- Dollarization

-

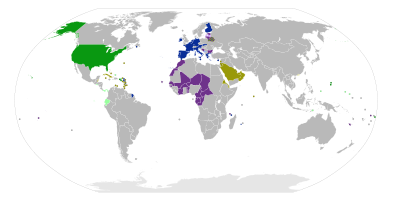

Worldwide use of the U.S. dollar and the euro:

Worldwide use of the U.S. dollar and the euro: United StatesExternal adopters of the US dollarCurrencies pegged to the US dollarCurrencies pegged to the US dollar within narrow bandExternal adopters of the euroCurrencies pegged to the euroCurrencies pegged to the euro within narrow band

United StatesExternal adopters of the US dollarCurrencies pegged to the US dollarCurrencies pegged to the US dollar within narrow bandExternal adopters of the euroCurrencies pegged to the euroCurrencies pegged to the euro within narrow band Worldwide official use of foreign currency or pegs:

Worldwide official use of foreign currency or pegs: U.S. dollar users, including the United StatesCurrencies pegged to the US dollarCurrencies pegged to the Euro

U.S. dollar users, including the United StatesCurrencies pegged to the US dollarCurrencies pegged to the Euro

Australian dollar users, including AustraliaNew Zealand dollar users, including New ZealandIndian rupee users and pegs, including IndiaPound sterling users and pegs, including the United Kingdom

Special Drawing Rights or other currency basket pegsThree cases of a country using or pegging the currency of a neighborDollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency.

The biggest economies to have officially dollarized as of June 2002 are Panama (since 1904), Ecuador (since 2000), and El Salvador (since 2001). As of August 2005[update], the United States dollar, the Euro, the New Zealand dollar, the Swiss franc, the Indian rupee, and the Australian dollar were the only currencies used by other countries for official dollarization. In addition, the Armenian dram, Turkish lira, the Israeli shekel, and the Russian ruble are used by internationally unrecognized but de facto independent states.

Contents

Origins

After the gold standard was abandoned at the outbreak of World War I and the Bretton Woods Conference following World War II, some countries were desperately seeking ways to promote global economic stability and hence their own prosperity. Countries usually peg their currency to a major convertible currency. When countries choose to use a major convertible currency parallel to or in place of their national currency, this is called the process of dollarization.

Effects of dollarization

The major benefit of dollarization is the elimination of risk of exchange rate fluctuations and possible reduction in the country's international exposure. Though dollarization cannot eliminate the risk of an external crisis, it provides steadier markets as a result of elimination of fluctuations in exchange rates. Dollarized economies can invoke greater confidence among international investors inducing increased investments and growth. Economic integration with the rest of the world becomes easier as a result of lowered transaction costs and greater acceptability of the dollarized currency. It helps promote greater fiscal discipline and thus greater financial stability and lower inflation.

On the other hand, dollarization leads to loss of revenue by seigniorage, is almost certainly met by political resistance and most importantly leads to absence of monetary policy autonomy. The country losses the rights to its autonomous monetary as well as exchange rate policies even in times of financial emergencies. [IMF 1] [1] [2]

Types

Dollarization can occur in a number of situations. It can be used unofficially, when private agents prefer the foreign currency over the domestic currency. For example, they hold deposits in the foreign currency because of a bad track record of the local currency, or as a hedge against inflation of the domestic currency.

It can be used semiofficially (or officially bimonetary systems), where the foreign currency is legal tender alongside the domestic currency.

Some countries use a foreign currency as the sole legal tender, and have ceased to issue the domestic currency. Another effect of a country adopting a foreign currency as its own is that the country gives up all power to vary its exchange rate, with its economy being pegged to that of the foreign country.

U.S. dollar

Countries using the U.S. dollar exclusively

- British Virgin Islands

- Caribbean Netherlands (from 1 January 2011)

- East Timor (uses its own coins)

- Ecuador (uses its own coins in addition to U.S. coins)

- El Salvador

- Marshall Islands

- Federated States of Micronesia

- Palau

- Panama (uses its own coins in addition to U.S. coins)

- Turks and Caicos Islands

Countries using the U.S. dollar alongside other currencies

- Cambodia (uses Cambodian Riel for many official transactions but most businesses deal exclusively in dollars)

- Lebanon (along with the Lebanese pound)

- Liberia (was fully dollarized until 1982; U.S. dollar still in common usage alongside Liberian dollar)

- Zimbabwe

- Haiti uses the U.S Dollar alongside its domestic currency called "Gourde"

Euro

Main article: International status and usage of the euro- Andorra (formerly French franc and Spanish peseta)

- Kosovo

- Monaco (formerly French franc; issues its own euro coins)

- Montenegro (formerly German mark and Yugoslav dinar)

- San Marino (formerly Italian lira; issues its own euro coins)

- Vatican City (formerly Italian lira; issues its own euro coins)

New Zealand dollar

- Cook Islands (issues its own coins and some notes)

- Niue

- Pitcairn Island

- Tokelau

Australian dollar

- Kiribati (issues its own coins)

- Nauru

- Tuvalu (issues its own coins)

South African rand

Further information: Common Monetary AreaZimbabwe

Due to the hyperinflation and official abandonment of the Zimbabwean dollar several currencies are used instead:

The U.S. dollar has been officially adopted for all transactions involving the new power-sharing government.

Others

- Armenian dram: Nagorno-Karabakh Republic

- Russian ruble: Abkhazia and South Ossetia (de facto independent states, but recognized as part of Georgia by nearly all other states)

- Indian rupee: Bhutan and Nepal

- Swiss franc: Liechtenstein

- Israeli shekel: Palestinian territories

- Turkish lira: Turkish Republic of Northern Cyprus (de facto independent state, but recognized as part of Cyprus by all states but Turkey)

See also

Notes

- ^ Berg, Borenzstein, Andrew, Eduardo. "Full Dollarization The Pros and Cons". Full dollarization. IMF. http://www.imf.org/external/pubs/ft/issues/issues24/index.htm. Retrieved 13 October 2011.

References

- ^ Broda, Levy Yeyati, Christian, Eduardo. "Endogenous deposit dollarization". Federal Reserve Bank of New York. http://ideas.repec.org/p/fip/fednsr/160.html.

- ^ Levy Yeyati, Eduardo. "Liquidity Insurance in a Financially Dollarized Economy, NBER Working Papers 12345". National Bureau of Economic Research, Inc.. http://ideas.repec.org/p/nbr/nberwo/12345.html.

External links

Wikimedia Foundation. 2010.