- DaimlerChrysler-Mitsubishi alliance

-

The DaimlerChrysler-Mitsubishi alliance refers to the 69 month period during which U.S.-German automaker DaimlerChrysler AG (DCX) held a controlling stake in Mitsubishi Motors Corporation (MMC). First established on March 27, 2000 with the signing of a letter of intent,[1] it was initiated by Jürgen E. Schrempp, the chairman of DCX, who was attempting to build what he called a "Welt AG" (global corporation) which would have as widespread a presence across worldwide automotive markets as its rivals.[2][3] The merger with the Chrysler Corporation had increased Daimler-Benz's share of the North American market, and Mitsubishi Motors offered a gateway to Asia.[1]

The deal was to prove costly for both DaimlerChrysler shareholders and for Schrempp personally, whose part in the deal contributed to his eventual replacement at the helm of DCX in 2006.[4]

Contents

Background

Jürgen Schrempp was one of the primary architects of the "Welt AG" plan, developed by Daimler-Benz to increase its presence in the American and Asian markets, and to improve its profitability. Schrempp believed that a modern automaker needed a full range of products beyond the luxury vehicle market in which Mercedes-Benz competed, and began looking for a partner as soon as he became chairman in 1994.[5] The Chrysler Corporation was targeted in 1995,[6] and on January 12, 1998 he met with Chrysler chairman Bob Eaton with the intent of negotiating a merger/takeover.[7] Following its completion in May that year, Schrempp then turned to Asia.

However, DaimlerChrysler's first steps came to nothing. It considered but ultimately declined to invest in Nissan prior to the Japanese company's alliance with Renault,[8] and it was rumoured that they also courted Honda that same year.[5][8] Schrempp, who had given a speech in Tokyo in early 1999 where he predicted DCX's market share in Asia would increase from 1.3 to over 10 percent, began to come under pressure to deliver on his promises.[8]

Mitsubishi Motors was DaimlerChrysler's third choice partner, but in 1999 MMC chairman Katsuhiko Kawasoe rebuffed their initial approach.[8] However, in the aftermath of the 1997 East Asian financial crisis MMC was saddled with ¥1.7 trillion of debt,[9][10] and some outside analysts were suggesting that the company should give priority to becoming a takeover or merger target.[11] Kawasoe rejected this, preferring to present Mitsubishi as an equal partner to potential suitors, adding that Mitsubishi would continue to follow their longstanding approach of establishing ventures without capital tie-ups.[11] But eventually a deal was struck: DCX would purchase a controlling 34 percent stake in the company for ¥450 billion (€2.1 billion).[12][13] This would ostensibly preserve Mitsubishi's "independence", as only three out of the company's ten board members would be elected by the new largest shareholder, although DaimlerChrysler did now possess a veto power over boardroom decisions.[14] For DCX, the benefit would come from increased market share without MMC's debts appearing on their balance sheet.[12]

Recall cover up

Shortly after the deal was finalised, Mitsubishi became embroiled in accusations that it had covered up complaints from customers about defects in their vehicles.[15] A police raid on its headquarters in July 2000 uncovered hidden documents stashed in a locker, and soon after over 500,000 vehicles were recalled for repairs. Mitsubishi's shares fell by 13 percent as these revelations became public,[15] and over the summer, further investigations took a similar toll on the company's stock. By the end of August, following a second police raid, the total number of vehicles recalled had reached one million, while the share price had fallen by almost 30 percent.[16][17] As a result of the collapse in the value of Mitsubishi, DaimlerChrysler renegotiated a €200 million reduction price of its stock purchase, while Kawasoe was forced to step down as chairman.[18][19]

Increasing control

Mitsubishi's difficulties contributed to a sharp fall in the DaimlerChrysler group's profits, and following the recall of a further 1.5 million cars in February 2001, including almost a million in the U.S.,[20] the German parent moved quickly to restructure; approximately 10,000 Mitsubishi employees would be axed and one of its four assembly plants would be closed.[21]

The following month, DaimlerChrysler approached Volvo about acquiring the Swedish automaker's 3.3 percent stake in Mitsubishi. Volvo had planned on forming a joint venture with MMC for bus and truck manufacturing as part of a deal originally negotiated in 1999, until the involvement of DaimlerChrysler, a rival in the commercial vehicle marketplace, led Volvo to ultimately withdraw.[22] The €760 million sale was concluded in April 2001, taking DCX's share to 37.3 percent.[23]

Olivier Boulay, then the head of DaimlerChrysler's Japanese design studio in Yokohama, was recruited by Mitsubishi in May 2001.[24] Answering directly to Rolf Eckrodt, the DCX-appointed Chief Operating Officer, Boulay's appointment was part of the "Turnaround Plan" initiated by Eckrodt and new Chief Executive Takashi Sonobe, where Mitsubishi tried to move away from an engineering-led approach to development.[25] Despite the new initiatives and increased investment, Mitsubishi Motors announced a revised profit forecast in April 2001,[26] and their downward projections were confirmed in May when the company reported a net loss for the year of ¥278 billion.[27]

