- Fixed exchange-rate system

-

Foreign exchange Exchange rates

Currency band

Exchange rate

Exchange rate regime

Exchange rate flexibility

Dollarization

Fixed exchange rate

Floating exchange rate

Linked exchange rate

Managed float regimeMarkets

Foreign exchange market

Futures exchange

Retail forexAssets

Currency

Currency future

Non-deliverable forward

Forex swap

Currency swap

Foreign exchange optionHistorical agreements

Bretton Woods Conference

Smithsonian Agreement

Plaza Accord

Louvre AccordSee also

Bureau de change / currency exchange (office)

Hard currencyA fixed exchange-rate system (also known as pegged exchange rate system) is a currency system in which governments try to keep the value of their currencies constant against one another.[1] In a fixed exchange-rate system, a country’s government decides the worth of its currency in terms of either a fixed weight of gold, a fixed amount of another currency or a basket of other currencies. The central bank of a country remains committed at all times to buy and sell its currency at a fixed price. The central bank provides foreign currency needed to finance payments imbalances.[2]

Contents

History

The gold standard or gold exchange standard of fixed exchange rates prevailed from about 1870 to 1914, before which many countries followed bimetallism.[3] The period between the two world wars was transitory, with the Bretton Woods system emerging as the new fixed exchange rate regime in the aftermath of World War II. It was formed with an intent to rebuild war-ravaged nations after World War II through a series of currency stabilization programs and infrastructure loans.[4] The early 1970s witnessed the breakdown of the system and its replacement by a mixture of fluctuating and fixed exchange rates.[5]

Chronology

Timeline of the fixed exchange rate system:[6]

1880–1914 Classical gold standard period April 1925 United Kingdom returns to gold standard October 1929 United States stock market crashes September 1931 United Kingdom abandons gold standard July 1944 Bretton Woods conference March 1947 International Monetary Fund comes into being August 1971 United States suspends convertibility of dollar into gold – Bretton Woods system collapses December 1971 Smithsonian Agreement March 1972 European snake with 2.25% band of fluctuation allowed March 1973 Managed float regime comes into being April 1978 Jamaica Accords take effect September 1985 Plaza accord September 1992 United Kingdom and Italy abandon Exchange Rate Mechanism (ERM) August 1993 European Monetary System allows ±15% fluctuation in exchange rates Gold standard

The earliest establishment of a gold standard was in the United Kingdom in 1821 followed by Australia in 1852 and Canada in 1853. Under this system, the external value of all currencies was denominated in terms of gold with central banks ready to buy and sell unlimited quantities of gold at the fixed price. Each central bank maintained gold reserves as their official reserve asset.[7] For example, during the “classical” gold standard period (1879–1914), the U.S. dollar was defined as 0.048 troy oz. of pure gold[8]

Bretton Woods system

Following the Second World War, the Bretton Woods system (1944–1973) replaced gold with the US$ as the official reserve asset. The regime intended to combine binding legal obligations with multilateral decision-making through the International Monetary Fund (IMF). The rules of this system were set forth in the articles of agreement of the IMF and the International Bank for Reconstruction and Development. The system was a monetary order intended to govern currency relations among sovereign states, with the 44 member countries required to establish a parity of their national currencies in terms of the U.S. dollar and to maintain exchange rates within 1% of parity (a "band") by intervening in their foreign exchange markets (that is, buying or selling foreign money). The U.S. dollar was the only currency strong enough to meet the rising demands for international currency transactions, and so United States agreed both to link the dollar to gold at the rate of $35 per ounce of gold and to convert dollars into gold at that price.[6]

Due to concerns about America's rapidly deteriorating payments situation and massive flight of liquid capital from the U.S., President Richard Nixon) suspended the convertibility of the dollar into gold on 15 August 1971. In December 1971, the Smithsonian Agreement paved the way for the increase in the value of the dollar price of gold from $35 50 $38 an ounce. Speculation against the dollar in March 1973 led to the birth of the independent float, thus effectively terminating the Bretton Woods system.[6]

Current monetary regimes

Since March 1973, the floating exchange rate has been followed and formally recognised by the Jamaica accord of 1978. Nations still need international reserves in order to intervene in foreign exchange markets to balance short-run fluctuations in exchange rates.[6]The prevailing exchange rate regime is in fact often considered as a revival of the Bretton Woods policies, namely Bretton Woods II.[9]

