- Bitcoin

-

Bitcoin

The official Bitcoin clientDeveloper(s) Satoshi Nakamoto (inactive, possibly a pseudonym)[1], Con Kolivas, Gavin Andresen, Amir Taaki, Jeff Garzik, David Francois, Luke Dashjr, Pavel Karoukin, Nils Schneider, John Tobey, Daniel Folkinshteyn, Patrick McFarland, Patrick Strateman, Matt Corallo, Pieter Wuille, and others Initial release January 9, 2009[2] Preview release 0.4.0 September 23, 2011 Development status Beta Written in C++ Operating system Windows, GNU/Linux, Mac OS X, FreeBSD Available in Dutch, English, French, Italian, German, Portuguese, Russian and Spanish. Type Electronic money License MIT License (open-source) Website bitcoin.org Bitcoin is a decentralized, peer-to-peer network that allows users to make transactions, and which then tracks and verifies those transactions. The word Bitcoin also refers to the digital currency implementation users transfer over that network, as well as the client software allowing them to access the network and conduct transactions.

Bitcoin implements a type of triple-entry accounting system, and uses a "proof-of-work" algorithm as the basis for a transaction journaling process that allows a large group of computers to agree on a single consistent transaction ledger without any centralized coordination. This process is designed to be able to work despite differences in timing, perspective, varying number of participants, and even despite varying levels of honesty among the individual participants.

Bitcoin was created by Satoshi Nakamoto[1] who began working on the software in 2007.[3] In October 2008 Nakamoto published a paper outlining his work[4][5] and on January 3rd 2009 the first Bitcoins were generated.[6] Bitcoin was released the same month as open-source software written in C++.[7][8]

Contents

Network

The Bitcoin network allows for an amount specified in Bitcoin(s) to be transferred between Bitcoin addresses using digital signatures. All data necessary to make any valid transaction is recorded in a publicly distributed database called the block chain. The block chain is built using a proof-of-work system that prevents double-spending and confirms transactions. Bitcoin transactions requires no centralized payment processing, and consequently are made at low cost.[1]

Addresses

Bitcoin is based on public-key cryptography. Any user in the Bitcoin network has a digital wallet containing a number of cryptographic keypairs. The wallet's public keys are transformed into Bitcoin addresses, which act as the receiving endpoints for all payments. Addresses in human-readable form appear as strings of numbers and letters around 33 characters in length, always beginning with the digit 1, as in the example of 175tWpb8K1S7NmH4Zx6rewF9WQrcZv245W.[9] The wallet's private keys are used to authorize transactions from that user's wallet.

Transactions

Any Bitcoin contains its current owner's wallet address. Users can create as many wallets as they wish. When a bitcoin belonging to user A is transferred to user B, then A’s ownership over that bitcoin is relinquished by adding B’s address to it and signing the result with the private key that is associated with A’s address.[10] Because of the asymmetric cryptographic method, nobody else can grant this signature, and the private key cannot be determined based on the signed bitcoin.[Notes 1] The resulting bitcoin is broadcast in a message, the transaction, on the peer-to-peer network. The rest of the network nodes validate the cryptographic signatures and the amounts of the transaction before accepting it.[11]

Confirmations

The main chain (black) consists of the longest series of blocks from the genesis block (green) to the current block. Orphan blocks (grey) exist outside of the main chain.

The main chain (black) consists of the longest series of blocks from the genesis block (green) to the current block. Orphan blocks (grey) exist outside of the main chain.

To prevent double-spending, the network implements what Nakamoto describes as a peer-to-peer distributed timestamp server, which assigns sequential identifiers to each transaction, which are then hardened against modification using the idea of chained proofs of work (shown in the Bitcoin client as confirmations). In his white paper, Nakamoto wrote: "we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions."[5]

Whenever a transaction is made, it is immediately labeled as unconfirmed. The confirmation status is reflective of the likelihood that the transaction could be successfully reversed in the event of a deliberate attempt to do so. Any transaction broadcast to other nodes does not become confirmed until it has been acknowledged in a collectively maintained timestamped-list of all known transactions, the block chain.

