties and Taxes on the Colonies, and to consider of a general and humble Address to his Majesty and the Parliament to implore Relief.[43]There was no attempt to keep this meeting a secret; Massachusetts promptly notified its agent in England, a member of Parliament, of the proposed meeting.[44]

Protests in the streets

While the colonial legislatures were acting, the ordinary citizens of the colonies were also voicing their concerns outside of this formal political process. Historian Gary B. Nash wrote:

Whether stimulated externally or ignited internally, ferment during the years from 1761 to 1766 changed the dynamics of social and political relations in the colonies and set in motion currents of reformist sentiment with the force of a mountain wind. Critical to this half decade was the colonial response to England’s Stamp Act, more the reaction of common colonists than that of their presumed leaders. …[45] Both loyal supporters of English authority and well-established colonial protest leaders underestimated the self-activating capacity of ordinary colonists. By the end of 1765 … people in the streets had astounded, dismayed, and frightened their social superiors.[46]Massachusetts

Early street protests were most notable in Boston. On August 14, 1765 Andrew Oliver, distributor of stamps for Massachusetts, was hung in effigy "from a giant elm tree at the crossing of Essex and Orange Streets in the city’s South End." Also hung was a Jack boot painted green on the bottom ("a Green-ville sole") – a pun on both Grenville and the Earl of Bute, the two persons most blamed by the colonists. The sheriff, Stephen Greenleaf, was ordered by Lieutenant Governor Thomas Hutchinson to take the effigy down, but was opposed by a large crowd. All day the crowd detoured merchants on Orange Street to have their goods symbolically stamped under the elm (the elm tree later became known as the "Liberty Tree"). At night, a crowd, led by Ebenezer MacIntosh, a Seven Years’ War veteran and current shoemaker, cut down the mock Oliver and took it in a funeral procession to the Town House where the legislature met. From there they went to Oliver’s office, tore it down, symbolically stamped the timbers, and took the effigy to Oliver’s home at the foot of Fort Hill where they beheaded and burned the effigy along with Oliver’s stable house and coach and chaise. Greenleaf and Hutchinson were stoned when they tried to stop the mob, which then looted and destroyed the contents of Oliver’s house. Oliver asked to be relieved of his duties the next day.[47] This resignation, however, was not enough. Oliver was ultimately forced by MacIntosh to be paraded through the streets and publicly resign under the Liberty Tree.[48]

As news for the reasons of Andrew Oliver’s resignation spread, violence and threats of aggressive acts increased throughout the colonies as did organized groups of resistance. Throughout the colonies, peasants and middle class members of society formed the foundation for these groups of resistance and soon called themselves the Sons of Liberty. These colonial groups of resistance burned effigies of royal officials, forced Stamp Act collectors to resign and were able to get businessmen and judges to go about without using the proper stamps demanded by Parliament.[49]

On August 26, MacIntosh led an attack on Hutchinson’s house. The mob evicted the family, destroyed the furniture, tore down the interior walls, and emptied the wine cellar. Hutchinson, who had been in public office for three decades estimated his loss at 2,218 pounds (in today’s money, at nearly $250,000). Nash concludes that this attack was more than just a reaction to the Stamp Act:

But it is clear that the crowd was giving vent to years of resentment at the accumulation of wealth and power by the haughty prerogative faction led by Hutchinson. Behind every swing of the ax and every hurled stone, behind every shattered crystal goblet and splintered mahogany chair, lay the fury of a plain Bostonian who had read or heard the repeated references to impoverished people as "rable" and to Boston’s popular caucus, led by Samuel Adams, as a "herd of fools, tools, and synchophants."[50]Governor Francis Bernard offered a 300 pound reward for information on the leaders of the mob, but no information was forthcoming. MacIntosh and several others were arrested, but were freed either by pressure from the merchants or released by mob action.[51]

The street demonstrations originated from the leadership of respectable public leaders such as James Otis who commanded the Boston Gazette and Samuel Adams of the "Loyal Nine" of the Boston Caucus, an organization of Boston merchants. They made efforts to control the folks below them on the economic and social scale, but they were often unsuccessful in maintaining a delicate balance between mass demonstrations and riots. These men needed the support of the working class, but also had to establish the legitimacy of their actions to have their protests to England taken seriously.[52] The Loyal Nine, in the autumn, was more of a social club with political interests than anything else. Only in December 1765 did they begin issuing statements as the Sons of Liberty.[53]

Rhode Island

In 1765, Martin Howard was appointed by the Crown, jointly with Dr. Moffatt and Augustus Johnson, stamp masters for Rhode Island.

