- Debt relief

-

Debt relief is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations. From antiquity through the 19th century, it refers to domestic debts, in particular agricultural debts and freeing of debt slaves. In the late 20th century, it came to refer primarily to Third World debt, which started exploding with the Latin American debt crisis (Mexico 1982, etc.). In the early 21st century, it is of increased applicability to individuals in developed countries, due to credit bubbles and housing bubbles.

Contents

International debt relief

War reparations

In the mid-20th century, the 1953 Agreement on German External Debts, which substantially reduced German's war reparations, is a notable example of international debt relief. Part of the reasoning was that German's World War I reparations were deeply resented in Germany, and credited internationally as a cause of World War II, and thus debt relief helped reconciliation and peace in Europe.

Third world debt

Debt relief for heavily indebted and underdeveloped developing countries was the subject in the 1990s of a campaign by a broad coalition of development NGOs, Christian organizations and others, under the banner of Jubilee 2000. This campaign, involving, for example, demonstrations at the 1998 G8 meeting in Birmingham, was successful in pushing debt relief onto the agenda of Western governments and international organizations such as the International Monetary Fund and World Bank. The Heavily Indebted Poor Countries (HIPC) initiative was ultimately launched to provide systematic debt relief for the poorest countries, whilst trying to ensure the money would be spent on poverty reduction.

The HIPC programme has been subject to conditionalities similar to those often attached to International Monetary Fund (IMF) and World Bank loans, requiring structural adjustment reforms, sometimes including the privatisation of public utilities, including water and electricity. To qualify for irrevocable debt relief, countries must also maintain macroeconomic stability and implement a Poverty Reduction Strategy satisfactorily for at least one year. Under the goal of reducing inflation, some countries have been pressured to reduce spending in the health and education sectors.

The Multilateral Debt Relief Initiative (MDRI) is an extension of HIPC. The MDRI was agreed following the G8's Gleneagles meeting in July 2005. It offers 100% cancellation of multilateral debts owed by HIPC countries to the World Bank, IMF and African Development Bank.

Arguments against debt relief

Opponents of debt relief argue that it is a blank cheque to governments, and fear savings will not reach the poor in countries plagued by corruption. Others argue that countries will go out and contract further debts, under the belief that these debts will also be forgiven in some future date. They use the money to enhance the wealth and spending ability of the rich, many of whom will spend or invest this money in the rich countries, thus not even creating a trickle-down effect. They argue that the money would be far better spent in specific aid projects that actually help the poor. They further argue that it would be unfair to third-world countries that managed their credit successfully, or do not go into debt in the first place. That is, it actively encourages third-world governments to overspend in order to receive debt relief in the future. Others argue against the conditionalities attached to debt relief. These conditions of structural adjustment have a history, especially in Latin America, of widening the gap between the rich and the poor, as well as increasing economic dependence on the global North.[citation needed]

Personal debt relief

Origins

Debt relief existed in a number of ancient societies:

- Debt forgiveness is mentioned in the Book of Leviticus, in which God councils Moses to forgive debts in certain cases every Jubilee year – at the end of Shmita, the last year of the seven year agricultural cycle or a 49-year cycle, depending on interpretation.

- This same theme was found in an ancient bilingual Hittite-Hurrian text entitled "The Song of Debt Release".[1]

- Debt forgiveness was also found in Ancient Athens, where in the 6th century BCE, the lawmaker Solon instituted a set of laws called seisachtheia, which canceled all debts and retroactively canceled previous debts that had caused slavery and serfdom, freeing debt slaves and debt serfs.

- In addition, the Qur'an (the Muslim scripture) supports debt forgiveness unable to pay as an act of charity and remission of sins for the creditor. The injunction is as follows:

If the debtor is in difficulty, grant him time till it is easy for him to repay. But, if ye remit it by way of charity, that is best for you if ye only knew.Contemporary

Personal debt has become an increasingly large problem in many developed countries in recent years, due to credit bubbles. For instance, it is estimated that the average US household has $19,000 in non-mortgage debt. With such large debt loads, many individuals have difficulty making repayments on debts and are in need of help.

There are many companies who offer debt consolidation services. However, such services may not always be in the best interests of the person involved and may involve taking out a loan secured by a person's home. Marketing materials are designed to persuade customers to take up the company's offer rather than offering a personal best solution for reducing debt. Where debt has become a problem, it is often best to turn to an independent consumer's association for advice before calling debt consolidation companies as consumer's associations often have great experience with such problems and may be able to advise the most effective avenues for debt relief- for the price.

As long as some form of Chapter 7 bankruptcy debt relief exists within American law, the credit card companies must pay attention, and do as much as they can to help their clients repay debts through relatively traditional means (depending upon the service those clients have entered). Even leaving bankruptcy aside, it is in the best interest of credit card companies that their debtors at least feel some motivation to continue repaying their accounts and not simply disappear or view those ever growing balances as untouchable.