Target

Every generating node in the Bitcoin network collects all the unacknowledged transactions it knows of in a file called a block,[12] which also contains a reference to the previous valid block known to that node. It then appends a nonce value to this previous block and computes the SHA-256 cryptographic hash of the block and the appended nonce value. The node repeats this process until it adds a nonce that allows for the generation of a hash with a value lower than a specified target. Because the hash function is not reversible, finding such a nonce is hard and requires on average a predictable amount of repetitious trial and error. When a node finds such a solution, it announces it to the rest of the network. Peers receiving the new solved block validate it by computing the hash and checking that it really starts with the given number of zero bits (i.e., that the hash is within the target). Then they accept it and add it to the chain.

Block chain

When a transaction is first acknowledged in a block, it receives one confirmation. The transaction itself is only acknowledged once, but blocks themselves are acknowledged repeatedly as time passes and the chain grows. Each time that first block is acknowledged by future blocks, the transaction is considered to have received another confirmation. After six confirmations, the Bitcoin client switches from showing "unconfirmed" to "confirmed". Although a transaction could be considered "confirmed" after a single confirmation, the client avoids reporting it as such until several further confirmations to ensure that it is overwhelmingly likely that the transactions are part of the main block chain rather than an orphaned one, and more importantly, practically impossible to reverse.

Eventually, the block chain contains the cryptographic ownership history of all coins from their creator-address to their current owner-address.[13] Therefore, if a user attempts to reuse coins he already spent, the network rejects the transaction.

The whole history of transactions must be stored inside the block chain, which grows constantly as new records are added and never removed. Nakamoto conceived that as the database became larger, applications for Bitcoin without the entire database on each user's computer would be desirable. To enable this, a Merkle tree is used to organize the transaction records in such a way that a future Bitcoin client can locally delete portions of its own database it knows it will never need, such as earlier transaction records of bitcoins that have changed ownership multiple times, while keeping the cryptographic integrity of the remaining database intact. Some users will only need the portion of the block chain that pertains to the coins they own or might receive in the future. At the present time however, all users of the Bitcoin software receive the entire database over the peer-to-peer network after running the software the first time.

Difficulty

Every 2016 blocks, the Bitcoin protocol reassigns the target. As the target changes, the result is a change in the difficulty of finding a suitable nonce. The difficulty is adjusted such that the distribution mean is λ = 2016 blocks per two weeks, so that there are roughly ten minutes between the creation of new blocks on average (the wait times between events in a Poisson process follow an exponential distribution). The difficulty updates happen every 2016 blocks. The difficulty is set to the value that would have most likely caused the prior 2016 blocks to take two weeks to complete, given the same computational effort (according to the timestamps recorded in the blocks).[14] All nodes perform and enforce the same difficulty calculation.

In addition to the pending transactions confirmed in the block, a generating node adds a "generate" transaction, which awards new bitcoins to the operator of the node that generated the block. The payout of this generated transaction is set according to the inflation schedule programmed into the protocol. The process of solving blocks is often referred to as mining, as in gold mining, in reference to the coins brought into existence by the generate transactions.[5] The "miner" that generates a block also receives the surplus from any transactions that have input value in excess of the output value, effectively a transaction fee that provides an incentive to give a transaction priority for faster confirmation.

The proof-of-work problems are especially suitable to GPUs and specialized hardware. Because of the growing computing power behind the system driving the difficulty to high levels, individual contributors with typical CPUs are no longer likely to solve a block on their own but can still receive small portion of the bitcoins generated in a new block by contributing their processing power to a mining pool.[15] This increased difficulty makes it cost prohibitive for an attacker to perform double-spending attacks so it is beneficial to the system.

The number of Bitcoins created per block is never more than 50 BTC, and the awards are programmed to decrease over time towards zero, such that no more than 21 million will ever exist.[16] As this payout decreases, the motive for users to run block-generating nodes is expected to change to earning transaction fees, funding from supporting auxiliary block chains,[17] and simply to improve the security of the public Bitcoin infrastructure they depend on.