The street violence spread. In Newport, Rhode Island, on August 27, a crowd built a gallows near the Town House where they carried effigies of Augustus Johnson, the Rhode Island stamp distributor and two other conservative local figures, Dr. Thomas Moffat and lawyer Martin Howard The crowd was originally led by three merchants, William Ellery, Samuel Vernon, and Robert Crook, but they soon lost control. That night the crowd, led by a poor man, John Weber, attacked the houses of Moffat and Howard – destroying walls, fences, art, furniture and wine. When Weber was arrested, the local Sons of Liberty, publicly opposed to violence, refused at first to support him until they were persuaded to come to his assistance when retaliation was threatened against their own homes. Weber was released and faded into obscurity.[54]

Howard became the only prominent American to publicly support the Stamp Act in his pamphlet "A Colonist's Defence of Taxation' (1765). After the riots Howard had to leave the colony but was rewarded by the Crown with an appointment as Chief Justice of North Carolina at a salary of ₤1000.[55]

New York

In New York, James McEvers resigned his distributorship four days after the attack on Hutchinson’s house. The stamps for several of the northern colonies arrived in New York Harbor on October 24. Placards appeared throughout the city warning , "the first man that either distributes or makes use of stamped paper let him take care of his house, person, and effects." New York merchants met on October 31 and agreed not to sell any English goods until the Act was repealed. Crowds of people, uncontrolled by the local leaders, took to the streets for four days of demonstrations, culminating in an attack by two thousand people on Governor Cadwallader Colden’s home and the burning of two sleighs and a coach. Unrest in New York City continued through the end of the year, and the Sons of Liberty had difficulty in controlling them.[56]

Other Colonies

The Stamp Act angered and united the American people like never before. It inspired both political and constitutional forms of literature throughout the colonies, strengthened the colonial political perception and involvement, and created new forms of organized resistance. These organized groups of resistance quickly learned that they could force royal officials to resign by using violent measures and threats.[57]

Other popular demonstrations occurred in Portsmouth, New Hampshire; Annapolis, Maryland; Wilmington and New Bern, North Carolina; and Charleston, South Carolina. In Philadelphia, Pennsylvania, demonstrations were subdued but even targeted Benjamin Franklin's home, although it was not vandalized.[58] By November 16, twelve of the stamp distributors had resigned. The Georgia distributor did not arrive in America until January 1766, but his first and only official action was to resign.[59]

Sons of Liberty

It was during this time of street demonstrations that locally organized groups started to merge into an inter-colonial organization of a type not previously seen in the colonies. Although the term "sons of liberty" had been used in a generic fashion well before 1765, it was only around February 1766 that its influence as an organized group, using the formal name "Sons of Liberty", extended throughout the colonies, leading to the development of a pattern for future resistance to the British that would carry the colonies towards 1776.[60] Historian John C. Miller noted that the name was adopted as a result of Barre's use of the term in his February 1765 speech.[61]

The organization spread month by month after independent starts in several different colonies. By November 6, a committee was set up in New York to correspond with other colonies, and in December an alliance was formed between groups in New York and Connecticut. In January, there was established a correspondence link between Boston and Manhattan, and by March, Providence had initiated connections with New York, New Hampshire, and Newport, Rhode Island. Also, by March, Sons of Liberty organizations had been established in New Jersey, Maryland, and Norfolk, Virginia, and a local group established in North Carolina was attracting interest in South Carolina and Georgia.[62]

While the officers and leaders of the Sons of Liberty “were drawn almost entirely from the middle and upper ranks of colonial society,” they recognized the need to expand their power base to include "the whole of political society, involving all of its social or economic subdivisions." To do this, the Sons of Liberty relied on large public demonstrations to expand their base.[63] They learned early on that controlling such crowds was problematical, although they strived to control "the possible violence of extra-legal gatherings." While the organization professed its loyalty to both local and British established government, possible military action as a defensive measure was always part of their considerations. Throughout the Stamp Act Crisis, the Sons of Liberty professed continued loyalty to the King because they maintained a "fundamental confidence" in the expectation that Parliament would do the right thing and repeal the tax.[64]

Stamp Act Congress

The first Stamp Act Congress was held in New York in October 1765. Twenty-seven delegates from nine colonies were the members of the Congress and their responsibility was to draft a set of formal petitions stating why Parliament had no right to tax them.[65] Historian John C. Miller noted:

