- Normal backwardation

-

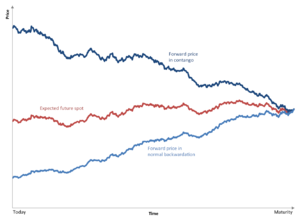

The graph depicts how the price of a single forward contract will behave through time in relation to the expected future price at any point time. A contract in backwardation will increase in value until it equals the spot price of the underlying at maturity. Note that this graph does not show the forward curve (which plots against maturities on the horizontal).

The graph depicts how the price of a single forward contract will behave through time in relation to the expected future price at any point time. A contract in backwardation will increase in value until it equals the spot price of the underlying at maturity. Note that this graph does not show the forward curve (which plots against maturities on the horizontal).

Normal backwardation, also sometimes called backwardation, is the market condition wherein the price of a forward or futures contract is trading below the expected spot price at contract maturity.[1] The resulting futures or forward curve would typically be downward sloping (i.e. "inverted"), since contracts for farther dates would typically trade at even lower prices. (The curves in question plot market prices for various contracts at different maturities—cf. term structure of interest rates)

The opposite market condition to normal backwardation is known as contango.

A backwardation starts when the difference between the forward price and the spot price is less than the cost of carry, or when there can be no delivery arbitrage because the asset is not currently available for purchase.

Futures contract price includes compensation for the risk transferred from the asset holder. This makes actual price on expiry to be lower than futures contract price. Backwardation very seldom arises in money commodities like gold or silver. In the early 1980s, there was a one-day backwardation in silver while some metal was physically moved from COMEX to CBOT warehouses.[citation needed] Gold has historically been positive with exception for momentary backwardations (hours) since gold futures started trading on the Winnipeg Commodity Exchange in 1972.[2]

The term is sometimes applied to forward prices other than those of futures contracts, when analogous price patterns arise. For example, if it costs more to lease silver for 30 days than for 60 days, it might be said that the silver lease rates are "in backwardation".

Contents

Occurrence

This is the case of a convenience yield that is greater than the risk free rate.

It is argued that backwardation is abnormal,[who?] and suggests supply insufficiencies in the corresponding (physical) spot market. However, many commodities markets are frequently in backwardation, especially when the seasonal aspect is taken into consideration, e.g., perishable and/or soft commodities.

In Treatise on Money (1930, chapter 29), economist John Maynard Keynes argued that in commodity markets, backwardation is not an abnormal market situation, but rather arises naturally as "normal backwardation" from the fact that producers of commodities are more prone to hedge their price risk than consumers. The academic dispute on the subject continues to this day.[3]

Examples

Notable examples of backwardation include:

- Copper circa 1990, apparently arising from market manipulation by Yasuo Hamanaka of Sumitomo Corporation in what has come to be called the "Sumitomo copper affair".[citation needed]

- Silver: In 2009 has been in backwardation since late January. This is due to suspected long term price suppression as cited by Ted Butler.[4]

Origin of term: London Stock Exchange

Like contango, the term originated in mid-19th century England, originating from "backward".

In that era on the London Stock Exchange, backwardation was a fee paid by a seller wishing to defer delivering stock they had sold. This fee was paid either to the buyer, or to a third party who lent stock to the seller.

The purpose was normally speculative, allowing short selling. Settlement days were on a fixed schedule (such as fortnightly) and a short seller did not have to deliver stock until the following settlement day, and on that day could "carry over" their position to the next by paying a backwardation fee. This practice was common before 1930, but came to be used less and less, particularly since options were reintroduced in 1958.

The fee here did not indicate a near-term shortage of stock the way backwardation means today, it was more like a "lease rate", the cost of borrowing a stock or commodity for a period of time.

In more recent years, a backwardation in equities quoted on the London Stock Exchange has come to signify the unusual occurrence of an individual equities quote whereby the bid appears to be higher than the offer. This (of course) cannot occur for electronically traded stocks via SETS or SETS MM but only for quote-driven stocks (SEAQ)

London Metal Exchange

The London Metal Exchange market rules allow it to set a limit on backwardation in contracts traded there. At present times, all base metal contracts (excluding LME Minis) are subject to "lending guidance". Therefore, the exchange controls neither the absolute price level directly nor the trading positions held by exchange members. It rather limits the price differential between trades that go into delivery the next day ("tom position") and the day after ("cash position").[citation needed]

Calendar spreads are known in LME jargon as "carries". Buying a carry is referred to as "borrow" and selling a carry as "lending". Thus, if a metal is subject to lending guidance, dominant position holders may be required to lend tom-next, that is sell a tom-position and buy a cash-position, should the backwardation for that period exceed a certain exchange-set percentage. The price differential and number of contracts to be lent is determined by LME regulation.[citation needed]

The LME uses backwardation limits in emergency situations, such as in 2005 following Hurricane Katrina when Zinc warrants in New Orleans were suspended until the warehouses were checked, or to act against possible or suspected market manipulation, such tightness in particular prompts for Aluminium in early 1999.[citation needed]

Normal backwardation vs. backwardation

The term backwardation, when used without the qualifier "normal", can be somewhat ambiguous. Although sometimes used as a synonym for normal backwardation (where a futures contract price is higher than the expected spot price at contract maturity), it may also refer to the situation where a futures contract price is merely higher than the current spot price.

References

- ^ Contango Vs. Normal Backwardation, Investopedia

- ^ Antal E. Fekete (2 December 2008). "RED ALERT: GOLD BACKWARDATION!!!(page 3)". http://www.professorfekete.com/articles%5CAEFRedAlert.pdf. Retrieved 20 December 2008.

- ^ Zvi Bodie & Victor Rosansky, "Risk and Return in Commodity Futures", FINANCIAL ANALYSTS' JOURNAL (May/June 1980)

- ^ Butler, Ted (31 March 2009). "All Talk, No Action". http://www.investmentrarities.com/03-31-09.html.

- Encyclopædia Britannica, eleventh edition (1911), articles Backwardation, Contango and Stock Exchange, and fifteenth edition (1974), articles Contango and Backwardation and Stock Market.

- Modern Market Manipulation, Mike Riess, 2003, paper at the International Precious Metals Institute 27th Annual Conference

- LME launches and investigation in primary aluminium trading, London Metal Exchange advice to members 15 January 1999, reproduced at aluNET International

- New Orleans – Temporary Suspension of Warrants, London Metal Exchange press release 6 September 2005.

- investopedia Website, Articles on Contango and Backwardation and Stock Market.

Categories:- Derivatives (finance)

- Financial terminology

Wikimedia Foundation. 2010.