Covert "mining"

In June 2011, Symantec warned about the possibility of botnets engaging in covert "mining" of bitcoins (unauthorized use of computer resources to generate bitcoins),[18][19] consuming computing cycles, using extra electricity and possibly increasing the temperature of the computer. Later that month, an employee of the Australian Broadcasting Corporation was caught after using the company's servers to generate bitcoins without permission.[20] Some malware also uses the parallel processing capabilities of the GPUs built into many modern-day video cards.[21] In mid August 2011, bitcoin miner botnets were found[22]; trojans infecting Mac OS X have also been uncovered.[23]

Transaction fees

Miners have no obligation to include transactions in the blocks they try to solve. A transaction fee can be associated with any transaction, giving miners an incentive to put the transaction in a block, as miners collect the transaction fees associated with all transactions included in blocks they solve. Very small transactions, or those that use relatively new coins, have low "priority" and may be assessed a transaction fee to reduce spam. As of version 0.3.23 of the official bitcoin client, the minimum transaction fee for low priority transactions is 0.0005 BTC.

Anonymity

Because transactions are broadcast to the entire network, they are inherently public. Unlike regular banking, which preserves customer privacy by keeping transaction records private, transactional anonymity is accomplished in Bitcoin by keeping the ownership of addresses private, while at the same time publishing all transactions. As an example, if Alice sends 123.45 BTC to Bob, a public record is created that allows anyone to see that 123.45 was sent from one address to another. However, unless Alice or Bob make their ownership of these addresses publicly known in some way, it is difficult for anyone else to connect the transaction with them. However, if an address is connected to a user at any point it can be possible to follow back a series of transactions because each participant likely knows who paid them and may disclose that information on request or under duress.[24][25][26]

Jeff Garzik, one of the Bitcoin developers, explained as such in an interview and concluded that "attempting major illicit transactions with bitcoin, given existing statistical analysis techniques deployed in the field by law enforcement, is pretty damned dumb".[27][28] He also said "We are working with the government to make sure indeed the long arm of the government can reach Bitcoin... the only way bitcoins are gonna be successful is working with regulation and with the government"[29]

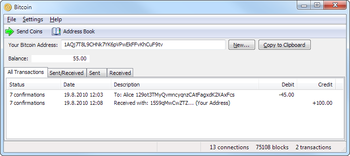

Client

People interact with bitcoin using a "wallet," which may be either stored on their computer by the bitcoin software or hosted on a third-party website. The wallet shows users their available bitcoin balance, transaction history, and the collection of bitcoin addresses they may use to send and receive bitcoins with other users. Because all transactions are added to the transaction log in the bitcoin block chain, which is a distributed database formed by all the bitcoin participants, a user's bitcoin software does not need to be running for that user to receive bitcoins.

Bitcoin payments are normally displayed to the receiver near-instantly, but they are initially displayed as unconfirmed, because the bitcoin system cannot yet assure that the transaction is permanent. A transaction may be invalidated due to conflicting transactions (such as the same bitcoins being sent to two different receivers). This may happen if a sender malfunctions, or if a sender intentionally attempts to defraud a receiver. When the bitcoin network processes the transaction, an increasing number of confirmations are added every time the chain containing the transaction is extended. Eventually, the bitcoin software displays the transaction as confirmed.

The process of confirming a transaction is accomplished by solving a computationally difficult proof-of-work problem.[30] The problem is based on data from the transactions that must be confirmed, as well as the entire previous transaction history. This process makes it infeasible for an attacker to rewrite the transaction history without having more computing power than the rest of the bitcoin system. Nodes that process blocks of transactions are rewarded by receiving a programmed amount of bitcoin, which arises "out of thin air," as well as any transaction fees associated with the transactions they process. This compensates the operators of these systems for their computational work used to secure bitcoin transactions against reversal, and also accomplishes the initial wealth distribution for the bitcoin system as a whole. The difficulty of the proof-of-work problems is automatically adjusted by the system so that the average time between new blocks being awarded is ten minutes. All participating systems check the validity of every transaction and of every block and ignore any that violate the rules, such as blocks that bring the wrong amount of new bitcoin into existence, or transactions that would involve one sender spending the same bitcoin twice.

