- Naked put

-

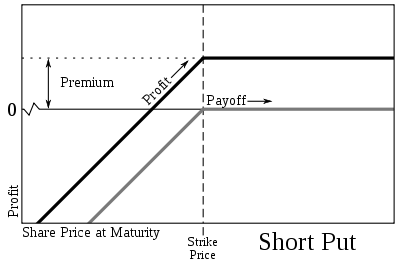

A naked put (also called an uncovered put) is a put option where the option writer (i.e., the seller) does not have a position in the underlying stock or other instrument. This strategy is best used by investors who want to accumulate a position in the underlying stock - but only if the price is low enough. If the investor fails to buy the shares, then he keeps the option premium.

If the market price of the underlying stock is below the strike price of the option when expiration arrives, the option owner can exercise the put option and force the writer to buy the underlying stock at the strike price. That allows the exerciser to profit from the difference between the market price of the stock and the option's strike price. But if the market price is at or above the strike price when expiration day arrives, the option expires worthless and the put writer profits by keeping the premium collected when the put option was sold. A naked put is like buying a stock at a discount on lay away. You can buy "reserve" the stock at a cheaper price and deposit money over time to cover the cost of delivery of shares to your account in the future as you get closer to expiration, converting over time the naked put to a cash secured put.

The potential loss on a naked put can be substantial. If the stock falls all the way to zero, the loss is equal to the strike price minus the premium received. The potential upside is the premium received when selling the option. If the stock price is at or above the strike price at expiration, then the option seller keeps the premium and the option expires worthless. During the option's lifetime, if the stock moves lower, then the option premium may increase (depending on how far the stock falls and how much time passes), and it becomes more costly to close (repurchase the put sold earlier) the position - resulting in a loss. If the stock price completely collapses before the put position is closed, then the put writer can face potentially catastrophic losses.

References

- Mark D. Wolfinger, "The Rookie's Guide to Options" The Beginner's Handbook of Trading Equity Options" W&A Publishing, Cedar Falls, 2008.

- John Brasher, "Writing Naked Puts I." "Money Newsletter" (December 15, 2005).

- Investopedia Staff, "Introduction to Naked Puts." "Investopedia" (March 1, 2002)

External links

- Chicago Board Options Exchange

- Australian Stock Exchange

- Investopedia, Options tutorial

Categories:- Options

Wikimedia Foundation. 2010.