The composition of this Stamp Act Congress ought to have been convincing proof to the British government that resistance to parliamentary taxation was by no means confined to the riffraff of colonial seaports. The members were some of the most distinguished men in the colonies.[66]The youngest was 26 year old John Rutledge of South Carolina, and the oldest was 65 year old Hendrick Fisher of New Jersey. Ten of the delegates were lawyers, ten were merchants, and seven were planters or land owning farmers; all had served in some type of elective office and all but three were born in the colonies. Four would die before the colonies declared independence, and four would sign the Declaration of Independence; nine would attend the first and second Continental Congresses, and three would be loyalists during the Revolution.[67] New Hampshire declined to send delegates, and North Carolina, Georgia, and Virginia were not represented because their governors did not call their legislatures into session to decide whether to attend. Eventually, every colony affirmed the decisions of the Congress.[68] Six of the nine colonies represented at the Congress agreed to sign the petitions to the king and parliament produced by the Congress. The delegations from New York, Connecticut, and South Carolina were prohibited from signing any documents without first receiving approval from the colonial assemblies that had appointed them.[69]

Massachusetts governor Francis Bernard believed that his colony’s delegates to the Congress would be supportive of Parliament. Timothy Ruggles was especially Bernard’s man and was elected chairman of the Congress. Ruggles' instructions from Bernard were to "recommend submission to the Stamp Act until Parliament could be persuaded to repeal it."[70] Many delegates felt that a final resolution of the Stamp Act would actually bring Britain and the colonies closer together. Robert Livingston of New York, stressing the importance of removing the Stamp Act from the public debate, wrote to his colony’s agent in England, "If I really wished to see America in a state of independence I should desire as one of the most effectual means to that end that the stamp act should be enforced."[71]

The congress met for 12 days, including Sundays. There was no audience at the meetings, and no information about the deliberations was released during or after the congress.[72] Their final product was called "The Declaration of Rights and Grievances", and was drawn up by delegate John Dickinson of Pennsylvania. This Declaration raised fourteen points of colonial protest. In addition protesting to the Stamp Act issue, it asserted that colonists possessed all the rights of Englishmen, and that since they had no voting rights over Parliament, Parliament could not represent the colonists. Only the colonial assemblies had a right to tax the colonies. They also asserted that trial by jury was a right that the recent Admiralty Courts abused.[73]

It is significant that in addition to simply arguing for their rights as Englishmen, they also asserted that they had certain natural rights solely because they were human beings. Resolution 3 stated, "That it is inseparably essential to the freedom of a people, and the undoubted right of Englishmen, that no taxes be imposed on them, but with their own consent, given personally, or by their representatives." Both Massachusetts and Pennsylvania in separate resolutions would bring forth the issue even more directly when they referred, respectively, to "the Natural rights of Mankind" and "the common rights of mankind".[74]

Christopher Gadsden of South Carolina had proposed that since the rights of the colonies did not originate with Parliament that the Congress’ petition should go only to the King. This radical proposal went too far for most delegates and was rejected. The "Declaration of Rights and Grievances" was duly sent to the king, and petitions were also sent to both Houses of Parliament.[75]

Repeal

Grenville was replaced as Prime Minister on July 10, 1765, by Lord Rockingham, the first lord of the treasury. News of the mob violence began to reach England in October. At the same time that resistance in America was building and accelerating, conflicting sentiments were taking hold in Britain. Some wanted to strictly enforce the Stamp Act over colonial resistance, wary of the precedent that would be set by backing down.[76]

Others, feeling the economic effects of reduced trade with America after the Sugar Act and an inability to collect debts while the colonial economy suffered, began to lobby for a repeal of the Stamp Act.[77] A significant part of colonial protest had included various non-importation agreements among merchants who recognized that a significant portion of British industry and commerce was dependent on the colonial market. This movement had spread through the colonies with a significant base coming from New York City where 200 merchants had met and agreed to import nothing from England until the Stamp Act was repealed.[78]

When Parliament met in December 1765, it rejected a resolution offered by Grenville, who remained in Parliament, that would have condemned colonial resistance to the enforcement of the Act. Outside of Parliament Rockingham and his secretary and member of Parliament, Edmund Burke, organized London merchants who in turn started a committee of correspondence itself to support repeal of the Stamp Act by urging merchants throughout the country to contact their local representatives in Parliament concerning repeal. When Parliament reconvened on January 14, 1766, the Rockingham ministry formally proposed repeal. Amendments that would have lessened the financial impact on the colonies by allowing colonists to pay the tax in their own script were considered to be too little and too late.[79]