Alternative implementations

Besides the original C++ Bitcoin client, there is an open source implementation of the Bitcoin protocol in Java called BitCoinJ.[31]

Alternative user interfaces include bitcoin-js-remote, a JavaScript web user interface for Bitcoin wallets,[32] as well as Spesmilo, a PySide interface more open to a diversity of users, which can run independently of an external wallet.[33]

Currency

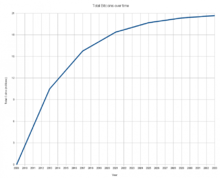

As of 2011[update], there were over 7 million bitcoins in existence.[34] This figure is algorithmically determined as described in Nakamoto's whitepaper. Because by definition the only spendable Bitcoins in existence are those represented in the block chain database passed around on the peer to peer network, the number is not only easy to determine, but can be quickly determined with precision by all participants.[5]

Anyone can view the block chain and observe transactions in real-time.[35] Currency exchanges also exist between bitcoins and other real and virtual currencies, such as the US dollar and the Linden Dollar.[36]By June 2011, a bitcoin was worth more than twenty-nine USD. By October 2011, the value of a bitcoin had fallen to less than three USD.[1]

Monetary differences

Unlike conventional fiat currency, Bitcoin has no centralized issuing authority.[11][37][38] There is a limited controlled expansion of the monetary base hardcoded in the Bitcoin software.[citation needed]

Transactions are facilitated directly without the use of a centralized financial processor between nodes, which makes reversal unlikely.[39] Bitcoin transactions can represent many kinds of operations such as pure peer-to-peer escrow and deposits but user interface software for this advanced functionality is currently underdeveloped.[citation needed] The Bitcoin client broadcasts transactions to surrounding nodes, which propagate them across the network. Corrupted or invalid transactions are rejected by legitimate clients. Transactions are free; however, an optional, often necessary, fee may be paid to other nodes to prioritize transaction processing.[citation needed]

The total number of bitcoins is programmed to approach 21 million over time.[11] The money supply is programmed to grow as a geometric series every 210,000 blocks (roughly every 4 years); by 2013 half of the total supply will be generated, and by 2017, 3/4 will be generated. To ensure sufficient granularity of the money supply, bitcoins are divisible down to eight decimal places (a total of 2.1 × 1015 or 2.1 quadrillion units).[16]

The diminishing geometric expansion combined with the expansion of Bitcoin users provides an incentive for early adopters, who can obtain bitcoin at preferential exchange rates.

Bitcoin's design allows for pseudonymous ownership and transfers. Because of this, Bitcoin has anonymity properties weaker than cash but stronger than traditional electronic payment systems[citation needed]. Although the complete history of every bitcoin transaction is public, it is not possible in general [24] to associate bitcoin identities with real-life identities. This property makes bitcoin transactions attractive to some sellers of illegal products.[40][41]

Conversion to and from other currencies

Conversion to and from other currencies can be done in person at local exchangers, but is more commonly performed online through sites such as Mt. Gox, Intersango (formerly Britcoin), and TradeHill exchange services.[42] As of July 2011[update], Mt. Gox handles over 80% of all Bitcoin trade volume.[43]

Reception and concerns

Adoption

Wikileaks,[44][45][46] Freenet,[47] Pioneer One,[48] and several others[49] already accept donations in Bitcoin. The Electronic Frontier Foundation did for a while but stopped doing so, citing concerns about a lack of legal precedent about new currency systems, and because they "generally don't endorse any type of product or service – and Bitcoin is no exception."[50] Gavin Andresen, one of the "core developers", is explicitly advising people "not to make heavy investments in Bitcoins", as it is "kind of like a high risk investment".[51] As of July 2011, adoption is limited, while many small businesses have started to do it.[52] LaCie, a public company, accepts Bitcoin for its Wuala service.[53] A frequent problem faced by retailers willing to accept Bitcoin is the high volatility of its exchange rate to the US dollar and the absence of futures and options permitting to hedge this volatility yet. Further, it has been suggested that hoarding by speculators could impede the adoption of bitcoins.[54]

Initial distribution

The initial bitcoin distribution is heavily advantageous towards early-adopters, which some say is unfair.[citation needed] As stated, bitcoins are distributed ("generated") as a reward for the solution to a difficult proof-of-work problem. The drawback is that the amount of work that must be done for one bitcoin is currently over 500,000 times more than the amount of work at which the first bitcoins were being distributed. As more people join, and also because of a reward function that halves the number of rewarded bitcoins every so many blocks, it becomes harder to generate bitcoins over time, using the same computing power.[55][56] Because early adopters may now have a disproportionate number of Bitcoins compared to newcomers, and newcomers will never have a chance to earn bitcoins through mining at the same cost of computing-power, the current positivity being generated by proponents has also been labeled by critics as a pump and dump scheme by early adopters looking to profit from their large number of Bitcoins.

