- Covered call

-

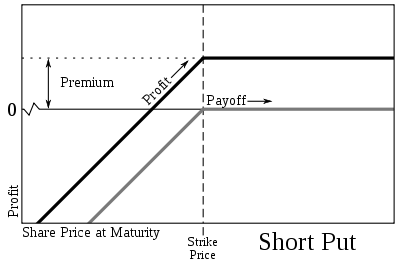

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument, such as shares of a stock or other securities. If a trader buys the underlying instrument at the same time as he sells the call, the strategy is often called a "buy-write" strategy. In equilibrium, the strategy has the same payoffs as writing a put option.

The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise.

Writing (aka selling) a call generates income in the form of the premium paid by the option buyer. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. The risk of stock ownership is not eliminated. If the stock price declines, then the net position will likely lose money.[1]

Since in equilibrium [reader: what does this mean?] the payoffs on the covered call position is the same as a short put position, the price (or premium) should be the same as the premium of the short put or naked put.

Contents

Examples

An investor has 500 shares of XYZ stock, valued at $10,000. He sells 5 call option contracts (in the US, 1 option contract covers 100 shares) for $1500 , thus covering a certain amount of decrease in the XYZ stock (i.e. only after the stock value has declined by more than $1500 would the investor lose money overall). Losses cannot be prevented, but merely reduced in a covered call position. If the stock price drops, it will not make sense for the option buyer to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and the seller (writer) will keep the money paid on the premium of the option, thus reducing his loss from a maximum of $10000 to [$10000 - (premium)], or $8500.

This "protection" has its potential disadvantage in that the investor (option writer) may be forced to sell his stock below market price at expiration, or must buy back the calls at a price higher than he sold them for.

If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he/she believes that stock will either fall or be neutral.

A call option can be sold even if the option writer doesn't initially own the underlying stock. If XYZ trades at $33 and $35 calls are priced at $1, then an investor can purchase 100 shares of XYZ for $3300 and sell one (100-share) call option for $100, for a net cost of only $3200. The $100 premium received for the call will cover a $1 decline in stock price. The break-even point of the transaction is $32/share. Upside potential is limited to $300, but this amounts to a return of almost 10%. (If the stock price rises to $35 or more, the call option holder will exercise his option and the investor's profit will be $35–$32 = $3). If the stock price at expiry is below $35 but above $32, the call option will be allowed to expire, but the investor can still profit by selling his shares. Only if the price is below $32/share will the investor experience a loss.

To summarize:

Stock price

at expirationNet profit/loss Comparison to

simple stock purchase$30 (200) (300) $31 (100) (200) $32 0 (100) $33 100 0 $34 200 100 $35 300 200 $36 300 300 $37 300 400 Concrete example

[2] Presenting a concrete example of a buy-write expiry payout, one will be able to see and understand what is the expiry value of a portfolio as a function of the option they wrote, and the stock price at expiry. See the 3D mesh plot and discussion. "The Figure on the right shows a 3-Dimensional plot of expiry value versus stock price for FCX on expiry Saturday versus the option purchased. Please take a few moments to study the chart making careful note of the Y-axis which represents the option purchased in the format of (Strike Price) - (Days to Expiry), e.g. 70-10 would be 70 dollars and 10 days to expiry, and 85-101 would be an 85 dollar strike price with 101 days to expiry." [3]

Taking a look at one slice (left) of the above data, namely what is the portfolio value if the stock price is $85 at expiry. This plot shows the Strike Price - Days to expiry vs the portfolio’s value at expiry. It is worth taking a couple of minutes to choke down what this plot is really presenting.[says who?] Stepping through the data, the bottom axis shows various call options which an investor could write (AKA sell or short). Each of the options indicates the number of days to expiry. The plot does not show the portfolio value of each of the options on the same day, instead the plot is showing the portfolio value at expiry. However, for some of the options expiry is 710 days away, and for other options expiry is only 10 days away. The implication of this is that for some of the positions you[who?] will have to wait a long time to realize the profit. Finally this chart makes the other assumption that the stock price is $85 at expiry. This is the case of being called for all the options. What this boundary condition presents is the maximum profit that this portfolio could have. [4]Marketing

This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since 1975 when Fischer Black published "Fact and Fantasy in the Use of Options". According to Reilly and Brown (2003); "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels." (p. 995)

Two recent developments may have increased interest in covered call strategies: (1) in 2002 the Chicago Board Options Exchange introduced a benchmark index for covered call strategies, the CBOE S&P 500 BuyWrite Index (ticker BXM), and (2) in 2004 the Ibbotson Associates consulting firm published a case study on buy-write strategies.[5]

References

- ^ Warner, Adam (2009). "Chapter 12: Buy-Write--You Bet". Options Volatility Trading: Strategies for Profiting from Market Swings (1 edition ed.). Amazon.com: McGraw-Hill. pp. 188, 177–193. ISBN 978-0071629652. http://www.amazon.com/Options-Volatility-Trading-Strategies-Profiting/dp/0071629653/ref=dp_return_2?ie=UTF8&n=283155&s=books. "When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. But volatility is also highest when the market is pricing in its worst fears...overwriting strategies that are dynamically rebalanced ahead of large market rallies or downturns can naturally enhance the returns generated, say Renicker and Lehman's Devapriya Mallick."