William Pitt, in the Parliamentary debate, stated that everything done by the Grenville ministry with respect to the colonies "has been entirely wrong." He further stated, "It is my opinion that this Kingdom has no right to lay a tax upon the colonies." While Pitt still maintained that "the authority of this kingdom over the colonies, to be sovereign and supreme, in every circumstance of government and legislature whatsoever," he made the distinction that taxes were not part of governing, but were "a voluntary gift and grant of the Commons alone." He rejected the notion of virtual representation, as "the most contemptible idea that ever entered into the head of man."[80]

Grenville responded to Pitt:

Protection and obedience are reciprocal. Great Britain protects America; America is bound to yield obedience. If, not, tell me when the Americans were emancipated? When they want the protection of this kingdom, they are always ready to ask for it. That protection has always been afforded them in the most full and ample manner. The nation has run itself into an immense debt to give them their protection; and now they are called upon to contribute a small share towards the public expence, and expence arising from themselves, they renounce your authority, insult your officers, and break out, I might also say, into open rebellion.[81]Pitt’s response to Grenville included, "I rejoice that America has resisted. Three millions of people, so dead to all the feelings of liberty as voluntarily to submit to be slaves, would have been fit instruments to make slaves of the rest."[82]

Between January 17 and 27, Rockingham shifted the attention from constitutional arguments to economic by presenting petitions from all over the country complaining of the economic repercussions felt throughout the country. On February 7, the House of Commons rejected a resolution, saying it would back the King in enforcing the Act by 274-134. In an attempt to address both the constitutional and the economic issues, Secretary of State Henry Conway introduced the Declaratory Act, which affirmed the right of Parliament to tax the colonies, "...in all cases whatsoever," while admitting the inexpediency of attempting to enforce the Stamp Act. Only Pitt and three or four others voted against it. Other resolutions did pass that condemned the riots and demanded compensation from the colonies for those who suffered losses because of the actions of the mobs.[83]

On February 21, a resolution to repeal the Stamp Act was introduced and passed by a vote of 276-168. The King agreed to the repeal on March 17, 1766.[84]

Later effects

Some aspects of the resistance to the act provided a sort of rehearsal for the resistance to the Townshend Acts of 1767. In the American Revolution a decade later, the Committees of Correspondence reappeared on a more formal basis.[citation needed] The boycott also became more formalized, as the colonies entered into a non-importation agreement in 1774 known as the Continental Association.[citation needed] While the Sons of Liberty faded after the repeal, they were never again entirely absent.[citation needed] The ability of the colonies to act in concert would also reappear in the Continental Congress.

See also

- American Revolution

- Board of Inland Revenue Stamping Department Archive

- British Library Philatelic Collections

- George Grenville

- Revenue stamps of the United States

Notes

- ^ Morgan and Morgan pg. 96-97

- ^ "The Stamp Act of 1765 - A Serendipitous Find" by Hermann Ivester in The Revenue Journal, The Revenue Society, Vol.XX, No.3, December 2009, pp.87-89.

- ^ Wood, S,G. "The American Revolution: A History." Modern Library. 2002, page 24.

- ^ Draper pg. 216-223. Nash pg. 44-56. Maier pg. 76-106

- ^ Middlekauff pg. 111-120. Miller pg. 149-153

- ^ Daniella Garran (2010-07-19). "Steps to the American Revolution" (HTML). Lesson Planet. http://www.lessonplanet.com/article/history/steps-to-the-american-revolution. Retrieved 2010-07-21.

- ^ Morgan and Morgan, Stamp Act Crisis, 21.

- ^ Anderson, Crucible of War, 563; Thomas, British Politics, 38; Middlekauff, Glorious Cause, 55.

- ^ Anderson, Crucible of War, 561; Middlekauff, Glorious Cause, 55.

- ^ Anderson, Crucible of War, 563.

- ^ Morgan and Morgan, Stamp Act Crisis, 22.

- ^ Anderson, Crucible of War, 560. See also Charles S. Grant, "Pontiac's Rebellion and the British Troop Moves of 1763", The Mississippi Valley Historical Review 40, no. 1 (June 1953), 75–88.

- ^ Anderson, Crucible of War, 510–11; Thomas, British Politics, 6; Middlekauff, Glorious Cause, 62.

- ^ Thomas, British Politics, 37.

- ^ Thomas, British Politics, 32.

- ^ Thomas, British Politics, 44.

- ^ Thomas, British Politics, 47–49.

- ^ Anderson, Crucible of War, 547.