During 2001 and 2002 DaimlerChrysler and Mitsubishi began to co-operate more closely on longer-term ventures. A €244 million plant would be built at Kölleda in Germany to manufacture engines for the new Z-car platform,[28] while in concert with Hyundai they established the Global Engine Manufacturing Alliance, a joint venture with an annual capacity of two million powerplants in five factories across the globe.[29][30] There was also extensive platform sharing,[31] cross-supply agreements,[32] and manufacturing subcontracts.[33]

Unravelling ties

Despite DaimlerChrysler's involvement, debts at Mitsubishi continued to accumulate. A torporous economy in Japan dragged down the company's domestic performance in 2003, while the same year the after effects of a disastrous credit scheme in the U.S. saw Mitsubishi Motors North America suffer a US$454 million loss.[34][35] By 2004 the automaker owed ¥1.14 trillion, and a ¥700 billion rescue plan was put to shareholders in April.[36] Other companies within the keiretsu of Mitsubishi which owned 23 percent of MMC were committed to the plan, and the Japan Development Bank had also been approached for support.[37]

However, at DaimlerChrysler there was dissent against the idea of further investment; only weeks before Schrempp had endured calls for his resignation from shareholders.[38] In the face of this and his the boardroom's opposition, DCX refused to pledge further funds, and formally stated that it would no longer financially support its partner.[39] Japan's finance minister, Nobuteru Ishihara, commented that the decision "could affect the future of the company", while corporate analysts were more forthright, calling it "a disaster" and claiming that "[Mitsubishi] will vanish if it continues this way."[36]

An alternative rescue package was formulated by May 2004, involving a ¥450 billion investment in newly issued stock by U.S. bank JPMorgan Chase, Tokyo-based private investment fund Phoenix Capital and other Mitsubishi Group companies. The deal was announced as MMC reported a loss for the year of ¥215 billion.[40] Further negotiations, and the involvement of the China Motor Corporation, boosted this figure to ¥546 billion by June, in return for 11,000 redundancies and cuts to corporate pensions, salaries and bonuses.[41] As a result of the new investment, DaimlerChrysler's own stake was diluted.

Profitability remained out of reach for Mitsubishi, and enlarged losses in 2005 were forecast by the company. The company's stock price slid 41 percent in 2004 to approximately one quarter the value of when DaimlerChrysler first became involved.[42]

Divorce

Following DaimlerChrysler's decision to cease further investment in its Japanese partner, Rolf Eckrodt stepped down as chairman and CEO of Mitsubishi, and retired from DCX in April 2004.[43] Soon after, Chrysler's Chief Operating Officer Wolfgang Bernhard also parted ways with the German parent over its continuing troubles and falling profits,[44] while the merger with MMC was now routinely being referred to by the media as a "debacle".[43][44][45][46] A third attempt to recapitalize Mitsubishi in January 2005 led to ¥540 billion of further investment,[47][48] and DaimlerChrysler's now owned only a 12.4 percent stake. Finally, on November 11, 2005, the remaining stock was sold for US$1.1 billion.[49] Three days later the buyer, investment bank Goldman Sachs sold the shares on for US$80 million profit.[50]

New major stockholder Phoenix Capital followed suit the following month, selling all but 50 million of its 575 million shares to JPMorgan on December 9, 2005, and once again the investment bank offloaded their purchase within a few days for tens of millions of dollars in profit. In both cases, the eventual buyers were part of the Mitsubishi keiretsu, returning MMC to Japanese ownership.[51]

Corporate performance

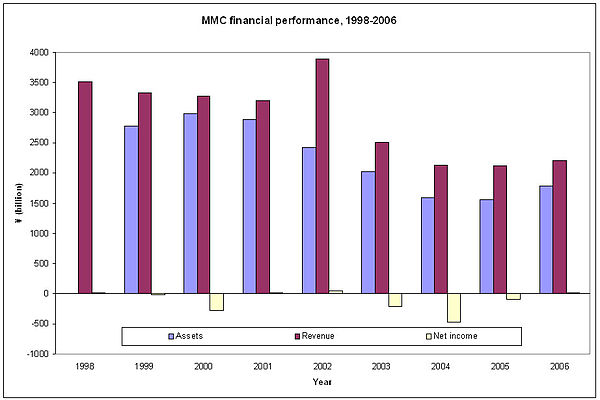

Mitsubishi Motors' revenue, net profit/loss, and assets before, during, and immediately after the period when DaimlerChrysler held a share.