Mechanism

Under this system, the central bank first announces a fixed exchange-rate for the currency and then agrees to buy and sell the domestic currency at this value. The market equilibrium exchange rate is the rate at which supply and demand will be equal, i.e., markets will clear. In a flexible exchange rate system, this is the spot rate. In a fixed exchange-rate system, the pre-announced rate may not coincide with the market equilibrium exchange rate. The foreign central banks maintain reserves of foreign currencies and gold which they can sell in order to intervene in the foreign exchange market to make up the excess demand or take up the excess supply [2]

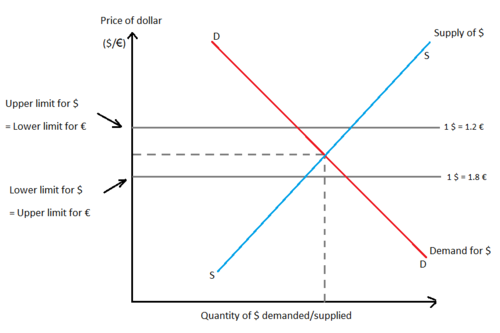

The demand for foreign exchange is derived from the domestic demand for foreign goods, services, and financial assets. The supply of foreign exchange is similarly derived from the foreign demand for goods, services, and financial assets coming from the home country. Fixed exchange-rates are not permitted to fluctuate freely or respond to daily changes in demand and supply. The government fixes the exchange value of the currency. For example, the European Central Bank (ECB) may fix its exchange rate at €1 = $1 (assuming that the euro follows the fixed exchange-rate). This is the central value or par value of the euro. Upper and lower limits for the movement of the currency are imposed, beyond which variations in the exchange rate are not permitted. The "band" or "spread" in Fig.1 is €0.4 (from €1.2 to €0.8).[10]

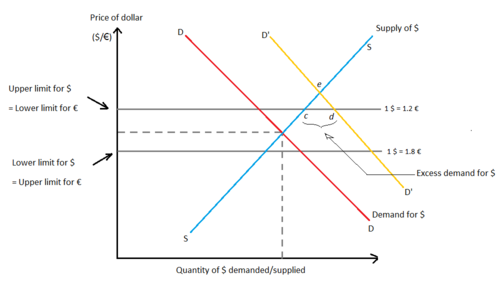

Excess demand for dollars

Fig.2 describes the excess demand for dollars. This is a situation where domestic demand for foreign goods, services, and financial assets exceeds the foreign demand for goods, services, and financial assets from the European Union. If the demand for dollar rises from DD to D'D', excess demand is created to the extent of cd. The ECB will sell cd dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would have been achieved at e.

When the ECB sells dollars in this manner, its official dollar reserves decline and domestic money supply shrinks. To prevent this, the ECB may purchase government bonds and thus meet the shortfall in money supply. This is called sterilized intervention in the foreign exchange market. When the ECB starts running out of reserves, it may also devalue the euro in order to reduce the excess demand for dollars, i.e., narrow the gap between the equilibrium and fixed rates.

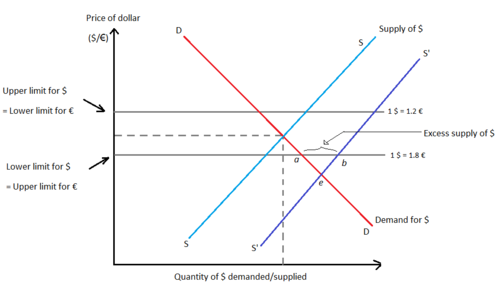

Excess supply of dollars

Fig.3 describes the excess supply of dollars. This is a situation where the foreign demand for goods, services, and financial assets from the European Union exceeds the European demand for foreign goods, services, and financial assets. If the supply of dollars rises from SS to S'S', excess supply is created to the extent of ab. The ECB will buy ab dollars in exchange for euros to maintain the limit within the band. Under a floating exchange rate system, equilibrium would again have been achieved at e.

When the ECB buys dollars in this manner, its official dollar reserves increase and domestic money supply expands, which may lead to inflation. To prevent this, the ECB may sell government bonds ans thus counter the rise in money supply.

When the ECB starts running out of reserves, it may also revalue the euro in order to reduce the excess supply of dollars, i.e., narrow the gap between the equilibrium and fixed rates. This is the opposite of devaluation.