Prices

Prices fluctuate relative to goods and services more than more widely accepted currencies, since the price of a bitcoin is not yet sticky.[57] Also, different exchanges quote different prices, implying the market is not yet efficient.[58] On 19 June 2011, a security breach of the Mt. Gox Bitcoin Exchange caused the leaking of usernames, emails and MD5 hashed passwords of over 60,000 users onto the Web. The price of a Bitcoin briefly dropped to $0.01 on the Mt. Gox exchange (but remained unaffected on other exchanges) after a hacker allegedly used credentials from a Mt. Gox auditor's compromised computer to illegally transfer a large number of Bitcoins to himself and sell them all, creating a massive "ask" order at any price. Within minutes the price rebounded to over $15 before Mt. Gox shut down their exchange and canceled all trades that happened during the hacking period.[59] The exchange rate of Bitcoins quickly returned to near pre-crash values.[60][61][62][63]

Security

If an attacker can compromise the machine storing a particular Bitcoin wallet, then they can easily transfer any Bitcoins to their own wallet. On June 16, 2011, computer security companies started publishing the discovery of malicious software that locates the wallet file on Windows computers and uploads it to a remote server.[64][65][66][67] This attack could be prevented by encrypting the wallet file; however, this functionality was lacking until version 0.4.0 of the official Bitcoin client.[68]

Dan Kaminsky, a leading Internet technology security researcher, investigated Bitcoin. His examination reached various conclusions on bitcoin, anonymity and its future scalability. In the area of security the basic model he concluded that bitcoin was well designed. This relates to the underlying bitcoin model rather than any particular attack against a specific client, such as described above.[69]

Criminal uses

Bitcoin is the currency used by the Silk Road online marketplace.[27][70] In a 2011 letter to Attorney General Eric Holder and the Drug Enforcement Administration, senators Charles Schumer of New York and Joe Manchin of West Virginia called for an investigation into Bitcoin and Silk Road.[70] Schumer described the use of Bitcoins at Silk Road as a form of money laundering.[11] Consequently Amir Taaki from Intersango (formerly Britcoin), the UK exchange, put out a statement calling for regulation of Bitcoin exchanges by law enforcement.[71][72] The hacking organization "LulzSec" accepted donations in Bitcoin, having said that the group "needs bitcoin donations to continue their hacking efforts".[73][74]

Creator

Bitcoin was created by a person, or persons, going by the name Satoshi Nakamoto. Nakamoto self-published a paper on Bitcoin in 2008 on the cryptography mailing list[75] and then in January 3, 2009 founded the open source project called Bitcoin. The real identity of "Satoshi Nakamoto" is unknown. In his P2P Foundation profile[76] he said he is from Japan. He would be a thirty-nine-year old man in 2011.[1]

The philosophical underpinnings of Bitcoin stem from a distrust of government-controlled central banks. "The root problem with conventional currency is all the trust that's required to make it work," Nakamoto wrote. "The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve."[1]

See also

- Anonymous Internet banking

- Crypto-anarchism

- Complementary currency

- DigiCash

- Digital currency exchanger

- Digital gold currency

- eCache

- ecash

- Economic secession

- Pecunix

- Ripple monetary system

- Ven

Notes

- ^ This statement is made on the assumption that it is infeasible to brute force the keys, and that no side channel attack is possible either.

References

- ^ a b c d e f Davis, Joshua (10 October 2011). "The Crypto-Currency". The New Yorker. http://www.newyorker.com/reporting/2011/10/10/111010fa_fact_davis. Retrieved 11 October 2011.

- ^ Bitcoin version 0.1 release date

- ^ "Questions about Bitcoin". Bitcoin forum. 2009-12-10. https://bitcointalk.org/index.php?topic=13.msg46#msg46.