Fiscal year Revenue Profit/Loss Assets 1998[52] ¥3,512.6 billion ¥5.7 billion n/a 1999[53] ¥3,335.0 bn -¥23.3 bn ¥2,784.1 bn 2000[54] ¥3,276.7 bn -¥278.1 bn ¥2,981.7 bn 2001[55] ¥3,200.7 bn ¥11.2 bn ¥2,894.6 bn 2002[56] ¥3,884.9 bn ¥37.4 bn ¥2,425.4 bn 2003[35] ¥2,519.4 bn -¥215.4 bn ¥2,029.0 bn 2004[57] ¥2,122.6 bn -¥474.8 bn ¥1,589.3 bn 2005[58] ¥2,120.1 bn -¥92.2 bn ¥1,557.6 bn 2006[59] ¥2,202.9 bn ¥8.7 bn ¥1,778.7 bn References

- ^ a b "For Daimler, Mitsubishi Opens the Door to Asia", John Schmid, International Herald Tribune, March 28, 2000

- ^ "Commercial Vehicles Feature: Truck business data – OEMs", Michael Hinks-Edwards, Automotive world, June 8, 2004 (subscription required)

- ^ (German)"Schrempp scheitert mit Welt AG", Orf.at

- ^ "Daimler Chief Schrempp to Be Replaced by Zetsche", Bloomberg News, July 28, 2005

- ^ a b "Jurgen Schrempp: The Auto Baron", Karen Lowry Miller & Joann Muller, BusinessWeek, November 5, 1998

- ^ "DaimlerChrysler 'merger of equals' put on trial", Ed Garsten, The Detroit News, November 26, 2003

- ^ "Projekt Welt AG", Henrik Böhme, DW-World.de, May 7, 2003

- ^ a b c d "DaimlerChrysler: Desperately Seeking an Ally", Jack Ewing, Emily Thornton & Moon Ihlwan, BusinessWeek International, December 13, 1999

- ^ "Mitsubishi: Fall of a Keiretsu", Brian Bremner, Emily Thornton, and Irene M. Kunii, BusinessWeek, March 15, 1999

- ^ History of Mitsubishi, Funding Universe.com

- ^ a b "Mitsubishi Coy On Partnership", Gerry Kobe, Automotive Industries, August 1999

- ^ a b "Daimler grabs Mitsubishi", CNN Money, March 27, 2000

- ^ "Don't Wait For More" (boxout), Murakami Mutsuko, Asiaweek vol.26, no.13, April 7, 2000,

- ^ "Daimler Gets Closer To Mitsubishi Deal", John Schmid, International Herald Tribune, March 23, 2000

- ^ a b "Mitsubishi recalls 514,000 vehicles", BBC News, July 19, 2000

- ^ "Mitsubishi extends recall", BBC News, August 13, 2000

- ^ "Police raid Mitsubishi headquarters", BBC News, August 28, 2000

- ^ "Cover-up forces Mitsubishi boss out", BBC News, September 8, 2000

- ^ " The Light and Shadow of Corporate Reconstruction", Takuya Ito, Electronic Journal of Contemporary Japanese Studies, April 15, 2006

- ^ "Mitsubishi recalls 1.5 million cars", BBC News, February 15, 2001

- ^ "DaimlerChrysler axes Mitsubishi jobs", BBC News, February 26, 2001

- ^ "DaimlerChrysler targets bigger slice of Mitsubishi", BBC News, March 8, 2001

- ^ "MMC-DaimlerChrysler commercial vehicle strategy to expand", Mitsubishi Motors press release, April 11, 2001

- ^ "MMC recruits Olivier Boulay from DaimlerChrysler", Mitsubishi Motors press release, April 25, 2001

- ^ "MMC Announces New Management Organization, Details Major Progress in", Mitsubishi Motors press release, March 28, 2001

- ^ "MMC Announces Revised Forecast for FY2000", Mitsubishi Motors press release, March 28, 2001

- ^ "Mitsubishi Motors Corporation Announces Financial Results, Reports on Achievement of Major Milestones in Turnaround", Mitsubishi Motors press release, May 18, 2001

- ^ "DaimlerChrysler AG and Mitsubishi Motors Corporation to Build Engine Plant in Thuringia, Germany", Mitsubishi Motors press release, December 20, 2001

- ^ "DaimlerChrysler, Hyundai, and Mitsubishi Motors to Form Global Engine Alliance", Mitsubishi Motors press release, May 6, 2002

- ^ "DCX kicks off Global Engine Manufacturing Alliance with Hyundai and Mitsubishi", GEMA press release, October 4, 2005

- ^ "DaimlerChrysler, Mitsubishi Sign Cross-Supply Commercial Engine Agreement", Autoparts Report, April 20, 2002