- ^ Reid, Authority to Tax, 206.

- ^ Miller pg. 109-113. Morgan and Morgan pg. 75-76. Weslager pg. 50

- ^ Draper 231-233. Middlekauff pg. 77

- ^ Miller pg. 109-113. Morgan and Morgan pg. 75-76. Weslager pg. 50.

- ^ Draper pg. 216, 230-233

- ^ Draper 231-233. Middlekauff pg. 77. Ingersoll would accept a position of stamp distributor for Connecticut despite his opposition. Middlekauff pg. 108

- ^ Middlekauff pg. 78-80

- ^ Middlekauff pg. 79

- ^ Weslager pg. 34

- ^ Morgan and Morgan pg. 96-97.

- ^ David Hackett Fischer, Albion's Seed (1989) p 825

- ^ Morgan and Morgan pg. 96-97. (Weslager pg. 42) also notes that the paper used had to be pre-stamped in England. While most paper came from there anyway, there were “approximately fifty colonial papermakers who operated their own mills” who would suffer from decreased demand for their products.

- ^ Morgan and Morgan pg. 97-98

- ^ Morgan and Morgan pg. 98

- ^ Draper pg. 223. Weslager pg. 51-52. Separate appointments were made for Canada (three), Florida (two), and the West Indies (five)

- ^ Morgan pg. 311-313.

- ^ Draper pg. 216

- ^ Morgan (1956) pg. 19

- ^ Draper pg. 216-217

- ^ Draper pg. 219

- ^ Weslager pg.58-59. Ferling pg 33.

- ^ Morgan pg. 314-315. Draper pg. 223

- ^ Ferling pg. 32-34. Middlekauff pg. 83

- ^ Middlekauff pg. 84. The Resolves were widely reprinted and many versions of them are still seen. Middlekauff used the wording from the journal of the House of Burgesses.

- ^ Weslager pg. 60

- ^ Weslager pg. 65

- ^ Nash pg. 44

- ^ Nash pg. 59

- ^ Nash pg. 45-47

- ^ Nash pg. 53

- ^ Wood, S,G. "The American Revolution: A History." Modern Library. 2002, page 29-30

- ^ Nash pg.48

- ^ Nash pg. 49-50

- ^ Nash pg. 49

- ^ Maier pg. 85

- ^ Nash pg. 50-51

- ^ Wilkins Updike, History of the Episcopal church in Narragansett, Rhode Island (1847) p 221

- ^ Nash pg. 53-55

- ^ Wood, S,G. "The American Revolution: A History." Modern Library. 2002, page 30

- ^ Nash pg. 55-56

- ^ Middlekauff pg. 98

- ^ Maier pg. 76-82. Maier noted that the term "sons of liberty", used in the generic sense, was used as early as the 1750s in some Connecticut documents.

- ^ Miller pg. 130

- ^ Maiers pg. 78-81

- ^ Maier pg. 86-88

- ^ Maier pg. 101-106. Miller pg. 139. Miller wrote, "Had Great Britain attempted to enforce the Stamp Act, there can be little doubt that British troops and embattled Americans would have shed each other’s blood ten years before Lexington. As Benjamin Franklin remarked, a British army would not have found a rebellion in the American colonies in 1765 but it would have made one."

- ^ Wood, S,G. "The American Revolution: A History." Modern Library. 2002, page 29

- ^ Miller pg. 137

- ^ Weslager pg. 108-111

- ^ Miller pg. 137-139. Morgan and Morgan pg. 139

- ^ Weslager pg. 148

- ^ Morgan and Morgan pg. 140-141

- ^ Weslager pg. 109

- ^ Weslager pg. 115. Morgan and Morgan pg. 142

- ^ Morgan and Morgan pg. 145-152. The actual resolutions are available at http://www.ushistory.org/declaration/related/sac65.htm

- ^ Morgan and Morgan pg. 151-152. The authors concluded, "Thus by the fall of 1765 the colonists had clearly laid down the line where they believed that Parliament should stop, and they had drawn that line not merely as Englishmen but as men."

- ^ Morgan and Morgan pg. 147-148

- ^ Middlekauff pg. 111-113

- ^ Middlekauff pg. 111-113. Miller pg. 149-151

- ^ Morgan and Morgan pg.49-50, pg. 331

- ^ Middlekauff pg. 113-114. Miller pg. 153. Miller wrote of the Rockingham ministry, "Of all the Whig factions, the Rockinghams were most benevolent toward the colonies. While they were as determined …as [other factions] to maintain the sovereignty of great Britain , they insisted the Americans must be treated as customers rather than as rebellious rogues who merited a sound whipping."