- ^ "Bitcoin P2P e-cash paper". http://article.gmane.org/gmane.comp.encryption.general/12588/.

- ^ a b c d Nakamoto, Satoshi (24 May 2009), Bitcoin: A Peer-to-Peer Electronic Cash System, http://www.bitcoin.org/bitcoin.pdf, retrieved 14 December 2010

- ^ "Block 0 - Bitcoin Block Explorer". http://blockexplorer.com/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f.

- ^ "Bitcoin v0.1 released". http://www.mail-archive.com/cryptography@metzdowd.com/msg10142.html.

- ^ "SourceForge.net: Bitcoin". http://sourceforge.net/news/?group_id=244765.

- ^ "Bitcoin documentation on addresses". https://en.bitcoin.it/wiki/Address.

- ^ "Transactions - Bitcoin". En.bitcoin.it. 2011-06-16. https://en.bitcoin.it/wiki/Transactions. Retrieved 2011-06-22.

- ^ a b c d Lowenthal, Thomas (June 8, 2011). "Bitcoin: inside the encrypted, peer-to-peer digital currency". Ars Technica. http://arstechnica.com/tech-policy/news/2011/06/bitcoin-inside-the-encrypted-peer-to-peer-currency.ars.

- ^ "Bitcoin documentation on the block hashing algorithm". https://en.bitcoin.it/wiki/Block_hashing_algorithm.

- ^ "Bitcoin Block Explorer". http://blockexplorer.com/.

- ^ "Bitcoin documentation on difficulty". https://en.bitcoin.it/wiki/Difficulty. Retrieved 26 May 2011.

- ^ "Bitcoin Wiki: Pooled mining". https://en.bitcoin.it/wiki/Pooled_mining. Retrieved 26 May 2011.

- ^ a b Nathan Willis (2010-11-10). "Bitcoin: Virtual money created by CPU cycles". LWN.net. http://lwn.net/Articles/414452/.

- ^ "Bitcoin forum thread on auxiliary block chains". http://forum.bitcoin.org/index.php?topic=7219.0. Retrieved 26 May 2011.

- ^ http://www.symantec.com/connect/blogs/bitcoin-botnet-mining

- ^ http://www.zdnet.com/blog/security/researchers-find-malware-rigged-with-bitcoin-miner/8934

- ^ http://thenextweb.com/au/2011/06/23/abc-employee-caught-mining-for-bitcoins-on-company-servers/

- ^ http://www.theregister.co.uk/2011/08/16/gpu_bitcoin_brute_forcing/

- ^ http://www.infosecurity-magazine.com/view/20211/researcher-discovers-distributed-bitcoin-cracking-trojan-malware/

- ^ http://www.techworld.com.au/article/405849/mac_os_x_trojan_steals_processing_power_produce_bitcoins

- ^ a b Fergal Reid and Martin Harrigan (July 24th 2011). An Analysis of Anonymity in the Bitcoin System. An Analysis of Anonymity in the Bitcoin System.

- ^ "Bitcoin documentation on anonymity". https://en.bitcoin.it/wiki/Anonymity.

- ^ "Bitcoin not so anonymous, Irish researcher says – Cyrus Farivar – Science and Technology". Deutsche Welle. 2011-06-01. http://www.dw-world.de/dw/article/0,,15276051,00.html. Retrieved 2011-07-29.

- ^ a b Chen, Adrian (June 01 2011). "The Underground Website Where You Can Buy Any Drug Imaginable". Gawker. http://gawker.com/5805928/the-underground-website-where-you-can-buy-any-drug-imaginable.

- ^ "Libertarian Dream? A Site Where You Buy Drugs With Digital Dollars – Alexis Madrigal – Technology". The Atlantic. 2011-06-01. http://www.theatlantic.com/technology/archive/2011/06/libertarian-dream-a-site-where-you-buy-drugs-with-digital-dollars/239776/. Retrieved 2011-06-22.

- ^ "CBSNewsOnline: BitCoin: The Future of Currency". http://www.youtube.com/watch?v=jYiWHNkZIes.