Types of fixed exchange rate systems

The gold standard

Under the gold standard, a country’s government declares that it will exchange its currency for a certain weight in gold. In a pure gold standard, a country’s government declares that it will freely exchange currency for actual gold at the designated exchange rate. This "rule of exchange” allows anyone to go the central bank and exchange coins or currency for with pure gold or vice versa. The gold standard works on the assumption that there are no restrictions on capital movements or export of gold by private citizens across countries.

Because the central bank must always be prepared to give out gold in exchange for coin and currency upon demand, it must maintain gold reserves. Thus, this system ensures that the exchange rate between currencies remains fixed. For example, under this standard, a £1 gold coin in the United Kingdom contained 113.0016 grains of pure gold, while a $1 gold coin in the United States contained 23.22 grains. The mint parity or the exchange rate was thus: R = $/£ = 113.0016/23.22 = 4.87.[6] The main argument in favour of the gold standard is that it ties the world price level to the world supply of gold, thus preventing inflation unless there is a gold discovery (a gold rush, for example).

Price specie flow mechanism

The automatic adjustment mechanism under the gold standard is the price specie flow mechanism, which operates so as to correct any balance of payments disequilibria and adjust to shocks or changes. This mechanism was originally introduced by Richard Cantillon and later discussed by David Hume in 1752 to refute the mercantilist doctrines and emphasize that nations could not continuously accumulate gold by exporting more than their imports.

The assumptions of this mechanism are:

- Prices are flexible

- All transactions take place in gold

- There is a fixed supply of gold in the world

- Gold coins are minted at a fixed parity in each country

- There are no banks and no capital flows

Adjustment under a gold standard involves the flow of gold between countries resulting in equalization of prices satisfying purchasing power parity, and/or equalization of rates of return on assets satisfying interest rate parity at the current fixed exchange rate. Under the gold standard, each country's money supply consisted of either gold or paper currency backed by gold. Money supply would hence fall in the deficit nation and rise in the surplus nation. Consequently, internal prices would fall in the deficit nation and rise in the surplus nation, making the exports of the deficit nation more competitive than those of the surplus nations. The deficit nation's exports would be encouraged and the imports would be discouraged till the deficit in the balance of payments was eliminated.[11]

In brief:

Deficit nation: Lower money supply → Lower internal prices → More exports, less imports → Elimination of deficit

Surplus nation: Higher money supply → Higher internal prices → Less exports, more imports → Elimination of surplus

Reserve currency standard

In a reserve currency system, the currency of another country performs the functions that gold has in a gold standard. A country fixes its own currency value to a unit of another country’s currency, generally a currency that is prominently used in international transactions or is the currency of a major trading partner. For example, suppose India decided to fix its currency to the dollar at the exchange rate E₹/$ = 45.0. To maintain this fixed exchange rate, the Reserve Bank of India would need to hold dollars on reserve and stand ready to exchange rupees for dollars (or dollars for rupees) on demand at the specified exchange rate. In the gold standard the central bank held gold to exchange for its own currency, with a reserve currency standard it must hold a stock of the reserve currency.

Currency board arrangements are the most widespread means of fixed exchange rates. Under this, a nation rigidly pegs its currency to a foreign currency, Special drawing rights (SDR) or a basket of currencies. The central bank's role in the country's monetary policy is therefore minimal. CBAs have been operational in many nations like

- Hong Kong (since 1983);

- Argentina (1991 to 2001);

- Estonia (since 1992);

- Lithuania (since 1994);

- Bosnia and Herzogovina (since 1997);

- Bulgaria (since 1997);

- Bermuda (since 1972);

- Denmark (since 1945);

- Brunei (since 1967) [12]

Gold exchange standard

The fixed exchange rate system set up after World War II was a gold-exchange standard, as was the system that prevailed between 1920 and the early 1930s.[13] A gold exchange standard is a mixture of a reserve currency standard and a gold standard. Its characteristics are as follows:

- All non-reserve countries agree to fix their exchange rates to the chosen reserve at some announced rate and hold a stock of reserve currency assets.

- The reserve currency country fixes its currency value to a fixed weight in gold and agrees to exchange on demand its own currency for gold with other central banks within the system, upon demand.

Unlike the gold standard, the central bank of the reserve country does not exchange gold for currency with the general public, only with other central banks.