- ^ Middlekauff pg. 115

- ^ Middlekauff pg. 116

- ^ Middlekauff pg. 116-117

- ^ Middlekauff pg. 117-119

- ^ Middlekauff pg. 120

Bibliography

- Alexander, John K. Samuel Adams: America’s Revolutionary Politician. (2002) ISBN 0-7425-2114-1

- Draper, Theodore. A Struggle For Power:The American Revolution. (1996) ISBN 0-8129-2575-0

- Ferling, John. A Leap in the Dark: The Struggle to Create the American Republic. (2003) ISBN 13: 978-0-19-517600-1

- Findling, John E. and Frank W. Thackeray. Events That Changed America in the Eighteenth Century. (1998) Greenwood Press.

- Maier, Pauline. From Resistance to Revolution: Colonial radicals and the development of American opposition to Britain, 1765-1776. (1991 - original 1972) ISBN 0-393-30825-1

- Middlekauff, Robert. The Glorious Cause: The American Revolution, 1763-1789. (2005) ISBN 13:978 0-19-516247-9

- Miller, John C. Origins of the American Revolution. (1943)

- Morgan, Edmund S. Colonial Ideas of Parliamentary Power 1764-1766. William and Mary Quarterly, Vol. 5, No. 3 (Jul., 1948), pg. 311-341. JSTOR

- Morgan, Edmund S. and Morgan, Helen M. The Stamp Act Crisis:Prologue to Revolution. (1963)

- Nash, Gary B. The Unknown American Revolution: The Unruly Birth of Democracy and the Struggle to Create America. (2005) ISBN 0-670-03420-7

- Reid, John Phillip. Constitutional History of the American Revolution: The Authority to Tax. Madison: University of Wisconsin Press, 1987. ISBN 0-299-11290-X.

- Arthur M. Schlesinger. The Colonial Newspapers and the Stamp Act. The New England Quarterly, Vol. 8, No. 1 (Mar., 1935), pp. 63-83.

- Thomas, Peter D. G. British Politics and the Stamp Act Crisis: The First Phase of the American Revolution, 1763–1767. Oxford: Clarendon Press, 1975. ISBN 0-19-822431-1.

- Weslager, C. A. The Stamp Act Congress. (1976) ISBN 0-87413-111-1

External links

- Text of the 1765 Stamp Act

- Resolves of the Pennsylvania Assembly on the Stamp Act, September 21, 1765

- 1766 Text of the Repeal of the Stamp Act

- Images of the type of stamps referred to in the Act.

British law and the American Revolution Before 1763 Grenville ministry

(1763–1765)Royal Proclamation of 1763 • Sugar Act (1764) • Currency Act (1764) • Quartering Act (1765) • Stamp Act 1765Rockingham ministry

(1765–1766)Chatham and Grafton

ministries (1766–1770)Townshend Acts (1767)North ministry

(1770–1782)Repeal Act (1770) • Tea Act (1773) • Coercive Acts (1774) • Restraining Acts (March & April 1775) • Proclamation of Rebellion (August 1775) • Prohibitory Act (December 1775) • Taxation of Colonies Act 1778Other legal issues  United Kingdom legislation

United Kingdom legislationPre-Parliamentary legislation Acts of Parliament by states preceding

the Kingdom of Great BritainActs of the Parliament of England to 1483 · 1485–1601 · 1603–1641 · Interregnum (1642–1660) · 1660–1699 · 1700–1706

Acts of the Parliament of Scotland

Acts of the Parliament of Ireland to 1700 · 1701–1800Acts of Parliament of the

Kingdom of Great Britain1707–1719 · 1720–1739 · 1740–1759 · 1760–1779 · 1780–1800

Acts of Parliament of the United Kingdom of

Great Britain and Ireland and the United

Kingdom of Great Britain and Northern IrelandChurch of England Measures Legislation of devolved institutions Acts of the Scottish Parliament

Acts and Measures of the Welsh Assembly

Acts of the Northern Ireland Assembly / of the Northern Ireland Parliament

Orders in Council for Northern IrelandSecondary legislation Categories:- Great Britain Acts of Parliament 1765

- 1765 in Great Britain

- 1765 in the Thirteen Colonies

- Acts of the Parliament of Great Britain

- 18th century in economics

- Laws leading to the American Revolution

- Repealed Great Britain Acts of Parliament

- History of taxation

Wikimedia Foundation. 2010.