- ^ Entering a Buy-Write Strategy

- ^ QuantPrinciple's Buy-Write Strategy

- ^ Buy-Write Strategy boundary condition for the MAXIMUM payout

- ^ Buy Writing Makes Comeback as Way to Hedge Risk, Pensions & Investments, (May 16, 2005)

External links

- Chicago Board Options Exchange

- Covered Call Worksheet.

- Benchmark Indexes for Buy-write Strategies.

- Option Screeners.

Bibliography

- Brill, Maria. "Options for Generating Income." Financial Advisor. (July 2006) pp. 85–86.

- Calio, Vince. Covered Calls Become Another Alpha Source." Pensions & Investments. (May 1, 2006).

- "Covered Call Strategy Could Have Helped, Study Shows" Pensions & Investments, Sept. 20, 2004, p. 38.

- Crawford, Gregory. "Buy Writing Makes Comeback as Way to Hedge Risk." Pensions & Investments. May 16, 2005.

- Demby, Elayne Robertson. "Maintaining Speed -- In a Sideways or Falling Market, Writing Covered Call Options Is One Way To Give Your Clients Some Traction." Bloomberg Wealth Manager, February 2005.

- Feldman, Barry, and Dhruv Roy, "Passive Options-Based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index." The Journal of Investing . (Summer 2005).

- Frankel, Doris. "Buy-writes Catch on in Sideways U.S. Stock Market." Reuters. (Jun 17, 2005).

- Fulton, Benjamin T., and Matthew T. Moran. "BuyWrite Benchmark Indexes and the First Options-Based ETFs" Institutional Investor—A Guide to ETFs and Indexing Innovations (Fall 2008), pp. 101–110.

- Szado, Edward, and Thomas Schneeweis. QQ_Active_Collar_Paper_website_v3 "Loosening Your Collar: Alternative Implementations of QQQ Collars." CISDM, Isenberg School of Management, University of Massachusetts, Amherst. (Original Version: August 2009. Current Update: September 2009).

- Kapadia, Nikunj, and Edward Szado. "The Risk and Return Characteristics of the Buy-Write Strategy on the Russell 2000 Index." The Journal of Alternative Investments. (Spring 2007). pp. 39-56.

- Renicker, Ryan, Devapriya Mallick. "Enhanced Call Overwriting." Lehman Brothers Equity Derivatives Strategy. (Nov 17, 2005).

- Tan, Kopin. "Better Covered Calls. Covered-Call Writing Yields Higher Returns in Down Markets." Barron's: The Striking Price. (Nov 28, 2005).

- Tan, Kopin. "More Bang, Less Buck. Selling Call Options." Barron's, SmartMoney. (Dec. 2, 2005).

- Piazza, Linda. "Options 101: Fashion Revival" OptionInvestor.com, Option Investor, Inc. (Oct. 3, 2009).

- Hill, Joanne, Venkatesh Balasubramanian, Krag (Buzz) Gregory, and Ingrid Tierens. "Finding Alpha via Covered Index Writing." Financial Analysts Journal. (Sept.-Oct. 2006). pp. 29-46.

- Lauricella, Tom. "'Buy Write' Funds May Well Be The Right Strategy." Wall Street Journal. (Sep 8, 2008). pg. R1.

- Moran, Matthew. "Risk-adjusted Performance for Derivatives-based Indexes - Tools to Help Stabilize Returns." The Journal of Indexes. (Fourth Quarter, 2002) pp. 34 – 40.

- Schneeweis, Thomas, and Richard Spurgin. "The Benefits of Index Option-Based Strategies for Institutional Portfolios" The Journal of Alternative Investments, Spring 2001, pp. 44 – 52.

- Tan, Kopin. "Covered Calls Grow in Popularity as Stock Indexes Remain Sluggish." Wall Street Journal, April 12, 2002.

- Tergesen, Anne. "Taking Cover with Covered Calls." Business Week, May 21, 2001, p. 132.

- Tracy, Tennille. "'Buy-Write' Is Looking Attractive." Wall Street Journal. (Dec 1, 2008). pg. C6.

- Whaley, Robert. "Risk and Return of the CBOE BuyWrite Monthly Index." The Journal of Derivatives (Winter 2002) pp. 35 – 42.

Categories:- Options

Wikimedia Foundation. 2010.