Hybrid exchange rate systems

The current state of foreign exchange markets does not allow for the rigid system of fixed exchange rates. At the same time, freely floating exchange rates expose a country to volatility in exchange rates. Hybrid exchange rate systems have evolved in order to combine the characteristics features of fixed and flexible exchange rate systems. They allow fluctuation of the exchange rates without completely exposing the currency to the flexibility of a free float.

Basket-of-currencies

Countries often have several important trading partners or are apprehensive of a particular currency being too volatile over an extended period of time. They can thus choose to peg their currency to a weighted average of several currencies (also known as a currency basket) . For example, a composite currency may be created consisting of hundred rupees, 100 Japanese yen and one U.S. dollar the country creating this composite would then need to maintain reserves in one or more of these currencies to satisfy excess demand or supply of its currency in the foreign exchange market.

A popular and widely used composite currency is the SDR, which is a composite currency created by the International Monetary Fund (IMF), consisting of a fixed quantity of U.S. dollars, euros, Japanese yen, and British pounds.

Crawling pegs

In a crawling peg system a country fixes its exchange rate to another currency or basket of currencies. This fixed rate is changed from time to time at periodic intervals with a view to eliminating exchange rate volatility to some extent without imposing the constraint of a fixed rate. Crawling pegs are adjusted gradually, thus avoiding the need for interventions by the central bank (though it may still choose to so in order to maintain the fixed rate in the event of excessive fluctuations).

Pegged within a band

A currency is said to be pegged within a band when the central bank specifies a central exchange rate with reference to a single currency, a cooperative arrangement, or a currency composite. It also specifies a percentage allowable deviation on both sides of this central rate. Depending on the band width, the central bank has discretion in carrying out its monetary policy. The band itself may be a crawling one, which implies that the central rate is adjusted periodically. Bands may be symmetrically maintained around a crawling central parity (with the band moving in the same direction as this parity does). Alternatively, the band may be allowed to widen gradually without any pre-announced central rate.

Currency boards

A currency board (also known as 'linked exchange rate system")effectively replaces the central bank through a legislation to fix the currency to that of another country. The domestic currency remains perpetually exchangeable for the reserve currency at the fixed exchange rate. As the anchor currency is now the basis for movements of the domestic currency, the interest rates and inflation in the domestic economy would be greatly influenced by those of the the foreign economy to which the domestic currency is tied. The currency board needs to ensure the maintenance of adequate reserves of the anchor currency. It is a step away from officially adopting the anchor currency (termed as dollarization or euroization).

Dollarization/euroization

This is the most extreme and rigid manner of fixing exchange rates as it entails adopting the currency of another country in place of its own. The most prominent example is the eurozone, where 17 seventeen European Union (EU) member states have adopted the euro (€) as their common currency. Their exchange rates are effectively fixed to each other. There are similar examples of countries adopting the U.S. dollar as their domestic currency- British Virgin Islands, Caribbean Netherlands, East Timor, Ecuador, El Salvador, Marshall Islands, Federated States of Micronesia, Palau, Panama, Turks and Caicos Islands.

Advantages

- A fixed exchange rate may minimize instabilities in real economic activity[14]

- Central banks can acquire credibility by fixing their country's currency to that of a more disciplined nation [14]

- On a microeconomic level, a country with poorly developed or illiquid money markets may fix their exchange rates to provide its residents with a synthetic money market with the liquidity of the markets of the country that provides the vehicle currency[14]

- A fixed exchange rate reduces volatility and fluctuations in relative prices

- It eliminates exchange rate risk by reducing the associated uncertainty

- It imposes discipline on the monetary authority

- International trade and investment flows between countries are facilitated

- Speculation in the currency markets is likely to be less destabilizing under a fixed exchange rate system than it is in a flexible one, since it does not amplify fluctuations resulting from business cycles

- Fixed exchange rates impose a price discipline on nations with higher inflation rates than the rest of the world, as such a nation is likely to face persistent deficits in its balance of payments and loss of reserves [6]

Disadvantages

- The need for a fixed exchange rate regime is challenged by the emergence of sophisticated derivatives and financial tools in recent years, which allow firms to hedge exchange rate fluctuations

- The announced exchange rate may not coincide with the market equilibrium exchange rate, thus leading to excess demand or excess supply