- ^ Thomas Lowenthal (8 June 2011). "Bitcoin: inside the encrypted, peer-to-peer digital currency". Ars Technica. http://arstechnica.com/tech-policy/news/2011/06/bitcoin-inside-the-encrypted-peer-to-peer-currency.ars. Retrieved 14 June 2011.

- ^ angry tapir, timothy (23 March 2011). "Google Engineer Releases Open Source Bitcoin Client". Slashdot. http://news.slashdot.org/story/11/03/23/0210207/Google-Engineer-Releases-Open-Source-Bitcoin-Client. Retrieved 2011-05-18.

- ^ tcatm. "bitcoin-js-remote". GitHub. https://github.com/tcatm/bitcoin-js-remote. Retrieved 2011-05-18.

- ^ "Spesmilo, PySide Bitcoin client". En.bitcoin.it. 2011-05-19. https://en.bitcoin.it/wiki/Spesmilo. Retrieved 2011-06-22.

- ^ "Total Number of Bitcoins in Existence". Bitcoin Block Explorer. 2011-08-23. http://blockexplorer.com/q/totalbc. Retrieved 2011-08-23.

- ^ "Home – Bitcoin Block Explorer". http://blockexplorer.com/. Retrieved 2011-06-08.

- ^ "Bitcoin Mining: The Free Lottery". Radoff.com. http://radoff.com/blog/2011/06/03/bitcoin-mining-free-legalized-lottery/. Retrieved 3 June 2011.

- ^ Sponsored by. "Virtual currency: Bits and bob". The Economist. http://www.economist.com/blogs/babbage/2011/06/virtual-currency. Retrieved 2011-06-22.

- ^ Geere, Duncan. "Peer-to-peer currency Bitcoin sidesteps financial institutions (Wired UK)". Wired.co.uk. http://www.wired.co.uk/news/archive/2011-05/16/bitcoin-p2p-currency. Retrieved 2011-06-22.

- ^ "Bitcoin documentation on chargebacks". https://en.bitcoin.it/wiki/Myths#Bitcoin_has_no_built-in_chargeback_mechanism,_and_this_isn_t_good.

- ^ Andy Greenberg (April 20, 2011). Crypto Currency. Forbes Magazine.

- ^ Madrigal, Alexis (2011-06-01). "Libertarian Dream? A Site Where You Buy Drugs With Digital Dollars". The Atlantic Monthly. http://www.theatlantic.com/technology/archive/2011/06/libertarian-dream-a-site-where-you-buy-drugs-with-digital-dollars/239776/. Retrieved 2011-06-05.

- ^ "How to use bitcoin". bitcoinme. http://bitcoinme.com/index.php/buy/.

- ^ Bitcoin Charts

- ^ "Donate". Wikileaks.org. http://wikileaks.org/support.html. Retrieved 2011-06-22.

- ^ http://twitter.com/#!/wikileaks/status/80774521350668288

- ^ Greenberg, Andy (2011-06-14). "WikiLeaks Asks For Anonymous Bitcoin Donations - Andy Greenberg - The Firewall - Forbes". Blogs.forbes.com. http://blogs.forbes.com/andygreenberg/2011/06/14/wikileaks-asks-for-anonymous-bitcoin-donations/. Retrieved 2011-06-22.

- ^ "/donate". The Freenet Project. https://freenetproject.org/donate.html. Retrieved 2011-06-22.

- ^ http://twitter.com/#!/pioneeronetv/status/36119594439544832

- ^ "Donation-accepting organizations and projects – Bitcoin". En.bitcoin.it. https://en.bitcoin.it/wiki/Donation-accepting_organizations_and_projects. Retrieved 2011-06-22.

- ^ "EFF and Bitcoin | Electronic Frontier Foundation". Eff.org. 2011-06-14. https://www.eff.org/deeplinks/2011/06/eff-and-bitcoin. Retrieved 2011-06-22.

- ^ "/59/Bitcoin – a Digital, Decentralized Currency (at 31 min.)". omega tau podcast. 19 March 2011.

- ^ https://en.bitcoin.it/wiki/Trade

- ^ http://www.wuala.com/en/bitcoin

- ^ James Surowiecki (September/October 2011). "Cryptocurrency". Technology Review: 106. http://www.technologyreview.com/computing/38392/.