Tax treatment

In US tax law, debt forgiven is treated as income, as it reduces a liability, increasing the taxpayer's net worth. In the context of the bursting of the United States housing bubble, the Mortgage Forgiveness Debt Relief Act of 2007 provides that debt forgiven on a primary residence is not treated as income, for debts forgiven in the 3-year period 2007–2009. The Emergency Economic Stabilization Act of 2008 extended this by 3 years to the 6-year period 2007–2012.

Bankruptcy and non-recourse loans

The primary mechanism of debt relief in modern societies is bankruptcy, where a debtor who cannot or chooses not to pay their debts files for bankruptcy and renegotiates their debts, or a creditor initiates this. As part of debt restructuring, the terms of the debt are modified, which may involve the debt owed being reduced. In case the debtor chooses bankruptcy despite being able to service the debt, this is called strategic bankruptcy.

Certain debts can be defaulted on without a general bankruptcy; these are non-recourse loans, most notably mortgages in common law jurisdictions such as the United States. Choosing to default on such a loan despite being able to service it is called strategic default.

Alternatives

Historical

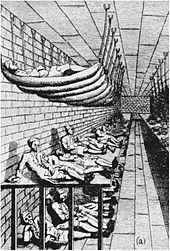

If a debt cannot be or is not repaid, alternatives that were common historically but are now rare include debt bondage – including debt peonage: being bound until the debt is repaid; and debt slavery, when the debt is so great (or labor valued so low) that the debt will never be repaid – and debtors' prison.

Debt slavery can persist across generations, future generations being made to work to pay off debts incurred by past generations. Debt bondage is today considered a form of "modern day slavery" in international law,[2] and banned as such, in Article 1(a) of the United Nations 1956 Supplementary Convention on the Abolition of Slavery. Nevertheless, the practice continues in some nations. In most developed nations, debts cannot be inherited.

Debtors' prison has been largely abolished, but remains in some forms in the US, for example if one fails to make child support payments.

Contemporary

In modern times, the most common alternatives to debt relief in cases where debt cannot be paid are forbearance and debt restructuring. Forbearance meaning that interest payments (possibly including past due ones) are forgiven, so long as payments resume. No reduction of principal occurs, however.

In debt restructuring, an existing debt is replaced with a new debt. This may result in reduction of the principal (debt relief), or may simply change the terms of repayment, for instance by extending the term (replacing a debt repaid over 5 years with one repaid over 10 years), which allows the same principal to be amortized over a longer period, thus allowing smaller payments.

Personal debt that can be repaid from income but is not being repaid may be obtained via garnishment or attachment of earnings, which deduct debt service from wages.

Inflation

Inflation - the reduction in the nominal value of currency - reduces the real value of debts. While lenders take inflation into account when they decide the terms of a loan, unexpected increases in the rate of inflation cause categorical debt relief.

Inflation has been a contentious political issue on this basis, with debasement of currency a form of or alternative to sovereign default, and the free silver in late 19th century America being seen as a conflict between debtor farmers and creditor bankers.

Debt relief in art

Debt relief plays a significant role in some artworks: in the play The Merchant of Venice by William Shakespeare, c. 1598, the heroine pleads for debt relief (forgiveness) on grounds of Christian mercy. In the 1900 novel The Wonderful Wizard of Oz, a primary political interpretation is that it treats free silver, which engenders inflation and hence reduces debts. In the 1999 film Fight Club (but not the novel on which it is based), the climactic event is the destruction of credit card records – dramatized as the destruction of skyscrapers – effecting debt relief.

References

- ^ Harms, William (1996-02-01). "Linking ancient peoples". The University of Chicago Chronicle 15 (10). http://chronicle.uchicago.edu/960201/hittites.shtml. Retrieved 2009-02-26.

- ^ The Bondage of Debt: A Photo Essay, by Shilpi Gupta

See also

- Agreement on German External Debts

- Anti-globalisation movement

- Conditionality

- Debt restructuring

- International development

- International Monetary Fund | World Bank

- Survie NGO activist group against Third World debt

- Odious debt

- Third World debt

- Jubilee USA Network

- Eurodad

Debt Debt instruments Managing debt Bankruptcy · Consolidation · Debt management plan · Debt relief · Debt restructuring · Debt-snowball method · DIP financingDebt collection and evasion Bad debt · Charge-off · Collection agency · Debt bondage · Debt compliance · Debtors' prison · Garnishment · Phantom debt · Strategic default · Tax refund interceptionDebt markets Consumer debt · Corporate debt · Deposit account · Debt buyer · Fixed income · Government debt · Money market · Municipal debt · Securitization · Venture debtDebt in economics Default · Insolvency · Interest · Interest rate Categories:

Wikimedia Foundation. 2010.