- ^ "New Colt lifts Mitsubishi's gloom", Jorn Madslien, BBC News, March 11, 2004

- ^ "Mitsubishi racks up huge losses", BBC News, November 11, 2003

- ^ a b "Mitsubishi Motors Announces First-Half FY 2003 Results, Gives Forecast for Full-Year FY 2003" Mitsubishi Motors press release, November 11, 2003

- ^ a b "DaimlerChrysler dumps Mitsubishi", BBC News, April 23, 2004

- ^ "Mitsubishi ditches sales chief", BBC News, April 2, 2004

- ^ "DaimlerChrysler pulls plug on Mitsubishi Motors", Alexander Huebner and Chang-Ran Kim, Forbes, April 23, 2004

- ^ "Remodelling Japan Inc" Sarah Buckley, BBC News, October 13, 2004

- ^ "Mitsubishi wins $4bn bailout deal", BBC News, May 21, 2004

- ^ "Mitsubishi boosts rescue package", BBC News, June 29, 2004

- ^ "Mitsubishi crashes into the red", BBC News, November 8, 2004

- ^ a b "News: Mitsubishi CEO resigns", 4Car, April 27, 2004

- ^ a b "DC finally outs Bernhard", Dean Slavnich, Automotive Engineer-Plus, July 30, 2004

- ^ "A New Driver For Mercedes-Benz?", Gail Edmondson, BusinessWeek, August 2, 2004

- ^ "Daimler pulls support on Mitsubishi", Leonie Wood, The Age, April 27, 2004

- ^ "Mitsubishi seeks $5.2bn bail out", BBC News, January 28, 2005

- ^ "Mitsubishi group to buy carmaker's shares", Naoko Fujimura, International Herald Tribune, February 15, 2005

- ^ "Daimler sells stake in Mitsubishi" BBC News, November 11, 2005

- ^ "Mitsubishi shares make Goldman Sachs $80 million in a day" Automotive Business Review, November 18, 2005

- ^ "J.P. Morgan buys carmaker's shares", International Herald Tribune, December 8, 2005

- ^ "Mitsubishi Motors reports consolidated results for year ended 31 March 1999", Mitsubishi Motors press release, May 27, 1999

- ^ "Financial Results for Fiscal Year 2000", Mitsubishi Motors press release, May 18, 2001

- ^ "FY 2000 Financial Results (Consolidated)", Mitsubishi Motors website

- ^ "FY 2001 Financial Results (Consolidated)", Mitsubishi Motors website

- ^ "Consolidated Financial Results for FY2002", Mitsubishi Motors website

- ^ "FY 2004 Consolidated Financial Statements (Revised 2005.5.30)", Mitsubishi Motors website

- ^ "FY2005 Consolidated Financial Statements (Revised)", Mitsubishi Motors website

- ^ "FY 2006 Financial Statements", Mitsubishi Motors website

Daimler AG Cars Trucks Detroit Diesel · Freightliner · Master Motors · Mercedes-Benz · Mitsubishi Fuso Truck and Bus · Sterling Trucks · Western StarBuses Vans Motorsport Shareholdings Automotive Fuel Cell Cooperation (50.1%) · EADS (22.41%) · Kamaz (10%) · Master Motors (80%) · Mitsubishi Fuso Truck and Bus (85%) · Tata Motors (7%) · Tesla Motors (10%) · Tognum AG (50%)

Category ·

Category ·  Commons

CommonsChrysler Marques CurrentDefunctAMC (1966–1988) · Commer (1905–1979) · Barreiros (1959–1978) · DeSoto (1928–1961) · Eagle (1988–1998) · Fargo (1920–1972) · Hillman (1907–1976) · Humber (1898–1975) · Imperial (1955–1975, 1981–1983) · Karrier (1908–1977) · Plymouth (1928–2001) · Singer (1905–1970) · Simca (1934–1977) · Sunbeam (1901–1976) · Valiant (1960–1966)

Divisions and

subsidiariesCurrentChrysler Australia · Chrysler Canada · Dodge · Jeep · Mopar · Ram Trucks · Street and Racing TechnologyDefunctAmerican Motors Corporation (1954–1988) · Chrysler Australia (1951–1981) · Chrysler Europe (1967–1981) · Chrysler-Plymouth · Chrysler UK (1970–1981) · EnviFormerJoint ventures and

alliancesCurrentDefunctPeople Walter Chrysler · Lee Iacocca · C. Robert Kidder · Thomas W. LaSorda · Sergio Marchionne · Louis RhodesPlaces Products Other Big Three · Cerberus Capital Management · Daimler-Chrysler (1998–2007) · Fiat SpA · History (Chapter 11 reorganization)

Category ·

Category ·  CommonsCategories:

CommonsCategories:

Wikimedia Foundation. 2010.