- ^ "Bitcoins, a Crypto-Geek Ponzi Scheme". http://www.hightechforum.org/bitcoins-a-crypto-geek-ponzi-scheme/. Retrieved 15 June 2011.

- ^ "Is the cryptocurrency Bitcoin a good idea?". http://www.quora.com/Bitcoin/Is-the-cryptocurrency-Bitcoin-a-good-idea. Retrieved 15 June 2011.

- ^ "Digital Black Friday: First Bitcoin "Depression" Hits". DailyTech. http://www.dailytech.com/Digital+Black+Friday+First+Bitcoin+Depression+Hits/article21877.htm. Retrieved 2011-06-22.

- ^ "Different Bitcoin Prices on different Exchanges". http://bitcoin-prices.com/. Retrieved 2011-07-19.

- ^ MtGox Clarification on June 19 hack

- ^ Jason Mick, 19 June 2011, Inside the Mega-Hack of Bitcoin: the Full Story, DailyTech

- ^ Timothy B. Lee, 19 June 2011, Bitcoin prices plummet on hacked exchange, Ars Technica

- ^ Mark Karpeles, 20 June 2011, Huge Bitcoin sell off due to a compromised account – rollback, Mt.Gox Support

- ^ Chirgwin, Richard (2011-06-19). "Bitcoin collapses on malicious trade – Mt Gox scrambling to raise the Titanic". The Register. http://www.theregister.co.uk/2011/06/19/bitcoin_values_collapse_again/.

- ^ Previous post Next post. "New Malware Steals Your Bitcoin | Threat Level". Wired.com. http://www.wired.com/threatlevel/2011/06/bitcoin-malware/. Retrieved 2011-06-22.

- ^ Updated: 17 Jun 2011 (2011-06-17). "All your Bitcoins are ours ... | Symantec Connect Community". Symantec.com. http://www.symantec.com/connect/blogs/all-your-bitcoins-are-ours. Retrieved 2011-06-22.

- ^ "Infostealer.Coinbit". Symantec. 2011-06-16. http://www.symantec.com/security_response/writeup.jsp?docid=2011-061615-3651-99. Retrieved 2011-06-22.

- ^ "Pickpocket Targets Wallets at Bitcoin Forum – F-Secure Weblog : News from the Lab". F-secure.com. 2011-06-17. http://www.f-secure.com/weblog/archives/00002187.html. Retrieved 2011-06-22.

- ^ https://github.com/bitcoin/bitcoin/commit/4e87d341f75f13bbd7d108c31c03886fbc4df56f

- ^ Dan Kaminsky Toorcon Seattle presentation slides, http://www.slideshare.net/dakami/bitcoin-8776098

- ^ a b Staff (June 12, 2011). "Silk Road: Not Your Father's Amazon.com". NPR. http://www.npr.org/2011/06/12/137138008/silk-road-not-your-fathers-amazon-com.

- ^ Reuters – Bitcoin exchanges offer anti- money-laundering aid

- ^ Britcoin.co.uk – statement to reuters from bitomat.pl and Britcoin.co.uk

- ^ Reisinger, Don (2011-06-09). "Senators target Bitcoin currency, citing drug sales | The Digital Home – CNET News". News.cnet.com. http://news.cnet.com/8301-13506_3-20070268-17/senators-target-bitcoin-currency-citing-drug-sales/. Retrieved 2011-06-22.

- ^ Olson, Parmy. "LulzSec Hackers Post Sony Dev. Source Code, Get $7K Donation – Parmy Olson – Disruptors – Forbes". Blogs.forbes.com. http://blogs.forbes.com/parmyolson/2011/06/06/lulzsec-hackers-posts-sony-dev-source-code-get-7k-donation/. Retrieved 2011-06-22.

- ^ Satoshi's posts to Cryptography mailing list

- ^ Satoshi Nakamoto profile on P2P Foundation

External links

- Bitcoin website

- Bitcoin Block Explorer (Used to search transactions inside the Bitcoin block chain.)

Categories:- 2009 introductions

- Electronic currencies

- Free software programmed in C++

- Peer-to-peer computing

- Software using the MIT license

Wikimedia Foundation. 2010.