- The central bank needs to hold stocks of both foreign and domestic currencies at all times in order to adjust and maintain exchange rates and absorb the excess demand or supply

- Fixed exchange rate does not allow for automatic correction of imbalances in the nation's balance of payments since the currency cannot appreciate/depreciate as dictated by the market

- It fails to identify the degree of comparative advantage or disadvantage of the nation and may lead to inefficient allocation of resources throughout the world

- There exists the possibility of policy delays and mistakes in achieving external balance

- The cost of government intervention is imposed upon the foreign exchange market [6]

See also

- Exchange rate regime

- Floating exchange rate

- Gold standard

- Bretton Woods system

- Nixon Shock

- Smithsonian Agreement

References

- ^ Sullivan, Arthur (2003). Economics: Principles in action. Princeton University Press. ISBN 0691087946.

- ^ a b Startz, Richard. Macroeconomics (11 ed.). Mcgraw-Hill. ISBN 9780073375922.

- ^ James, Harold (2004). NBER Working Paper (no.92).

- ^ Cohen, Benjamin J, "Bretton Woods System", Routledge Encyclopedia of International Political Economy

- ^ Kreinin, Mordechai (2010). International Economics: A Policy Approach. Pearson Learning Solutions. pp. 438. ISBN 0558588832.

- ^ a b c d e f g Salvatore, Dominick (2004). International Economics. John Wiley & Sons. ISBN 978-81-265-1413-7.

- ^ Bordo, Michael (1999). Gold Standard and Related Regimes: Collected Essays. Cambridge University Press. ISBN 0-521-55006-8.

- ^ White, Lawrence. Is the Gold Standard Still the Gold Standard among Monetary Systems?, CATO Institute Briefing Paper no. 100, 8 Feb 2008

- ^ Dooley, Michael P.; Folkerts-Landau, David; Garber, Peter M. "Bretton Woods II Still Defines the International Monetary System", NBER Working Paper series no. 14731 (February 2009)

- ^ O'Connell, Joan ,"{An International Adjustment Mechanism with Fixed Exchange Rates", Published in Economica New Series no. 139, Vol. 35, (Aug., 1968), pp. 274–282

- ^ Cooper, R.N. (1969). International Finance. Penguin Publishers. pp. 25–37.

- ^ Salvatore, Dominick; Dean, J; Willett,T. The Dollarisation Debate (Oxford University Press, 2003)

- ^ Bordo, Michael D.; MacDonal, Ronald. "The Interwar Gold Exchange Standard: Credibility and Monetary Independence", NBER Working Paper no. 8429, August 2001

- ^ a b c Svensson, Lars E. (1994). The Operation and Collapse of Fixed Exchange Rate Regimes. NBER Working Paper series (no. 4971).

External links

- http://internationalecon.com/Finance/Fch80/F80-1.php

- http://eh.net/encyclopedia/article/redish.bimetallism

Further reading

- http://www.wellesley.edu/Economics/weerapana/econ213/econ213pdf/lect213-05.pdf

- http://www.utexas.edu/lbj/faculty/gavin/articles/gold_battles.pdf

- http://people.ucsc.edu/~mpd/InternationalFinancialStability_update.pdf

- http://www.polsci.ucsb.edu/faculty/cohen/inpress/bretton.html

- http://www.imf.org/external/pubs/ft/issues13/index.htm

- http://www.imf.org/external/pubs/ft/issues/issues38/ei38.pdf

- http://www.cato.org/pubs/bp/bp100.pdf

- http://econ.la.psu.edu/~bickes/goldstd.pdf

- http://www.economics.harvard.edu/files/faculty/51_QJE2004.pdf

- http://www.oenb.at/en/img/wp92_tcm16-22389.pdf

- http://www.nber.org/papers/w8963.pdf

- http://www.eusanz.org/pdf/conf04/choi_baek.pdf

- http://mpra.ub.uni-muenchen.de/14070/1/MPRA_paper_14070.pdf

News articles

- http://www.washingtonpost.com/wp-dyn/content/article/2005/07/26/AR2005072600681.html

- http://www.forexrealm.com/forex-analytics/exchange-rates/exchange-rate-regimes.html

- http://www.gold-eagle.com/greenspan011098.html

- http://www.washingtonpost.com/wp-dyn/content/article/2005/07/21/AR2005072100351.html

Categories:

Wikimedia Foundation. 2010.